Temu is a China-based ecommerce marketplace owned by Pinduoduo Inc., which launched in 2015 and has since gained traction in markets all over the world. Temu is valuable for both consumers and retail businesses alike, offering access to a huge range of products at extremely affordable prices. Let’s take a look at some Temu stats to see if it makes sense for your business strategy, either to source or sell your products.

Key Takeaways:

- Rapid user growth: Temu gained over 100 million users in less than two years. Consider leveraging its platform to tap into this growing audience or find products to resell on your own channels. It is good for sourcing affordable products for your budget-conscious customers.

- High mobile app engagement: The Temu mobile app has outpaced Amazon in downloads. It’s worth exploring if you aim to expand beyond traditional channels.

- Trade-offs: While Temu offers advantages like affordability and reach, its slower shipping times and lower customer service ratings highlight areas where businesses need to manage customer expectations.

Sales, Traffic & Downloads

1. Temu had a monthly gross merchandise volume of $635 million in 2023

Temu launched in September 2022 and quickly started generating sales. The last measure of gross merchandise volume (GMV) was in May 2023, when Temu generated $635 GMV in just 31 days.

2. Temu grew its user base to over 100 million in less than two years

In March 2023, there were about 70.5 million active users. In April 2023, Temu grew to more than 100 million active users. This represents massive and rapid growth from less than 6 million in October 2022, a month after its launch date.

3. Temu is the top 41st website in the world in terms of traffic

Of all the websites in the whole world, Temu ranks towards the top. According to SimilarWeb, it’s the 41st website in the world in terms of traffic. Visitors who stay on the site typically spend around five minutes browsing through six or seven different pages.

4. The Temu website receives more than 500 million monthly visits

In April 2024, the Temu website saw 503.3 million visits, a significant increase from 358 million in February 2024.

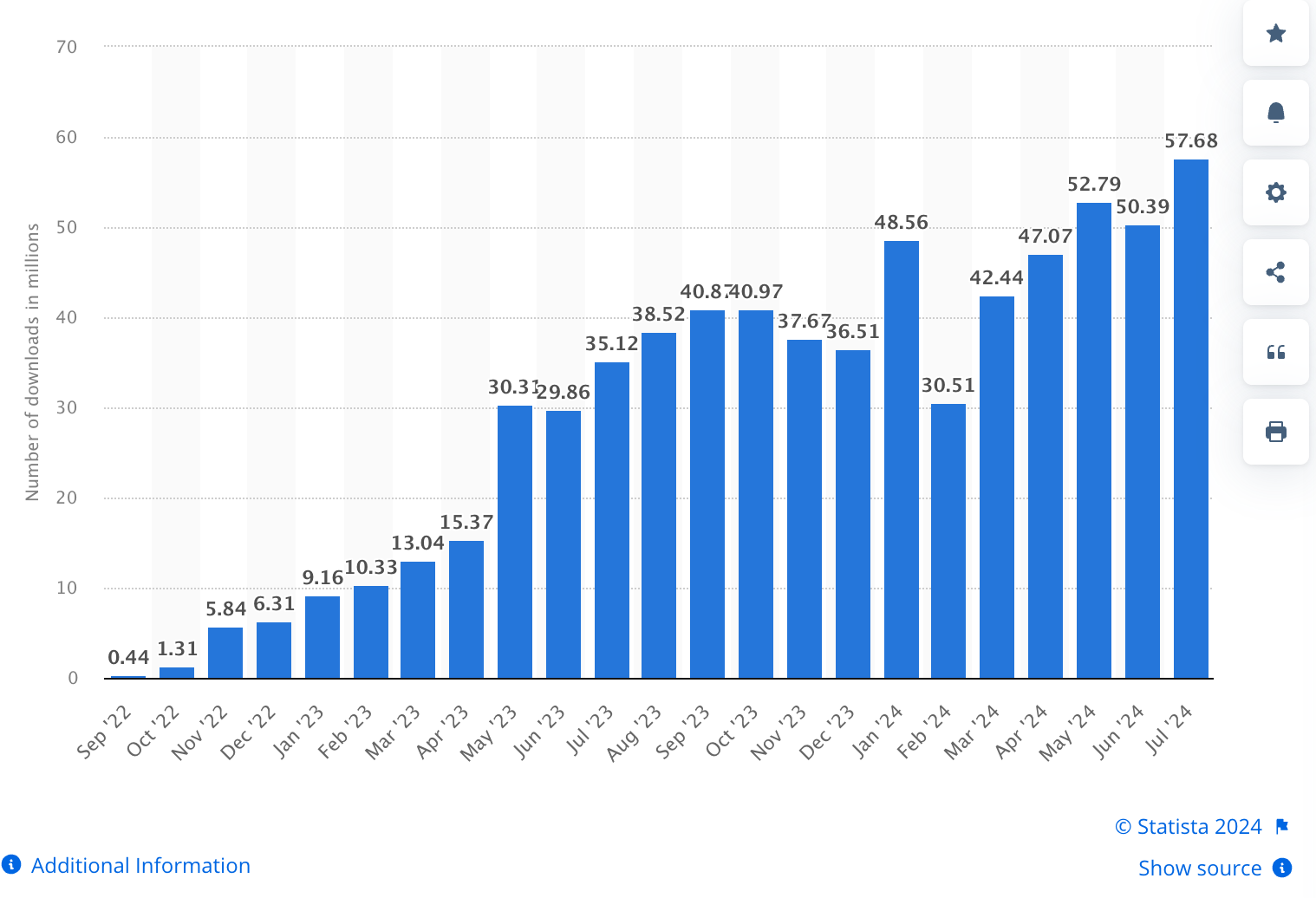

5. The Temu mobile app has been downloaded nearly 58 million times worldwide

The Temu mobile app launched in September 2022 and has grown to 57.68 million global downloads, experiencing spikes in May 2023, January 2024, and March 2024. It’s actually more frequently downloaded than the Amazon mobile app, per July 2024 metrics. (source)

Number of global downloads of the Temu app, September 2022 to July 2024. (Source: Statista)

6. The Temu mobile app is the most popular shopping app in the US in terms of downloads

In the US, Temu is the most popular shopping app in terms of downloads in 2023, accumulating a total of 122 million downloads.

7. Cyber Monday 2023 drove an average order value of $30

Temu has seen action on the Black Friday and Cyber Monday shopping holidays—especially Cyber Monday. In 2023, US shoppers clocked in at the highest average order (AOV) yet—$30 per Temu order. However, this hasn’t quite caught up to its competitors. Here’s the full breakdown:

- Shein and Walmart: $49 AOV

- Target: $44 AOV

- Amazon: $36 AOV

- Temu: $30 AOV

Competitive Landscape

8. Temu is the most popular marketplace app in the world in terms of downloads

As far as marketplace apps specifically are concerned, Temu ranks number one for downloads globally. In 2023, it was downloaded 338 million times, compared to Amazon Shopping at 188 million and Shopee at 160.7 million.

It was also the top marketplace app in the US for the same time period. It clocked in at 122 million US downloads, surpassing Amazon at 21 million and eBay at 11 million for the same time period.

The trend followed suit in the UK as well. It was the top-downloaded marketplace app with 20.86 million downloads. Amazon was downloaded 4.1 million times and eBay 2.2 million times during the same time period.

9. It’s also the most popular shopping app

Temu is also the most downloaded shopping app. Here’s the full breakdown:

- Temu: 338 million

- Shein: 262 million

- Temu: 122 million

- Shein: 21 million

- Temu: 20 million

- Vinted: 8.87 million

- Shein: 7.36 million

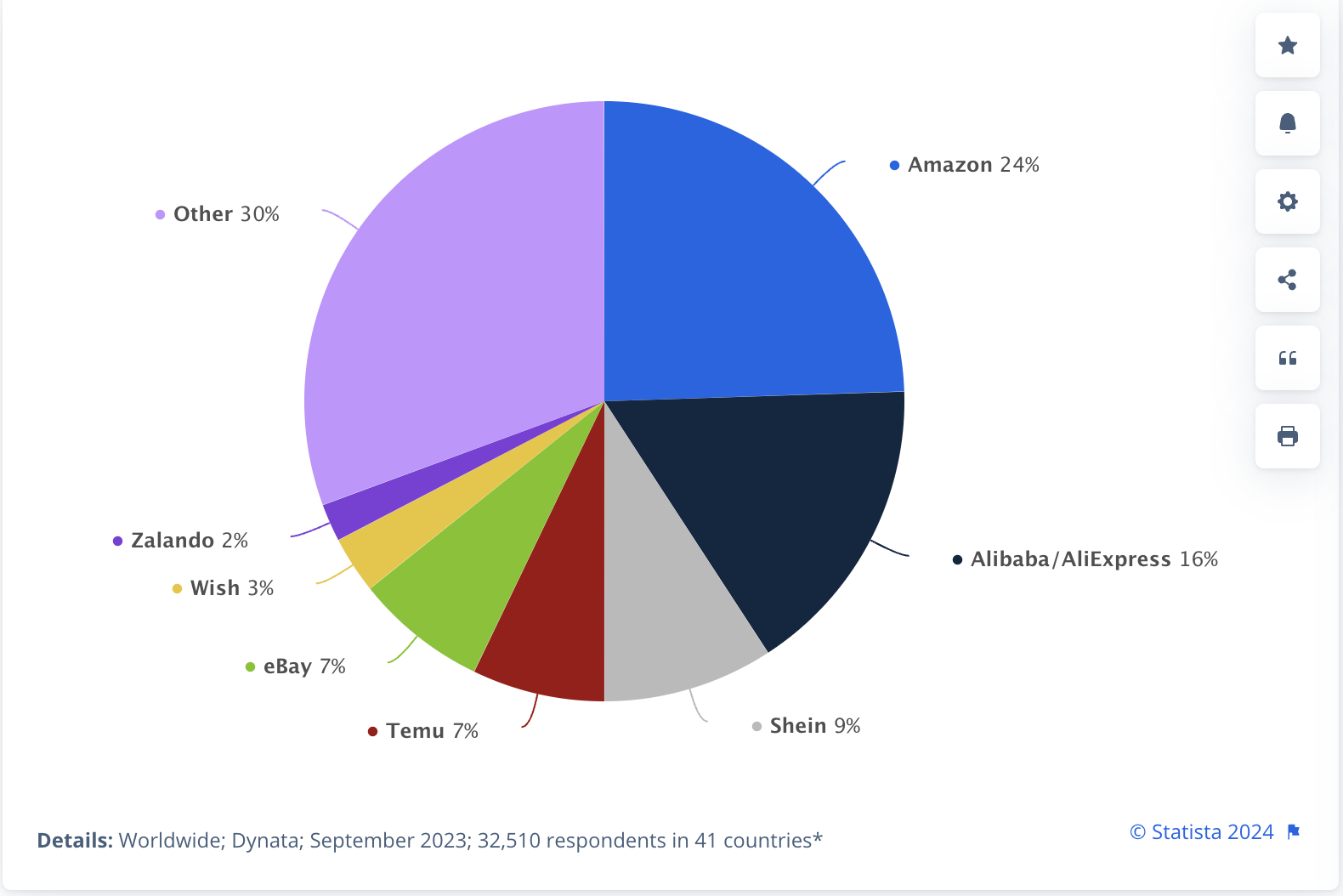

10. 7% of shoppers made their last purchase on Temu

According to one survey, 7% of shoppers made their last “cross-border” or international purchase from Temu. This comes in toward the middle of the list, which breaks down like this:

- 24% Amazon

- 16% Alibaba or AliExpress

- 9% Shein

- 7% Temu

- 7% eBay

Online retailers from which global shoppers made their last cross-border purchase. (Source: Statista)

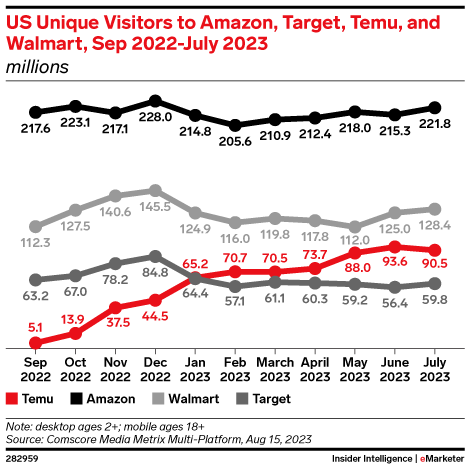

11. Temu has surpassed Target in terms of monthly unique visits

Temu is catching up with its big-box retail competitors. In January 2023, it officially surpassed Target’s web traffic as measured by unique monthly visits. It hit 65.2 million unique visits that month. In July 2023, Temu received 90.5 million unique visits. It’s looking to overcome Walmart next, if trends continue.

Source: eMarketer

12. 76% of shoppers believe Temu is cheaper than Amazon

Of shoppers who use both Temu and Amazon, more than three-quarters believe Temu is the more affordable option. More specifically, 40% think it’s “much cheaper” and 36% believe it’s “somewhat cheaper.”

13. 24% of shoppers believe Amazon has ‘much greater’ variety than Temu

Nearly a quarter of shoppers believe Amazon has a “much greater variety” of products, while 18% believe it has a “somewhat greater variety” when compared to Temu. However, nearly half (45%) think they offer similar variety.

Perception still reigns in Amazon’s favor here, though. Only 9% believe Temu’s product selection has “somewhat greater variety” and 3% say it has “much greater variety.”

14. 66% of shoppers believe Amazon offers faster shipping than Temu

There’s one category where Amazon is a clear winner: shipping. A whopping 66% of shoppers believe Amazon ships “much faster” than Temu.

15. 50% of shoppers prefer Amazon’s return policies

When it comes to return policies, most shoppers believe either Amazon is better, or both Temu and Amazon offer similar options. Here’s how it breaks down:

- 32%: Amazon’s policy is much better

- 18%: Amazon’s policy is slightly better

- 39%: Amazon and Temu offer similar policies

- 7%: Temu’s policy is slightly better

- 3%: Temu’s policy is much better

16. One-third of customers believe Amazon has ‘much better’ customer service

Customer service is another area of comparison for Temu and Amazon. Here, Amazon pulls ahead. While 45% say both platforms offer similar customer service experiences, a combined 50% say Amazon has “much better” or “slightly better” customer service. Temu is only ranked better for customer service by 5% of consumers.

17. 58% of consumers believe reviews are equally important when shopping on Temu and Amazon

Customer reviews are important for ecommerce shoppers, and both Amazon and Temu offer reviews on their respective marketplaces. More than half (58%) of shoppers say reviews are equally important to them when shopping on Amazon or Temu.

Brand Awareness

18. 88% of US consumers have heard of Temu

Temu has been around for less than a decade, a much shorter period of time than Amazon or eBay, for example. So, it’s still generating brand awareness around the globe. In the US, about 88% of consumers have heard of the platform.

19. 52% of consumers who know Temu have heard about the platform through advertising

More than half of US consumers who know of Temu say they heard about it through advertising. Another 77% say they can recall seeing an ad for Temu in the past three months. This suggests Temu is actively using advertising to generate brand awareness.

20. Women are more likely than men to have heard of the brand

Women are more likely to have heard of the marketplace—95% of women have heard of it compared to 80% of men.

21. More men know about Temu because of advertising than women

While American women are more aware of Temu as a platform, advertising seems to have a bit more traction with men. More than half (55%) of men have heard of Temu through advertising, compared to 50% of women.

More women (22%) hear about it through friends and family than men (18%). They also find it via online search more frequently than men, though men (9%) hear about Temu through the news more frequently than women (3%).

22. 56% of people who have heard of Temu have never made a purchase from Temu

Despite brand awareness, many people still have yet to make a purchase using the ecommerce site. About 56% of US consumers who know about it have not bought anything from Temu before.

Customer Demographics & Behavior

23. Temu has a seven-day customer retention rate of 18.5%

Temu is slowly but surely boosting customer retention rates. As of July 2023, its seven-day customer retention rate was 18.5% for US customers.

24. 24% of Temu customers say they’d likely purchase from the platform again

Temu customers are generally willing to make future purchases. In the US, nearly a quarter of customers say they would make a future purchase from the platform. Only 15% say they’re unlikely to do so. Of those who would make repeat purchases, 34% are between 18 and 29 years old. Customers who are between 30 and 44 years old are the least likely to make future purchases.

25. Clothing and accessories is the top product category on Temu

Although many clothing shoppers haven’t heard of Temu, clothing and accessories is the top category. The least popular categories were pet supplies and sports or outdoor equipment.

Here’s the list of top product categories for 2023:

- Clothing and accessories

- Household items

- Consumer electronics

Pinduoduo Inc.

26. Pinduoduo Inc. generated roughly $35 billion in revenue in 2023

Pinduoduo Inc. is the parent company of Temu, and it generated 247.64 billion yuan in revenue in 2023. That’s roughly $34.72 billion. This is an increase from 130.56 billion yuan ($18.3 billion) in 2022. In 2023, it generated a gross profit of around 155.92 billion yuan ($21.86 billion).

27. Pinduoduo holds $48.8 billion in total assets

Per 2023 metrics, Pinduoduo was estimated to hold about 348 billion yuan in assets—roughly $48.8 billion. This is an increase from 237 billion yuan ($33.23 billion) in 2023.

28. Pinduoduo invests about $11 million in advertising in one year

Also per 2023 metrics, Pinduoduo spent about 76 million yuan ($10.66 million) on advertising. It had an approximate 50 million yuan ($7 million) advertising spend in 2022.

29. Pinduoduo earned $590 billion in gross merchandise value in one year

Pinduoduo is giving other ecommerce giants a run for their money. While Amazon held onto the top spot in 2023 for gross merchandise value, Pinduoduo is gaining traction. Here’s the full breakdown:

- Amazon: Between $700 billion and $750 billion

- Pinduoduo: $590 billion

- Taobao: $550.4 billion

- Tmall: $535 billion

Frequently Asked Questions (FAQs)

Click through the tabs below to get answers about Temu.

In April 2023, Temu had more than 100 million active users. The month prior, there were about 70.5 million active Temu users. This represents massive and rapid growth from less than 6 million in October 2022, a month after its launch date.

Temu had a monthly gross merchandise volume of $635 million in 2023. Its parent company, Pinduoduo Inc., had a gross merchandise volume of $590 billion in the same year.

The United States and Mexico downloaded the Temu app the most in 2024. The UK is another popular country for Temu.

While we can’t predict the future, there are no public plans for Temu to leave the US market.

Bottom Line

Temu is new to the game but it doesn’t show any signs of slowing down. As it continues to invest in advertising to raise brand awareness, consumers all over the world will be more comfortable with and willing to purchase from the ecommerce marketplace.

Temu’s commitment to product variety and affordable pricing will be especially appealing if consumers continue to be more concerned about the economy and persistent inflation. These Temu stats can give you a great starting point to see if and how the platform fits into your business strategy.