Thimble is an online-based managing general agent (MGA) for small business insurance. This means it has the authority to do its own underwriting while working with a number of top-rated carriers. So, it can generate quotes in hardly any time and bind the policy for same-day coverage. It offers insurance for more than 300 different types of small businesses in 50 states. Once you’ve purchased a policy, you can manage the policy online or via the Thimble app.

The provider started out with the name Verifly and sold drone insurance. In 2019, it rebranded to Thimble and began offering scalable and flexible insurance to small businesses. In March 2023, it discontinued offering drone insurance through the Verifly app and is now exclusively a provider of small business insurance. Then, in April 2023, Arch Insurance Group purchased Thimble.

Pros

- App to manage your policy

- Purchase policy online

- Tailored coverage to fit your industry

- Online account and instant certificates of insurance (COIs)

- Broad range of industries covered

Cons

- Does not handle claims

- No commercial auto insurance

- Has lower limits

- Speaking with a person is very difficult

Average Annual Beginning Pricing

- $504 for general liability

- $500 for professional liability

- $115 to $340 for special event insurance

Standout Features

- Very fast and easy online quoting and policy purchasing system

- App to generate quotes, manage policy, and file claims

- Short-term liability for jobs or special events

Use Cases

Thimble Insurance Alternatives

Best for: Businesses looking to save money by comparing quotes | Best for: Small business owners who have filed claims | Best for: Those needing a one-stop shop for handling policy and claims |

AM Best financial rating: A- (Excellent) to A+ (Superior) | AM Best financial rating: A- (Excellent) to A+ (Superior) | AM Best financial rating: A+ (Superior) |

Thimble Insurance Options

Thimble has the core policies a business needs for operations, and most of these are widely available in every state. You can get a quote and purchase a policy entirely online for:

- General liability

- Professional liability

- Commercial property

- Business owner’s policy (BOP)

- Workers’ compensation

- Special event

- Short-term liability

- Business equipment (inland marine)

- Cyber

General liability, professional liability, business equipment insurance, and the BOP are available in all 50 states and Washington, D.C. Meanwhile, workers’ comp is available in all nonmonopolistic states.

Cyber and event insurance are more limited:

- Cyber insurance is currently unavailable in Washington, California, Alaska, Hawaii, Louisiana, Florida, North Dakota, Colorado, Kansas, North Carolina, Virginia, New York, Connecticut, and Massachusetts.

- Special event insurance is currently unavailable in Texas, New York, and North Carolina.

It is worth noting that Thimble is still relatively new and is continuing to expand coverage as it grows.

Thimble Insurance Partners

As an MGA, Thimble has the authority to underwrite policies—but the policies are still serviced by different insurance companies. All of the carriers it works with have AM Best ratings that range from A- (Excellent) to A++ (Superior).

According to its website, Thimble partners with the following carriers to offer insurance:

- American Alternative Insurance Corporation

- American Commerce Insurance Company

- Mitsui Sumitomo Insurance Company of America

- National Indemnity Company

- Tokio Marine America Insurance Company

- Central States Indemnity Company of Omaha

- National Indemnity Company of the South

- State National Insurance Company

However, the majority of its policies are placed through the following carriers:

- Markel Insurance Company

- Employers Insurance Group

- National Specialty Insurance Company

In addition to working with the above carriers, Thimble also utilizes the services of other large independent agencies. If you are an agent or broker interested in selling Thimble insurance, it will work with you to use its quote bind technology. Visit Thimble to learn more about those options.

Thimble Quoting Process

Thimble states you can get a quote in 60 seconds or less and be covered in minutes. The quote process is accelerated by a simplified application of fewer questions focused on your ZIP code, what you do, and how long you need insurance.

As you answer questions about your business, its system will suggest coverage based on recommendations for your industry.

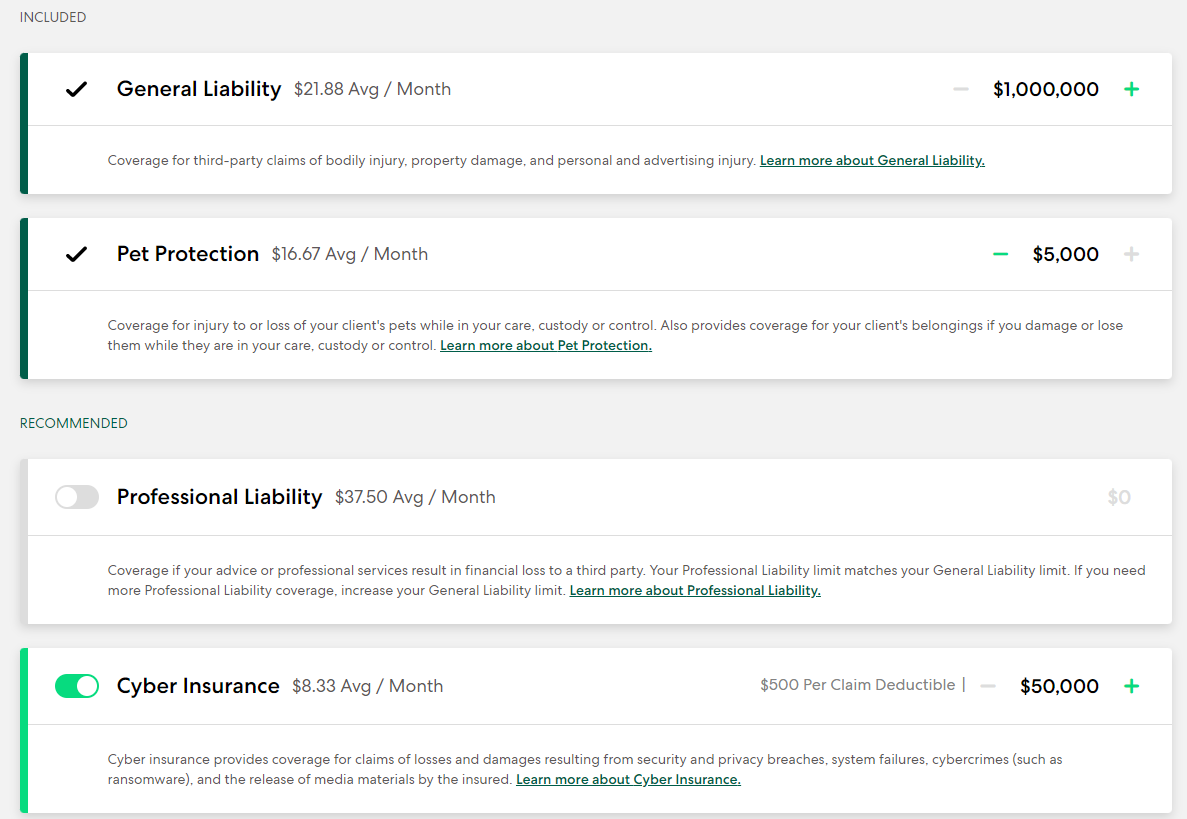

Optional coverage and limits during the quote

You can then modify your quote by adding or removing the coverage before proceeding to the purchase page. Once you are ready to buy, you can make more fine-tuned changes to your policy by changing the limit and deductibles and adding coverage. You can also review what activities are excluded from coverage to make sure this policy is right for your business.

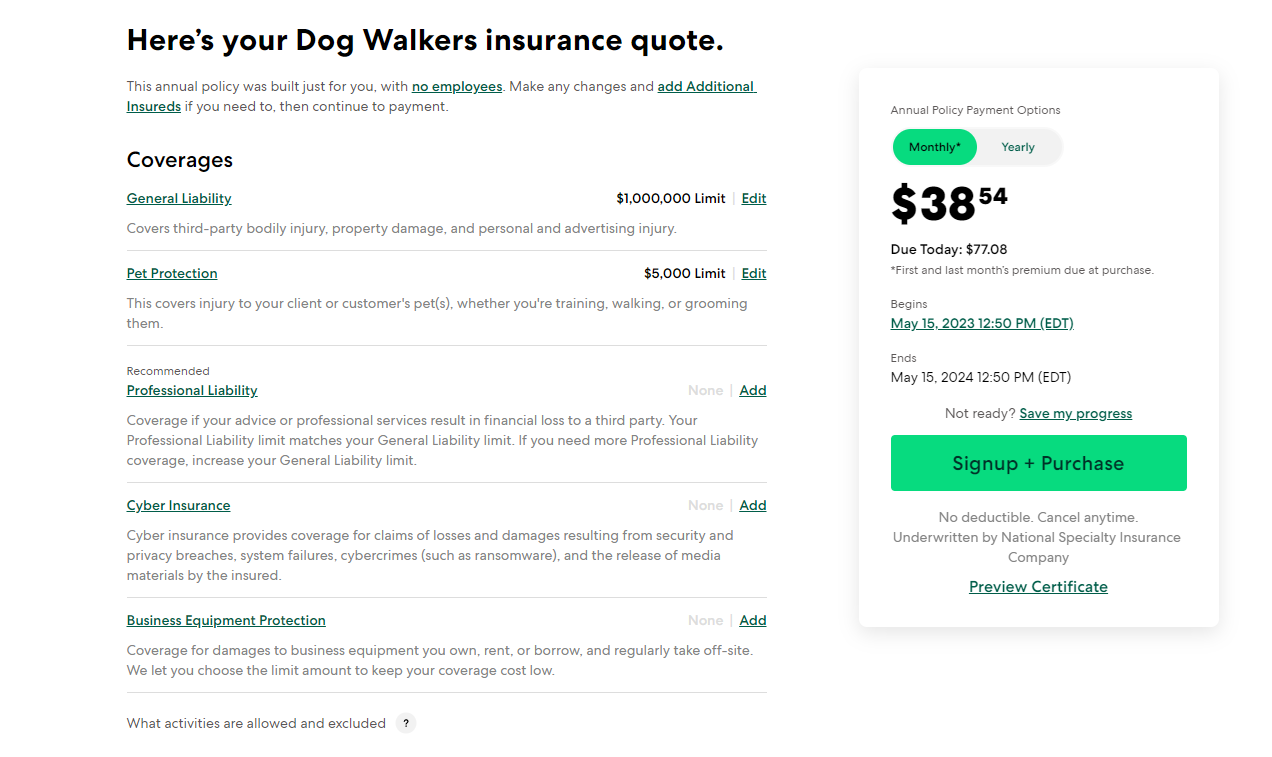

What the final quote looks like

From there, you sign up and purchase the policy. All of this can be done without speaking to anyone directly. An added benefit of Thimble is you can usually get instant, same-day coverage.

Thimble Insurance Costs

Helpfully, Thimble publishes many of the median costs online.

The median costs for short-term general liability insurance are as follows:

- $49: A month of coverage

- $32: A week of coverage

- $15: A day of coverage

- $5: An hour of coverage

The median monthly costs for general liability by industry are:

- $96.94: Handypersons

- $36.53: Landscapers

- $23.75: Pet services

- $20.80: Beauty and fitness

The median monthly costs for a BOP by industry are:

- $129: Janitor

- $120.50: Carpenters

- $119.50: Landscapers

- $111.58: Handypersons

- $88.50: Dogwalkers

- $87.17: DJs and wedding planners

Thimble states that business equipment insurance (like inland marine) is available on every monthly policy, which starts at $23. As a standalone coverage, it starts at $6 with three coverage limits: $1,000, $2,500, and $5,000 with a deductible of $500 for each level. As you can see, $5,000 as the maximum limit for scheduled tools and equipment is not very high but the lower limit is in keeping with Thimble’s target audience of businesses that are just starting out.

Thimble Customer Service

The strong side of Thimble is online account management. You can do this via a browser or its app, which enables you to request a COI, edit existing COIs as the project evolves, make policy changes, pay your bill, and file a claim.

If you need to speak with anyone, Thimble’s hours are Monday through Friday from 9 a.m. to 6 p.m. Eastern time. However, it should be noted that it is nearly impossible to speak with anyone. Everything is done through the website, where you can email or chat in real time.

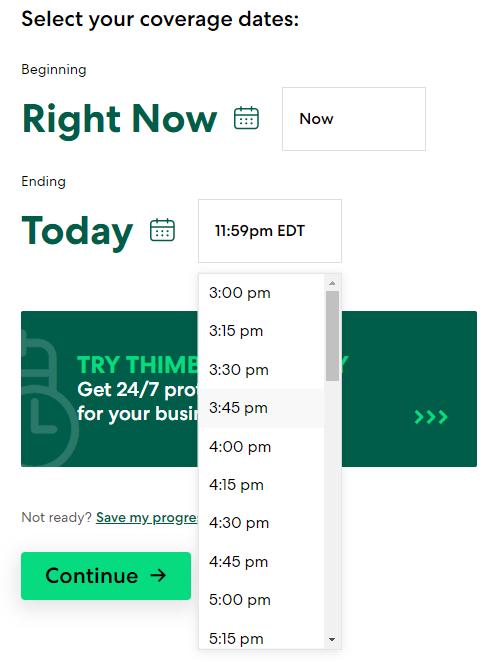

Thimble’s short-term liability is worth a call out as a customer service. It is unique, and most providers that offer something similar do so by offering it through Thimble. Short-term liability coverage is available for general liability and professional liability insurance. You can select when the coverage starts and when it ends, with both options being flexible by the hour.

Options for time and date of coverage.

Insurance Compliance Certificate Manager

Thimble offers a certificate manager when you are running a project, making it easy to manage all of the moving pieces. It has a digital checklist of all insurance requirements.

You just enter the email addresses of the contractors, and Thimble will send this checklist to them and allow them to upload the requested documents. You can check the dashboard to see the status of the requests so that you’ll know when you have everything you need.

Thimble Mobile App

The app functions like a 24/7 call center for your business. You can manage your policy, create and share a COI, and file a claim.

One significant advantage of the app—one that no other insurance provider appears to have—is that you can get a quote and purchase insurance through it. This is advantageous for small business owners who are employed full-time but run a business as a side hustle. Whenever you need coverage, say for a weekend job, you can pull out the app to get a quote and buy a policy.

Thimble Business Insurance Reviews

Customers who left a Thimble business insurance review said that the MGA provides convenience and policies that are easy to get and manage. One reviewer highlighted one of Thimble’s key benefits: same-day, short-term coverage, adding that Thimble made it quick and convenient for them to provide their services at a one-time event.

Some of the negative reviews are focused on the price of the premium or difficulty in getting a reimbursement. A few clients focused on the claims experience, including the resolution of a claim—but regarding that, it should be noted that Thimble does not handle claims; those are handled by the provider that the policy is through.

Thimble makes an app for Android and iOS. The app, which is a key piece to being a customer since it is very difficult to speak to anyone, has positive reviews on both Google Play and App Store.

Here are the Thimble business insurance review scores on third-party websites:

- Truspilot1: 4.6 out of 5 stars out of over 1,200 reviews

- Better Business Bureau (BBB)2: 4.52 out of 5 stars from around 30 reviews

- Google Play3: 4.4 out of 5 stars from more than 330 reviews

- App Store4: 4.8 out of 5 stars out of nearly 600 ratings

Frequently Asked Questions (FAQs)

Yes. Thimble is a real insurance provider and has sold policies to more than 40,000 small businesses. Quotes are available online or through its mobile app. It also works with independent agents and brokers.

Premiums vary depending on industry and claims history, but the median monthly cost for short-term general liability starts at $49 monthly. For professional liability, the median monthly cost starts at $45. For a BOP, a handyperson will pay around $111.58 monthly and a dog walker will pay about $88.50 monthly.

Thimble’s phone number is (855) 940-4525, and its hours of operation are Monday through Friday from 9 a.m. to 6 p.m. ET. However, when you call that number, you’ll hear a recording providing you with different email addresses for different questions with no option to speak to anyone.

All the core policies a business needs are available through Thimble: general and professional liability, business equipment, commercial property, cyber insurance, and workers’ comp. Availability varies by state, but general liability, professional liability, and a BOP are available in all 50 states.

To report a claim, visit the dedicated “report a claim section” on its website. Once the claim is submitted, a representative from the actual insurance company handling the policy will reach out to you. If you have a general liability policy, Thimble states the claim will be handled by Markel or Sedgwick. You can also call Markel and Sedgwick to report a claim 24/7.

Bottom Line

If you’re a small business looking for small but mighty coverage, then Thimble is a great option. As an online insurance agent, it works with several top providers to bring you near-instant coverage that you can change online or through its app as a customer. The main downside is that trying to speak with someone is impossible and that the limits may sometimes be lower than your business requires.

In our Thimble insurance review, we’ve determined that for a new business starting out, or for a solopreneur, the provider is a great option. Get a free, no-obligation quote in 60 seconds today.

User review references: