TSYS, a leading merchant services provider, has expanded its offerings through a merger with Global Payments. Along with its existing card issuing solutions for enterprise-level businesses and independent sales organizations, TSYS now provides a comprehensive platform that includes payment gateway tools, merchant plug-ins, merchant portal platforms, and chargeback management. Smaller businesses can access TSYS merchant services through resellers like PaySimple, Revel Systems, and Lightspeed.

We reviewed TSYS Merchant Solutions based on how we evaluated the best merchant services, and it earned an overall score of 2.85 out of 5. It offers custom pricing, long-term contracts, and high early termination fees, making it unsuitable for small businesses.

TSYS Merchant Solutions at a Glance

In the news: In July 2021, TSYS was the subject of a seven-count civil lawsuit for alleged wrongful retention of reserve funds in excess of $100,000 and have failed to properly remit those funds to the merchant.

As robust as its features are, TSYS’s solutions are more suited for midsize to large financial institutions and resellers, as well as small issuers. It comes with a tiered pricing model, long-term contracts with automatic renewal, and hefty termination fees unsuitable for small merchants, startups, and businesses with low-volume transactions.

Businesses intent on having a direct merchant account with TSYS will have to sign up for its point-of-sale (POS) brands—Vital POS or RiO Restaurant. But because transaction fees are not advertised, and with TSYS’s reputation for long-term contracts and expensive early termination fees, we can only recommend TSYS for larger, enterprise-level businesses. Smaller businesses would be better served with one of our recommended merchant service providers, which includes Square, our top choice.

TSYS scored poorly in this category because of its monthly fees, custom pricing, three-year contract, and hefty early termination fees. The exact terms and pricing may vary for every TSYS merchant, but the available information is not small business-friendly. Aside from high cancellation fees, its chargeback and miscellaneous fees are also hefty and unsuitable for small businesses.

TSYS’s pricing is designed for large financial institutions and resellers, so its plans and transaction rates are customized and entirely different from what end-users or merchants would charge when processing payments. Enterprise-level businesses may still be able to sign up directly with TSYS but will likely be quoted tier-based pricing. Transaction fees for its POS systems are also custom-quoted.

However, some monthly and incidental fees do get passed down to merchants. A quick browse of TSYS’s merchant application form gave us the following:

- Payment gateway fee: $5/month + 5 cents per transaction

- Application and setup fee: $195

- Chargeback/retrieval fee: $25

- Refund processing fee: $25

- Transaction limit fee: $25

- ACH fees:

- ACH return fee: $35

- ACH proof of authorization request fee: $10/request

- ACH refund fee: $25

- Miscellaneous fees:

- Monthly statement fee: $9.50

- Monthly minimum: $25

- Per batch fee: 25 cents

- Annual PCI compliance fee: $99.50

- Early termination fee:

- Less than 12 months remaining of the contract term: $250

- More than 12 months remaining of the contract term: $500

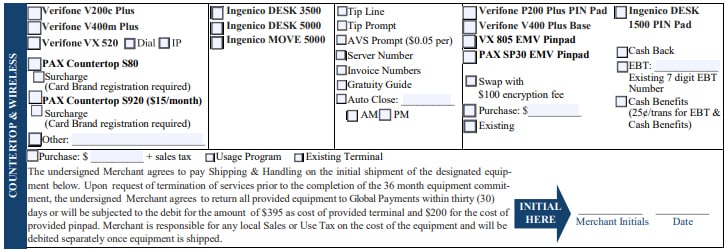

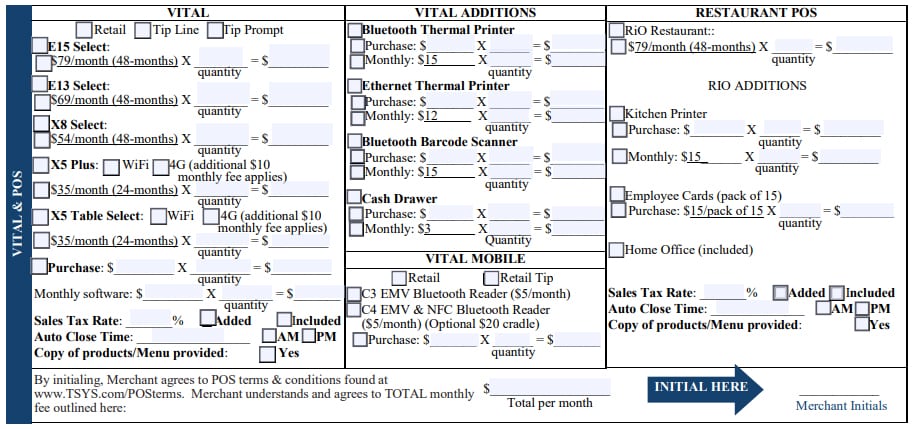

Hardware is usually offered by resellers that provide front-end payment processing to merchants with their own series of card readers, such as Clover, which offers proprietary POS hardware, and Payline Data. However, a closer look at the TSYS merchant application form shows that it also supplies partner card terminals, and has its own POS hardware brand, Vital and RiO Restaurant.

TSYS POS hardware cost ranges from $35–$79 with add-ons that include mobile card readers for $5/month and peripherals that cost between $3–$15. Option for outright purchase is available, while installments will tie you into a long-term contract that lasts two to four years and imposes separate early termination fees.

TSYS provides a list of its merchant application and terms and conditions on its website; however, these are for ISOs/payment processors that retail TSYS services to businesses with a different set of contracts and terms of service. So, from a merchant end-user standpoint, you will only have to focus on the terms set by your payment processor. Before obtaining a TSYS merchant account by signing up for a POS system, there are a couple of things you should do:

- Make sure you do not sign up for a tiered-pricing payment plan

- Avoid leasing equipment, as this will lock you into a long-term contract (possibly up to four years)

- Clarify early termination fees, both for payment processing and hardware (they may have separate terms)

- Ask to specify incidental and miscellaneous fees—the provider may impose hidden/additional fees for PCI compliance, high chargeback, returns, and authorization or retrieval request

These recommendations are based on the conditions set for TSYS resellers which may be passed down to end-users.

Businesses that want a merchant account with TSYS will have to either sign up with an ISO/reseller or sign up for its POS solution. The application and setup process will vary depending on your choice. However, in both cases, the application process may take anywhere between a couple of days to a week. You’ll be asked to provide the following information:

- Business type and category

- Business name and address

- Business website and other proof of operation

- Beneficial owners and authorized signatories

- Contact information for owners and signatories

- Personal information of applicant

- Business bank information

TSYS scored strongly in this category. It offers all the payment types we considered in our evaluation, although there may be additional fees, such as for its POS software. For payment flexibility, TSYS does not fall short.

Process all major bank brands, networks, and private-label cards for credit, debit, prepaid, and retail transactions. Accept EMV chip, debit, and credit card payments with a tap, dip, or swipe. What’s important to note is that, as a direct processor, accepting payments with TSYS is more secure, and depositing your funds to your account is faster compared to alternatives.

TSYS provides its own gateway platform, TransIT WebPASS, and a virtual terminal to process card-not-present transactions securely and in real time from any computer with an internet connection. It also offers an online payment system infrastructure that’s easy to integrate with third-party payment gateway providers.

TSYS provides clearing and settlement services for all ACH and echeck payments. It also offers a highly secure solution for moving funds from the payment processor to your bank. If you run a business that requires a recurring billing feature, TSYS supports invoice automation and custom payment form creations where your customers can settle using any preferred mode of payment.

TSYS has a proprietary internet-based virtual terminal that allows merchants to receive payments by keying in the card details. The virtual terminal offers various features such as level 3 data acceptance, automatic batch processing, multiple users, billing options, and real-time reporting.

TSYS offers level 2 and 3 credit card processing, making it suitable for B2B and corporate payment processing. Using level 2 and 3 processing for eligible transactions can help merchants save on transaction fees because these transactions are charged with lower interchange rates.

TSYS scored strongly for customer support but lost some points for deposit speed and its non-payment processing tools with add-on fees. It provides 24/7 customer support but only guarantees two to three days’ funding.

Those who sign up with a TSYS payment processor/reseller get to experience its seamless payment processing service. As a direct processor, it eliminates the intermediary in your card processing service, which usually means faster funding. TSYS offers multichannel bill payment features that allow its users to process a wide range of payment methods. It gives you access to a merchant portal for access to paperless account statements and premium services.

TSYS offers data security (format-preserving encryption and triple data encryption standards), tokenization, fraud prevention, and merchant tax reporting. It also provides point-to-point encryption (PCI P2PE) that ensures that all sensitive data is protected and payment security is enhanced. Please note: only P2PE devices are certified by the PCI security standards council.

It also provides a rules-based fraud detection and risk management solution that allows you to set rules and transaction settings for more customized fraud monitoring.

You receive payment in your local currency while you enable your international customers to pay in theirs. This supports both Visa and Mastercard transactions. Contact TSYS for specific information on any additional fees and currency exchange rates.

TSYS provides access to a merchant portal for its users, which contains information regarding the status of the processor’s services and communications, additional virtual POS capability for mail order/telephone order (MOTO), data export options, and quick view of real-time merchant data such as POS transactions, authorizations, and payments.

The search bar on TSYS’s website is the closest it has to a help center. A help support function is available within the merchant portal and on the mobile app. For direct merchant accounts, phone support is also available 24/7. However, it’s important to note there are a number of complaints about TSYS’s poor customer service.

After our evaluation of TSYS, we think that it is not a small business-friendly merchant services provider. The biggest disadvantages of TSYS for small businesses are its three-year contract with auto-renewal and the hefty early termination fee of $250 to $500. For small businesses, being locked into a three-year payment processing contract is not ideal, especially if you are charged a minimum of $250 for early termination.

Aside from the contract length and pre-termination fees. TSYS offers custom pricing, which means your monthly and processing fees will depend on your business’s type, nature, and size. Although this may be a good thing for enterprise-level businesses that can negotiate lower fees, it is unsuitable for small businesses looking for clear, transparent pricing and quick sign-ups.

TSYS earned average scores for ease of use, integrations, and popularity. It did not do too badly in existing user reviews, and these aspects are often what TSYS customers like.

TSYS Reviews From Users

Back when it still offered payment processing directly to small merchants, online TSYS reviews were generally favorable. Most users agree that it has done a decent job in developing tools for almost all kinds of payment processing situations. Smooth integration with card associations is also a big plus.

- Trustpilot: Fewer than 10 users rated TSYS an average of 2.3 out of 5 stars.

- G2: Around 20+ users rated TSYS an average of 4.5 out of 5 stars.

You’ll notice that almost all of the negative TSYS reviews come from medium to large businesses with multiple locations, most citing expensive fees. While it no longer directly works with end-users, the feedback we have gathered below seems to be as expected based on TSYS’s pricing and the features they currently offer.

| Users Like | Users Don’t Like |

|---|---|

| Seamless card processing | Expensive fees |

| Wide variety of payment processing options | Requires a learning curve |

| Handy card management tools | Long-term contracts |

Methodology—How We Evaluated TSYS Merchant Solutions

We test each merchant account service provider ourselves to ensure an extensive review of the products. We compare pricing methods, identifying providers that offer zero monthly fees, pay-as-you-go terms, and low transaction rates. We then further evaluate according to a range of payment processing features, scalability, and ease of use.

The result is our list of the best overall merchant services. However, we adjust the criteria when looking at specific use cases, such as for different business types and merchant categories. This is why every merchant services provider has multiple scores across our site, depending on the use case you are looking for.

Click through the tabs below for our overall merchant services evaluation criteria:

25% of Overall Score

We awarded points to merchant account providers that don’t require contracts and offer month-to-month or pay-as-you-go billing. Additionally, we prioritized providers that don’t charge hefty monthly fees, cancellation fees, or chargeback fees and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts and extra points if those discounts are transparent or automated.

30% of Overall Score

The best merchant accounts can accept various payment types—including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and echeck payments—and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

25% of Overall Score

We prioritized merchant accounts with free 24/7 phone and email support. Small businesses also need fast deposits, so payment processors offering free same- or next-day funding earned bonus points. Finally, we considered whether each system has affordable and flexible hardware options and offers any business management tools, like dispute and chargeback management, reporting, or customer management.

20% of Overall Score

We judged each system based on its overall pricing and advertising transparency, ease of use (including account stability), popularity, and reputation among business owners and sites like Better Business Bureau. Finally, we considered how well each system works with other popular small business software, like accounting, point-of-sale, and ecommerce solutions.

Bottom Line

While it offers direct merchant solutions through its POS brand, TSYS’s major activity is to supply card issuing and merchant acquiring solutions. Businesses may deal directly with TSYS for their credit card processing needs, but pricing will still depend on the rates and fees set by its partners. We recommend that small business owners who require direct processing look into alternative merchant services that offer better value, pricing transparency, and more flexible or no contracts.

Businesses that do not want a POS system but really want to have TSYS’s payment solution should consider an ISO or reseller that may be able to negotiate better rates.