Merchant services, also referred to as payment processors, are a necessary but frustrating part of running a business. We list 10 providers that offer fair and transparent pricing

10 Best Merchant Services of 2024

This article is part of a larger series on Payments.

Merchant services The main role of a merchant services provider is to set up merchant accounts that businesses need to start accepting credit cards and other types of payments. This is why merchant services providers are also often called payment processors even though there are some differences in the type of merchant account they provide. Learn more about merchant accounts. allow businesses to accept credit and debit card payments. Many also offer additional tools such as payment gateways, virtual terminals, and point-of-sale (POS) systems.

The best solutions offer competitive rates, month-to-month contracts with no cancellation fees, and flexible solutions for processing in-person and online transactions.

Note that there are several pricing structures for merchant services. To truly compare pricing side-by-side, you should request a quote or use a tool like our calculator below.

The best merchant services for small businesses are:

- Square: Best overall

- Helcim: Cheapest

- Chase Payment Solutions: Best direct processor

- Payment Depot: Best with no percentage markup U.S. businesses only

- Stax: Best for recurring billing U.S. businesses only

- QuickBooks: Best for QuickBooks users

- Stripe: Best for online payments

- PayPal: Best for occasional sales

- PaymentCloud: Best approval odds

- Dharma Merchant Services: Best for transparency

Best Merchant Services Compared

Quiz: Which Payment Processor Is Right for You?

Square: Best Merchant Services for Small Businesses

Pros

- Transparent, predictable pricing

- Free, user-friendly software

- No application, contract, monthly fees, or minimum requirements

Cons

- Account stability issues

- Automated clearing house (ACH) processing only available through invoicing feature

- Not compatible with high-risk businesses

What we like:

Square is an all-in-one merchant services provider, meaning it can process payments in-store and online as well as via mobile, virtual terminal, invoice, and even quick response (QR) code payments. The simplest merchant account provider to get started with, Square is free to use except for pay-as-you-go transaction fees.

Easy, low-cost, and flexible merchant services, combined with the best free POS software, makes Square the best value for new and small businesses. It is also our leading free merchant account.

As soon as you create your free Square account, you can accept credit card payments, record cash and check sales, process invoices, set up an online checkout or ordering system, and accept contactless payments. It’s also HIPAA-compliant, making it a good choice for healthcare businesses.

- Monthly fee: $0

- Card-present transaction fee: 2.6% + 10 cents

- Ecommerce and invoice transaction fee: 2.9% + 30 cents

- Card-not-present transaction fee: 3.5% + 15 cents

- Contract length: None, pay-as-you-go billing

- Early termination fee: $0

- Chargeback fee: None, plus up to $250 per month for chargeback protection

- Card reader: $49

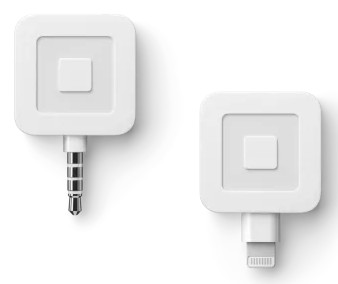

Magstripe Reader | Contactless and Chip Reader | Square Terminal |

|---|---|---|

|  |  |

First free, additional $10 | $49 | $299 or $27 per month for 12 months |

Accepts payments via magstripe (swiped), available in jack or lightning connector. | Bluetooth reader that accepts EMV (chip), and near-field communications (NFC), such as Apple Pay and Google Pay payments. Optional countertop dock and phone case mount. | Stand-alone mobile POS that can take orders, accept card payments, and issue receipts with built-in printer. |

The following user review websites rate Square as:

- Capterra rating: 4.7 out of 5 from about 2,300 reviews

- G2 rating: 4.6 out of 5 from about 150 reviews

Users Like | Users Don’t Like |

|---|---|

Easy-to-use interface | Processing fees are pricey for large volume |

Automated invoicing | Reports of frozen funds |

Fast set up, no approval process | Occasional disconnection of card reader |

Square is one of our favorite tools for small businesses. Learn more about all Square has to offer:

- What is Square?

- Square Point-of-Sale (POS) Review

- How to Use Square to Process Credit Cards

- Square Fees & Pricing Guide (+ Calculators)

Helcim: Cheapest Option

Pros

- Interchange-plus pricing with no monthly fee

- No contracts or early termination fees

- Free POS, customer relationship management (CRM), invoicing, and online store software

- Options to pass processing fees on to customers

Cons

- Limited third-party integrations

- Charges extra for Amex transactions

- Strict approval process

What we like:

Helcim is an all-in-one merchant account provider. Similar to Square, it comes with free sophisticated sales solutions, including a fully hosted online store, invoicing software, POS app, a mobile payment app, basic inventory tracking, hosted payment pages, and more.

Like Payment Depot and Stax by Fattmerchant, Helcim offers interchange-plus pricing, which is great for businesses doing heavy volume.

Unlike the others, it has no monthly fee and offers automated discounts as you scale. Helcim’s free software, interchange-plus pricing with no monthly fee, and transparent volume discounts make it the best and most affordable choice. In fact, we rated it the cheapest credit card processor for small businesses.

Helcim recently updated its transaction fee table. Rates now range from interchange plus 0.15% + 6 cents to 0.4% + 8 cents for card-present transactions and interchange plus 0.15% + 15 cents to 0.50% + 25 cents for card-not-present transactions. Automatic discount starts at $50,000 in monthly sales volume.

- Monthly fee: $0

- Card-present transaction fee: From Interchange plus 0.15% + 6 cents*

- Card-not-present transaction fee: Interchange plus 0.15% + 15 cents*

- American Express transaction fee: + 0.10% + 10 cents

- Contract length: None, pay-as-you-go billing

- Early termination fee: $0

- Chargeback fee: $15 per lost dispute

- Card readers: $99

- POS terminal: $349

*Starting rates. Volume discounts are automatically applied to businesses processing more than $50,000 monthly.

Helcim also has a free credit card processing program called Helcim Fee Saver, which allows merchants to pass processing fees over to customers via a “convenience fee” for certain types of transactions like invoices and online payments.

New in 2023: Helcim launched an all-in-one touch-screen Smart Terminal for payment processing, point of sale, inventory, and customer management all in one device. And, it comes with a built-in receipt printer.

Since Square launched its Square Terminal all-in-one device a few years ago, more processors have been releasing similar products, with Helcim being the latest. Stripe is also launching a similar product, which we detail below.

Card Reader | Smart Terminal |

|---|---|

|  |

$99 | $349 |

Tap, Chip & PIN transactions | Tap, Chip & PIN transactions |

Email receipts, batch history, inventory tracking | Email & print receipts, batch history, inventory tracking, built-in POS, employee logins |

The following user review websites rate Helcim as:

- Capterra rating: 4.1 out of 5 from around 25 reviews

- G2 rating: 4.2 out of 5 from around 15 reviews

- Trustpilot rating: 4.2 out of 5 from about 350 reviews

Users Like | Users Don’t Like |

|---|---|

Helps save on monthly credit card fees | Software bugs/issues |

Free invoicing feature | Issues with the mobile payment app |

Excellent onboarding support | Limited scalable features |

Chase: Best Direct Processor

Pros

- Direct processor

- Same-day funding for Chase Business Checking customers

- Negotiable rates

- Leverages all Chase network data to offer business insights

Cons

- Some plans require long-term contracts

- Not all pricing disclosed on website

- Best value for Chase banking customers

What we like:

Chase Payment Solutions (formerly Chase Merchant Services) offers merchant services for any business looking to work with a traditional bank, especially if your business accounts are with Chase. Having Chase as both the processor and receiving bank in transactions can provide speed and security by removing the intermediary.

Chase Business Checking customers really get the best value from using Chase as a merchant service provider. With a checking account, you can access Chase QuickAccept, a free mobile payments app that includes same-day deposits and dispute management.

Chase is one of the few direct processors that offer flat-rate fees for small businesses. Larger businesses can also negotiate competitive interchange-plus pricing, like you’d find with Helcim.

- Monthly fee: $0

- Card-present transaction fee: 2.6% plus 10 cents

- Card-not-present transaction fee: 2.9% plus 25 cents

- ACH processing fee:

- Real time deposits: 1% (capped at $25), non reversible

- Same-day deposits: 1% (capped at $25), reversible

- Standard deposits (1-2 business days): $2.50 for the first 10 transactions, 15 cents for additional, reversible

- Contract length: Most plans are month-to-month

- Early termination fee: $0

- Chargeback fee: $25

- Card readers: From $49.95

Chase Smart Terminal* | Countertop Terminal | Mobile Terminal | Chase QuickAccept Mobile Card Reader* |

|---|---|---|---|

|  |  |  |

$399 | $299 | $399 | $49.95 |

Wireless, Wi-Fi-enabled credit card terminal with digital and email receipts, transaction search, and more. | Ethernet or Wi-Fi connection with 24/7 support. Color screens with tipping functions and built-in receipt printers. | Same as the countertop terminal, but with a mobile battery that can power 450 transactions between charges. | Use the Chase Mobile app and optional card reader to accept swipe, chip, and contactless payments on the go. |

Only one online user review website has a profile for Chase’ payment processing:

- Trustpilot rating: 4.4 out of 5 from about 60 reviews

Users Like | Users Don’t Like |

|---|---|

Helps save on monthly credit card fees | Software bugs/issues |

Free invoicing feature | Issues with the mobile payment app |

Excellent onboarding support | Limited scalable features |

Payment Depot: Best for No Percentage Markup

Pros

- Low-cost membership pricing

- No contract or cancellation fee

- 24/7 customer support

Cons

- Next-day funding available w/ fee

- ACH payment is an add-on service

- US merchants only

What we like:

Payment Depot is a merchant service provider with a membership pricing model that offers payment processing at extremely competitive rates. One membership with Payment Depot includes interchange-plus pricing for card-present, online, virtual terminal, and mobile payments.

After being acquired by Stax, Payment Depot now also offers similar wholesale interchange-plus rates with no percentage markup—just a flat fee of 8 cents for card-present transactions and 18 cents for card-not-present transactions.

However, with its much lower monthly fee of $79 (compared to Stax’ $99 for the same processing volume of up to $21,000/month), Payment Depot is one of the cheapest credit card processors for small established businesses, including retailers, restaurants, salons, auto shops, medical practices, and B2B companies.

In 2023, Payment Depot changed to a single subscription plan of $79. However, there are volume restrictions and businesses processing $21,000 and more per month will pay higher monthly fees.

- Monthly fee: $79 (for up to $250,000 annual sales volume or $21,000/month)

- Card-present transaction fee: Interchange plus 8 cents

- Card-not-present transaction fee: Interchange plus 18 cents

- Contract length: Month-to-month

- Early termination fee: $0

- Chargeback fee: $25

- Card readers: From $49

- Other fees: Payment Depot will charge a $19.99 monthly fee for Payment Card Industry (PCI) noncompliance if you do not keep your business compliant

Payment Depot also no longer offers free equipment reprogramming or same-day funding options. However, since its merger with Stax, Payment Depot subscriptions now come with Stax’s software solutions including invoicing, Text2Pay, recurring payments, an analytics dashboard, and more.

Payment Depot has a wide selection of card readers available, including mobile and countertop solutions from popular brands like Clover, Poynt, and SwipeSimple. Those hardware items have quote-based pricing.

Mobile Card Reader | Smart Terminals | POS Hardware |

|---|---|---|

|  |  |

Swipe Simple B250 | Clover and Dejavoo | Clover |

The following user review websites rate Payment Depot as:

- Capterra rating: 4.7 out of 5 from about 60 reviews

- Trustpilot rating: 3.8 out of 5 from about 1,300 reviews

Users Like | Users Don’t Like |

|---|---|

Seamless payment processing migration | Poor customer support |

Latest card terminal models | Lacks support for PCI compliance |

Great rates for large volume sales | Reports of unexpected fees |

Stax: Best for Recurring Billing

Pros

- Membership model interchange-plus pricing

- User-friendly software

- Unique add-on tools

Cons

- Pricey software packages

- Lacks same-day funding options

- ACH payments and next-day funding w/fee

What we like:

Stax (Formerly Fattmerchant) is a popular merchant service provider with dedicated solutions for small and large businesses, as well as SaaS platforms. Similar to Payment Depot, Stax offers membership-based interchange-plus pricing. However, Stax’s pricing plans are targeted more toward fast growing businesses processing above $20,000 per month.

With Stax, merchants get robust invoicing and recurring billing tools such as secure card-on-file payments, advanced CRM, and white-label customer portals. It even offers

short message service (SMS) text-to-pay solutions and robust reporting, which are also not common offerings.

These tools make Stax ideal for growing businesses that primarily collect payments through invoicing and particularly recurring billing such as professional services.

- Monthly fee: From $99 (depends on processing volume and software packages)

- Card-present transaction fee: Interchange plus 8 cents

- Card-not-present transaction fee: Interchange plus 18 cents

- Contract length: Month-to-month, 30-days’ notice to cancel

- Early termination fee: $0

- Chargeback fee: $25

- Card readers: Custom quote

Stax hardware is custom-quoted. A selection of BBPOS mobile readers, Z terminals, and PAX terminals are available. We have previously been quoted $100 for mobile readers, $175 to $300 for Z terminals, and $500 to $650 for PAX models. These are available for purchase for a one-time fee, or through monthly fees with protection plans.

Mobile Card Reader | Smart Terminals | POS Hardware |

|---|---|---|

| ||

Swipe Simple B250 | Clover and Dejavoo | Clover |

The following user review websites rate Stax as:

- Trustpilot rating: 4.1 out of 5 from about 1,000 reviews

- G2 rating: 4.9 out of 5 from about 15 reviews

Users Like | Users Don’t Like |

|---|---|

Wholesale rates | Lacks same-day funding |

Feature-rich software | Unexpected charges |

Responsive customer support | Onboarding errors |

QuickBooks: Best for QuickBooks Accounting Users

Pros

- Transparent, flat-rate pricing

- Volume discounts for businesses processing more than $7,500 monthly

- Invoicing and recurring billing tools, including ACH payment processing

- Seamless integration with QuickBooks accounting

Cons

- Only makes sense if you already use QuickBooks

- Limited hardware options

- Not ideal for high volume of card-present transactions or ecommerce payments

What we like:

If you already have a QuickBooks account, QuickBooks Payments can provide you with strong features and good rates. If you regularly process over $7,500 a month, you can apply for a discount of up to 40% on transactions. The other processors on our list that offer discounts usually do so at a higher volume.

QuickBooks, along with many others on this list, rank among the best B2B payment solutions. It has Level 2 processing, which gets you cheaper rates for B2B transactions. It also has invoicing tools and lets you designate multiple accounts for deposits.

- Monthly fee: $30 (for QuickBooks Online)

- Card-present transaction fee: 2.5%

- Invoice transaction fee: 2.99%

- Keyed-in transaction fee: 3.5%

- ACH transaction fee: 1%, $10 max

- Contract length: None

- Early termination fee: $0

- Chargeback fee: $25

- Card readers: $49

Note: Lower rates may be available with other QuickBooks plans although please also note that QuickBooks has announced the discontinuation of service for most QuickBooks Desktop services. QuickBooks also frequently offers promotions on its subscriptions, so you may be able to get a lower initial monthly fee.

QuickBooks Card Reader |

|---|

|

$49; $79 with Power Stand |

Accept EMV chip, debit, credit, Apple Pay, and Google Pay payments. Connects wirelessly to phone or tablet via Bluetooth for the QuickBooks GoPayment app. Stays charged for up to a week. |

QuickBooks offers a single mobile card reader option that is compatible with QuickBooks’ GoPayment mobile app. Countertop pin pads were previously available through QuickBooks POS, but the QuickBooks POS product is being discontinued.

You can also accept payments directly through the QuickBooks Online accounting software by sending an invoice or manually keying in the payment. Learn more in our tutorial on how to enter credit card transactions in QuickBooks Online.

The following user review websites rate QuickBooks as:

Users Like | Users Don’t Like |

|---|---|

Easy-to-use payment platform | Faulty card reader and payment app |

Convenient invoicing on mobile app | Poor customer service |

Integrated accounts receivable | Additional cost for payment processing |

Did you know? Fit Small Business has an entire QuickBooks course led by our in-house CPA, Dr. Tim Yoder. See our QuickBooks tutorials for more information.

Stripe: Best Online Payment Processor

Pros

- Powerful, user-friendly developer tools, and application programming interfaces (APIs)

- Robust security, reporting, and account management tools

- Supports more than 35 countries and 135 currencies

- Transparent, flat-rate pricing

Cons

- Lacks out-of-the-box mobile functionality

- Best for those with software development skills or resources

- Add-on fees for invoicing and recurring billing

What we like:

Stripe is a payment processor with sophisticated software and APIs ideal for online businesses. Stripe’s pre-built integrations make it easy to connect a Stripe checkout to almost any website or software. Besides PayPal, it’s the easiest to integrate for online sales.

One of the best features of Stripe is the number of different payment types it can work with. Accept ACH and echeck payments, WeChat, Klarna, Apple Pay, Google Pay, cross-border payments, and more.

With Stripe, you can configure subscriptions, recurring billing, or one-time payments for different checkout needs, such as per-seat pricing, metered billing, coupons, free trials, prorates, overages, and usage-based fees. You can also update expired or renewed customer card information automatically.

Though custom solutions are what Stripe is best at, it also offers several no-code options like payment links, adding a pricing table to your website, and setting up a basic checkout page.

- Monthly fee: $0

- Card-present transaction fee: 2.7% plus 5 cents

- Card-not-present transaction fee: 2.9% plus 30 cents

- Keyed-in transaction fee: 3.4% plus 30 cents

- ACH: 0.8%, $5 cap

- Invoicing: + 0.4%–0.5%

- Recurring Billing: + 0.5%–0.8%

- 1% additional fee for international cards and currency conversion

- Contract length: None, pay-as-you-go billing

- Early termination fee: $0

- Chargeback fee: $15 per lost dispute

- Chargeback protection and coverage available for 0.4% transaction fee

- Card readers: $59–$349

You will need to sign up for a Stripe merchant account to access the purchase hardware options within the merchant account dashboard.

Stripe Reader M2 | BBPOS WisePOS E | Stripe Reader S700 |

|---|---|---|

|  |  |

$59 | $249 | $349 |

Accept EMV chip, contactless, and mobile wallet payments. This battery-powered reader connects to your POS app via Bluetooth. | Android-based POS with a 5-inch display including PIN functionality. Connects to a third-party POS app via Wi-Fi. | Android-based smart reader for mobile and countertop use. Customize or use pre-built elements. Connects via Wi-Fi or Ethernet. |

The following user review websites rate Stripe as:

- Capterra rating: 4.7 out of 5 from about 3,000 reviews

- G2 rating: 4.3 out of 5 from about 290 reviews

Users Like | Users Don’t Like |

|---|---|

Simple and easy to use once completely set up | Extended holding time of, and some reported canceled, payouts |

Ability to do test payments | Some reports of delayed account approval |

Wide range of ecommerce integrations | Refunds to customers without notice |

Did you know? Stripe makes our list of:

PayPal: Best for Ecommerce & Occasional Sales

Pros

- Easy to use

- Trusted by customers

- Accept international and PayPal payments

Cons

- Account stability issues

- Monthly fee for virtual terminal

- Complex pricing

What we like:

PayPal is a household name offering user-friendly payment processing for online, mobile, and in-store sales. PayPal offers competitive flat-rate fees and is quick and easy to sign up for. It also has discounted rates for nonprofit organizations.

Plus, adding PayPal as a payment option can increase online store conversions and reduce cart abandonment because shoppers don’t need to type in payment or shipping information. PayPal alone makes this distinction and is often used with other merchant accounts like those on our list.

However, PayPal is not a traditional merchant account. This means business accounts can be flagged and frozen if the company deems anything suspicious, which is problematic for businesses relying on daily deposits. So, PayPal is a recommended option for low-volume and occasional sales or an additional payment option for online stores.

- Monthly fee: $0 to $30

- Card-present transaction fee: 2.29% plus 9 cents through PayPal Zettle (PayPal’s free POS app)

- Online transaction fee: 2.99% plus 49 cents

- PayPal Checkout transaction fee: 3.49% plus 49 cents

- QR code transaction fee: 2.29% plus 9 cents

- Contract length: None, pay-as-you-go billing

- Early termination fee: $0

- Chargeback fee: $20

- Card readers: $29–$199

PayPal changes its pricing frequently. The rates in this guide were last updated July 2023. Check the PayPal website for current pricing.

PayPal Card Reader | PayPal Terminal |

|---|---|

|  |

$79 (first one $29) | $199 (model with built-in barcode scanner available for $239) |

Accept chip, PIN, and contactless payments. Connect to Zettle POS app via Bluetooth. Battery lasts eight hours or 100 transactions. Optional charging dock available. | Portable touch-screen POS pre-programmed with PayPal Zettle. Accept chip, PIN, contactless, and QR payments. Battery lasts 12 hours (four to six hours with intensive use).

|

The following user review websites rate PayPal as:

- Capterra rating: 4.7 out of 5 from about 25,000 reviews

- G2 rating: 4.4 out of 5 from about 2,000 reviews

Users Like | Users Don’t Like |

|---|---|

Easy-to-use payment app | Frozen funds |

Easy website integration | High currency conversion fees |

Now available for in-store payments | Poor customer support |

Still deciding if PayPal is right for you? Learn more:

PaymentCloud: Best Approval Odds

Pros

- 98% of high-risk accounts are approved

- Excellent customer support

- Customized high-risk payment gateway

- Crypto and zero-cost processing available for low-risk businesses

Cons

- Pricing not disclosed

- Longer application and approval process

- Charges extra for virtual terminal and payment gateway

What we like:

PaymentCloud is a popular merchant service provider that specializes in high-risk accounts. The company has relationships with more than 10 banks and a step-by-step application process to help you submit all the documents needed to get approved by one of their partner banks. Even if other merchant account providers have turned you down, PaymentCloud can likely get you approved.

PaymentCloud does offer traditional merchant services in addition to high-risk account services. However, high-risk payment processing is what PaymentCloud is best known for. Many other merchant service providers refer high-risk businesses to PaymentCloud because of its excellent reputation in getting businesses approved.

- Monthly fee: $10–$45

- Typical low-risk transaction fees: 2%–3.1%

- Typical mid-risk transaction fees: 2.25%–3.4%

- Typical high-risk transaction fees: 2.7%–4.3%

- Payment gateway monthly fee: $15

- One-time virtual terminal fee: $15-$45

- Contract length: None, month-to-month options available

- Early termination fees: Waived

- Chargeback fees: $25–$45

- Cross-border fees: 1%–2%

- 1,000+ integrations available, no API required

Monthly account fees depend on the business type. Flat-rate and interchange rates are available depending on your business needs and discounts are available for high-volume businesses.

PaymentCloud has many options for card readers and POS systems. However, PaymentCloud does not disclose specific models or pricing on its site. You’ll need to contact PaymentCloud for a specific quote.

If you’re migrating over to PaymentCloud from a different processor, PaymentCloud will reprogram your existing equipment if possible.

The following user review websites rate PaymentCloud as:

- Capterra rating: 4.7 out of 5 from about 20 reviews

- Trustpilot rating: 4.3 out of 5 from around 500 reviews

Users Like | Users Don’t Like |

|---|---|

Excellent customer service | Complaints of unexpected fees |

Seamless onboarding and set up | Some issues of frozen accounts |

Easy-to-use system | Could use more guides/tutorial |

Dharma: Best Merchant Services for Transparent Pricing

Pros

- Affordable and transparent pricing

- Next-day funding options

- Free MX Merchant account

Cons

- Higher markups for American Express transactions

- Monthly fees for some payment services

- Strict application process

What we like:

Dharma Merchant Services specializes in working with small businesses and is known for being very transparent and honest in its practices. Every single fee—even account closure fees—is listed on Dharma’s website. In addition to transparency and affordable pricing, Dharma is an eco-friendly company and, to date, has donated over $750,000 to nonprofits.

Dharma offers low-cost interchange-plus pricing to low-risk merchants processing at least $10,000 monthly. Merchants processing more than $100,000 or 5,000 transactions qualify for volume discounts, which are also available on Dharma’s website. There are also special rates for restaurants with low average tickets.

- Monthly fee: $10-$15

- Card-present transaction fee: Interchange plus 0.15% plus 8 cents

- Card-not-present transaction fee: Interchange plus 0.20% plus 11 cents

- American Express card-present transaction fee: Interchange plus 0.25%

- American Express card-not-present transaction fee: Interchange plus 0.3%

- Invoicing and recurring billing: $10 per month

- Integrated ACH (check) processing: $25 per month, 40 cents per transaction

- B2B (level 2 and level 3) processing: $20 per month to get reduced interchange rates

- Contract length: Month-to-month

- Account closure fee: $49

- Chargeback fee: $25

- Card readers: $269 to $479 for full terminal

- Clover POS systems available

Verifone Engage V200c Terminal | FD-150 Terminal | Ingenico Desk/5000 for B2B | Dejavoo Z11 |

|---|---|---|---|

|  |  |  |

$295 | $295 | $369 | $295 |

Accepting swipe, chip, PIN, and contactless payments and print receipts. Compatible with B2B payments, level 2 rates, and multimerchant configuration. | Accept swipe, chip, PIN, and contactless payments. Print receipts and reports and connect optional customer-facing displays. | Swipe, chip, PIN, and contactless payments, including B2B card-present transactions. Hardwire, Wi-Fi, or 4G cellular connectivity. | Swipe, chip, PIN, and contactless payments. Compatible with MX Advantage to program surcharging. |

Dharma has additional terminals available with external-facing PIN pads designed for accepting tips. Additionally, because Dharma is part of the TSYS network, it is compatible with many POS systems. You can also purchase Clover POS hardware, including Clover Flex, Mini, and Station, through Dharma.

The following user review websites rate Dharma as:

- Capterra rating: 5 out of 5 from 1 review

- Trustpilot rating: 4.7 out of 5 from 110 reviews

Users Like | Users Don’t Like |

|---|---|

Easy-to-use platform | Occasional card processing fails |

Excellent tech support | Pricing can be confusing for beginners |

Transparent pricing |

Methodology—How We Evaluated the Best Merchant Services

We evaluated dozens of payment processors across 22 data points divided into the categories of Pricing and Contract, Payment Types, Account Features, and Expert Score. We also considered our personal experience using each processor, feedback from small business owners, and our own interactions with customer support for the different systems.

We only considered processors that offer flat-rate, subscription, or interchange-plus pricing and excluded processors that only offer tiered pricing models because they can be misleading for small businesses.

Click through the categories below for our full criteria:

30% of Overall Score

Transaction fees weighed heavily here. We also awarded points for month-to-month or pay-as-you-go billing and no monthly, cancellation, or chargeback fees. and only included providers that offer competitive and predictable flat-rate or interchange-plus pricing. We also awarded points to processors that offer volume discounts.

30% of Overall Score

The best merchant accounts can accept various payment types, including POS and card-present transactions, mobile payments, contactless payments, ecommerce transactions, and ACH and e-check payments, and offer free virtual terminal and invoicing solutions for phone orders, recurring billing, and card-on-file payments.

20% of Overall Score

20% of Overall Score

Meet the Experts

| Meaghan Brophy has about 5 years of experience evaluating payment processors at Fit Small Business, including testing systems first-hand and interviewing small businesses on their experiences. Previously, Meaghan has 10+ years of experience working in independent retail. |

| Anna Dizon has over 5 years of experience evaluating payment processors for Fit Small Business. Before that, she worked for PayPal and handled payments automation for a risk mitigation company. |

How to Choose the Best Merchant Services

Some merchant services are more compatible with certain business types than others. So when choosing the best payment processor, it’s crucial that you are already familiar with the types of services that your business needs. Once you have that down, follow these guidelines:

Merchant services offer a wide range of payment methods for both card-present and card-not-present transactions. You will likely be looking for a combination of both so narrow down your options with providers that can offer the cheapest rates based on your processing volume.

- Card-present methods are generally done through swiped, EMV chip, contactless, and digital/mobile wallet payments. Debit cards and prepaid cards such as gift cards, EBT, and FSA are also card-present payments.

- Card-not-present payment methods are primarily remote transactions that not only refer to credit card payments, but other forms of payments as well such as ACH, echecks, and bank transfers.

Payment processing tools refer to a merchant service provider’s set of features used to process card-present and card-not-present payment methods.

- Invoicing and recurring billing

- Virtual terminal

- Online payment gateway (website checkouts, shareable payment links)

- Stored card payments

- Level 2 and 3 data processing for B2Bs

- Cross border payments

- Nonprofit payment processing

Ideally, you will find a provider that offers most of these features for free, otherwise, you should look for one that matches your business needs without charging additional monthly cost. Check out our recommendations for international payments, high-risk, B2Bs, and nonprofits.

Some merchant services come with business management integrations. You will find providers with built-in integrations that will allow you to use these features for free, while others come with an additional monthly cost.

Examples:

- QuickBooks and Wave are primarily paid accounting and bookkeeping platforms with built-in payment processing.

- Square offers free and paid POS software with built-in payment processing features. It also provides add-on business management tools such as loyalty and rewards management, marketing tools, and employee management.

- iATS is a nonprofit management platform with its own credit card processing service.

- Clover is a point-of-sale (POS) software and hardware provider with a range of business management features that can be programmed to work with a number of merchant services providers.

Note that all of the merchant services providers in our list have direct integrations with third party business management softwares.

Card readers can be mobile paired with a mobile payment app, wireless stand alone with an integrated POS app, or built-in to your countertop POS hardware. Depending on your business model, you may need one or all of these card readers.

Whatever card reader type you need, check for the following features before deciding on an option:

- At least a one year warranty on the hardware

- Your preferred card-present payment methods (swipe, EMV chip, contactless, digital payments)

- Compatibility with mobile device operating systems for mobile credit card readers with mobile apps

- Payment/POS app that’s integrated to your main POS system for mobile and wireless card readers

- Ability to process credit card payments without internet connection

- Great user reviews to ensure reliability (minimal failed transactions) and long battery life for processing payments on the go

- Security features (tokenization, encryption) to protect your transactions

In general, merchant services differ in pricing structure, set up & application, contract terms, security measures, funding speed, and customer service. For this category, choosing the right merchant account features will depend on your business size.

- Small businesses and startups benefit more from merchant services that do not require an application process, simple set ups, pay-as-you-go term, zero monthly account fees, and flat payment processing rates.

- Small, established businesses as well as mid-sized, and fast growing businesses will get better rates with its higher sales volume. Instead of flat payment processing fees, they can look for merchant services that offer interchange plus transaction rates. Pay-as-you-go contract terms are still ideal, but these types of merchants can easily qualify for a more secure traditional merchant account that requires an application process.

- Mid-sized to large businesses that process higher transaction volumes can get even better rates with a merchant service provider that offers monthly fees plus wholesale transaction rates (with no percentage markups).

- High-risk payment processing requires a special category of merchant services that can help businesses that fall under the category of “high risk” get approved for a merchant account.

- Funding speed is ideally business day with option for same-day deposits for a fee. Merchant services for small businesses usually charge for batch fees while some that cater to large volume businesses do not charge extra.

- Payment security such as various tokenization and encryption technology should be one of your non-negotiable requirements for a merchant account service. Fraud detection tools can be simple (best for small businesses and startups) or customizable (ideal for large volume businesses). PCI security is also essential but look for a provider that will assist you with compliance.

- Customer support should include availability of live assistance (phone, email, chat) as well as offline resources such as knowledge base and video guides. Additionally, you should also know how much assistance you would need and you would get during the merchant application process, migration, and setting up of your merchant account.

Applying for Your Merchant Account

Choosing the merchant services you want for your business is just the beginning. Depending on the solution you choose, you’ll need to submit an application.

Our guide walks you through the application process, the documents you’ll need, red flags to watch out for, and tips for negotiating lower rates.

Best Merchant Services Frequently Asked Questions (FAQs)

Anything under 2.5% is good and under 3% is average.

Small businesses typically pay between 1.9% to 3.75% per transaction, with online and card-not present transactions being more expensive.

550 is the minimum credit score you’ll likely need for a dedicated merchant account. Aggregate payment processors (like Square or PayPal) don’t require a credit check. However, aggregate processors aren’t compatible with all businesses. It’s possible to get a merchant account with bad credit, you just may need to work with a dedicated high-risk processor.

Square is the best option for many businesses. Helcim offers low pricing, and PaymentCloud is excellent if you’re having trouble getting approved.

No. In some cases, you can pass along the fees to your customers through surcharging, cash discounting, or convenience fees, but there is no way to accept credit or debit payments without a fee.

Bottom Line

Choosing the right merchant account provider can save your business lots of money in fees each month. The best payment processors are also easy to use, offer good value with business solutions, and integrate with popular software. Plus, merchant accounts should be transparent and reliable.

Visit Square, our top pick, to see if it’s a good fit for your business.