Level 2 and 3 credit card processing are transaction types reserved for businesses that accept payments from other organizations (typically high-volume B2B transactions) instead of individual customers. These processing levels can save your company money—but they come with additional requirements, so you need a card processing service that can handle that additional data.

We’ll explore Level 2 and 3 processing, including those additional requirements, further in this guide.

What Are Processing Levels?

Credit card processing transactions are categorized into three levels depending on the amount of information needed and who is making the purchase: Levels 1, 2, and 3 (or Levels I, II, and III). Level 1 is the most common and used for most purchases by individuals. Meanwhile, Levels 2 and 3 are used for government and business purchases and require more information.

Credit Card Data Processing Compared

Level 1 | Level 2 | Level 3 | |

|---|---|---|---|

Used For | Business-to-customer (B2C) transactions | Business-to-business (B2B), corporate | B2B, corporate, government (B2G) |

Average Savings (via Reduced Interchange Rate) | N/A | 0.45%-0.90% | 1% |

Information Needed | Basic purchasing information | Basic purchase info, plus more details on taxes, orders, invoice | Level 2 data, plus more details on products, discounts, shipping |

Card Providers | All major card brands | Visa, Mastercard, American Express | Visa, Mastercard |

Transaction Levels | No minimum requirement |

| 20,000-1 million in ecommerce transactions |

Level 2 and Level 3 processing primarily differ in data verification and credit card processing fees. Level 2 requires less customer data but offers a smaller discount in rates than Level 3.

Level 3 collects more customer information but generally provides merchants with the best discounts. Collecting additional customer data makes the transaction more secure and reduces the risk of fraud or chargebacks.

Who Uses Level 2 and Level 3 Credit Card Processing?

In general, you can benefit from Level 2 or 3 card processing if you process a high number of purchases from businesses, corporations, commercial enterprises, or the government. Any kind of business can qualify, from retail to service, as long as it meets the customer set and minimum number of transactions.

However, it is best practice to consult with your payment processor to ensure that you qualify for the reduced rates

Level 2 Data

Often used by small and mid-sized businesses that sell to other businesses, Level 2 data processing involves additional transaction details. Merchants include the relevant customer reference number, sales tax, merchant tax ID, merchant state, minority, and zip code in addition to the basic credit card information.

Most advanced payment processors can add this program as a built-in feature or via API configuration.

- Merchant name

- Merchant category code

- Billing zip code

- Purchase amount

- Purchase date

- Purchase order number

- Customer code

- Destination zip

- Destination address

- Destination city

- Destination state

- Invoice number

- Merchant tax identification number (TIN)

- Sales tax amount

- Sales tax indicator

While lower than Level 3 processing, Level 2 still affords merchants significant discounts. The average card-not-present fee is 2.9% + 30 cents per transaction but for Level 2 qualified transactions, merchants only pay anywhere between 2.05% to 2.5% + 10 cents.

Because more information is gathered, Level 2 purchases are more secure than Level 1 and less likely to be disputed. This means fewer chargebacks for you.

You must meet the minimum transaction levels and fill out the applications for each card provider. Note that Discover does not offer a Level 2 or 3 data processing program.

For Visa:

- Process between 1 to 6 million Visa transactional annually

- Fill out a Self Assessment Questionnaire

- Submit an Attestation of Compliance form

- Conduct a quarterly network scan by an approved scan vendor to maintain your qualifications

For Mastercard:

- Process between 1 to 6 million combined Mastercard/Maestro transactions

- Fill out an Annual Self Assessment form

- Fill out an Onside Assessment of Merchant Discretion form

- Conduct a quarterly network scan by an approved scan vendor

For American Express: Pre-approval is required

- Submit Level 2 Merchants’ Validation Documentation, which includes:

- Summaries of findings of the Quarterly Network Scan

- Completed Payment Card Industry (PCI) Self Assessment Questionnaire

Level 3 Data

Businesses that have governments and other businesses as clients can qualify for Level 3 data processing. These organizations use specially issued corporate and government credit cards for making payments. The amount of additional data needed for this program is far greater than Level 2 and would require a merchant to work with a payment processor that can automate the collection.

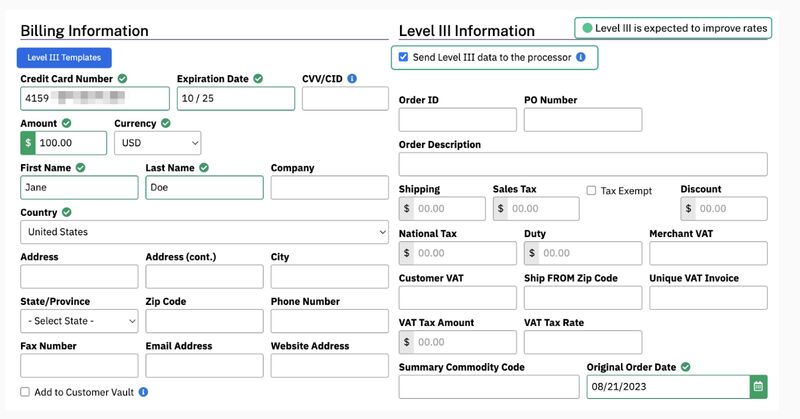

Level 3 data processing on a virtual terminal (Source: NMI)

- All Level 2 data

- Commodity code

- Country code destination

- Debit/credit indicator

- Duty and/or import taxes assessed

- Extended price

- Freight and/or shipping cost

- Item ID or SKU

- Item description

- Line discount

- Unit of measure (each)

- Unit price

- Unit quantity

- VAT information/reference number

By default, Level 3 data transactions are processed faster than Levels 1 and 2. Interchange rates are also far lower with Level 3 data processing, providing an average of 1% savings per transaction.

Like Level 2, the additional collected information improves security and protection from chargeback. However, the extensive data requirement means that merchants can manage and track transactions more efficiently than Level 2 data.

As with Level 2, your business should meet the minimum transaction levels and fill out the applications for each card provider. Note that American Express does not offer Level 3 data processing.

For Visa:

- Process between 20,000 to 1 million ecommerce transactions annually

- Fill out a Self Assessment Questionnaire

- Submit an Attestation of Compliance form

- Conduct a quarterly network scan by an approved scan vendor to maintain your qualifications.

For Mastercard:

- Process between 20,000 to 1 million combined Mastercard/Maestro transactions annually

- Fill out an Annual Self Assessment form

- Complete an Onside Assessment of Merchant Discretion form

- Conduct a quarterly network scan by an approved scan vendor.

How Do I Start Taking Level 2 & Level 3 Payments?

Once you have approval, you need to make sure you have a credit card processing terminal and point-of-sale (POS) software that can handle the additional data.

Sign Up for a Merchant Account

Many merchant services can help you with processing Level 2 and 3 payment data. Among those we review, Stax, Payment Depot, and Dharma Merchant Services come to mind. These services offer interchange-plus pricing that takes into account the reduced interchange rates provided by the card services when using Level 2 and 3 payments.

Choose a Payment Gateway

Sometimes, the merchant service and payment gateway are the same. However, if you need a payment gateway—which handles the transfer of information—speak to your merchant service or check out our list of the best payment gateways.

Set Up Your POS system

Your POS or invoicing system needs to be able to collect the data needed for the increased processing level. You’ll also need to train your employees to ensure that the information is provided. For example, if you process a payment for a nonprofit, you won’t need to calculate taxes. However, to qualify for the Level 2 or 3 processing, this information is required, so you must put in a zero rather than leaving that area blank. See our guide to the leading POS systems and software for options.

Configure Your Card Terminal

Not every card terminal retrieves the data needed for Level 2 or 3 processing. Be sure to discuss your needs with your vendor and make any necessary software upgrades to ensure the data is collected and transmitted.

Frequently Asked Questions (FAQs)

These are some of the most common questions we encounter about Level 2 and Level 3 credit card processing.

If you are not getting Level 2 or 3 business rates, then there are a few things that could be happening:

- You don’t qualify to receive the special pricing. See our section above.

- Your merchant account or gateway is not processing the transactions accordingly. You need to check your contract or contact your payment processor about this.

- Your payment processor charges a flat rate. If you use a flat rate processor like Square, you will not get special rates.

- Your equipment is not sharing the correct data. Be sure your card terminal is up to date and programmed to handle enhanced data programs.

Your customers can benefit from higher processing as well. Business cards allow corporations to set spending limits and add restrictions. The additional data you provide through the Level 2 and 3 processing helps them track sales tax details and ensure the card is being used properly.

Level 3 requires additional product identification information and freight or shipping cost information, in addition to the shipping and tax information required for Level 2. Businesses also need to meet certain volume requirements for Level 3. The benefit is lower processing fees.

Discover does support Level 2 data, but it does not offer a decreased interchange rate.

Bottom Line

Level 2 and 3 credit card processing is not for every business, but for those that do steady commerce with other businesses, corporations, or the government. These entities must charge with a Visa, Mastercard, or (for Level 2 only) American Express. In return, you need a payment processor and equipment that can handle the increased data. You get reduced card processing fees and your customers get more information about the purchases made by employees.