TurboTax, by Intuit, is a do-it-yourself (DIY) tax software that allows you to prepare and file your returns electronically either online or through its desktop versions. Its features include W-2 import, a deduction maximizer, and a mobile app. With its online products, you can file simple returns for free or choose from two paid DIY packages that start at $69 per return for federal filing, plus $59 per state for state filing.

You can sign up for a Live version of TurboTax―unlimited tax advice as you do your taxes―for FREE if you file your simple return before March 31, 2024. TurboTax Live starts at $89 for simple Federal returns and $64 for state returns filed after March 31, 2024. You can also upgrade to full service, where a tax pro does your taxes for you, with prices that also start at just $89 for federal filing and $79 for state filing.

Pros

- Offers complete products for every tax situation

- Includes maximum refund and 100% accuracy guarantees

- Ability to import cryptocurrency transactions

- Excellent customer support options

Cons

- More expensive than most other DIY tax filing programs

- State returns cost an additional $59 each

- Need to purchase a separate program for corporations and partnerships

- Requires an additional fee if you use your refund to pay the software cost

- QuickBooks users wanting a streamlined tax solution: TurboTax allows you to transfer your financial data quickly from QuickBooks to your tax forms. You can also import data from Square, Lyft, and Uber.

- Freelancers and self-employed professionals needing a tax expert: Consult with a tax professional to understand the impact of tax reforms on your unique tax situation and get the best possible outcome when filing.

- Taxpayers looking to import cryptocurrency transactions: TurboTax partners with Coinbase to help you e-file your cryptocurrency gains and losses. With TurboTax Premier, you can import up to 250 transactions at once from Coinbase.

- Businesses needing inexpensive DIY filing options: The online DIY filing options of H&R Block are less expensive than TurboTax in every category, including state filing fees.

- Freelancers looking for free software to file an individual return with Schedule C: We selected FreeTaxUSA as the best free tax software for freelancers because it allows self-employed business owners to file their Schedule C for free, plus a state tax return at a low cost.

- Businesses requiring an online program to prepare both individual and business returns: TaxAct is the only software reviewed that allows for online preparation of both individual returns (Form 1040) and business returns (Forms 1120, 1120S, and 1065).

Check out our guide on the best small business tax software for additional options. In it, we evaluated several solutions and narrowed our recommendations down based on the price of preparing the typical bundle of returns required by most business owners.

TurboTax Deciding Factors

Intended Users | QuickBooks users and freelancers who want to consult with a tax expert |

Business Returns Supported |

|

Communication | Phone, live chat, one-way video conferencing |

User Reviews | User reviews averaged 2.4 out of 5 over the three review sites we examined |

Federal Online Preparation & Filing | $0 to $129 |

State Online Preparation & Filing | $0 to $59 |

Federal Live Assisted | $0 to $219 if filed before March 31, 2024 $89 to $219 if filed after March 31, 2024 |

State Live Assisted | $0 for simple returns filed before March 31, 2024 $64 for others |

Federal Live Full Service | Starting at $89 to $389 |

State Live Full Service | $79 |

CD or Downloadable Version | $50 to $130 |

Free Trial of TurboTax | Pay only when you file for the online program |

Mobile App | ✓ |

100% Accuracy Guarantee | ✓ |

Cryptocurrency Support | ✓ |

Free Plan Available | ✓ |

Tax Calculator | ✓ |

TurboTax Alternatives

Best for: Businesses that want inexpensive DIY filing options | Best for: Freelancers looking for free software to file an individual return with Schedule C | Best for: Taxpayers looking for an online program to prepare both individual and business returns |

Business returns from $99.95 for federal and state plus $19.95 for state return e-filing | Free filing of complex federal returns and $14.99 for state returns | S-corp returns from $159.99 for federal plus $54.99 per state. |

Read our H&R Block review | Read our FreeTaxUSA review | Read our TaxAct review |

TurboTax Pricing

TurboTax Online pricing can be confusing. First, you choose the situations that apply to you and TurboTax will show you the price of their Free/Basic, Deluxe, or Self-Employed version that applies to your needs. Then, you select DIY, Live Basic (assisted), and Live Full Service depending on your preference. Assisted plans provide a consultation with a tax professional, while with the Full Service plan, a tax professional prepares your entire return. All of these versions can also be purchased as desktop software with prices from $50 to $130 for federal returns.

Notice that the pricing for the Full Service plan is only the starting price and the final price will depend on your exact needs and the forms that are required to be filed with your return.

Free/Basic | Deluxe | Self-Employed | |

|---|---|---|---|

DIY Federal ($/Return) | $0 | $69 | $129 |

DIY State ($/Return) | $0 | $59 | $59 |

Live Assisted Federal ($/Return) | $89 | $139 | $219 |

Live Assisted State ($/Return) | $54 | $64 | $64 |

Live Full Service Federal ($/Return) | Starting at $89 | Starting at $219 | Starting at $389 |

Live Full Service State ($/Return) | $79 | $79 | $79 |

W-2 Income | ✓ | ✓ | ✓ |

Child Tax Credit & Earned Income Tax Credit (EITC) | ✓ | ✓ | ✓ |

Audit Guidance | ✓ | ✓ | ✓ |

Mortgage & Property Tax Deductions | N/A | ✓ | ✓ |

Cryptocurrency Transactions | N/A | N/A | ✓ |

Automatic Import of Investment Income | N/A | N/A | ✓ |

Schedule C Business Income & Loss | N/A | N/A | ✓ |

Schedule E Rental Property | N/A | N/A | ✓ |

The free edition is only for simple tax returns, and it covers W-2 income, small amounts of interest and dividends, student loan interest deduction, child tax credit, and EITC. You can file Form 1040 and a state return for free, but you can’t file Schedules 1 through 3. Upgrade to its Live Basic version and get on-demand video access to a tax specialist plus final review.

Deluxe includes all the features in Free, plus access to more than 350 tax deductions and credits. It’s best for maximizing mortgage and property deductions, and it comes with a standalone app called “ItsDeductible” that helps you maximize your charitable donations.

You may wish to upgrade to TurboTax Deluxe Live if you need support for W-2 and unemployment income, mortgage and property tax deductions, charitable donations of more than $300, and student loan interest and education expenses.

The Self-Employed edition is required if you have business income and expenses, cryptocurrency transactions, or rental income. It also allows you to import investment income and can handle many complex investment types.

TurboTax Business

In addition to the individual return software listed in our table above, Intuit offers TurboTax Business as a downloadable program for $190 for the federal program. It can prepare the tax returns for S corporations (1120S), C corporations (1120), partnerships (1065), and trusts (1041). Each state form is an additional $55.

TurboTax Features

TurboTax gives you access to several guarantees and features that help you easily file your federal and state returns while maximizing your deductions. Below is a sample of TurboTax’s most attractive features.

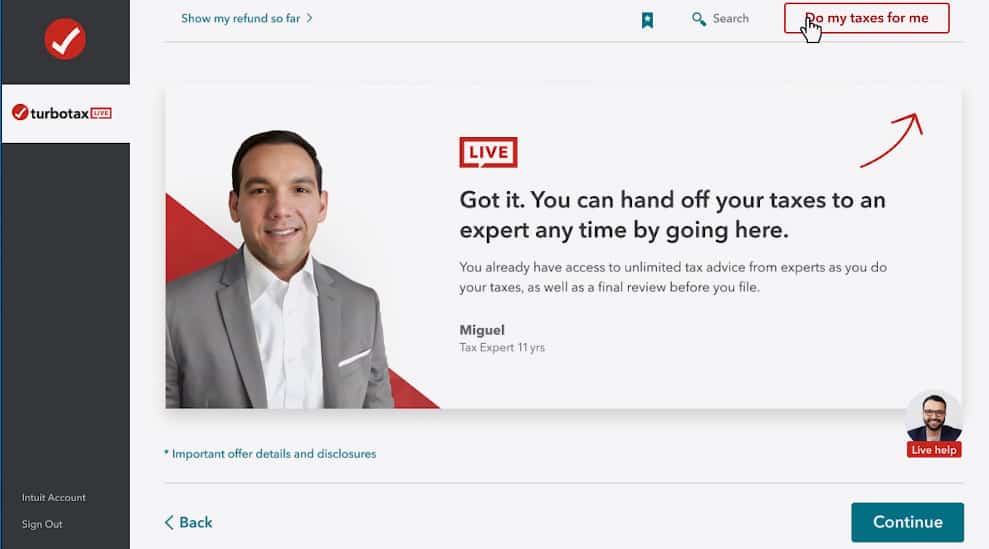

TurboTax Live offers tax services on two different levels: assisted and full-service. The assisted service is ideal if you want access to expert advice while you’re working on your taxes, with a final review.

If you would rather let a tax expert do your taxes for you, you can upgrade to TurboTax Live Full Service. Upon enrollment, you’ll be matched with an accountant or certified public accountant (CPA) who will connect with you on a one-way video call to learn more about your business and then prepare your return from start to finish.

Once your return is ready for review and filing, you’ll meet with your tax specialist again to ensure that the information is accurate. TurboTax Live services are available with each of the subscription plans, from Basic to Self-Employed.

TurboTax Live (Source: TurboTax)

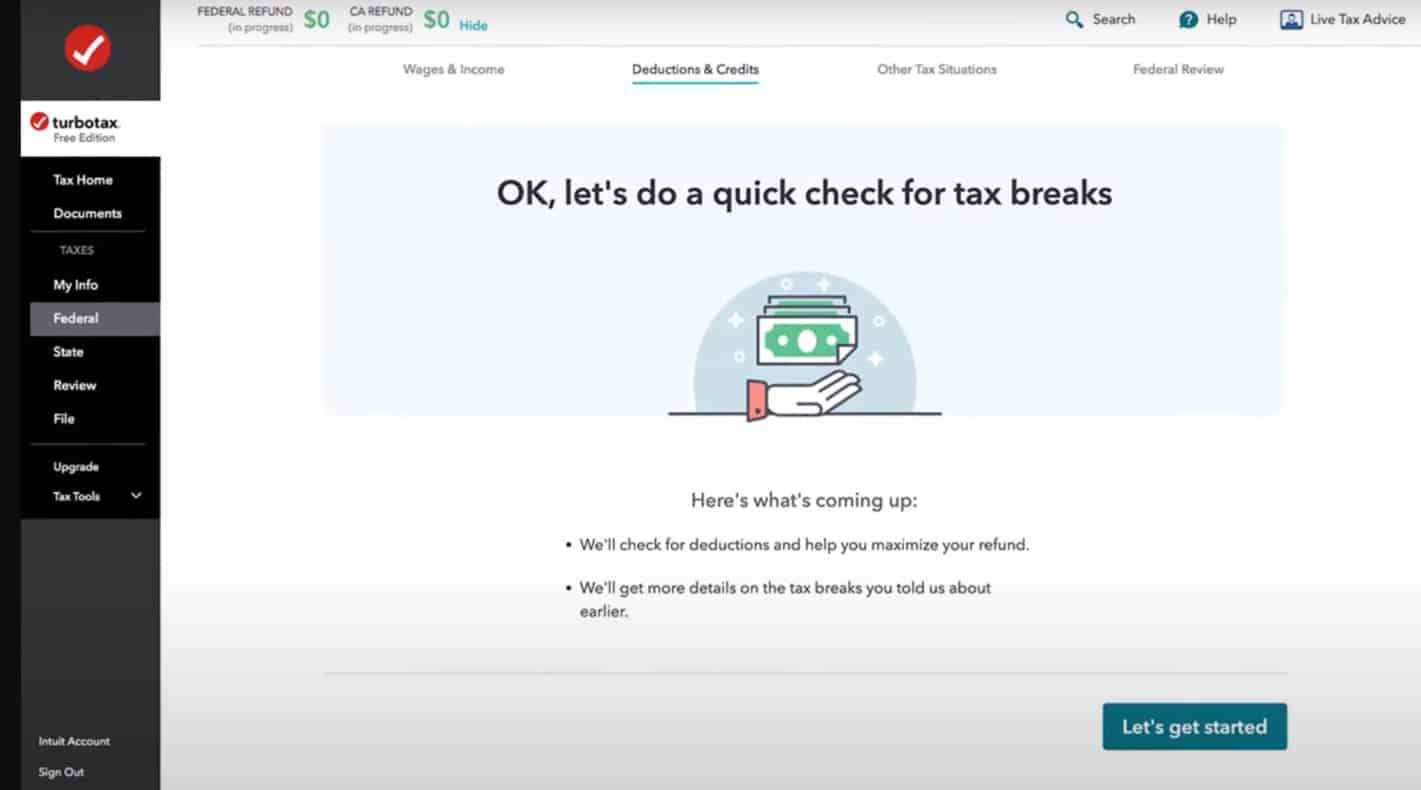

TurboTax will search more than 350 tax deductions and credits to find every qualified tax opportunity that maximizes your refund. You’ll also get step-by-step guidance on how to turn your investments into tax breaks.

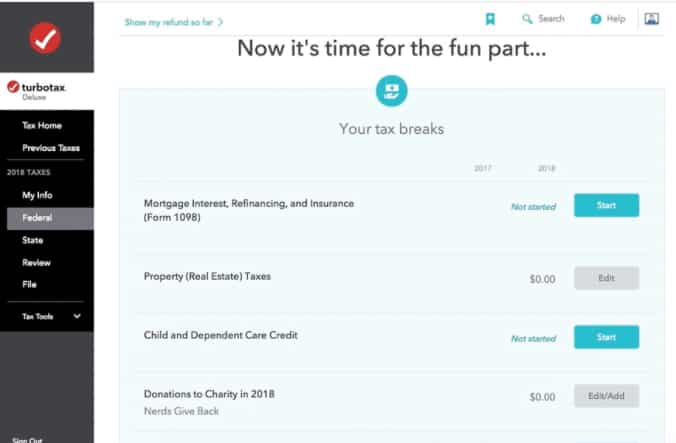

TurboTax Deduction Maximizer (Source: TurboTax)

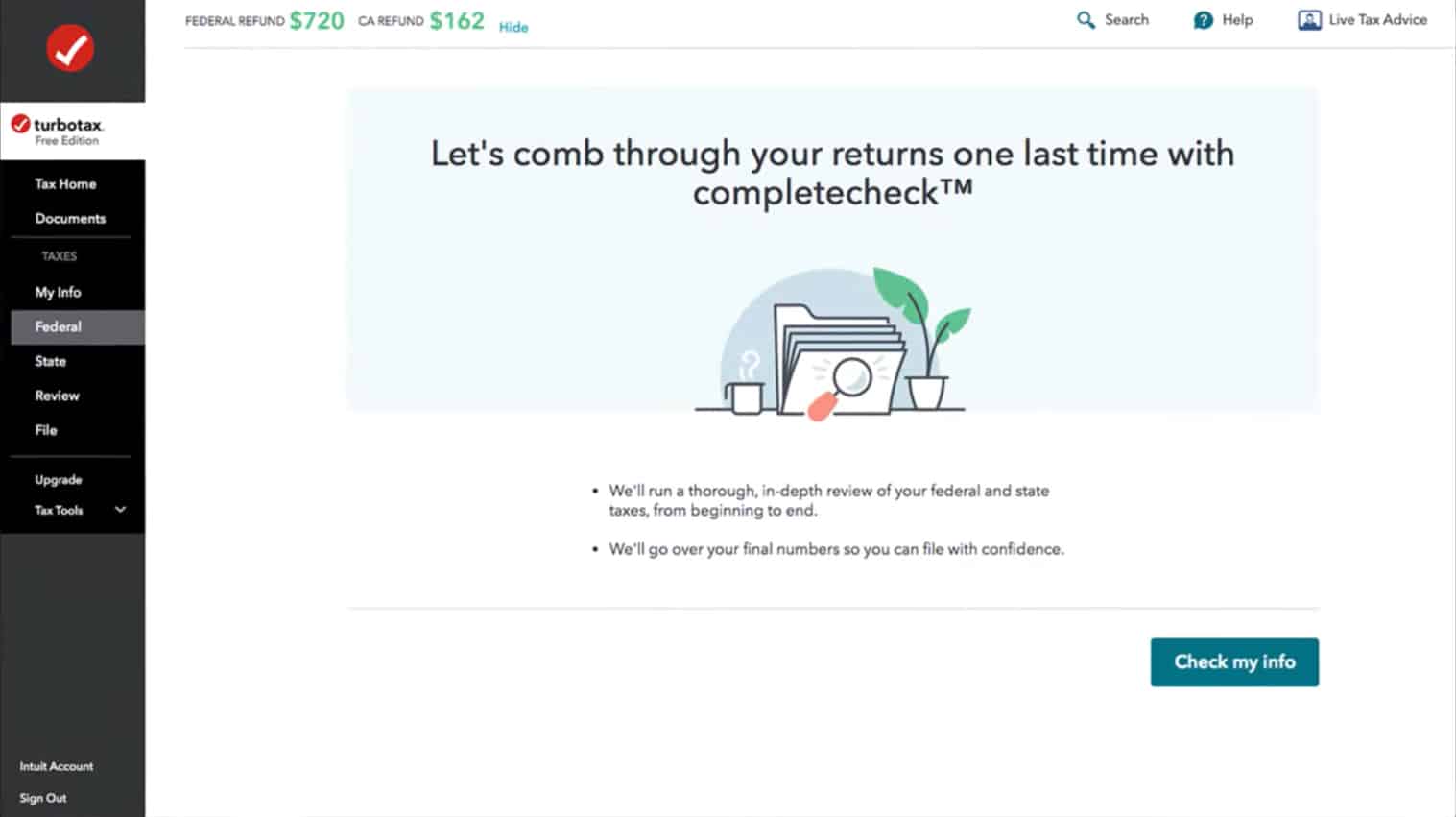

TurboTax CompleteCheck checks for missing, incomplete, or conflicting information. It then guides you to easily fix errors before you file. If you have elected to work with TurboTax Live, a tax specialist will double-check your return for errors before you file and as you go. TurboTax guarantees that all calculations are 100% accurate, or it’ll pay any penalties and interest that you’re charged by the IRS.

TurboTax CompleteCheck (Source: TurboTax)

In the event of an IRS audit, you’ll receive free one-on-one audit guidance from a qualified TurboTax specialist who’ll help you understand your IRS notice and answer all of your audit-related questions. Your tax pro won’t represent you in the audit or provide audit advice (including legal advice), but they’ll provide you with step-by-step guidance on how to get through the process.

If you’re looking for audit defense, TurboTax has partnered with TaxAudit to provide this service. For $49.99 per year, you can avoid the unknown expense of hiring a tax expert by having a prepaid audit defense each year with TaxAudit. It’ll defend both state and federal income tax returns, including those that were filed late. It’ll also explain your options and help you develop a strategy, as well as schedule and attend all audit appointments on your behalf.

The TurboTax mobile app (available for free on Google Play and App Store) lets you use your smartphone or tablet to work on your tax return. You can file your own taxes for free with the edition for simple tax returns, or you can talk live on-screen with one of TurboTax Live’s tax experts. They’ll provide unlimited tax advice and an expert final review before you file with TurboTax. You can also snap a photo of your W-2 and e-file securely from your mobile device.

TurboTax Mobile App (Source: TurboTax)

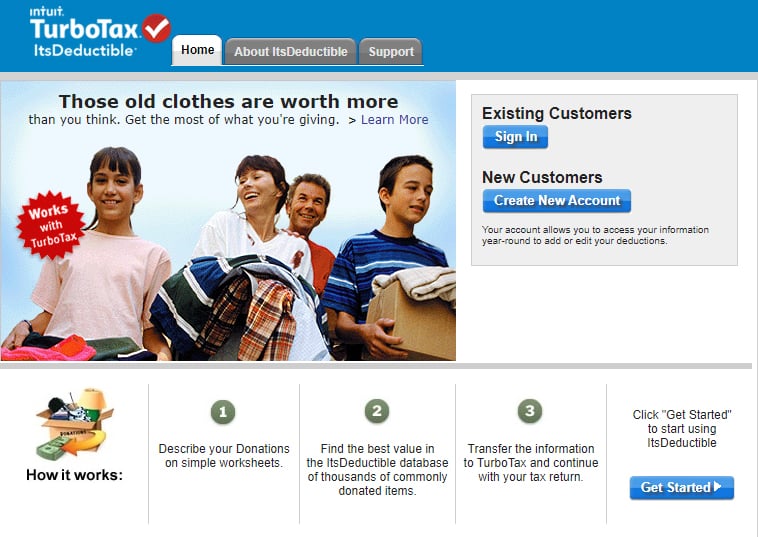

If you make regular noncash charitable donations, you can benefit from TurboTax’s ItsDeductible, which is available with the Deluxe, Premier, and Self-Employed plans. It’s a free online tool that provides the IRS-approved values of your donations. It uses market data from online thrift stores, resale shops, and auction websites such as eBay to estimate the dollar value of your donated items.

To use this app, you need to set up a free account and provide some basic information, including your name, approximate income, and tax filing status.

TurboTax’s ItsDeductible Donation Calculator (Source: TurboTax)

TurboTax imports your W-2 directly from your employer automatically if your employer is partnered with TurboTax. Alternatively, you can take a picture of your W-2 and upload it to your return using the mobile app. You can also import certain 1099s, and TurboTax’s Self-Employed version lets you upload 1099-NEC images as well as income and expenses from Square, Uber, and Lyft.

You can choose to receive your tax refund in several ways: get a paper check, receive a direct deposit to your bank account, apply it to next year’s taxes, or buy US savings bonds. You can also choose to use a portion of your refund to pay for your software, but additional fees apply.

TurboTax Customer Service & Ease of Use

TurboTax features a neat and intuitive user interface that offers easy access to the important tools you need. The left side of the screen displays a vertical toolbar that lets you go to important sections, including MyInfo, Federal, State, File, and Review. Other helpful features for new filers include the site’s content outline, a searchable list of tax forms and schedules, and embedded links with tips and explainers.

There are several ways to get help from TurboTax. You can contact technical support through a chatbot or a contact form. If you’re a paid user, you have access to a TurboTax specialist. Its most outstanding support option is TurboTax Live, which gives you access to a one-on-one review with a tax expert prior to filing and unlimited advice as you do your taxes.

You can also opt for its newest feature, TurboTax Live Full Service, which will prepare and file your return for you. You’ll meet the tax specialist on a video call before they begin work, and then again when your return is ready for review and filing.

TurboTax Dashboard (Source: TurboTax)

TurboTax User Reviews

User reviews for TurboTax are shockingly low with well over 50% of reviewers on the three review sites linked below awarding one star. Many of the negative reviewers discuss issues with less-than-knowledgeable tax professionals and pricing. I agree that TurboTax pricing for 2023 returns continues to be unnecessarily complicated and opaque. Unlike their competitors, TurboTax doesn’t present a straightforward list of the plans, prices, and tax situations covered for their online products. Some users reported being charged an unexpected price after unknowingly upgrading their plan while preparing their return.

Users appreciate that there are tax services available for every tax situation, including the ability to customize the software for users that are well-versed with their particular situation. Reviewers also praised the 100% Accuracy and Audit Support Guarantees which provided peace of mind when filing. The solution’s biggest drawback is the steep price point for state tax filing, and other users issues with applying for the refund advance.

TurboTax earned the following average scores on popular review sites:

- Consumer Affairs: 2.3 out of 5 based on about 3,391 reviews

- GetApp: 4.6 out of 5 based on around 245 reviews

- Trustpilot: 1.2 out of 5 based on 295 reviews

Frequently Asked Questions (FAQs)

Does TurboTax have a mobile app?

Yes, TurboTax offers a free iOS and Android app.

Does TurboTax guarantee a maximum refund?

Yes, with TurboTax’s Maximum Refund Guarantee, if you receive a larger refund or smaller tax due from another tax preparation method, TurboTax will refund the applicable federal and/or state purchase price paid.

Does TurboTax offer live tax help?

Yes, TurboTax offers live tax help in the form of two plans. Live Basic (assisted) plans provide a consultation with a tax professional, while with the Live Full Service plan, a tax professional prepares your entire return.

Bottom Line

TurboTax is the leading DIY tax prep software in the U.S. and is a solid product. However, user reviews have declined sharply in recent years and I encourage you to read some of these reviews to decide for yourself if TurboTax is the right product for you. While tax filers with complex situations will need to upgrade to more expensive plans, it’s still a less expensive option than getting a CPA to do your taxes.