The difference between IRS Forms W-9 vs 1099 is that the former is given to contractors for the purpose of collecting personal information, while the latter is for reporting wages to the IRS.

- Form W-9 is used to gather information about a contractor (like name, address, and Tax ID/SS number) so their earnings can be reported at year-end. It is generally filled out when you first begin working with a contractor.

- Meanwhile, Form 1099 (1099-NEC) is the income-reporting document sent to contractors at year-end (no later than the following Jan. 31), if they earned $600 or more, so they can report and pay taxes on the earnings you paid them. A copy must also be sent to the IRS.

1099 | W-9 | |

|---|---|---|

Information Gathering Document | ✕ | ✓ |

Income Reporting Document | ✓ | ✕ |

Contractor-only Form | ✓ | ✓ |

Employee Form | ✕ | ✕ |

Who Fills Out Form | Employer | Freelancer/Contractor |

When to Collect & Where to File Form | Complete at year-end; Deliver to contractor by Jan. 31; File with IRS by Feb. 28 | Collect from contractor prior to start date; File on site |

Download Forms from the IRS |

As a small business, collecting W-9s and filing 1099s can be a payroll nightmare, especially if you’re managing multiple contractors. Gusto, a payroll software, makes it easy for 1099 workers to enter W-9 information through a self-service portal—no paper required. It also automatically files your 1099s and sends them to both your contractors and the IRS. Sign up for a free trial of Gusto to start paying your independent contractors today.

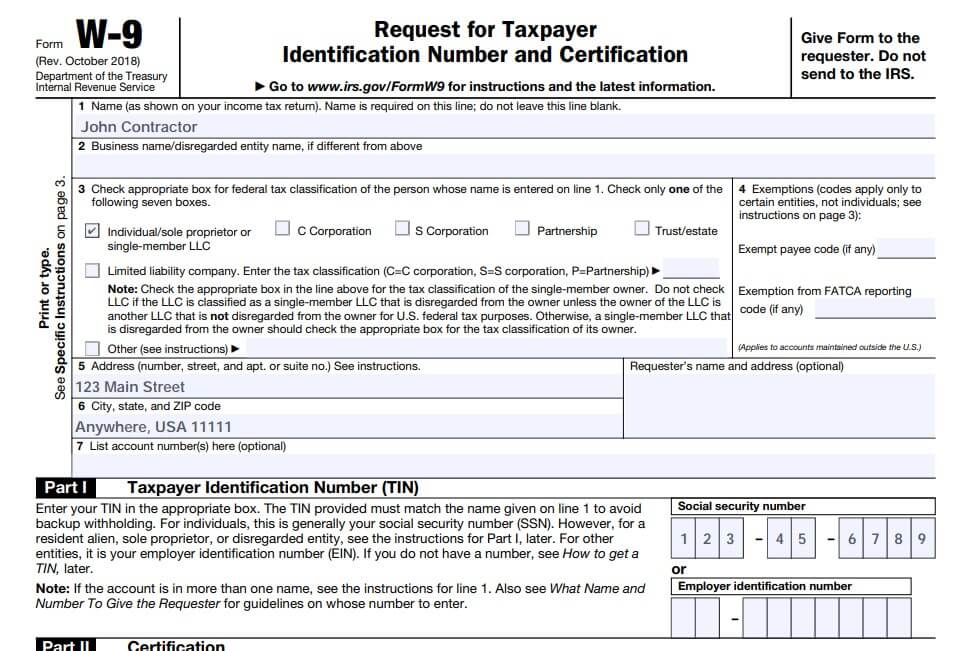

What Is the W-9 Form?

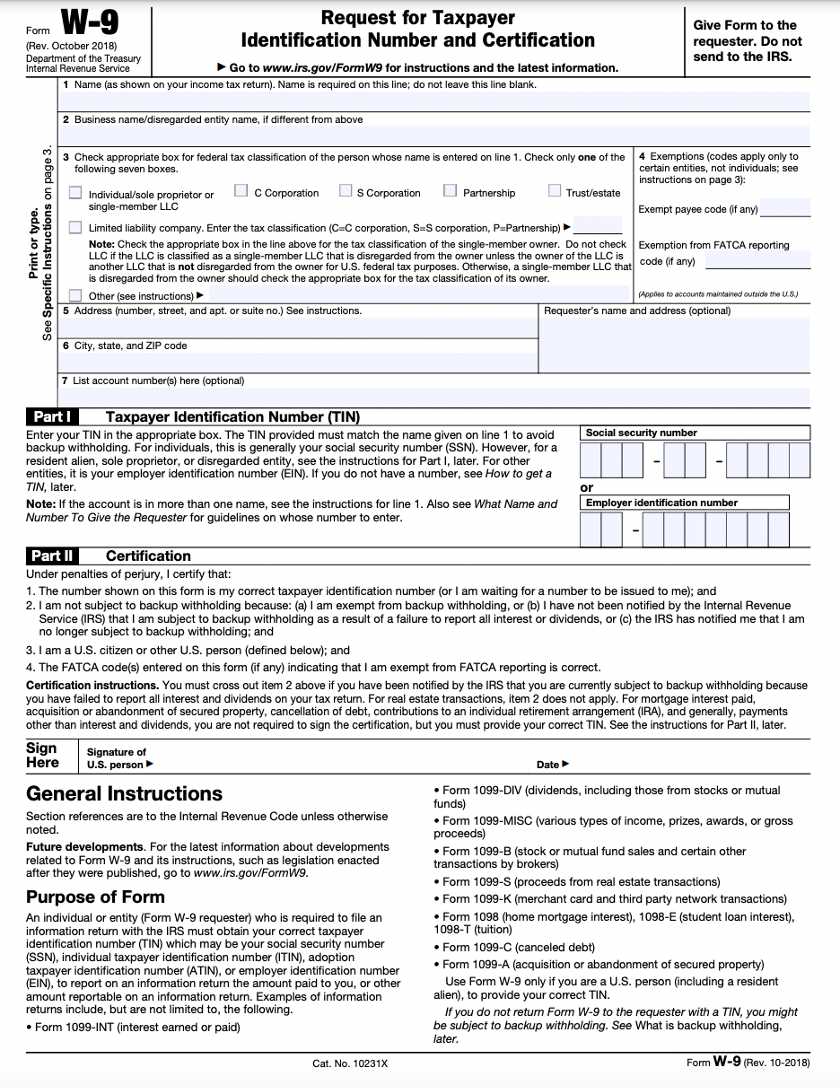

Form W-9, Request for Taxpayer Identification Number and Certification, is an IRS document used to gather data from contractors that your business needs to report to the IRS at year-end. Since IRS forms change, your best option is to use the IRS website as your primary source for any IRS tax forms or instructions. You’ll find detailed directions for filling out the W-9 form there to help your contractors complete the form correctly.

Once your contractor completes the W-9, keep a copy of it on file in case you’re ever audited. The completed and signed document demonstrates that you gathered the correct data for the taxpayer. The IRS does not need a copy of this document.

You can download the W-9 document and instructions in English or Spanish from the IRS website using the links below, or go directly to IRS.gov and search for “W-9.”

- Download a blank copy of the W-9 Form

- Download a blank copy of the W-9SP Form (in Spanish)

- View instructions to complete Form W-9

Most of the data fields on a W-9 are self-explanatory—like name, address, and tax classification—but there is a common question: What is a TIN? The TIN (Taxpayer Identification Number) is issued either by the Social Security Administration (SSA) or the IRS and is used to identify an individual (social security number) or business (employer identification number).

Did You Know? If the contractor doesn’t provide a TIN, you must withhold 24% for federal taxes per IRS regulations. In turn, this should be reported on the 1099-NEC at year-end.

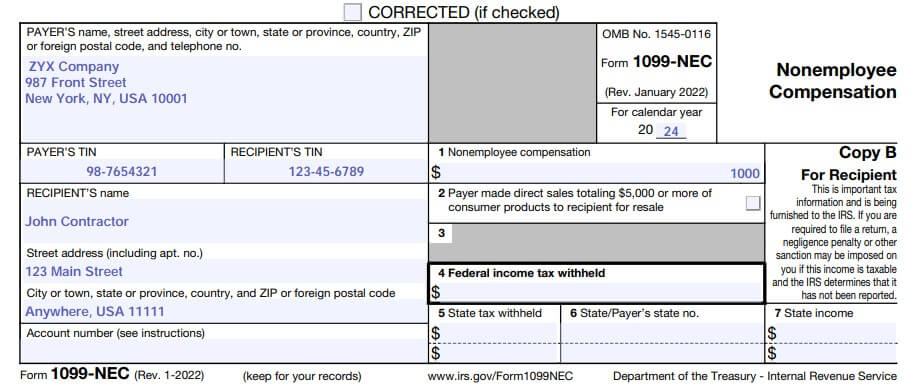

What Is the 1099-NEC Form?

The 1099-NEC is an IRS document that’s used to report all kinds of income, such as that received by an independent contractor for work provided to a business or private employer. It is similar to an employee’s year-end W-2 but used by businesses that pay non-employee contractors, such as freelancers or contract workers.

Typically, you should use a 1099-NEC to report payments made to a contractor who earns $600 or more in a tax year. However, there are a few other scenarios in which a 1099-NEC is needed, such as:

- Reporting crop insurance proceeds: Money insurance companies pay farmers for crops that are damaged or destroyed

- Recording fishing boat proceeds: For self-employed crew members earning money on a fishing boat or vessel

- Disclosing golden parachute payments: Severance pay, cash bonuses, and stock options given to terminated employees

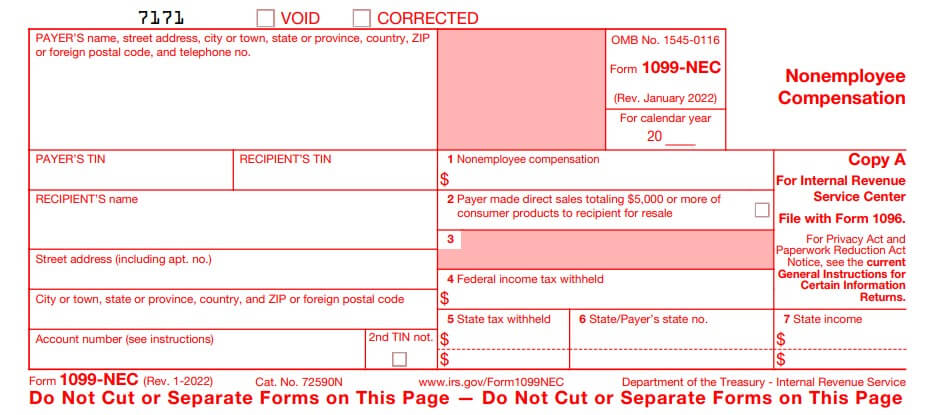

Like the W-9, the 1099-NEC, as well as instructions to use it and a definition of every field, are available to view or download by searching for “1099” on the IRS website.

Download Federal Form 1099-NEC.

SPECIAL NOTE FROM THE IRS WEBSITE: Copy A is provided online for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable, but the online version of it is not. Do not print and file copy A downloaded from the IRS website; a penalty may be imposed for filing with the IRS information return forms that can’t be scanned. Copy B and other copies of this form, which appear in black, may be downloaded and printed and used to satisfy the requirement to provide the information to the recipient.

You can download the 1099 document and instructions by using the links below or going directly to IRS.gov and searching for “1099-NEC.”

- Download a blank copy of the 1099-NEC

- View instructions for completing the 1099-NEC

- View instructions for completing the 1099-NEC in Spanish

When you file your 1099 forms, you will also submit a Form 1096. The 1096 form is a summary of all 1099s you are submitting to the IRS. Check out our complete article on the IRS 1099 form reporting for more details.

The best payroll software makes it easy to import payroll data into an electronic 1099 form so that you don’t have to download or purchase and mail paper copies. This saves you from having to spend money on forms and stamps and provides more accuracy than calculating earnings manually.

For a 1099-NEC, you’ll add your information under “Payer’s Name” and the contractor’s information under “Recipient’s Name.” Then, you’ll show how much you paid in gross income, in Box #3, “Other Income.” You’re not likely to have taken out federal or state income taxes, so leave those boxes blank. Be sure to include your and the contractor’s TIN numbers, where indicated.

Fill out all required boxes on the 1099-NEC form on each copy.

Although the 1099-NEC is used for reporting payments to independent contractors, if the contractor is a non-resident alien or foreign business entity, an IRS Form 1042-S is used instead. This form accounts for unique tax withholding rates and foreign treaties.

The IRS provides a webinar on 1042-S that explains what a 1042-S is and when to use it.

Because W-9s are used to gather information for all kinds of future 1099 payments, we’ve included a few of the common 1099s below. Each 1099 is linked to the IRS webpage where the downloadable documents and instructions for using them can be found.

- 1099-MISC: Used to report miscellaneous income (rents, prizes, and other income payments)

- 1099-DIV: Used to report dividend income and distributions

- 1099-C: Used for cancellation of debt in amounts of $600 or more

- 1099-K: Used for merchant cards and third-party network payments

- 1099-INT: Used to report interest income in amounts of $10 or more

- 1099-S: Used to report proceeds from real estate transactions

While IRS rules are pretty clear, there are little mistakes that may require you to re-issue a 1099. For instance, missing the full name of the contractor, making spelling errors, incorrectly inputting the TIN number, and providing an incorrect payment amount are quite common. You don’t want the contractor to have to pay taxes on $6,000 when they only earned $600, after all.

Other common mistakes include:

- Issuing 1099s to employees: Employees should receive W-2s instead. Learn more in our 1099 vs W-2 Workers article.

- Issuing 1099s to corporations: You don’t need to. Only independent contractors that work for you need 1099s. If you hire a corporate business to do a service, like clean your office each week, no 1099 is needed.

- Missing the Jan. 31 due date: You must submit all 1099-NEC forms with non-employee compensation (in “Box 7” of the 1099) by Jan. 31 of the year following the year for which you’re reporting. Other reported income may be submitted later.

- Sending the wrong 1099 copy to IRS: The IRS provides five copies of the 1099 online, one each for federal and state returns, the contractor, and your records. It also gives an example (that shouldn’t be printed and submitted) of the original one you will submit to the IRS. Printing and submitting this copy (the copy in red ink) can lead to penalties.

- Filing the wrong type of 1099 form: There are numerous 1099 forms. 1099-NEC is what you need to submit to report income for independent contractors.

Aside from having to reissue incorrect 1099s, you are subject to penalties if you don’t submit a proper 1099. The IRS increased penalties associated with 1099s in 2021, and, as a result, businesses were liable to pay up to $280 per return if not filed properly. Rates are set to go up again starting in 2024 (see table below). Additionally, you can be charged separate penalties for not filing correct 1099 copies with the IRS or for not submitting them to your contract workers.

You may incur the following penalties if you fail to file 1099s timely and accurately:

Penalty Per Return | Delay |

|---|---|

$60 | More than 30 days late |

$120 | More than 30 days late but before August 1 |

$310 | Filed on or after August 1 |

$630 | Intentionally neglecting to file |

If you intentionally file a fraudulent information return for payments you claim to have made to another person, you may be liable for additional damages. The person can sue you for up to $5,000 or more in civil damages.

Why You Need Tax Forms for Contract Workers

When processing payroll for contractors, you’re not required to withhold or pay taxes, such as FICA. However, gathering, tracking, and reporting their earnings on the appropriate payroll form is vital because the IRS requires contractors to pay taxes on their own.

Although you’re not responsible for making sure your contract workers pay taxes, you do have the burden of ensuring they receive accurate earnings information by Jan. 31 of the following year to comply; otherwise, you can be penalized.

1099 vs W-9 Frequently Asked Questions (FAQs)

No. The relationship between a W-9 and 1099 is that the W-9 gathers the data that’s later reported to the IRS on a 1099-NEC for contractors that earn $600 or more in a tax year.

A copy of the W-9 is kept in your business files, while copies of the 1099-NEC are provided to the IRS and your contractor. The contractor then uses the 1099 to report their income when filing their taxes.

No. W-2 forms are provided to employees whom you paid through your payroll and 1099 forms are provided to contractors who made $600 or more in the previous year.

Bottom Line

Knowing the difference between W-9 and 1099 forms means your business is prepared to provide the right forms to contractors at the start of their relationship with your business and at the end of each year for tax filing.

If you’re currently working with 1099 contractors or considering doing so in the near future, consider using Gusto. Its system lets contractors submit W-9 information online that transfers to electronic 1099s you’ll send to your contractors and the IRS. Gusto also makes it easy to make direct deposit payments and helps you stay compliant with all federal and state employment laws. Sign up for its contractor-only plan now and get one month free when you run your first payroll (this offer will be applied to your Gusto invoice while all applicable terms and conditions are met or fulfilled).

.