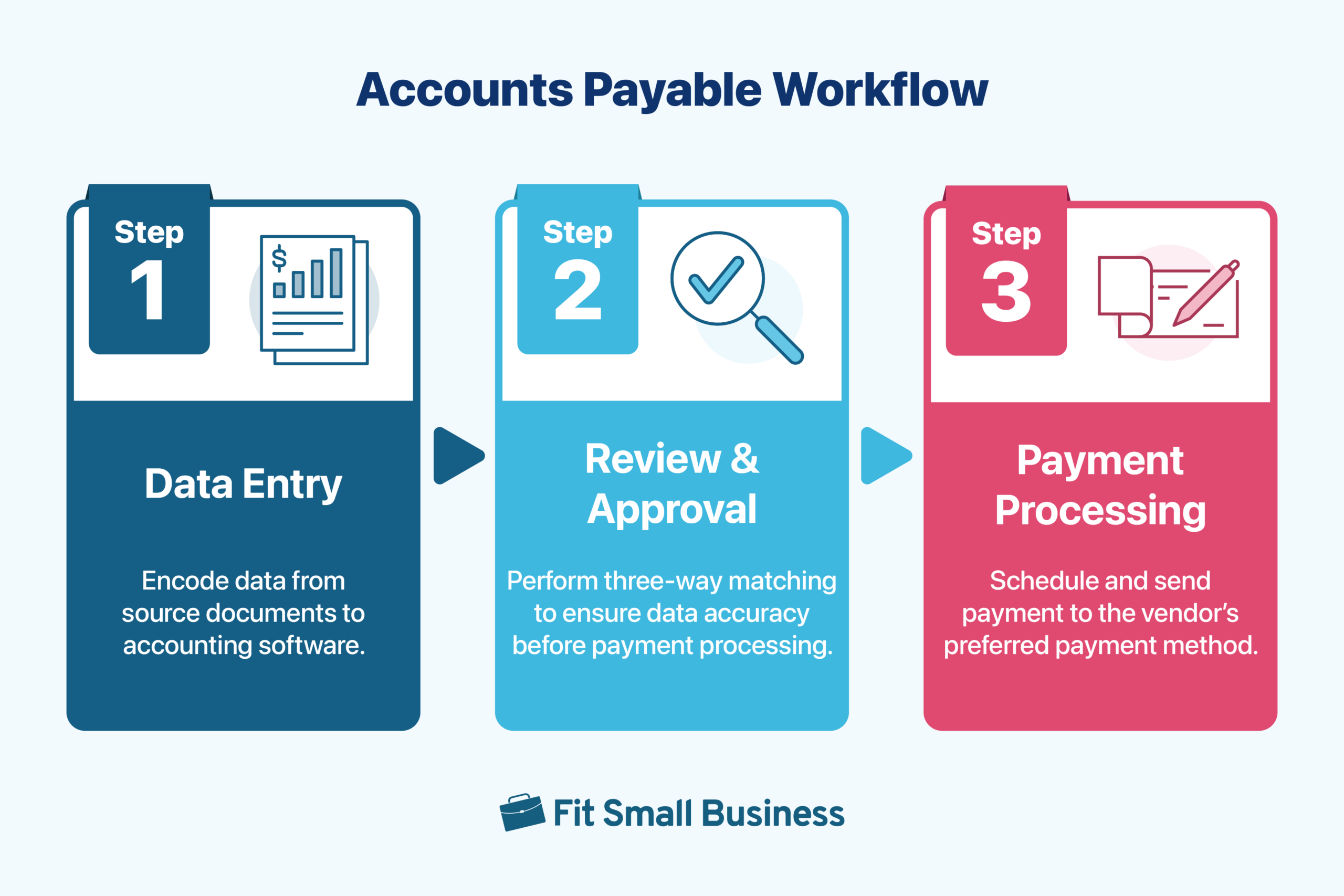

The accounts payable workflow is the process of entering, reviewing, approving, and processing vendor invoices for payment.

Accounts Payable Workflow: 3 Easy Steps for Small Businesses

This article is part of a larger series on Bookkeeping.

The A/P workflow starts immediately after goods have been received. The A/P clerk will first gather all the necessary documents and enter them into the accounting system. They will then review the documents to ensure the accuracy and correctness of the information. After review and approval, they will prepare the payment request and forward it to the employee who will send the payment to the supplier.

The image below is the summary of the full cycle accounts payable process:

Step 1: A/P Clerk Enters the Data in the System

The A/P clerk must first enter the data in the accounting system to officially record the transaction. All documents must be with the A/P clerk to commence this process.

Person Responsible | A/P Clerk |

Documents Needed |

|

Step 1.1: Secure Copies of the PO, RR, and Invoice

The A/P department doesn’t have a copy of the 1) PO right after an order has been made and 2) RR after the goods have been received. They will only receive copies of these documents for payment processing.

Here are things the A/P clerk should do:

- Ask the purchasing department for the accounting department’s copy of the PO.

- The purchasing department often prepares two types of POs: a complete PO and a blind PO. For accounting purposes, you need the complete PO because the blind PO doesn’t show the quantity ordered and the total amount.

- Ask the receiving department to furnish a copy of the RR together with the original copy of the invoice.

- If the vendor sends invoices via email, it’s best to ask vendors to email all invoices directly to the A/P department’s email address.

- Photocopies of the invoice may be furnished to the requesting party but the original copies must stay with the A/P department.

- Stamp both PO and RR documents as RECEIVED with the date of receipt and the signature of the A/P clerk.

- For paperless businesses, the A/P clerk must provide any kind of notification to the sender that the documents have been received.

- For example, replying ACKNOWLEDGED in the email is a form of notification of receipt.

Step 1.2: Enter the PO, RR & Invoice in the Accounting System

Depending on the accounting system you use, the A/P clerk must enter the three documents in the platform for recordkeeping.

- Some small business accounting software don’t have features to record POs and RRs. In that case, another platform must be used for recordkeeping (e.g., spreadsheets). We recommend attaching the scanned PO and RR in the invoice entry as proof of the transaction.

- When recording invoices from vendors, accounting systems record this as a bill. Find the Create Bill or Add Bill function in your software to record.

- After recording, save them as a draft. Since these documents haven’t been reviewed, it’s best not to save and record them in the system.

Step 2: A/P Clerk Reviews the Submitted Documents

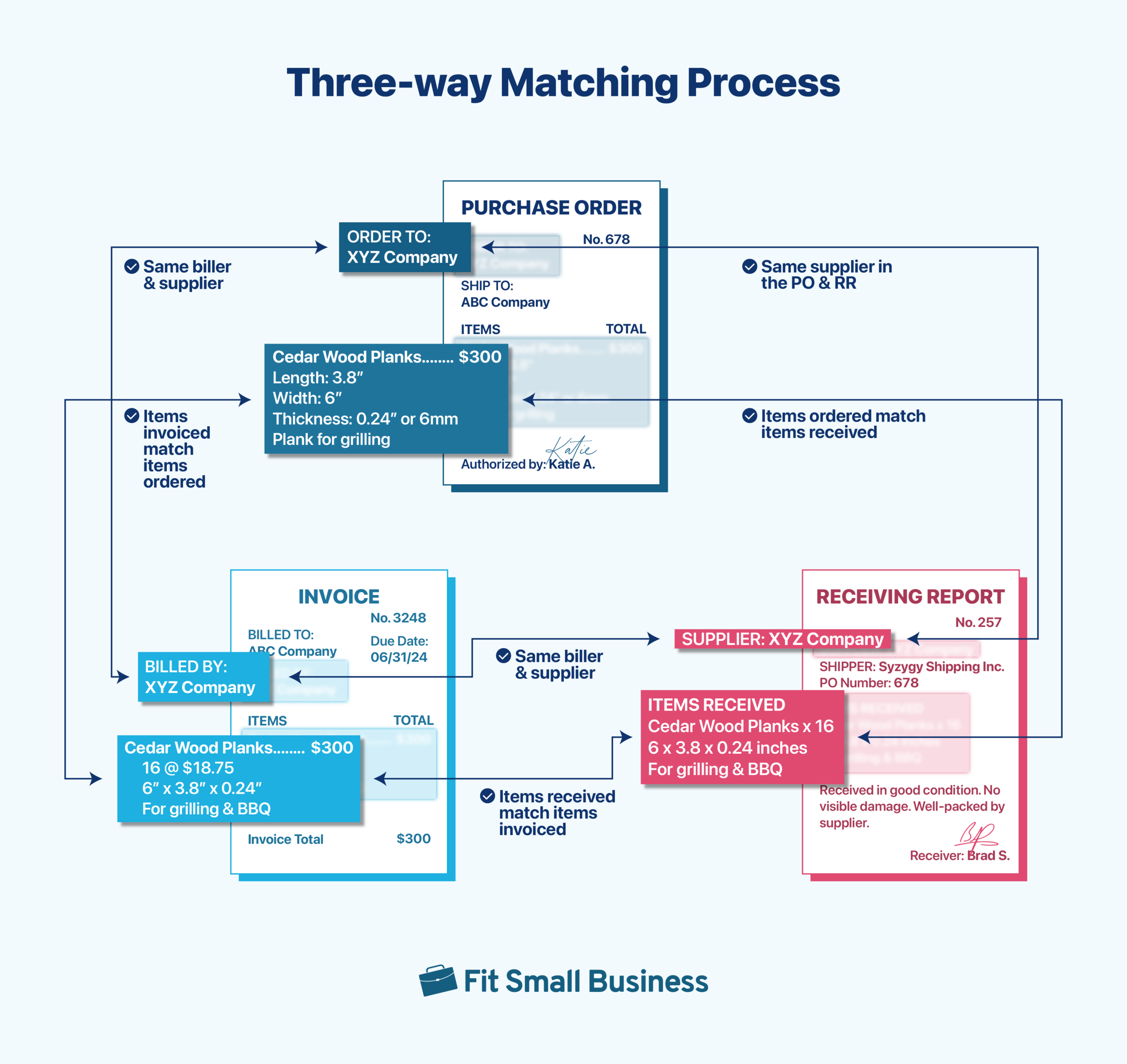

In the second step of the A/P workflow, the A/P clerk’s main responsibility is to ensure that what the company ordered is actually what it received and what it’s been billed for. The A/P clerk should perform a three-way match to verify the completeness, accuracy, and existence of each transaction.

- Completeness: The A/P clerk must have all three documents (PO, RR, and invoice) upon request for payment. All documents must be filled out and have no missing information.

- Accuracy: All information in the PO, RR, and invoice must match. The arithmetical accuracy of all numerical information must also be correct.

- Existence: All items invoiced and ordered must be physically received, meaning that the actual goods are already on the premises of the buyer and in good condition.

Person Responsible |

|

Documents Needed |

|

Step 2.1: Perform a Three-way Match

Three-way matching compares the information in the PO, RR, and invoice to ensure that all information is accurate and correct. The image below shows how to perform a simple three-way match.

In performing a three-way match, the A/P clerk should do the following:

- Check if the invoice and PO match: The biller and supplier, items invoiced, items ordered, and total amounts for both documents should match.

- Check if the PO and RR match: The supplier names, items ordered, and items received for both documents should match.

- Check if the RR and invoice match: The biller and supplier, items received, and items invoiced for both documents should match.

If one of the documents doesn’t match another, reach out to the responsible personnel for questions or clarifications. Learn more about the three-way match in A/P.

Step 2.2: Assemble the Voucher Package

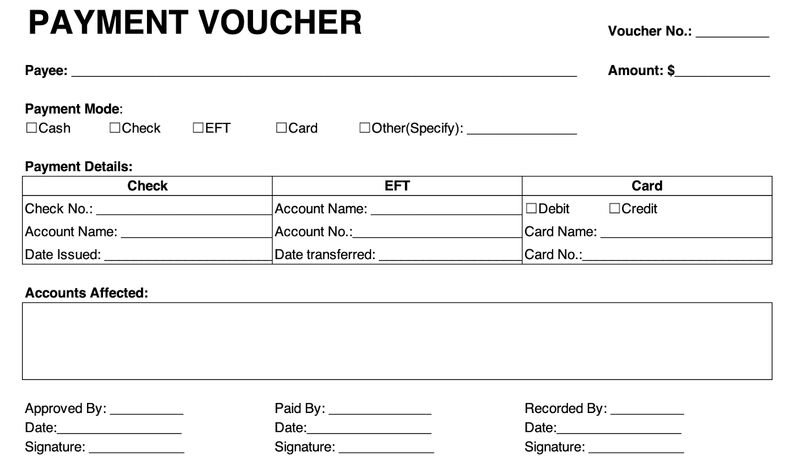

After the A/P clerk performs the three-way match and determines that there are no discrepancies in the documents, they assemble the voucher package and submit it to the A/P manager for payment approval. The voucher package is a compilation of the PO, RR, and invoice. It is attached to the payment voucher.

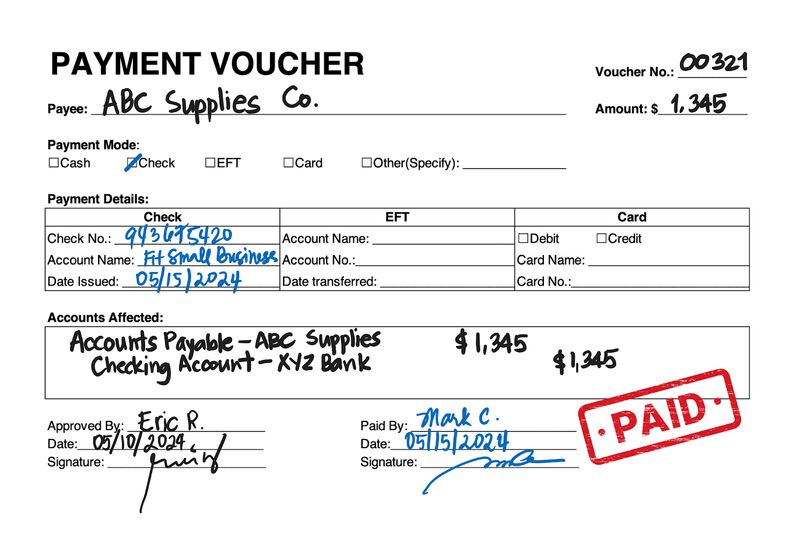

Payment Voucher Template Sample

The payment voucher summarizes the required payment once the A/P clerk determines that all supporting documents match. Which payment method to use is not the A/P department’s decision—the A/P department will only supply the voucher number, amount requested for payment, and accounts affected when completing the form. The A/P manager will then sign the voucher in the Approved By field to approve the voucher for payment processing.

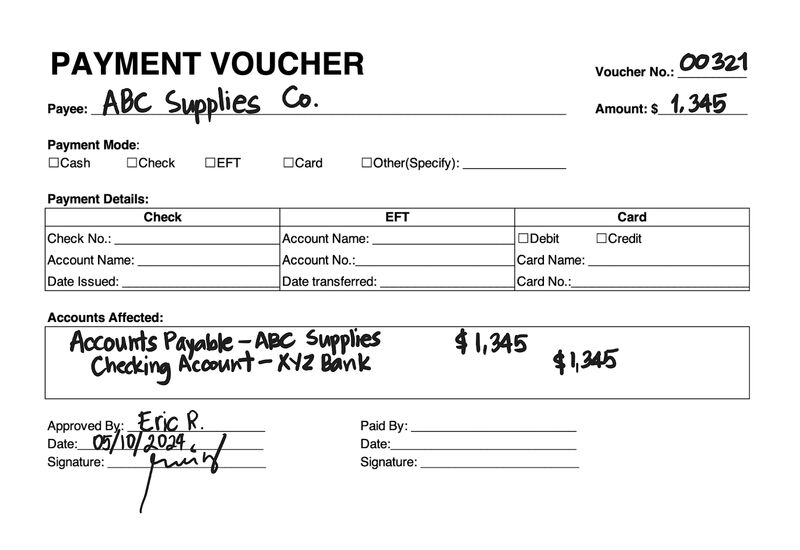

Partially Filled Out Payment Voucher After Clerk’s Approval

The A/P manager then forwards the voucher package to the finance officer who will send out the payment to the vendor.

Step 3: The Finance Department Processes and Sends the Payment

After the A/P department records and approves the payment, the finance officer must be the one who will approve the payment.

While job titles and responsibilities differ across companies, the person who has access to all bank accounts, checks, and cards should be the one to process the payment.

Person Responsible | Finance Officer |

Documents Needed |

|

Step 3.1: Review the Voucher Package

The finance officer should receive the voucher package from the A/P department for payment processing. Though it has already been approved, it is still part of the finance officer’s due diligence to review it and to be the second set of eyes to check if everything is indeed correct. If there are errors, they should return the voucher package to the A/P department for correction.

Here are some things that the finance officer can check for:

Item to Check | How to Check |

|---|---|

Payment Voucher vs Invoiced Amount |

|

Payee vs Biller |

|

Voucher Number |

|

Accounts Affected |

|

Approval Signature |

|

Step 3.2: Send Payment

If everything is correct after the finance officer’s review, they should fill out and complete the payment voucher to include the payment mode and details and affix their signature at the bottom. Once the check has been written or payment has been sent electronically, the finance officer must stamp the payment voucher as PAID to signify that the payable has been settled.

Completed Payment Voucher with “PAID” Stamp

Stamping the voucher ensures that it cannot be reused for fraudulent purposes and signifies that the company has settled its payables to suppliers. The voucher package can then be archived if it has no further use.

Do You Need to Automate the Accounts Payable Workflow?

Automation makes things easier and faster. But in our expert opinion, automating the A/P workflow is only beneficial for businesses processing voluminous transactions daily.

While volume is subjective, we recommend that you still perform an assessment of your business operations and determine if automation is needed. Here are some questions to ask yourself:

- Is A/P processing taking more hours away from your accountant, bookkeeper, or A/P clerk?

- Do you have enough resources (capital and human resources) to accommodate a fully automated A/P workflow?

- Does automating the A/P workflow yield more benefits that outweigh its cost?

- How will automating A/P workflow impact employee productivity? Will it cause layoffs due to redundancies in the manual process?

Our other resources:

Frequently Asked Questions (FAQs)

The A/P workflow should at least have three steps: data entry, review and approval, and payment processing. But as your business grows, these three steps can give birth to multiple additional steps to accommodate the complexity of your transactions and business processes.

The P2P (procure-to-pay) cycle is the parent cycle of the A/P workflow. The P2P cycle starts with the purchase requisition and ends with vendor payment. The A/P workflow happens toward the end of the P2P cycle.

Bottom Line

A well-organized accounts payable workflow can help your business track, manage, and settle payments on time. With clear steps, employees can easily do their jobs and ensure that all A/P transactions are carefully reviewed before sending the payment to the customer.