A credit invoice, sometimes called a credit note or credit memo, is a document issued by a business to a customer when a refund or credit needs to be applied to an already-issued invoice. For example, if your customer returned a defective product or you’ve overcharged them, you may need to issue them a credit invoice to document the refund or credit.

Issuing a credit invoice essentially allows you to correct or cancel the invoice amount without actually deleting the original invoice. This is crucial, as deleting an invoice removes the audit trail—making it very difficult to determine what happened if the situation is reviewed by someone else, like the IRS.

When Is a Credit Invoice Issued?

- Returns and refunds: When a customer returns a product or requests a refund for a service, a credit invoice is issued to reduce the amount the customer owes.

- Pricing adjustments: If a pricing error occurs on the original invoice and results in an overcharge to the customer, the seller issues a credit invoice to reflect the mistake and refund the excess amount.

- Discounts or promotions: Sometimes, sellers retroactively apply discounts or promotional offers after the initial invoice has been issued. In such cases, a credit invoice is issued so that the invoice amount is reduced by the value of the discount or promotion.

- Invoices issued by mistake: When this happens, the seller may issue a credit invoice so that a customer is informed that they don’t have to pay.

- Incorrectly calculated taxes: A credit memo can also be issued to adjust the tax amount on the original invoice and provide a refund for the overpaid tax.

Benefits of Using Credit Invoices

A credit invoice benefits both the seller and customer in several ways, as it:

- Keeps your financial records accurate: By issuing credit invoices, all necessary adjustments to your transactions are reflected in your records. This means that your books reflect the correct amount your customers owe you.

- Builds trust with customers: When you issue a credit invoice to reflect a pricing error, for instance, the customer will get the impression that you are honest and upfront about your financial transactions.

- Resolves disputes quickly: Since you have a clear record of adjustments made to the original transaction, you can resolve any disputes with a customer easily and quickly.

- Ensures legal compliance: Credit invoices provide proper documentation of returns, refunds, and adjustments, which may be necessary for tax purposes in the event of an audit.

Credit Invoice vs Regular Invoice

The main difference between a regular or standard invoice and a credit invoice lies in their purposes:

- A regular invoice typically is used to request payment from a buyer for goods or services provided.

- It increases a business’ accounts receivable (A/R).

- A credit invoice is used for specific purposes like adjustments, returns, and refunds. It’s issued to adjust the amount of the original invoice.

- It reduces a business’ A/R.

Credit Invoice vs Debit Invoice

A debit invoice, also called a debit note or a debit memo, is essentially the opposite of a credit invoice:

- A debit invoice is used when the amount the customer owes the seller needs to be increased. This could be requesting additional payment for goods or services that were undercharged or not included in the original invoice.

- A credit invoice is issued to reduce the amount owed by the customer.

What To Include in a Credit Invoice?

Credit invoices generally have a similar structure to regular invoices, but there are some differences to reflect their purpose of adjusting the amount owed by the customer. Here’s a list of essential information that should go in a credit invoice:

- Company information

- Buyer’s information

- Date of credit invoice issue

- Credit invoice number

- Customer reference number

- Contact information

- Total amount credited

- Itemized lists of products or services (including quantities and prices)

- Reason for issuing the credit invoice

How Credit Invoices Affect A/R

Essentially, a credit invoice is a negative invoice, since it reduces the amount owed by the customer. This means that when a business issues a credit invoice, it reduces the outstanding amount in the A/R ledger for the specific customer by the amount of the credit. That said, credit invoices are essential for managing collectibles by adjusting customer balances and reflecting refunds and returns properly.

How To Create a Credit Invoice

You can create a credit invoice manually using a word processing or spreadsheet tool like Microsoft Word or Excel. It typically involves:

- Adding header information, such as company name, address, and contact details

- Creating a table or list to detail the adjustments being made

- Creating sections for other information, such as the original invoice details, total adjustments, payment terms, and signature if needed.

If you want to save time, the best way to create a credit invoice is by using accounting software like QuickBooks Online (read our QuickBooks Online review). You can choose from premade credit invoice templates, and you can customize and email them to your customers in a few minutes.

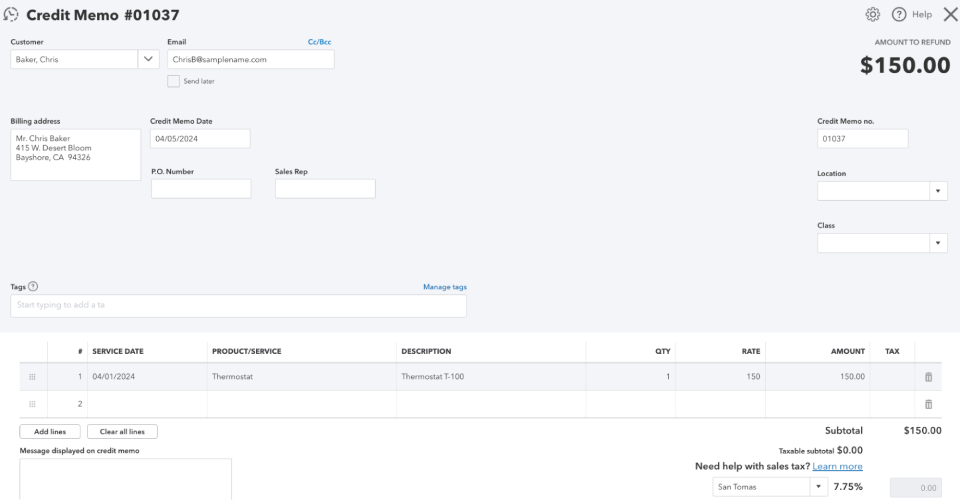

Here’s a glimpse of how easy it is to create a credit invoice in QuickBooks Online. Navigate to the Credit Memo screen and provide all the required information, including the service date, product/service information, quantity, and the amount to refund. Once the credit memo is created, you can email it to your customer directly.

Creating a credit memo in QuickBooks Online

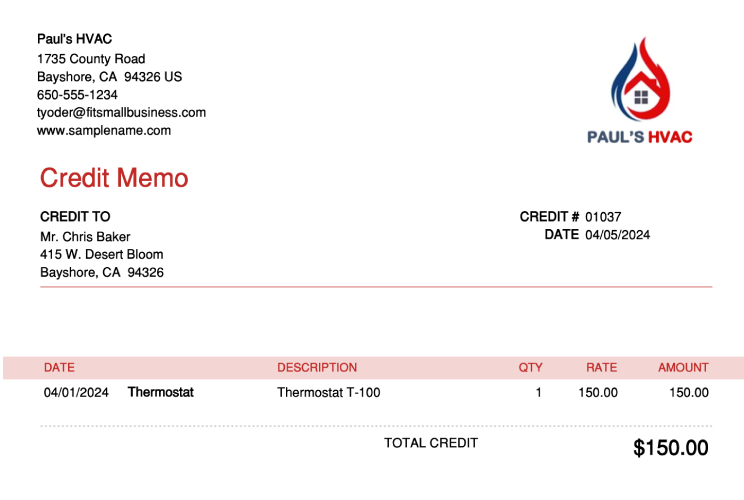

Below, you’ll find a credit invoice example that is being issued to document a $150 refund for a defective thermostat returned by a customer.

Sample credit memo in QuickBooks Online

Frequently Asked Questions (FAQs)

A credit invoice or credit memo is a document issued by a seller to adjust or reduce the amount owed by a customer. It is often issued for several purposes, such as requests and refunds, billing errors, discounts or promotions, and prepayments.

A credit invoice is a statement that details a credit to the customer, while a regular invoice is an itemized bill to request payments from customers for goods and services rendered.

While you can create a credit invoice manually using tools like Microsoft Word and Excel, the fastest and most efficient way is to use an accounting or invoicing software like QuickBooks Online.

A credit invoice is issued by a seller to a customer or buyer.

Bottom Line

A credit invoice is an essential tool for maintaining accurate financial records, complying with legal requirements, and building positive relationships with your customers. Essentially, it’s preferable to deleting the original invoice from your records because it leaves an audit trail of exactly what happened.