Plaid is a financial technology company that acts as an intermediary between financial institutions and third-party applications. Using Plaid makes it easy for users to quickly and safely connect their bank accounts with apps, helping them manage money and make transactions effortlessly without providing the apps with their bank login information.

While users may sign up for a Plaid account, it mostly works in the background—most Plaid users first encounter it while they are linking their financial account with a third-party app, and they are asked for permission to allow Plaid to connect the accounts. Generally, Plaid is considered a safe and secure service and is trusted by established institutions and applications.

Key takeaways:

- Plaid makes it easy for users to securely link financial accounts with various third-party applications.

- Access to Plaid may be through bank or third-party applications—some popular apps that offer Plaid integration are Varo, Wave, Venmo, and Wise—or directly through the Plaid Portal.

- Plaid uses industry-leading encryption protocols, is certified in internationally recognized security standards, and utilizes multi-factor authentication to ensure that users’ data are safe and secure.

- Small businesses may use Plaid to integrate with their payment processors, financial management apps, accounting software, and ecommerce platforms, and to accept pay by bank methods, such as Automated Clearing House (ACH) payments.

How Plaid Works

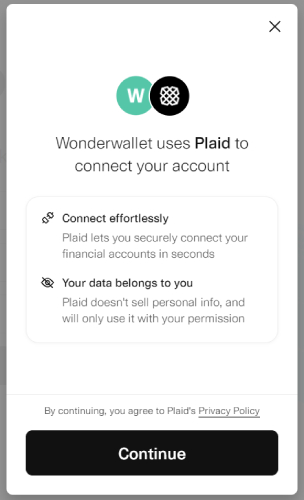

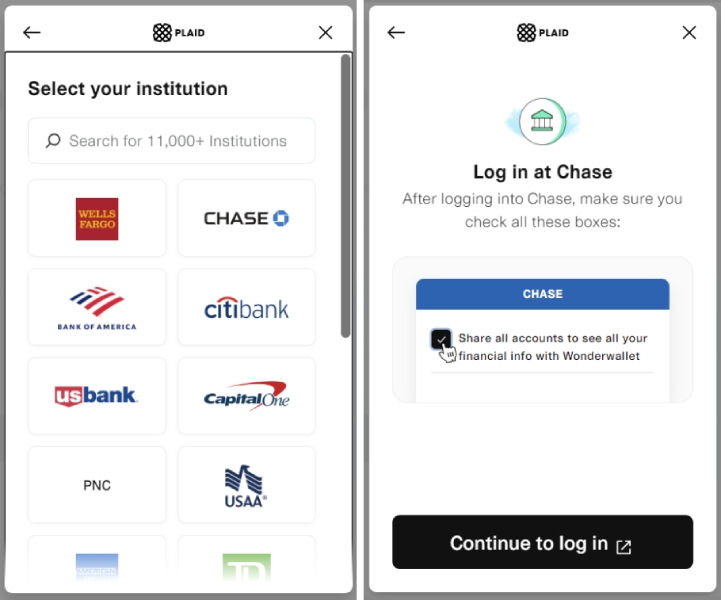

Plaid’s functionality revolves around simplifying the connection between users’ bank accounts and various third-party applications. When a user needs to link their bank account to an app, Plaid steps in to ensure a smooth and secure process without the need to disclose their bank login details. Here’s a breakdown of how Plaid works:

- Integration Process: Plaid seamlessly integrates with popular apps, eliminating the need to provide users’ bank information to every app that needs it. It acts like a behind-the-scenes facilitator, making the connection process hassle-free.

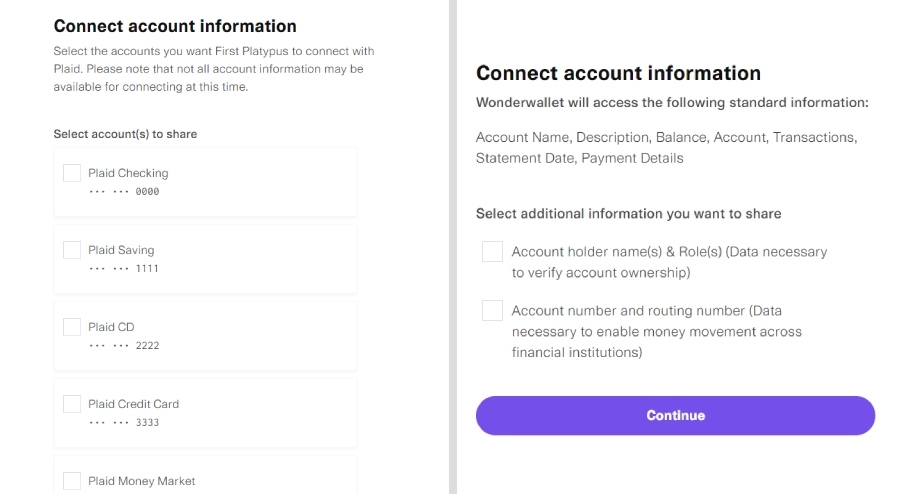

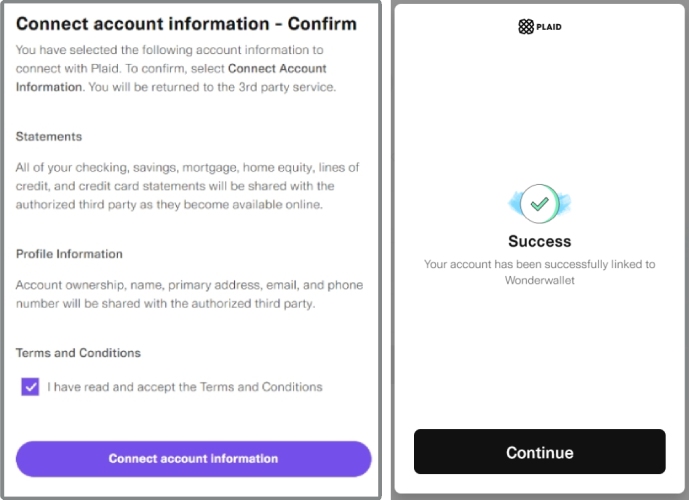

- User Authentication: When a user initiates a connection, Plaid prompts them to enter their bank credentials directly within its secure interface. This step ensures that users’ sensitive information stays confidential and is not shared directly with the third-party app.

- Verification and Two-Factor Authentication (2FA): Plaid goes the extra mile to verify users’ login information with their bank, and can set up two-factor authentication for an added layer of security if the bank supports it. If a user’s bank doesn’t support 2FA, Plaid offers its own secure authentication process.

- Security Protocols: Plaid takes security seriously. Certified in internationally recognized standards like ISO 27001 and ISO 27701, and compliant with SSAE18 SOC2, Plaid ensures that user data is transmitted using best-in-class encryption protocols, such as the Advanced Encryption Standard (AES 256) and Transport Layer Security (TLS). Learn more about secure payment systems.

- Authorization and Data Transfer: Once authenticated, Plaid establishes a secure connection with the user’s bank. After Plaid bank verification, this connection can be used by the app to access specific financial information the user permits, like transaction history, balances, or other relevant data.

Is Plaid Safe?

Plaid prioritizes the security of users’ financial data through stringent measures. It uses advanced encryption standards like AES 256 and TLS, to ensure that data transmission remains highly secure.

Additionally, Plaid adheres to internationally recognized security standards such as ISO 27001 and ISO 27701, complemented by SSAE18 SOC2 compliance. Plaid’s commitment extends to multifactor authentication, independent security testing, and a bug bounty program, providing users with confidence in the protection of their sensitive financial information.

How to Use Plaid

There are two ways to use Plaid: when offered by a bank or third-party application or by creating your Plaid account through the Plaid Portal.

Through a Bank or Third-party Application

Some people may first learn about Plaid when a service or application prompts them to connect their bank accounts using Plaid.

Through the Plaid Portal

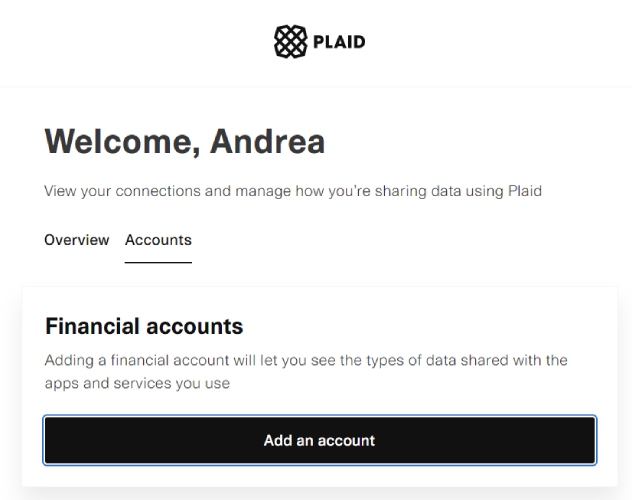

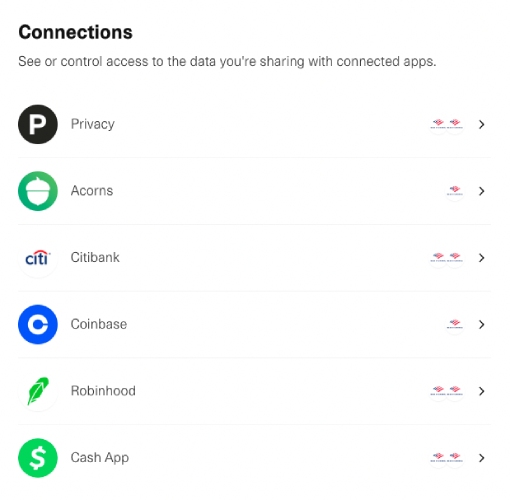

Another way to use Plaid is to sign up for an account through the Plaid Portal. When you sign up for an account, Plaid asks for your mobile number and checks to see if you have connected any financial accounts to apps using Plaid.

The Plaid Portal lets you easily see all your connected accounts and apps, as well as the type of data you are sharing with each connection. You are also able to disconnect any accounts or apps if you no longer want to share any info or link any service.

How Small Businesses Use Plaid

While Plaid is used by individuals, its versatility extends beyond individual users. Small businesses can use Plaid to improve the efficiency of their operations. It also offers small businesses better access and control of their data. Instead of going through several steps and processes to access their financial data for different aspects of their business, Plaid allows them to manage everything in one seamless connection. Here are some examples:

- Payment Processors Integration: Some payment processors offer Plaid integrations to allow for swift and secure verification of bank information. Aside from connecting their bank account to their payment processor, businesses can facilitate ACH payments seamlessly for their customers. Some processors that offer Plaid integration are Square and Helcim.

- Financial Management Apps: Businesses that use financial management applications like Wave can easily get real-time access to their financial data, allowing them to manage budgets, track expenses, and make informed financial decisions efficiently.

- Accounting Software: Accounting software such as QuickBooks often relies on Plaid to authenticate and link business bank accounts. This integration ensures accurate and up-to-date financial data for businesses, simplifying the accounting and bookkeeping processes.

- Loan Application Platforms: Businesses seeking loans can streamline the application process through Plaid. Loan platforms integrating with Plaid can verify financial information quickly, expediting the approval process and providing businesses with faster access to the capital they need.

- Ecommerce Platforms: Plaid can also facilitate secure connections between businesses and their chosen payment gateways. This integration ensures that transaction information is efficiently and safely transmitted, enhancing the overall customer purchasing experience.

Plaid Partner Institutions & Applications

Plaid can connect with over 12,000 financial institutions in the US, Canada, and Europe. Here are some of them:

- Bank of America

- American Express

- Wells Fargo

- U.S. Bank

- Bank of England

- BMO Bank of Montreal

- Scotiabank

- Sterling Bank and Trust

Here are some of the popular applications that have partnered with Plaid:

- Dwolla

- Checkout.com

- Moov Financial

- Cloudsquare

- Check

- Gusto

- Square

- Helcim

- QuickBooks Online

- Wave

- Invoice2go

- Venmo

- Wise

- Wave

Frequently Asked Questions (FAQs)

Click through the sections below for answers to common questions about Plaid:

Plaid is used to securely connect financial accounts, such as bank and credit card accounts, to various apps and services. It acts as an intermediary so that your apps do not have direct access to the login information of your financial accounts.

It is generally safe to provide your bank login to Plaid. Plaid uses advanced encryption and security protocols, ensuring the confidentiality of your data and following best practices to protect your financial information during the authentication process.

While no system is entirely risk-free, using Plaid is generally considered safe. Plaid employs robust security measures, including encryption and multifactor authentication, to protect user data and has a track record of being a trusted intermediary in financial transactions.

No, Plaid cannot see or access your bank account. Plaid acts as a secure intermediary, facilitating the transfer of information between your bank and third-party apps, and ensuring that your sensitive data is kept private and confidential during the authentication process.

Bottom Line

Plaid streamlines financial transactions for individuals and small businesses by securely connecting financial accounts with third-party apps. With strong encryption, international certifications, and multifactor authentication, Plaid is a trusted intermediary, facilitating seamless connections. Small businesses benefit from Plaid’s versatility, integrating payment processors and financial apps, and improving loan applications and ecommerce transactions. In essence, Plaid serves as a reliable and secure bridge, ensuring efficient financial interactions while prioritizing data safety.