A purchase order (PO) is a document that you (the buyer) send to suppliers when ordering goods. The PO contains essential order information like product type, quantity, and agreed price. POs serve as the basis for fulfilling the order from the supplier’s perspective and inspecting the goods delivered from the buyer’s perspective.

It’s useful for businesses with complex organizational structures. If the business has several departments, POs ensure proper management of inventory ordered and accurate recording in the books. Also, using POs in your small business is one of the accounts payable (A/P) best practices, and ensuring POs match invoices received before any bills are paid is one of a bookkeeper’s responsibilities.

Purchase Order Purposes

- Prevents duplicate purchase transactions: By entering POs in your bookkeeping system as soon as they’re made, your bookkeeper can catch any duplicate POs that have been created.

- Organizes incoming orders: In a multidepartment business setup, the receiving department is responsible for receiving, examining, and confirming the receipt of goods ordered. The receiving department personnel compares the quantity and description of the goods on the PO to what’s received.

- Tracks available inventory: POs will show in your inventory records as “goods on order” so that you know goods are on the way and avoid unnecessary reordering.

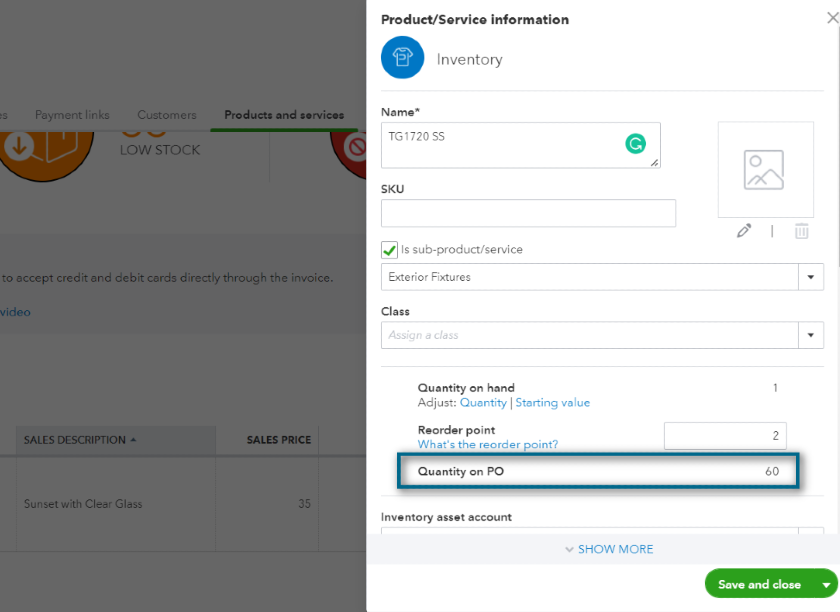

In QuickBooks Online, you can check inventory on POs by going to the Product and Services window, clicking on Sales, and then choosing Products and Services. Type the inventory item in the search bar, select it, and then click Edit (located on the far left). A side window that lets you modify inventory details will appear. Read our QuickBooks Online review to learn more about the solution’s pricing and full functions.

Viewing Quantity on PO on QuickBooks

- Supports invoices: Invoices received from your vendors should be compared to POs to make sure that you’re billed for the proper goods.

- Is a basis for disputing vendor billings: If the PO doesn’t match either the goods or the invoice received, you can provide a copy of the PO to your vendor to show what goods were ordered.

How To Create a Purchase Order

You can create a purchase order easily using accounting software programs, such as QuickBooks Online. It’ll even allow you to customize, print, and send POs to your vendors. Otherwise, you may buy standard PO forms from office supplies stores.

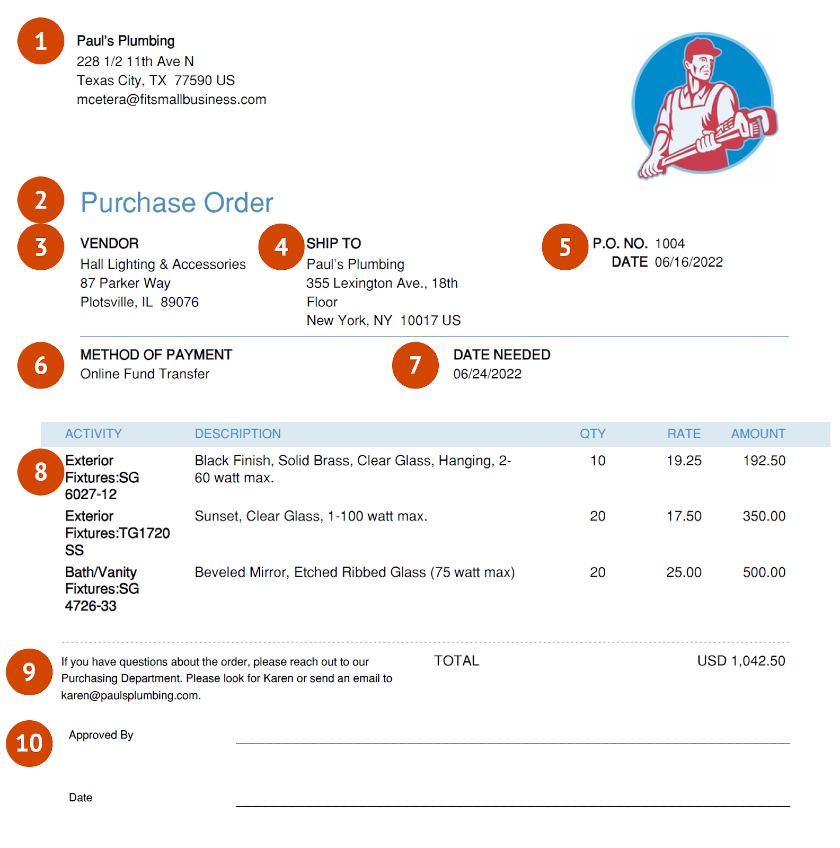

The image below is an example of a PO generated by QuickBooks Online. No matter how you create your PO, it should contain the information found after this image.

Purchase Order from QuickBooks Online

- Company Details: Indicate your company’s name, address, and contact information. You may add a logo to personalize the PO and make it stand out from other POs.

- Document Title: Display the words “Purchase Order” prominently in the document to prevent confusion. Sometimes, people mistake POs as sales orders.

- Vendor Details: Insert the vendor’s name and address.

- Recipient’s Details: Insert your company’s name and main office address. If you store your inventory elsewhere, you should enter the warehouse address, not the business’ main office address. You may also indicate the point person in the warehouse.

- PO Number: The purchase order number is a sequential numbering system that’s unique to a purchase order. You can use the PO number to keep track of orders.

- Method of Payment: Since you’re the one sending the PO, it’s best to indicate the most convenient method of payment. Otherwise, the vendor will inform you if there are alternative payment methods available.

- Date Needed by Buyer: Set a date when you need the goods delivered to your address. It’s best to set this date two to three days earlier than when it’s needed. This allowance gives a buffer in case of delays in delivery, such as bad weather and canceled flights.

- Itemized Description of Goods and Services Ordered: List the details of the order in this section. It always pays to be specific in the letter because it reduces errors and mistakes in fulfilling the order.

- Notes: Adding special notes to the vendor, like who the point of contact is and how to reach them, can speed up the processing of the PO in case some goods aren’t available.

- Approved Signature: The vendor should affix a signature on the PO. The signature means that the vendor has accepted the order, making the PO a legally binding contract.

How To Process a Purchase Order

Your business should implement the following workflow to use purchase orders effectively to help manage your purchases.

Step 1: Purchase Requisition Form

The requesting employee or department should complete a purchase requisition form stating the quantity and items to be purchased. For example, the accounting department needs to replenish its stock of continuous form papers. It must create a purchase requisition form and forward it to the purchasing department.

Step 2: Create a Purchase Order

The purchase department reviews the purchase requisition form, and if approved, prepares the purchase order. The items in the PO should match the items requested.

Step 3: Send a Copy of the Approved PO to the Vendor

The purchasing department personnel will send a copy of the purchase order to the vendor. Note that its sales rep might even get in touch with you at this point to offer promos and discounts.

Step 4: Wait for Vendor Confirmation & Approval

If the vendor can accommodate the order, it’ll notify you that it approved the purchase order. You may ask the vendor to send the approved PO or wait until the goods are delivered.

Automate the purchase order process with the right accounting software. Check out our guide on the best small business accounting software.

Purchase Order vs Invoice

A PO is created by the customer to start the purchase process, whereas an invoice is a document sent by a vendor requesting payment from a customer when the sale is complete.

Purchase Order vs Sales Order

Sales orders are internal documents used by a vendor to fulfill a customer’s order. When customers order goods, sales orders document the order and share that information with all the departments involved in fulfilling the order. Meanwhile, POs are sent by the customer to the vendor. When a vendor accepts a PO from a customer, they then create a sales order to use internally.

Purchase Order vs Receipt

A receipt is provided by a vendor to a customer showing that the customer has paid the amount due. Customers should request receipts for vendors anytime a payment is made in case of any confusion. Whereas receipts provide proof of payment, POs provide proof of an order a customer placed with a vendor.

Frequently Asked Questions (FAQs)

Do you need purchase orders for your business?

You need a purchase order if you order in bulk and from numerous vendors. Otherwise, you may choose not to use a PO to track orders. However, using POs is still beneficial if you want to establish a proper document trail.

Is a purchase order proof of payment?

No, a purchase order is a document that presents the customer’s order. The receipt is the appropriate document to refer to when looking for proof of payment.

Bottom Line

A PO is a written request from a customer to a vendor to purchase goods. When the vendor accepts your order by signing the PO, they have created a legal obligation to provide the goods and bind you to make payment when the goods are delivered. Internally, you can use POs to manage incoming inventory orders and allot cash for vendor payments.