Wave Financial is a financial management software designed specifically for small businesses. It offers a suite of tools that includes accounting, invoicing, payroll, payment processing, receipt scanning, and a business checking account for select users. Wave Accounting is known for its user-friendly interface and is often recommended to small business owners who aren’t accounting experts. We even selected it as one of the best QuickBooks alternatives.

Wave Financial’s services are centered on and integrated with Wave Accounting, which is free forever. To learn more about what is Wave Financial best for, sign up for an account with Wave Accounting and explore your options.

Wave Financial Products, Services & Integrations

One of the benefits of using Wave Financial’s software is the ease of using products and services that integrate seamlessly together. It offers payroll, invoicing, an assisted bookkeeping service, the ability to accept online payments, and a Wave Money account for qualified users.

Wave Accounting

Wave Accounting provides all of the standard accounting features. We chose it as one of the leading small business accounting software, specifically as the best free solution for tracking income and expenses.

It allows you to connect your bank and credit card accounts, invoice customers, manage unpaid bills, add sales tax to invoices, bills, estimates, and expense and income transactions. However, since Wave Accounting is free, it has some limitations. For instance, its reconciliation features are limited, and it doesn’t allow you to print checks.

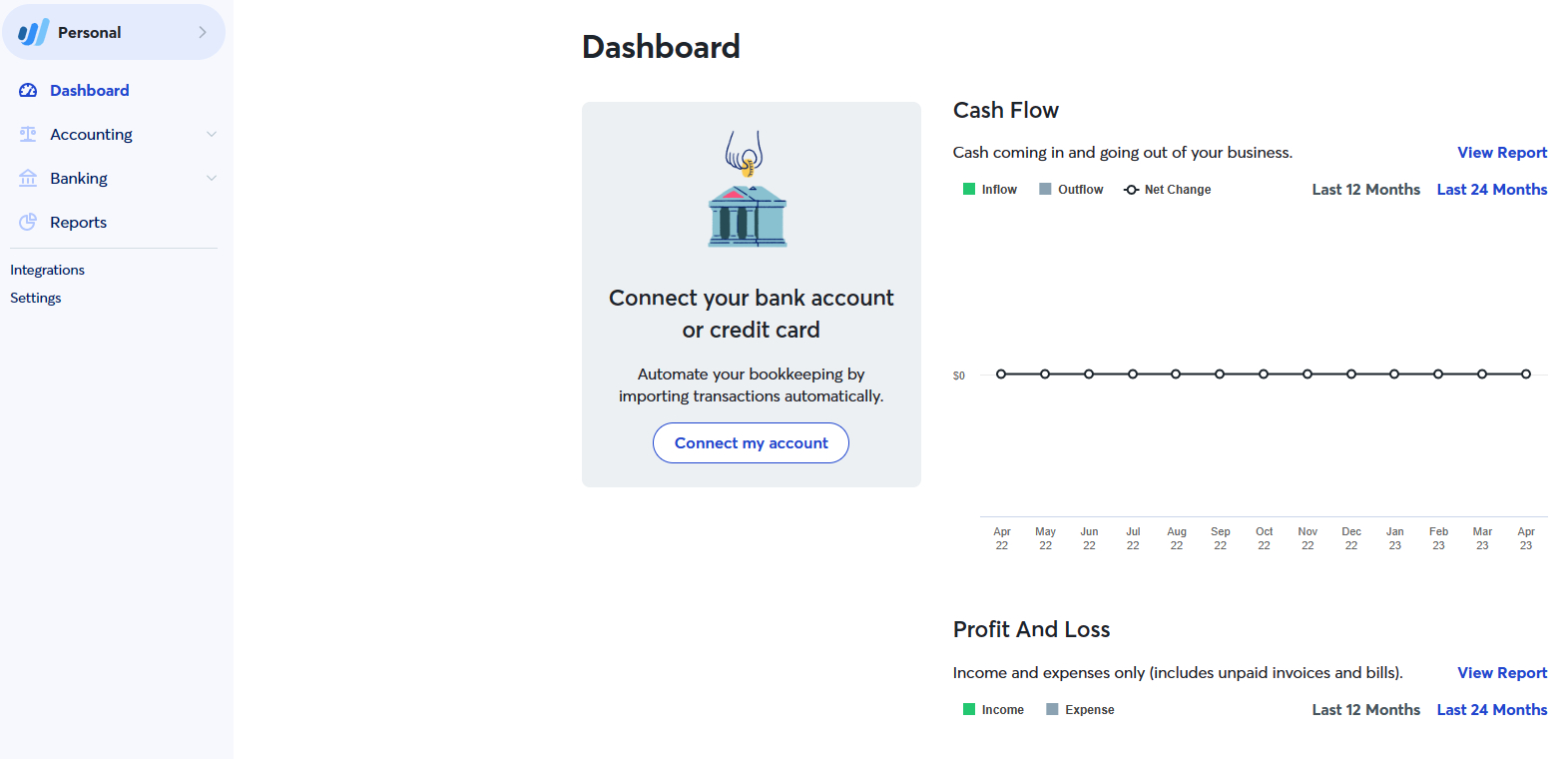

Wave dashboard (Source: Wave)

One of its strengths is that there is no limit to the number of users. Also, in our review of Wave Accounting, the platform scored relatively well in reporting. This is given its ability to generate several common reports, like profit and loss (P&L) statements, accounts receivable (A/R) aging, accounts payable (A/P) aging, general ledger (GL), and expenses by vendor.

Wave Accounting works seamlessly with Wave Financial’s other solutions, such as Wave Payroll, Wave Invoicing, and Wave Payments, to help you manage your finances.

Wave Payroll

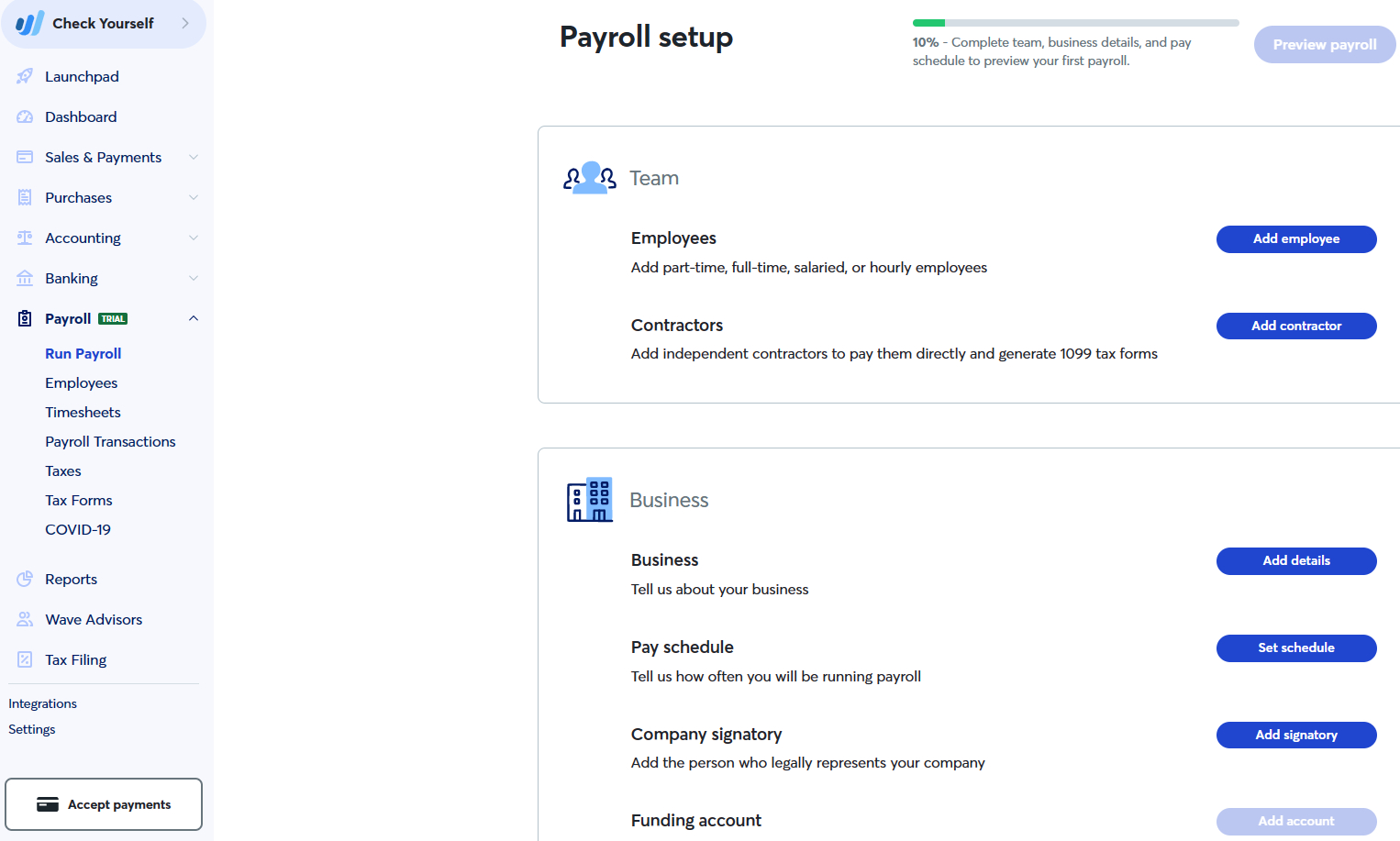

Starting at $20 per month plus $6 per employee, Wave Payroll streamlines the payroll process for small businesses by automating tasks such as calculating and filing taxes, generating paystubs, and issuing direct deposits to employees. It can also manage payroll tax filings, including year-end tax forms, such as W-2s and 1099s.

What’s more, you can set up and run your payroll online, eliminating the need for manual calculations and paperwork. Various features, such as employee self-service and automatic reminders for important deadlines, will help your business stay compliant with payroll regulations. Our in-depth review of Wave Payroll provides more information about its payroll features.

Setting up payroll in Wave (Source: Wave)

Worker’s compensation insurance is also included in the payroll plan—this is offered through Next Insurance, which you can learn about through our Next Insurance review. And in addition to integrating with Wave Accounting, Wave Payroll integrates with popular accounting software like QuickBooks and Xero by using Zapier.

We consider Wave Payroll a cost-effective solution whether or not you live in one of the 14 states it offers tax filings and payments in (the full-service tax states are Arizona, California, Florida, Georgia, Illinois, Indiana, Minnesota, New York, North Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin). All of the data integrates with Wave Accounting, making it easy for you to generate reports. Its robust tax engine automatically calculates federal, state, and local taxes.

Wave Advisors

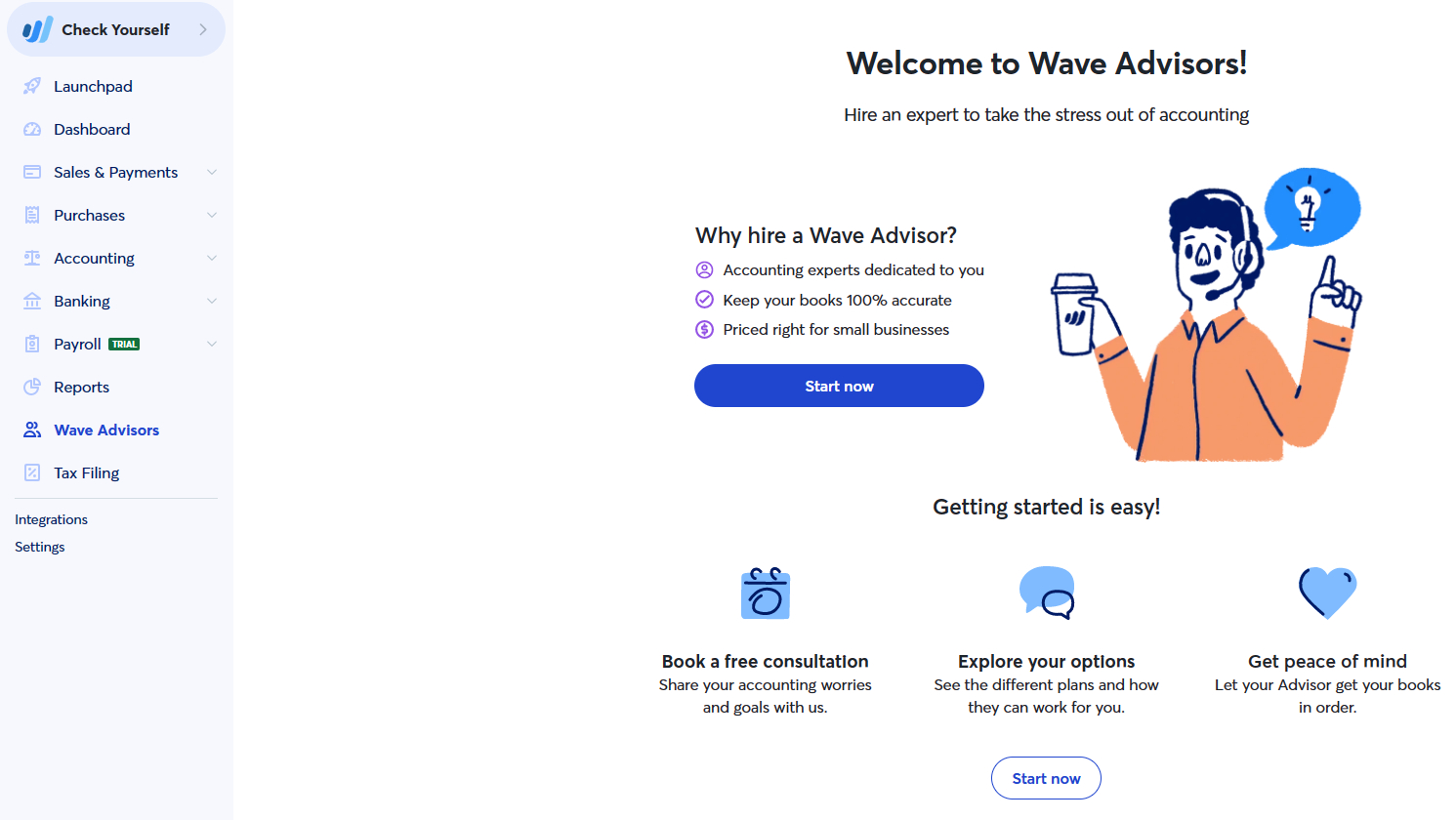

Wave Advisors, which costs $149 per month, is a bookkeeping service offered by Wave Financial. It provides assisted bookkeeping services to small businesses, helping them with tasks such as managing accounts payable and receivable, reconciling bank accounts, and generating financial reports.

There are currently two main tiers of service: Bookkeeping and Bookkeeping + Payroll.

- Bookkeeping includes monthly bookkeeping services, reconciliation of accounts, and customized reports.

- Bookkeeping + Payroll has all of the services above plus payroll management, tax filing, and compliance support

Signing up for Wave Advisors (Source: Wave)

One of the benefits of using Wave Advisors is that it integrates with Wave’s accounting software, which allows businesses to have a complete view of their financials in one place. Additionally, Wave Advisors offers a team of dedicated bookkeeping professionals to help businesses manage their finances.

Wave Invoicing

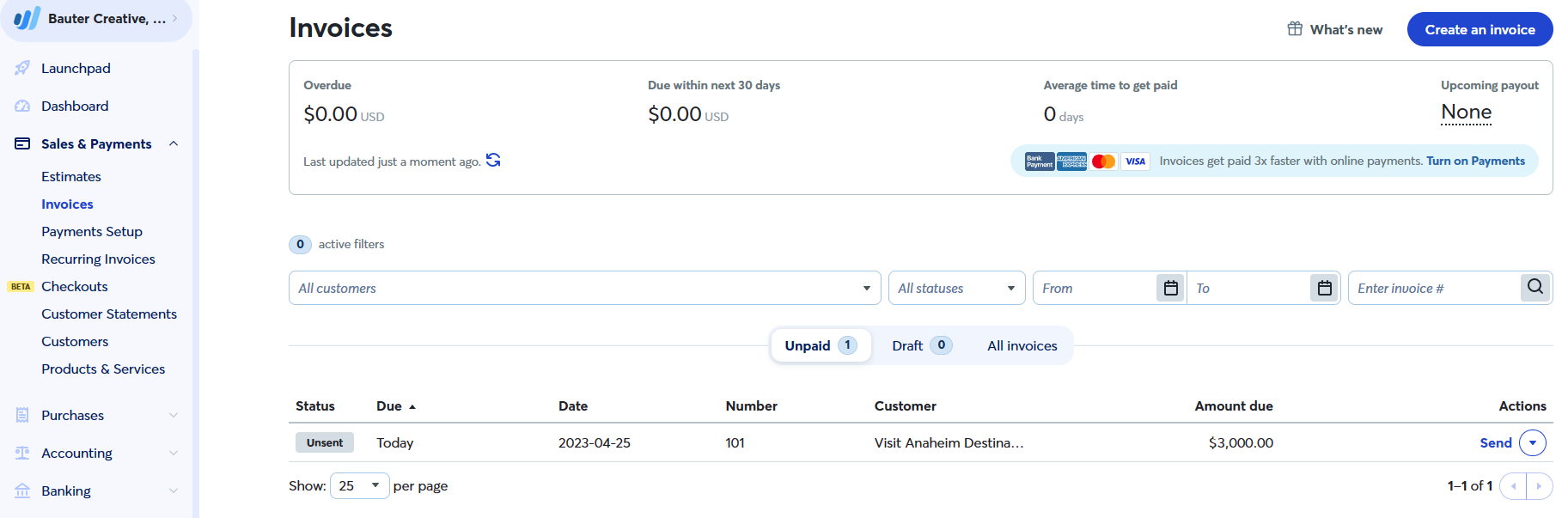

Wave Invoicing can be accessed from the Wave Accounting dashboard, under Sales and Payments. To invoice a customer, you simply have to click on the “Create an Invoice” button on the upper right corner.

The solution excels with its customization options, including the ability to select from different templates, add your logo, add a personalized message, and change colors. You can also set up recurring invoices and track sales tax collected and remitted by jurisdiction.

Invoicing in Wave (Source: Wave)

It is free, but it works especially well with Wave Payments, a paid service that lets customers click on a “Pay Now” link on their invoice so that you can accept quicker payments. You have the added benefit of being able to invoice on the go, as invoicing is available on the mobile app for both iOS and Android users. It also syncs automatically with Wave Accounting once you have downloaded the app and linked accounts.

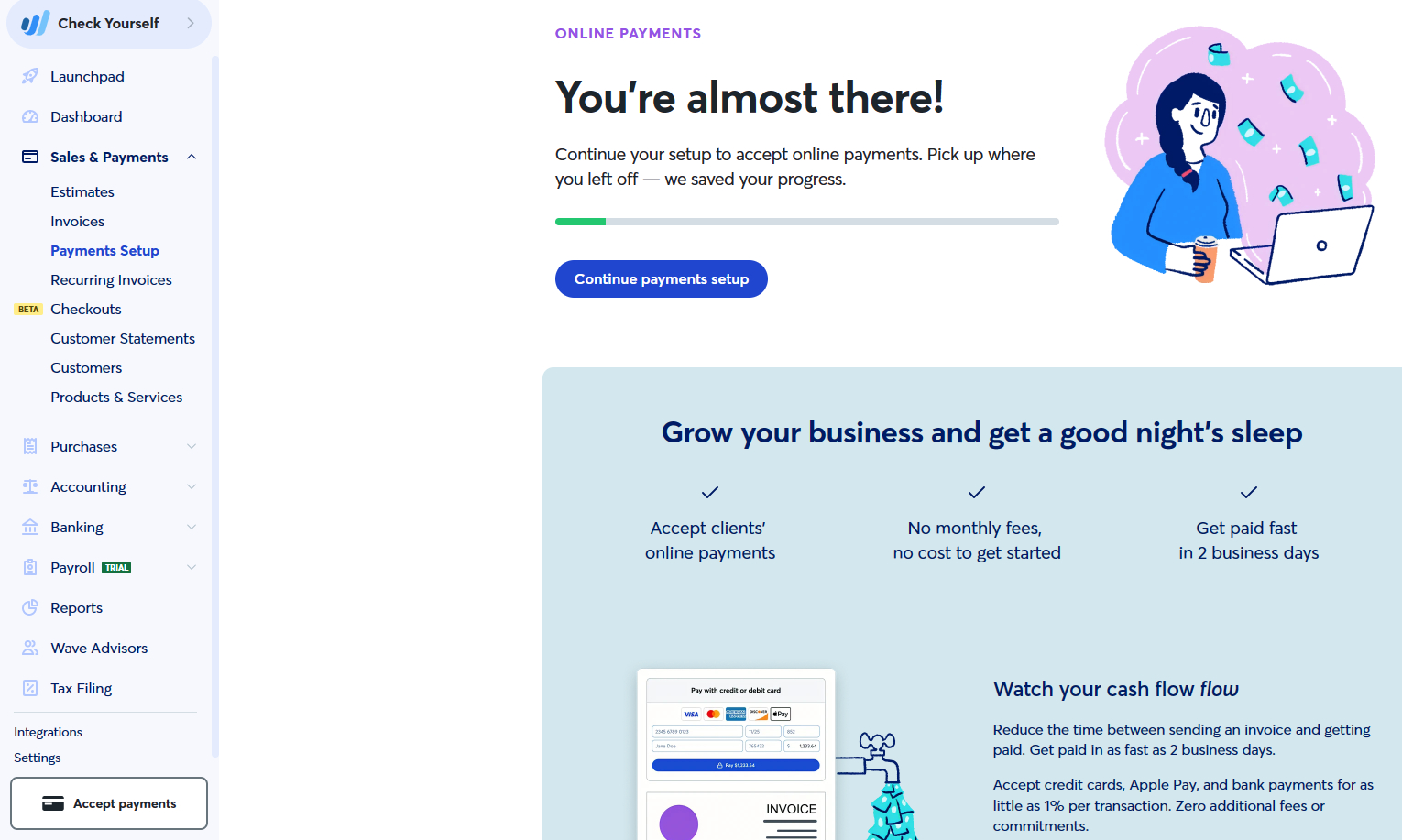

Wave Payments

Wave Payments, which connects seamlessly with Wave Accounting, is a payment solution that allows you to add a “Pay Now” button on your invoices by enabling the online payments option. This gives customers another way to pay your invoices and allows you to potentially get paid faster.

Customers can pay your invoice with their bank account, credit card, or Apple Pay, and the funds will be deposited to your account within two business days. You can also set up recurring billing for repeat customers.

Accepting online payments in Wave (Source: Wave)

Both payments and processing fees are recorded automatically in Wave Accounting, and you can choose the payment method per invoice. You can also create a unique payment link with checkouts, where no invoice is needed.

If you run into any issues, you can access a live support agent via chat or email. The cost for Wave Payments is 1% per transaction with a $1 minimum fee for automated clearing house (ACH) payments, 2.9% plus 60 cents per transaction for credit cards, and 3.4% plus 60 cents per transaction for AMEX.

Wave Money

Wave Financial also offers a business banking account and debit card via Wave Money, which is completely free. It is currently only available to single-owner businesses in the United States, and each Wave bank account can be linked to one business.

Banking eligibility is based on factors, including business category and location, currency, and security. All of the Wave Money transactions are automatically accounted for in Wave Accounting, with a Wave Money asset account that is created in your chart of accounts.

Wave Money in Wave’s mobile app

You can access Wave Money on the Wave mobile app by clicking Banking on the bottom menu. Once you sign up, you can send money directly from the app and receive payments directly into your Wave checking account. You’ll also be issued a virtual card, which you can use right away both online and in-store.

There are no minimum daily balance requirements, account opening fees, monthly fees, transaction fees, and cash withdrawal fees on Wave’s surcharge-free ATM network. However, you can only view Wave Money information on your mobile device as it’s unavailable on desktop. See Wave on Google Play or Wave on App Store.

Are you interested in learning about other free options and how Wave compares? Our guide to the best free accounting software evaluates Wave and its competitors.

Spoiler alert: We chose Wave as the best overall for unlimited users.

How Wave Makes Money: Pricing & Business Model

Wave’s Pricing

Wave’s accounting, invoicing, and receipt scanning features are completely free. Wave Financial also offers the following services for an additional fee:

- Credit card payments: 2.9% plus 60 cents per transaction or 3.4% plus 60 cents per AMEX transaction

- Bank payments: 1% per transaction with a $1 minimum fee

- Wave Payroll: Fixed monthly cost of $40 for tax service states or $20 for self-service states plus an additional $6 per month per active employee or independent contractor.

- Wave Advisors: $149 per month for bookkeeping support

- Accounting and payroll coaching: $379 per coaching session and email support

Wave’s Business Model

Wave makes money by attracting businesses with Wave Accounting, which is free and offers good accounting, invoicing, bill pay, and receipt scanning features. Businesses that sign up for Wave Accounting are offered additional services that easily integrate with the free accounting software.

The additional services are reasonably priced, and there is no pressure or effort to force users to subscribe. Users who decline the paid services can continue to use Wave Accounting for free. Here’s a breakdown of Wave’s revenue-generating sources:

- Payment processing fees: Wave offers payment processing services that allow small business owners to accept credit card payments and bank transfers from customers. It charges a transaction fee for each payment processed through its platform, which typically is a percentage of the transaction value.

- Payroll processing: Wave also offers a payroll processing service, which lets small business owners manage their employees’ payroll and compliance needs. The company charges a fee for each payroll transaction processed through its platform.

- Partnerships and integrations: Wave also generates revenue from partnerships and integrations with other financial service providers. It partners with banks, financial institutions, and other software providers to offer its users additional financial services and integrations, which can result in referral fees or revenue-sharing agreements.

The History of Wave Financial, Inc.

Wave Financial, Inc. was founded in 2009 by Kirk Simpson and James Lochrie in Toronto, with the mission of helping small business owners manage their finances more efficiently. The company initially started as a free online accounting software but has since expanded its offerings to include payment processing, payroll, and invoicing tools.

In 2019, H&R Block, a leading tax preparation company, acquired Wave Financial for approximately $405 million. The acquisition was aimed at expanding H&R Block’s digital offerings and providing more services to small business owners. Despite the acquisition, Wave Financial continues to operate independently and serves more than 400,000 small business owners across the globe.

The company’s success has been driven by its user-friendly platform, affordable pricing, and commitment to providing high-quality financial management tools to small business owners. With the continued growth of the small business sector and the continued demand for digital financial services, Wave Financial is well-positioned to continue its growth trajectory and expand its services to serve a wider range of customers.

Frequently Asked Questions (FAQs)

The Wave Accounting platform is free to use for its core features such as accounting, invoicing, and receipt scanning. However, Wave Financial charges a fee for additional features, such as payroll and payment processing.

Yes, Wave is known for its user-friendly interface and intuitive design. The software is designed to be simple to use, even if you don’t have an accounting background.

Yes, Wave has a mobile app for Android and iOS devices, though there are very limited features. It offers invoicing, receipt scanning, and expense tracking, but you can’t set up and create projects, track time worked, categorize bank transactions, and view reports.

Yes, Wave provides customer support via a chatbot, email, and self-help library. Live chat is also available to customers using one of Wave’s paid services.

Bottom Line

Wave Financial is a comprehensive financial management solution that can help small business owners manage their finances easily and efficiently. With its user-friendly features, such as invoicing, payment processing services, assisted bookkeeping, payroll, and access to free business checking for single-owner businesses, it is an excellent choice for small business owners seeking an affordable solution for accounting, payroll, invoicing, and payment processing.