The Work Opportunity Credit (WOTC) is a federal tax credit for employers who hire and pay people who are having trouble getting into the workforce.

- The credit is usually equal to 40% of the qualified first-year wages of employees who worked at least 400 hours.

- The credit is reduced to 25% of the qualified first-year wages for employees who worked at least 120 hours but less than 400 hours in their first year.

Most employers can claim around $2,400 in WOTC. This powerful tax savings tool expires on December 31, 2025.

Businesses That Qualify for the WOTC

You must be a taxable employer or a specific type of tax-exempt employer who hires and pays workers with certification from a state workforce agency as members of one of the 10 groups listed below to qualify:

- Veterans

- Ex-felons

- IV-A recipients

- Designated community residents

- Vocational rehabilitation referrals

- Summer youth employees

- Supplemental Nutrition Assistance Program (SNAP) benefits recipients

- Supplemental security income (SSI) recipients

- Long-term family assistance recipients

- Long-term unemployment recipients

You may be interested in our guides on how to claim the WOTC for some of these groups:

- How To Claim the Tax Credit for Hiring Felons

- How To Claim the Tax Credit for Hiring Veterans

- How To Claim the Tax Credit for Vocational Rehabilitation Referrals

- How To Claim the Tax Credit for Long-term Unemployment Recipients

Claiming the Work Opportunity Tax Credit

Step 1: Have Applicant Complete Form 8850

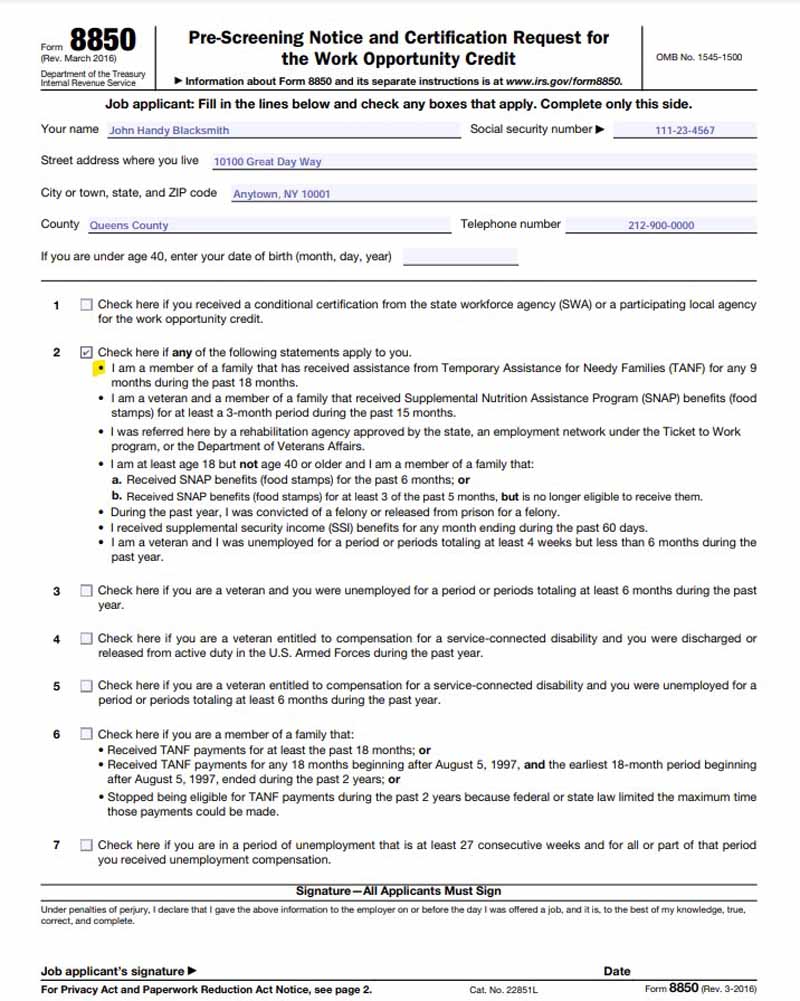

As a requirement, your prospective job applicant must also fill out IRS Form 8850, Pre-Screening Notice, and Certification Request for the Work Opportunity Credit. You’ll use Form 8850 to pre-screen and to make a written request to your state workforce agency (SWA) to certify an individual as a member of a targeted group for purposes of qualifying for this credit.

The applicant will review the information in boxes 1 through 7 on Page 1 and check the box that matches their targeted group. For instance, if your applicant is an IV-A Recipient, an individual who is a member of a family that receives Temporary Assistance for Needy Families (TANF), the applicant will check box 2, as shown below.

Filled out sample of IRS Form 8850 Page 1

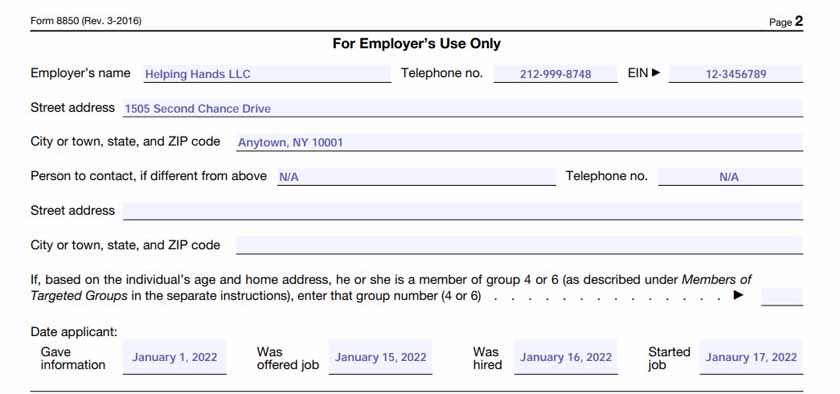

This questionnaire must be completed prior to offering a role to your prospective applicant. And to demonstrate that you, the employer, prescreened the applicant in addition to the disclosures made by the applicant, you’ll need to fill in the date on the line next to “Gave Information” on page 2 of Form 8850.

Step 2: Interview & Make Your Hiring Decision

As part of claiming this credit, you must also interview the applicant and make a hiring decision. If you decide to interview and hire the potential candidate, you should write down the date the job was offered and the date the candidate was hired on Page 2 of Form 8550.

Filled out sample of IRS Form 8850 Page 2

Step 3: Apply for Certification From Your State Workforce Agency

Once completed, Form 8850 must be signed under penalty of perjury by both you, the employer, and your new candidate. Afterward, send the form to your state workforce agency no later than 28 days after your new employee’s start date, together with Form 9601 and any supporting documents. A wet signature is required.

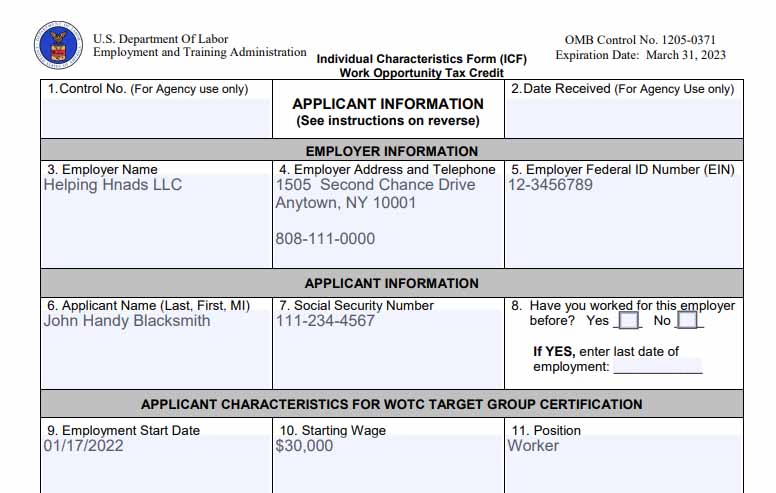

ETA Form 9061, Individual Characteristics Form (ICF) Work Opportunity Tax Credit, is used together with IRS Form 8850 to help SWAs determine eligibility for the WOTC Program. If you’re unsure how to locate an agency in your state, the Department of Labor has a complete list of WOTC State Coordinators.

Let’s take a look at the first part of this form using the sample information from above.

Example of a filled out IRS Form 9061

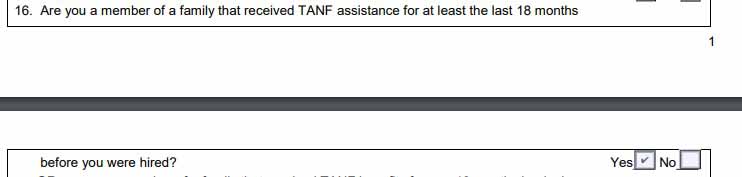

Once the first section is completed, you’ll need to check the box that indicates which targeted group your new hire holds membership. This information will appear in questions 12 through 23. For the purpose of our example, the box next to question 14 was checked.

A sample of Form 9061’s Question 16 filled in

Step 4: Calculate the Credit

You must also keep records of the employee’s earnings and hours worked to qualify for this credit. Qualifying wages range from $3,000 to $24,000, depending on the applicant’s category.

Target Group | Maximum Qualifying Wages |

|---|---|

Veterans | $24,000 |

Ex-felons | $6,000 |

IV-A Recipients | $6,000 |

Designated Community Residents | $6,000 |

Vocational Rehabilitation Referrals | $6,000 |

Summer Youth Employees | $3,000 |

SNAP Benefits Recipients | $6,000 |

SSI Recipients | $6,000 |

Long-term Family Assistance Recipients | $6,000 |

Long-term Unemployment Recipients | $6,000 |

Qualified wages will be multiplied by either 25% or 40%, depending on the number of hours your employee worked.

- 40% of qualified wages will be used to calculate the credit if your employee worked at least 400 hours

- 25% of qualified wages will be used to calculate the credit if your employee worked less than 400 hours but more than 120 hours

Step 5: Report the Tax Credit on Your Tax Return

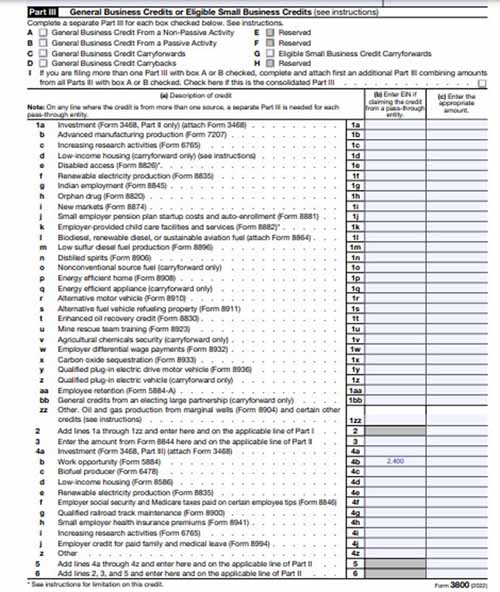

Once you’ve calculated the credit using IRS Form 5884, you can claim the credit as part of the general business credit reported on IRS Form 3800 if you operate as sole proprietors and C-corporations. S-corporations and partnerships will report the credit on Schedules K and K-1

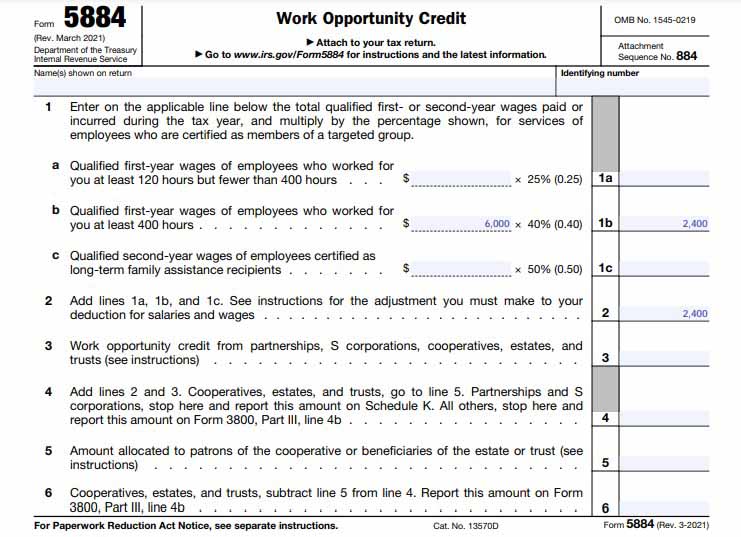

IRS Form 5884 is used to claim the work opportunity credit for qualified first- and/or second-year wages paid to or incurred for targeted group employees during the tax year. The credit is typically calculated on lines 1 and 2.

Let’s take a look at those lines.

- 1(a) Enter qualified first-year wages of employees who worked for you at least 120 hours but fewer than 400 hours and multiply this amount by 25% (0.25)

- 1 (b) Enter qualified first-year wages of employees who worked for you at least 400 hours and multiply this amount by 40% (0.40)

Calculating the WOTC for 2023 on IRS Form 5884

The values from Form 5884 are carried to Form 3800 and then reported to your tax return.

Carrying the WOTC for 2023 on IRS Form 3800

Read step-by-step instructions for completing Form 5884.

Where To Report the WOTC

Depending on your entity’s classification, your credit will be reported on one of the following forms:

Entity Type | Where to Report |

|---|---|

Sole Proprietor | IRS Form 1040 or 1040 SR, Schedule 3, line 6a |

C Corporation (C-corp) | IRS Form 1120, Schedule J, Part I, line 5c |

S Corporation (S-corp) | IRS Form 1120-S, Schedule K, line 13g |

Partnership | IRS Form 1065, Schedule K, line 15f |

Frequently Asked Questions (FAQs)

If the state workforce agency does not grant the request, it will explain why in writing. If a certification was initially approved and then later revoked due to inaccurate information submitted by the individual, then wages earned or incurred after the date you receive the notification of revocation will be ineligible for the credit.

You can claim or elect not to claim the work opportunity credit at any time within 3 years from the due date of your return on either your original return or an amended return.

If the credit expires and is retroactively extended, the IRS may allow you more time to submit Form 8850 for an individual who began work while the credit was expired or for a reasonable time after it was extended or is a member of a new or modified targeted group.

Bottom Line

Giving individuals who have faced significant barriers gaining access to employment can be a rewarding experience. If you hire an eligible employee, do not forget to claim your tax credit during the first 12 months of employment. For more information on other tax credits for which you might be eligible, check out our article on 7 Small Business Tax Credits That Your Company May Qualify For.