The deductibility of business credit card payments depends on what kind of credit card charges the payments are covering. If only some of the credit card charges are deductible, then only the portion of the payment relating to the deductible expenses can be included on the tax return. The IRS lets you deduct “ordinary and…

What is

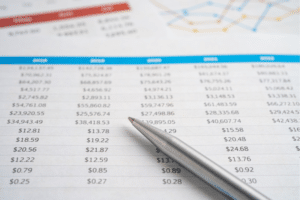

Cash Disbursement Journal: Definition & Sample Entries

A cash disbursement journal (CDJ) is a specialized accounting journal used to record all cash payments in one place.

A CDJ helps bookkeepers track outgoing cash transactions efficiently, eliminating the need for repetitive entries in the general journal (GJ). Instead of posting each payment separately, it summarizes all disbursements at the end of the accounting period and records them as a single compound entry in the GJ. This process streamlines bookkeeping, reduces redundancy, and…

What Is FinCEN and How Does It Protect Business Accounts?

The Financial Crimes Enforcement Network (FinCEN) is a bureau that operates within the US Department of the Treasury (USDT) under the Secretary for Terrorism and Financial Intelligence. FinCEN safeguards and monitors the flow of money within the US and internationally. It collects and analyzes transactions from financial institutions and shares all criminal findings with law…

10 Common Elements of a Business Loan Agreement

A business loan agreement has many elements that outline the various terms and conditions associated with getting a loan — including the loan amount, the interest rate, the repayment schedule, penalties, covenants, and dates. Understanding each of these can help you outline the terms and conditions of your transaction and supply you with the knowledge…

What Are Retained Earnings in Accounting & How To Calculate?

Retained earnings (RE) are the total profits a company has kept over time instead of paying them out to shareholders. These funds are either reinvested in the business or reserved for future needs. RE are commonly associated with businesses structured as corporations or LLCs, whereas sole proprietorships and partnerships generally do not maintain a retained…

Business Credit Report: What It Is & How To Read It

A business credit report is a snapshot of a company’s financial health. It shows details about the company’s debt and how it handled debt payments in the past. It is broken into various sections, each showing different information for company liens, outstanding loans, derogatory payment information, and recent credit applications. Lenders and investors often use…

What Is an Applicable Federal Rate (AFR)?

An applicable federal rate, also commonly known as an “AFR,” is the minimum interest rate required of a private loan. It is enforced and designated by the IRS and applies to loans with an interest rate lower than the tax rate if the loan is considered income. There are differing AFRs assigned to various loan…

Prepayment Penalty: What It Is & How It Affects Your Loan

A prepayment penalty is a fee that a lender can charge if you pay off or pay down a loan by a certain amount before a specified date. In order for a lender to charge a prepayment penalty, it must be disclosed upfront in its loan agreement. It must also specify the specific conditions in…