Zoho Expense is an expense tracking app designed to automate travel and expense management for businesses. It is part of the Zoho suite and integrates with other Zoho products, including Zoho Books and Zoho CRM. I find Zoho Expense useful for business expense tracking, but it excludes advanced expense management features like issuing company spending cards to employees.

The platform has a free plan for up to three users, and paid subscriptions start at $5 monthly per user. Learn if it’s right for you through my detailed Zoho Expense review.

Pros

- Uses OCR Optical Character Recognition for receipt scanning

- Can capture and submit expenses on the go through the mobile app

- Has a built-in mileage tracker

- Lets you create customized workflows for expense approval

- Offers direct feed integration with corporate card programs

- Integrates with top accounting software like QuickBooks Online and Xero

Cons

- Can’t connect corporate cards in the free plan

- Doesn’t issue prepaid cards

- Won’t let you set up multiple organizations unless you upgrade to the most expensive plan

- Free expense tracking: Zoho Expense offers a free plan intended for freelancers and small businesses (up to three users) on a limited budget. It’s ideal for simple expense tracking. It has 5 GB of receipt storage, which is more than enough for freelancers or small businesses without a lot of expenses to track.

- Expense approval for employees on trips or fieldwork: Employees need only an internet connection and the Zoho App to record and submit an expense on the go, meaning managers need not wait for their staff to return to the office to submit their expenses.

- Companies with employees working remotely or in different branches, cost centers, or departments: Zoho Expense can group expense reports based on the source of the expense. If your company has different working groups or departments, the app can classify expenses on specific reports that belong to the group. In return, reviewing, approving, and reimbursing expenses is easier.

- Companies already using Zoho apps: You only need to have a Zoho account to use Zoho Expense—log in with one account to get access to all the Zoho apps you’ve subscribed to. So, companies using Zoho CRM or Zoho Books won’t have a hard time integrating with Zoho Expense.

Zoho Expense Alternatives & Comparisons

Zoho Expense Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Excellent receipt scanning | A bit confusing |

| Auto-sync feature | Can’t manage multiple organizations |

| Easy to add trips via mobile app | |

Here’s a summary of the most recent Zoho Expense reviews:

- Excellent receipt scanning features: One user explained how easy it is to capture and upload receipts from their mobile device through the mobile app. After exploring it myself, I can confirm that it’s pretty easy to use—expenses can be submitted within 30 seconds.

- Auto-sync feature for credit cards: Another reviewer likes that they can connect their credit cards and automatically import credit card transactions. I consider this a must-have feature, especially for those who handle multiple transactions daily.

- Can easily add trips on the go: Some users mentioned that they could easily add their trips from their phones through the mobile app. The built-in GPS mileage tracker makes it a great option for those who often travel for business purposes.

- A bit confusing: Many praise Zoho Expense for its ease of use, but one reviewer complained that the interface is sometimes confusing. For instance, there’s an icon on the dashboard that shows the status of an expense—but they can’t click on it. I personally find it easy to use, but it may require some time to become comfortable with all its features.

- Can’t set up multiple companies: I found a negative review about the lack of multi-company support in Zoho Expense. It’s actually possible, but you have to upgrade to the custom plan to use this feature.

As of this writing, here’s how Zoho Expense is rated by third-party sites:

- Software Advice[1]: 4.6 out of 5 from over 1,000 reviews

- G2[2]: 4.5 out of 5 from over 1,200 reviews

The Zoho Expense pricing structure is affordable and ideal for small businesses. Freelancers can start with the free plan and then upgrade to higher tiers if they need more features. The only reason I didn’t give it a perfect mark in my assessment is that the paid subscriptions require at least three users, which can be an issue for those who only have one or two members.

You can choose among four plans, but the free version is always the best to start with if you’re new to expense trackers. You can also get the 14-day free trial to discover the features of paid options.

The table below shows a quick comparison of the plans in terms of pricing and features included.

Free | Standard | Premium | Custom | |

|---|---|---|---|---|

Monthly Price per User (Monthly Billing) | $0 | $5 | $9 | Custom |

Monthly Price per User (Annual Billing) | $0 | $4 | $7 | Custom |

Users Included | 3 | |||

Receipt Scanning | ✓ | ✓ | ✓ | ✓ |

Mileage Tracking | ✓ | ✓ | ✓ | ✓ |

Receipt Forwarding Email Address | ✓ | ✓ | ✓ | ✓ |

Personal Card Connection | ✓ | ✓ | ✓ | ✓ |

Commercial Card Feeds | ✕ | ✓ | ✓ | ✓ |

Corporate Card Reconciliation | ✕ | ✓ | ✓ | ✓ |

Automated Reminders | ✕ | ✓ | ✓ | ✓ |

Trip Allocation Reports | ✕ | ✕ | ✓ | ✓ |

Expense Report Automation | ✕ | ✕ | ✓ | ✓ |

Travel Request Management | ✕ | ✕ | ✓ | ✓ |

Travel Manager | ✕ | ✕ | ✕ | ✓ |

Multilocation and Branch Management | ✕ | ✕ | ✕ | ✓ |

Advanced Audit Trail Report | ✕ | ✕ | ✕ | ✓ |

I recommend checking out Zoho Expense’s pricing page for a detailed comparison and more information on each plan’s features.

Zoho Expense excels at expense tracking, but I noticed that users still need to submit expense reports before expenses are reviewed. Although this isn’t a significant drawback, I’d prefer the platform to allow real-time expense approval for faster review, approval, and reimbursement.

Here are some of the most notable expense tracking features in Zoho Expense.

Zoho Expense uses OCR technology for receipt scanning. You can upload receipts using your mobile device or through the web interface. What I like about the receipt scanning tool is that it supports various formats, including physical receipt photos, PDFs, and email receipts.

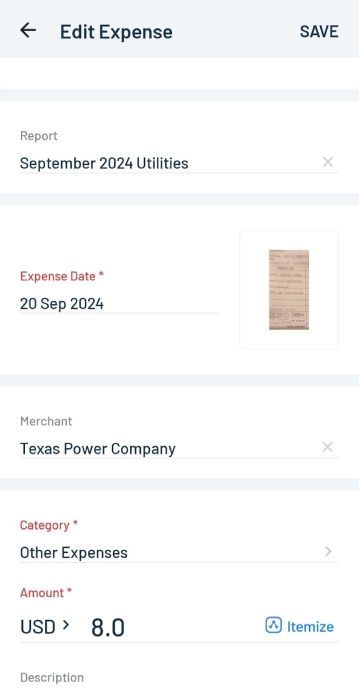

The web interface is easy to use, but I love the mobile app even more. I was able to upload a receipt easily, and the software instantly created a digital transaction. I could also make any necessary edits.

Editing an expense entry through the Zoho Expense mobile app

Zoho Expense allows you to forward receipt emails directly to your Zoho Expense account. You’ll receive a unique receipt forwarding email address, and when the receipt is forwarded, the system automatically scans and converts it into an expense entry. Currently, Zoho Expenses integrates with Zoho Mail, Gmail, and Microsoft Outlook for this feature.

You’ll appreciate Zoho Expense’s mileage tracker if you often travel for work or business-related purposes. While you can manually log your odometer reading, you can use the GPS tracker to track your trips automatically. You only need to activate the GPS feature at the start of your trip and end it upon arrival. The app will then automatically calculate the distance traveled and your expenses.

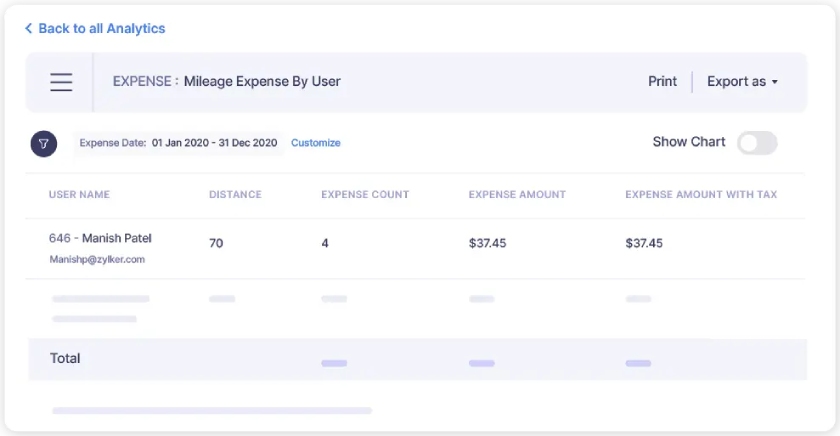

For managers, Zoho Expense also provides an analytics report that shows the mileage each employee or user has logged.

Mileage Expense by User report in Zoho Expense (Source: Zoho Expense)

To help you accelerate the approval process, you can create customizable workflows based on your specific needs. For example, you can set up a workflow that routes expenses to different approvers depending on the expense amount or specific approvers within specific teams or departments. You can also route expenses to certain project managers if you manage projects.

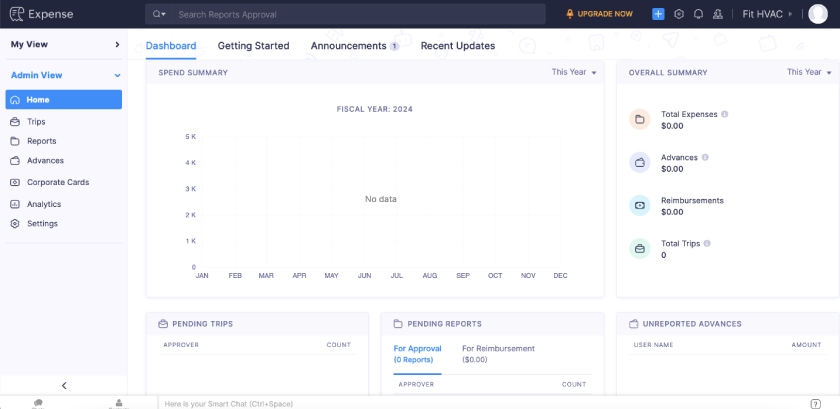

The dashboard is available in the Admin view. Companies can delegate certain employees with the Admin role so that they can oversee everything in the expense reporting and reimbursement process. Only users with the Admin role can add Submitters, Approvers, or other Admins.

On the dashboard, you can see an overview of everything that’s happening, from pending trips to pending reports and unreported advances.

Admin dashboard in Zoho Expense

Once submitted for approval, the approver will see the report on their end. After viewing the report, the approver may reject it and enter the reason for rejection in the pop-up textbox window. Once rejected, the report will be categorized as “Rejected.” The accountable person may re-submit the report after addressing the reason for rejection.

If the user doesn’t have a corporate card, the reimbursement must be made manually. Otherwise, all expenses charged to the corporate card will feed into Zoho Expense’s approval and reimbursements automatically.

Once an expense report is approved, managers can easily process the reimbursement through the Record Reimbursement page. Once done, the report’s status will be marked “Reimbursed.”

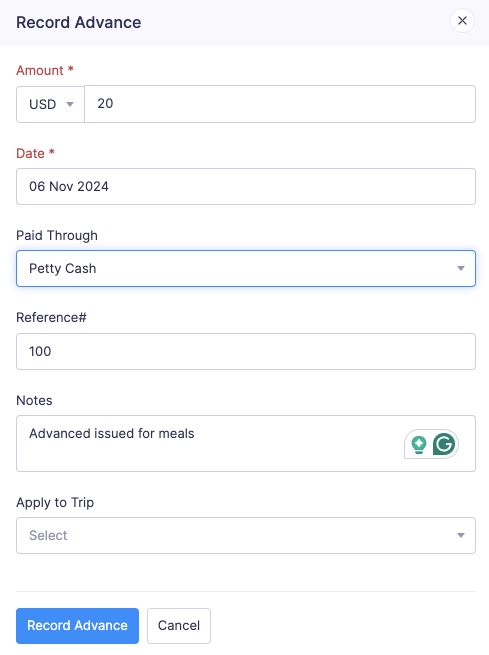

You can record advances if you need to track advanced funds provided to your employees. There’s a dedicated Advance tab in your dashboard where you can enter important information, including the employee receiving the advance and the total amount. You may also apply the advance to a specific trip if needed.

Recording an advance in Zoho Expense

Zoho Expense has a mobile app that can be downloaded from App Store or Google Play. The app contains the same features as the web version. Through it, submitters can use mileage tracking to monitor travel expenses and submit payments and reports for faster reporting of expenses.

Zoho Expense lets you connect personal and corporate card programs to the system. I would have awarded it a higher mark if it could also issue prepaid cards as an added function. If you need to issue prepaid credit cards to employees, then you may consider integrating Zoho Expense with PEX, a spend management tool that offers prepaid credit cards for Zoho Expense uses.

Alternatively, you may check out our guide to the best spend management software for managing employee spending.

Zoho Expense has a neat and organized dashboard that provides users easy access to all its features. As I mentioned earlier, it’s easy to enter trips and expenses, and the mobile app is also very user-friendly.

I didn’t give it a perfect mark because there are a few areas that could be improved. For example, when I was editing an expense through the mobile app and selecting options from dropdown fields, it wasn’t immediately clear that I could add a new item, as there was no visible + button.

Overall, Zoho Expense scored well in my ease of use evaluation because it has excellent customer support channels, including phone, email, live chat, and chatbot. It also provides a detailed knowledge base that discusses all the software’s features and capabilities.

Furthermore, its integration with accounting and ERP software like QuickBooks, Zoho Books, Xero, Oracle, SAP, and Sage makes the platform a flexible pick. Also, Zoho’s integration with productivity software—like Google Workspace, Microsoft 365, and Slack—adds more ways for Zoho Expense to send alerts and gather receipts much faster.

How I Evaluated Zoho Expense

The Fit Small Business accounting team developed an internal rubric to evaluate expense trackers. Given that, I was able to score Zoho Expense on the following criteria:

15% of Overall Score

Pricing is an important part of your decision. In evaluating this criterion, we considered factors, such as a free trial, monthly and annual billing options, scalability, plan customizability, and price comparison with competitors.

40% of Overall Score

Since we’re evaluating expense trackers, we placed significant weight on expense tracking features. We evaluated this criterion based on the major expense workflow steps: recording, review, approval, and reimbursement.

25% of Overall Score

We include card programs in our rubric since we believe that expense tracking should be tied to the business’ card program. Here, we considered whether the provider can issue cards or enroll in third-party corporate programs.

20% of Overall Score

The ease of use score revolves around customer support channels, integrations, user reviews, and our expert rating. The software must make it easy for users to access support in case of problems. Moreover, it must have adequate integrations with other software so that it would be easier to insert it into existing business processes. We looked at user reviews from third-party websites for the user review scores. We weighed the comments and made sure that we remained objective in our evaluation.

Frequently Asked Questions (FAQs)

Zoho Expense is focused on tracking, approving, and reimbursing employee expenses, while Zoho Books is bookkeeping software that tracks assets, liabilities, revenue, and expenses to produce financial reports like an income statement or a balance sheet. Both are apps within the Zoho environment.

Aside from the 5 GB receipt storage and maximum limit of three users, features like travel requests, approval flows, and budgeting are unavailable. The free tier is suitable for mom-and-pop shops, freelancers, solopreneurs, and startups.

Bottom Line

Zoho Expense is a great auxiliary app to supplement your dedicated accounting software. It helps speed up expense recording, approval, and reimbursement processing. Moreover, users of Zoho apps only need one account to integrate with Zoho Expense easily. Overall, it is an excellent tool for tracking and managing expenses.

[1]Software Advice

[2]G2