Ramp offers a free suite of financial management tools that help businesses manage their expenses, invoices, and budgets. These tools are designed to be user-friendly and accessible to businesses of all sizes, with features like automated expense categorization, receipt capture, and approval workflows.

This platform also provides a corporate charge card that offers cashback rewards on most purchases. It also has other useful features, such as spending controls, real-time alerts, and integrations with popular accounting software like QuickBooks and Xero.

Pros

- Streamlined expense management tools

- Integration with Gusto to control employee spending

- User-friendly dashboard

- Virtual card feature offers security and control for online transactions

Cons

- Unable to carry a balance on Ramp charge card

- Limited customization options

- Not a complete bookkeeping system

- Limited customer support

Supported Business Types | Startups, small and midsize companies, remote businesses, and financial services firms |

|---|---|

Pricing | Free |

Bookkeeping Integrations | QuickBooks Online, Xero, NetSuite, and Sage |

Standout Features |

|

Customer Support | Email form on website |

- Small and midsize companies seeking scalable software: Ramp is designed to be accessible to companies of all sizes, but it is particularly well-suited for businesses looking for software with the ability to scale.

- Financial services firms: Ramp’s advanced financial management tools and automated processes can be valuable for financial services firms, such as investment firms, hedge funds, and venture capital firms. These businesses may have complex financial structures that require a high degree of accuracy and control.

- Businesses with remote workforces: With more businesses transitioning to a remote setup, Ramp’s cloud-based platform and mobile app can be valuable tools for managing expenses and financial processes from anywhere. The software’s real-time reporting and analytics can be especially beneficial.

- Startups: Ramp is an excellent choice for startups, especially those looking for a streamlined and automated accounting system. Its expense management tools can help businesses stay organized and manage their cash flow more effectively, while the charge card’s cash back rewards can help them save money on essential expenses.

Ramp Alternatives & Comparison

Ramp Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Set-up is quick and easy | Limited customer service features |

| Mobile receipt capture feature | Doesn’t work with ApplePay |

| Streamlined spending in one place | No ability to chargeback |

Those who left a positive Ramp review on third-party review sites shared that the expense management tools, such as the mobile receipt capture feature, have streamlined their workflows. Users also praised the corporate card features, like cash back on many transactions, and the fact that it doesn’t charge late fees or interest. Ramp’s negative feedback focused on its limited customer service features, as it is only possible to communicate via an email form on the website.

Here are its scores on user review sites:

- G2[1]: 4.8 out of 5 based on over 2,000 reviews

- GetApp[2]: 4.9 out of 5 based on more than 180 reviews

- App Store[3]: 4.8 out of 5 based on over 18,000 reviews

Ramp Accounting Features

Ramp isn’t a full accounting system. It focuses on paying bills, managing expense approvals, and categorizing expenses. However, it integrates with the most popular small business accounting programs, including QuickBooks, Xero, and Sage.

Ramp offers automatic expense submission, which allows users to take a picture of the receipt and email or text it to Ramp. It also automatically categorizes transactions based on the rules you set up and auto-declines transactions that are out of policy, flagging them to the manager and finance teams. It uses the latest technology in OCR Optical Character Recognition to digitize the invoices you forward automatically.

Meanwhile, Ramp’s corporate card was designed to reduce unnecessary spending. It offers up to 1.5% cash back on most transactions and automated savings insights that will identify opportunities to help you save money. You’ll receive spending alerts in real-time for large transactions, and an integrated expense policy will allow you to define your amount thresholds for receipts and other specifications. You can also choose which vendors to exclude or allow on any given card.

Our related resource: Ramp Card Review

With Ramp’s Bill Pay feature, you can handle all of your company’s spending in one place. You can email or upload PDF invoices that you receive, and create, approve, and pay your bills in less than a minute. Ramp syncs every bill and payment to your accounting software, streamlining your accounting tasks. The ability to import purchase orders is another feature that will be added soon.

Ramp also allows you to pay vendors at no charge by card, ACH, or check. Payment by wire to global and domestic vendors is also available at a $20 flat fee per transfer. Your business will earn up to 1.5% cash back when paying bills by card.

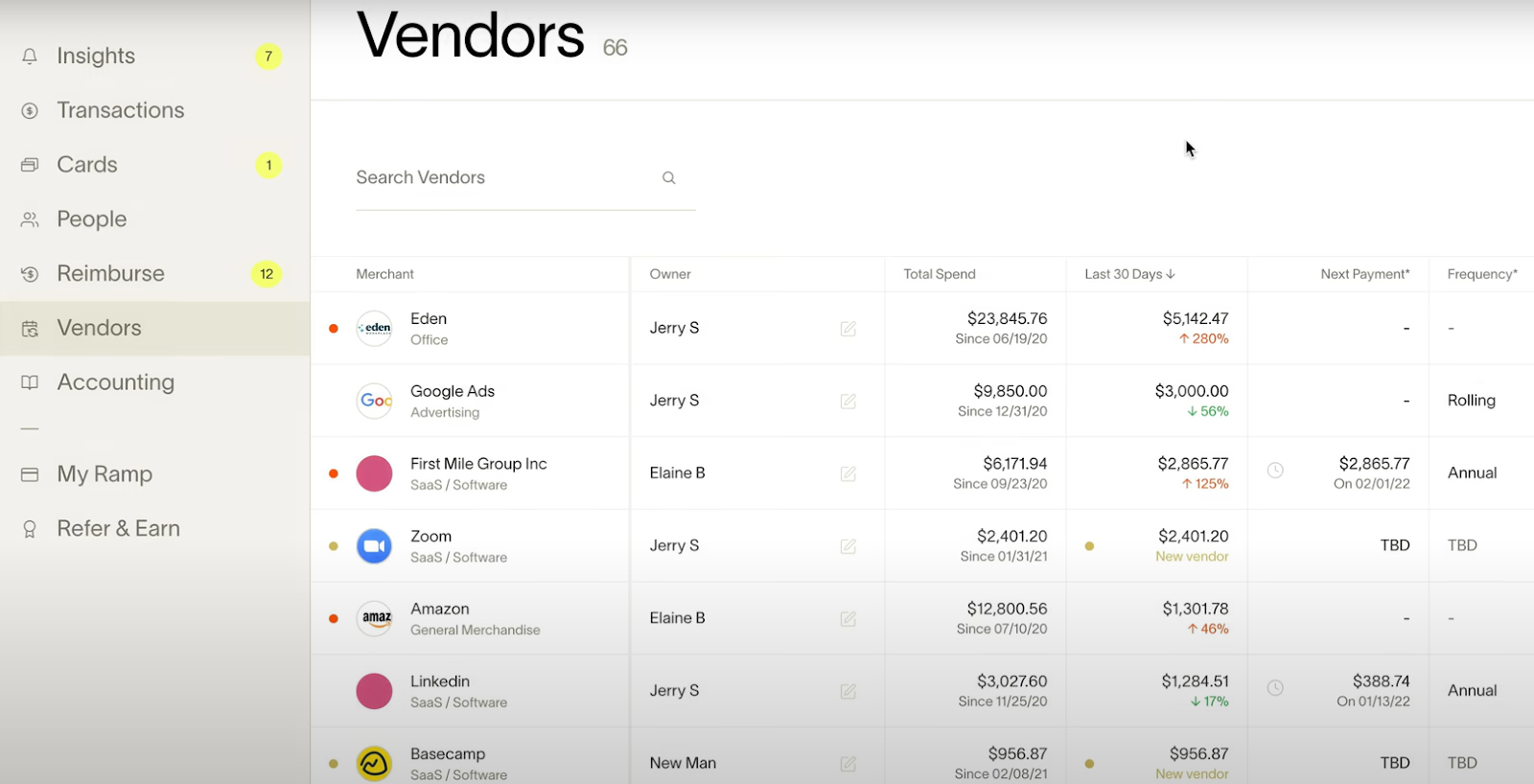

Ramp’s Vendors section (Source: Ramp)

What’s more, you can download an A/P aging report to forecast outflows and create and customize approval workflows. Ramp’s payments platform automates check payments, securely delivers ACH transfers and international wires, and gives you cash back on most transactions when you pay with a Ramp card. You can also set up recurring bills to make routine vendor payments, customizing the frequency and ending date.

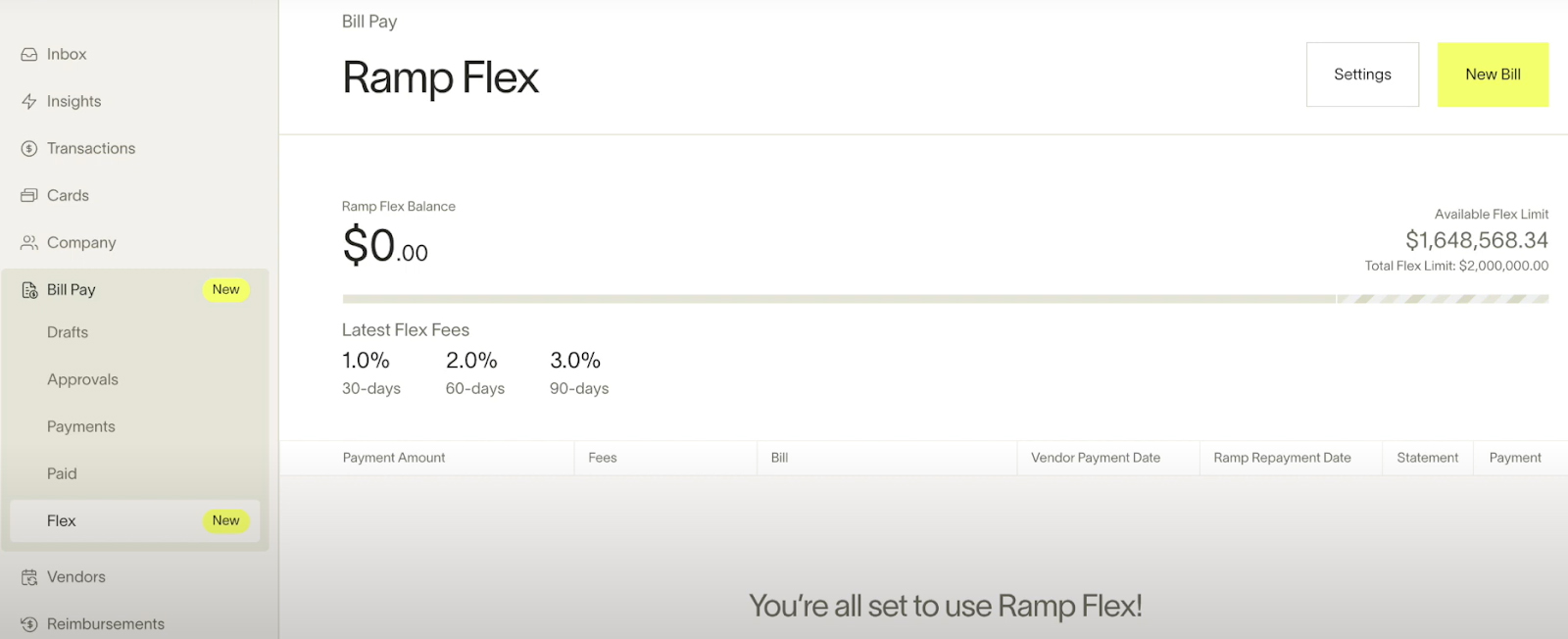

Ramp also offers Flex, a financing solution embedded in Bill Pay. It provides easy financing when you are unable to pay your bills. Your vendor will be paid immediately and then you’ll repay Ramp over a short time period. Using Flex to finance a bill will incur a small fee, which will be communicated to you upfront before you select the payment option.

Ramp Flex (Source: Ramp)

Ramp lets you manage and pay all of your vendors in one place, and you can store all of the vendor details within Ramp including payment and W-9 tax information. A vendor portal is available for vendors to submit their payment details themselves. Once a payment has been made, Ramp will email the vendor with a summary of the date when the payment will be received and a picture of the invoice. Ramp doesn’t require vendors to create an account in order to receive payments.

Ramp offers more than 80 bank connections, so you can automate your payments within one single platform. This includes your corporate card, ACH, and international wires. This allows you to control your cash flow and streamline accounts payable, from employee expenses to bills. You can also use Ramp’s priority referrals program to open new accounts securely.

If you’re interested in looking at other expense management options, see our guide to the best business expense trackers.

Other Ramp Features

Ramp streamlines the bill approval process by enabling automated approval workflows. Customizable rules and conditions ensure that bills are routed to the appropriate approvers based on factors like the bill amount. The system automatically notifies approvers via Slack or email, facilitating timely review and payment. Upon full approval, payments are processed on the scheduled date, eliminating manual intervention and ensuring that you meet your financial obligations.

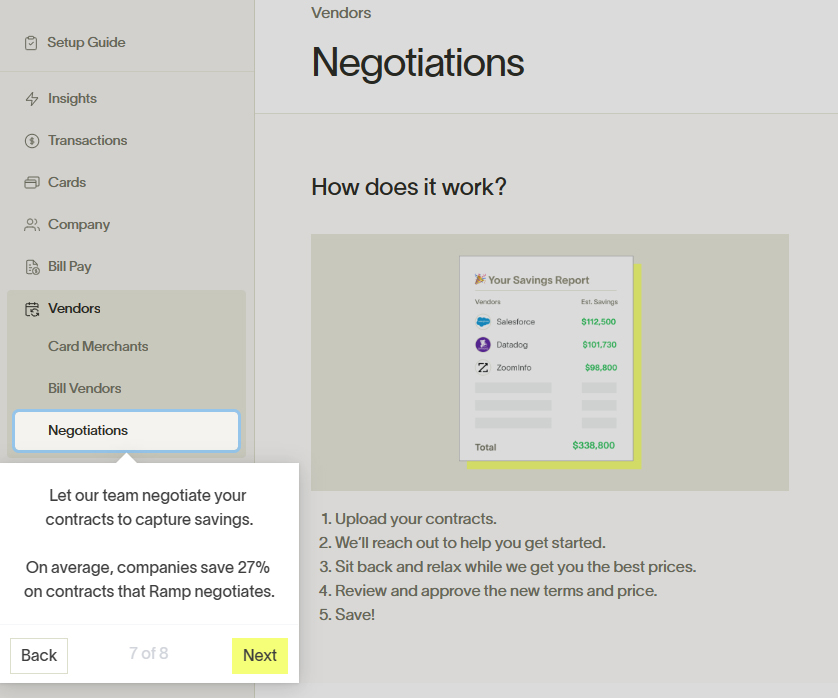

Ramp Negotiations is a software-as-a-service (SaaS) negotiations service that is exclusively available to Ramp customers. Its dedicated procurement team is readily available to negotiate vendor contracts and manage time-consuming vendor communications, all on your behalf. Ramp allows you to test out its service with one free contract negotiation, and if you’re satisfied, then you can reach out to your account manager to determine your monthly fee.

Setting up Ramp Negotiations (Source: Ramp)

Currently, Ramp can negotiate SaaS, cloud, payment processing, and more on the following types of contracts:

- New purchases

- Contract renewals

- Contracts that have just been signed

- Mid-term contract expansion

- Contract reductions

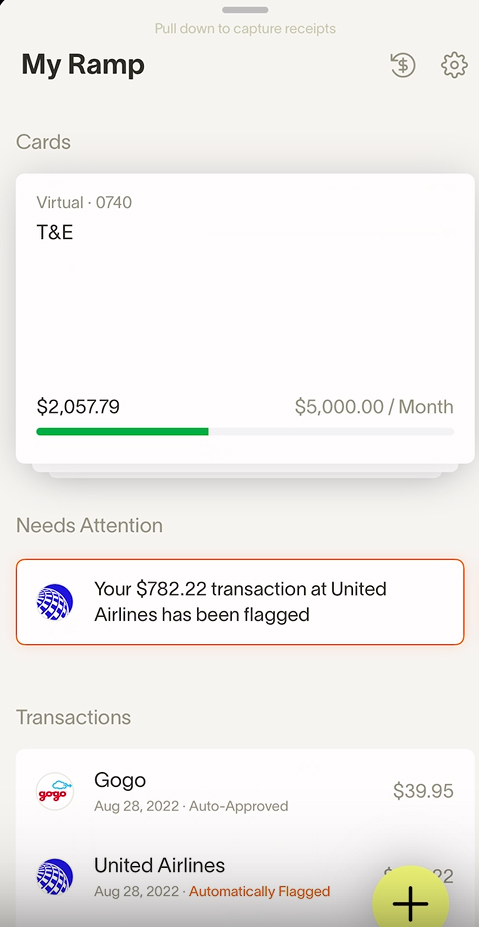

Ramp’s mobile app, available for both iOS and Android devices, has many useful features. It allows you to view card details, request limit changes, lock cards, and submit reimbursements for out-of-pocket spending and mileage. Ramp lets you view and flag transactions as accidental, request policy exceptions, flag incorrect merchant info, and add attendees to meals.

Ramp mobile app (Source: Ramp)

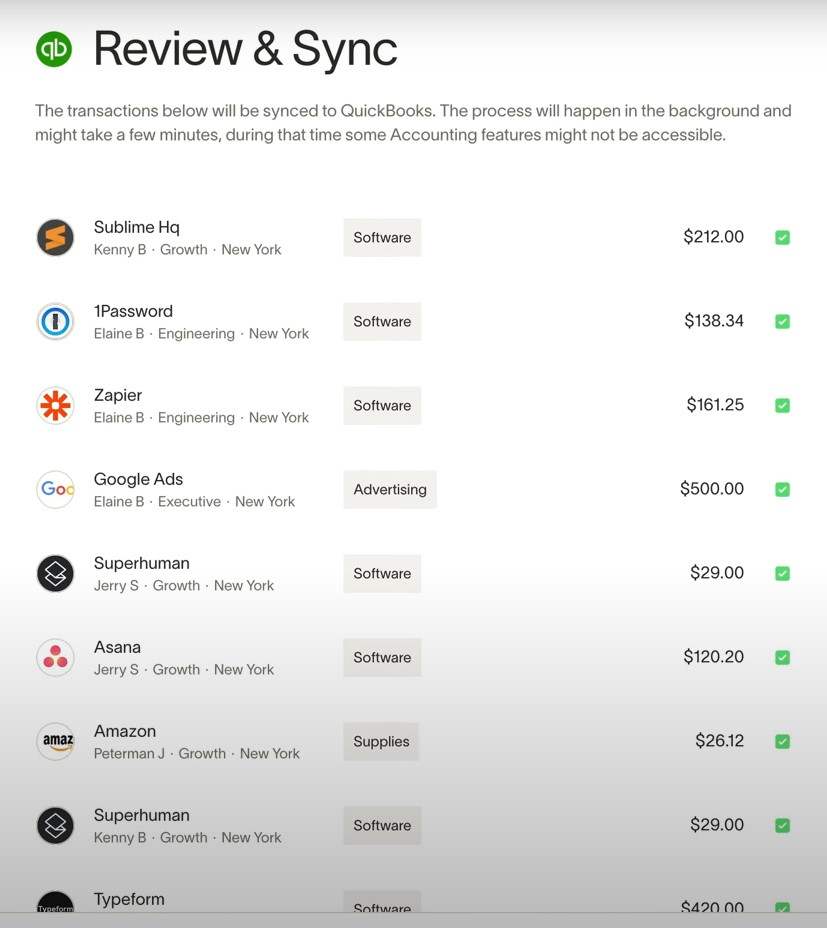

Ramp provides automated accounting sync, which lets you customize the software to fit your company’s accounting structure. You can integrate Ramp with your accounting software to close your books quicker and automate financial tasks. It currently integrates with QuickBooks Online, Xero, Netsuite, and Sage.

The platform allows you to manage vendor data, tracking categories, and bill payment details. You can also access the history of every transaction, providing an audit trail.

Syncing transactions to QuickBooks (Source: Ramp)

Ramp offers over 1,000 integrations, including:

- Accounting: QuickBooks, Xero, Sage, Oracle NetSuite

- Webmail: Gmail, Outlook

- Expense automation: Amazon Business, Lyft

- HR/Payroll solutions: Gusto, BambooHR

- Productivity: Slack, AngelList Stack

- Security: 1Password, Okta, Google SSO

Ramp Customer Service & Ease of Use

If you need to contact Ramp for questions about your account, issues with your cards, or anything else, you can use your Ramp dashboard. Simply click on the (?) icon on the bottom right of your screen, type “contact,” and send an email to the support team. Ramp promises a quick response, but it’s not the same as being able to pick up the phone and call someone or communicate via live chat.

Fortunately, Ramp is easy to use, with a user-friendly and uncluttered dashboard and a mobile app that complements the cloud-based software. It also has an extensive list of FAQs and live onboarding events.

Ramp Assisted Bookkeeping Options

Ramp offers an accountant directory that allows you to find a bookkeeping or accounting expert with just a few clicks. Its database of partners allows it to filter results by industries and sectors served, accounting software, and types of services offered. You can view Ramp’s Accountant directory.

Frequently Asked Questions (FAQs)

Ramp’s corporate card and expense management software are free to use.

Certain foreign transactions on your card may include a markup on the exchange rate that Ramp receives from its network partners (such as Visa) if currency conversion is required.

Yes, Ramp uses AI to suggest expense categories based on transaction data, past classifications, and vendor information. You can also create custom rules to further automate the categorization process.

Ramp takes security and data protection seriously. Its approach includes multi-factor authentication by phone number, encrypted data, tokenization, and SSO support through your identity provider, such as Google or Okta.

Yes, Ramp seamlessly integrates with popular accounting software like QuickBooks Online and Xero. It will automatically sync your transaction data and ensure your financial records are always up-to-date.

Bottom Line

Ramp can be a powerful tool for businesses looking for a streamlined and automated financial management system. It is a good fit for startups, small and midsize businesses, financial services sectors, and those who work remotely. It offers multi-functional software that consolidates corporate cards, expense management, bill payments, accounting, and reporting into one simple and free solution that was designed to save time and money.