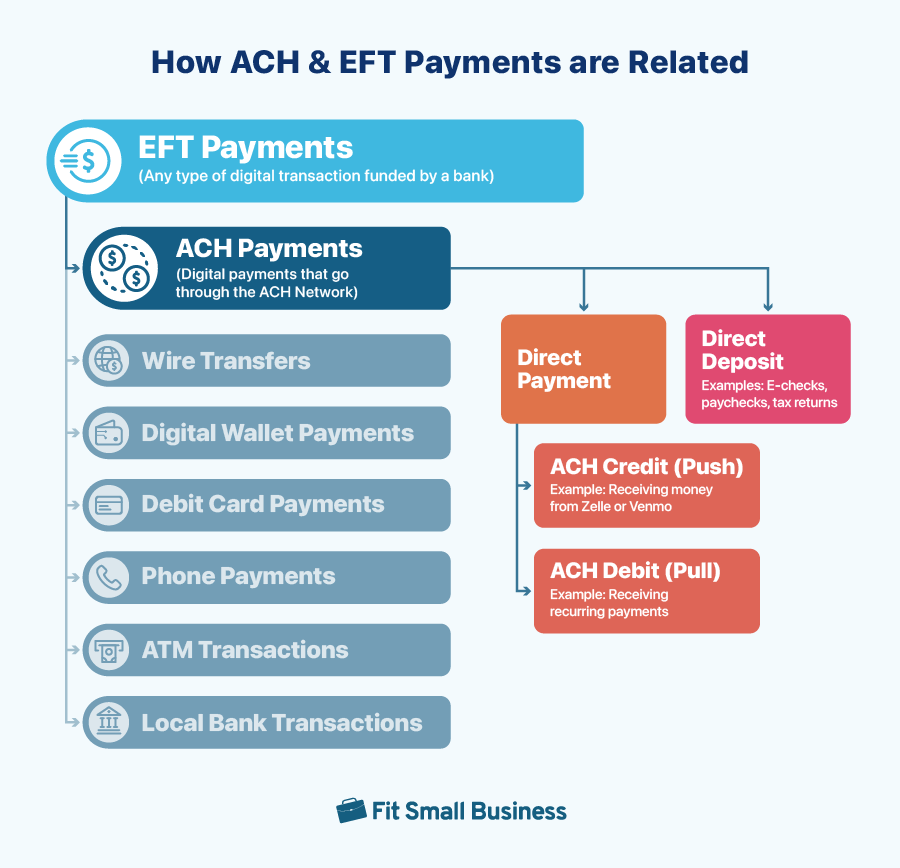

Automated Clearing House (ACH) and electronic fund transfers (or EFTs) are both catch-all phrases for certain transaction types. The main difference between ACH and EFT payments is that EFT is a larger term that refers to any type of digital transaction funded by a bank account, including ACH. Meanwhile, an ACH payment is any bank-funded transaction that is processed through the Automated Clearing House (ACH) network.

Key Takeaways:

- EFT is a broad term that refers to all types of digital bank-to-bank payments.

- ACH is a type of EFT payment that’s processed through the ACH network.

- Other forms of EFT payment do not go through the ACH network.

- With EFT and ACH, funds go straight to the business bank account instead of a merchant account used for credit card payments.

The diagram below explains the relationship between ACH and EFTs:

ACH payments are one of the many types of EFT transactions but are unique in the way funds are processed and settled.

What Is an EFT?

Electronic fund transfers, as the name suggests, are digital transactions whereby funds are transferred electronically from one account to another. The Electronic Funds Transfer Act (EFTA) is a federal law that regulates all EFT transactions for the purpose of protecting the payor. Note that it specifies “funds,” so lines of credit are not considered EFTs.

Not all EFTs are the same. For example, phone payments, debit card payments, digital wallet payments, and ACH payments are types of transfers done by virtue of a business transaction. This is not always the case for wire transfers, ATM, and local bank transactions, which are often used for remittances.

What Is an ACH?

Automated Clearing House transactions are a type of EFT payment where funds are transferred through the ACH network. The ACH network, regulated by the US National Automated Clearing House Association (Nacha) is responsible for processing, clearing, and settling all ACH payments. Payments received by echeck are also processed through the ACH network.

ACH payment is a popular payment method accepted by most local businesses as an alternative to credit cards. It is often used by B2Bs receiving local payments for large transactions. Businesses that receive payments for subscriptions, memberships, and donations also often accept ACH payments.

EFT vs ACH Comparison

Earlier we explained how ACH is a type of EFT transaction, so they essentially share certain characteristics. To help with the discussion, we will compare ACH with other types of EFT payments instead.

ACH | Other EFTs | |

|---|---|---|

Payment process used | ACH network | Direct bank-to-bank |

Transaction location | Local and some international | Local and international |

Average cost | 1% | Varies |

Funding time | Same-day to 2 business days | Instant, same-day, or up to 5 business days |

Used for business types | B2Bs, subscription/membership model, nonprofits | B2Bs, subscription/membership model, nonprofits |

Recommended for point-of-sale (POS) transactions? | No | For digital wallet and PIN debit payments only |

How Businesses Accept ACH Payments

ACH payments are processed through the ACH network. When a customer chooses ACH as a payment method, the merchant creates a payment request and sends it through to the customer’s bank along with the customer’s authorization. The customer’s bank then sends the funds and the transaction date to the ACH network, which then clears the funds and sends them to the merchant’s bank.

The entire process takes anywhere from same-day to up to two business days. This is because the ACH network operator’s business hours are only limited to when the Federal Reserve is open. Cut-off times determine if a transaction is settled the same day, the next day, or more if the transaction falls on a holiday or weekend. This makes ACH an unsuitable payment method for point-of-sale transactions.

Originally, ACH payments were exclusive to transactions within the US. However, recent technology has allowed for merchants to accept international payments processed through an equivalent ACH network in the customer’s country of origin.

How Businesses Accept Other EFT Payments

By now, we already know that there are different types of EFT transactions, including ACH payments. However, unlike ACH, other EFT payment methods have a more direct-to-bank approach for processing transactions.

Wire transfers, for example, use SWIFT or Fedwire to send data and funds between banks. ATM transactions are routed through ATM networks (check the logos on your debit card).

The speed by which EFT transactions are funded depends on the type of EFT being used. E-wallet/digital wallet payments are instantly completed. Local wire transfers can be processed the same day or up to three business days, while international wires can take as long as five business days to clear. Fees vary as well.

Frequently Asked Questions (FAQs)

These are some of the most common questions I encounter around the difference between EFT and ACH payments.

EFT covers all types of bank-funded digital payments regardless of how it is processed. ACH payments are a type of EFT processed through the ACH network.

Not all types of EFT are ideal for accepting payments for businesses. Digital wallet payments are a great option if you use a POS system. ACH is a type of EFT payment that’s also popular as an alternative to credit cards. However, it is more ideal for B2Bs and service-type businesses that collect subscription or membership payments because of the lower ACH fees compared to credit card transactions.

Both EFT and ACH payments comply with federal guidelines of the Electronic Funds Transfer Act protecting EFT transactions. This includes ensuring that all digital transactions use high-level encryption while handling and sharing transaction data.

Bottom Line

When comparing ACH versus EFT, the easiest approach is to look at how each payment type is processed. Both refer to digital payments but ACH is particularly for transactions that go through an ACH network while other EFT payments are straight bank-to-bank transactions. Choosing between other EFT versus ACH as a payment method for your business should be based on your business type, funding speed, and cost based on your expected transaction volume.