As we move to a cashless economy, the range of next-generation payment methods, such as contactless payments, digital wallets, and customer financing, continue to grow. We’ve seen these payment innovations evolve in the past year—not just as separate payment solutions, but also into seamless integrated payment strategies that bring faster, more secure, and seamless payment processing.

To compete, businesses need to stay up-to-date to meet the needs of every kind of shopper—whether online or in person.

Below, we look at how small businesses are impacted by the latest consumer payment trends in:

- Digital transactions

- Mobile and banking apps

- B2B transactions

- Buy Now, Pay Later (BNPL)

- Accounts receivable (AR) and recurring payments

- Real-time transactions

- AI-driven automations

- Augmented reality

- Open banking

- Cryptocurrency

1. The way consumers prefer to pay has changed forever

Just shy of 70% of consumers say the way they pay has changed forever due to the pandemic. By the end of 2022, the use of credit cards increased from 28% to 31% as opposed to the use of cash, which is on a steady decline. Another survey revealed that more than half of consumers now rely on digital wallets when they go out to shop.

Businesses benefit from these new consumer preferences. Many retailers are enjoying the time-saving benefits of online payments. Small businesses surveyed by Square stated it took them 542 hours to process $100,000 in non-digital payments, compared to only 189 hours to process digital payments. Consumers, who are becoming accustomed to fast and convenient shopping experiences, are more than ready to take their business elsewhere when faced with checkout delays.

Credit and debit card users also spend more than cash buyers. The average credit card transaction is $95 while cash transactions average $39, clearly giving businesses that offer credit card payments a huge incentive. And with cash payments costing 28% more to process, offering more non-cash payment methods is a great way to boost your store’s average order value (AOV).

Takeaway: Businesses clearly have a lot to gain from offering consumers payment alternatives. According to Square, more than a third of retailers are already interested in implementing new payment options.

2. Tap to pay is outpacing payment terminals

Thanks to the increasing popularity of tap to pay among iOS and Android phone users, contactless payments are starting to overtake payment terminals. Payper’s latest payment methods report predicts that tap to pay on phone and wearable devices will be the norm for in-person payments.

Tap to pay, has, in fact, extended its reach beyond retail and into the hospitality industry. Post-pandemic travelers prefer to digitally book, pay, and even send tips. Seventy-three percent (73%) have expressed their interest in using their mobile devices to check into hotels, order, and pay for food.

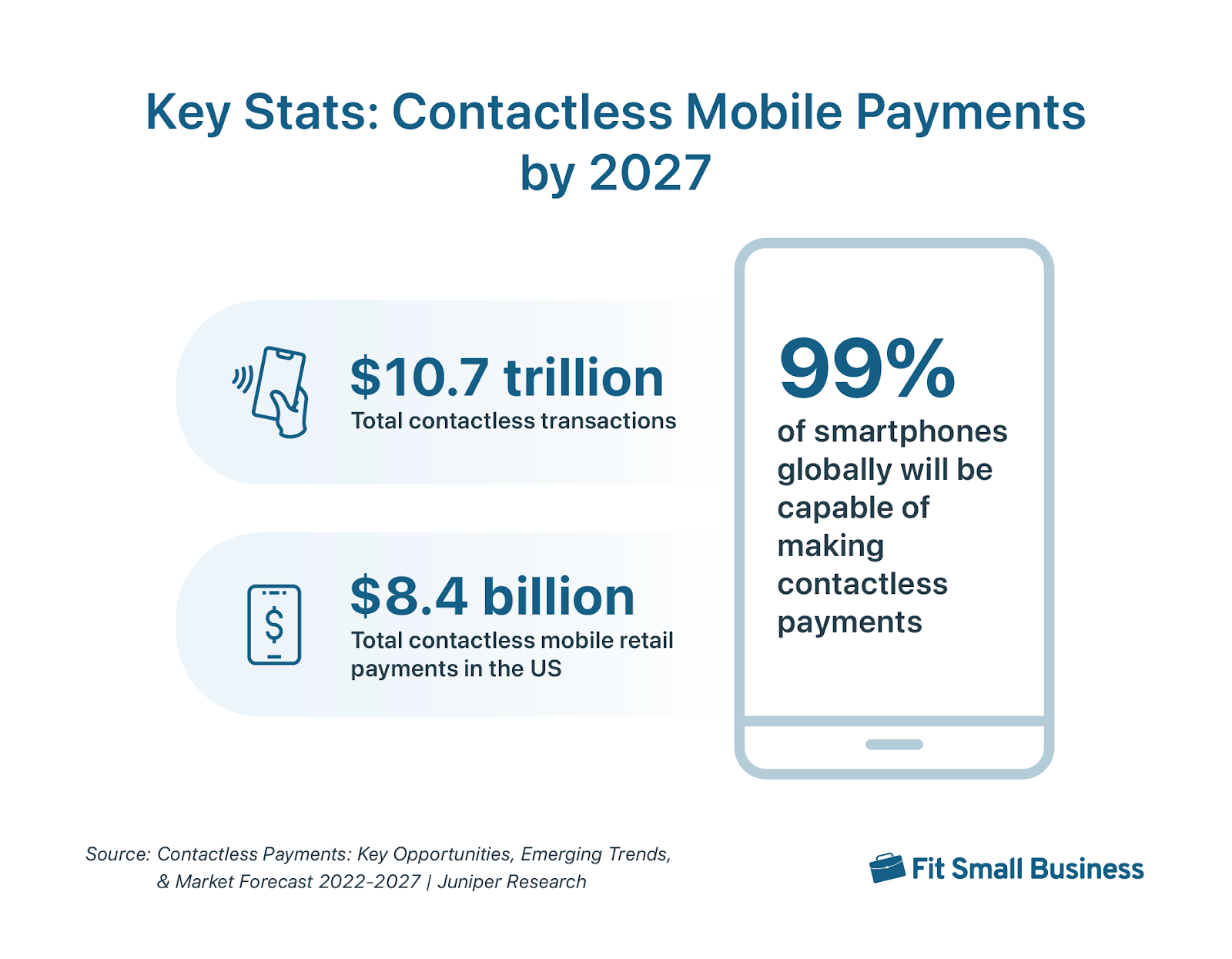

The latest Juniper research on contactless payments estimates the global growth of contactless transactions from $4.6 trillion in 2022 to $10.7 trillion in 2027. The major driving factor for said forecast is the continued development of contactless-enabled point-of-sale (POS) systems.

Takeaway: Tap to pay is becoming a popular method to accept contactless payments. For businesses, it is a cost-effective way to accept payments without the need for additional hardware. Meanwhile, tap to pay is a convenient and secure option for consumers. Learn more about tap to pay in our guide.

3. Digital wallets are winning the battle vs physical cards

In the same payment methods report, Edgar, Dunn, & Company shared their latest research on digital wallets vs physical cards. While three out of five transactions were made with physical cards in 2022, the use of physical cards in North America will grow at an average rate of 9% by 2030.

While digital wallet transactions are expected to grow at more or less the same rate, the average transaction value through digital wallets is forecast to increase to $96 trillion (up from $50 trillion in 2022) by 2030, marking a “definitive shift” toward this payment method. This is attributed to the increasing popularity of digital wallets as a safer, more convenient way of making payments in person.

Takeaway: As more and more consumers adopt digital wallets, include payment options like Apple Pay and Google Pay.

4. Biometric-enabled payments are becoming increasingly popular

Fingerprint scan, facial, eye, and voice recognition make up biometric-enabled payment processing technology. Biometrics technology is not new, but it has recently gained traction in the payments industry as a means of authenticating and completing mobile purchases. We have also seen the same technology applied to ATM transactions as well, replacing PIN codes.

According to a recent PYMNTS and Amazon Web Services survey, more than 50% of online consumers used biometrics authentication, of which 80% were for mobile purchases. Faster checkout and improved security were the main drivers for using biometrics during checkout.

Takeaway: Offer contactless payment methods that are equipped with biometric authentication (Apple Pay and Google Pay are two examples).

5. Super apps are on the rise

A super app is a mobile application/platform that offers a wide range of functions including both payment processing and personal finance management services. It also supports other tools for communication and commerce where consumers can get personalized travel, entertainment, lifestyle, and personal services (food delivery, personal insurance, stock & cryptocurrency trading, dental services, and more).

At the moment, there are a number of thriving super apps across Asia-Pacific countries. However, the latest survey among consumers outside the region saw a huge potential for super apps. Accenture’s 2022 Global Consumer Payments survey revealed 60% of consumers are open to using super apps as a single platform for tracking payments for all their merchant providers.

Additionally, small businesses can do more than just accept credit and debit cards, contactless pay, and subscriptions. Consumers can now use buy now, pay later (BNPL), split the purchase into payment installments, pay via mobile phone, or scan a QR code, among others.

Takeaway: Use a POS system and payment processor that can handle a variety of payment methods. Learn more about NFC and contactless payments.

6. B2B payments are getting more creative

Business-to-business (B2B) payments are on the rise. Though there was a small decrease in 2020, likely linked to the COVID-19 pandemic, these payments have rebounded. In 2022, total B2B payments surpassed $88 trillion.

B2B payment trends are similar to business-to-consumer (B2C) transactions—like B2C payments, B2B transactions are increasingly digital. Around 80% of B2B payments are expected to be conducted online by 2025. Additionally, 42% of executives strongly believe there will be an “acceleration of cross-border, cross-currency instant, and B2B payments” through 2025.

This year, B2B payments have been a hot topic for innovation:

- Digital payments are becoming a priority payment method for 66% of B2Bs, replacing paper checks

- Same-day ACH payments are becoming popular among B2Bs, growing by 44% from 2022

- Digital payments are slowly replacing outdated cross border B2B payment processes

- Short-term business-to-business lending is getting a boost with the adoption of buy now, pay later (BNPL)

- AI plays an even bigger role in account receivables (A/R) collection

Takeaway: Don’t be afraid to adopt new technologies when it comes to B2B payment solutions.

Check out these other resources to help you run a better B2B business:

- What Is B2B Sales? The Ultimate Guide to Business-to-Business Selling

- B2B Sales Lead Generation Ideas for Small Business

- Best B2B CRM for Sales Teams

7. Peer-to-peer payments grow

Just as innovations in B2B payments are on the rise, so are C2C—or consumer-to-consumer—payments. Peer-to-peer (P2P) payment apps and platforms like Venmo, Zelle, and PayPal have made it easy for consumers to send money to one another. This is helpful for splitting bills at a restaurant, for example.

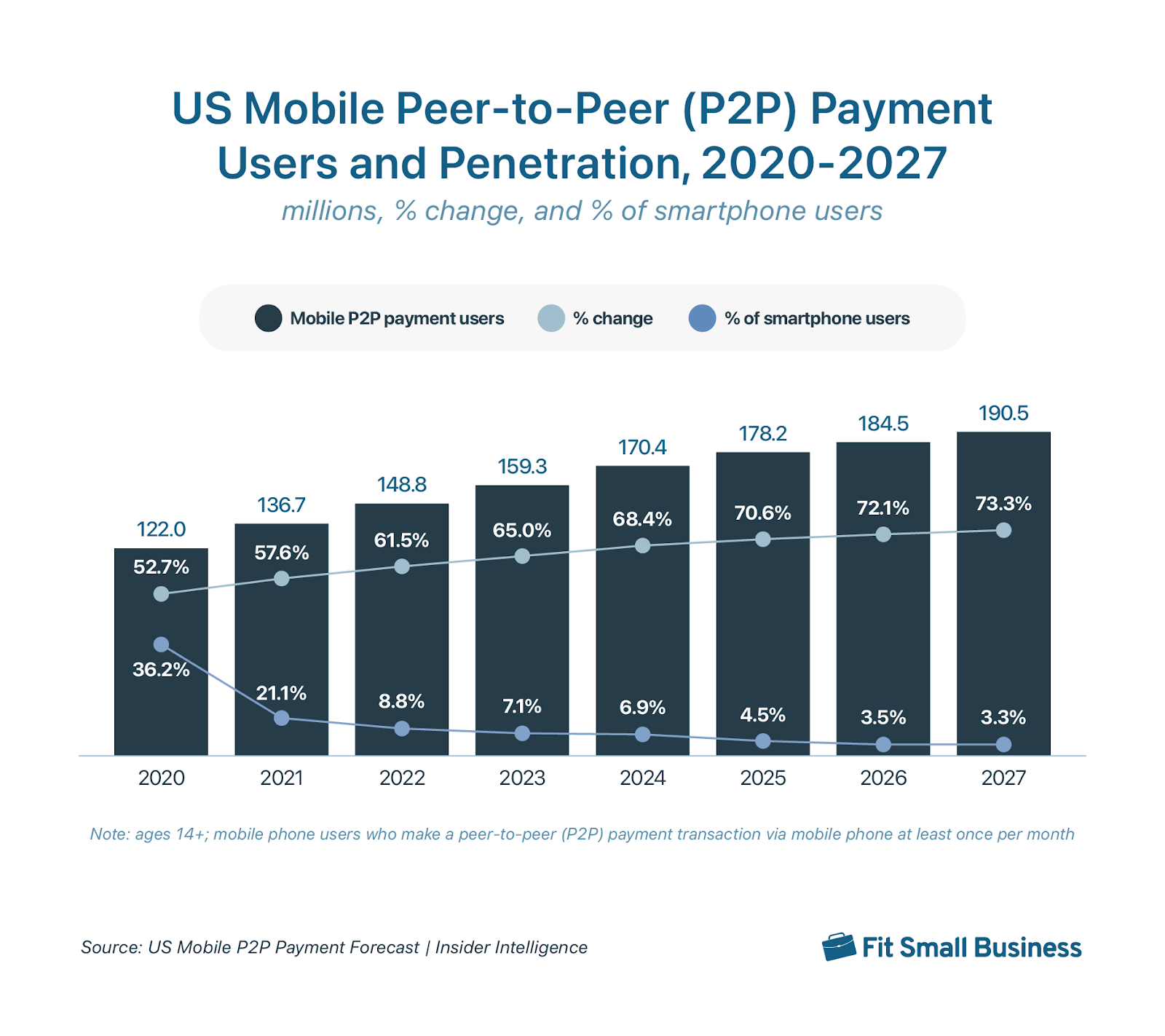

It’s estimated that by 2025, more than 70% of US smartphone owners will have a P2P mobile app. Majority (84%) of consumers have used P2P services, with convenience being a top consideration.

However, Insider Intelligence also highlights that by 2027, the growth of mobile P2P users will start to taper out and leading P2P apps will have to step up with value-added services to stay on top.

Takeaway: Consider a POS system with built-in payment processing that allows for bill-splitting. You can always give customers the option to split the bill that way or handle it on their own with a peer-to-peer money app.

8. QR codes are here to stay

Quick-response (QR) codes saw a resurgence during the pandemic, with contactless payments for in-store purchases emerging as a safe and convenient way to make transactions. QR codes are also more sustainable and allow businesses to make changes on the fly. The market size for QR code payments is expected to grow 59% from $2.9 billion in 2023 to $4.8 billion in 2028.

QR code payments are widely used across Southeast Asia, with usage expected to reach up to 590% in the next five years. It is also widely used in Latin America and West Europe. However, QR code payments struggle to penetrate developed countries, including the US, to the same extent, primarily because most consumers prefer digital wallet platforms like Apple Pay.

Here are some of the major players to consider when implementing QR codes for your small business:

- Venmo now has business profiles with scannable codes for sole proprietors.

- PayPal also launched QR codes for businesses.

- Popular payment processors like Square have deployed QR code payment options.

- Shopify’s Shop code QR code feature has existed since 2017.

Takeaway: Be an early adopter. The US has fallen behind the rest of the world in terms of payment processing technology but is finally starting to play catchup. QR codes have been a popular payment method in China for years. We expect this to be among the payment industry trends that will stick around.

9. Consumers are shopping and paying via mobile, text, and live chat

Did you know? SMS-based shopping and purchasing is part of the larger ecosystem of “over the top (OTT)-based conversational commerce” where consumers are given the opportunity to shop through various voice and messaging technologies such as chatbots, messaging apps, and smart speakers powered by conversational AI (for example, Alexa).

Nearly 20% of today’s shoppers want to be able to purchase products directly via text message or a live chat platform. As consumers become more technologically savvy and take advantage of new advancements, it’s up to small business retailers to keep up and compete with big box stores.

Consumer spending via conversational commerce is expected to reach more than $25 billion in 2023, up from $13.3 billion in 2022. The trend is expected to continue as technology like AI becomes more accessible. This is both good and bad news to small businesses as simply having this type of selling platform no longer provides a unique advantage.

Meanwhile, SMS is becoming a strong purchasing platform for US consumers. Eighty-seven percent (87%) of US shoppers who are subscribed to a brand’s SMS marketing are likely to make a purchase.

Takeaway: On top of implementing a chatbot or live chat option on your store’s website and social media accounts, provide value-added services such as digital loyalty programs to encourage repeat purchases. Don’t ignore simple strategies such as SMS marketing.

10. Payments by voice command gain traction

Voice command and voice search technology continue to improve, thus encouraging more people to adopt it. According to Voicebot.ai, some 35% of American adults own a smart speaker.

Voice command has also emerged as a commerce “channel” and gained traction as of late, with shopping via voice commerce forecasted to reach $19.4 billion by the end of 2023. A little over a quarter of US consumers confirmed using smart assistants to make online purchases in the past year.

11. Augmented reality in payments is now more accessible

If you’re familiar with Pokemon Go, chances are you already have an idea of the potential of virtual reality (VR) as a customer engagement platform. So it comes as no surprise that the technology behind augmented reality is slowly making its way into the payment industry, now that artificial intelligence (AI) has been made commercially available.

Initially accessible through VR glasses, developers have been working on adding augmented reality payments and personal finance management using smartphone cameras.

Leading names in augmented reality for commerce include:

- Mastercard: In 2020, Mastercard launched its very own augmented reality app where consumers can browse and pay their purchases using VR glasses or smartphone cameras.

- IKEA: One of the earliest proponents of augmented reality in commerce, using the technology to design a space with any IKEA products.

- Visa: Also launched its own augmented reality payment app that allows users access to a 3D map to locate shops, browse products, and make purchases.

12. Convenience powers one-click checkout growth

Since Amazon’s patent on one-click checkout expired several years ago, ecommerce businesses have been racing to develop, implement, and perfect the technology to streamline the checkout process and boost conversions.

A staggering 97% of buyers have bailed on an online order because it was complicated or inconvenient to finish, causing shopping cart abandonment rates of up to 71.4%. And 83% of shoppers say convenience is even more important now than five years ago.

A 2023 Baymard Institute study found that three of the top five reasons for cart abandonment are linked to convenience: complex checkout process, long delivery timeframes, and being required to create an account.

Who Are the Major Players for One-click Checkouts?

- Expect to see more of the one-click ecommerce payments like Bolt, Shop Pay, Apple Pay, Google Pay, and PayPal One-touch.

- According to Shopify, conversion rates increase by more than 50% when using Shopify Payments; it also results in winning 45% more chargeback disputes.

- PayPal checkout boosts conversions by 28%, increases unplanned purchases by 19%, and increases repeat purchases by 13%.

- With ecommerce giants like Shopify, it will be an uphill battle for newcomers and third parties to get widespread adoption. However, in one sign of smaller providers making inroads, Bolt checkout partnered with Authentic Brands Group in November 2020 to offer one-click checkouts to their more than 50 consumer product companies.

13. Buy Now, Pay Later (BNPL) popularity continues to rise

Installment-based purchases were already on the rise before the jump to buying online in the form of BNPL apps. However, once the pandemic hit, US adoption rates of BNPL technology, both by retailers and shoppers, skyrocketed. According to the Consumer Financial Protection Bureau, the dollar volume of BNPL loans increased by over 1,000% from 2019 to 2021, from $2 billion to $24.2 billion. BNPL lending in the US is forecast to hit $127.73 billion by 2025.

Businesses should be aware that BNPL increases average order value (AOV) and draws consumer loyalty and repeat purchases. But it hasn’t come without its investigations and headaches. In the UK, regulators banned an advertising campaign by international payment solution Klarna for causing irresponsible spending, particularly among young consumers.

Furthermore, the Federal Reserve reports American credit card debt increased by $61 billion in Q4 2022 to $986 billion, surpassing the pre-pandemic record of $927 billion. This could push consumers toward BNPL even more if they don’t have room on cards for purchases or want to avoid continued credit card interest. In fact, a Motley Fool study found that 33% of consumers use BNPL to avoid credit card interest and 48% use it for purchases they can’t afford in their budget. More than one in 10 (14%) say when credit is maxed out they turn to BNPL.

Who Are the Major Players in the BNPL Market?

- Klarna raised $650 million at a $10.65 billion valuation in September 2020. With over 12 million active monthly users and 55,000 daily downloads, Klarna signals to the retail industry that BNPL is here to stay.

- Afterpay reported 1.9 million active US customers in June 2019. That number jumped 219% to 5.6 million active customers in June 2020.

- In 2020, PayPal released a new Buy Now, Pay Later program as an installment solution.

- The number of Shopify merchants offering BNPL has increased by 60% since the start of the pandemic.

- In 2021, Amazon partnered with Affirm to offer customer financing options on purchases of $50 or more.

- Square acquired Afterpay in 2021 for $29 million, with plans to incorporate Afterpay services into Square POS plans.

BNPL expands to B2B and encourages responsible lending

Global B2B transactions are expected to reach $113 trillion by the end of 2023. And with 80% of global B2B transactions being made through trade credit (short-term lending), the potential for BNPL in this space is huge. Small businesses will benefit the most from this strategy.

In 2022, a number of BNPL startups have begun offering B2B BNPL solutions:

- Billie: Offering businesses the ability to use BNPL in investing on business equipment.

- Mondu: Focusing on offering BNPL in the trade finance industry

- Tranch: Designing BNPL solutions for SaaS and service providers

- Tillit: Combining invoice financing with BNPL

To adapt to the way B2Bs operate, a number of BNPL platforms now include features such as lengthier payment terms, instant mobile checkouts, custom-tailored limits based on credit history, and AI-driven custom credit terms.

While the future of BNPL for B2Bs comes with a move for stricter regulations and vetting, businesses are used to underwriting and are already more likely to be approved for loans. Ultimately, small and micro businesses will have a better chance with BNPL than with banking institutions.

Takeaway: Don’t forget to designate a special space in your retail store for BNPL customers. The whole idea of BNPL is convenience—the last thing you want to do is make your customers wait in long lines to receive their order. Learn more in our roundup of BNPL statistics.

14. Cash stays on the decline but is not going anywhere

As little as 11% of POS transactions are paid for in cash. A 2023 study from the Federal Reserve Bank of San Francisco found that 82% of consumers prefer cashless payments.

Globally, cashless payments grew 42% and are expected to more than double by 2030.

That said, cash payments are far from extinct. According to Accenture’s latest payment survey, 59% of consumers still use cash at least five times a month. Some business types like laundromats are also cash-based, making it impossible to ignore the sales opportunities by continuing to offer cash as a payment option.

Takeaway: Keep cash as an available payment alternative regardless of your business type to make sure you don’t lose out on customers who carry cash. Ensure that your business has a concrete policy on how to record cash sales and track petty cash.

15. Automation powers more payments

Automation and artificial intelligence (AI) are two buzzwords in business lately, and they’re also impacting the payments industry. Automation helps businesses boost efficiency, accuracy, and profitability. As many as 41% of retailers plan to automate operations with the goal of increasing staff efficiency.

While there’s been trepidation in the past, consumers are more open to the technology than ever before. In fact, three-quarters of shoppers say automation technology wouldn’t dissuade them from shopping with a retailer, and nearly a quarter would even be more inclined to shop with a retailer if they do use the technology.

Modernizing accounts receivable (A/R) with automation

According to a survey from Billtrust, 81% of businesses reported an increase in delayed payments in 2023 while another report found that around half of businesses are being paid late by their customers. But while delinquency is a major concern, a recent survey revealed that 77% of businesses are behind with their accounts receivable collections.

A separate study shows that businesses that have automated half of their A/R process saw significant improvements, primarily an 85% decrease in aging transactions. The automation also improved efficiency in order processing as well as invoice accuracy and tracking. Already, 90% of executives are intending to expand automation in their A/R process by next year.

AI-driven payment automation

Artificial intelligence has long been involved in key payment processing functions. As early as 2019, 25% of small businesses were already using AI for digital banking and other financial services. With the latest advances in AI technology, AI is set to play a major role in other payment automation efforts beyond fraud management and chatbots.

This includes:

- Automating repetitive tasks such as data entry, reconciliation, and reporting for a more streamlined payment workflow.

- Faster transaction approvals by reducing the need for manual reviews through machine learning algorithms

- Optimizing customer sales journey by analyzing behavior, preferences, and trends

- Creating highly customized shopping carts for a better ecommerce checkout experience

- Improving mobile payments with personalized payment options and recommendations

Takeaway: Start small with automation. Audit your current payments workflow and see where you have the most opportunity for efficiency. You can automate one thing at a time.

Check out these automation resources:

- Best Sales Automation Software Tools

- What Is CRM Automation? Benefits & Examples

- Artificial Intelligence in Customer Service: The Ultimate Guide

16. Digital currencies remain unpredictable but viable

The rise of Bitcoin and other digital or cryptocurrencies took a hit in the recent past, but it still continues to be a viable payment method to keep on your radar. Though nine of 10 American adults have heard about the digital currency, only 16% have invested in it. However, it’s growing rapidly.

One survey shows that 61% of consumers are satisfied with their experience with cryptocurrency and will likely buy more this year—and not just for trading. As many as 33% purchase cryptocurrency for shopping, of which 26% say they would switch to merchants who offer crypto as a payment method.

It is estimated that Bitcoin payment adoption has grown at an average rate of 21.3% since 2022 and will continue till 2025.

Cryptocurrency available in credit unions

Lately, the demand for cryptocurrency has expanded into credit unions. More than half of cryptocurrency owners have expressed an interest in accessing their cryptocurrency assets through their financial institutions.

Unlike traditional banks, credit unions (though limited) are more open to the idea of cryptocurrency investing, with 5% currently offering this service, and another 5% planning to launch the same. Among the list, WeStreet Credit Union was the first to partner with cryptocurrency platforms Etana Custody and CryptoFi allowing its members the ability to trade cryptocurrency.

The rise of Central Bank Digital Currency (CBDCs)

The rise of CBDCs is primarily driven by the decreasing use of cash. However, at the moment, CBDCs are not available in the US, but it is gaining popularity in major countries around Europe and Asia.

Takeaway: Learn how to accept crypto as a small business and consider enlisting a payment processor that can handle crypto and other digital currencies. Crypto payments often have lower transaction fees.

17. ACH payments are getting an upgrade

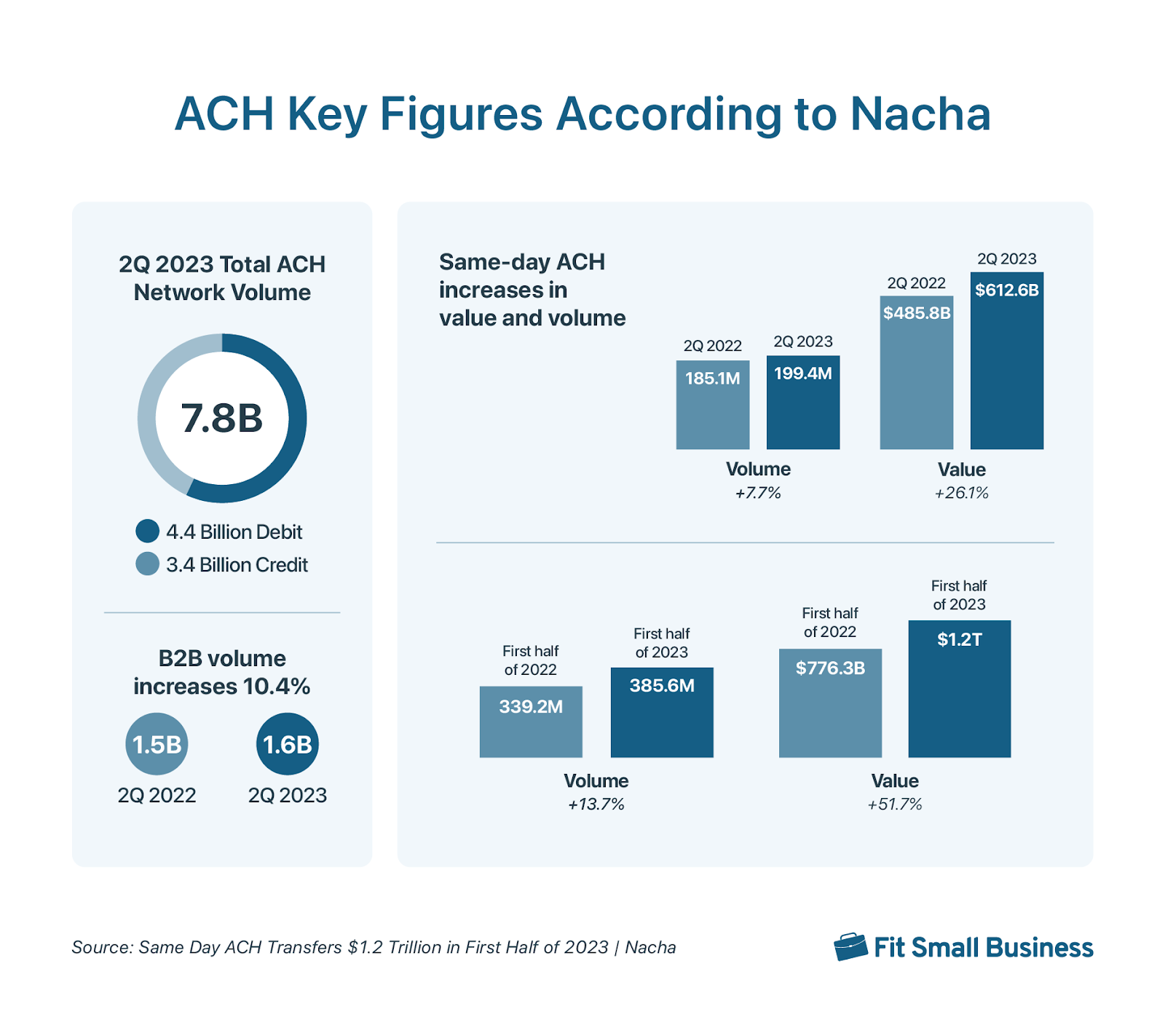

Waiting for days to process ACH payments is becoming a thing of the past. Same-day ACH payments are growing in popularity, primarily because it is a significant step up to the traditional ACH payments, which take days to process. The first half of 2023 alone saw a 13.7% increase in the volume of same-day ACH transactions from 2022 equivalent to $1.2 trillion. Of these, B2Bs contributed 1.6 billion in the volume of same-day ACH transactions.

The advent of same-day ACH payments also ushered in more payment method innovations such as Pay by Bank, which offers higher payment authorization and significantly better customer experience.

Takeaway: Even consumers are now aware of the ever-increasing cost of credit card payment processing. B2Bs, subscription-based, and those that accept cross-border payments should consider offering this more efficient and cost-effective ACH payment method.

Related reading:

18. Real-time bank payments are now possible with Open Banking

Mastercard’s 2022 New Payments Index report shows how open banking is already being widely used for personal banking, bill payment, and BNPL financing. This is driven by 71% of consumers who prefer to make payments directly from their bank accounts. With this also comes the use of biometrics—fingerprint and facial recognition as a convenient and reliable way of securing user banking information.

With the latest improvements to open banking technology, real-time bank payment methods like account-to-account payments (A2A or bank-to-bank transfers) have become more mainstream. Studies show that leveraging open banking for A2A payments results in a more than 95% payment conversion rate.

Bottom Line

In almost any buying situation, the checkout transaction can make or break the experience and the sale. As we’ve learned from the consumer payment trends listed above, shoppers want convenience and simplified checkout—both online and in store.

If you aren’t taking the steps to offer seamless transactions through one-click online payments, BNPL, QR code payments, and voice command payments, among other services, you’re likely missing out on sales.