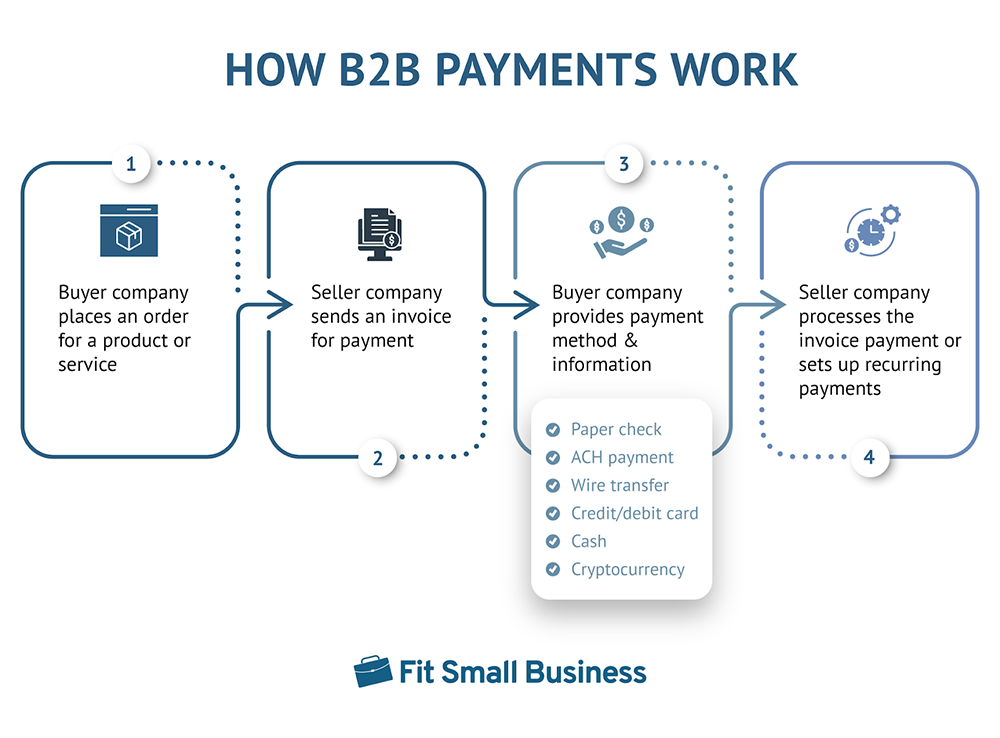

Business-to-business (B2B) payments are transactions between two companies, usually for the exchange of goods or services. They are often made through invoices and purchase orders and processed via check, ACH, or credit card.

In this guide, we take a look at common terms, payment methods, challenges, and trends in B2B payment processing.

How are B2B payments different from B2C payments? While B2B payments are the exchange of funds between businesses, B2C (business-to-consumer) payments are everyday transactions, like shopping online and in person or paying a bill. B2B payments are generally larger and happen after products are received or on a set schedule.

Common B2B Payment Terms

B2B payments are not as straightforward as B2C payments. In B2B transactions, various payment terms are used to define the timing, method, and conditions under which payments for goods and services are to be made. These terms play a crucial role in shaping the financial relationships between companies, impacting cash flow, working capital management, and overall business operations.

Below are some common B2B payment terms that can be defined in a B2B transaction:

- Net 30, Net 60, Net 90: These terms specify the number of days within which payment is expected after the invoice date. For example, “Net 30” means the buyer is expected to settle the invoice within 30 days from the date of the invoice. These terms provide a clear timeline for payment and help businesses manage their cash flow.

- Due on Receipt (DOR): With this term, the payment is due immediately upon receipt of the goods or services. It’s often used for smaller transactions or when there’s a sense of urgency in completing the payment. DOR is more common in ecommerce and retail environments.

- Cash on Delivery (COD): In COD transactions, the payment is collected by the seller at the time of delivery. This term is prevalent in industries where goods are physically delivered, such as wholesale distribution.

- Advance Payment: Some transactions require buyers to make an upfront payment before the goods or services are provided. This provides assurance to the seller and can be especially important when dealing with new or international clients.

- Payment in Advance (PIA): Similar to advance payment, payment in advance specifies that the full amount must be paid before the goods are shipped or services are rendered. This is often seen in high-value or custom orders.

- Partial Payment: Partial payments involve splitting the total amount into multiple installments, with each installment paid at specified intervals or milestones. This approach is common for large projects or long-term contracts.

- Letter of Credit (LC): A letter of credit is a financial instrument issued by a bank that guarantees payment to the seller upon meeting certain conditions, such as providing the required documentation. LCs are commonly used in international trade to reduce the risk for both parties.

- Open Account: In an open account arrangement, the seller ships the goods or provides services upfront and extends credit to the buyer, who agrees to pay within a specified timeframe. This is based on mutual trust and is common between established business partners.

- Consignment: In consignment, the goods are sent to the buyer, but ownership remains with the seller until the goods are sold. The seller receives payment once the goods are sold, reducing the risk for the buyer.

- Escrow: Escrow involves using a third-party agent to hold funds until the terms of the transaction are met. Once the conditions are satisfied, the funds are released to the seller. This is often used in complex transactions to ensure both parties fulfill their obligations.

- Installment Payment: Installment payments divide the total amount into equal parts to be paid at regular intervals. This is commonly used for high-ticket items like machinery or equipment.

B2B Payment Methods

Businesses have just as many choices for making B2B payments as consumers do for B2C payments. In fact, there is a growing percentage of businesses paying bills through peer-to-peer channels like PayPal or Venmo and even using cryptocurrency. We discuss the most common methods below.

It’s important to keep in mind that a business may use many different payment methods, from a corporate card for on-the-go expenses to wire transfers for large, one-time purchases. Cash, while decreasing in popularity, is still used for in-person purchases. Your business needs to be flexible in the kinds of payments you accept.

Non-monetary Payments: Not all payments between businesses are monetary. Sometimes, businesses negotiate for shared or traded services, advertising, and even equity in the other’s company. While we don’t cover those in this article, they do have an impact on payment collection and tracking.

Paper Checks

A 2022 B2B payments survey reported that 49% of businesses plan to convert from paper checks to electronic payments. Although the use of checks has decreased over the years (from 51% in 2016 to 42% in 2019), a third or 33% of organizations still used checks for B2B payments in 2022.

There are several reasons for the decrease in the use of paper checks. The main reason is that they take longer to process. First, checks usually need several approvers before they are issued. Second, they need to be snail-mailed, which can take two days to two weeks. Then, they must be approved. It takes two to five days for a paper check to clear the bank. However, some businesses continue to use them because they make an easy audit trail.

Further, paper checks can be used to “buy” time. If a business does not have the funds immediately, they may issue a check-in anticipation of the funds being available when the check is cashed. They can even request you hold the check. This, of course, makes a problem for you if they time it wrong and the check bounces.

According to NACHA, it costs about $1 to $2 to receive and process a check when accounting for manpower and other costs. Other payment methods can be cheaper, depending on the amount of the invoice.

ACH Payments

ACH payments are made through the Automated Clearing House and are essentially bank-to-bank transfers of cash. They work great for invoices and recurring payments. ACH payments are fast, often taking as little as 24 hours, and are more secure for several reasons:

- They require an American bank account, which gives identification for law enforcement in case of fraud.

- They have a guarantee of payment—no chargebacks.

- NACHA enforces rules and regulations while keeping numbers confidential.

Most payment processors can handle them, making it easy to include them in your invoices.

ACH payments generally cost about 1% of the transaction and often have a $10 cap. Some financial institutions don’t charge at all to process ACH transactions because they are more convenient. It’s expected that as companies move away from paper checks, this will become the most common B2B payment type. Already, the Association for Financial Professionals says that 87% of businesses use ACH Credit for payment transactions.

Looking to accept ACH payments? Learn more about accepting ACH payments in our small business guide and check out our ranking of the best ACH payment processors.

Wire Transfers

Research by Juniper found that by 2026, 80% of the overall transaction value of B2B cross-border payments will be by wire. They are most popular where ACH transfers don’t work: international payments and payments over $1 million per day.

Wire transfers can make funds available to you within 24 hours and generally cost around $15. One drawback of using wire transfers is that they don’t consistently include remittance information, which can be an issue for recordkeeping.

Credit Card Processing

Credit cards are a convenient way to pay for things, from gas or meals on a business trip to an invoice or recurring subscription to business software. However, they can be expensive for both the sender and the receiver. Nonetheless, card use is expected to experience a compound annual growth rate of 7.3% by 2026, according to Beroe.

The use of virtual cards is also on the rise, and B2B payments are expected to make up 71% of total virtual card payments by 2026. Virtual cards make it convenient for businesses to issue employee cards and track spending.

However, credit card processing costs an average of 2% to 4% per transaction, often with an additional flat fee of 5 to 35 cents. Any business can process a corporate credit card, but if you can qualify for Level 2 or Level 3 credit card processing and have a merchant account that offers the discounts associated with these levels, you can save up to 1% on your card processing fees. This is significant, especially with higher-value transactions.

Learn more about Level 2 and 3 credit card processing, including their qualifications and benefits.

Cryptocurrency

Cryptocurrency is a growing B2B payment field. PYMNTS reported that over 37% of businesses say they are using blockchain and cryptocurrencies for cross-border transactions. Another 13% are considering adopting the technology for that purpose.

This payment method provides speed, predictability, and security—especially seen when dealing with international transactions, which otherwise can involve exchange rates, multiple processors, and other hindrances. The disadvantage, of course, is the volatility of the cryptocurrency market.

Cryptocurrency exchanges charge up to 1.5% per trade. Many payment processing systems are also jumping into cryptocurrency processing.

Cash

Cash is most often used for businesses doing in-person transactions in the hundreds of dollars range or less. While it costs nothing to “process” a cash payment, you do need to be careful to record the details (amount, date received, etc.) as there is no other printed or electronic “paper trail” for tracking. So, cash is not commonly used for B2B payments because they are rarely processed in person and they do not have the same paper trail as other payment methods.

Interested in accepting cash payments only? Learn more in our guide to running a cash-only business.

B2B Payment Challenges & Solutions

Taking B2B payments offers many challenges, but digitization can provide solutions to address these challenges. In general, strong technology, well used, can help alleviate these issues.

Delayed Payments

Most small businesses are familiar with chasing payments. It’s an unfortunate reality of business. In fact, one analysis found that the average payment period lasts 34 days, despite expected terms of 27 days. The analysis found that one of the biggest contributing factors is that checks account for around 40% of B2B payments. Another is the remote workforce, which can delay approvals.

Solution: It is important to set clear payment terms and expectations upfront. Suppliers could impose penalties for late payments and incentives for early payments. Choose an invoicing solution that could be set to automatically send invoices and reminders.

According to Tipalti.com, 9% of accounts payable (AP) teams are now fully automated, a marginal increase from the 8% reported in 2019. However, 41% of AP teams also expect complete automation in their department within one to three years.

Fraud Risk

According to a PYMNTS and TreviPay study, 98% of B2B businesses reported fraud attacks in 2021, losing 3.5% of their annual sales revenues on average. Unfortunately, many payment platforms don’t offer the security needed to protect your data and your customer’s data.

Solution: Upgrading to a more secure B2B payment processor will help mitigate the likelihood of falling victim to fraud, as does qualifying for Level 2 and 3 payment processing, which requires more payment information to decrease the chance of fraud.

The tips in our guide to ecommerce payment security can help address risks of fraudulent activity.

Complexity

Complexities can cost businesses up to 10% of their revenue, and almost half lose 4% to 5% of their monthly revenue to inefficiencies. Companies that do business internationally are twice as much at risk. Some of the few complexities to watch out for are the company’s preferred way to pay, software that is not set up properly, and payments in kind.

Solution: To address these potential complexities, it is important to carefully document and monitor any payment term agreements. It is also good to choose a B2B system that supports a wide range of payment methods and is easy to set up.

Slow Processing Times

In B2B payments, the speed at which transactions are processed is a crucial factor that can significantly impact the efficiency and financial health of businesses. Unfortunately, slower processing times in B2B payments present a substantial challenge that can lead to various operational and financial setbacks.

Solution: Digitizing payment processing can significantly increase the processing times. Look for B2B payment processors that offer faster processing times and instant transfers.

High Transaction Fees

Transaction fees are always a concern for all kinds of businesses, and it is a bigger concern for B2B payments because they often involve higher amounts. Cumulative transaction fees can become a substantial operational expense.

Solution: To alleviate the effects of high transaction fees, shop for affordable B2B payment solutions. Look for providers that offer lower fees for Level 2 and 3 processing or lower rates for higher volume transactions.

B2B Payment Trends & Outlook

In general, businesses can expect to see an increase in B2B payments and a strong move toward digitization, especially with payments by ACH. Here are some particulars to consider:

- B2B payments are growing by a predicted CAGR of 10.1% through 2030, with over $111 trillion in payments expected by 2027.

- Up to 80% of B2B transactions will be digital by 2025.

- The use of cryptocurrency cross-border payments is expected to increase to a volume of 745 million by 2025.

- Cybersecurity is a top accounts receivable (AR) and B2B payments concern for 52% of businesses.

- 21% of small businesses are interested in applying artificial intelligence (AI) or robotic process automation.

See more in our rundown of B2B payment statistics.

B2B Payments Frequently Asked Questions (FAQs)

Expand the sections below for the most commonly asked questions about b2b payment processing.

B2B businesses primarily work with other businesses, so it’s really a matter of degree and practice. Learn more in our article on B2B sales.

B2G simply means business to government, where a government entity is your customer rather than a business. There aren’t any specific changes to how you handle payments as far as processing them.

In general, yes. A payment processor will enable you to take credit, more easily process ACH payments, and may even handle crypto for you. If you only choose to take checks and cash and will work with your bank for wire transfers and ACH, you can avoid getting a merchant account, but you are limiting your capabilities and making things more difficult for your staff, which could increase costs in the long run.

Any business working with another business as a customer accepts B2B payments by definition. However, if you take credit card payments from businesses, you may want to check with your merchant account or payment processor about qualifying for Level 2 or Level 3 card processing. These are B2B/B2G rates but require extra security and have transaction volume minimums.

Bottom Line

Globally, B2B payments are growing. If you work with businesses, then understanding how to handle B2B payments will save you time and money. The key word is digitization.

Automating your accounts receivable process and invoicing, getting a payment processor experienced with B2B payments, and making sure your software cannot only accept digital payments but also collect, share, and analyze the information associated with these payments will save you time, money, and headaches.