An accounts receivable (A/R) aging report shows all unpaid customer invoices grouped by the number of days outstanding. Its primary purpose is to keep track of unpaid customer invoices and how long they remain unpaid. A summarized A/R aging report will have one total for each customer broken up by the age of the invoice, which will typically be grouped by: 0 to 30 days, 31 to 60 days, 61 to 90 days, and over 90 days. Included in our best practices for managing Accounts Receivable is to monitor your A/R report closely and act swiftly when an invoice becomes overdue.

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

When & How To Generate an A/R Aging Report

You should generate an accounts receivable aging report at least once a month, if not more often. This allows you to stay on top of invoices so that you can remind your customers that an invoice is coming due or notify them of invoices that are past due.

With accounting software like QuickBooks Online, you can generate an A/R aging report in just minutes. Within QuickBooks, click Reports in the left-hand menu bar and look for the Accounts Receivable Aging Report. Click it, then QuickBooks Online will generate the report. You can also create one manually using Excel or Word by listing your outstanding invoices by due date, but it can be very time-consuming.

How To Read an A/R Aging Report

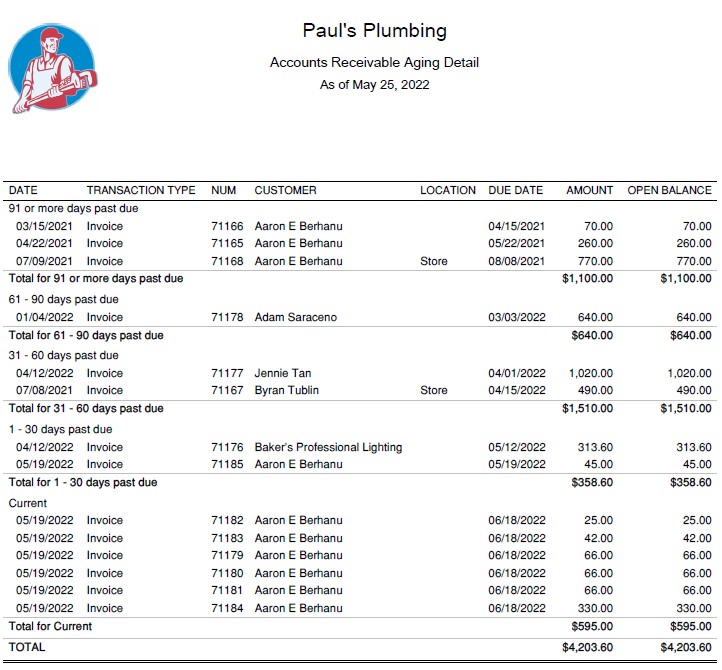

Compared to other accounting reports, the A/R aging report is fairly easy to understand. The detailed A/R aging report still shows you the age groups but provides more information on the receivables belonging to the age groups. The detailed report is the one you’ll need to use to follow up with customers because you’ll have more details about particular accounts under each age group.

Most accounting software like QuickBooks Online have both a summary and detailed report that you can run.

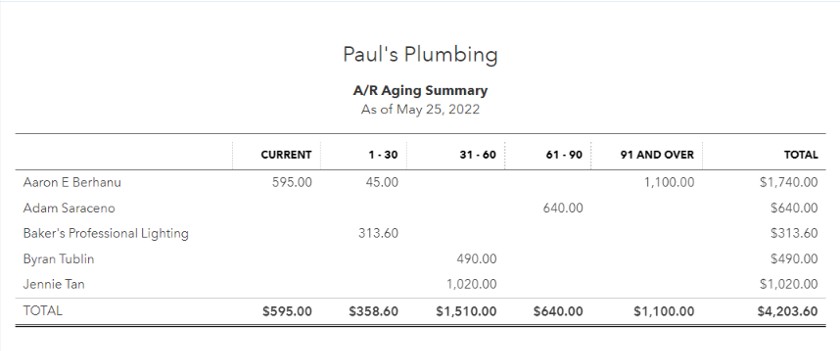

Accounts Receivable Aging Summary report

In the screenshot above, we have a sample A/R aging summary report from QuickBooks Online that shows a total accounts receivable balance of $4,203.60. We can see that only $595 of the A/R isn’t yet due while the rest of the receivables are overdue between one to over 90 days.

Moreover, we can also see that 36% of total receivables are in the 31-60 days age group. We can derive from this report that the company is not doing good in collecting balances from customers. Understanding collection patterns and practices can be evaluated by looking at the A/R aging report.

Detailed Accounts Receivable aging report

While the first image provides an example of a summary report, the image above is an example of a detailed A/R aging report, which separately states each invoice. In our sample detailed report above, we notice that one of our customers, Aaron E Bernahu, has several outstanding invoices that are 30 days past due, more than 30 days past due, and more than 90 days past due.

Given this information, we should strengthen our collection requests to Aaron E Bernahu because of his unpaid accounts. We can also use the information in the detailed report when sending a payment reminder for past due accounts.

Aside from enhancing collection from these delinquent accounts, we can also assess the business’ credit granting policies. By using Aaron E Bernahu’s account, we can see that the business keeps on granting credit to the customer even if it already has long overdue balances. This credit granting practice is not good because it increases the risk of default.

Using the A/R Aging Report To Get Paid Faster

When we extend credit to customers, it’s good practice to remind them of their outstanding balances. We can use the A/R aging report to send them timely reminders and reduce the occurrence of late payments from them. Here’s how we can use the A/R aging report when asking for payments:

- Current accounts: An account is current if it’s not yet past the due date. Meaning, it’s still within the credit period. You should send a payment reminder to customers in the current section of the report when their invoice is within seven days of the due date.

- One to 30 days past due: You should call, text, or email a client within two business days of an invoice becoming overdue. The communication should be informal and a simple reminder to pay their invoice. If the invoice isn’t paid within 14 days of the due date, you should send the first in a series of four collection letters along with follow-up telephone calls. If the invoice is still not paid as the 30-day overdue mark approaches, you should send the second collection letter.

- 31 to 60 days past due: If an invoice has been overdue for more than 30 days, the collection problem has become serious and a third, more strongly worded, collection letter should be sent. In addition to the formal letter, you should conduct weekly phone calls to these customers.

- 61 to 90 days past due: Invoices that are more than 60 days past due can be considered delinquent accounts. You should now send the fourth collection letter, which highlights your planned actions if the customer doesn’t pay. Assuming the customer hasn’t responded to any of the letters or calls, you should freeze their account and stop accepting orders from them until they settle their account. You can also consider legal action or turning the account over to a debt collection agency. .

You can learn more about collection letters and download templates for all four recommended letters by visiting How To Write a Collection Letter.

Estimating Bad Debts Using the Aging Schedule

One of the uses of the aging schedule is to estimate bad debts. Since the aging schedule classifies customer accounts per age group, you can set a target collection rate per age group, such as 30% collectible for accounts 91 days past due. You can set higher collection rates for accounts that are less than 30 days overdue.

Generally accepted accounting principles (GAAP) require businesses to estimate the amount of their outstanding A/R that is uncollectible. However, small businesses don’t have to follow GAAP unless required by a bank, investor, or other creditors. Instead of estimating bad debts, they can use the direct method of writing off a bad debt once they give up trying to collect it. For income tax purposes, most businesses must use the direct method and aren’t allowed an allowance for bad debt as required by GAAP.

Writing Off Uncollectible Accounts

When a customer can’t pay their debts after a series of collection letters, you can instead write them off the books using the direct write off method. The decision and amount to write off often depends on the cost-benefit consideration. Other companies resort to receivable financing or invoice factoring to recover these amounts.

The entry to write off an uncollectible account is:

Debit | Credit | |

|---|---|---|

Bad debt expense | 330 | |

Accounts receivable | 330 |

Sometimes, it’s better to write off the receivable rather than factor it due to the fees involved in invoice factoring. When deciding whether to factor or write off, you should consider working capital needs and cash flow concerns.

Bottom Line

An A/R aging report lists everything you’re owed by customers, separated by how many days the amounts are overdue. It can help you to stay on top of unpaid invoices so that you can collect payment on time and avoid the additional costs of hiring a collection agency. With QuickBooks Online, you can put your invoice and payment collection on autopilot and get back to doing what you enjoy most.