When evaluating the best accounting practice management software, I recommend looking into essential features like client management, project and task management, and invoicing. Additionally, some software programs offer advanced features, like customer relationship management (CRM), capacity management, and document management. It’s even better when the software integrates with various business tools, like accounting and tax preparation software.

After reviewing several accountancy practice management software, I narrowed the list down to my top six choices:

- Karbon: Best overall accounting practice management software

- Jetpack Workflow: Best for basic tax and workflow automation

- QuickBooks Online Accountant: Best for managing QuickBooks Online clients

- Financial Cents: Best for tracking profitability by client or project

- Xero Practice Manager: Best for managing Xero clients

- TaxDome: Best for managing tax processes and client communications

Best Accounting Practice Management Software: Quick Comparison

Karbon: Best Overall Accounting Practice Management Software

Pros

- Has more features than other similar software I reviewed

- Includes a unique Triage feature to streamline task and email management

- Has plenty of premade templates for common tasks

- Provides budget vs actual reporting in the Business plan

- Has Android and iOS mobile apps

- Has an open API, so you can integrate apps and build custom solutions

Cons

- Is a bit expensive, especially for small businesses

- Requires a lot of setup work to access complete usability

- May take time to fully understand all its features

- Requires the higher plan to set up automatic client reminders

Monthly Pricing |

|

Payment Processing Pricing |

|

Number of Users Included | |

Free Trial | None, but offers a free demo |

Customer Support Channels | Email, live chat, and phone support; access to a dedicated customer support agent with the Enterprise plan |

Average User Review Rating | 4.7 out of 5 from over 170 reviews on Software Advice |

Karbon is my overall best accounting practice management software because it provides all the features I wanted to see, including task and project tracking, workflow automation, and time tracking and billing. It’s also scalable, as you can upgrade to a lower or higher plan depending on your desired features.

What I like most is the unique triage feature, which allows users to assign emails and tasks to team members directly from Karbon. You can create rules so that Karbon automatically assigns specific types of emails to specific team members. Furthermore, with the Business plan, you can create automatic reminders to alert clients of their responsibilities.

Standout Features

- Allows you to track time worked by your team members

- Lets you invoice clients and accept payments directly from the platform

- Enables you to respond to and assign emails to team members

- Integrates with QuickBooks Online and Xero accounting software

- Has a client portal for easy communication with clients

- Lets you manage client profiles, activity timelines, and requests

- Allows you to track tasks’ statuses using Kanban boards

- Has a mobile app that lets you manage tasks and emails on the go

Use Cases

- Accounting firms and professionals needing robust accounting practice management software: Karbon offers more features than most of its competitors on this list. In addition to workflow management, it includes specialized features, such as team collaboration, project management, and document management.

- Firms receiving tasks and communications via email often: You can view, manage, and respond to emails without leaving Karbon. Also, you can convert emails into actionable tasks and assign them to specific team members. This is a unique feature that isn’t found in the other software I reviewed.

- Accounting firms that charge clients hourly: Karbon has a built-in time tracker for recording time spent on client-related tasks and activities. Once users have logged their billable hours, they can easily convert the time entries into invoices and send them to their clients. They can also accept payments directly from Karbon.

Jetpack Workflow: Best for Basic Task and Workflow Automation

Pros

- Lets you automate routine tasks, like client onboarding, invoice processing, and expense reimbursement

- Allows you to create unlimited jobs, documents, and clients

- Enables you to create recurring projects

- Integrates with QuickBooks Online, Google Workspace, and over 2,000 apps through Zapier

Cons

- Has no CRM features

- Doesn’t allow you to update templates for assigned jobs

- Has no customizable reports

- Lacks a document management system; can only store documents within a job’s profile

Monthly Pricing | $45 (paid monthly) or $30 (paid annually); includes all core features, including project management and team collaboration |

Number of Users Included | |

Free Trial | 14 days |

Customer Support Channels | Live chat, phone and email, and self-help guides |

Average User Review Rating | 4.8 out of 5 from over 50 reviews on GetApp |

Jetpack Workflow isn’t exclusively designed for an accounting practice, but it can align well with the needs of accounting firms. It isn’t as robust as Karbon, but I’m confident that it can help you streamline processes commonly found in small businesses, like task tracking, recurring project management, and client communication.

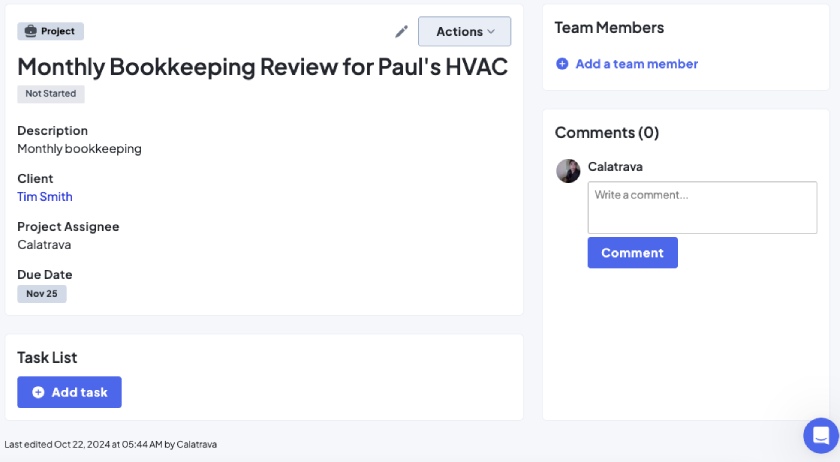

One of the things I like best is that it’s easy to add a new task. You only need to add the project name and assign it to a team member and a client. Here’s an example of a project that I quickly set up in Karbon:

Sample project created in Karbon

Standout Features

- Allows you to create a new job and assign it to a client and your team members

- Enables you to determine which tasks are due or overdue and which have been completed

- Lets you set up tasks to occur repeatedly; you won’t have to create separate jobs for projects with the same schedules

- Provides a single platform where you can track each employee’s performance in real-time

Use Cases

- Firms with repetitive onboarding tasks: Firms that onboard new clients and employees frequently can benefit from the workflow automation feature of Jetpack Workflow. They can set up customized workflows for repetitive tasks, such as collecting new hire information and setting up user accounts. Karbon also provides automated workflows, but they’re more suitable for complex processes like compliance and tax filing.

- Small accounting firms on a budget: For only $45 a month, you can manage unlimited clients and jobs. You can also create unlimited templates and automations. It’s more affordable than the other similar software in this guide; for instance, QuickBooks Online Accountant and Xero Practice Manager can be used for free, but your clients need to have a subscription to QuickBooks or Xero.

- Project-based firms: Jetpack Workflow uses project-based time entries—meaning you have to set up a job before recording a new time entry. If you don’t find this convenient, then I recommend Karbon, which lets you log time even without initially creating a project.

QuickBooks Online Accountant: Best for Managing QuickBooks Online Clients

Pros

- Is free and includes a subscription to QuickBooks Online Advanced

- Comes with a portal to your client's QuickBooks Online books

- Seamlessly integrates with Intuit ProConnect Tax for streamlined tax filing

- Lets you track projects across multiple clients

- Provides free access to the QuickBooks Online ProAdvisor program

Cons

- Is incompatible with QuickBooks Desktop

- Has no due date list

- Doesn't calculate realization percentage when employee time is written off of a job or project

- Lacks CRM and document management features

Pricing | Free for accountants and bookkeepers |

Number of Users Included | 1 |

Free Trial | N/A, as it’s free |

Customer Support Channels | Phone support (callback), live chat, community forum, and online guides |

Average User Review Rating | 4.5 out of 5; check out users’ insights in our QuickBooks Online Accountant review |

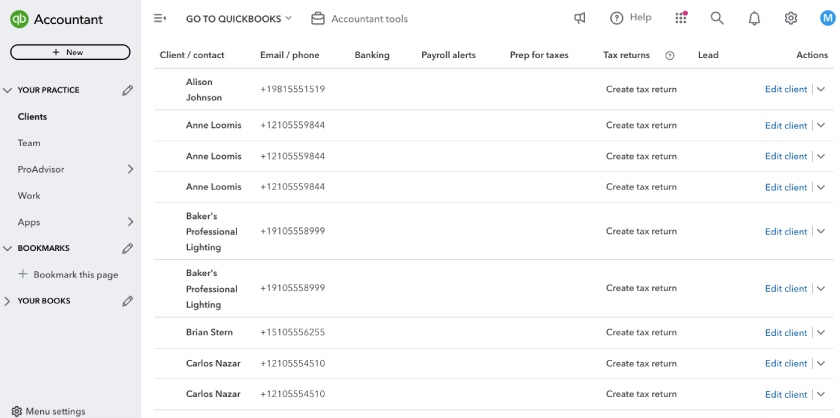

QuickBooks Online Accountant is necessary if you’re working for a client using QuickBooks Online. One thing I admire about it is its organized client management dashboard, which provides me with easy access to my clients’ books. From here, I can view client data, manage books, and easily make adjustments if needed, as you can see in the screenshot below.

Client management dashboard in QuickBooks Online Accountant

It also provides specialized tools, such as the ability to review and adjust clients’ accounts and reclassify transactions. You even get access to the QuickBooks ProAdvisor Program, which enables you to support your clients regardless of their version of QuickBooks Online.

Standout Features

- Has specialized accountant-only tools that let you reclassify transactions, close books, write off invoices, and review and adjust your client’s books in QuickBooks Online

- Lets you create tasks or projects and assign them to your team member

- Allows you to access your own books through the QuickBooks Online mobile app

- Enables you to record your deductible mileage

Use Cases

- Accountants and firms with clients using QuickBooks Online: When a QuickBooks Online client invites you to share their books, the only way to access them is through QuickBooks Online Accountant. You can also access tax returns prepared in Intuit ProConnect Tax directly from the client information in QuickBooks Online Accountant.

- Those wanting to become QuickBooks Online ProAdvisors: The platform comes with free training courses that you can use to gain more knowledge and expertise in QuickBooks and pass the certification exam to become a QuickBooks ProAdvisor.

- Virtual accounting teams: Accounting teams that work remotely or provide outsourced accounting services can benefit from QuickBooks Online Accountant. Since it is cloud-based, you and your team members can collaborate effectively from anywhere in real time.

Financial Cents: Best for Tracking Profitability by Client or Project

Pros

- Lets you compare the amount billed with the hours tracked

- Is more affordable than most paid accounting practice management software

- Offers advanced features, such as a client portal, client requests management, and document management

- Has a comprehensive capacity management feature

Cons

- Is not a complete bookkeeping solution

- Requires QuickBooks integration to send invoices

- Has limited reporting capabilities

- Doesn’t provide extensive customization options for workflow templates

Monthly Pricing |

|

Add-ons Pricing | |

Number of Users Included | |

Free Trial | 14 days |

Customer Support Channels | Phone and email, live chat, and self-help resources |

Average User Review Rating | 4.8 out of 5 from about 150 reviews on Software Advice |

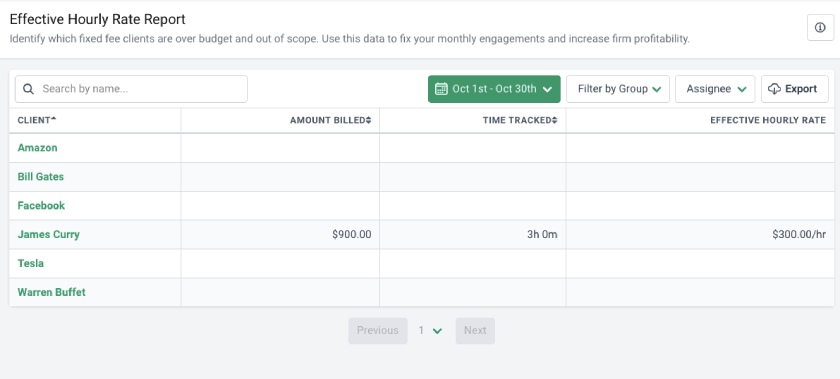

I find Financial Cents excellent for managing multiple clients and engagements, especially those who are focused on analyzing returns on investment from every project they handle. I also like that you can compare the amount billed to your hours tracked, which, in turn, provides you with an effective hourly rate for your work, as seen below.

Effective Hourly Rate Report in Financial Cents

You’ll understand whether you are fairly compensated for your time and effort by accurately calculating your effective hourly rates. Also, it helps you identify which clients are the most profitable based on factors like the amount billed per hour worked and the complexity of projects. This way, you may choose to prioritize high-profit clients or adjust your pricing accordingly.

Standout Features

- Allows you to log work hours and then compare them to the amount invoiced to improve hourly billing strategies

- Lets you create and assign tasks to team members and even set up recurring work

- Enables you to organize and track client information, activities, and interactions in one place

- Automates the process of reminding clients to provide their required information or documents

- Allows you to specify the number of hours each team member is expected to work per week

Use Cases

- Midsize accounting firms with multiple projects or departments: The program’s ability to compare the billed amount with the tracked hours is helpful for midsize accounting firms with multiple projects, departments, or service lines. It allows them to analyze the profitability of different teams, services, or client engagements. However, Karbon may be more suitable for larger project-based businesses because of its robust workflow automation features.

- Solo practitioners needing an affordable but comprehensive accounting practice management solution: Financial Cents offers an inexpensive solution for solo practitioners on a budget. There are free alternatives like QuickBooks Online Accountant and Xero Practice Manager, but they often lack specialized features like those found in Financial Cents.

- Firms with multiple team members: Financial Cents’ capacity management feature lets you set the number of hours for each team member. This helps you monitor the workload of individual members, identify if some have excessive workloads compared to others, and adjust the allocation of tasks accordingly. This feature isn’t offered in other software like QuickBooks Online Accountant and TaxDome.

Xero Practice Manager: Best for Managing Xero Clients

Pros

- Is free for Silver, Gold, and Platinum partners

- Has strong time and billing features, including a dedicated time sheets section

- Allows you to allocate jobs and tasks with due dates

- Offers a variety of integration options and a dedicated mobile app

- Robust mobile app with many features

Cons

- Is expensive for new and Bronze-level partners

- Lacks tools for efficient team collaboration within the software

- Has no telephone support

- Reduces discount rates for new partners

Pricing | New Xero partners and those at Bronze level can try Xero Practice Manager for 14 days for free. Then, you can subscribe for $149 per month for up to 10 users. There is no charge once you reach Silver, Gold, or Platinum partner status. |

Number of Users Included | 10 |

Free Trial | 14 days for New Xero partners and Bronze-level users—subject to review and approval |

Customer Support Channels | Xero Central, in-app ticket, and self-help guides |

Average User Review Rating | 4.1 out of 5; see what users have said in our Xero Practice Manager review |

If you have clients using Xero and need a strong billing system, I recommend you consider Xero Practice Manager. It helps you efficiently manage client jobs, practice workflows, timesheets, and invoicing. It also lets you assign work to staff, track and invoice time, integrate with Xero for invoicing and payments, and create customized reports.

Unfortunately, small startup firms and solo practitioners may struggle to earn enough points to reach the Silver, Gold, or Platinum partner levels. Hence, if you are still in the early stages of generating revenue, you may find the $149 monthly cost a burden. I recommend you consider Jetpack Workflow, which is a bit more affordable. Also, it integrates with the Xero accounting software, so you can easily sync your client’s data between the two programs.

Standout Features

- Gives you access to the Xero Partner Program, where members get benefits that increase with every upgrade in status

- Lets you create and send invoices and collect payments for your customers

- Allows you to streamline compliance processes using templates

- Offers a mobile app that lets you manage your practice’s workflow and track time and job costs on the go

- Enables you to create jobs, assign them to team members, and track them until they are completed

Use Cases

- Firms managing Xero clients: Xero Practice Manager provides a portal to your clients’ Xero accounts.

- Firms needing fixed asset accounting: Xero Practice Manager’s direct integration with Xero allows you to manage and track your clients’ fixed assets, such as vehicles, machinery, and equipment.

TaxDome: Best for Managing Tax Processes for Clients

Pros

- Includes built-in e-signature functionality

- Lets you create document requests for clients

- Allows easy collaboration with clients through the built-in portal

- Has its own invoicing and billing features

- Provides unlimited document storage with a PDF editor

Cons

- Has no direct access to your client’s books

- Provides only a single plan

- Lacks budget vs actual reporting

Pricing | TaxDome costs $85 a month, but it is also available in multi-year subscription options:

|

Number of Users Included | |

Free Trial | 14 days; no credit card required |

Customer Support Channels | Chatbot, online resources, and onboarding sessions |

Average User Review Rating | 4.7 out of 5 from over 3,000 reviews on Software Advice |

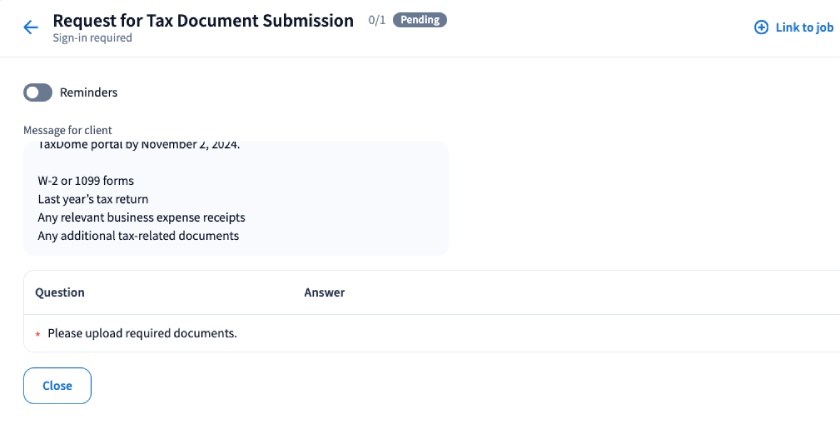

I’ll start by pointing out how easy it is to request tax documents from clients using TaxDome. It allows you to set up automatic document request reminders, which will notify clients when they need to upload documents or submit forms. Here’s a client request I was able to complete with a few clicks:

Client request automation tool in TaxDome

Another thing I like about TaxDome is that it has a client portal where clients can easily upload tax documents and sign tax forms electronically. They can also use the portal to view all their tax filings and invoices, so there’s no need to deal with scattered email communications with clients.

Additionally, the software tracks the status of all documents and client communications, and it integrates with tax software like Drake and Lacerte for a more streamlined tax filing process.

Standout Features

- Lets you create customized workflows for recurring tasks such as tax preparation and filing

- Allows clients to submit tax documents, review completed returns, and sign documents electronically via the client portal

- Enables you to track client document submissions and sends automated reminders for missing files

- Organize all your documents in the cloud based on client and task categories:

- Allows you to invoice clients directly through the platform and set up automated payment reminders

Use Cases

- Firms managing a large volume of tax returns: TaxDome’s time-saving features, like client request automation and client portal, make it easy for you to manage and track tax-related documents for your clients. All the other software on this list have no features for automating client requests.

- Firms offering recurring monthly services: You can set up recurring invoices, which is great if you provide monthly or ongoing bookkeeping or tax advisory services.

- Accounting firms needing a CRM system: The program has a built-in CRM system that lets you manage your client’s relationships and interactions with their customers and leads. If CRM is important to you but you aren’t focused on tax services, I suggest looking into Jetpack Workflow, which is a more affordable option.

How I Selected the Best Accounting Practice Management Software

I chose the best accountancy practice management software based on key factors, including:

- Pricing: I evaluated whether the software’s pricing generally is affordable for most small accounting firms and whether it provides benefits, such as free trials and multiple-user access.

- Ease of use: I tested each software to see how easy they are to navigate and use. The dashboard must be streamlined and provide an easy way to assign tasks and manage your clients’ books.

- Feature set: I focused on essential features, such as the ability to create customized workflows, collaborate with team members, and create and assign tasks—as well as easily track their statuses.

- Scalability: I checked whether there’s an option to upgrade to a higher plan with additional features and support for multiple users.

- Integration capabilities: Good accounting practice management software integrates with various business apps, such as accounting and CRM solutions.

- Customer support: I assessed whether the provider has convenient customer support options, such as live chat, phone, and email support.

Frequently Asked Questions (FAQs)

You must look for advanced features, such as time tracking and billing, project management, document management, CRM, and reporting.

No, as most platforms are designed to be easy to use and don’t require special training. However, for beginners, software providers offer free training tools and resources to help you better understand their platforms.

Yes, and a good example is QuickBooks Online Accountant, which is designed to be used by accountants with clients using QuickBooks Online.

Bottom Line

The best accounting practice management software depends on your specific needs. I have provided six options—all with varied use cases—to help you find one that fits the bill. Once you consider your needs and the type of businesses you cater to, you can select the best fit for your business.