Xendoo, a technology-based online bookkeeping and accounting service, specializes in working with small businesses. It provides you access to a dedicated team of expert bookkeepers and accountants who provide bookkeeping, tax preparation, tax consulting, and filing services.

With transparent pricing that’s based on your monthly expenses (starts at $395 per month for up to $50,000 monthly expenses) and catch-up bookkeeping available, it is an excellent option for businesses looking for a scalable all-in-one accounting solution. See if it fits the bill by reading our in-depth Xendoo review.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Offers a 30-day money-back guarantee

- Integrates with Xero and QuickBooks

- Has a mobile app that gives you access to your dashboards

- Integrates with Gusto for payroll and most major ecommerce platforms

Cons

- Lacks a free trial

- Has no accrual-based accounting in the Essential plan

- Lacks invoicing and bill pay

- Offers a custom chart of accounts only with the most expensive plan

Xendoo Alternatives & Comparison

Do you want to see how Xendoo stacks up against other virtual bookkeeping services? See our guide to the best online bookkeeping services.

| Users Like | Users Dislike |

|---|---|

| Fees are transparent | Reports of issues with communication during onboarding |

| User-friendly dashboard that is easy to navigate | |

| Customer support is accurate and responsive | |

Users who wrote a Xendoo review said that its dashboard is user-friendly and easy to navigate. Reviewers also praised the responsiveness of the customer support team, the transparency of fees, the available tax services, and the accuracy of services. They also commended the catch-up bookkeeping service, which helped them to stay on top of their financial obligations.

There are no major complaints about the service, which earned the following average scores based on popular review sites:

- Bark[1]: 5.0 out of 5 based on around 35 reviews

- Birdeye[2]: 4.0 out of 5 based on nearly 100 reviews

- Google[3]: 4.5 out of 5 based on around 70 reviews

The Xendoo pricing scheme consists of three subscription plans, which are based on the monthly expenses of your business and the number of bank and credit card accounts connected. Custom plans are available for those with more than $125,000 in monthly expenses.

Essential, the lowest plan, starts at $395 per month for $50,000 of monthly expenses. While this is a competitive price for that size company, businesses with substantially lower expenses than $50,000 monthly might be able to find a better value elsewhere.

Xendoo’s services are pay as you go and are charged at the beginning of your subscription term. A discount of 10% is offered if you sign up on an annual basis, and a 30-day notice is required for cancellation.

Essential | Growth | Scale | |

|---|---|---|---|

Monthly Fee | $395 | $695 | $995 |

Monthly Expenses Limit | $50,000 | $75,000 | $125,000 |

Number of Bank Card/Credit Card Accounts | Up to 4 | Up to 6 | Up to 12 |

Number of Integrations Allowed | 1 | 2 | 4 |

Dedicated Bookkeeping Team | ✓ | ✓ | ✓ |

Semi-Annual Tax Consultation | ✕ | ✓ | ✓ |

Custom Chart of Accounts | ✕ | ✕ | ✓ |

Deferred Schedules | ✕ | ✕ | ✓ |

This initial signup process takes about four minutes. It should be mostly seamless since the platform integrates well with popular small business accounting software, such as QuickBooks and Xero. Once you enroll, Xendoo will schedule a short onboarding call of about 30 minutes with you and will need your year-to-date balance sheet and profit and loss (P&L) statement—or you can discuss catch-up work if needed.

Your dedicated bookkeeper will set everything up and connect your accounts. The portal is available 24/7, and you can access it at any time. If you ever decide to leave Xendoo, you can take your file with you so that your new financial partner can pick up where it left off. Your books will be reconciled weekly, and your bookkeeper will maintain consistent communication with you. You’ll be sent reports monthly, and they can be customized based on the needs of your business.

Unlike some services, such as QuickBooks Live, you can’t meet with your bookkeeper via video conference. Your bookkeeper is available during normal business hours by phone, email, and live chat.

Xendoo offers a variety of useful features, including a powerful mobile app and integrations for ecommerce. You’ll work with a dedicated bookkeeper who will send you financial reports and catch-up bookkeeping is also available if needed. Xendoo also supports franchises and multiple companies and integrates with Gusto to help manage your payroll. It also backs its work with a 30-day money-back guarantee if you’re dissatisfied with Xendoo’s services.

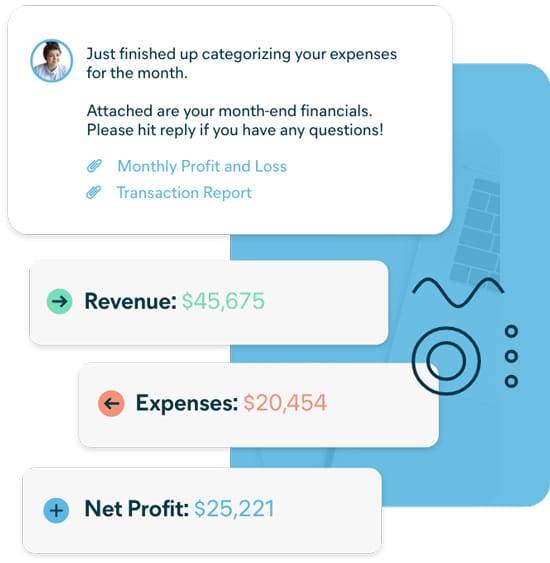

After month-end, Xendoo will send your P&L and balance sheet by the fifth business day of the following month. The reports can be reviewed, downloaded, and shared from the desktop portal and mobile app. You can access these reports from your dashboard, and you can also review your sales tax returns and sales tax confirmations. If your business needs customized reporting, Xendoo can work with you to provide that as well.

Xendoo reporting features (Source: Xendoo)

In addition to the monthly services, Xendoo offers catch-up bookkeeping starting at $295 per month for past bookkeeping and prior years’ tax returns. Upon approving the scope of work, the catch-up services will be billed at the agreed-upon rate, and no refunds will be issued once the work has been completed and delivered.

If after 30 days of working with Xendoo, you’re unsatisfied with your bookkeeping team and don’t see the guaranteed results, Xendoo will refund the fee for your first month. To qualify, you must have completed the onboarding workshop and provided all documentation as requested, plus services must have gone live within one week of the start date.

Available for both iOS and Android, Xendoo’s mobile app works seamlessly with the service. The app allows you to send and receive important financial documents with your dedicated bookkeeper, such as IRS notices, prior tax returns, and copies of checks.

You can also access your monthly balance sheet, P&L statement, tax returns, and payroll returns right from the app. You can opt to receive push notifications when your tax documents are ready to view and reminders of how much sales tax is due and when.

Whether you’re selling on one platform or multiple marketplaces, Xendoo integrates with Amazon, Shopify, Walmart, Etsy, WooCommerce, BigCommerce, and eBay.

Your dedicated bookkeeper is available for any questions or to review transactions as needed. They’ll record all of your bank and credit card transactions, reconcile your statements to ensure that every transaction has been recorded, and send you financial reports monthly.

If you have more than one business, you can add multiple companies within the same account, and Xendoo will manage the books for all of them.

Xendoo can address the needs of franchises with accurate reporting based on a customized chart of accounts and support for multiple currencies. You also gain access to roll-up dashboards and group benefits such as group training sessions and webinars.

Xendoo integrates with Gusto, which helps you manage your employee information, benefits, and deductions. You can process payroll, file payroll taxes and forms, and process W-2s for employees.

Business tax preparation and filings are available with all plans for an additional fee of $1,200 per year. Whether you’re a sole proprietor, corporation, S-corporation (S-corp), or partnership, Xendoo will file and prepare and file your tax return for the same low price. It has tax experts who are well-versed in the requirements of each and will help you navigate your next tax season accurately. They’ll also file your personal taxes if needed.

Xendoo’s sales tax experts will prepare and file your taxes accurately and on time so that you stay compliant. They’ll also give you plenty of advance notice so that you can ensure that funds are available.

Small businesses without a CFO can take advantage of Xendoo’s fractional CFO services starting at $1,500 per month.

Communication with Xendoo bookkeeper (Source: Xendoo)

Xendoo Customer Service & Ease of Use

Your dedicated bookkeeper is readily available via phone, email, and live chat from the standard business hours of 8 a.m. to 6 p.m. With advance notice, they can speak with you after-hours as well. If, for any reason, your regular bookkeeper is unavailable, another bookkeeper on its team will be able to assist you.

Xendoo offers free online resources such as frequently asked questions (FAQs), free calculators, and eBooks about topics such as cash flow and planning. It also hosts a blog and playbooks with strategies, news, and ideas for growing businesses.

How We Evaluated Xendoo

We evaluated Xendoo based on bookkeeping services, personal bookkeeper, user reviews, tax and consulting services, and pricing.

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

Xendoo partners with Gusto for payroll services and offers customers a 15% discount plus two months free. Gusto is a cloud-based payroll, benefits, and human resource (HR) management software company. In addition to offering support for employees, its payroll services include features for issuing and filing 1099s.

You’re welcome to reach out to your bookkeeper whenever you need them, and they’re available by phone, email, and text during normal business hours and after hours by appointment. It’s possible to set up monthly calls to review financials as well. They’ll reach out to you if they have any questions about your transactions.

Currently, modified accrual accounting is available with the Growth and Scale plans. If you need full accrual accounting, you can contact Xendoo to find out about a custom plan, and modified accrual accounting includes loans payable and month-end inventory adjustments. Reports include A/R and A/P if you utilize invoicing and bill pay in Xero or QuickBooks Online, and they exclude deferred revenue, prepaid expenses, prepaid insurance, and other accruals. A year-end entry for depreciation and amortization is made if Xendoo files the company’s tax return.

Xendoo will assign one dedicated bookkeeper to your account. They’re supported by a full bookkeeping team to ensure your books are up-to-date and compliant. The team will assist you if your bookkeeper is unavailable.

If you elect to sign up for an annual contract, you can cancel anytime with a 30-day notice.

Bottom Line

Xendoo offers expert bookkeeping and tax services and one-click access to your financials via an online portal and mobile app. Using QuickBooks or Xero, it reconciles your books digitally to provide your business with financial reporting so that you can stay on top of its financial health. Bookkeeping services are available for a flat monthly fee, and you can even opt for catch-up bookkeeping. Tax preparation, filing, and planning services can be added to any plan for an additional fee.