Key takeaways:

- A collection letter is a written correspondence informing a client of a lapsed invoice date and reminding them to settle their debt.

- It is typically sent within 14 days after the missed due date.

- The process of how to write a collection letter requires having four parts.

- Basic details: The names and addresses of the seller and buyer, as well as the purpose of the letter (missed invoice date and adjustment of payment deadline)

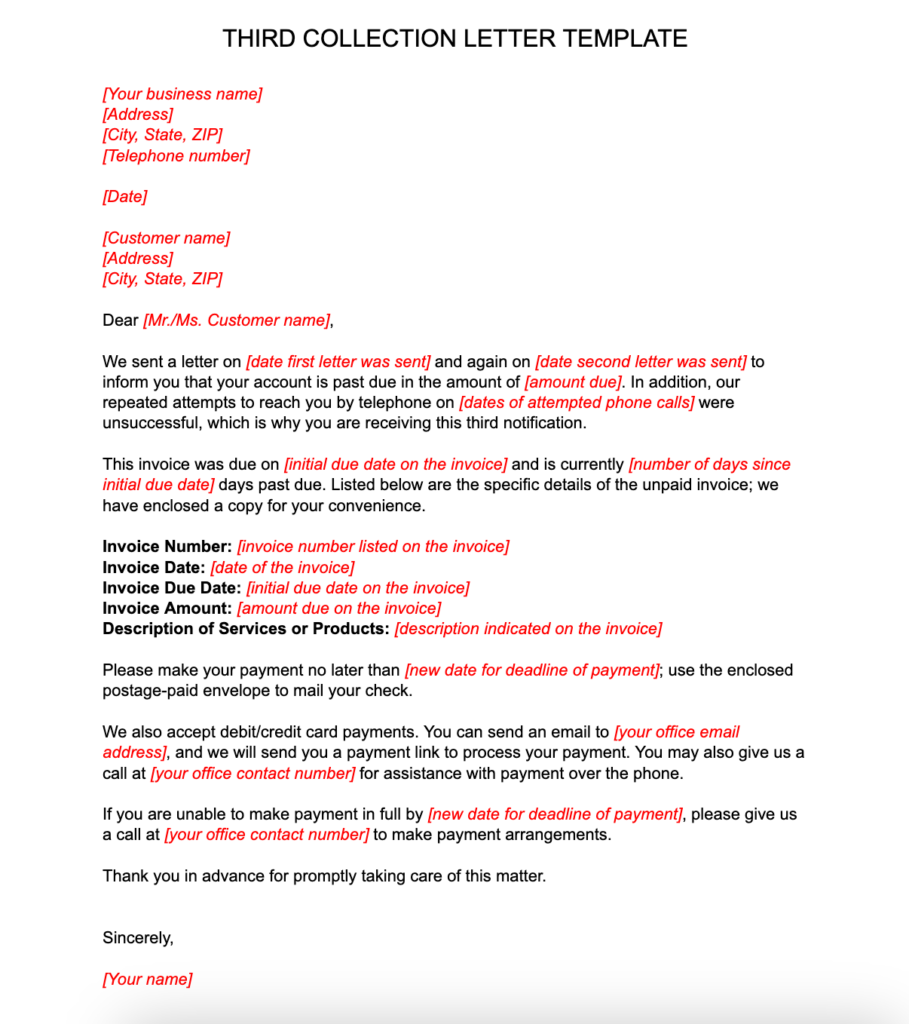

- Debt information: Invoice details, like the number, debt amount, and original due date

- Next steps: New deadline, methods of payment, and potential stern actions (for cases of repetitive non-payment)

- Contact details: A friendly reminder for any concerns/questions

- Using a collection letter template ensures that you have empathetic yet stern language while hitting all the important points.

- There are two options for non-payment after repeated follow-ups: hiring a collection agency and writing the account off as a bad debt.

For your convenience, we’ve created a series of free collection letter templates. Download and customize these with your company logo, mailing address, and other essential information for them to land better with your clients.

What to include when writing a collection letter

Collection letters are much like any type of business correspondence, with the main purpose of letting your clients know that they missed a payment deadline. Writing effective collection letters is an important part of extending credit to customers and one of the accounts receivable best practices.

To ensure that you hit the point clearly, here are some things to include in your collection letter format.

Basic details

Your letter should include the name and address of the seller and the buyer who purchased on credit. This makes it clear to the recipient that it’s intended for them and that it came from your business. It’s also crucial to indicate the purpose or objective of the letter, which is to remind your customer that their balance is past due and should be settled as soon as possible.

Debt information

It’s important to reiterate to your client which invoice they missed their payment for, how much it was, and when it was supposed to be due. This serves two purposes:

- To literally remind them of their dues; and

- To help them cross-reference the invoice, in case they actually made a payment and will need to dispute the invoice.

It would also be good to attach a copy of the invoice to make it perfectly clear to your client which invoice you’re referring to.

Indicating the invoice details would clarify what debt your client owes you while ensuring they know what invoice you’re referencing in your letter.

Next steps

After informing your client about the missing payment, they’ll need to know how to deal with it and by when. Mention the methods of payment they can use and when the adjusted deadline for payment is. If you’re sending a final notice, then you should indicate what exactly it means for your client should they still not meet the deadline.

Contact details

Ensure that your collection letter indicates your most up-to-date contact information: your email address, cellphone number, and company landline number. That way, clients will know how to reach you if they have concerns about the invoice or payment or just have general questions about how to proceed next.

While social media is popular, I don’t recommend having your clients reach out to you through socials for concerns about collections. Since this is a sensitive matter — as well as to remain professional — it’s best to communicate about debt collection through official professional channels, like email or phone call. Text messaging is another gray area that I recommend steering away from.

Should your clients reach out through those avenues anyway, route them to your official lines and take the conversation from there.

For more in-depth insights from a CPA, check out our video on how to write a collection letter.

Best practices for creating and sending collection letters

While straightforward, there are certain best practices to follow when writing and sending collection letters to ensure your message lands well with the recipient.

Overview of the types of collection letters and how to use each

Typically, you’ll send your customer four collection letters before hiring a collection agency or recording a bad debt expense. Here’s a quick rundown of each.

First letter | Second letter | Third letter | Final letter | |

|---|---|---|---|---|

Suggested Cadence of When to send | Within 14 days after the invoice due date | Within 7 to 14 days after sending the first letter | Within 7 days after sending the second letter | Within 7 days after sending the third letter |

How to send | Email or registered mail | Email or registered mail | Registered mail | Registered mail |

Specific notes about the content | Keep it light yet professional — let it serve as a mere reminder. Give the client the benefit of the doubt. | Take a stern tone. Indicate the date the first letter was sent and when phone call attempts were made. | Use a stern tone with a hint of urgency. Indicate the dates of the previous letters and phone call attempts. | State the previous connection attempts, and give an ultimatum for non-respondence. Indicate the repercussions if the deadline is not met. |

For a more detailed look at each letter, as well as what to do at each stage, click on the dropdowns below.

Before sending the first letter, try asking for payment in an email or telephone call. Those using software like QuickBooks Online can also typically use the platform to send an invoice to clients for easier facilitation.

If the customer hasn’t made payment arrangements with you after contacting them via telephone and email, then it’s time to mail the first letter. In general, this should be no later than 14 days after the invoice due date.

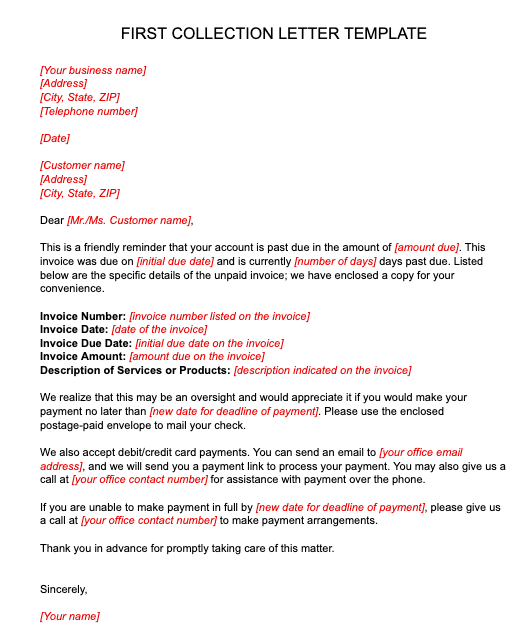

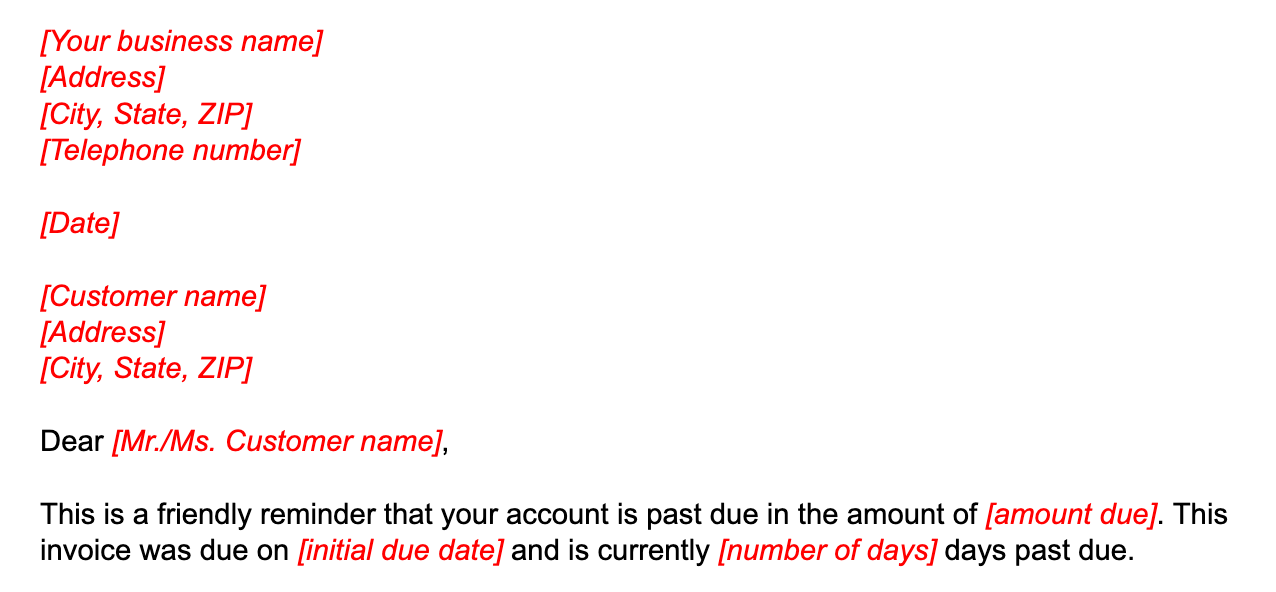

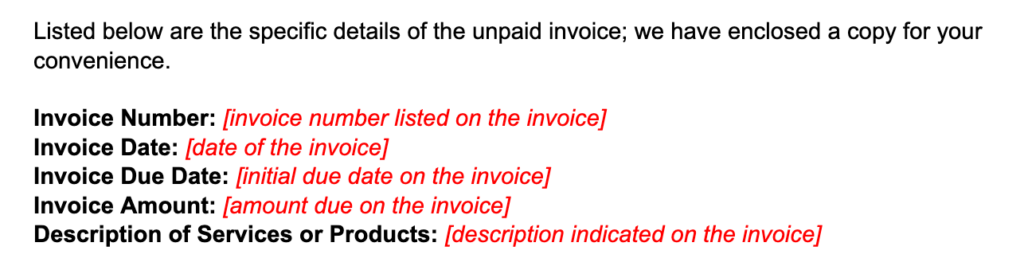

Example of a first collection letter template

Before sending this letter, I recommend attempting another phone call to see if the first letter was received and if the customer would like to make payment arrangements. If unsuccessful, then the second collection letter is necessary.

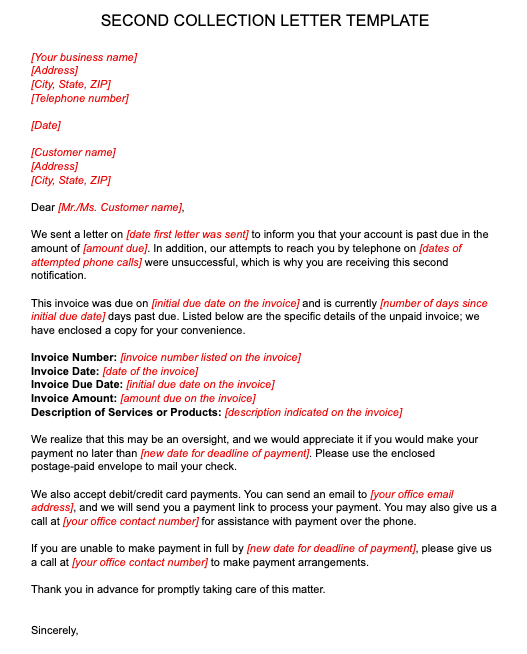

The primary difference between the content of the first and the second notice is to indicate that you did attempt to reach the customer via the first letter and phone calls. You can also take a stern tone — but keep it respectful and non-threatening.

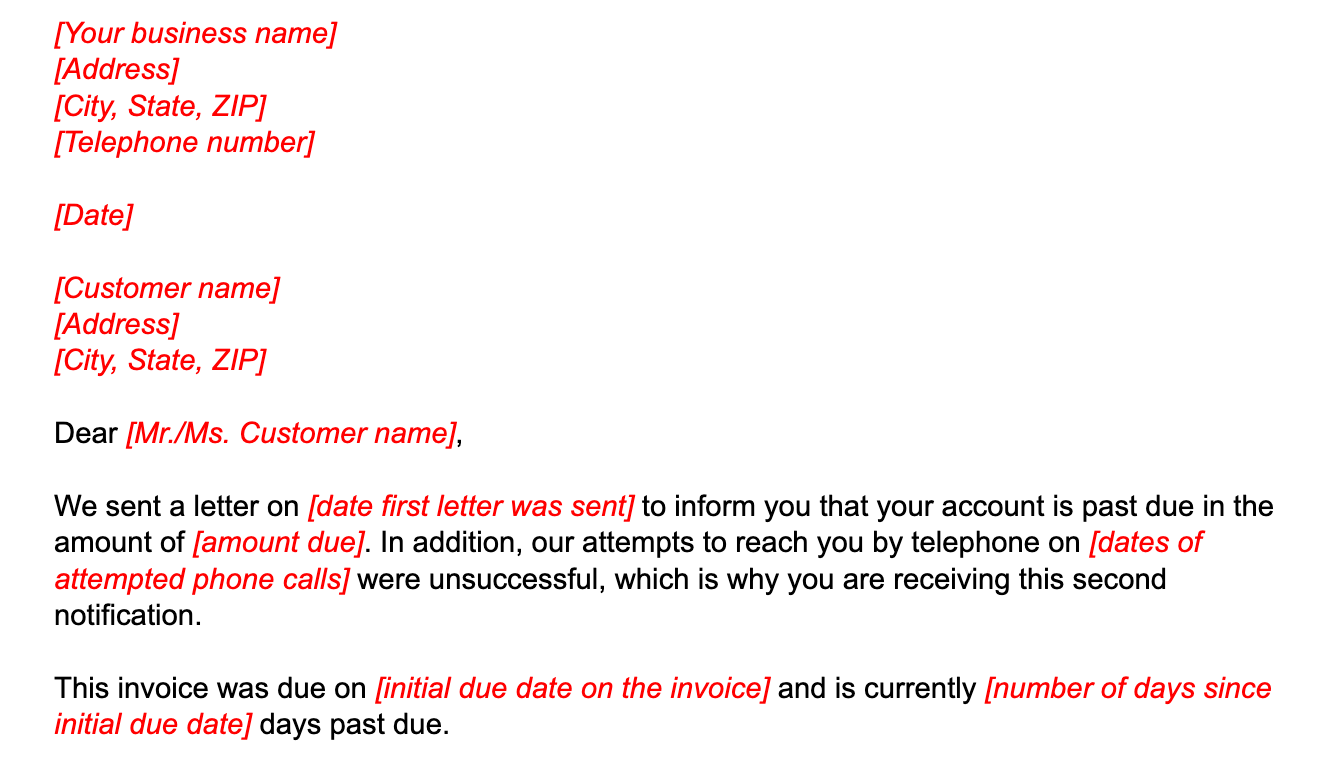

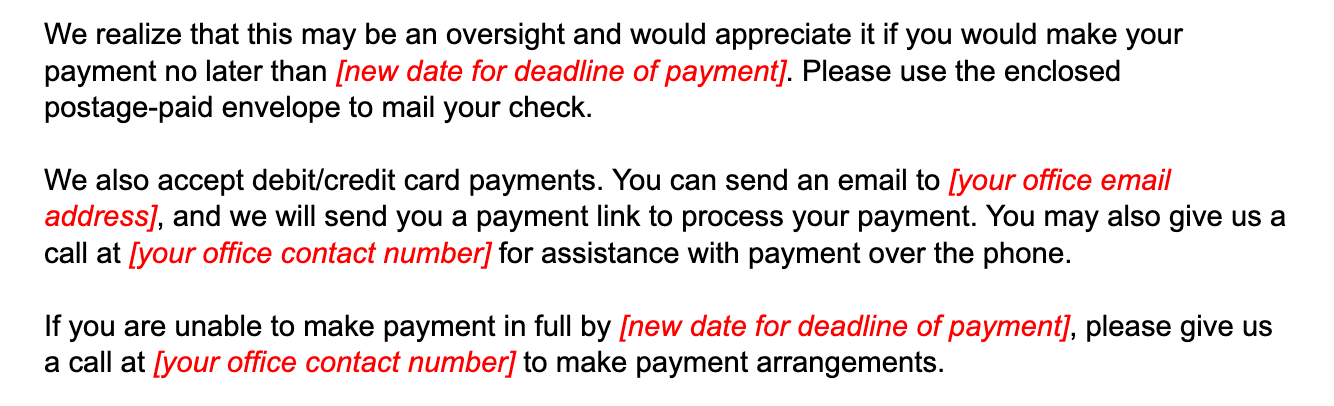

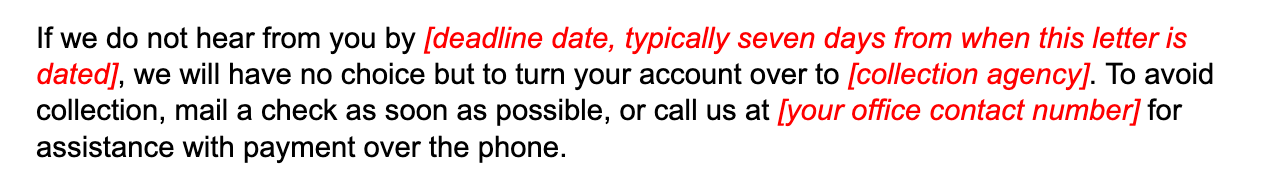

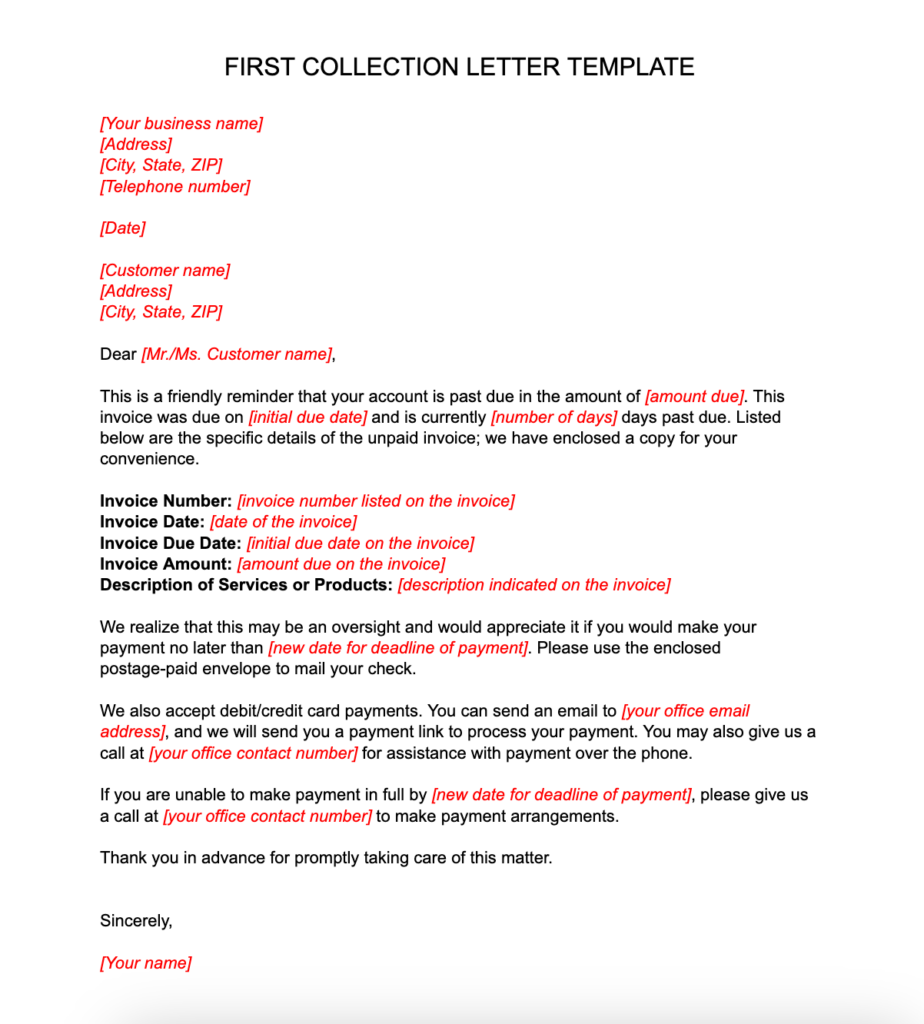

Example of a second collection letter template

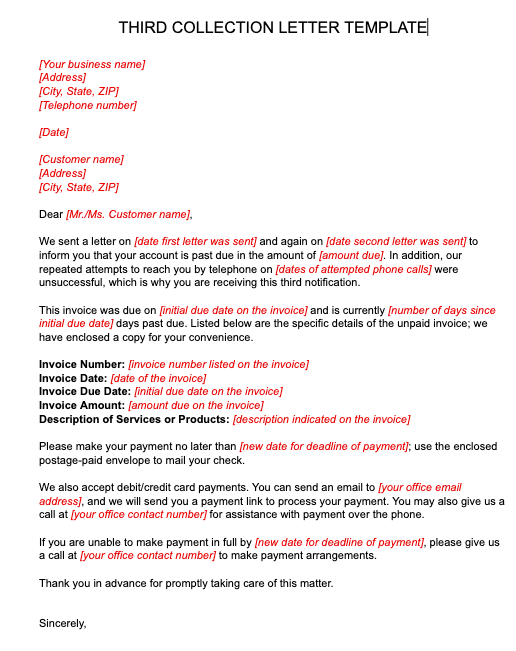

If the customer doesn’t respond within the next two weeks of having sent the second letter, send the third. Similar to the second notice, include language that informs customers that previous contact attempts via letters and telephone calls have been unsuccessful, resulting in this third attempt.

I also recommend that you send this letter by certified mail. This will require someone to sign for the letter, providing you with proof that the letter was received. This kind of documentation will be important if you have to take legal action to collect this debt.

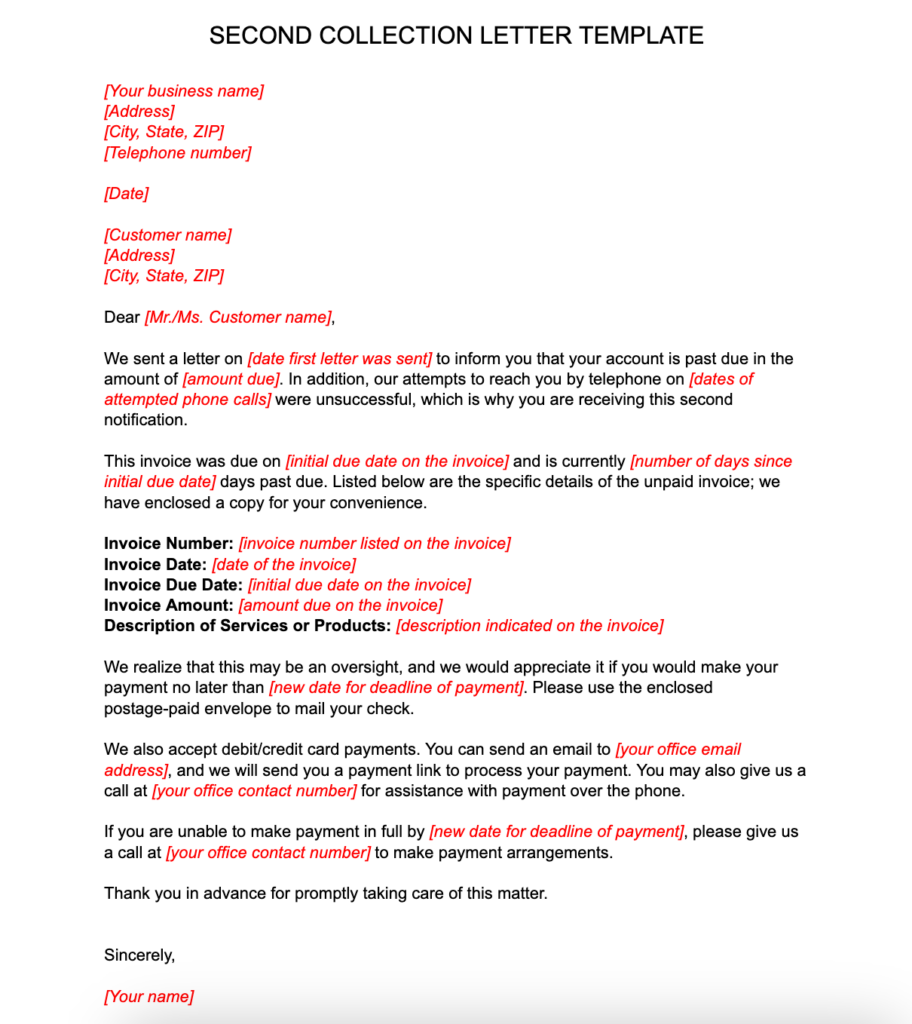

Example of a third collection letter template

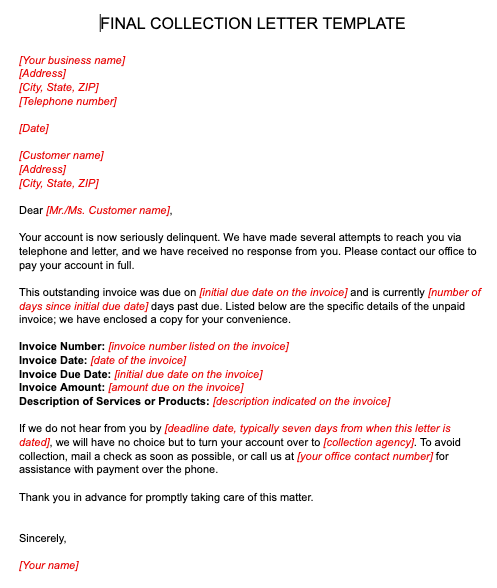

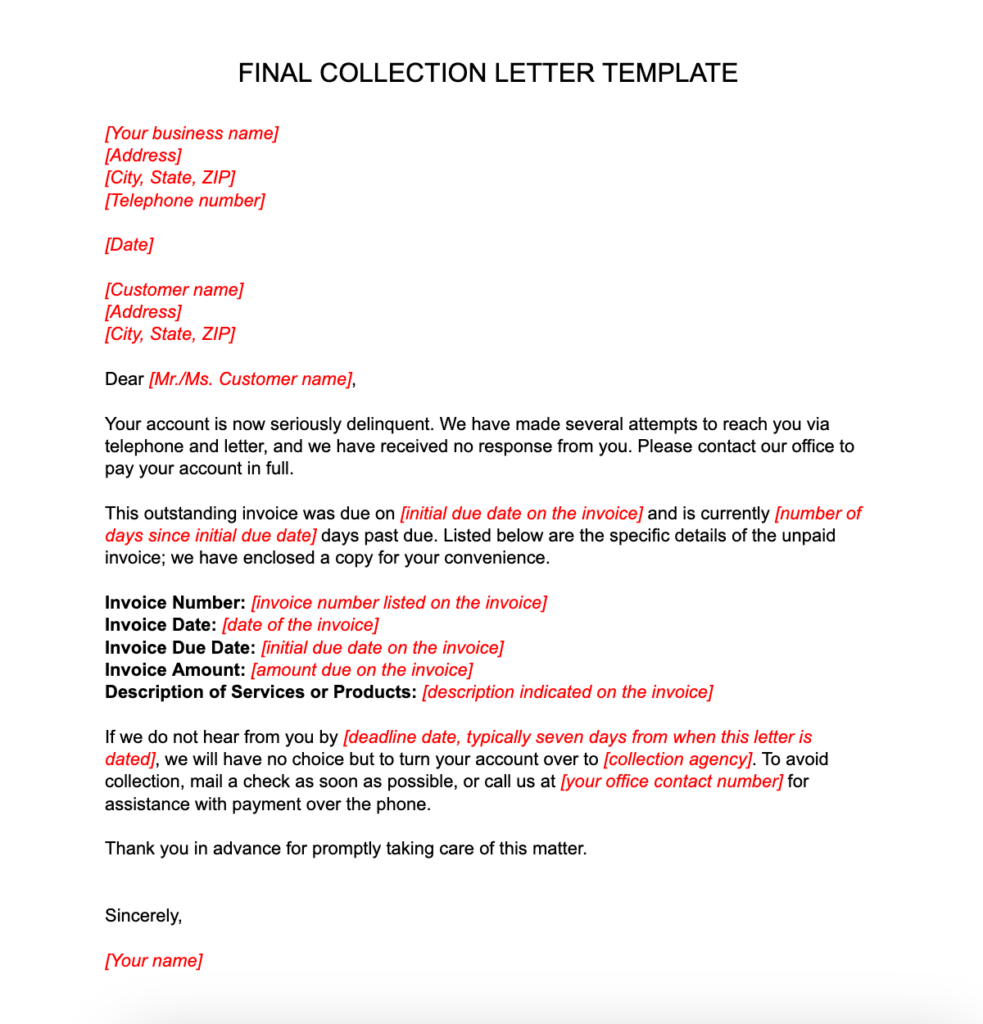

While there may be some exceptions, by the time you get to a fourth collection letter, it should be painfully clear that your customer is either unwilling or unable to pay their debt. The language will be the most assertive of the letters but should remain professional. Similar to the third notice, you need to send this final collection letter via certified mail.

Example of a final collection letter template

Handling debt collection disputes and discrepancies

If the client gets back to you disputing the amount or noting a discrepancy when collecting the debt, it’s important to act quickly, professionally, and thoroughly. After all, this is a reflection of your company, and you’ll want to clear up any misunderstanding and ensure an amicable resolution.

- Acknowledge the claim. It’s important to acknowledge that you’ve received their claim and state that you’re looking into it. Give the client a timeline for you to review the matter and promise a response within a reasonable amount of time.

- Double-check your records. Pore through your records to see where the error may have occurred, if any. If you notice the error from your end, then rectify it immediately and inform the client of any changes. This is best done before asking your clients for their documents first, so as not to antagonize them.

- Request for documentation. If you find no error in your records, check where the client is coming from. It’s best done after checking your own records so that you can show them that you’ve already done your due diligence in checking their request. If they provide anything that may be unclear, politely ask them for any clarifications.

- Start the dispute resolution process. Should there really be a discrepancy, start the resolution process. Do an in-depth internal review of where things may have gone wrong and correct the process in the future. Also, collect any necessary information you may have to show your clients.

- Resolve the dispute to close the matter. Regardless of how the findings go, get back to your client. Communicate with them regularly and empathetically. Offer alternative solutions if warranted, and provide a leeway if there is a misunderstanding.

- (As necessary) Consult with a legal professional. Should things escalate further, secure legal counsel to figure out your next steps. Present all your findings and back them up with data and documentation.

What to do when the client doesn’t respond to the letter

While it’s the hope that your client will get back to you immediately and pay what they owe, there will be instances when this won’t happen. After multiple attempts to collect on a delinquent account with telephone calls and letters fail, you have two options: hiring a collection agency and writing the account off as bad debt.

Hire a collection agency

Typically, you should send out four letters before resorting to a collection agency. One thing to keep in mind is that once you hire a collection agency, you won’t receive the full amount that is owed to you. Generally, collection agencies charge anywhere from 25% to 45% of the total amount to be collected. Depending on the amount of the outstanding debt, this may not be worth hiring a collection agency for.

Keep this option as a last resort. Hiring a collection agency can be seen as an aggressive move by your clients, and this may harm your relationship with them. As such, ensure that all avenues have been taken before hiring a collection agency.

Write the account off as bad debt

If you decide to cut your losses and not hire a collection agency, you should go ahead and write the account off as bad debt. This will at least allow you to claim a tax deduction for the amount owed to you if you’re an accrual-basis taxpayer.

Our related resources:

Frequently asked questions (FAQs)

A collection letter is proof that you have attempted to collect what a customer owes you. In case it escalates to a collection suit, the letters will be considered as hard evidence that you tried to reach out to the customer.

You can send collection letters via post mail or email. For speed and convenience, I recommend sending via email, although always send at least the last two notices via registered mail. You can also do both for good measure.

Bottom line

Sending collection letters is a delicate process, so it’s best to have templates that hit the necessary points while maintaining empathy and kindness. By following the collection letter formats I shared above, you’re sure to maintain that professional tone while giving all the details necessary for your clients to pay their dues.