Getting the best commercial real estate loan rate will depend on your qualifications as a borrower and the loan type you’re looking to get to finance your real estate investment. Rates will vary depending on the lender and loan details, so it’s best to consider several options. Commercial real estate loans can be obtained from different sources, such as the Small Business Administration (SBA), conventional banks, and hard money lenders.

Type of Loan | Average Commercial Mortgage Rates |

|---|---|

SBA 7(a) Loan | 11%-14.5% |

SBA 504/CDC Loan | 5.75%-6% |

Conventional Bank Loan | 6%-11% |

Hard Money and Bridge Loan | 7%-20% |

SBA 7(a) Loans

Who an SBA 7(a) Loan Is Right For

An SBA 7(a) loan is the most common type of loan issued by the SBA. Loan proceeds can be used to purchase real estate, land, and buildings. It can also cover costs associated with constructing and renovating a building, including specialized projects such as self-storage financing.

The SBA defines qualification criteria with stricter requirements than other CRE loans due to the government-backed nature of the loan. However, this poses less risk to the lender and allows for favorable rates and terms for borrowers with a strong credit history.

Before applying for this loan, you should know that these loans take longer to facilitate than most. They also carry a prepayment penalty for the first three years—5% during the first year, 3% during the second year, and 1% during the third year. A prepayment penalty also applies if you voluntarily repay 25% or more of the loan’s outstanding balance.

If you think an SBA 7(a) loan can benefit your business, check out our partner Grasshopper Bank. As an SBA-preferred lender, it offers a streamlined application process to help you get preapproved and receive funds faster.

Pros & Cons of SBA 7(a) Loans

| PROS | CONS |

|---|---|

| Favorable low interest rates | Application and approval process can be lengthy |

| Funds have limited restrictions for business purposes | Significant amount of documentation is required |

| Large loan amounts and long repayment terms | Qualification criteria can be strict |

SBA 504 Loans

Who an SBA 504 Loan Is Right For

An SBA 504 loan offers long-term fixed-rate financing options and is available through Certified Development Companies (CDCs) to fund assets that promote job and business growth. It applies to borrowers who plan on making investments such as purchasing buildings, constructing new facilities, or improving land.

While the SBA does set some general eligibility criteria, individual lenders can have additional requirements. For this reason, specific requirements for things like credit score, time in business, annual income, and debt service coverage ratio (DSCR) can vary. Other qualification standards include management expertise, a solid business plan, and a demonstrated ability for loan repayment.

If you think an SBA 504 loan suits your financing needs, you can apply with our partner Grasshopper Bank. It facilitates SBA loans and is a preferred lender that can assist you with the application process.

Pros & Cons of SBA 504 Loans

| PROS | CONS |

|---|---|

| Favorable low interest rates and repayment terms | Approval and disbursement of funds can take months |

| Lower down payment requirements than other types of loans | Documentation and application process can require lots of paperwork |

| No additional collateral requirements beyond the assets being acquired | Qualification requirements may make it difficult for early-stage businesses to be eligible |

Conventional Commercial Real Estate Loans

Who a Conventional Commercial Loan Is Right For

CRE loans can be used to finance properties that will be used for business purposes, such as investment property, office space, warehouse, or manufacturing facilities. Traditional banks, credit unions, brokers, and online lenders typically offer these loans.

A big advantage of getting a commercial real estate loan through a bank is that the available loan amounts usually exceed those from loans backed by the federal government, like SBA loans. Rates are also competitive, but the qualification requirements can be strict. You’ll typically need to have strong credit, have an established history of conducting business, and be able to show that your business is performing well financially.

If you meet those requirements, U.S. Bank is an excellent provider to consider for long-term owner-occupied commercial real estate loans.

Pros & Cons of Conventional Commercial Real Estate Loans

| PROS | CONS |

|---|---|

| Higher loan amounts in comparison to other CRE loans | Higher down payments may be required |

| Competitive interest rates and flexible repayment terms | Qualification criteria can vary depending on the lender |

| Quicker approval and disbursement process | Closing and lender fees may be higher |

Hard Money Loans

Who a Hard Money Loan Is Right For

A hard money loan, such as a bridge loan and a mixed-use loan, is a popular alternative to investment property financing and can be a good option if you can’t get funding elsewhere. This can be due to insufficient credit or revenue qualifications or the property condition not meeting the requirements of a traditional lender. Hard money loans typically have higher interest rates and fees than traditional loans due to their short-term nature and the increased risk they pose to lenders. Therefore, they are often considered a last-resort financing option.

These loans are commonly used by fix-and-flip and fix-and-hold investors, as they can use this type of loan to purchase a property in need of repairs at a low price. Once the repairs are completed, they will sell the property for a profit, at which point the loan will be paid off. Fix-and-hold investors often replace a hard money loan with a permanent source of financing after repairs are completed.

Qualification requirements for a hard money loan usually revolve around prior flipping experience and credit scores. Although there are lenders that can finance those with no prior flipping experience, you’ll have a much better chance of getting approved with a track record of successful flips and a strong credit score.

An advantage of a hard money loan is that it can be funded quickly compared with other CRE loans. Some of the best hard money lenders can provide funding in as little as 10 days. If you’re considering this type of loan, we recommend looking at our partner RCN Capital for its low rates and fast funding speeds.

Our related resources:

Pros & Cons of Hard Money Loans

| PROS | CONS |

|---|---|

| Fast approval and funding speeds | Higher rates and fees than most CRE loans |

| Generally easier to qualify for | Large down payments are often required |

| Interest-only payment options | Shorter repayment terms |

Factors to Consider to Get the Best Commercial Propert Loan Rates

To ensure you get the best commercial property loan rates for your real estate investment needs, you’ll need to research and prioritize your goals and budget. Rates will be determined based on your credit score, industry experience, and existing debt obligations. However, there are also external factors that can also play a role, such as:

- Type of commercial real estate loan: Different types of loans will have varying ranges of rates offered, usually depending on the risk tolerance of the lender. Loans that have strict requirements, such as good credit and collateral, will typically be able to offer lower rates because of the reduced risk to the lender.

- Condition of property being acquired: Properties in good condition can be more easily resold. This reduces the lender’s risk especially if the property is used as collateral for a loan. If you fail to make payments on time, the lender can foreclose and resell it to cover its losses.

- Your business qualifications: Common requirements revolve around your company’s annual revenue, time in business, investment experience, and credit score. Highly qualified businesses represent a lower risk to lenders, which typically leads to more competitive rates being offered.

- Loan terms requested: Loan terms that can impact the rate you get include the loan amount, length of the loan, and whether you want a fixed or variable rate.

- Market rates: Economic conditions can impact the general range of rates available for loans. As the cost of borrowing money becomes more expensive for banks, the increased costs are typically passed on to borrowers.

Our guide to the best commercial real estate loans can save you time and money when searching for a lender. These lenders offer a variety of programs with competitive rates and fees. Many also have flexible qualification requirements to cater to startups and borrowers with low credit scores.

How Much Do Rates Change Over Time?

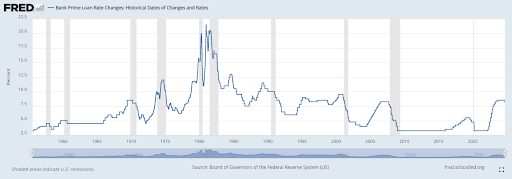

Although rates have risen over the past year, they are still low from a historical standpoint. Rates on many types of loans fluctuate with the US prime rate, and the following chart shows its changes since 1955.

Board of Governors of the Federal Reserve System (US), Bank Prime Loan Rate [DPRIME], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/PRIME, October 3, 2024

Alternatives to Commercial Real Estate Loans

If you think you may be ineligible for a CRE loan or simply want to explore all of your potential financing options, consider the following alternatives:

- Rollover for business startups: With a rollover for business startups (ROBS), you can use funds from your retirement account tax- and penalty-free with a minimum investment of $50,000. It’s important to note that this isn’t a loan, but it does carry certain risks if not managed properly. For that reason, we recommend using the services of one of our leading ROBS providers.

- Business line of credit: A business line of credit is a revolving credit facility that can provide quick access to funds to be used as needed. Funds can be used for virtually any business expense, with the balance repaid over time. Our list of the top small business lines of credit contains our recommendations.

- Personal loan for business: Personal loans are issued based on your personal credit and finances and can be easier to qualify for. Loan amounts are generally smaller than what you could receive with other CRE loans, but it’s a good option for borrowers who need quick access to funds and have limited financing options. For a jumping-off point, see our roundup of the best personal loans for business funding.

- Friends and family loan: Raising money from friends and family to fund your business can be a less formal financing option to secure favorable rates and repayment terms. You’ll have to apply an applicable interest rate and ensure you meet regulations; but overall, it’s a way to access funding without using a traditional lender.

Frequently Asked Questions (FAQs)

Depending on the loan type you choose, interest rates will vary. Government-backed loans, such as the SBA 7(a) and SBA 504 programs, typically offer the most favorable interest rates ranging from 5.75% to 14.5%. Conventional CRE loans can also offer low starting rates depending on your qualifications and the terms set by the lender.

To finance a commercial loan, you have several types, including SBA loans, term loans, conventional commercial mortgage loans, commercial bridge loans, and hard money loans.

Getting a commercial loan can be difficult depending on the loan type you’re pursuing and its required qualifications. Qualification requirements will vary depending on the lender, and some may have stricter criteria than others. Although most are flexible and review applications case-by-case, you may still qualify even if you don’t check all the boxes.

You have many options when it comes to securing a commercial mortgage loan. Traditional banks, credit unions, brokers, and online lenders all provide these loans. The best choice for you will depend on your business needs and preferences.

Bottom Line

You’ll need to consider your qualifications and financing needs when seeking the best commercial mortgage loan rates. Depending on your business needs and real estate investment goals, you have several loan options to consider. Generally, businesses with a good credit score, strong cash flow, and track record of success will usually qualify for lower rates. Loans that require collateral or a large down payment also tend to offer more competitive rates and fees.

In addition to qualifications, it’s wise to compare loan rates and terms with multiple lenders before making a final decision. While shopping around, you can use a commercial loan calculator to see if you can afford the monthly loan payments. If financing a property is not right for you, you can also consider leasing commercial property, and our article on how to lease commercial real estate will guide you.