The average cost of flipping a house varies depending on the property location, type, and degree of the required renovations, but the total house flipping budget is usually around 10% of the purchase price. To get the most accurate estimations, you’ll need the sum of the four main costs of flipping a house, which include acquisition costs, rehab, carrying costs, marketing, and selling costs.

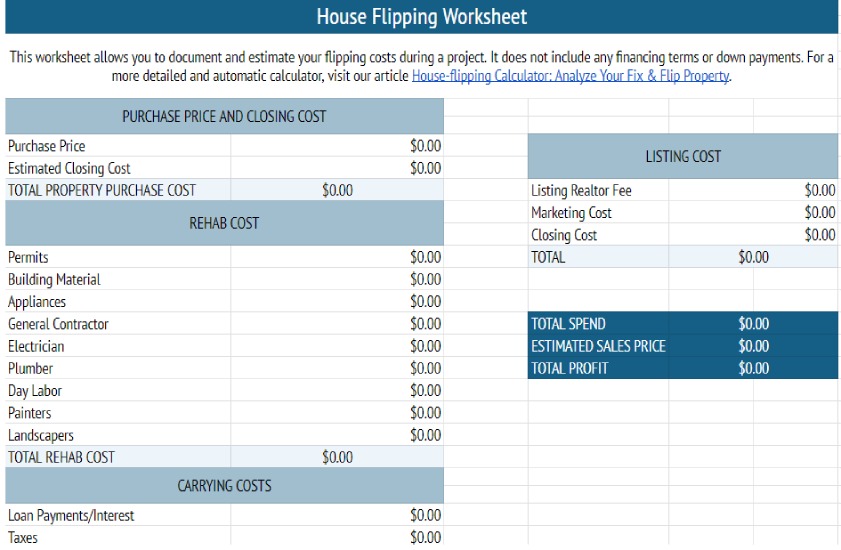

Use our free fix-and-flip costs worksheet, which provides simple calculations to help you evaluate the cost to flip a house, including carrying costs, rehab, potential sale price, and selling costs.

House Flipping Cost Breakdown & Calculations

To help you evaluate potential flip properties, start by gathering accurate estimations of the property’s costs. You will also need an accurate understanding of the property’s after-repair value (ARV). Then, with the information in this guide, you can calculate your potential profits and return on investment (ROI).

You can estimate how much it costs to flip a house based on these criteria:

- Purchase price: The cost of purchasing the house before repairs are made, including out-of-pocket closing costs.

- Rehab costs: The total costs associated with repairing the house, including getting the necessary permits, buying materials, and hiring contractors.

- Carrying costs: The total monthly fees of owning the property, like mortgage payments, insurance, and utilities.

- Listing costs: The total amount of money required to work with a real estate agent or market the property yourself, including closing costs.

- After-repair value (ARV): The estimated sale price of the home after all repairs and renovations have been completed.

To determine these calculations, use the above worksheet to document, but you can also do automatic calculations with the free calculator in our article Free House Flipping Calculator: Analyze Your Fix & Flip Property.

4 Main Factors That Influence Flipping Cost

When considering the cost of flipping your investment property, there are a few factors that every investor should look into in order to achieve success. These factors—purchase, rehab, carrying, and marketing and sales costs—will affect the total return on investment you can earn when selling the property to a new owner. Read along for a breakdown of each of these costs.

1. Purchase Price of a Fix & Flip Property

The most significant expense for a house-flipping investor is the cost of acquiring the property, also known as property acquisition. It is critical for the house-flipping budget and the overall success of the flip to purchase a home at a reasonable price point. This is why it’s necessary for investors to know the best ways to find houses to flip that are undervalued, like foreclosures or distressed homes.

When considering how much it costs to flip a house, you can’t make a good decision based on a property’s price alone. Determining whether a property is worth the price depends on a few factors, like the local real estate market and the property’s after-repair value (ARV). In order to make a profit on your fix-and-flip project, make sure you compare the property to similar properties in the area. By doing a comparative market analysis (CMA), you’ll ensure your proposed ARV won’t price you out of the neighborhood and guarantee you’re not overpaying for the property in its current condition.

In addition, remember to apply the 70% rule. In house flipping, the 70% rule states that investors should pay not more than 70% of a property’s after-repair value, minus the cost of the renovations required.

Formula: After-repair value (ARV) x .70 − Estimated repair costs = Maximum buying price

In addition, the average cost to flip a house will heavily depend on the local real estate market. To decide if the area is a good market for flipping houses, look for these housing market indicators:

- Median household income

- Average home value

- Number of realtors

- Cost of living

- Average listing and selling price

- Average days on market

Closing Costs

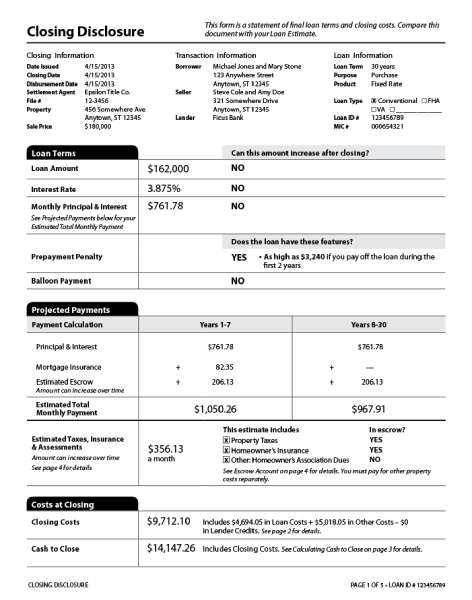

Part of your property acquisition expenses will include closing costs, which are fees paid at the end of a real estate transaction. They include transfer taxes, your share of broker fees, property taxes, property insurance, legal fees, title company fees, and title insurance. Your real estate agent and the lender will break down your closing costs in a closing disclosure form.

Example closing disclosure

(Source: Consumer Financial Protection Bureau)

Closing costs can range from 2% to 6% of the purchase price. However, a conservative rule of thumb to calculate your closing costs is to estimate about 5% of the property’s purchase price. For example, if you purchased a property for $300,000, expect to pay around 5% of $300,000, which is $15,000. So the $300,000 property has now cost you $315,000. It’s crucial to consider these expenses when estimating your flip cost because they will impact your budget and return on investment (ROI).

2. Rehab Costs to Fix the Property

One of the most important elements of your house flipping cost breakdown will be rehab costs. These are the total expenses for rehabilitating or renovating the property you purchase, including materials and hiring contractors. Keep in mind that calculating the average cost to flip a house will vary significantly because costs depend on the extent of the renovation, the state of the property, its size, and the cost of labor in your area.

However, these are the rehab costs you’ll need to consider:

- Building materials: Aluminum, lumber, drywall, concrete, brick, tiles/flooring, countertops, and hardware

- Cosmetic materials: Paint, polish, carpet, flooring, light fixtures, and cabinet

- Professional labor: General contractor, handypersons, plumber, and electrician

- Landscaping: Mowing the lawn, mulch, trimming bushes, and planting flowers or trees

- Appliances: New refrigerator, TV, air conditioning and heating, microwave, stove, dishwasher, and washer/dryer

To help you get the most profit out of your fix-and-flip and to get the project done without unnecessary stress, use your network to find reputable contractors. The longer it takes to complete the rehabilitation and renovations, the longer you’ll have to pay monthly carrying expenses, reducing your budget and ROI.

Different Types of Home Repairs

Properties that require some fresh paint and landscaping will be much less expensive than homes that need significant structural, plumbing, or electrical work. The key to learning how to flip a house on a budget is only making necessary renovations to increase the property’s value. Home renovations are generally categorized into three types: cosmetic, moderate, and extensive.

Cosmetic repairs are the least expensive, but they significantly impact how potential buyers perceive the house. Although they don’t change the home’s functionality, they add significant value to the home when done correctly. Cosmetic repairs and estimated costs can include:

- Replacing carpets: 65 cents to $2.50 per square foot

- Refinishing floors: $1,000 to $3,000

- Repainting and patching walls: $300 to $900 for drywall, $1,000 to $3,000 for painting

- Repainting cabinets: $400 to $1,500

- Basic landscaping: $20 to $500

Hardwood floor before and after refinishing (Source: Fabulous Floor Michigan)

These repairs are completed in a shorter time period than others, which reduces carrying costs. The material and labor costs will also be lower. However, acquisition costs for properties that only need cosmetic repairs are typically higher, since they’re in better condition than homes that need total rehab.

Moderate home repairs can include cosmetic changes, but require more planning and expertise. Some real estate investors with home improvement experience may be able to make moderate repairs, but they’re likely to hire out many of the jobs because of the time and expertise required to do them well. A few examples of moderate home repairs include:

- Renovating the kitchen to incorporate stone countertops: $14,550 to $40,000

- Installing new light fixtures: $100 to $650 per fixture

- Replacing appliances: $2,100 to $5,400

- Removing or replacing tile: $15 to $20 per square foot

- Installing new flooring: $1,500 to $4,500

- Updating bathroom fixtures: $200 to $600 per fixture

- Adding pavers and shrubs to increase curb appeal: $4.50 to $20 per square foot

- Painting or refinishing the property’s exterior: $1,800 to $13,000

Bathroom remodel in a flipped house before and after

(Source: Mannington)

When calculating how much it costs to flip a house that needs moderate repairs, the acquisition cost will generally be lower than homes that only need cosmetic repairs. However, your timeline, labor, and material costs will increase, which will also increase your carrying costs.

Extensive home repairs, sometimes known as “gutting,” are required when a house has major problems that must be completely removed, replaced, and renovated. Homes that need extensive repairs typically have the lowest acquisition costs, but the highest material and labor costs. These types of fix-and-flip projects also have the longest timeline, which increases your carrying costs because they require contractors and building permits. Extensive home repairs can include:

- Structural problems or foundation repairs: $2,100 to $8,000

- Adding onto the home to increase square footage: $90 to $120 per square foot

- Removing walls: $400 to $3,000

- Adding a bathroom to increase the property value: $15,000 to $57,000

- Replacing the roof: $6,700 to $80,000

- Removing mold or asbestos: $2,500 to $12,500

- Major plumbing upgrades: $3,000 to $16,000

Cracks in house foundation

(Source: Design Everest)

3. Carrying Costs to Hold the Property During Rehab

Anyone thinking about investing in real estate should learn how to calculate and plan for carrying costs, which are the ongoing expenses of owning a property. These expenses are typically paid monthly, so your total carrying costs will depend on how long it takes to complete all necessary repairs and sell the property. The longer you work on the property, the higher your carrying costs will be. Carrying costs typically include financing, utilities, homeowner’s association fees (HOA), insurance, and property taxes.

Financing costs are the fees associated with borrowing money to buy and renovate a home, which depend on which type of investment property financing you choose. As a general rule, your down payment will be about 20% to 25% of the purchase price. Aside from this, a first-time investor must cover loan origination fees of approximately 3% to 4% of the loan amount and standard closing costs of another 1.5% of the purchase price.

Plus, interest rates on different types of financing can vary drastically. For example, in September 2023, the average interest rate on a conventional 30-year fixed-rate mortgage is 7.12%. Hard money loans usually have much higher interest rates, often around 10% to 18%. Moreover, typical fix-and-flip lenders provide high-interest rates and short-term loan products.

On the other hand, using cash is a great alternative to financing a property. This saves you money in the short term because you don’t have any lending fees, interest, or points. However, this will deplete your funds because you’ll need the cash to purchase and rehab the property. You will also need to have money set aside for unanticipated expenses.

Here is an example comparing two financing options, isolating the cost of financing a fix-and-flip project:

Costs | All Cash | Hard Money Loan |

|---|---|---|

Purchase Price | $100,000 | $100,000 |

Rehab Costs | $25,000 | $20,000 |

Down Payment | $100,000 | $24,000 |

Loan Amount | $0 | $96,000 |

Interest Rate | 0% | 12% |

Financing Related Closing Costs | $0 | $2,880 |

Monthly Mortgage Payment | $0 | $960 |

Out-of-Pocket Rehab Costs | $20,000 | $0 |

Total Costs for First 30 Days | $120,000 | $123,840 |

These numbers are only estimates and do not represent the project's total cost. | ||

Property taxes have two effects on the cost of flipping a house. First, you might need to prepay the remaining taxes for the remainder of the year at settlement. Second, you may be required to pay monthly or quarterly property taxes, which will be included in your carrying costs.

Property tax rates differ significantly across the country because states and municipalities set their property tax requirements. According to World Population Review, the top five states with the lowest and highest property taxes are as follows:

Property taxes are an important factor in knowing the cost to flip a house. Excessively high property taxes can be a turnoff for homebuyers, and they can increase your carrying costs.

Property insurance is a policy that protects homeowners from damage or loss if your flip house is vandalized, broken into, or suffers storm damage. Many financing options require you to have an insurance policy, especially those with a loan-to-value ratio (LTV) over 80%. When selecting an insurance package, ensure it includes full coverage, including flood and fire damage coverage, depending on the property’s location.

For a fix-and-flip property, you will likely need vacant or unoccupied property insurance. The average cost of this insurance is about 50% to 60% more than the average home insurance policy, or around $2,170, even for a smaller home. It is expensive because there’s a greater chance of property damage since no one is on the property to protect it. Generally, there are three ways to pay for a policy: upfront, at or before settlement, or monthly.

Utility costs are a large part of your monthly carrying costs, including water, electricity, gas, and oil. Some utility companies also demand upfront payments, mainly if you are the owner of an apartment complex or the previous owner had significant monthly expenses.

Utility bills vary depending on usage, property size, and condition. You can get a monthly cost estimate from the utility providers or the previous owner. Make sure you plan for your utilities ahead of time, because it can take a week or more for utility companies to start providing services after you buy a property. Without water and electricity, you won’t be able to start work on the property, which will incur additional costs and extend your timeline.

Not all properties have a homeowners association (HOA), but you will be responsible for the fees if your fix-and-flip property does. HOA fees can be paid monthly or annually, and they cover municipal services, association insurance, maintenance and repairs, amenities and services, and reserve funds. HOA fees vary widely depending on where you live, what type of home you’re in, and what your HOA offers. On average, single-family homes in the U.S. have an HOA fee between $200 and $300 per month.

As we’ve discussed, the longer you hold on to a fix-and-flip property, the higher your carrying costs will be. For this reason, thoroughly planning the timeline for your property is essential for determining the cost to flip a house. For instance, your timetable might be 60 days from buying the property to the time you plan to list it on the market.

The timeline must take into account:

- The amount of rehabilitation and renovation projects on the property

- The property’s size

- Yours and contractors’ availability and schedule

- Marketing and selling the property

4. Marketing & Sales Costs to Sell a Flipped House

Once the renovations are complete, the only remaining house flipping costs are marketing and sales, which are used when you are selling your newly flipped property. To calculate these costs and maximize your profits, you need to decide whether to work with a real estate agent or sell the property yourself (for sale by owner, or FSBO). Depending on which path you take, the cost of marketing tools and strategies you use will differ.

Sales Costs

Real estate agent commissions are generally 6% of the property’s sales price, usually deducted from the seller at closing. For instance, if the subject property sells for $300,000, the real estate agent fees will be $18,000. By listing the house yourself, you can theoretically pocket that money, which appeals to most home flippers.

However, selling the house yourself will require an extensive amount of work, time, and added expenses. You will have to market the house without access to the Multiple Listing Service (MLS), and if you don’t already have a network of homebuyers or a wide local audience on social media, that can be a challenge. These are a few likely reasons why FSBO homes usually sell for between 5% and 26% less than comparable homes. According to the National Association of Realtors (NAR), FSBO homes sell for an average of $225,000, while homes listed by an agent sell for an average of $330,000.

Marketing Costs

If you choose to sell the property yourself, you’ll need to spend money to spread the word. There are thousands of real estate marketing ideas you could use, so it will be important to evaluate the costs and potential reach of each strategy. Unless you are a seasoned marketer or have a sizable network to help spread the word and provide assistance and resources, learning how to successfully market your flip properties can take months.

However, a few of the top listing marketing strategies include:

- Hosting an open house

- Real estate signs

- Direct mail like postcards and flyers

- Social media marketing

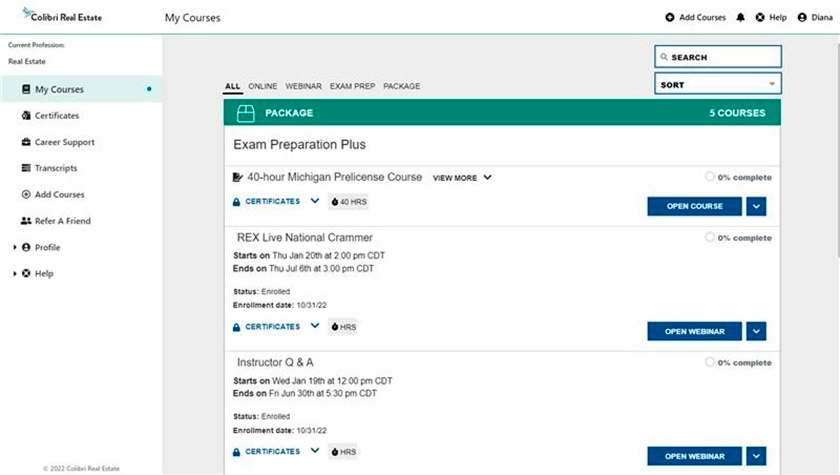

Colibri Real Estate interface

For those who want to start a house flipping business and repeat this process over and over, another option is to get a real estate license to access the tools and support to sell properties more successfully. The first step to becoming a real estate agent is getting your prelicensing education through a licensed provider like Colibri Real Estate.

It is an accredited online real estate school that provides engaging, self-paced real estate education in every state. Students can choose from multiple course packages with varying levels of support, including instructor access and an exam prep course that comes with a Pass or Don’t Pay Guarantee.

Visit Colibri Real Estate – Use Promo Code: FSB30 for 30% off

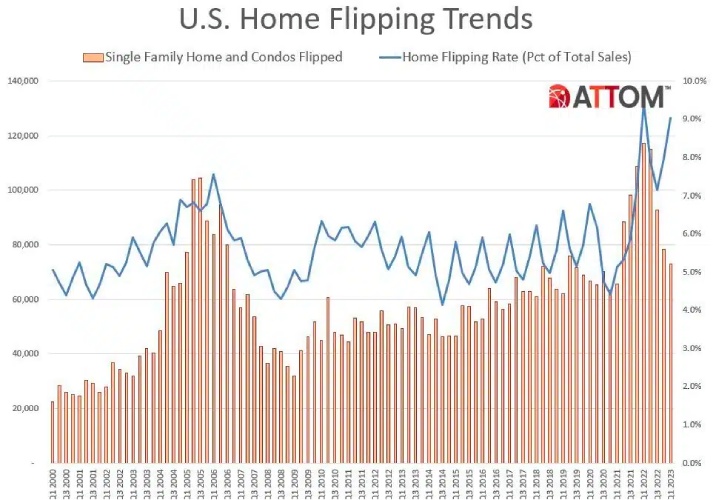

Flipping a House Cost Statistics

If you’re considering whether or not to start or continue flipping houses, it’s helpful to know how other flippers are performing. We’ve gathered the top statistics on the average cost to flip a house, average ROIs, and the best locations throughout the U.S. These statistics from Attom Data may help you decide whether to invest in house flipping.

- In the first quarter of 2023, 72,960 single-family homes and condominiums were flipped.

- 9% of all real estate transactions in the first quarter of 2023 were fix-and-flips.

- The average gross profit of real estate flips in 2023 is $56,000. This is a decrease of an average profit of $67,900 in 2022 and $70,000 in 2021.

- The average ROI of home flips in 2023 is 22.5%.

- The average resale price of flipped homes in the first quarter of 2023 was $305,000.

- The two markets with the largest ROIs for home flips were Scranton, Pennsylvania, with an average ROI of 121.9%, and Pittsburgh, Pennsylvania, with an average ROI of 109.8%.

- The areas with the smallest ROIs at the beginning of 2023 were Austin, Texas (10.2% loss), Phoenix, Arizona (2.4% loss), and Ogden, Utah (0.5% loss).

- 66.1 of home flippers in 2023 purchased their properties with cash. Only 33.9% of flippers used financing.

- The average time to purchase and resell a fix-and-flip property in 2023 was 178 days, or about six months.

U.S. home flipping trends graph (Source: Attom)

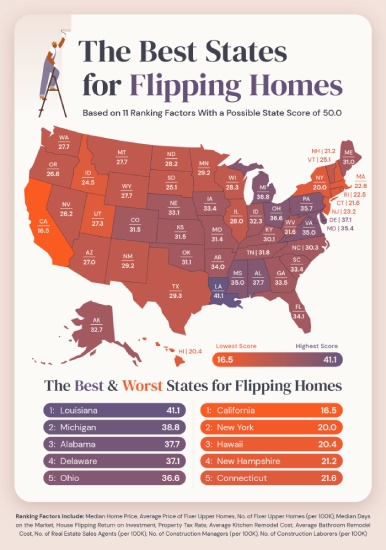

A study by Joybird found that the top five states to flip houses are Louisiana, Michigan, Alabama, Delaware, and Ohio. These states have short turnover time, high homeownership rates, low remodeling costs, solid quality of life, and a high average return on investment (ROI) for house flipping. As you calculate how much it is to flip a house, make sure to consider whether your current city or state is the most profitable for this career choice.

Best states for flipping houses (Source: Joybird)

Frequently Asked Questions (FAQs)

Although the average gross profit of flipped houses in 2023 is $56,000, the cost of flipping a house varies dramatically based on your location. For example, the average median home value in Alabama is $147,200, while the average in Hawaii is $615,300. To determine how much money is needed to start flipping houses, you need to find under-valued properties in your area, calculate rehab costs, financing costs, and selling costs.

According to Forbes, the average cost to build a house is $300,000, although it can range across the U.S. from $30,000 to millions. This breaks down to about $150 per square foot, although luxury homes can cost up to $500 per square foot. On the other hand, Angi estimates an average cost of flipping a house at $49,236. Ultimately, there are many factors that impact the prices of building and flipping, so you need to start by determining the location, target price, and type of home you want.

It’s estimated that the average cost of flipping a house is about 10% of the purchase price. To determine your house flipping budget, calculate the cost of acquiring a property in your area, the ARV, rehab costs, carrying costs, and selling costs.

Bottom Line

Finding the answer to the question “how much does it cost to flip a house?” depends on several variables. The average cost of flipping a house is about 10% of the purchase price, depending on the price of buying the property, the cost of renovating it, and the cost of financing the property. After considering each of these factors, you should be well on your way to determining how much money you need to start flipping houses.