Employee benefits are a key component of the compensation package you offer and play an important role in attracting and retaining workers. Even workers’ perks, such as staff discounts and access to wellness or fitness programs, can help influence an employee’s decision to work or stay at your company. While it’s difficult to know what benefits are vital to workers, these 33 employee benefits statistics will help you understand which ones will have the most impact on your workforce.

General Benefits Statistics

1. 53% of employees are somewhat likely to accept a job offer with low pay but better benefits

The benefits you provide can make or break a jobseeker’s decision to work for a company. As an employer, it’s important you create an employee compensation plan that includes a balanced mix of both monetary and non-monetary items (such as health insurance) to attract qualified applicants.

(Aflac)

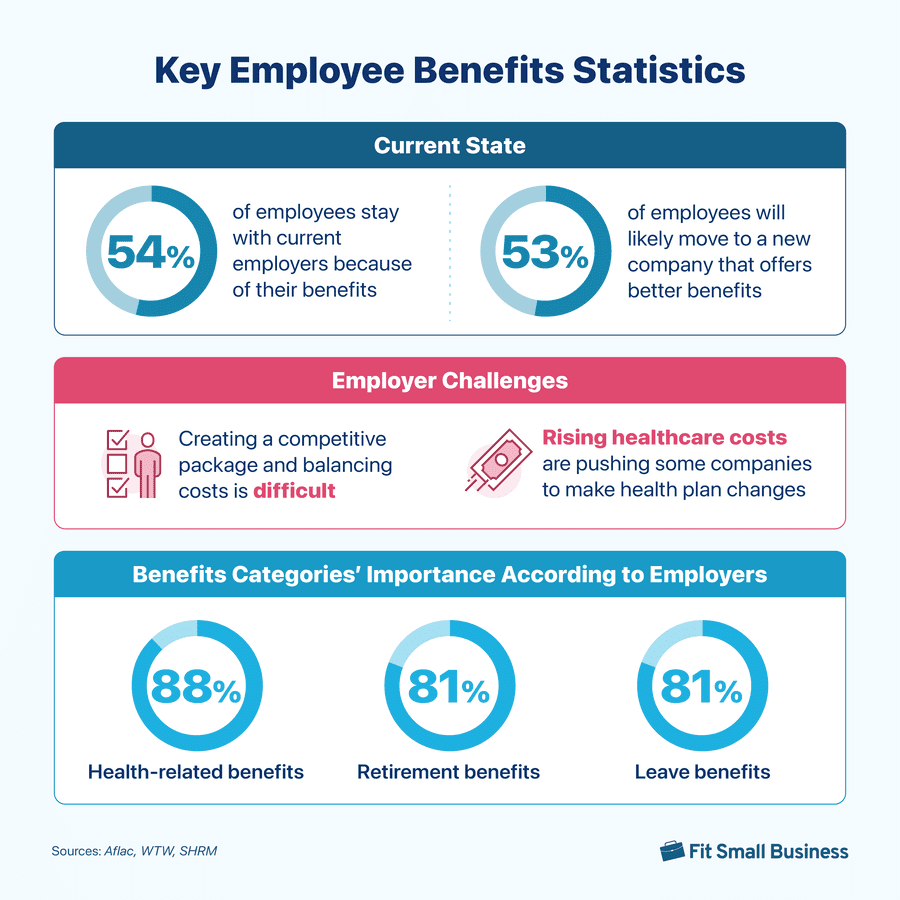

2. 54% of employees stayed with their current employers because of their benefits packages

While pay is still a critical part of retaining workers, the benefits packages available to employees also matter. Half of workers are willing to stay with employers who provide the benefits they need. The study furthers this, saying that 40% of employees will even leave their employers for a company that offers better benefits but no change in pay. This is why creating a benefits program that invests in the workforce’s long-term and overall well-being is important—it provides workers a sense of security and entices them to stay at a company given the benefits they receive.

(WTW)

3. The benefits that employees want vary by generation

When creating an employee benefits program for your company, you should look at several factors, such as your budget and statistics about employee benefits and industry trends. If you have a multi-generation workforce, you should consider the benefits that each generation values.

For Gen Z employees, access to mental health benefits is more important to them than for millennials, Gen X workers, and baby boomers. However, while each has different preferences, the common benefit that all generations want is flexible work options.

Benefits That Employees Value (by Generation) | |||

|---|---|---|---|

Gen Z (born: 1997-2012) | Millenials (born: 1981-1996) | Gen X (born: 1946-1965) | Baby Boomers (born: 1997-2012) |

Struggles with:

| Struggles with:

| Struggles with:

| Struggles with:

|

Benefits options:

| Benefits options:

| Benefits options:

| Benefits options:

|

(Marsh McLennan Agency)

4. 63% of workers say their benefits package helps reduce their stress

Employee benefits can help boost your company’s recruitment and retention strategies, but they also improve worker well-being and morale. If your workforce has the benefits they want, they feel more secure knowing that some of their basic necessities are being addressed, such as access to health care and/or financial support in case they need it. And, with workers feeling physically and financially healthy, they are more likely to become more focused and productive at work, which saves the company money in the long run.

(MetLife)

5. There’s a gap between what employers & employees feel about their overall benefits package

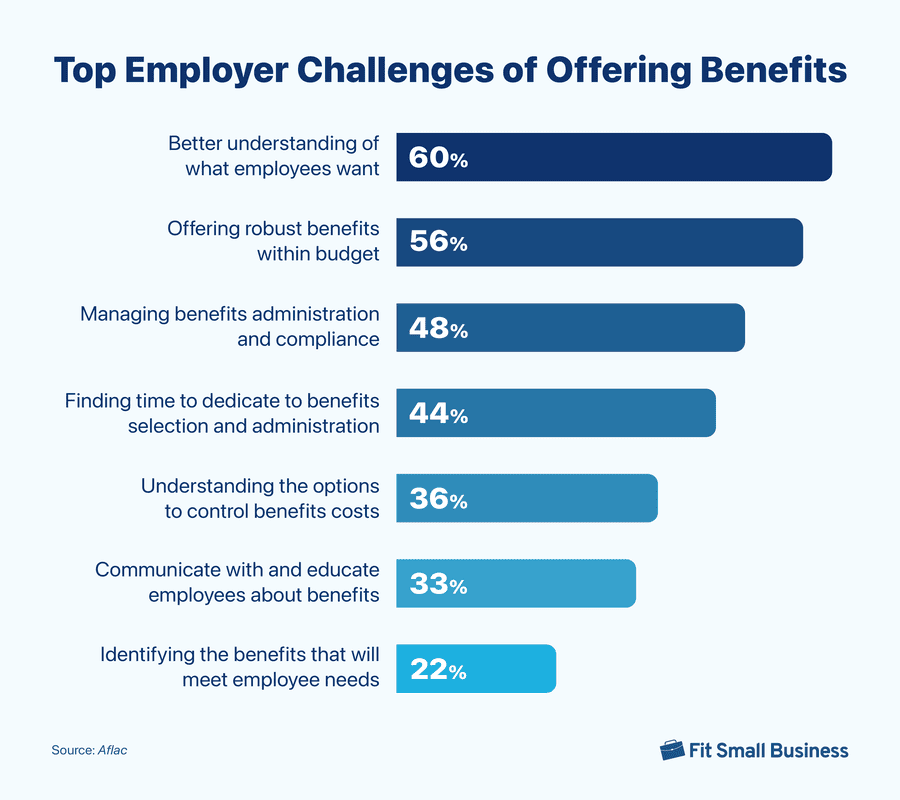

78% of employers believe their workers are highly satisfied with their benefits, but only 59% of employees agree. One reason for this gap is that employers don’t know what their employees want. 60% of companies also consider this as their top challenge in offering benefits.

To help address this, running and creating staff surveys with a section asking about the company’s benefits plans will provide you with the data you need to understand what team members want and think. Looking at market data will also arm you with the latest employee benefits trends you should know.

(Aflac)

6. 56% of employers are struggling to balance offering a competitive package and managing finances

While employees want to get better benefits, making sure this happens is a challenge for most businesses. Half of employers rank providing a robust package while staying within budget as their second top difficulty in offering benefits, just under gaining a better understanding of what workers want. Companies also struggle with benefits administration and finding dedicated resources to handle the benefits selection process.

(Aflac)

Leave Benefits Statistics

7. 81% of employers consider leave benefits as one of the most important employee benefits

Providing leave benefits to let employees rest, recuperate from sickness, or attend to emergencies will help you attract and retain workers. 96% or more of employers offer separate paid vacation and sick leaves, although some employers (68%) combine both vacation and sick time as paid time off (PTO). Meanwhile, unlimited paid leave isn’t a popular option, with only 7% of employers providing this leave type.

Having a PTO policy can help you manage employee time off transactions and track accruals. If you need help coming up with one, check out our creating a PTO policy guide, which includes a template you can use for free.

(SHRM)

8. 77% of organizations use an employee’s tenure or service years to determine leave benefits

For more than three-quarters of US employers, the amount of paid leave days offered to employees depends on how long they’ve stayed at a company. Those with a higher tenure receive more PTO days as compared to those who are new to the organization. Meanwhile, other companies look at the employee’s number of work hours (45%) or the worker’s level (28%) to identify leave benefits.

Small businesses and companies (such as those in the manufacturing industry) that follow a tenure-based PTO system can use the chart below to benchmark and compare their time off policies with market data.

Leave Type | Under 1 Year | 1 Year | 5 Years | 10 Years | 20 Years |

|---|---|---|---|---|---|

Paid Vacation Leave | 10 days | 12 days | 16 days | 19 days | 21 days |

Paid Sick Leave | 10 days | 10 days | 12 days | 12 days | 12 days |

Paid PTO | 13 days | 15 days | 20 days | 23 days | 26 days |

(SHRM)

9. Parental leaves continue to be popular benefits options

Apart from state-mandated paid parental leaves, more companies are offering separate paid maternity, paternity, and family leave to eligible workers. In 2023, those with paid maternity and paternity leaves rose to 40% and 32%, from 35% and 27% in 2022, respectively. Paid adoption leaves also increased to 34%—up six percentage points since 2022.

With parental leave not a federally mandated benefit, offering this will be a huge competitive advantage in attracting and retaining top talents. Plus, if you’re managing employees who mostly belong to the millennial and Gen X generations, they will appreciate the additional time off days to care for family members.

Need more information about parental leave-related laws? Read our paternity leave and maternity leave guides, which also include free policy templates you can download.

(SHRM)

10. The median number of paid weeks for parental leave has slightly increased

For paid parental leave, the median number of paid weeks has increased to seven in 2024, from six weeks in 2015. While the increase isn’t significant given the timeframe, it’s a good indication of employers gradually expanding the paid time off days they provide to employees to bond with their children. What also helped is the growing number of states passing laws that require employers to provide paid parental leave to eligible workers. An example is Maine, which passed a similar law in 2023 that will go into effect on May 1, 2026.

For other family-related leaves, the median number of paid weeks is eight for surrogacy leave and six for adoption leave. Foster child leaves also have a median number of six paid weeks.

(Mercer)

11. New or expanded leave benefits include paid bereavement, grandparent, and floating holiday leaves

While many employers offer some form of paid bereavement leave in 2024, less than half extend this to workers who experience the loss of a pregnancy, failed surrogacy, or failed adoption. Meanwhile, more than a third of employers provide a floating holiday leave to let employees take paid time off for special events, such as birthdays or religious observances. On the other hand, only a few companies provide grandparent leave for workers who need time off for the birth or adoption of a new grandchild.

(SHRM)

12. 56% of workers are interested in PTO donations as an additional benefit

If many of your workers end the calendar year with a lot of unused PTO credits and you don’t allow these to be carried over to the next year, you may want to consider offering a PTO donation program. This allows workers to donate their unused credits in a shared pool, which other employees can use to cover extended medical-related leaves or for emergencies.

(MetLife)

Health Benefits Statistics

13. 88% of organizations rank health care benefits as the top employee benefit

Statistics about employee benefits show that health insurance is considered a must-offer benefit by 97% of companies. Of those organizations, 70% provide a fully insured health plan With this plan, employers pay a fixed premium amount to an insurer, who then pays the medical claims. while 27% manage their own health plan and pay the medical claims themselves or via a third-party administrator.

Aside from health insurance, the common health care benefits include dental (99%) and vision insurance (96%). Others have bundled prescription drug coverage with the medical insurance plan (92%). Many companies have also included telemedicine and telehealth services (91%) in their benefits offerings.

(SHRM)

14. 63% of companies offer high-deductible health plans (HDHPs) linked with a savings or spending account

Unlike traditional health plans, an HDHP option comes with a larger annual deductible for medical expenses and lower monthly premiums. However, if linked to a savings or spending account, it can be used to cover deductible expenses and other medical costs. This option is great for those with a young and healthy workforce who may not need doctor checkups unless there’s a medical emergency. It also allows employees to significantly contribute to a health savings account (HSA) as a way of saving money.

Key coverage features include an HSA, a health reimbursement arrangement (HRA), or a flexible spending account (FSA). For these accounts, the 2024 employee health benefits statistics are:

Medical FSAs | HSAs | HRAs |

|---|---|---|

|

|

(SHRM)

15. More employers are planning to add benefits that support women’s reproductive health

In 2023, 37% of employers planned to provide specialized benefits to support women’s reproductive health needs—from preconception to menopause. That number has risen to 46% in 2024. Employers are either currently offering or plan to provide support for one or more of the following items/conditions:

- Preconception family planning (32%)

- High-risk pregnancy (31%)

- Lactation (30%)

- Post-partum (24%)

- Pregnancy loss (20%)

- Menopause (15%)

Of the six items in the above list, the benefit that saw the most increase is menopausal support. The percentage of employers looking to offer this has tripled—from 4% in 2023 to 15% in 2024.

Did You Know? By 2032, women ages 45 to 54 will make up 20.5% of the total US labor force, according to the Bureau of Labor Statistics (BLS). This is the age range where women are most likely to experience menopause. Setting up your menopausal support benefits now will help you become more prepared to meet the special needs of women employees.

(Mercer)

16. Rising costs are influencing how companies deliver health benefits

Organizations have implemented various strategies to help offset the rising cost of health care. Employers who experienced this have either increased the amount of employee deductibles (46%) or the share of health insurance premiums that workers pay (45%).

However, as employers strive to balance costs and offer competitive benefits, using these tactics comes with the risk of workers not being willing to shoulder the additional costs. They may also likely decide to look for a job opportunity with better benefits.

(Aflac)

17. 40% of large companies have taken extra steps to manage the utilization of Semaglutide drugs

Semaglutide medications, or glucagon-like peptide-1(GLP-1) drugs, are intended to manage diabetes. However, these products have also become popular medications to combat obesity. To manage their workforce’s usage of these medicines, both large-sized businesses These refer to companies with 500 and more employees. (40%) and enterprises These refer to companies with 5,000 and more employees. (52%) have added these control points:

- 27% of large businesses and 31% of enterprises require a doctor’s authorization to confirm the diabetes illness (or present a blood test that confirms it)

- 13% of large businesses and 17% of enterprises use a “smart” prior authorization option, allowing employees to bypass the doctor’s authorization requirement if their medical history shows they are diabetic

- 7% of large businesses and 9% of enterprises require a doctor’s reauthorization to confirm that the employee is having a positive result from the GLP-1 drug

While there may be some companies that are willing to provide coverage of semaglutide drugs for weight loss, this will not be a sustainable option given the cost. The average annual cost of GLP-1 drugs (e.g., Ozempic and Wegovy) is $17,000 per patient, according to Marsh McLennan Agency’s 2024 Employee Health & Benefits Trends report.

Employers must also be mindful of how these drugs can impact health equity, the employee experience, and diversity, equity, and inclusion. For example, the current high out-of-pocket costs for GLP-1 drugs negatively affect lower-wage employees, creating access disparity.

(Mercer)

Retirement Benefits Statistics

18. Traditional 401(k) plans are the most prevalent retirement savings option

Retirement savings continue to be one of the important benefits offerings with 94% of companies offering the typical 401(k) plan or similar defined contribution programs. However, employer-sponsored Roth 401(k) options are steadily becoming popular. 73% of companies offer this plan in 2024, up from 71% in 2023 and 68% in 2022.

(SHRM)

19. 84% of employers with traditional retirement plans offer a 401(k) match

To help improve an employee’s long-term financial security, companies with traditional 401(k) programs contribute an average maximum match of 6.61% of the worker’s salary to a retirement savings plan. Meanwhile, 75% of employers with Roth 401(k) plans offer an average maximum percentage match of 6.50%.

(SHRM)

Family Care Benefits Statistics

20. Companies with onsite lactation rooms for mothers increased to 73%

The federal government’s Providing Urgent Maternal Protections (PUMP) for Nursing Mothers Act, which was passed on December 29, 2022, has helped expand the family care service offered to employees who are nursing. Since 2023, the percentage of organizations providing a dedicated lactation room for eligible workers has increased 19 percentage points to 73% in 2024.

(SHRM)

21. 58% of employers offer a dependent care FSA

Balancing work and personal responsibilities can be stressful for some employees, especially if they need to take care of elderly family members or their children. Providing support and family care benefits for these workers will help improve employee productivity and retention. With a dependent care FSA, employees can contribute to a pre-tax benefit account and use it to pay for eligible services, such as adult or children daycare, preschool and nursery school for kids, and summer day camps.

(SHRM)

22. 22% of companies provide pet health insurance

Many individuals treat their pets as family members and use them to destress from work or keep them active. More organizations have started to recognize the connection between employee well-being and pet ownership, and how this can help boost staff retention. In 2024, 22% of employers offer pet health insurance plans to help eligible workers care for their pets. This is three percentage points higher than in 2023 and up eight percentage points from 2022.

To allow workers to care for a sick pet or take time off for a pet adoption, 3% of large companies provide a paid “paw-ternity” leave, according to Mercer’s 2024 Health & Benefits Strategies study.

(SHRM)

Mental Health & Wellness Benefits Statistics

23. 62% of small and 80% of large firms offer health and wellness promotion programs

Employee benefits trends indicate that 62% of small companies and 80% of large businesses offer at least one program that focuses on weight management, smoking cessation, and behavioral or lifestyle coaching. These programs can help employees identify and manage health and behavioral issues, enabling them to avoid health risks while boosting their work productivity.

(Kaiser Family Foundation)

24. Organizations are veering away from location-based wellness benefits

With the rise in hybrid work arrangements, companies are exploring more flexible wellness programs. As a result, they anticipate reduced investments in several areas, such as on-site fitness classes, biometric screenings, free healthy food/stocked kitchens, and health fairs.

(Wellable)

25. 9 in 10 companies are offering some form of mental health coverage

With 90% of organizations offering support for mental health issues, it suggests that this benefit is becoming part of the standard offerings for many employers. What also contributed to its popularity is the Mental Health Parity and Addiction Equity Act (MHPAEA), which prevents health plans from placing restrictions on mental health and substance use disorder benefits.

Access to mental health programs is also important to employees as these can help them avoid burnout and manage other mental health issues. According to data from the American Psychological Association’s 2023 Work in America Survey, 92% of workers are saying it is very (52%) or somewhat (40%) important for them to work in a company that provides mental health programs.

(SHRM)

26. Employers plan to provide holistic and personalized wellness offerings

Employee benefits statistics show that companies plan to increase investments in mental health programs (91%), stress management and resilience tools (66%), telemedicine (65%), and mindfulness and meditation programs (55%). Meanwhile, 52% plan to increase funding for lifestyle spending accounts (LSAs), which let employees contribute funds to cover a wellness activity or expense of their choice. With this option, employers can provide a personalized wellness benefit, as well as offer incentives (such as providing extra LSA credits) to workers who meet wellness or health goals.

(Wellable)

Financial Support Statistics

27. 40% of employees want access to financial wellness programs

Two in five workers are looking for a financial wellness program to increase their financial health. Not only will this alleviate their stress, but it can also improve their productivity at work, especially if they don’t need to constantly worry about their bills.

Consider offering a financial management program with learning sessions and tools to help employees handle their budgets. Providing an on-demand pay benefit will also allow them early access to earned wages between paydays in case of emergencies.

Did You Know? A 2024 MetLife benefits trends study shows that 40% of workers have problems paying their bills. This is mainly due to the rising cost of living.

(Aflac)

28. 82% of workers are interested in emergency fund support

Of these workers, 50% would like to have access to insurance products for financial emergencies, while 47% are hoping to get interest-free loans offered by employers. Aside from partnering with a financial insurance provider, providing payroll advances to workers can help. This allows them to get their wages in advance as a short-term loan and then repay the amount in agreed-upon paycheck deductions.

Before offering this option, check federal and state laws that may affect payroll advances. While federal law doesn’t prohibit deductions that will lower the employee’s pay below the minimum wage, this is allowed for payroll advance payments. To know more about payroll-related laws, read our payroll compliance guide.

(MetLife)

29. Employers are offering other forms of financial wellness programs

The cost of living continues to rise, making it difficult for workers to manage their budgets and allot funds for unexpected expenses. To help with this and promote financial wellness, some companies are providing additional support through these programs:

- Free or subsidized meals at work (21%)

- Employer-provided or subsidized transportation via commuter cards (18%)

- Student loans refinancing assistance (14%)

- Student loans assistance with employers contributing to the repayments (12%)

- Employer-paid legal services (9%)

- Employer-provider or subsidized housing (2%)

(Mercer)

Flexible Workplace Benefits Statistics

30. Offering flexible work arrangements is important to most companies

To support employee work-life balance, many organizations are providing flexible work schedule policies and benefits. 80% are allowing at least some employees the option to work from home regularly—but not every day. This is also beneficial for employers, allowing them to save on the cost of office space rentals. In IWG’s View from the Top survey, 89% of CEOs said that hybrid working is a key strategy in achieving business savings targets.

(Mercer)

31. 56% of employers offer subsidies for at-home work equipment

To support employees working from home or those with hybrid work arrangements, over half of companies are providing subsidies or reimbursement options to eligible team members. For 2024, the average annual maximum reimbursement that these organizations allow is $871.

(SHRM)

32. Gen Z and millennials consider flexible work schedules more important than baby boomers

While many employees generally prefer to have flexible work schedules, certain generations want it more. 76% of Gen Z workers and 74% of millennials rated it very or extremely important, these are slightly lower than Gen X (67%) and baby boomers (63%).

For businesses that don’t require team members to follow specific work schedules (e.g., restaurants), consider looking into benefits that provide employees some flexibility to select the times they start and end their work day. Not only will these initiatives increase staff engagement, and promote work-life balance, but they will also boost productivity and talent retention.

(Marsh McLennan Agency)

33. 22% of companies offer a four-day workweek or other consolidated schedule

Organizations are slowly embracing compressed work schedules, allowing team members to work the full 40 hours in less than five days. This provides employees with more days off to rest, spend time with family, or attend to personal matters. It can also improve work-life balance, worker productivity, and engagement.

(Mercer)

Employee Benefits Frequently Asked Questions (FAQs)

Employee benefits are important because they help to attract and retain workers. A competitive benefits package also improves worker engagement and satisfaction, especially if employees have access to benefits that they need and want.

The standard benefits offerings include paid time off or employee leaves, health insurance, and retirement plans. Mental health programs are also becoming a popular choice among employers, allowing them to provide support to help workers manage work stress and prevent burnout.

Apart from budget and the cost of benefits for employers and employees, consider whether the benefits will have an impact on the employees. Does it cater to their needs, or is it something they want? Compliance with federal, state, and local laws is also important to ensure that the benefits you’re offering meet labor rules and regulations.

Bottom Line

Offering employee benefits is a great way to improve your talent retention and recruiting strategies. If workers have access to benefits they want and need, they are likely to stay longer with a company. Looking at employee benefits statistics can help you stay competitive, allowing you to identify the right mix of benefits to offer to your workforce.

References:

Aflac, WTW, Marsh McLennan Agency, MetLife, SHRM, Mercer, Kaiser Family Foundation, Wellable