EMV is a global standard for secure payment transactions involving the use of smart cards, also known as chip cards, that contain an embedded microprocessor chip. Instead of relying solely on magnetic stripes, EMV cards generate a unique transaction code for each purchase—this enhances security by making it more difficult for fraudsters to replicate card information. EMV technology is widely adopted in point-of-sale terminals where customers insert their chip cards into card readers for more secure and reliable payment transactions.

What Is EMV?

EMV stands for “Europay, Mastercard, and Visa.” These three financial institutions created this smart payment card standard as a more secure alternative to magnetic stripes on cards. The EMV standard is now facilitated and managed by EMVCo, which is co-owned by Mastercard, Visa, American Express, Discover, JCB, and UnionPay.

EMV Chip

The EMV chip is a smart chip or microprocessor chip that is embedded in credit and debit cards. This chip enhances security in payment transactions by generating a unique code for each transaction, making it more difficult for fraudsters to clone or counterfeit card information. Unlike traditional magnetic stripe cards that are swiped at terminals, EMV cards are inserted into card readers or used for contactless transactions, providing a more secure method of processing payments. Some payment cards also still have a magnetic stripe for backward compatibility.

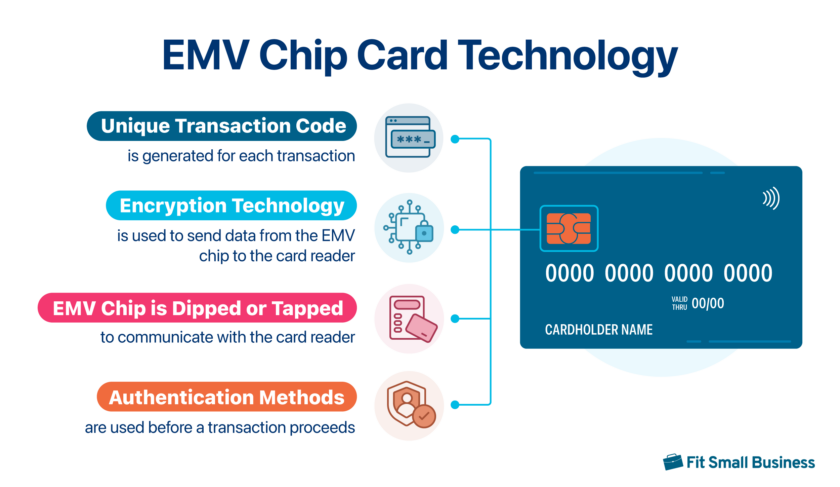

How Does EMV Technology Work?

EMV technology ensures a more secure payment environment compared to traditional magnetic stripe transactions. Here’s a breakdown of how EMV technology works:

- Unique Transaction Codes: Unlike magnetic stripe cards, EMV chip cards do not transmit the actual card number during a transaction. Instead, the embedded chip generates a unique transaction code for each purchase. This dynamic code is used for that specific transaction and cannot be reused, making it significantly more challenging for fraudsters to replicate or manipulate card information.

- Card Insertion (Dipping): In an in-person transaction, instead of swiping the card, users insert their EMV chip cards into card readers. This process is known as “dipping.” The chip interacts with the card reader, initiating the transmission of encrypted data containing the unique transaction code.

- Encryption Technology: The core of EMV security lies in the encryption technology of the chip. As the chip communicates with the card reader, it sends an encrypted, one-time code containing essential card information. This secure communication method ensures that even if intercepted, the transmitted data is useless to potential fraudsters.

- Authentication Methods: EMV transactions use additional authentication methods.

- Chip-and-PIN: Some EMV chip cards require users to enter a Personal Identification Number (PIN) at the point of sale to authenticate the transaction. This adds an extra layer of protection, as the payment cannot proceed without the correct PIN.

- Chip-and-Signature: Some EMV chip cards use a signature for transaction verification. While this method is less common, it still provides an additional means of confirming the cardholder’s identity.

- Transaction Completion: After the cardholder has inserted the card and provided the necessary authentication (PIN or signature), the transaction continues like any other card payment. The card reader transmits the encrypted payment data to the business’s Point of Sale (POS) system, which then forwards it to the payment processor for authorization.

- Contactless Payments: Besides dipping, many EMV chip cards support contactless payments using near-field communication (NFC) technology. NFC mobile payments allow cardholders to simply tap their cards against a compatible reader for quick and secure transactions. Some payment processors even offer Tap To Pay on mobile where businesses may use compatible mobile phones as card readers and customers only need to tap their EMV cards on the merchant’s mobile device.

EMV Payment Security

The robust security features of EMV chip cards have made this technology the global standard for secure payment transactions. By generating unique transaction codes for each payment, the EMV chip helps safeguard transactions against payment fraud and reduces the risk of counterfeit transactions.

The one-time unique code generated by the EMV chip during transactions and the encryption technology it uses prevent the transmission of actual card numbers and reduce vulnerabilities compared to magstripe payments. Additional security measures, such as Chip-and-PIN requiring a personal identification number and Chip-and-Signature relying on a signed verification, further safeguard transactions. Most credit and debit cards offer chip-and-PIN, chip-and-signature, or both options.

Benefits of EMV Compliance

For merchants, the increased adoption of EMV technology not only provides a secure payment environment but also ensures compliance with industry standards. The transition to accepting EMV payments is crucial for mitigating fraud and protecting against potential liabilities.

An EMV-compliant business simply means that the payment environment of the business is safe and secure—the point-of-sale (POS) devices support chip technology and the business processes payments securely by using the EMV chip instead of the magstripe for EMV-equipped cards. The adoption of EMV technology in card payments has helped reduce card fraud. In a 2019 report, Visa reported that there has been an 87% decrease in counterfeit fraud.

How to Accept EMV Payments

Accepting EMV payments is essential for businesses aiming to provide secure and compliant payment transactions. The first thing a business needs to do is to ensure EMV compliance.

Making Your Business EMV-Compliant

Here are some tips to help your business seamlessly integrate EMV technology into your point-of-sale (POS) systems:

- Upgrade Your POS System and Hardware: Ensure your POS system supports EMV chip card transactions. Reach out to your payment processor to discuss EMV integration. They can guide you in selecting a suitable card reader and assist with any necessary software updates to enable EMV functionality.

If you are still looking for a payment processor, choose one that offers EMV-certified card readers that can securely process transactions with chip cards.

- Train Staff on EMV Transactions: Ensure that your staff is trained on how to process EMV transactions. Familiarize them with the steps involved, including card insertion, authentication methods (PIN or signature), and understanding the response messages on the POS system.

- Update Payment Policies and Promote EMV Payments: Communicate your payment policies to customers. Encourage the use of chip card transactions by explaining the enhanced security benefits and the liability shift associated with EMV compliance.

- Regularly Perform EMV Compliance Check: Regularly check and ensure that your POS system and card reader remain EMV compliant. This involves keeping software up-to-date, addressing any security patches, and staying informed about advancements in EMV technology.

- Educate Customers: Let your customers know about the benefits of EMV technology. Emphasize the added security measures in place and how their transactions are better protected with chip cards compared to traditional magnetic stripe transactions.

Accepting EMV Payments Step by Step

When a customer presents an EMV card for payment, businesses should follow specific steps to ensure a secure and smooth transaction. Here’s a step-by-step guide:

- Step 1: Card Insertion or Tapping

Instruct the customer to insert their EMV card into the card reader chip side up, chip end first. Alternatively, if the card and reader support contactless payments, the customer can tap their card on the contactless-enabled area.

- Step 2: Prompt for PIN or Signature

Depending on the type of EMV card (chip-and-PIN or chip-and-signature), the card reader will prompt the customer to provide additional authentication.

For chip-and-PIN cards, the customer will be required to enter their Personal Identification Number (PIN) on the keypad. For chip-and-signature cards, the customer may need to sign on the receipt or provide a signature using the card reader.

- Step 3: Wait for Authorization

After PIN or signature verification, the card reader sends the transaction data to the payment processor, which contacts the card issuer for authorization. The system may take a few moments to process the transaction.

- Step 4: Check for Approval or Decline

Monitor the card reader display for the authorization response. If the transaction is approved, it will proceed as usual. If declined, follow any on-screen instructions and inform the customer about the issue. In certain cases, the customer may need to contact their card issuer.

- Step 5: Prompt Customer to Remove Card

Once the transaction is complete, the card reader will display a prompt indicating that the customer can safely remove their card. Remind the customer to do so.

- Step 6: Issue a Receipt

If your business provides paper or digital receipts, issue one to the customer. Ensure that the receipt includes details such as the transaction amount, date, and business information.

- Step 7: Securely Store Transaction Records

Maintain records of transactions securely for accounting purposes and potential future reference. This could include electronic records within your POS system or physical copies if needed.While accepting EMV card payments for in-person transactions is safe and secure, it is also best to establish and adhere to best practices within your business to further ensure a secure and smooth transaction.

EMV Payments Statistics

Here are some EMV payment statistics to give a clear picture of how widely these chip-based cards are used, showing their effectiveness in reducing fraud and making transactions safer for everyone:

- EMV cards are widely deployed around the world. In 2022, 69.25% of issued cards globally are EMV cards.

- The adoption of EMV technology is on the rise. At the end of 2022, approximately 12.8 billion cards in circulation were EMV chip cards.

- Almost all card-present transactions around the world are processed through EMV chips. According to EMVCo, 93.91% of transactions globally from Q3 2022 and Q2 2023 are EMV Chip.

- EMV payments make up the bulk of card transactions in the US. Sixty-three percent of all credit card transactions in the US were made through EMV transactions.

Frequently Asked Questions (FAQs)

Click through the sections below to find answers to common questions on EMV payments:

Apple Pay is a mobile payment service, while EMV refers to a global standard for secure card transactions using chips embedded in cards. Apple Pay utilizes Near Field Communication (NFC) technology to enable contactless payments, while EMV involves chip cards inserted into or tapped on card readers. While both prioritize security, Apple Pay is a specific digital wallet solution, whereas EMV encompasses a broader standard for chip-enabled transactions.

An EMV payment dispute occurs when there is a disagreement or problem related to a transaction made with an EMV chip card. It could involve issues such as unauthorized charges, errors in the transaction amount, or dissatisfaction with a purchase. Resolving EMV payment disputes typically involves communication between the cardholder, the merchant, and the card issuer to investigate and address the concerns.

On a receipt, “EMV” indicates that the payment was processed using the embedded chip technology in the card rather than relying solely on the magnetic stripe, enhancing security during the transaction.

Yes, a small business should consider accepting EMV payments as it enhances security during transactions. EMV technology helps protect against fraud, and its widespread adoption means businesses can provide a safer payment environment for customers, reducing the risk of certain liabilities and boosting customer trust.

Bottom Line

EMV technology helps secure transactions, reduce fraud, and shield businesses from liability. Businesses must upgrade their systems, train staff, and educate customers to ensure a secure EMV payment environment. There is widespread global adoption of EMV and it has helped to significantly decrease counterfeit payment incidents. In the dynamic landscape of payment processing, embracing EMV is not just a choice; it’s a necessity for secure, reliable transactions.