Everlance is a mileage and expense tracking app that helps self-employed professionals and businesses monitor mileage deductions. Some of its notable features include automatic mileage tracking, team reporting, long session tracking, and customizable approval workflows. You can track up to 30 trips per month for free or subscribe to a monthly paid plan starting at $12 per user for businesses and $8 per user for self-employed individuals. Everlance also provides VIP phone and chat support with its paid plans.

The provider offers flexible plans for businesses, which include a cost-per-mile program or a fixed and variable rate reimbursement. The platform is well-regarded on third-party review sites, with an average score of 4.5. Users appreciate its auto-classification of trips, mileage budgets, and commute auto-detection. Two drawbacks of Everlance is that it doesn’t offer route planning and an integration with QuickBooks.

The Fit Small Business mission is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions readers have. This ensures that the content is rooted in knowledge and accuracy.

Additionally, we employ a comprehensive editorial process that involves expert writers. This ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These criteria ensure that the content is trustworthy, easy to understand, and unbiased.

Everlance Alternatives & Comparison

Fit Small Business Case Study

We compared Everlance with TripLog and MileIQ. TripLog is our best overall mileage tracker app while MileIQ is our recommended mileage tracker for simple tracking.

Everlance vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

Everlance $12 per business, per month

-

TripLog $5.99 per user, per month

-

MileIQ $5.99 per user, per month

Pricing isn’t Everlance’s strongest suit because TripLog and MileIQ have more affordable pricing plans. At $12 per user, per month, Everlance offers similar features with TripLog and MileIQ. However, the possible justification for a higher price is the VIP support and live admin and user training included in this plan.

TripLog takes the win for mileage tracking features with a perfect score, but Everlance gets second place in this comparison. Our evaluation reveals that Everlance offers decent features with advanced functions like approval workflows. It leads over TripLog and MileIQ in related app features because it has a reimbursement system and tax deduction finder. However, TripLog offers two features that Everlance lacks—route planning and a clock-in/clock-out timesheet.

Everlance Pricing

Everlance offers two pricing packages: one for self-employed individuals and another for businesses. Both offer a free plan that includes up to 30 automatic trips per user, per month. Paid plans for businesses and self-employed start at $12 and $8 per user, per month, respectively.

The tables below summarize the plans for self-employed individuals and businesses.

Everlance New Features for 2023

- Updated Members page: You can now customize the information that is displayed on the Members page, such as Name and Compliance Status. You can tailor the view to ensure that you see only the most relevant information at a glance. Everlance’s advanced filter feature lets you find team members’ information effortlessly.

- Programs for admins: Programs let you define customized reimbursement plans that contain unique rates and trip purposes. You can then assign these programs to individual drivers or groups via Schedules. Programs also allows you to determine how you will reimburse team members, and for how much.

- Reimbursement schedule: This feature includes strict reports, reminders for important actions, and schedules, as well as one-off reports. You can now view pay periods and timelines in your dashboard and enjoy improved filters and report settings.

- Bulk Update via comma-separated values (CSV) files: The Bulk Update feature lets you bulk update and change attributes on multiple member profiles at one time via CSV upload. Whether you need to update your team members’ commutes with individual mileage amounts or place multiple team members on leave, this tool will help you streamline your workflows.

Everlance Features

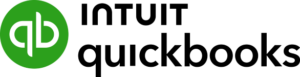

Everlance offers many useful features, such as classifying trips and uploading receipts, which are accessed through the web dashboard. Its mobile app is equally useful, with such options as tracking single long trips, setting work hours, and tagging your trips, which helps with organization. You can also set approval workflows and track expenses with Everlance.

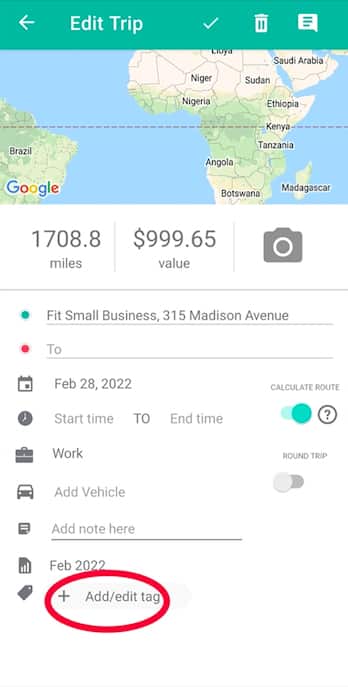

While you can’t track mileage directly automatically from the web dashboard, Everlance allows you to classify trips taken from the app, enter in trips and notes manually, upload receipts, and view a snapshot of your income and expenses.

The web homepage gives you access to Everlance’s key features, such as trips, transactions, data export, and team dashboard. If you signed in to your Everlance account for the first time with a free plan, you’ll see a default web dashboard similar to the image below.

Everlance Dashboard

The Everlance app uses GPS navigation to track your drives automatically. Once you start driving, the app will start tracking your mileage details. After the trip, you can categorize it as business or personal.

You can even download PDF or Excel reports of your trips directly from the mobile app. If you want to keep expense receipts for future use, you can take a photo of your receipt and upload it through your mobile app. You can download the app on Google Play and the App Store.

There are three ways to track mileage on Everlance: Auto-detection, Start Tracker, or Manual Entry:

1. Auto-detection: This tracks your trips in the background on your smartphone; you don’t need to start the tracking before a trip, just classify the trip afterward: swipe right to classify it as work-related and left as personal. Auto-detection is available in any of the paid plans.

2. Start Tracker: This is the default mode for tracking mileage. Start the tracking manually, and Everlance will use GPS to track your location and mileage. When you’ve reached the destination, end the trip to stop tracking. Classify it as either Work or Personal afterward.

Start Tracker in Everlance

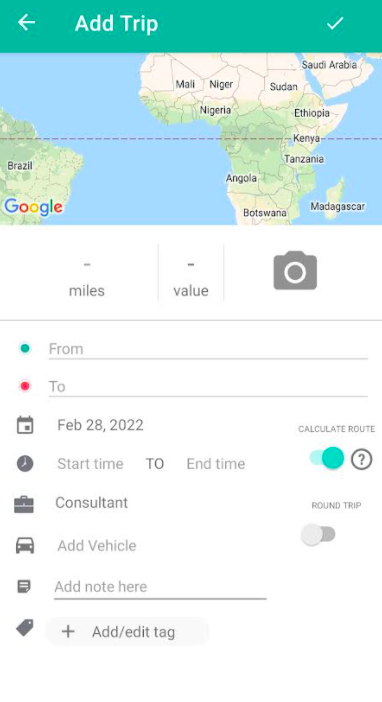

3. Manual Entry: In case you forget to record a trip, manual entry is available. To add a trip, you need to provide details, such as your origin and destination, the start and end time of the trip, and the vehicle you used for the trip.

Adding a Trip Manually in Everlance

Classifying trips in Everlance is easy. Swipe right on the trip card to categorize your trip as Work, and swipe left for Personal. If you wish to categorize the trip as other, such as Commute, Charity, or Medical, swipe far left on the trip card.

Categorize Trips in Everlance

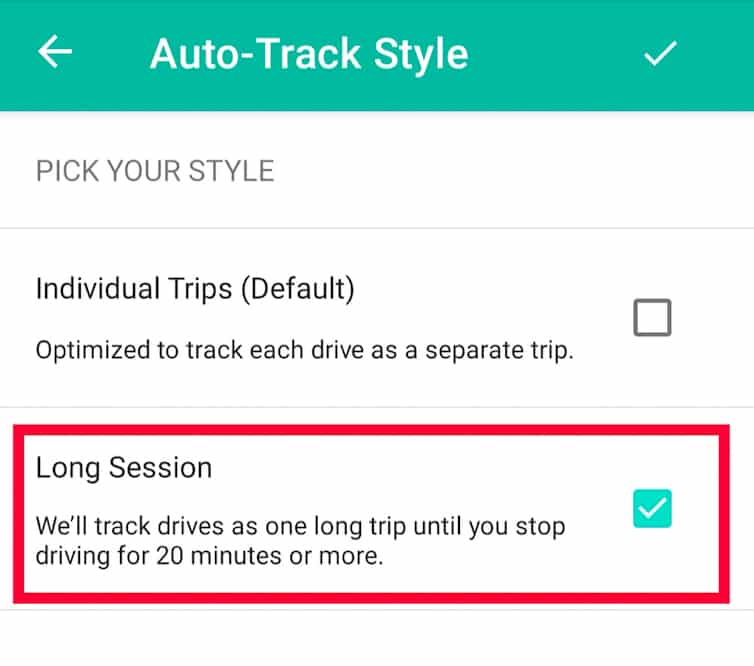

Those who drive long shifts will find Long Session tracking useful. With this feature, Everlance will track your drive automatically as a single long trip. The app will stop when it detects that you’ve stopped driving for 20 minutes or more. You can set up Long Session tracking from the Auto Track Style menu under the Tracker Settings tab of your mobile app.

Choose Long Session to Track Long Shifts

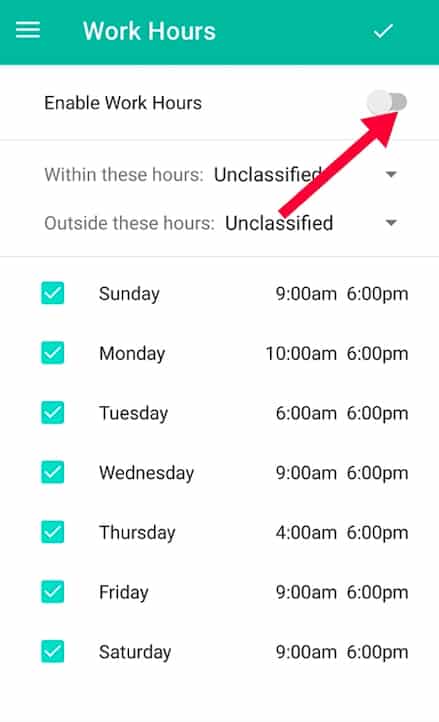

For greater efficiency, you can enable Work Hours so that Everlance can distinguish between personal and business trips automatically. Trips during work hours will be classified as Business automatically. You can activate Work Hours via the web dashboard, Android app, or iOS app.

In the web dashboard, navigate to your Account and click Work Hours under Trips on the left panel. From there, you can set your hours and choose how Everlance should categorize your trips.

If you’re using the mobile app, the process is the same as with the web dashboard. Go to your Account and click Work Hours under Trips. Then, choose how you’d like to classify trips within work hours.

Enable Work Hours in Everlance

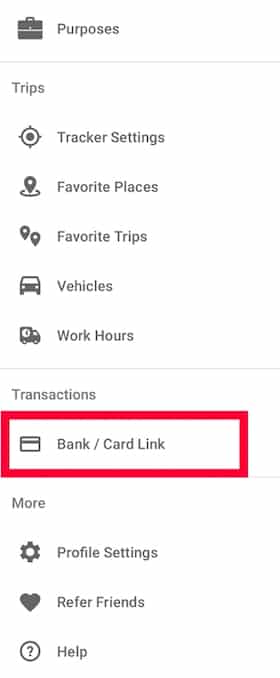

Another important feature of Everlance is its expense tracking. We like that Everlance included this feature so that mileage and expense reimbursements can be made at the same time. You can also integrate your bank accounts or credit cards to import transactions automatically—add your bank or credit card from the web dashboard or the mobile app.

To sync via the web dashboard, click on Banks & Cards under the Transactions menu, and then add your bank or credit card. To connect via the mobile app, click on Bank/Card Link under the Transactions menu.

Connect Your Bank or Credit Card to Everlance to Track Expenses

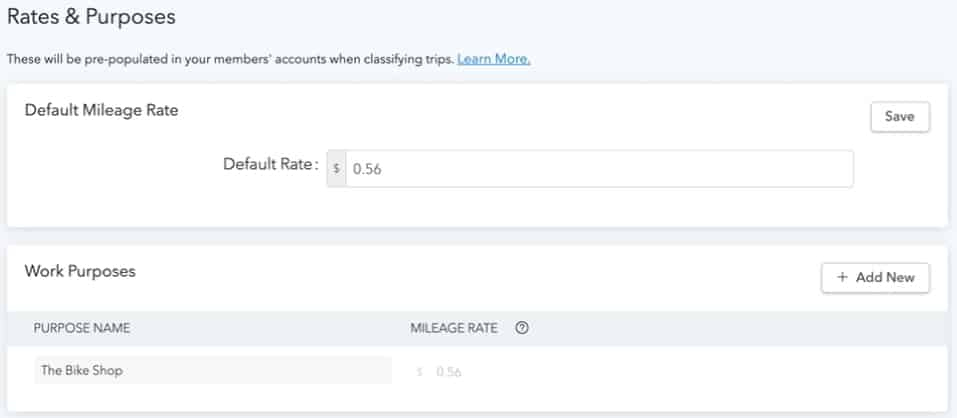

Another thing that we like about Everlance is its “Work Purposes” feature, which lets you set specific mileage rates for different purposes like deliveries, pickups, or client meetups. You can do this by going to Team Settings and then clicking Rates & Purpose.

Setting Work Purposes and Default Mileage Rates (Source: Everlance)

What we like about this is that you can pay different mileage rates for different purposes instead of always paying the default rate. Be aware that if you pay more than the standard mileage rate set by the IRS, you’ll need to include any excess payment as compensation to your employee or contractor.

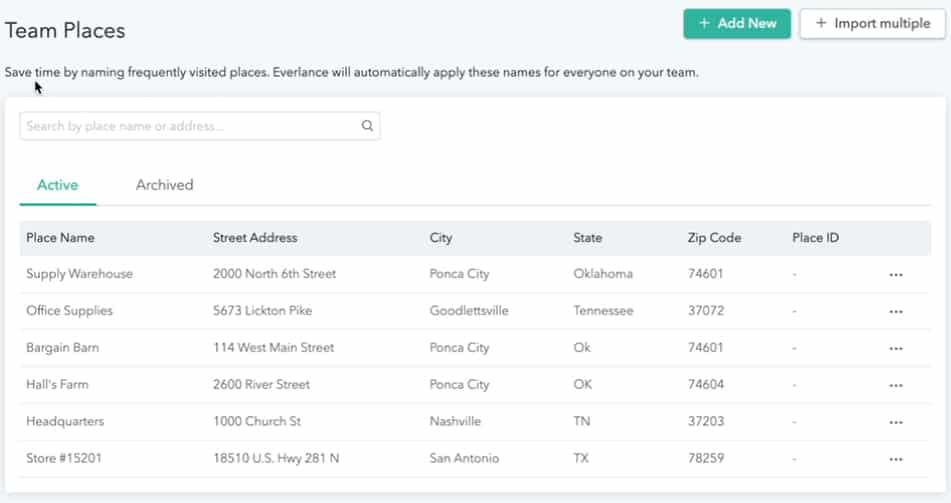

Unlike other mileage trackers we’ve reviewed, Everlance is the only app that lets you manage frequent places. Other mileage trackers have a feature that remembers frequent places—but only when the app detects multiple visits to a particular location. With Everlance, admins can add frequent places for easier tracking.

Setting Frequent Places on Everlance (Source: Everlance)

This feature is helpful for deliveries or pickups to frequent customers or businesses. If you have multiple office locations, you can add them here as well.

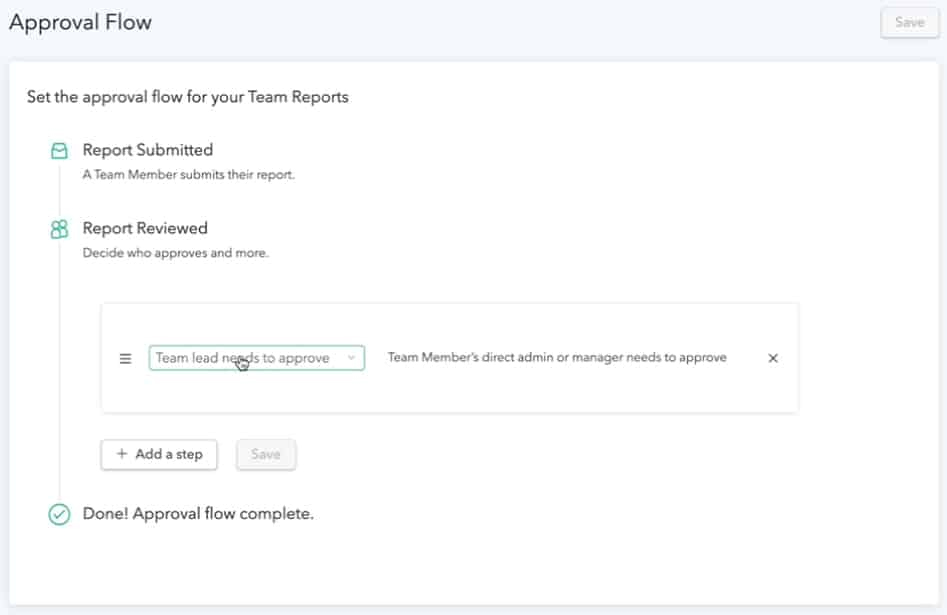

Approval flows on mileage trackers aren’t uncommon today. However, Everlance takes it to a different level. Everlance’s visual approach to creating an approval flow makes it easy to use and understand, even for first-time users. Only account owners can set or edit approval flows:

Approval Flows on Everlance (Source: Everlance)

When setting point persons for approval flows, you can include the following roles or actions:

- Team Lead Needs to Approve (default): The member’s direct manager will approve the report.

- Needs to Approve: Assign another person aside from the team lead.

- Needs to Mark as Paid: Assign a person to mark reports that have been paid.

- Receives a Copy: Assign a person who will receive a copy of all the reports at selected steps.

Everlance integrates with Xero, FreshBooks, and Wave. You can export data from your Everlance app to any of these platforms.

Everlance Customer Service & Ease of Use

Everlance has a neat and minimalistic layout, both in the web dashboard and app, making it easy to navigate, even for first-time users. The mobile app is very comprehensive, and the features are easy to locate.

Free subscribers can seek help through email, while Premium users receive exclusive access to customer service representatives via telephone or live chat. If you want customized training and support from a dedicated onboarding and customer success manager, you might want to upgrade to the most expensive plan, FAVR.

Everlance Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Automated GPS mileage tracking | Mileage is tracked automatically, even if riding in someone else’s car |

| Mileage deductions make tax filing easier | Can drain smartphone battery if left on for too long |

| Easy to set up and use | No route planning feature |

Many users who left an Everlance review reported that the mileage log is detailed enough to meet the IRS requirements when taking vehicle deductions, and others appreciated the automatic mileage tracking. However, there were some complaints about the app inaccurately tracking mileage and draining smartphone batteries.

Based on Everlance reviews from popular review sites, the program received the following scores:

- GetApp[1]: 4.5 out of 5 stars based on around 60 reviews

- G2.com[2]: 4.3 out of 5 stars based on about 100 reviews

- App Store[3]: 4.8 out of 5 stars based on around 25,600 reviews

- Google Play[4]: 4.4 out of 5 stars based on almost 20,200 reviews

How We Evaluated Everlance

We rated and evaluated Everlance and other leading mileage tracking software using an internal scoring rubric with six major categories:

20% of Overall Score

In evaluating pricing, we considered the affordability of the software based on price, number of users, and any limitations on transactions or customers.

30% of Overall Score

This section focuses on key mileage tracking features, such as the ability to track mileage, connect to a bank or credit card to account to track expenses automatically, categorize trips as personal or business, and generate tax-compliant reports. The software should include multiple tracking options and route planning and be able to accommodate multiple vehicles. You should also be able to snap photos of receipts and secure data through the cloud. Additional useful features include a clock-in/clock-out timesheet and accounting software integrations.

20% of Overall Score

For this section, we evaluated the software’s customer support options, including whether unlimited customer support and support via live chat and telephone are available. We also looked at whether the software is cloud-based and its subjective ease of use.

10% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

10% of Overall Score

We assigned an expert score that is based on the following categories: features, accessibility, ease of use, reports, and popularity of the software.

Frequently Asked Questions (FAQs)

Yes, it is, as you can get IRS-compliant reports and relevant tax data even with the free plan. The only advantages of getting paid plans are unlimited trips, automations in mileage tracking, and advanced features like approval workflows.

Yes. Self-employed individuals like real estate agents need to spare only $8 per month to get decent mileage tracking features. However, it can get expensive for businesses that allow mileage tracking for multiple employees.

Yes, Everlance offers a free mobile app for both iOS and Android users.

A cent-per-mile program is a method used by some businesses to calculate and reimburse individuals for their travel expenses based on the number of miles traveled. It is popular because it simplifies the reimbursement process and provides a straightforward way of compensating employees for their business-related travel expenses.

A FAVR program is a more sophisticated mileage reimbursement program that factors in each employee’s local fixed costs of vehicle ownership (depreciation, taxes, insurance, license, and registration) and variable costs of vehicle operation (oil and gas, maintenance, tire wear). This creates a customized mileage reimbursement rate that is specific to each driver, based on the employee’s location and vehicle type.

Bottom Line

If you’re looking for a single app to track your mileage and expenses, Everlance is a good choice. Whether you’re a solo entrepreneur, a small business, or a large company managing many drivers, you can find the right package for you.

The provider has a generous free plan that has many useful features you’ll find in premium packages, such as automatic tracking and unlimited receipt uploads. If you’re a solo business owner or a self-employed individual needing to track mileage for tax purposes, the free plan might be enough. If you’re a company with many employees who drive for work, an upgrade to Premium is worth your money.

[1]GetApp

[2]G2.com

[3]App Store

[4]Google Play