TripLog is a cloud-based mileage tracking app with integrated expense and time tracking tools. It tracks your mileage automatically, and you can then categorize your drive as personal or business with a single swipe. It provides various ways to track your mileage—including manual, Bluetooth-enabled, and automatic tracking—and allows you to track up to 40 trips per month for free.

It also integrates with third-party software like QuickBooks, making it easier to manage your mileage expenses. For individuals, it has a free plan and a paid monthly option at $5.99 per user and, for businesses, its paid monthly subscriptions begin at $10 per user. It also offers several add-ons, like time and scheduling.

The app is well-regarded on third-party review sites, with an average score of 4.5. Users said that they like its customizable mileage rates, multiple auto-start options, and IRS-compliant reports. However, one major drawback of TripLog is that it doesn’t offer phone or live chat support.

Our editorial policy is rooted in the Fit Small Business mission: to deliver the best answers to people’s questions. This mission serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. We leverage expertise and extensive research capabilities to identify and address the specific questions readers have, ensuring that the content is based on knowledge and accuracy.

We employ a comprehensive editorial process that involves expert writers—and this ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers; including accuracy, clarity, authority, objectivity, and accessibility. These ensure that the content is trustworthy, easy to understand, and unbiased.

TripLog Alternatives & Comparison

Fit Small Business Case Study

We compared TripLog with other leading mileage tracker apps to help you decide whether it’s right for you or if you need to look elsewhere.

TripLog vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

TripLog $5.99 per user per month

-

Hurdlr $10 per month

-

MileIQ $5.99 per user per month

In our evaluation of the mileage trackers above, each has individual advantages and disadvantages. MileIQ leads in pricing because it offers three pricing tiers for business plans, whereas TripLog only offers two. MileIQ takes the lead because of its flexibility in packages.

However, TripLog gets a perfect score in mileage tracking features because it allows users to track mileage in different ways. It offers devices that track mileage if you don’t want to use your smartphone. Meanwhile, Hurdlr takes the lead in related app features because it also offers accounting and tax calculations.

Overall, TripLog deserves to be our best mileage tracker app because of its flexibility and affordable price point. On the contrary, we still recommend MileIQ for smaller companies needing more affordable business plans, while Hurdlr is best for rideshare drivers or self-employed individuals.

TripLog Pricing

TripLog offers two packages, one for individuals and another for businesses. The free option for individuals supports a single user and lets you log up to 40 trips per month manually, while Premium supports unlimited tracking for individuals.

Meanwhile, the business plans’ prices start at $10 per user, per month, which includes automatic tracking with GPS and route planning. Enterprise, the most expensive plan at $15 per user monthly, has advanced mileage tracking features, like multi-level approval hierarchy and custom tags. A Time and Scheduling add-on is also available at $4 per user, per month.

Optional Devices & Add-ons

TripLog offers two optional devices that you can use for tracking your mileage. You need to subscribe to a paid plan to purchase these devices.

- 1. TripLog Drive ($79.99): This device is powered by your car’s USB port and uses very little battery and data. TripLog Drive connects to your phone automatically and then transfers the GPS data for processing:

-

- Powered by your vehicle’s USB port

- Bluetooth 4.0 Low Energy (BLE) technology

- Built-in GPS

- Storage for offline recording

- Start and stop tracking with the push of a button on the device

- 2. TripLog Beacon ($19.99): This is a USB device that complements the mobile app for more accurate tracking. Simply download the app, activate the iBeacon auto-start option, and plug the device into your car’s USB port. Tracking starts when it detects that you’ve started your car:

-

- Powered by your vehicle’s USB port

- Autostart with Bluetooth iBeacon

- TripLog offers a 30-day return policy on its devices from the day the item is delivered.

The provider also offers the Time & Scheduling add-on. For an additional $4 per user, per month, you’ll get:

- Clock-in and out features

- Timesheets

- Project tracking

- Leaves and paid time off (PTO) management

- Scheduling

TripLog New Features for 2023

- TripLog Card: TripLog offers a reloadable company debit card service to improve user experience in expense tracking and reimbursements. With this program, users can charge company expenses using TripLog and reconcile all TripLog card transactions automatically.

- TripLog ACH: The automated clearing house (ACH) feature enables users to reimburse employees for mileage within the TripLog dashboard. All ACH reimbursements will also appear as separate within your accounting software for faster categorization.

- Notification System: This allows TripLog admins to send notifications to their teams, i.e., TripLog users within your organization, specific segments, or even to company-specified departments. You can also set certain notifications to be recurring, scheduled, or to additionally send an email notification.

- In-app Approval Management: Administrators in the Enterprise plan can now approve their drivers’ mileage and expense reports, as well as time cards, from within the TripLog app.

TripLog Features

TripLog offers features that can help your company efficiently track mileage and related costs such as parking, tolls, and fuel expenses. Let’s check out TripLog’s core features below.

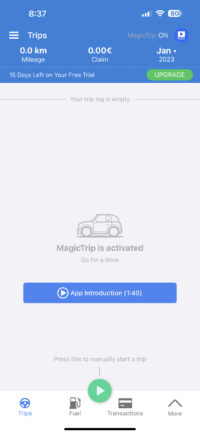

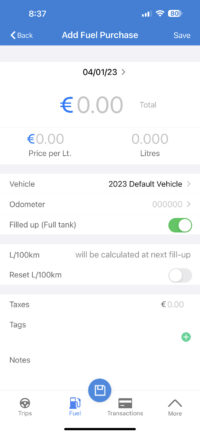

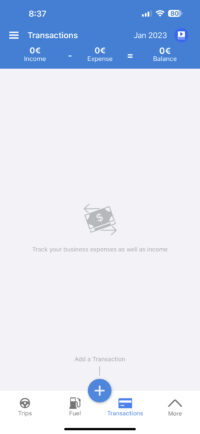

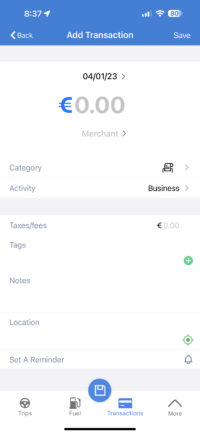

The TripLog mobile app lets you track your mileage and expenses from your smartphone. When you open the mobile app, you will notice that it’s set to MagicTrip tracking by default.

Slide through the images below to see the mobile app interface of TripLog:

When you click on Compare Auto Start Options from the Setup menu, you can take the virtual quiz to help you decide which option is best suited to your needs. Based on your answer, TripLog will recommend a tracking option for you.

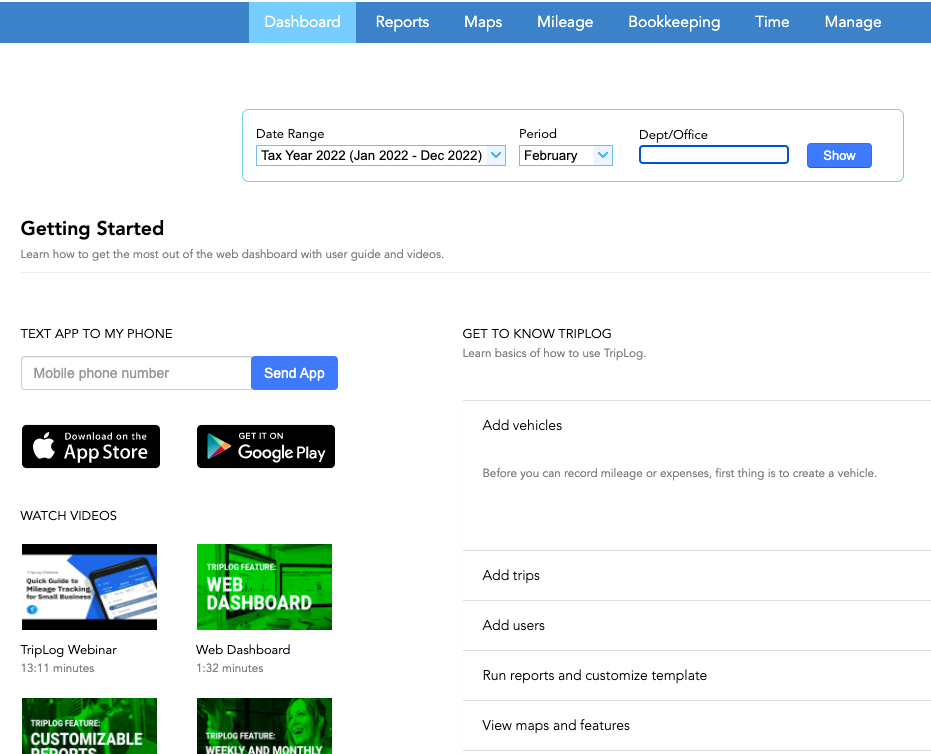

Employers and administrators can manage their company’s trips, vehicles, and app users from the web dashboard. The TripLog dashboard gives you access to all the app’s features, including mileage tracking, expense tracking, reports, credit card integration, and timesheets. You can add trips and users, view maps, and adjust settings. The web dashboard also provides you with an option to download the mobile app:

TripLog Web Dashboard

TripLog offers six different options for automatic mileage tracking:

- MagicTrip: With MagicTrip, TripLog can track your driving in the background automatically. It starts tracking automatically within the first two minutes of driving and stops automatically if you’ve been idle for five minutes, or whatever time period you specify. MagicTrip also responds with your Speed Threshold and automatically tracks if you’re reaching these thresholds. The advantages of this method are that it’s easy to set up, and it tracks in the background. MagicTrip is available only in the paid plans.

- Vehicle Bluetooth: With this option, you only need to connect your smartphone to the vehicle’s Bluetooth. Tracking starts if you drive over the speed threshold while connected. An advantage of this method is that it only tracks when connected to Bluetooth.

- TripLog Drive: This device is a dedicated device from TripLog. It has built-in GPS, and tracking doesn’t involve smartphone use. An advantage of this method is that it doesn’t use your phone’s battery and data resources.

- TripLog Beacon: This device uses Bluetooth technology but boasts of its moderate battery consumption. Beacon starts tracking when driving over the speed threshold and while connected to the smartphone Bluetooth. An advantage of this method is that it doesn’t use your car’s Bluetooth, so you can connect your vehicle’s Bluetooth to other devices without interrupting tracking.

- Plug-n-Go: If you’re in the habit of plugging in your smartphone while driving, the Plug-n-Go feature will also allow you to track while your device is charging. Unplug your phone, and the tracking stops. An advantage of this method is its minimal battery consumption.

- OBD-II Scanners: This is a device that connects to your vehicle’s onboard diagnostics scanner (OBD) connector and transfers data via Bluetooth.

In addition to setting your preferred tracking method, there are other important adjustments you need to make:

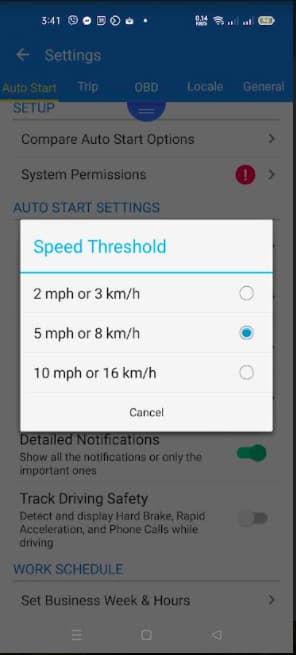

- Timeout and Speed Threshold: The Speed Threshold feature dictates when the app should start tracking. By default, it’s set at 5 mph or 8 km/h. It means that the app will start tracking automatically if you reach a minimum speed of 5 mph. The Timeout feature dictates when the app should stop tracking. For example, say you stop at a Starbucks on the way to work. If your Timeout is set at 15 minutes, the tracking won’t stop unless the car is idle for more than 15 minutes. If you expect heavy traffic, it’s best to set Timeout at a higher duration so that the app keeps on tracking even if you’re stuck in traffic:

Setting up Speed Threshold in TripLog

- Responsiveness: MagicTrip utilizes GPS to track your driving distance. To improve the accuracy of tracking, you can choose More Responsive. It means that the app will have to use GPS more often to track your location. As a result, it’ll use more battery and data. The opposite is true for Less Responsive. Adjusting responsiveness can help you accurately track nearby drives. For example, there’s a delivery that’s only two blocks away. Due to the relatively short distance, more responsive tracking yields more accurate tracking information:

Setting Up Responsiveness in TripLog

TripLog also allows you to add vehicles for efficient tracking. You can also set a default vehicle so that you don’t always have to choose when recording a trip.

In manual tracking, you’ll need to enter the starting point and endpoint of your journey. For Lite plan subscribers, manual tracking is the only option available. TripLog will compute the distance automatically. You’ll also need to input the time. We don’t recommend using manual tracking because accuracy will always be an issue here.

TripLog calculates fuel economy based on the fuel transaction information that you enter into the app. It calculates the total, average price, and fuel economy to help you reduce fuel consumption.

One of the reasons TripLog is our overall best mileage tracker app is because of its added expense tracking feature. You can add different kinds of expenses associated with your miles. We like this feature because it’s easier to relate and pinpoint expenses. For example, you can add a Meals and Entertainment expense if you meet with a client. To record tolls and parking, click on the trip and edit it.

TripLog classifies a trip as business or personal in a single swipe. Swipe right to classify the trip as business and left as personal. Alternatively, you can click on the item and choose the appropriate category.

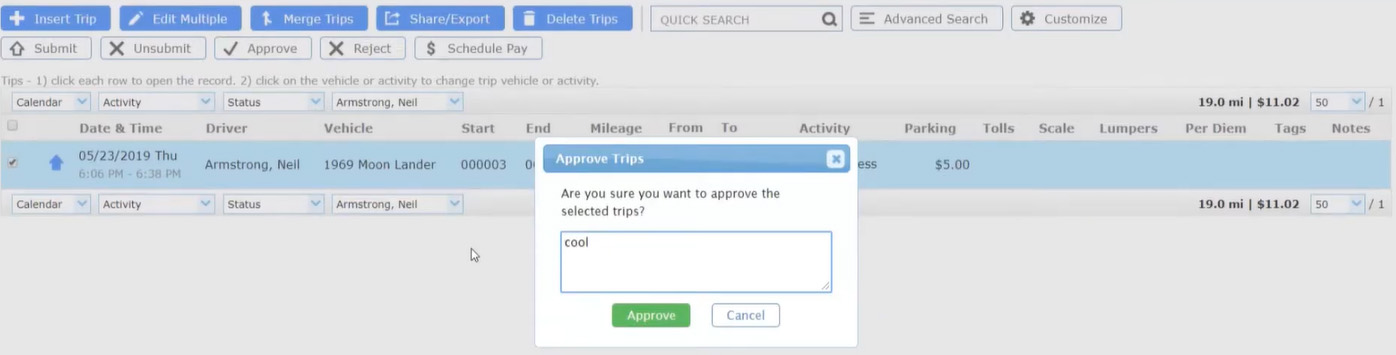

Through the app, drivers can submit mileage and other expenses to be processed. Approving expenses happens on the Web Dashboard. Only account administrators and approvers can access this dashboard. This feature is available starting with the Premium plan.

To approve expenses, go to the Mileage tab to see the list of submitted expense reports from drivers. The approver can either approve or reject an expense. Either way, the approver will have to leave a comment for the submitter:

Approving Mileage Expenses through the Web Dashboard (Source: TripLog Tutorial Videos)

Once approved, TripLog can generate a report for payroll. This report will be used as reimbursement documentation to be included in the submitter’s next paycheck. By clicking Schedule Pay All, reimbursements will be scheduled, and the submitter will be notified.

Another great feature of TripLog is route planning, which enables you or your company drivers to plan trips using the shortest routes. The route planning feature is integrated with Google Maps. With this feature, you can establish an optimal route that incorporates up to eight destinations. When planning routes, the app starts with your current location, and you can then add up to eight stops. The app will create a round trip that brings you back to your point of origin automatically.

TripLog generates reports on vehicle tax deductions, nonvehicle-related tax deductions, profit and loss, and time spent on each location. TripLog has a default report template—but in any of the paid plans, you can modify the template by removing or adding elements. Reports from TripLog are IRS-compliant, and you can submit them as supporting documents for your allowable deductions. You have the option to download or email reports in HTML, CSV, or PDF format.

Users of both the mobile app and the web dashboard can enjoy reporting features for mileage expense tracking. TripLog’s reporting feature can help with tax filing, especially if you’re claiming allowable expenses.

TripLog Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Automatic trip tracking | Limited customer support options |

| Mileage reimbursements include option to submit notes and reports | Issues with inaccurate GPS tracking |

| Centralized reporting and recording of mileage for teams | Free plan only allows up to 40 trips per month |

Those who left a TripLog review said that they like the system because it is easy and convenient to use, especially the mobile app. However, some reviewers shared problems with the app and occasional bugs in the system.

Here are TripLogs average ratings on popular user review sites:

- G2.com[1]: 4.7 out of 5 stars based on around 55 reviews

- Software Advice[2]: 4.0 out of 5 stars based on about 75 reviews

- App Store[3]: 4.6 out of 5 stars based on about 3,300 reviews

- Google Play[4]: 4.5 out of 5 stars based on almost 8,200 reviews

How We Evaluated TripLog

We rated and evaluated TripLog and other leading mileage tracking software using an internal scoring rubric with six major categories:

20% of Overall Score

In evaluating pricing, we considered the affordability of the software based on price, number of users, and any limitations on transactions or customers.

30% of Overall Score

This section focuses on key mileage tracking features, such as the ability to track mileage, connect to a bank or credit card to account to track expenses automatically, categorize trips as personal or business, and generate tax-compliant reports. The software should include multiple tracking options and route planning and be able to accommodate multiple vehicles. You should also be able to snap photos of receipts and secure data through the cloud. Additional useful features include a clock-in/clock-out timesheet and accounting software integrations.

20% of Overall Score

For this section, we evaluated the software’s customer support options, including whether unlimited customer support and support via live chat and telephone are available. We also looked at whether the software is cloud-based and its subjective ease of use.

10% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

10% of Overall Score

We assigned an expert score that is based on the following categories: features, accessibility, ease of use, reports, and popularity of the software.

Frequently Asked Questions (FAQs)

It will consume mobile data if you use smartphone GPS to track mileage.

If you’re using smartphone GPS, expect heavy battery usage. We recommend plugging your phone into a power source to keep battery levels high.

TripLog Beacon costs $19.99 each and assists the mobile app with instant trip detection, operating on Bluetooth 4.0 Low Energy (BLE) with the advantage of low battery usage. Meanwhile, TripLog Drive costs $79.99 each and has an advanced GPS chip that provides concurrent reception of up to three GPS satellite systems. It provides both real-time and offline tracking modes and holds up to one month of driving data. Additionally, it offers a trip classification button and near zero battery usage since it offloads mobile phone GPS use.

Autostart options are ways that you can allow the app to automatically track vehicle mileage. TripLog offers several options for this, including MagicTrip, TripLog Drive, TripLog Beacon, Plug-N-Go, and Car Bluetooth.

Bottom Line

TripLog is a great mileage-tracking solution for businesses needing a single solution for tracking mileage, time worked by employees, and vehicle-related expenses like parking, fuel, and meals. It offers six different ways of tracking mileage, so you’ll certainly find one that meets your exact tracking needs.

Additionally, it has a useful route planning feature that you won’t find in most other mileage tracking software on the market. Instead of having to get three separate apps for tracking mileage, expenses, and time, TripLog gives you an all-in-one solution.

[1]G2.com

[2]Software Advice

[3]App Store

[4]Google Play