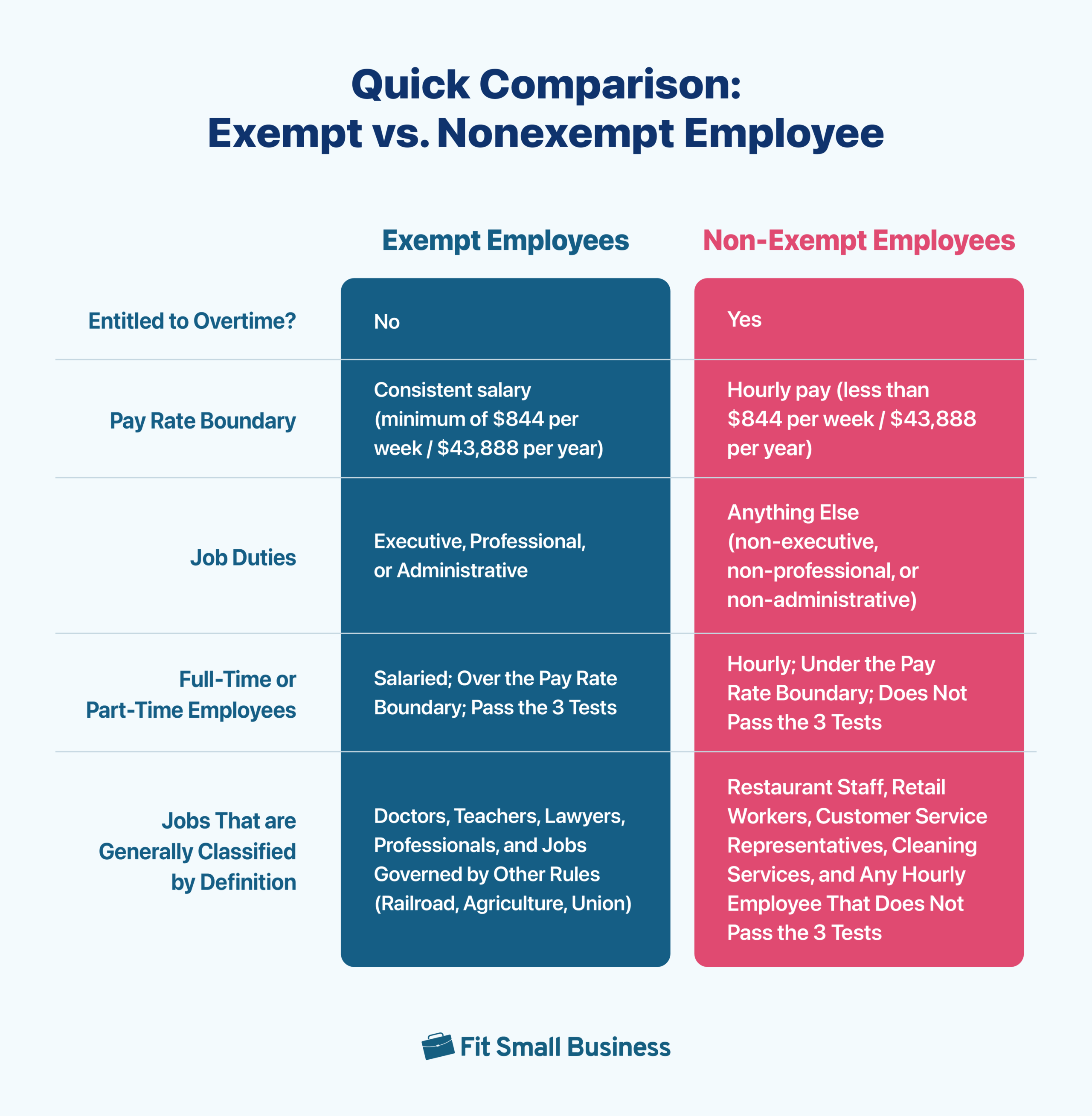

Exempt and nonexempt employees are worker classifications established by the Fair Labor Standards Act (FLSA) that determine whether these employees must receive overtime pay.

- Exempt employee: An employee who, based on job duties and salary, is “exempt” from receiving overtime pay.

- Nonexempt employee: An employee who, based on job duties and salary, will receive overtime pay as required by federal and state law (overtime pay in most states is 1.5 times the hourly rate whenever the employee works over 40 hours in a workweek).

Per the FLSA, when determining exempt vs nonexempt employees, you need to consider their salary, the consistency of their pay and hours, and the particular tasks they perform—not simply their job title. Many employers mistakenly believe that by calling an employee a manager or paying them a salary, they’re automatically exempt. That might not always be the case.

3 Exempt vs Nonexempt Tests for Classification

According to the FLSA’s minimum wage and overtime exemptions, to be considered exempt from overtime, an employee must pass three tests: salary level, salary basis, and duties. An employee must meet all three tests to be exempt from overtime pay unless exclusions apply.

- Salary level test: An employee must be paid a minimum of $43,888 per year to be considered exempt. On January 1, 2025, this amount increases to $58,656.

- Salary basis test: The employee must be paid a consistent salary based on a standard work schedule.

- Duties test: The employee’s job duties must be executive, administrative, or professional.

If an employee’s role satisfies all three tests, then the job is likely considered exempt, and you’re not required to pay overtime.

Employees who are paid more than $844 per week or $43,888 per year pass the salary level test to be classified as exempt and are ineligible for overtime pay, according to the DOL’s final rule. In contrast, employees who make less than this are considered nonexempt and are eligible for overtime pay.

Although the Biden administration was unable to get the federal minimum wage increased to $15 per hour, many states are pushing to increase their minimum wages. A few states have already increased the minimum salary threshold for exempt employees to align with federal rules.

The federal law states that employers must follow the law that is most protective of employees, so some states will overrule it.

- California: The minimum salary level for exempt employees in California is $66,560 annually. California law requires exempt employees to earn at least double the state minimum wage. Note that in the November 2024 election, voters may choose to increase California’s minimum wage. If that passes, the salary threshold will also increase.

- Colorado: Exempt employees in Colorado must make a salary minimum of $55,000 annually to meet the salary level test.

- New York: To qualify for exempt status in New York, employees must be paid at least $58,458.40 annually in 2024, $62,400 if they work in New York City, Nassau, Suffolk, or Westchester Counties. These amounts will increase on January 1, 2025, to $60,405.80 and $64,350, respectively. On January 1, 2026, they’ll increase to $62,353.20 and $66,300, respectively.

- Washington: Exempt employees in Washington state must make a minimum salary of $67,724.80. On January 1, 2025, this amount will increase to $69,555.20 for employers with up to and including 50 employees, and to $78,249.60 for employers with over 50 employees. Washington has laid out the increases through January 1, 2028.

We recommend you check the minimum wage and salary requirements for exempt employees in your state.

As long as you pay your employees the same amount consistently with very small variance, they would pass the salary basis test and be considered exempt. However, if you pay an employee hourly and their payouts vary widely based on their work schedule and the hours provided, they are classified as nonexempt.

Take note that there are salary exceptions, such as farmworkers and outside salespeople, whose jobs may be considered exempt even when they are paid hourly.

An employee who meets the salary level and salary basis tests are exempt only if they also perform exempt job duties considered to be executive, professional, or administrative. This is also referred to as a White Collar Exemption.

Keep in mind that job titles and job descriptions alone can’t determine whether this test is met. It is the actual job tasks that matter. For example, if you give someone the job title “Director of Facilities Operations,” but they are functioning as the janitor, doing maintenance and cleaning floors, this rule would require you to classify that employee as nonexempt. This test was put in place to prevent companies from circumventing overtime rules with inflated job titles.

Employees may have executive, professional, and administrative job duties.

- Executive: Requires that a person in the job role supervises two or more full-time employees. Management of employees is the primary task of the job, and the person with the job provides input on decisions affecting those team members, like hiring, firing, job promotions, or work assignments. Often, this includes people managers and sometimes supervisors.

- Professional: Includes jobs in “learned” and “creative” professions like doctors, lawyers, graphic designers, and engineers. These professional roles are generally considered to be exempt. Professional applies to those jobs that require an advanced degree past high school.

- Administrative: Jobs done while working on business support teams, like marketing, operations, accounting, or human resources, are considered administrative. These functions keep the business running and are often provided by office staff members providing support to the business.

Federal hiring laws require that you classify employees as exempt vs nonexempt correctly upon hire. Misclassification of your employees and failure to pay them earned overtime pay may subject you to penalties (up to $10,000 in fines or incarceration) and back pay (often double the hourly rate) to all misclassified employees for all overtime hours worked for up to three years.

To help you avoid wage penalties, Bambee offers affordable, on-demand HR managers to ensure small businesses comply with employment classification and other labor laws. You also get help with job descriptions, internal HR policies, employee onboarding, termination, and general employer coaching and HR guidance starting at $99 per month.

Exclusions to Exempt vs Nonexempt Employee Classification

Unlike most federal and state labor laws, with employment law, there are many job types with exceptions. Current professions that are exempt regardless of the three tests are:

|

|

*If a business is calculating their wage on a daily basis, the employee may be nonexempt, even if they’re making a substantial salary.

Determining Exempt vs Nonexempt Employee Classification

So how do you put the tests into action when determining exemption classification for your job roles when hiring employees?

First, look at the salary. If you don’t intend a position to make over $844 per week, you can stop. The role is nonexempt, and workers in that position would be entitled to overtime pay.

If you’re paying over that amount, or higher in certain states, then ask yourself whether you’re paying a regular salary. If you’re going to vary the pay based on the employee’s hours worked, the role is nonexempt. But if you’re consistently paying the same amount every week regardless of the number of hours worked, then the role might be exempt. Keep going.

If you determine a position meets the salary basis and consistency requirements, move to the next step of job duties. If this is a new position and no one currently sits in the role, you may have to make some assumptions about what the person will actually do on a day-to-day basis.

Use the job description you’ve created to determine what the employee will do each day. If you already have a person working in the role, discuss with them and their manager if their daily work aligns with the job description. If it doesn’t, revise the job description.

Look at the worker’s primary job duties and evaluate their major daily responsibilities to determine if they align with the FLSA criteria for exempt status. Does the employee have any decision-making authority? If so, and it requires independent judgment, the position is likely exempt. Does the employee oversee at least two employees? This could also make the position exempt.

Examples of Exempt vs Nonexempt Employees

Exempt | Nonexempt |

|---|---|

A marketing manager who oversees a team of six employees, creates marketing strategies for a small business, and earns a salary of $60,000 per year. | A marketing assistant who supports the marketing team with administrative tasks, is paid $12.50 per hour, and does not have management responsibilities. |

A software engineer who designs and tests software applications, exercises independent judgment, and earns a salary of $85,000 per year. | A data entry clerk who inputs information into databases, is paid $11.25 per hour, and follows specific guidelines for their work. |

An HR director who manages HR policies, supervises four HR staff members, and earns a salary of $70,000 per year. | An HR assistant who follows onboarding procedures, files documents, earns $10 per hour, and has no management responsibilities. |

Keep in mind that this is a general list, and even if you employ someone with a job on this list, you should still conduct an internal analysis for whether your specific position is exempt or nonexempt.

Legal Implications of Incorrect Classification

Incorrectly classifying your employees as exempt or nonexempt can result in severe legal consequences. Review potential consequences and recommendations on how to correct classification mistakes and conduct audits.

Penalties & Costs of Misclassification

Unpaid wages and overtime: If an employer incorrectly classifies a nonexempt employee as exempt, they may be liable for unpaid wages, including overtime pay for any hours worked beyond 40 in a single workweek. This liability could extend back up to two years, or three years if the violation is deemed willful.

Back taxes: Employers who misclassify employees may also be responsible for back taxes, including Social Security, Medicare, and unemployment taxes that were not properly withheld or paid. Employers may be responsible for both their share of the taxes and the employee’s share.

Fines and penalties: The DOL may impose fines and penalties on employers who violate FLSA regulations, including those related to employee misclassification. These fines can range from hundreds to thousands of dollars per violation.

Lawsuits: Employees who have been misclassified may file a lawsuit against their employer seeking back pay, damages, and attorney’s fees. Such lawsuits can be costly and time-consuming, and if the employer loses, they may be required to pay substantial sums in damages and legal fees.

Reputational damage: Employers who are found to have misclassified employees may suffer damage to their reputation, which can affect their ability to attract and retain talent. This can also impact customer trust and business relationships.

Correcting Classification Mistakes & Conducting Audits

Employers should periodically review their employee classification through an internal audit to ensure compliance with federal and state labor laws. This process should involve reviewing job descriptions, actual job duties, salary levels, and salary basis information to determine if employees are correctly classified as exempt or nonexempt.

If an external organization, like the DOL, identifies misclassification issues during an audit, the employer should cooperate fully and work to resolve any problems. If a classification mistake is discovered, employers should take immediate steps to correct the error.

This may include reclassifying the employee, adjusting their salary, or paying any unpaid wages or overtime due. Employers should also take this time to review their recordkeeping practices to ensure accurate tracking of hours worked by nonexempt employees.

In the event of a misclassification issue, it’s advisable to consult with legal counsel specializing in employment law. They can provide guidance on correcting the mistake, minimize potential liability, and ensure compliance with labor laws moving forward.

Why the Classification Tests Are Important

In May 2023, The Guardian published a report alleging Nike may have misclassified thousands of workers, potentially facing fines of over half a billion dollars. While the Nike case involves independent contractor misclassification, it highlights the severe consequences businesses can face when they fail to classify their workforce correctly.

If found liable, Nike would not only be subject to hefty fines but also may be required to pay back pay, overtime, and back taxes for both their employees and the business. This type of financial burden could significantly impact the company’s bottom line and public image.

This high-profile case—which is by no means the first—serves as a cautionary tale for businesses of all sizes regarding the importance of properly classifying employees. Employers must comply with federal and state labor laws to avoid costly fines, lawsuits, and reputational damage.

Common Classification Mistakes to Avoid

Mistake | Why It’s Common | How to Avoid It |

|---|---|---|

Assuming all salaried employees are exempt | Many small businesses mistakenly believe salaried employees are automatically exempt | An employee's eligibility for exemption depends on their job duties, salary level, and salary basis—not just their payment method. Carefully review each employee’s role and responsibilities, ensuring they meet all criteria for exemption before classifying them as exempt. |

Misclassifying employees based on job titles | Job titles can be misleading or inaccurately reflect the worker’s actual job duties | Focus on the actual job duties, rather than a job title. Ensure that employees classified as exempt meet the specific criteria for executive, administrative, or professional duties. |

Failing to re-evaluate classifications when job duties change | Employees’ roles and responsibilities can evolve | Regularly review employees’ job duties, especially when they take on a new role or have responsibilities added to their existing role. Update classifications as needed. |

Ignoring state-specific labor laws that may have stricter requirements than federal laws | Small businesses may be unfamiliar with state labor laws | Stay informed about state labor laws in every state where you have an employee. Consult with a labor law attorney or HR consultant to guide you. |

Not keeping accurate records of hours worked by nonexempt employees | Small businesses may lack the resources or systems to track employee hours effectively | Implement a reliable timekeeping system to accurately track the hours worked by nonexempt employees. Train employees on how to use the system and emphasize the importance of recording their hours correctly. Regularly review time records and address discrepancies promptly. |

Frequently Asked Questions (FAQs) About Classifying Your Workers

Most salaried employees are exempt. However, salary alone doesn’t determine exempt status, so some salaried employees may be nonexempt. To be exempt, an employee must meet specific job duties and salary requirements.

The three factors are: 1. The employee’s salary must meet the minimum requirements; 2. They must be paid on a regular basis; 3. Their job duties must primarily involve executive, administrative, or professional tasks.

An exempt employee is one who is not eligible for overtime pay under the FLSA. This typically includes employees in executive, administrative, or professional positions who meet specific salary and job duty criteria.

Exempt employees aren’t entitled to overtime pay, regardless of how many extra hours they work. This can lead to longer workweeks without additional compensation and increase the risk of burnout.

It depends on your business needs and job roles. You may give exempt employees more responsibilities and higher salaries, but it’s easy for them to work too much and burn out, leading to high turnover. Nonexempt employees are eligible for overtime. But if you don’t monitor or budget hours carefully, overtime costs can get high.

Bottom Line

When it comes to exempt vs nonexempt employee job classifications, it is crucial to ensure you’re paying your workers fairly and abiding by federal and state labor laws. Before classifying a job as exempt from overtime, it’s best to have solid job descriptions in place documenting the kinds of tasks the worker does.