Federal labor laws and related state laws affect all businesses with employees—even more so for companies with at least 50 workers. They govern workforce practices and areas such as overtime, minimum wage, on-call pay, employee breaks, sick leave, hiring minors, and employment discrimination. Labor laws provide workers with protections and contain enforcement and reporting requirements, including rules on how long to keep payroll records.

Complying with labor laws as an employer can help you avoid thousands of dollars in fines, as well as costly employee lawsuits. Keep in mind that the full list of state and federal labor laws is long, but we’ve compiled those most likely to impact small businesses.

State Employment Laws

Nearly every US state has labor laws that affect businesses that employ workers in that state. Companies located in just one state can typically learn about these laws by searching the local state government website or attending a local HR or labor law seminar.

Multistate employers must also stay compliant. Even if your business has no physical presence in a state (which is becoming more common given today’s remote work environment), you’ll need to comply with that state’s laws if you hire an employee there and, in some cases, advertise a job and accept applicants within that state.

Use our map below to be directed to your states specific labor law webpage:

State Labor Law Map

Looking for help doing payroll? Use our state payroll directory for guidance specific to your state; otherwise, try signing up for one of our recommended HR payroll services and see if they can help you with state law compliance. That can be particularly helpful for multistate employers.

Federal Employment Laws

As with state laws, federal employment laws can change suddenly. If managing compliance in-house, we recommend you or your HR manager schedule regular time to check for any new or pending activity; you can also opt to hire or partner with an HR provider that will stay abreast of changes for you.

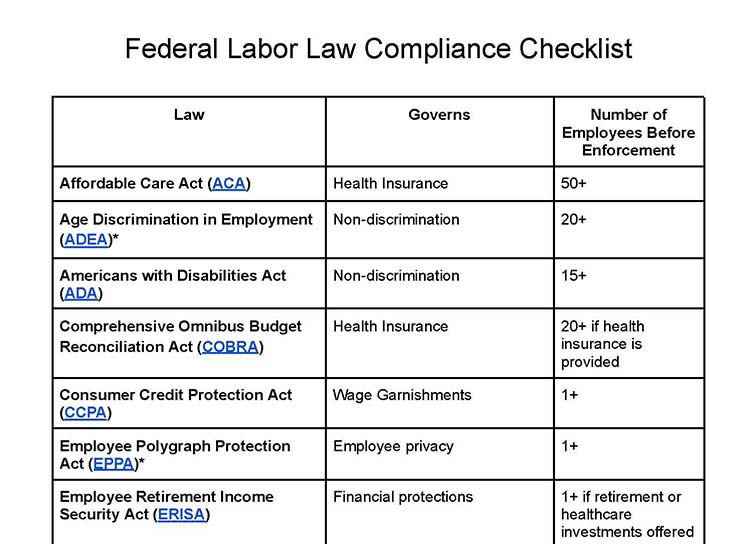

Download our list of the most common federal labor laws that impact small businesses, plus links to each website for more information:

The FLSA is the overarching labor law that all businesses need to know. Its basic principle is to ensure employees are paid fairly. The law requires you to pay overtime for certain employees—based on classifications referred to as exempt or nonexempt.

Nonexempt employees are eligible to receive overtime pay, while exempt employees are not. To be exempt, employees must meet certain criteria related to their job duties and salary level. Small businesses need to be aware of how to properly classify employees to remain compliant with labor laws.

At the federal level, overtime is calculated at 1.5 times an employee’s regular hourly pay rate for all hours over 40 worked in a week. The FLSA also mandates a federal minimum wage with exceptions in a few industries, like agriculture, railroads, and education. Many states and cities require businesses to pay a higher minimum wage or calculate overtime more generously.

The current federal minimum wage is $7.25 per hour—yet California is one state with minimum wage rates that vary by city (almost $20 per hour). And, it has a significant number of additional laws that protect workers by providing, for example, mandatory paid sick leave.

The DOL announced a final rule which regulates how employers can take tip credits for employees that receive tips. The tipped minimum wage is only $2.13 per hour at the federal level, though it is much higher in some states. This new rule only allows employers to take a tip credit from an employee’s wages for the hours worked on tip-producing work.

For example, if an employee receives tips for just half of their shift work and the rest of their duties involve work that’s not tip-producing, the employer can only take a tip credit for half of the employee’s shift. Imagine a server at a breakfast diner who opens the restaurant, spending two hours preparing the restaurant for customers by opening the cash registers and conducting administrative or operational work that’s not tip-producing work. In this scenario, the server’s employer cannot take a tip credit for the two hours the employee spends opening the restaurant each shift.

FLSA compliance issues—such as misclassifying salaried and hourly employees, failing to pay overtime, having inconsistent pay practices such as missing paydays, or paying men and women differently for the same job—can plague small businesses.

The NLRA gives employees the right to collectively bargain with their employers and form or join a labor union. It also establishes guidelines for union organization and the bargaining process, as well as protections for employees to engage in union-related activities.

If employees decide to organize and form a union, small businesses must follow the NLRA rules and regulations for engaging in collective bargaining. This means complying with requirements for meeting and negotiating with union representatives.

Employers cannot take any action that may be considered retaliatory or discriminatory against employees attempting to organize or join a union. Specifically, employers cannot coerce or interfere with union activities. Violations can result in costly fines and penalties.

INA ensures that your workers have the right to work in the US. It’s why you need to complete I-9 forms within three business days of onboarding your new employees. Verification is determined by reviewing a passport, driver’s license, and Social Security card—or other nonimmigrant visas. If you’re not using a payroll program to handle this for you, we highly recommend signing up for the E-Verify program, which is managed by the Department of Homeland Security.

For more information, read our article on how to complete the I-9 form correctly.

Forgetting to complete employee I-9 forms within the three days allocated can result in problems down the line should your employees not actually be eligible to work in the US. Some employers also make the mistake of keeping I-9s in the employee’s personnel file, when they should instead be kept in a separate I-9 folder in case your business is audited by ICE.

FICA requires you to withhold Social Security and Medicare taxes from your employees’ wages, and you must also contribute a matching amount of these taxes per employee. Your role as an employer is to collect the employee’s share of the tax from their earnings and provide quarterly payments to the IRS.

FICA works by taking a percentage of your employees’ income that you match and send to the government. For example, if Joel earns $2,000 a month, you’ll collect 6.2% of his income for Social Security and 1.45% for Medicare, match it, and send it in as a quarterly tax payment using IRS Form 941.

The most common mistakes made are missing quarterly tax payments, misclassifying employees as exempt, and calculating tax payment amounts incorrectly. All can result in penalties against your business, in addition to having to pay back pay with fines double that amount. FICA does not come into play when you hire independent contractors, such as self-employed freelance or gig workers.

OSHA is both the act and the agency that governs workplace safety and health. This can range from bed bugs affecting hotel workers to printer fumes causing respiratory concerns.

OSHA regulates safety and health conditions in the workplace. All employers have a general duty under this act to provide a safe, clean, and hazard-free workplace—which may include establishing an emergency exit plan in an office and setting up an eye-wash station near where chemicals are stored. In addition, like most federal laws, employees have the right to file complaints without fear of retaliation.

Need help establishing a hazard-free workplace? Check out our article on the most common workplace injuries and how to avoid them.

If you have more than 10 employees, annual OSHA reporting is required, and any injuries should be reported annually between February and April. Therefore, it’s a good idea to conduct a monthly safety check on things like electrical outlets, computer wires, and other potential safety hazards.

For small businesses, most OSHA-related issues are caused by unsafe employee practices, such as employees standing on chairs, leaving desk heaters plugged in, or not wearing protective gear. Safety training can prevent these risks, and many insurance providers can help by offering training resources.

Check out our roundup of the best insurance providers for small businesses for options.

The Whistleblower Protection Act protects employees who report suspected violations of law, fraud, or other misconduct from retaliation by their employer. Companies cannot retaliate against an employee who reports illegal activity or unethical behavior in the workplace. Retaliation could include firing, demoting, or otherwise harming an employee who has reported misconduct.

Employees who experience retaliation can file a complaint with the DOL. Businesses may face legal and financial consequences not only for illegal acts but also for retaliating against an employee who has reported misconduct.

Title VII prohibits discrimination in employment and hiring practices. The current list of protected classes includes race, color, sex, creed or religion, national origin or ancestry, genetic information, age, veteran status, citizenship, and physical or mental disabilities.

All businesses, regardless of size, should comply with anti-discrimination as a best practice. Title VII has expanded greatly over the years to be more inclusive of all Americans and their right to employment.

Any business with 15 or more full-time employees must comply with Title VII. Many states’ versions of this law also include gender identity, financial status, and sexual orientation, and a few states require that annual training be provided to all employees. It’s best to check the anti-discrimination laws in your state as they’re likely to be more inclusive.

Compliance Tip: If you have remote employees in states that require annual training or have greater protections than federal law, you need to follow those requirements for those specific employees. In practice, it can be more effective to simply align your company policies with the most protective state so that you’re certain to be in compliance and able to reduce the administrative burden on your HR team.

To prevent hiring bias, consider training managers on how to avoid discrimination and use structured interviews in your recruitment process. Training, including sexual harassment prevention, can help your team focus on work-related traits and help you create an inclusive workforce, free of discrimination.

Check out our article on employment laws in hiring for guidance, as well as our guide on how to practice diversity hiring in your workplace.

The ADA added extra protection for people with physical and mental disabilities to Title VII when it was passed in 1990. While pregnant women are protected under a different law, pregnancy and childbirth are also treated as a temporary disability and protected by the ADA as well.

The ADA prohibits private employers, governments, recruiting agencies, and labor unions from discriminating against qualified candidates with disabilities in job application procedures, hiring, firing, advancement, compensation, job training, and other employment processes. Unlike other federal laws, there’s no enforcement agency for the ADA—it relies on individuals to file complaints. The ADA is only enforced for employers with 15 or more employees, but we recommend that all businesses comply.

Complying with the ADA includes providing reasonable accommodation to support a disabled person, a current employee who becomes disabled, or a disabled job applicant. For example, if a vision-impaired candidate is a perfect fit for your customer service job and needs a $150 special keyboard to input caller data, that would constitute a reasonable accommodation.

In contrast, if a person in a wheelchair wanted to work for you, but your accounting office is located up three flights of stairs, then the construction of an elevator would not be a reasonable accommodation for your small business as it could be deemed a financial burden. In this scenario, allowing them to work from home would be considered a reasonable accommodation.

GINA protects employees from discrimination based on their genetic information. Employers cannot use genetic information to make employment decisions, such as hiring, firing, or promoting an employee. Companies also cannot request or require employees to undergo genetic testing. While employers cannot request genetic information from an applicant or employee, any genetic information an employer obtains must be kept confidential.

All employers with 15 or more workers must comply with GINA. Violations can result in costly fines and penalties.

PDA prohibits discrimination against employees due to pregnancy, childbirth, or related medical conditions. Employers cannot discriminate against an employee or applicant because they are pregnant or have medical conditions related to pregnancy.

Companies must provide the same treatment to pregnant employees as to other employees with similar limitations, abilities, or inabilities to work. For example, employers must provide reasonable accommodations to pregnant employees, like modified work duties or a temporary leave of absence.

Employers also cannot take adverse employment actions, like demotion or termination, due to an employee’s pregnancy or related medical condition. Employers with at least 15 employees must comply with this law and violations may result in fines, penalties, and employee lawsuits.

The PUMP Act gives additional protections for nursing mothers at work. Nursing mothers are entitled to break time to express breast milk for up to one year after their child’s birth. Employers must provide a private location that is not a restroom.

Employers with fewer than 50 employees must comply. An employee cannot receive a reduction in pay, benefits, or any other adverse employment action for utilizing this right. When an employer learns of an employee’s pregnancy, they must provide them notice of their rights under the PUMP Act.

The ADEA prohibits employment discrimination against individuals age 40 or older. Employers cannot discriminate against an employee or job applicant because of their age, and they cannot retaliate against an employee who reports age discrimination. Employers are also prohibited from using age as a factor in employment decisions.

There is no federal pay transparency law. However, certain states and cities have implemented pay transparency laws. If you plan to hire employees in these states or cities, you’ll need to comply with these laws.

Pay transparency laws are designed to promote fairness, reduce pay disparities, and encourage open discussions about compensation in the workplace. These laws require employers to disclose information about employee salaries and other compensation, either in a job posting or during the interview process.

Related, employers cannot prohibit employees from discussing their own wages. If you have such a policy, eliminate it immediately. The National Labor Relations Board (NLRB) specifically states that employees have a right to discuss their own wages at work.

Cannabis is still technically illegal at the federal level. However, several states have legalized cannabis for recreational use, and even more for medical use. Businesses in these states need to be aware of state laws that may offer protections for cannabis users, especially medical users.

Some states provide protections for employees and do not allow employers to take adverse employment actions against an employee who tests positive for cannabis—unless the use of cannabis would impair the employee’s job performance. If you hire employees in states with legal recreational or medical use marijuana, review your existing policies to ensure they align with state law.

The Speak Out Act is a recent law that just became effective in 2023. It prohibits employers from imposing mandatory arbitration agreements on employees in cases of workplace harassment and discrimination. Employers cannot require employees to sign arbitration agreements that waive their rights to litigate harassment or discrimination claims in court.

The law also makes non-disclosure and non-disparagement clauses unenforceable as they relate to allegations of sexual assault and harassment. The key to note here is that the law only prohibits these agreements if entered into before the dispute arises. In practice, this means that once an allegation is made, a dispute has arisen, and any agreement entered after that point, would not be valid.

The FMLA is a federal labor law requiring employers to offer unpaid, job-protected leave to eligible employees for the birth or adoption of a child or the serious illness of the employee or a spouse, child, or parent.

FMLA requires you to protect the job of an employee who is out on leave for up to 12 weeks. It also allows up to 26 weeks for the same protection for an injured or ill military service person or for the family members caring for a military service person. Any employer who has 50 or more employees must provide FMLA. However, in some states, family leave laws are more comprehensive and may apply to employers with as few as five full-time workers and require paid leaves.

Only employees who have a year of service are eligible for FMLA, and there’s typically a policy and an application process they need to use. For example, if your new hire of three months requests six weeks of FMLA for non-work related knee surgery, you can decline the leave request under the FMLA.

Learn how to develop an FMLA-compliant maternity leave policy, which is the most common situation you’ll likely face as a small employer. Keep in mind that new dads have many of the same FMLA rights. Some states now also require paid paternity leave.

The FCRA allows an employer to obtain an applicant’s or employee’s consumer report for employment-related purposes if it (1) gives the applicant or employee a written disclosure notifying them that a consumer report may be obtained; and (2) obtains written authorization from that person. Some states have similar laws for pre-employment drug testing.

The ECPA governs the interception and disclosure of electronic communications. Employers cannot intercept or disclose their employees’ electronic communications without their consent unless an exception applies.

This does not mean, however, that employers cannot access employees’ emails without permission—they can. Employers are advised to have a clear electronic communication policy, putting all employees on notice that the computer system and electronic communication are the property of the employer and may be reviewed by the employer at any time.

The EPA requires that men and women be given equal pay for equal work at a business. It is the content of the job and the work responsibilities, not job titles, that determine whether jobs are roughly equal.

USERRA is a federal labor law from 1994 that protects military workers’ jobs. It establishes the length of time that a person may be absent from work for military duty, such as active duty and guard duty, while retaining reemployment rights. This law can protect someone for up to five years.

The CPPA applies to employers that manage wage garnishments and limits the percentage amount of pay that can be garnished from a worker’s paycheck. If you have employees with garnishments from liens, student loans, or child support, you will want to make sure you are in compliance.

The GDPR is a European Union (EU) law—so why are we discussing it here? Because your business may collect data from EU citizens, making you subject to this law.

A US-based company that offers goods or services to individuals in the EU or monitors the behavior of individuals in the EU may be subject to the GDPR. This includes collecting personal information, like names, email addresses, and IP addresses.

The GDPR requires companies to obtain explicit consent from individuals before collecting their personal data, appoint a Data Protection Officer, and adopt certain data privacy practices to ensure the security of personal data.

If your company processes the personal data of any EU citizen or a remote worker located in the EU, then you must comply. Retaining certain personal data of your employees, like names and addresses, will not require specific consent—but any additional personal data collection will. For all the data, you’ll need to comply with the storage requirements.

It’s always been the employer’s responsibility to post federal labor law rights in a conspicuous location at work. In 2023, a few new requirements went into effect. Two additions to the federal posters include the PUMP for Nursing Mothers Act and Pregnant Workers Fairness Act. If your compliance posters don’t have these notices, you could be out of compliance and face additional fines.

Fines are also increasing this year, as they now do every year, adjusted for inflation. The fines for not posting certain federal laws are:

- OSHA: $15,625 for each violation

- FMLA: $204 for each violation

- Employee Polygraph Protection Act: $24,793

- Know Your Rights: $659 for each violation

If all of your employees work remotely and typically receive company communication electronically, then you may post federal labor laws electronically. To satisfy this requirement, you should post on a company message board or email to the entire company, ensuring that every employee has received the posters. Note that in New York State, all labor law postings and workplace notices must be posted electronically.

If some of your employees are remote and others work in a physical office, you may post electronically or physically. We recommend doing both to ensure every employee views the posters.

Federal Labor Laws if You Provide Benefits

If you provide employee benefits or have over 50 full-time equivalent (FTE) employees (requiring you to provide benefits), you will need to understand the following federal labor laws. Your benefits provider should guarantee compliance with these laws, and it is good to understand how they work.

The ACA requires most employers, including small businesses, to offer health insurance coverage to their employees. Any employer with at least 50 employees, or the full-time equivalent, must provide affordable health insurance coverage that meets certain minimum standards. Small businesses under 50 employees are not required to comply, but, if they do, then they may be eligible for tax credits.

COBRA is the law that requires the option for continuation of health insurance for employees who have been fired or laid off for any reason from a business. Only businesses that offer employee benefits need to be concerned with COBRA. If you provide medical insurance and have 20 or more employees, you must also comply with COBRA, and some states, like California, offer extended COBRA benefits.

When an employee is terminated and about to lose their employer-sponsored healthcare coverage, COBRA kicks in to provide them continued health insurance coverage they can pay for themselves.

HIPAA is a health insurance and medical privacy law that protects employees’ privacy regarding any health information. It often requires you to train workers who handle sensitive employee data. HIPAA’s rules cover everything, from medical information privacy to the coverage you need to provide, as well as the timeframe you need to provide it in, if you offer health insurance.

If you provide benefits, you need to comply with HIPAA, no matter the size of your employee base. In addition, if an employee discloses personal medical information to you or your managers, it’s important you safeguard that private information.

Make sure your personnel files and medical insurance information is password protected or kept in a locked cabinet. Train managers to keep employee personal information private. Even something as simple as a manager publicly discussing information shared in a doctor’s note can put your business at risk of a HIPAA violation.

The MHPAEA seeks to ensure equal mental health coverage as physical health coverage under insurance plans. Health insurance plans cannot impose more restrictive limitations on mental health and substance abuse disorder benefits than they do on medical benefits. Small businesses must comply with this law if they offer a group health plan that includes mental health coverage.

ERISA provides rules for employers offering pension, retirement, or welfare benefit plans for their employees, such as a 401(k). The law regulates qualified versus unqualified retirement plans, the conditions behind them, when you can make pre-tax payments, and more.

If you provide a 401(k) or other type of retirement plan, including an HSA, you will need to comply with ERISA regardless of your company size or contribution amount.

As you review the federal labor laws above, be aware that your state may have more restrictive rules, offer greater protection for employees, or have enacted local laws with which your small business must also comply.

Potential Upcoming Changes

From year to year, labor laws change—some more dramatically than others. Also, some states are more likely to update and change laws. It’s vital to stay updated on these changes so you can ensure your small business stays compliant.

The Federal Trade Commission (FTC) has proposed a rule change regarding non-compete agreements. While many changes are expected before any rule becomes law, employers should take note that a common hiring and business protection tool may become radically changed or altogether obsolete in the near future.

Some employers have highly compensated daily rate employees, generally those making over $107,00 per year, who are exempt from overtime. There’s currently a case before the US Supreme Court involving a highly compensated executive employee who’s classified as exempt and not entitled to overtime.

The worker is arguing that their daily rate of pay does not satisfy the salary basis test for exemption. If the worker prevails, it will have significant implications for employers who pay daily rates to highly compensated workers, possibly requiring them to restructure their compensation or pay overtime.

Another case currently before the US Supreme Court involves labor rights. A labor strike occurred where the employer’s property was damaged. The question before the court is whether the NLRA protects unions and members from claims of property damage suffered during a labor strike.

The Court’s ruling could have implications for both employers and unions. A ruling in favor of the company could give businesses more rights for certain losses incurred during labor disputes. It could also mean that unions are less likely to strike, as they may be on the hook for losses suffered by the business.

A third relevant case before the US Supreme Court could affect discrimination policies and practices, including religious exemptions in employment. This case challenges public accommodations under a state anti-discrimination statute that prohibits a company’s ability to deny services to a customer based on their disability, race, religion, color, sex, sexual orientation, marital status, national origin, or ancestry.

If the Court sides with the business in this dispute, it would expand the rights of businesses to deny services to customers on otherwise protected grounds. In this scenario, companies should prepare for objections from employees.

Who Labor Laws Impact

Labor laws are applied differently based on company size, often adding enforcement and reporting requirements for larger employers. Other laws provide exceptions for workers in certain industries—like farm labor and live-in domestic employees. As examples, the minimum wage is lower for businesses whose employees earn tips. In fact, a lower minimum wage can be paid to students and those with limited productivity due to a disability such as Down syndrome.

Here are examples of how federal labor laws impact businesses of various sizes:

- Employers with one or more employees must abide by the FLSA in terms of overtime pay, equal pay, and employing minors and should provide regular pay at fixed intervals.

- Businesses that generate over $500,000 in annual revenue must abide by FLSA minimum wage, with few exceptions.

- Firms with 10 or more employees must provide OSHA safety and incident reports.

- Employers with 15 or more employees must abide by anti-discrimination laws, including providing reasonable accommodations for disabled employees.

- Employers with 20 or more employees must prevent discrimination based on age and must comply with COBRA if they provide health insurance benefits.

- Employers with 50 or more FTEs must offer health insurance to workers and make family medical leave available to qualified individuals, i.e., new parents.

- Employers with 100 or more employees must give employees 60 days’ notice for layoffs or closure; they must also file EEO surveys showing worker demographics.

- Employers with 250 or more employees must file ACA paperwork electronically.

What’s important to note as you view the list of labor laws is that many states build upon these federal labor laws by adding their own compliance criteria.

For example, the Family Medical Leave Act (FMLA) applies to employers with 50 or more workers, but in more than 10 states, some of this leave must be made available to employees as paid time off (PTO). As a business, you must comply with whichever law (state or federal) is more favorable to the employee.

Benefits of Federal & State Employment Law Compliance

It may seem obvious that your business needs to comply with labor laws. However, in case you’re thinking about skirting the rules by paying employees “under the table” or maintaining discriminatory hiring practices, there are some things to consider.

The primary benefits of complying with federal, state, and local labor laws include:

- Risk mitigation: Reducing the risk of labor law audits, fines, and penalties alone is the best reason to stay compliant with federal, state, and local labor laws. Fines are often based on the number of workers affected multiplied by the number of days your business is out of compliance. It doesn’t take many fines and penalties to bankrupt a small business.

- Strong employment brand: It’s common for current and former employees to leave reviews about your company online. Job seekers read those reviews and aren’t likely to want to work for a company that breaks the law. Compliance helps you remain an employer of choice.

- Great reputation: Consumers are often aware of how employers treat their workers, and many won’t do business with firms that practice illegal and discriminatory behaviors.

- Low turnover: By complying with labor laws, you’ll likely increase employee retention and reduce turnover. That can save you thousands of dollars a year per retained employee.

Note that maintaining compliance requires that you educate yourself and managers about labor laws while establishing policies that need to be maintained and enforced. Whether you choose to manage HR on your own with software or hire consultants or legal advisers, there are costs involved in compliance because labor laws change regularly at federal, state, and local levels.

And while annual HR compliance audits take time, they are necessary to identify and rectify problems proactively. You’ll want to do your own audits to find issues well before a federal or state agency shows up to do its audit of your employment practices.

Need help from experts in managing your HR processes? Look into our roundup of the best HR outsourcing services that can help you remain compliant with federal and state laws.

Labor Law Frequently Asked Questions (FAQs)

- The right to a safe and healthy workplace: Workers have the right to protection from hazards that can cause injury or illness in the workplace. Employers are responsible for providing a safe work environment and ensuring that workers have proper training and equipment to perform their jobs safely.

- The right to be treated fairly: Workers have the right to be treated fairly and with respect in the workplace, regardless of their race, gender, age, religion, sexual orientation, or any other status that may be protected under federal or state law. Employers are prohibited from discriminating against employees on the basis of these protected statuses.

- The right to form or join a union: Workers have the right to form or join a union to collectively bargain with their employer for better wages, benefits, and working conditions. This right is protected under the National Labor Relations Act.

An example of an unfair labor practice is an employer interfering with or restraining employees from exercising their rights to form or join a labor union, collectively bargain, or engage in protected concerted activity. This could include threatening employees with job loss or discipline for union activity or retaliating against employees who engage in such activity.

The main difference between exempt and nonexempt employees is their eligibility for overtime pay. Nonexempt employees are entitled to overtime pay. Exempt employees are not eligible for overtime pay, as they are exempt from the overtime provisions of the Fair Labor Standards Act.

Most US businesses must follow OSHA regulations. Some of the key regulations to follow include maintaining workplace safety and recordkeeping.

- Developing and implementing workplace safety programs and policies to ensure a safe and healthy work environment.

- Providing employees with the necessary safety equipment and training to perform their jobs safely.

- Regularly inspecting the workplace to identify and correct any potential hazards.

- Maintaining accurate records of workplace injuries and illnesses, and reporting them to OSHA as necessary.

- Providing employees with regular safety training, including training on hazard communication, emergency procedures, and workplace violence prevention.

- Complying with OSHA’s standards for specific industries or hazards, such as hazardous chemicals, construction, or electrical work.

Reasonable accommodations are changes or adjustments made by employers to accommodate employees or applicants with disabilities, allowing them an equal opportunity to perform their job duties or have access to a fair job application process. The ADA requires employers to make reasonable accommodations upon request by an employee or job applicant so long as it doesn’t cause undue hardship to the employer.

Here are some examples:

- Making physical changes to the workplace to ensure accessibility, such as installing ramps or elevators for an employee in a wheelchair.

- Providing specialized equipment, like a computer screen reader or hearing aids

- Adjusting work schedules or providing additional breaks to accommodate medical treatments

- Changing job tasks or responsibilities to better suit the employee’s abilities

- The Health Insurance Portability and Accountability Act (HIPAA) sets standards for the privacy and security of personal health information for individuals.

- The Electronic Communications Privacy Act (ECPA) regulates access to electronic communications and online activity.

- The Fair Credit Reporting Act (FCRA) regulates the use of consumer credit information in employment decisions.

- The Family Educational Rights and Privacy Act (FERPA) regulates the release of student education records.

- The Sarbanes-Oxley Act (SOX) regulates financial transactions and accounting practices to prevent fraud and protect investor confidence.

- The General Data Protection Regulation (GDPR) oversees the collection and processing of personal data for individuals in the European Union.

Bottom Line

Federal labor laws are the broad term for the laws that US businesses with employees must follow. Enforcement of these laws varies by company size, such as those with 15 employees or more. However, it is recommended that small business owners do their best to comply with these laws in order to be supportive of employees and maintain a strong reputation as a business owner.