Thank you for downloading!

If you want to automate expense management, track employee spending, and process reimbursements via payroll, consider Rippling.

It’s an all-in-one HR platform with an expense reimbursement solution that can process local and international payments. It even offers employee corporate cards, which come with customizable rules to control spending.

Thank you for downloading!

If you want to automate expense management, track employee spending, and process reimbursements via payroll, consider Rippling.

It’s an all-in-one HR platform with an expense reimbursement solution that can process local and international payments. It even offers employee corporate cards, which come with customizable rules to control spending.

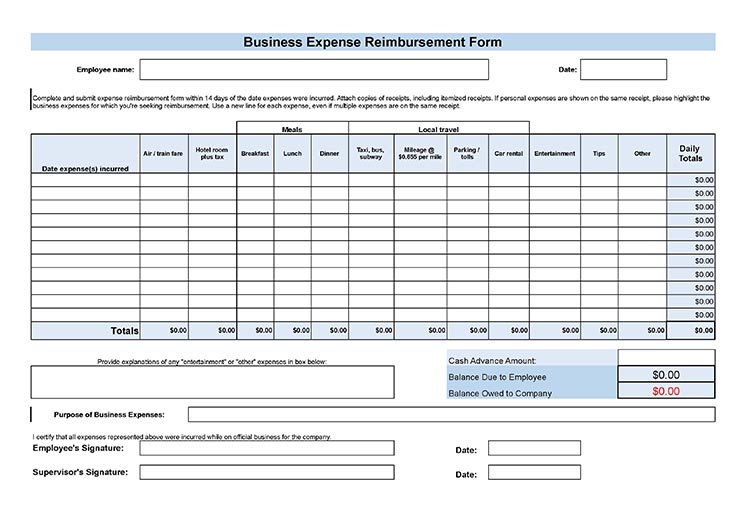

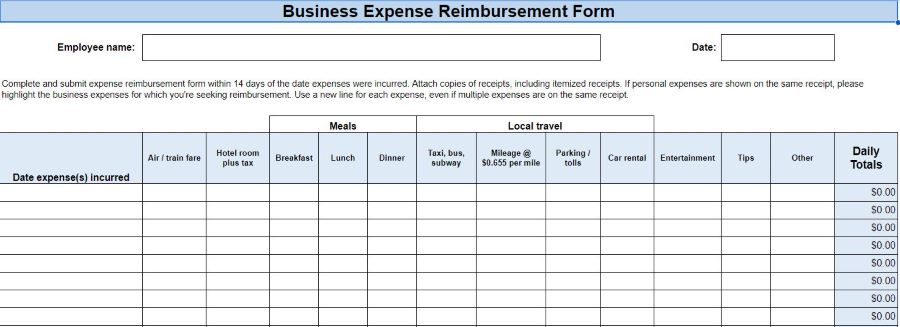

An expense report template makes it easy for employees to record the details of reimbursable business-related expenses. It also helps employers when running payroll by allowing them to monitor and track those expenses and ensure accurate reimbursement.

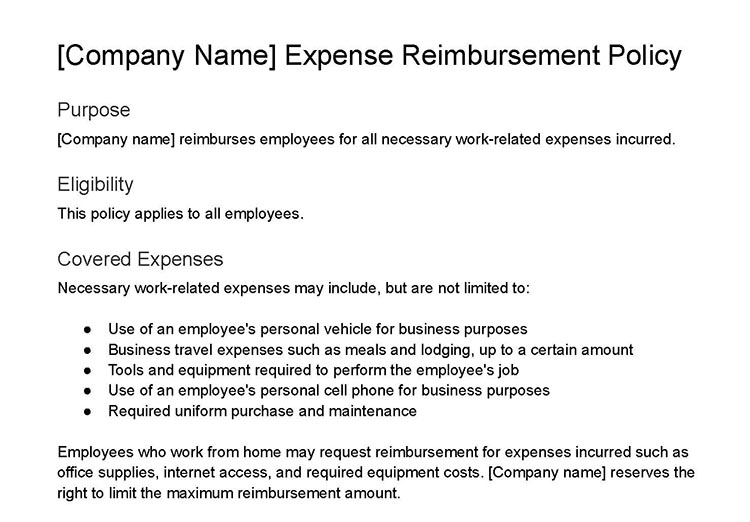

To help you track your employees’ work-related spending effectively, we’ve created a free expense report template. We also recommend setting an official employee expense policy detailing how to submit expenses for work-related purchases, helping reduce confusion and ensuring employees are held accountable for their spending.

Tracking and controlling employee spending and expenses can be challenging and cumbersome. If you want to simplify and automate expense reimbursement processes, consider Rippling. In addition to its feature-rich HR payroll platform, it offers corporate cards with customizable spending rules and an expense management solution that integrates seamlessly with its payroll module for stress-free reimbursements.

What Is an Employee Expense Report & Why Use One

An employee expense report is a form employees fill out to document their work-related expenses. The report typically provides the details of each expense, the date incurred, the amount, what it was for, and any receipt or documentation verifying the purchase. Employers use this report to reimburse employees for the approved expenses, tax-free.

Your expense report template may include fields for travel-related expenses such as airfare and meals.

If your business anticipates employees making work-related purchases, it’s prudent to develop a policy and form for accurate tracking and recordkeeping. Expense reports provide employers with a detailed account of how company resources are being used, enabling informed financial decisions. Having employees submit expense reports also allows you the ability to accurately deduct eligible expenses from taxable income and have a verified record for tax reporting.

Types of Expenses—Reimbursable vs Not

Reimbursable expenses listed on your report and in your policy should include those that are and are not approved, as well as those requiring pre-approval. While our expense policy template is fairly basic, you might want to specify which expenses are approved if your employees frequently travel or entertain clients. You could also establish a daily limit (per diem) on employee spending—usually ranging from $50 to nearly $400 per day, depending on your state and permitted expenses.

Some companies provide ranges of what’s acceptable for expenses, such as meals while traveling or mileage reimbursements. Most businesses limit the kinds of approved expenses to what the IRS will allow, which can include:

- Meals while traveling or business-related meals (e.g., a sales lunch)

- Car rental

- Hotel expenditures

- Parking and tolls

- Mileage (65.5 cents per mile for transportation and travel expenses)

Find out more about how to reimburse mileage in our ultimate guide to mileage reimbursement for small businesses.

Other nontraditional approved expenses may include:

- Remote office supplies (e.g., computer and printer)

- Employee perks (e.g.,T-shirts and coffee mugs)

- Food (e.g., pizza for a company event and donuts for a meeting)

- Entertainment

Tip: Don’t list every possible expense reimbursement in your policy. Provide general items that may be approved, and note that the list is not exhaustive.

Some companies choose to provide examples of expenses that are not approved. This most commonly includes alcohol, but can also include things like service class. For example, you may want to reimburse traveling staff for coach or business-class airfare, but not first-class.

Many companies feel that if an employee wants a glass of wine with dinner, that should be a personal expense; others simply set a daily or per-meal limit without restricting the type of expense. Again, don’t list every possible item that’s not approved. Provide a general idea for employees.

Some businesses require all or most expenses to be pre-approved, and companies should provide employees with guidelines. Pre-approval is a great way to keep company finances in check. For example, your sales team may not need your go-ahead to buy gas for a sales trip in the company vehicle, but you may want them to obtain your approval before they book an out-of-town flight for a client meeting.

Think about different circumstances or situations and document the kinds of expenses or the dollar amount you will require your employees to get approval on before spending money and submitting the expense. You can even build notes into your expense report to remind employees of the limits or reimbursement amounts.

Compliance Note: Be sure that you approve expenses equally, or you could face claims of discrimination. If you approve business class travel for one employee but not another, make sure you have a legitimate business reason for doing so.

Expense Report Guidelines

If you are creating your own expense templates or policy, or are customizing the templates we provided above, consider the following:

Aside from filling out an expense report form, be sure to communicate what else your employees need to provide (such as original receipts, pictures of receipts, dates, times, client names, and reasons for expenses). This is usually the section of your expense policy that needs to be as clear as possible to prevent issues.

You may want to add columns in your expense report template to track the client name and reason for the expense. In fact, some companies go so far as to require each employee to assign each expense to a cost center to make it easier for the finance team to do payroll accounting.

Make it clear in your policy that any expense over the limit, if one is set, needs approval. This can be a good policy if team members buy equipment that can be expensive.

Notify your employees about how they report expenses to you, whether through their supervisor, HR, or your payroll provider. We recommended having one point of contact (POC) for tracking reimbursable employee expenses to avoid chaos. The POC can also ensure that expenses are properly allocated to the correct cost center in your accounting system.

You should let your workers know how often they should submit expenses (e.g., immediately or on the first of every month). Be as specific as possible by listing the day of the month or date by which they should submit expense reports and whether the expenses expire. Also, note how long it will take to process the expense report so employees have an idea of when to expect reimbursement.

The most common reimbursement periods are monthly and quarterly, with an expense submission timeline of at least five to 10 days before the next payroll cycle. If expenses are reported late, they can be reimbursed the following pay period.

The most common practice to document employee expenses is to use a form, like our company expense policy template above. Whatever method you use, track employees’ expense amounts and make sure they are appropriate.

We recommend keeping your expense form template in your company’s shared drive or leaving copies in a designated folder everyone can access. Have your accountant or HR professional review your expense reporting policy before you distribute it to employees. Then, once you have finalized it and the accompanying form, ensure all employees get a copy of the policy and understand it (e.g., hold a companywide meeting or video call).

Tracking and recording the expense reports also gives you insight into any potential misuse or abuse of company funds. While most employees are honest, some employees might try to get reimbursed for personal purchases.

To avoid this, have each employee sign and date a copy of the expense policy and document this in their personnel files (electronic or paper is fine). The expense policy should also be added to your company’s employee handbook for full visibility.

Having employees use personal credit cards to make purchases and then request for reimbursement has advantages. Companies can better control how business resources are used since you won’t be providing upfront funding. It also eliminates the risk of misuse of company credit cards.

However, using personal credit cards may lead to higher costs for the company because of extra administrative work. Some companies don’t want the hassle of using employee expense reports, so they provide company-issued employee credit cards to authorized workers or loan the sole company credit card to an authorized employee to make a specific purchase.

When deciding which option is best for your company, consider how much control and oversight you want for employee spending. Company credit cards provide more visibility than personal cards and less administrative burden.

It also depends on the types of expenses you intend to reimburse. If most expenses are office supplies, a company card might be the best choice. However, if most expenses are related to work-from-home supplies, personal vehicle or cell phone usage, or similar items, it might be best to have employees front these costs and request reimbursement using the expense report form.

How Expense Reimbursements Affect Payroll

Regardless of whether you’re using payroll software or doing payroll via Excel, when an employee is reimbursed for expenses incurred on behalf of the company, it can affect payroll calculations, depending on how the reimbursement is distributed. If paid through payroll with a nonaccountable plan, it increases the employee’s gross pay because the reimbursement amount is included in the employee’s taxable income. Any associated taxes (e.g., Social Security and Medicare) are also taken out of that amount.

When done correctly, an expense reimbursement is fully tax-free. This ensures the employee gets reimbursed the full amount and your company doesn’t incur additional and unnecessary payroll taxes.

Use our free payroll templates to help you calculate employee expenses.

Expense Reimbursement Alternative: Work-from-home Stipend

If you have distributed team members who regularly have work-related expenses, consider offering a work-from-home stipend. This can be a static amount, say $100, for each full-time employee. Each month, they receive an additional $100 on their paycheck to help cover any work-related expenses, like improved internet service, a better desk, or a more ergonomic chair.

While these stipends reduce the administrative burden, it’s important to note they are not expense reimbursements. This means that the stipend is generally taxable income to both your company and your employees.

Bottom Line

An employee expense policy and an employee expense report form are fairly easy to create and implement. Download our free expense report template and expenses policy template to give you insight into your workers’ spending and provide you with valuable records.