Conducting a payroll audit helps ensure your payroll process complies with labor, accounting, and tax laws. Further, regular payroll audits reduce occurrences of fraud, embezzlement, and wage theft. To help strengthen your financial controls and address potential issues, you can use our free customizable payroll audit checklist that covers how to conduct a payroll audit.

Here are the seven steps you’ll need to follow in order to conduct an effective payroll audit:

- Determine the Timeframe and Process

- Develop a Spot Checking Strategy

- Run Reports for Employee and Payroll Data

- Compare Hours Worked Against Timecard Data

- Run a General Ledger Report

- Look for and Document Any Atypical Transactions

- Reconcile Payroll Accounts with Bank Account

For step-by-step guidance and tips that may help you along the way, check out our How to Conduct a Payroll Audit video, part of our Payroll Video Library.

Step 1: Determine the Timeframe and Process for Your Payroll Audit

Set yourself up for success when planning your payroll audit by considering the who, what, and when. We recommend conducting a payroll audit annually—but if this is your first audit, and you want to make sure your payroll and data controls are working, you should consider doing mini-audits more frequently (such as quarterly or even monthly).

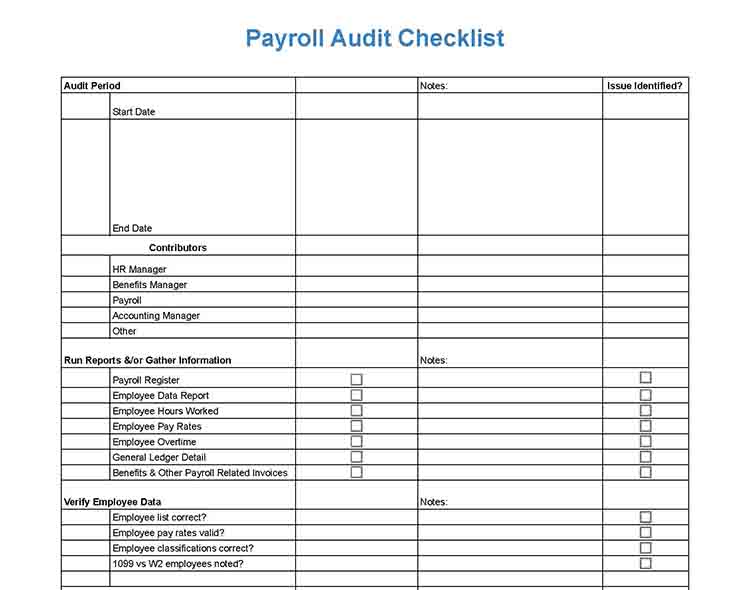

You can use our Payroll Audit Checklist to come up with a plan for what you will be testing, when it should happen, and in what order. You may also want to note the names of individuals who can assist in the audit activity. This will help ensure the right team members are present when you need them, so the audit isn’t delayed or completed out of order.

Step 2: Develop a Spot Checking Strategy

Instead of verifying data for all employees, look at the payroll data for 5% to 10% of your total workforce. You should also determine how you will randomly select employees, payroll periods, and payroll transactions.

Step 3: Run Reports for Employee and Payroll Data

If your business is using either a payroll software or service, note that these providers typically offer reports that help make payroll auditing easier. If you’re handling payroll yourself, then you need to create and manage your own reports. To help you review employee and payroll data, here’s a list of what you should verify for payroll audits.

Verify Active Employees

Some of the important items that you should look at include staff names, jobs, and start dates. You should also check if terminated employees are still on the payroll or if there are employee names that you’ve never heard of. The presence of either one indicates that there might be a problem.

If you are a small business owner, you can check the staff list yourself as you’ll likely know the names of all your workers. However, if your company is a midsized business or large firm, you can ask help from your managers to ensure all their employees are listed correctly.

For businesses using various employee-related systems (like HR, timekeeping, and payroll solutions), you may want to verify whether the staff data matches between these software programs. Also, double-check contract worker information as their payment details may be stored in your accounting software instead of in your payroll system.

Verify Employee Pay Rates

Match the pay rates showing in the employee file to the amounts on your payroll reports. If you’re using either an HR software or a payroll system, or both, these solutions typically have reports that list your employees’ names, start dates, and pay rates. You ultimately want to see that no one is getting paid more or less than they should.

Verify Pay Periods Worked

If you have both a timekeeping and payroll system, you can compare data for a specific time frame (like a random pay period). You’ll need to check that the pay periods line up and that data (such as actual hours worked) from one system matches what the employees got paid in that timeframe.

You also want to make sure that employees are receiving their pay on the designated day. If funds are being transferred too early, you may experience cash flow shortages that could impact inventory or supply purchases. If they’re being remitted too late, you could face a labor law violation. Certain states have minimum pay frequency laws governing how your pay periods should flow.

Payroll rules vary by state. Some states let you mandate direct deposits, while others don’t. There are those that dictate specific pay periods and have regulations on final paychecks. As you’re auditing your payroll, confirm that your company’s payroll process aligns with the requirements for your location and industry.

For more info, check our state payroll directory and click on your state for the state-specific regulations you need to account for. Also, check out our guide to the most important payroll compliance laws that you need to know.

Step 4: Compare Hours Worked Against Timecard Data

Once you’ve taken a look at the big picture data—such as employees, pay rates, and pay periods—it’s good to do a deeper dive. You can check timekeeping records to ensure employees are being paid correctly for hours worked, including overtime for nonexempt employees. Here are some of the essential data points you should check.

Make Sure Employee Hours Worked Match Amounts Paid

Whether you’re using paper time sheets, punch cards, or an employee time clock app, you can look at historical time card details and compare these to payroll data of the same time frame. If an employee’s timesheet shows they worked 35 hours from Sept. 2 through Sept. 9, the payroll data (i.e., on the pay stub) should reflect the same information. Be sure you’re comparing data that covers the same pay periods, and then list any differences or discrepancies between the two data sources.

Most payroll software will enable you to override electronic time cards or payroll data manually, such as when a worker forgets to clock in/out and when a worker is paid a bonus. You should always note those changes and verify the manual time adjustments, if any.

Ensure Overtime Hours Are Calculated and Paid Correctly

A common payroll issue many employers experience is not paying workers overtime correctly. Most states require overtime to be calculated at time and a half, meaning that for every hour an employee works past 40 hours in a pay period, they get paid 1.5 times their regular rate. Note, however, that state overtime laws vary (i.e., California requires any employee working over 12 hours per day to be paid double their regular hourly rate).

Make sure you’ve calculated and paid overtime correctly per your state requirements. To verify that you’ve paid out the right amount to employees, you may need to recompute some payroll transactions. If there are differences, you need to backtrack and figure out what the problem is. Incorrectly paying overtime could subject you to fines and penalties, plus you may end up owing more money in taxes.

How to Manually Recalculate a Payroll Transaction for Payroll Audit

Find a list of your pay runs and choose a few transactions that include overtime pay. Multiply the 40 regular work hours by the regular pay rate—for example, 40 x $20 regular pay rate = $600. Then, find your overtime pay rate by multiplying it by 1.5 or time and a half. For example, $20 regular pay rate x 1.5 = $30 overtime pay rate.

Finally, multiply the hours worked over 40 in the pay period (which could differ depending on your state) by the overtime pay rate. For example, 10 overtime hours x $30 overtime pay rate = $300 overtime pay. In this instance, the employee’s paycheck should reflect gross earnings of $900 ($600 regular pay + $300 overtime pay).

Verify Tips, Bonuses, and Commissions

If your business is in the restaurant, services, and sales industries, you need to verify that additional payments are being tracked and managed correctly. These include bonuses, commissions, and tips to staff. You should track these amounts as they’re earned and paid, and ensure the resulting employee pay matches on pay stubs.

If you’re using HR or payroll software, check to see if it can create tip reports; they enable you to view employee tip data, amounts, and dates paid. Bonus payouts should be classified as what they are instead of tagging them as regular pay. You should also have documentation in your files to support the payout. Plus, it should be clear what the bonus is for (such as performance and holiday bonus) and who approved for it to be paid.

As for verifying commission payments, dig a little deeper to find paperwork that shows how the commission payment was calculated. You should know how many sales the employees made and which products they sold to earn money.

Step 5: Run a General Ledger Report

Your general ledger (GL) shows every transaction that occurred within your company, making it an essential data source for conducting effective payroll audits. For payroll, you typically have expense and payable accounts. The expense accounts show what expenses your business incurred (like wage expenses), while the payable accounts show the amounts that your business owes others (such as Social Security, Medicare, and FICA taxes).

You’ll need to verify whether the amounts in your payroll records match what’s on the books—the accountant’s term for GL. If there are any amounts in your payroll records that you cannot trace back to the GL, you need to do some research.

Note that these records won’t reflect work hours paid but rather amounts paid. You need to trace the payroll transactions you choose to analyze for the audit throughout the entire process—from timekeeping system and payroll records to GL. You can start by choosing random transactions in the general ledger and work back to check that they align with your other records.

Verify Federal and State Tax Payments and Deductions

It’s important to review the taxes you’ve paid on behalf of your business in addition to the taxes you’ve withheld from your employees’ paychecks to remit to the IRS.

As you start reviewing your payroll tax general ledger accounts, spot-check a few W-4 forms to ensure you’re withholding the correct tax amounts for those employees and paying the right amount of taxes. Note also that regardless of whether you remit your payroll taxes quarterly or annually, there will be a delay from the time the expense and liability show up on your books until they are paid. You have to trace some of these transactions to ensure they are being handled correctly.

For example, when you pay quarterly taxes, the monies held from January to March shouldn’t still be sitting in the taxes payable account in September. The amounts will enter your taxes payable accounts as credits on each payday and then clear as debits when you pay the IRS. If the amounts in your tax payable accounts are steadily increasing throughout the year, even at the end of the quarters after payments should have been made, then there’s a problem.

If your payroll tax accounts don’t seem to be clearing properly, and you’re sure you’ve been paying the IRS, check the cash GL account. The best way to search is by dates. Find all transactions that are posted on and around the date you believe you paid the taxes—pull a receipt or some other tax documentation to help you pinpoint.

Look for the amount of the payment in the GL account, and once you find it, you should be able to see the other side of the transaction. If the other part of the transaction doesn’t show your tax payable account, that would explain why your accounts aren’t clearing. You’ll need to see where the charges are going and make some corrections to your books. This is essentially payroll accounting, so you may need to solicit help from your bookkeeper or certified public accountant (CPA).

Verify Non-Tax Deductions Are in the Correct Accounts

Most employers deduct monies from an employee’s paycheck for benefits, uniforms, or court-ordered judgments (like child support). You should verify if your payroll deductions are being booked properly by following a similar process to how we suggested you trace your payroll tax transactions—from beginning to end. This will confirm your end-to-end payroll deductions are functioning properly and whether you need to conduct further investigation into potential data discrepancies.

Look at the funds withheld on a payday and follow through to ensure those funds were credited to the correct account for holding and then immediately debited in the proper time frame. For example, 401(k) contributions and health insurance premiums can be sent to the provider every payday or at month’s end.

You should also look at a few pay stubs to check that benefits premiums that your employees are responsible for paying are coming out of their paychecks. Here are some of the employee deductions you should verify.

- Health insurance: Aside from checking whether health insurance deductions have been deducted from the correct employees’ payroll, you should verify that these are being placed in the right insurance payable account and timely payments are being made to the insurance carrier.

- Garnishments: What you’re looking for is whether payroll garnishments are being tracked and deductions are being made against the employees’ paychecks. You should also check if the withheld amounts are paid to the requesting agency on time and from a garnishments payable account.

- Retirement: Verify that the 401(k) employee and employer contributions are being sent to the bank at the end of each pay period and if the employer contribution amounts or percentages are correct.

You may want to consider having separate payables accounts for each vendor and deduction type. For example, businesses in states that require employers to provide commuter benefits can set up a separate account for the said item. This makes payroll accounting and payroll auditing easier for you.

Verify If Payroll Account Data Matches Bank Account Data

By looking at bank account statements and comparing them to your payroll cash GL account, you can see whether there are amounts being paid out of the cash account that don’t belong. You can also find if some employees haven’t cashed their final checks or a payroll amount was paid twice to the same worker. These are issues you’ll want to address.

If you have terminated employees whose unclaimed final paychecks have gone stale, then you have to void and reissue the checks. To avoid this situation, we recommend reaching out to these employees a reasonable number of times. If you’re unable to reach them, you need to send their checks to the state as unclaimed funds.

Step 6: Look for and Document Any Atypical Transactions

This is where you’re doing a gut check and looking for anything that’s out of the norm. If you see an employee is paid $2,600 every pay period for three months and, all of a sudden, they receive a $5,000 paycheck, you should look into it. If you notice a garnishment payment that seemingly starts all of a sudden, and you have no knowledge of it, dig deeper.

Here are some atypical transactions to look for and monitor.

- Retro Pay: This is typically a line item that’s added to an employee’s paycheck when you’re paying them after a payroll mistake has been made in a prior pay period. Maybe they got a raise, but it wasn’t processed on time, or perhaps they forgot to tell you they worked six hours on a Saturday. The applicable retro pay amounts are then added to their current paycheck. However, these transactions should be infrequent.

- Back Pay: Back pay is due when you’re ordered by a government agency to pay a person for prior pay period items—such as miscalculated overtime pay, having paid a worker below minimum wage, and docking an employee’s pay illegally. In cases of wrongful termination, back pay may be ordered by the court as part of the judgment. If you find yourself being ordered to pay back pay often, then it indicates that you have an HR or payroll compliance problem in your business that you have to fix going forward.

- Garnishments: Garnishments (like child support) are managed differently in different states, plus the IRS may also garnish a person’s wages for back taxes. You should ensure that the correct amounts are being deducted and paid, and that garnishment documentation is on file for payroll record-keeping purposes.

- Freelancer Pay: Review 1099 Form and W-9 Form copies. In addition, you should ensure that your business is not expensing payroll taxes on the amounts paid to freelancers and that your freelancers are classified correctly to avoid tax penalties.

Step 7: Reconcile Payroll Accounts With Bank Account

Besides the GL, take a look at the specific bank accounts you have set up to manage payroll (like employee paychecks and direct deposit transactions) and payroll tax payments. Here are data items that you should verify.

Make Sure the Numbers Match

There are times when banks make mistakes, such as issuing paper checks when you have all your employees signed up on direct deposit and fees or reversals on your bank statement that don’t look right. Compare what’s in your GL accounts versus the balances and transactions in your bank accounts used for payroll processing—make sure that the data they reflect line up.

Look for Any Uncashed Checks

Checks that have gone uncashed for a year or more need to be managed according to your state’s escheat laws, commonly known as unclaimed property laws. The check amount belongs to the employee, but how you handle it varies by state. Check your state’s regulations on how to turn over unclaimed funds to a state agency.

Confirm Tax Payments Are Made Correctly and Timely

Compare your bank statement to the tax agency due dates so you can determine whether or not tax payments are being made on time. Even if you’re working with a third-party payroll software or service that manages your tax payments, you should still check these transactions since mistakes can happen. Note that in those cases, you—not the payroll processor—are typically liable for late tax payment penalties.

Why You Need a Payroll Audit

Payroll audits can help you check the accuracy of your company’s payroll processes. It works as a risk-avoidance tactic to prevent you from making mistakes that may end up being costly to your company and business reputation. For payroll audits, you typically examine and verify data across various software systems and tools that manage your staff data, such as pay rate, overtime rules, pay type (like salary vs hourly), and employee job classification (exempt vs nonexempt).

Auditing also helps you uncover payroll-related fraudulent activity and innocent mistakes. For example, a staff member may have switched to part-time but is still being paid a full-time salary. On the more nefarious side, a staffer with access to payroll and bank accounts can deduct money from one account to pay themselves extra. Your payroll audit will likely catch that.

One of the best practices to avoid potential fraudulent payroll activities is to have separate individuals managing employees, timekeeping, and payroll data. If HR can add a new hire, they shouldn’t be allowed to also make payroll changes. Instead, you need segregation of duties to eliminate any temptation for staffers to steal from you. Payroll audits then verify that your processes are being followed.

Tips for Effective Payroll Auditing

To ensure your payroll audits are effective, here are some tips:

- Make sure you understand payroll laws. It’s important to have a clear understanding of the payroll laws at the federal level but also in your state and every state where you have a remote employee. Certain jurisdictions have specific rules and regulations for overtime, minimum wage, and employee classification which could significantly impact your payroll.

- Regularly conduct payroll audits. While the frequency of payroll audits may vary depending on the size and nature of your business, it’s generally recommended to conduct one at least annually.

- Use payroll software. Using automated payroll systems can reduce human errors and make the auditing process simpler. However, it’s important to periodically review the system’s settings to ensure accuracy.

- Work with a professional. If you’re unsure about conducting a payroll audit yourself, consider working with a CPA or other payroll audit professional. They can provide valuable insights and help ensure compliance.

- Be transparent with your employees. Keep your employees informed about the payroll audit process. Transparent communication can alleviate concerns and ensure smooth cooperation from all parties involved.

Payroll Audits Frequently Asked Questions (FAQs)

Can I conduct a payroll audit myself?

Yes, whether you’re a small business owner or an HR or payroll employee, you can conduct the audit yourself. However, it’s important to understand the complexities involved, including multiple state laws if you have remote workers. If you’re not comfortable or familiar with these regulations, consider seeking help from your payroll provider or CPA.

How can I prevent payroll errors in the future?

Implementing a reliable payroll system, providing proper training to those who handle payroll, and conducting regular audits can significantly reduce payroll errors and costs. Keeping updated with changes in labor and tax laws also helps ensure compliance and accuracy.

What are some common payroll errors I should look out for during an audit?

Common payroll errors include incorrect employee classification, miscalculated overtime pay, inaccurate tax deductions, and missed or late payments. These can result in significant penalties if not corrected.

What are the consequences of not conducting regular audits?

Failure to conduct regular payroll audits can lead to undetected errors, overpayment or underpayment of employees, non-compliance with labor and tax laws, and potential legal issues. Regular audits help mitigate these risks.

How can a payroll audit help improve my business operations?

Besides ensuring compliance and accuracy, a payroll audit can reveal inefficiencies in your payroll process. The insights gained from an audit can help you streamline operations, save time, and potentially reduce costs.

Bottom Line

You don’t have to wait until year-end to do a payroll audit. Listen to your gut. If something looks or feels off in your accounting system or payroll bank account, it’s time to investigate. After all, it’s your money at risk and your business reputation at stake if payroll violations that you aren’t aware of crop up. By doing regular payroll audits, you can avoid getting fined for late taxes or sued for unfair pay practices.