Financial Cents is a cloud-based accounting practice management software designed to help you effectively manage your projects and streamline workflows. Our Financial Cents review will discuss the program’s pricing, pros and cons, and most notable features, including effective hourly rate reporting, capacity management, and client request management. The program costs $49 per user, per month, and you can try it for free for 14 days with no credit card required.

Financial Cents Alternatives

| ||

|---|---|---|

Best for: Firms seeking an all-in-one accounting practice solution | Best for: Firms that hire temporary or seasonal staff frequently | Best for: Firms with clients using Xero |

Cost: Quote-based | Cost: $1,500 per year | Cost: Free |

Financial Cents New Features for 2023

- Drag and drop within the client portal: Your clients can select files from their computer and drop them into the desired location within their portal, making it easy for them to upload requested documents.

- Set the date and time for when client reminders are sent: This new feature allows you to indicate the date and time for automated reminders to be sent to clients. Note that you can’t customize this feature on a client basis.

- Detailed time tracked: You and your team can now view the total time tracked for the day by clicking the “Track time” drop-down on the upper right-hand corner of your dashboard.

- Email templates: Financial Cents now provides email templates to help you standardize client communication.

Financial Cents Pricing

Financial Cents costs $49 per user, per month, when billed monthly or $39 per user, per month, when billed annually. You can sign up for a 14-day free trial with access to all of its features.

Financial Cents Features

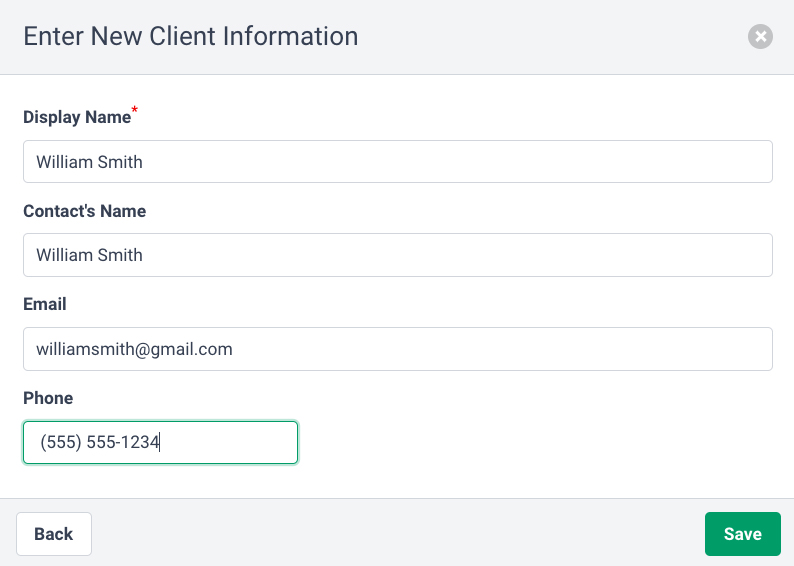

Financial Cents allows you to add a new client and manage client information, including contact and company details. To add a new client, you can either enter one manually or import your list of clients through a spreadsheet or QuickBooks. It’s easy to add a new client manually as you only need to complete a few fields, including the client’s name, email, and phone number.

New client setup form in Financial Cents

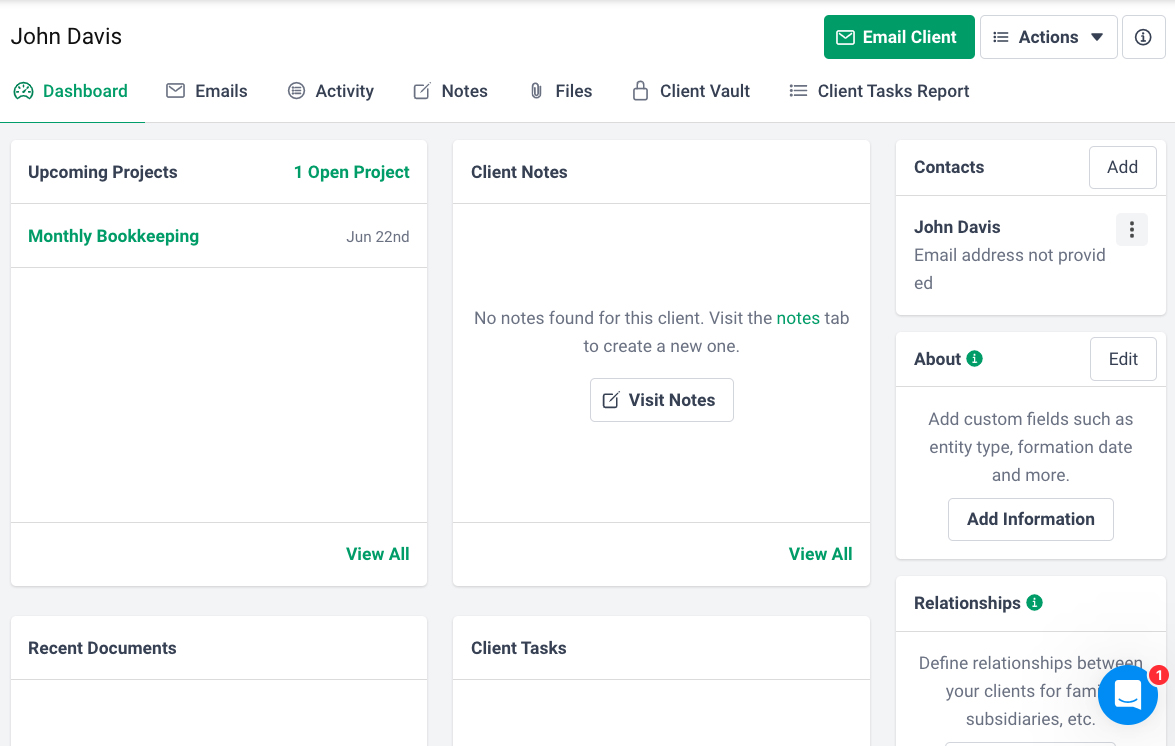

Once a new client is added, you can manage their profile by clicking on the client’s name under the Clients tab on the left sidebar.

We like Financial Cents’ client management module because each client has their own dashboard, where you can easily view and track important information, including activity history, client notes, and projects associated with the client. Also, you can integrate your email with their profile, share files, and access reports particular to a client.

Client profile management dashboard in Financial Cents

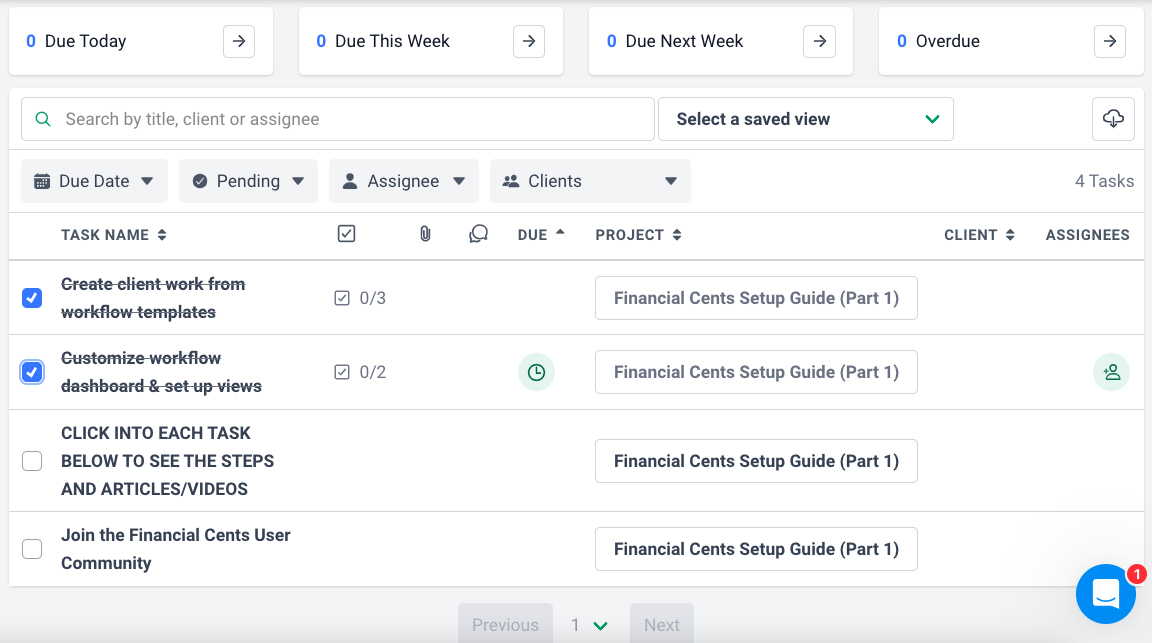

Financial Cents’ project management feature, found under the workflow module, allows you to create a project and assign it to team members and clients involved in the project. You can specify deadlines and add tasks and subtasks to break down larger projects into smaller, more manageable components.

To track the status of tasks and projects, Financial Cents offers three options: pending, completed, and snoozed. This feature allows you to monitor task progress in real-time and easily identify which tasks are still pending, which ones have been completed successfully, and which ones may have been postponed or temporarily put on hold.

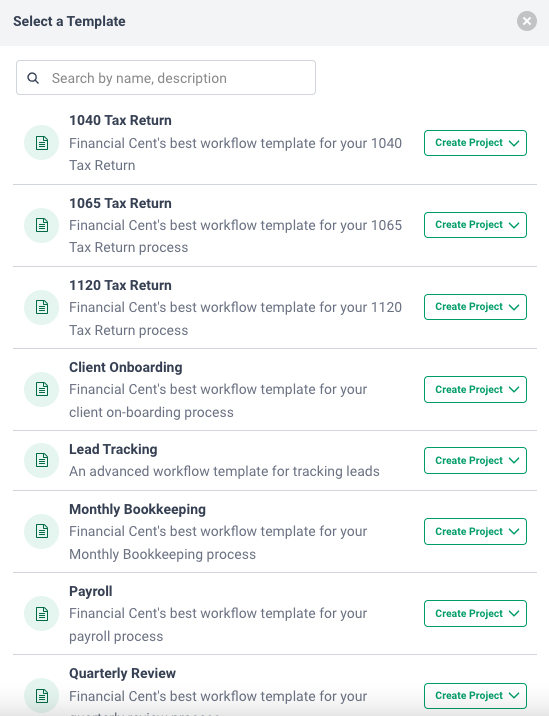

You can create projects in three ways: from scratch, an existing template, or a new template. For common projects such as client onboarding, monthly bookkeeping, and quarterly review, Financial Cents offers templates as starting points. You can use these templates and then customize them as needed.

Project templates available in Financial Cents

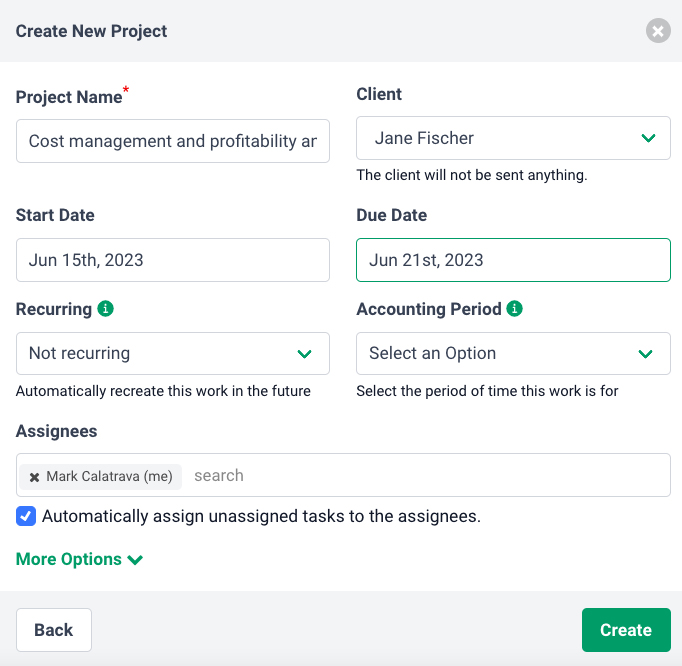

If you have a new or unique project that doesn’t fit into any existing templates, then you can create a new project from scratch.

Creating a new project from scratch in Financial Cents

Additionally, Financial Cents includes a task checklist feature that provides a list of specific action items within each task. As you progress through the task, you can mark off each item on the checklist as it is completed.

Task checklist feature in Financial Cents

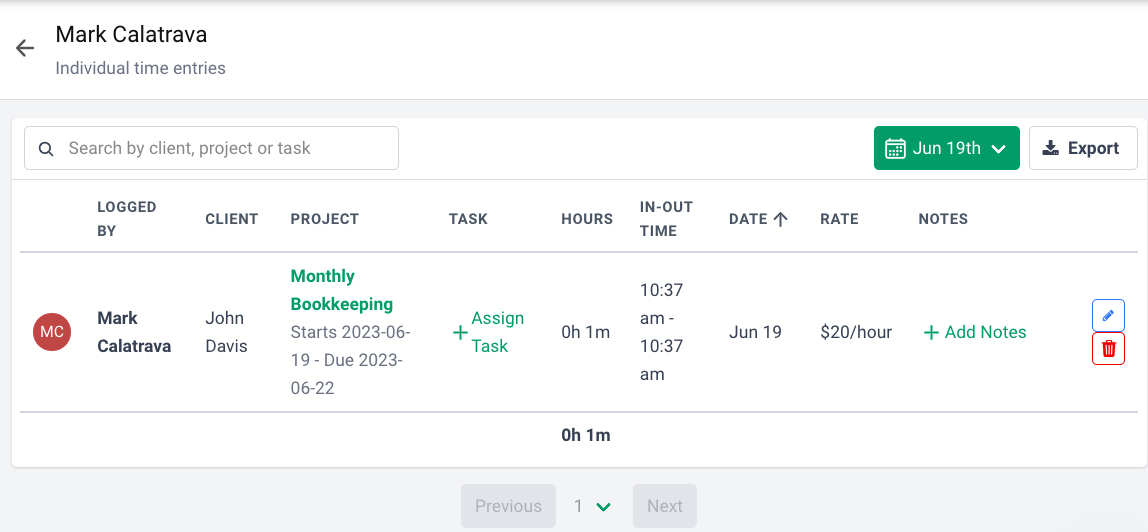

To track billable time, you can use Financial Cents’ built-in time tracker or enter time manually. You can start, stop, and pause the timer as you work on billable activities. When you stop the timer, Financial Cents automatically records the time and associates it with the corresponding task. The time entry shows the relevant details, such as the client and project, the number of hours worked, the rate, and the option to add a new task and notes.

Sample time log in Financial Cents

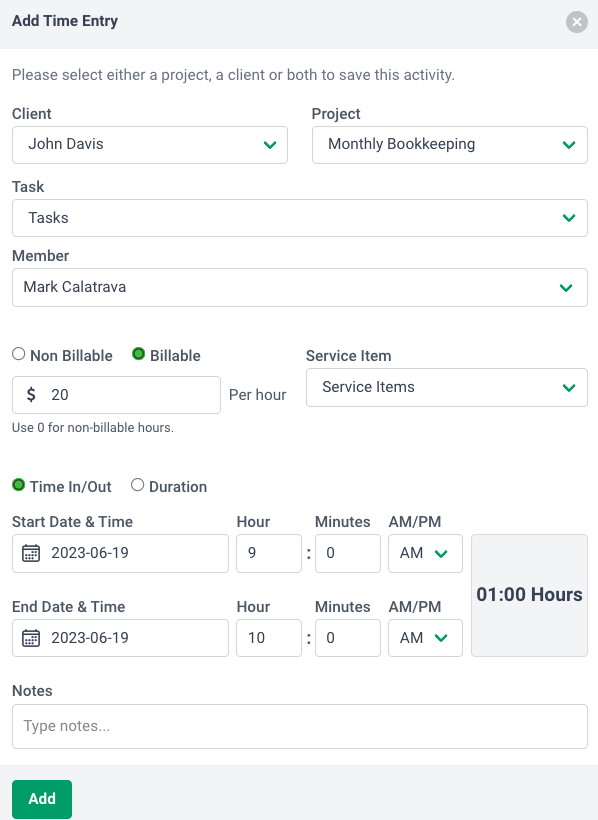

For manual time entry, you just need to enter the time-in and time-out on the Add Time Entry form, and the program will automatically calculate the total number of working hours.

Adding a time entry manually in Financial Cents

Financial Cents has no built-in billing feature, but it integrates with QuickBooks Online so that you can send invoices to clients. This integration allows you to sync your time entries in Financial Cents with QuickBooks Online, eliminating the need to manually transfer the time into the system. Once the time entries are transferred, you can use QuickBooks Online’s invoicing feature to create, customize, and send the invoices to your clients.

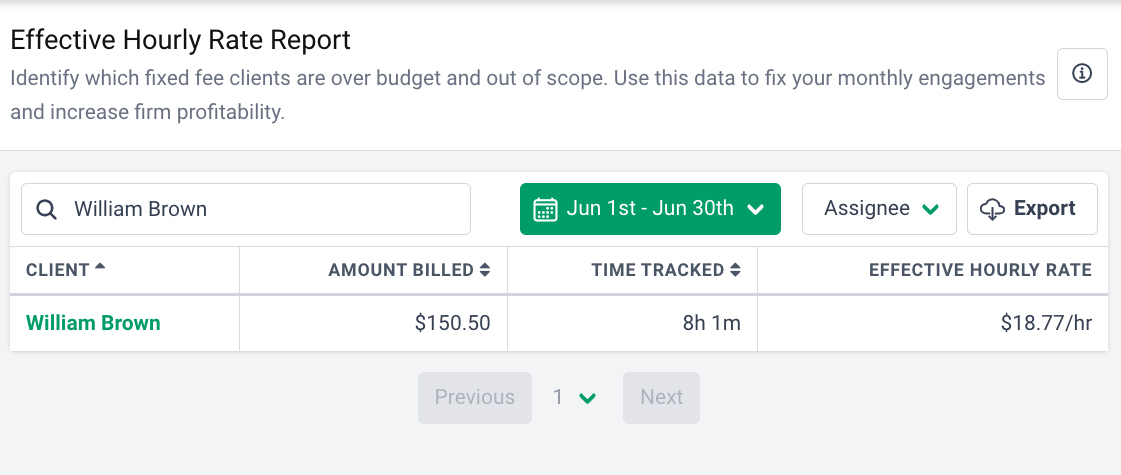

The Effective Hourly Rate report, found under the Report module, is one of the best features of Financial Cents. It provides an overview of your firm’s earnings per hour for the services provided to each client. To calculate the effective hourly rate, Financial Cents divides the amount billed by the hours tracked. The result shows the average earnings earned per hour of tracked time for the client.

The Effective Hourly Rate report can be used to evaluate the profitability of your engagements, track how effective you are using your time, and identify areas where adjustments may be needed. For instance, if the effective hourly rate is relatively high, it means you are generating a substantial amount of revenue for each hour worked—indicating efficient pricing strategies.

Sample effective hourly rate report in Financial Cents

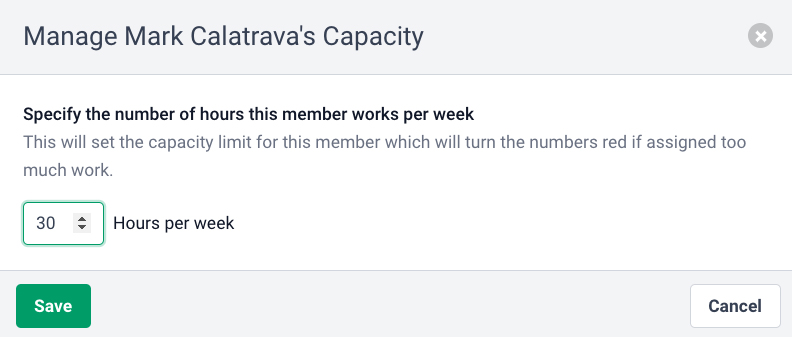

To ensure that everyone has sufficient time to complete their work on schedule, Financial Cents allows you to set the number of hours team members work every week. Also, you can easily track how much work is assigned to each team member so that you’ll know who may have too much work on their plate and who needs additional work.

Setting up expected weekly hours for a team member in Financial Cents

The capacity management report shows the number of hours that each team member is over their capacity. This data can help you determine if there are workload imbalances and whether you need to make some adjustments to the team’s workload.

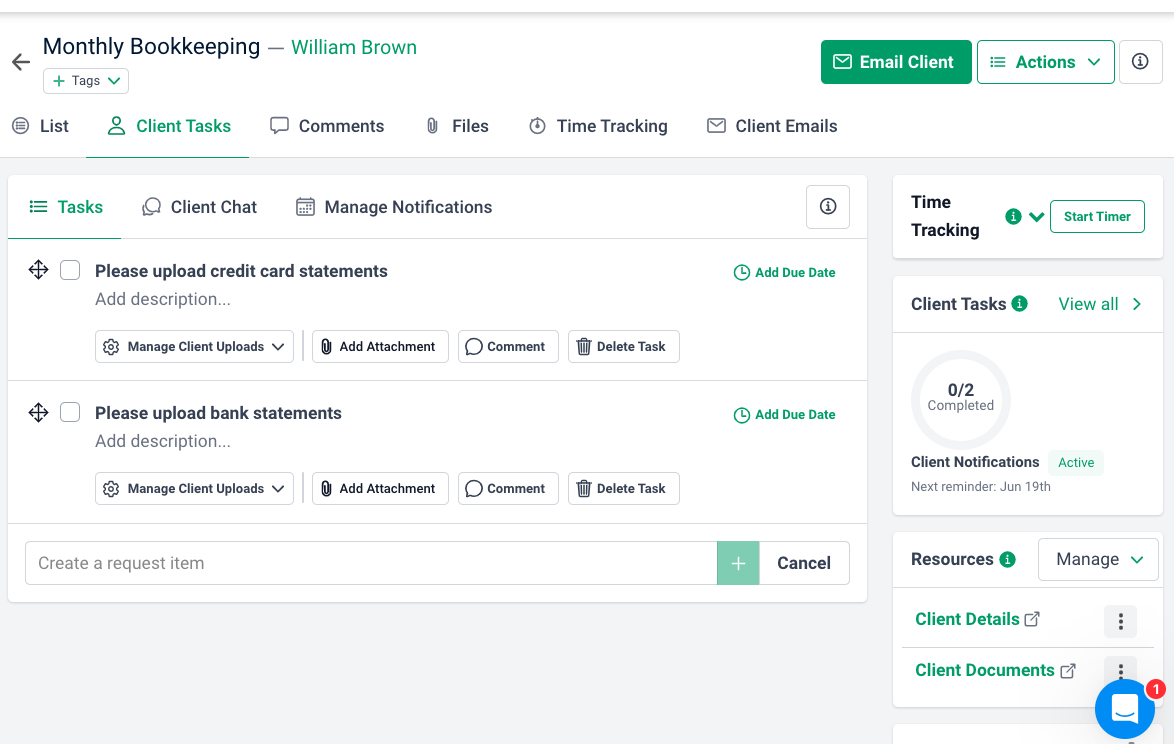

This feature allows you to request specific information or documents from your clients, making it easy for you to collect necessary data for accounting and financial tasks. To create a client request, click on the project involved from the Projects tab.

For instance, for a “Monthly Bookkeeping” project, you may create a request for your client to upload their latest bank or credit card statements. They can then view the request list and access the tasks assigned to them via the client portal.

Setting up requests for clients in Financial Cents

Instead of having a dedicated document management module, files are stored within individual profiles, tasks, and projects. While this may be a convenient approach if you have few clients or projects, it can be challenging for firms with a large client base and those managing a large volume of projects daily.

Additionally, Financial Cents lacks certain time-saving features commonly found in dedicated document management systems, such as a search capability. For instance, you can’t search by document name, keywords, tags, or even content within the documents. Instead, you have to manually browse through profiles and projects to find the desired files. TaxWorkFlow has a more enhanced document management feature as it allows you to locate files using keywords.

In addition to effective hourly rate reports, Financial Cents allows you to generate reports on billable and non-billable hours, capacity management, client requests, and team activity. The reports are a bit basic, but they still provide valuable information to track different important aspects of your firm. For example, the time tracking reports provide an overview of how time is being allocated within your team.

Sample time tracking report by project in Financial Cents

Financial Cents Ease of Use & Customer Service

While Financial Cents generally is easy to use because of its simple user interface (UI), it still requires some time to learn and navigate because of the interconnected workflows, such as how tracking time within the program is tied to the creation of projects for clients. This means that you need to create a project or task first for a client before tracking time.

To help new users navigate the platform, Financial Cents offers different customer support options. You can talk to an agent through chat or contact them by phone or email. There are also plenty of helpful guides that you can use, including blogs and tutorial videos.

Financial Cents Reviews From Users

Users who left Financial Cents reviews said that the platform is easy to set up and use. Many appreciate its robust features, such as the ability to track profitability by hour and project and automatically send reminders to clients. Others like that it’s easy to create new projects, especially with the use of pre-existing templates. Meanwhile, we found very few negative reviews, which include the lack of e-signature capability and the inability to import project templates.

Here’s how Financial Cents is rated by users on popular review websites:

- G2[1]: 4.8 out of 5 based on more than 60 reviews

- Capterra[2]: 4.8 out of 5 based on about 90 reviews

Frequently Asked Questions (FAQs)

Financial Cents is an accounting practice management software that helps you automate various aspects of running an accounting firm, such as project management, time tracking, client collaboration, and reporting.

Yes, it is. Financial Cents is designed for small and midsized accounting firms.

Yes, Financial Cents is generally easy to use. However, it may still require some time to learn and familiarize yourself with the program’s features and workflows.

Yes, and this integration provides additional functionality to Financial Cents, including invoicing.

You can generate different types of reports, including time tracking, capacity management, client tasks, effective hourly rates, and team activity reports.

Bottom Line

Financial Cents offers many benefits for firms and accountants, including strong project management and time tracking, effective hourly rate reporting, and the ability to manage client requests and team capacity. However, it also has some drawbacks, such as the lack of built-in invoicing and limited scalability due to its single pricing plan. That said, evaluating your specific needs is best to see if Financial Cents is right for you or if you’re better off with an alternative, such as OfficeTools Workspace, TaxWorkFlow, or Xero Practice Manager.