TaxWorkFlow is a tax and accounting practice management solution that helps tax firms and professionals speed up their accounting and internal and client-facing communication processes. It’s a unique hybrid solution that combines the speed of desktop software and the accessibility of a cloud-based app.

The program offers a centralized platform for managing tax-related processes, making it ideal for tax firms that provide ongoing services, such as annual tax returns and monthly bank reconciliation. TaxWorkFlow is priced at $1,500 per year for unlimited users and the price will never increase as long as you remain a customer. Unfortunately, there aren’t any monthly plans available. To determine if it’s suitable for your firm, you can weigh the pros and cons after reading this in-depth TaxWorkFlow review.

We understand the importance of choosing the right accounting practice solution for your firm, so are committed to providing you with credible software reviews—as outlined in our Fit Small Business editorial policy. We don’t just rely on surface-level evaluation. We dive deep into the system’s features and objectively analyze other aspects, such as pricing and customer support. To avoid any biases, we use an internal scoring methodology that allows us to assess each software objectively across key criteria.

Pros

- Price will never increase

- Includes customer relationship management (CRM) features, including the ability to create email marketing campaigns

- Supports an unlimited number of users

- Has a convenient client-facing tax portal

- Strong project management features, including the ability to set up recurring projects

- Integrates with several accounting solutions, including QuickBooks

Cons

- Desktop software requires installation

- Bookkeeping software must be purchased separately and then integrated

- No direct access to your client’s books

- Limited mobile app; can’t be used to send invoices

TaxWorkFlow Alternatives & Comparison

TaxWorkFlow Reviews From Users

As of this writing, we haven’t found any TaxWorkFlow reviews. We recommend conducting further research or reaching out directly to the provider to learn more about their user satisfaction.

TaxWorkFlow vs Competitors

We conducted a comparative scoring rubric to evaluate how TaxWorkFlow stacks up with our recommended alternatives based on key criteria. The chart below sums up our findings:

TaxWorkFlow vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

TaxWorkFlow $1,500 per year Secondary Series (More faded, in the background, than the primary series)

-

QuickBooks Online Accountant Free

-

Xero Practice Manager $149 per month

-

Jetpack Workflow From $56 per user monthly

While TaxWorkFlow didn’t stand out in any of the criteria, it does excel in some aspects. For instance, it has a more extensive accounting practice feature set than Jetpack Workflow; thanks to its additional features like CRM and document management.

TaxWorkFlow also did well in ease of use due to its Windows-based interface (discussed in detail in the ease of use section). However, we believe QuickBooks Online Accountant is a bit easier to use since it doesn’t require installation and setup, which is the case with TaxWorkFlow.

TaxWorkFlow lost in pricing because of its hefty annual one-time fee. Xero Practice Manager and Jetpack Workflow offer scalable monthly plans, while QuickBooks Online Accountant, the winner for pricing, is available for free.

TaxWorkFlow is priced at $1,500 per year and doesn’t have monthly plans, which we believe are a more scalable option for most accounting and tax firms. However, we like that the TaxWorkFlow pricing structure supports an unlimited number of users and the price will never increase as long as you remain a customer.

Tip:

New users can sign up for TaxWorkFlow for free for six months without subscription fees or initial deposits. This limited-time offer is an effort by TaxWorkFlow to help businesses stay productive during the COVID-19 pandemic.

If you choose TaxWorkFlow to manage your firm, you’ll also need to choose a separate bookkeeping software. Check out our review of the best small business accounting software for help.

We found TaxWorkFlow’s accounting practice management features quite impressive. It would have earned a perfect score if it offered a payroll module and the ability to directly access your client’s books from the platform. However, it still comes with a wide range of features that help you streamline your accounting practice workflows.

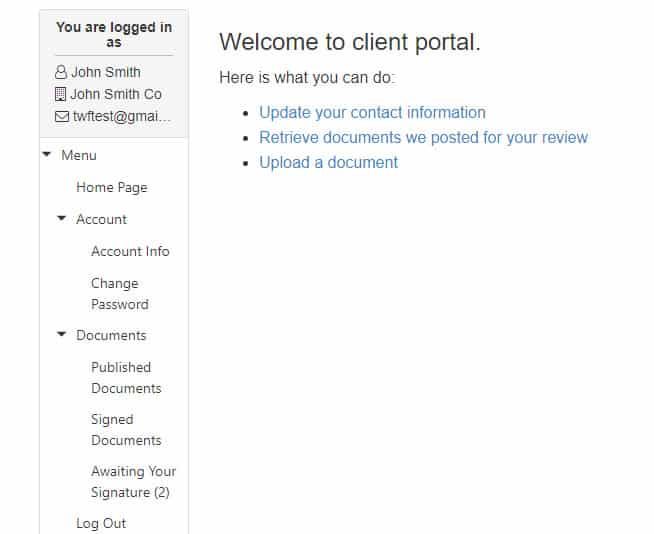

This gives you access to your client’s files, and it integrates with the document management system. Your clients can use the portal to upload documents securely to the TaxWorkFlow database, which you’ll be able to access. Client appointments, documents that need to be signed, and invoices to be paid can also be viewed from the client portal.

TaxWorkFlow Client Portal (Source: TaxWorkFlow)

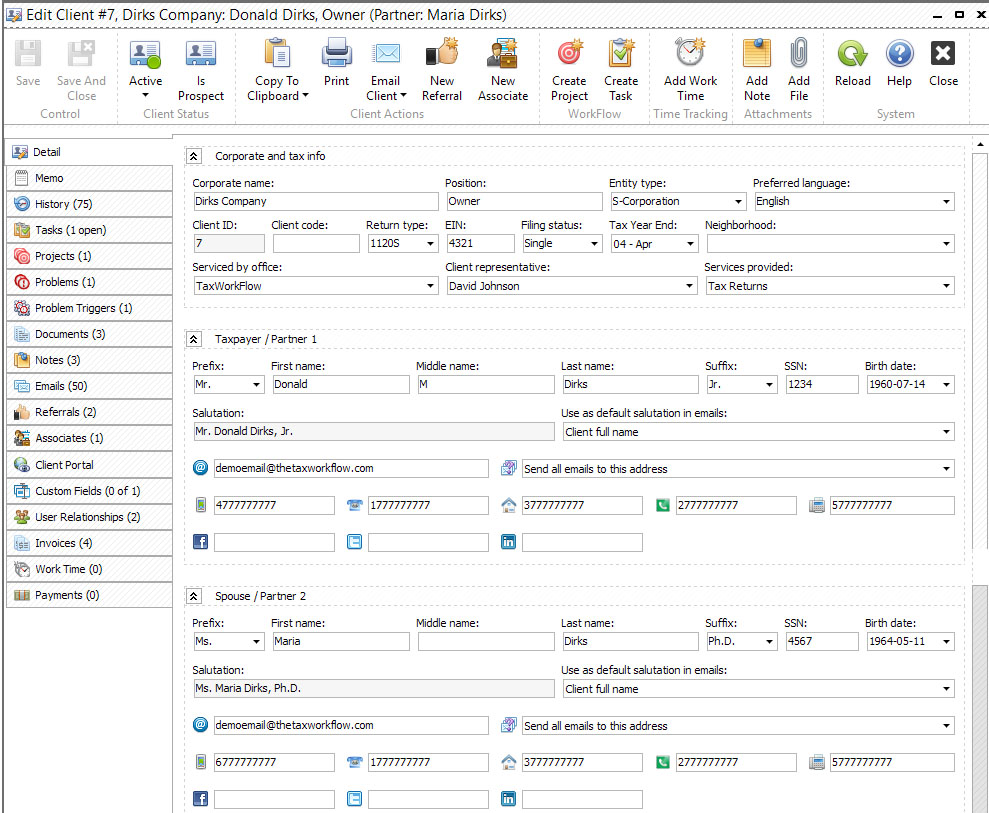

You can look up your clients quickly with a keyword search, and the dashboard itself is customizable. You can add or remove columns or group clients by various criteria, such as by state or entity type.

When you open a client’s record, on the left navigation bar, you’ll see all the relevant information about various aspects of the client record. You can take notes for the client with an embedded timestamp, which can be used as a historical record of the information you have updated.

TaxWorkFlow’s client management system (Source: TaxWorkFlow)

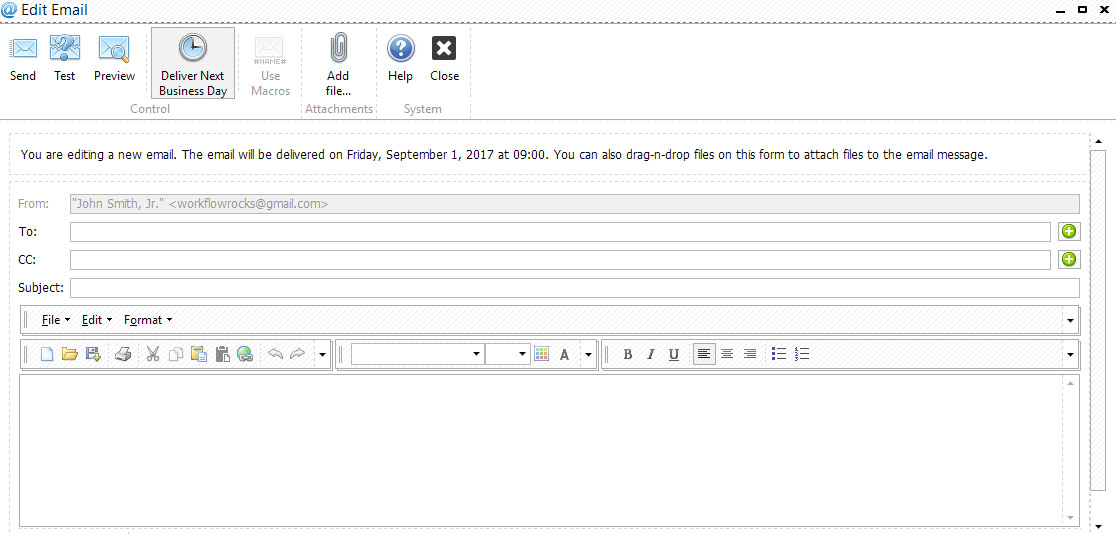

The ability to store emails inside TaxWorkFlow enhances your productivity because you can assign emails to a task or create projects from the email easily. The built-in email integration feature captures emails from your client so that you can retain correspondence for historical purposes and reply directly within the software.

Another feature of the workflow is problem-solving, in which email communications can be used to solve those problems. There are different email templates available for different situations like birthday or holiday greetings. These can be customized to be used for a certain context so that you don’t have to type the same information repeatedly.

From the email management dashboard, you can execute several tasks, such as Edit Email Reply, Reply All, Forward, Assign Email to a Client, Assign Email to a Project, and Assign Email to a Task:

Edit Email form in TaxWorkFlow (Source: TaxWorkFlow)

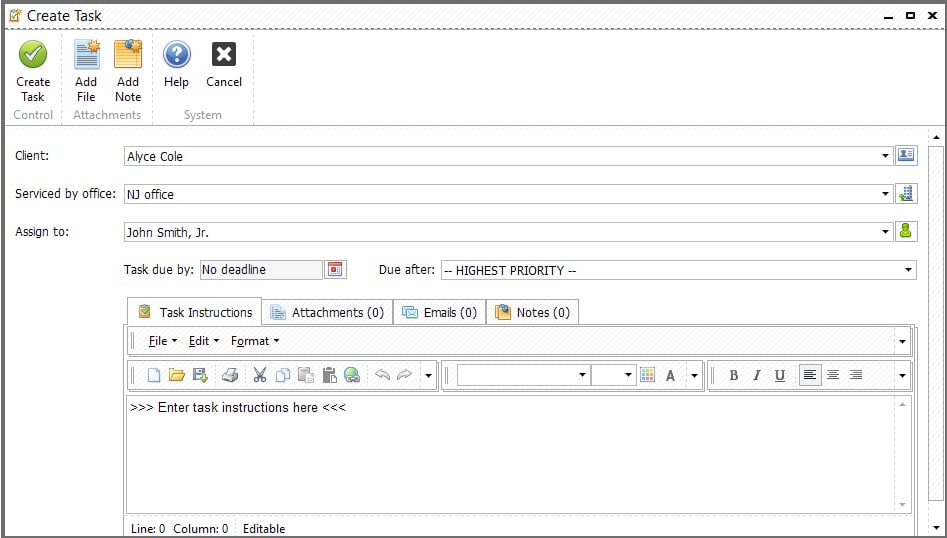

TaxWorkFlow enables you to create a task and assign it to a team member and track the status until it’s completed. You can create a new task, such as interview client, review file, or print tax return, from the Create task page under the Workflow menu. You can specify the deadline and priority level and add instructions or attach notes if needed.

Creating a new task in TaxWorkFlow (Source: TaxWorkflow)

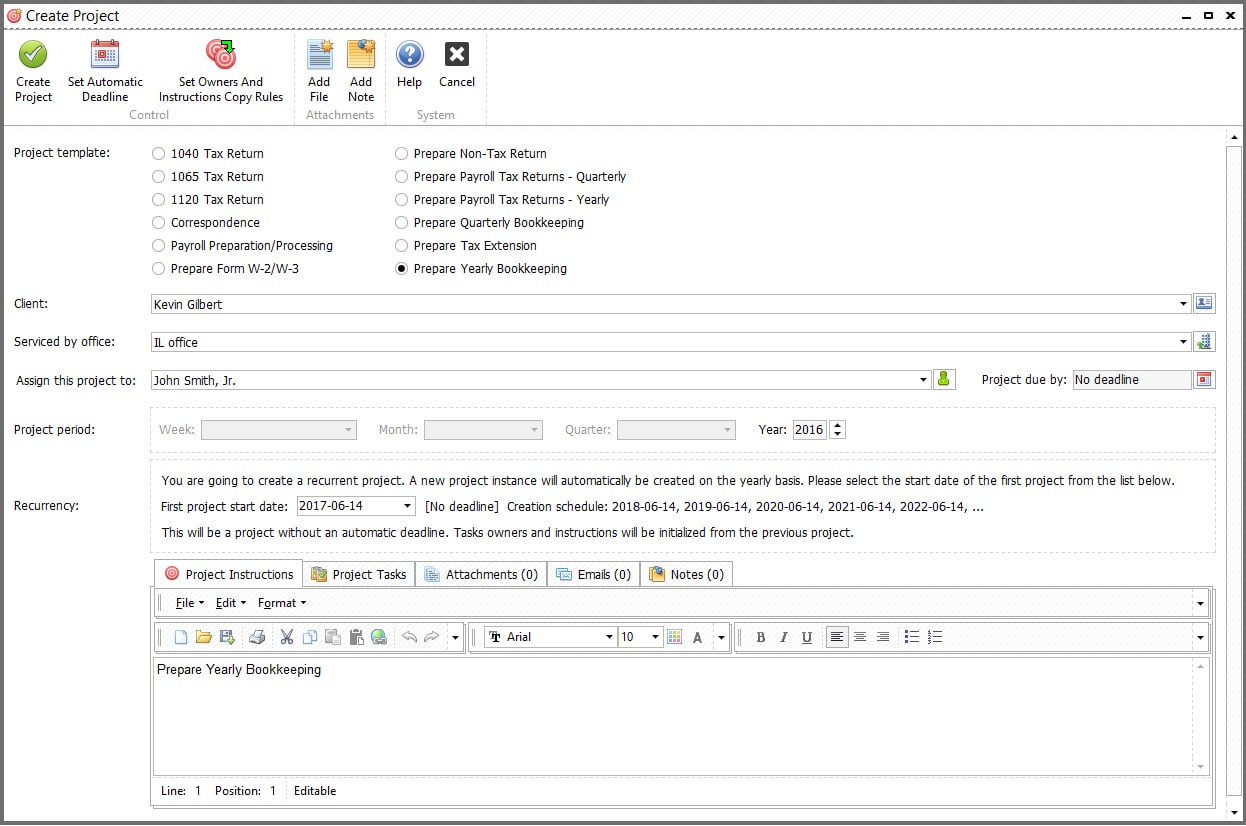

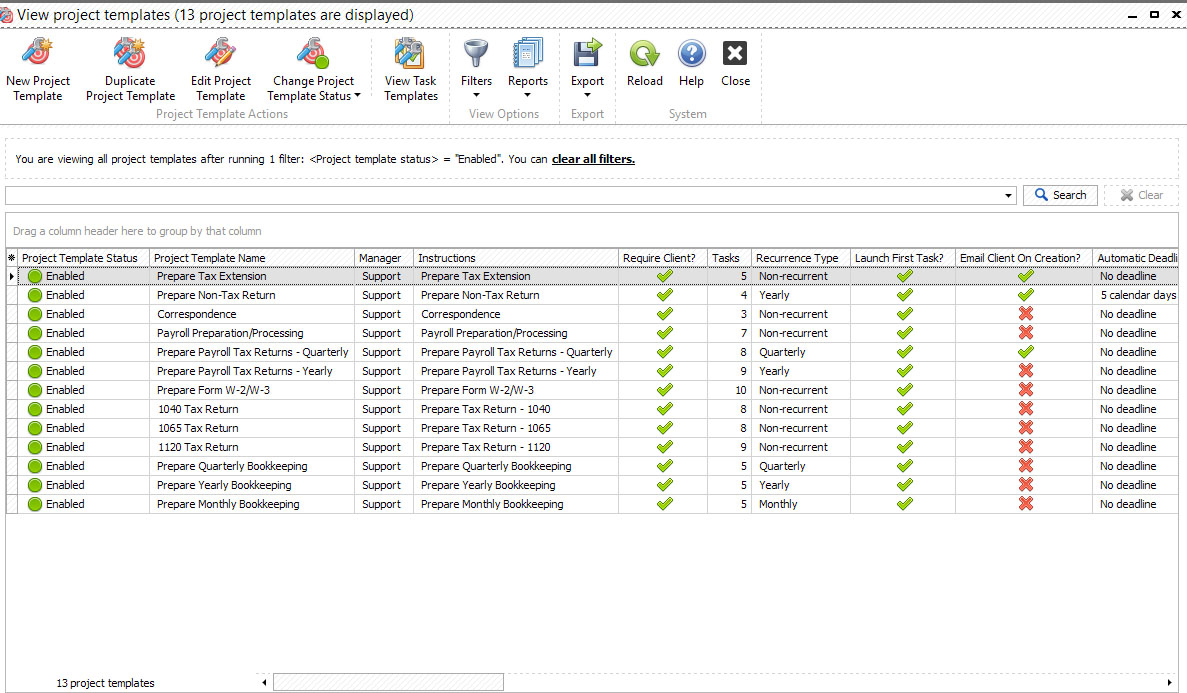

If you have multiple tasks to manage, then you can organize them into projects. Projects in TaxWorkFlow are a group of tasks that include a predefined set of instructions in sequential order. Projects are useful if you use the same sequence of steps for different clients.

To add a new project, click on Workflow and then select Create project. You can create a project from a template, assign it to a client or project manager, and add deadlines. You can also set up recurring projects or duplicate them if you need to use the same instructions in your existing project as well as attach files, including expense reports and bank statements.

Creating a new project in TaxWorkFlow (Source: TaxWorkflow)

The workflow is a combination of the project, task, and problem. It’s driven by templates, just like emails or documents. There are templates for your projects, your tasks, and your problems, and they describe how it operates.

For example, a sequence of steps created by your staff in a certain order would comprise one workflow. These steps can be customized, and you can also define the rules and how you would like to route tasks to different people. Essentially, you can delegate task management to TaxWorkFlow using workflow rules.

Workflow management system in TaxWorkFlow (Source: TaxWorkFlow)

You can add new staff users to TaxWorkFlow by sending them an email invitation. You can customize their data access based on their roles in the company. The system also allows you to create a task, track how much time your staff uses on a project, adjust priorities as needed, and create productivity reports based on their performance.

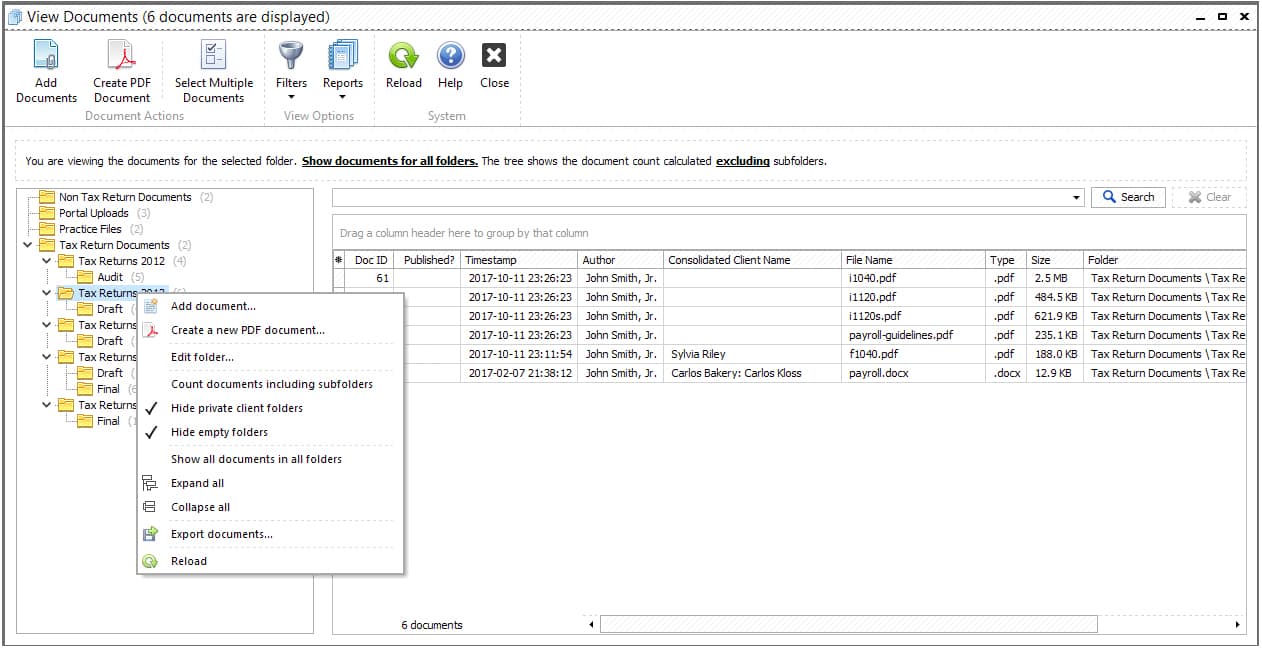

Document management is very similar to email syncing because you can set up TaxWorkFlow to sync a folder or many folders that contain your client’s documents. It gives you more syncing options because you can sync multiple locations into one single database.

There are many ways that you can put documents into TaxWorkFlow. You can attach these documents to tasks or projects, and they’ll end up in the document management system. You can drag and drop them or attach files from your local file system. The system is flexible enough to accommodate various acquisitions and delivery of documents to and from your clients, which are organized into folders.

TaxWorkFlow’s document management system (Source: TaxWorkFlow)

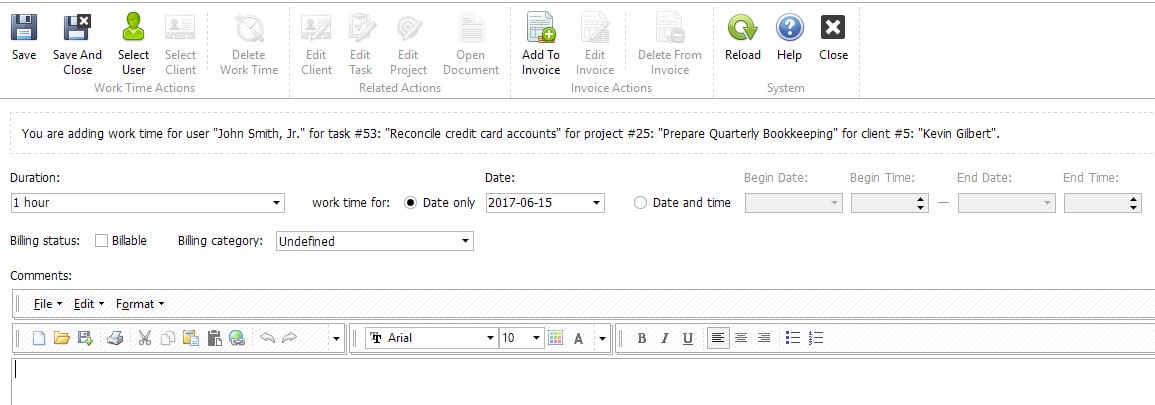

TaxWorkFlow lets you automatically track billable time by using the time tracking buttons in the toolbar. Click the “Begin work” button to start tracking time and click “End work” to finish recording. Alternatively, you can add time entries manually by clicking the “Add work” button.

When entering a work time, you need to select the user for whom you want to record a time entry. You can specify the duration, change start and end work data and time, and mark the billing status as billable.

Adding a time entry manually in TaxWorkFlow

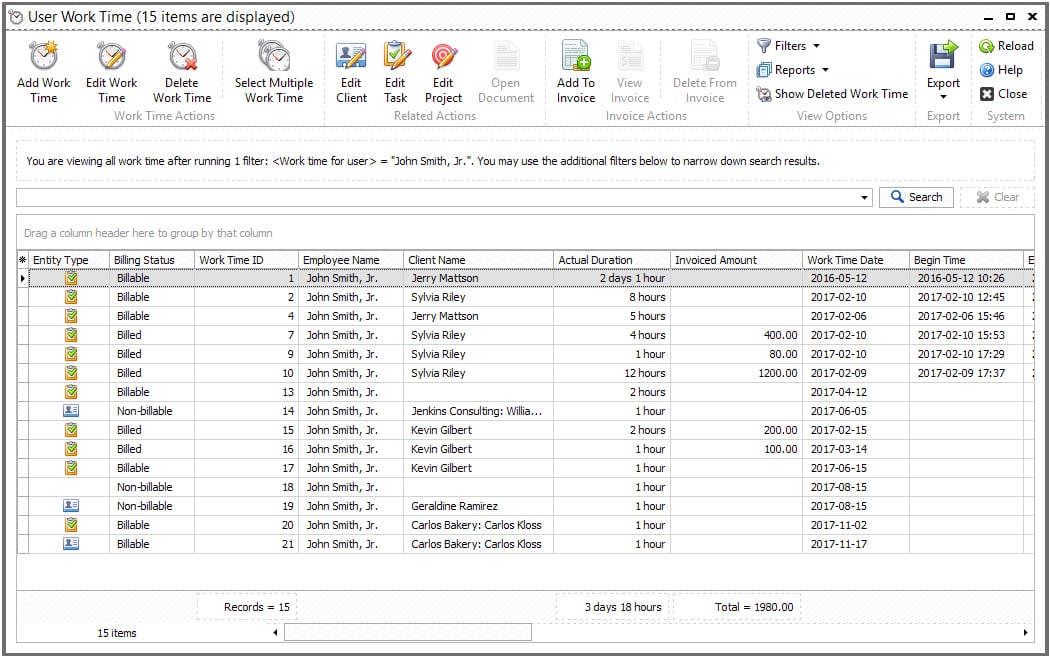

Time entries can be converted into an estimate or invoice, which can be emailed to your clients. To view work time by your staff, click on the Billing menu and select View User Work Time:

View work time in TaxWorkFlow (Source: TaxWorkFlow)

TaxWorkFlow is not a dedicated accounting software, but it could have been more useful for accounting firms if it had all the essential bookkeeping features we wanted to see. However, while it has some missing important tools, like A/P management and bank reconciliation, you can still count on its invoicing, project accounting, and project reporting tools.

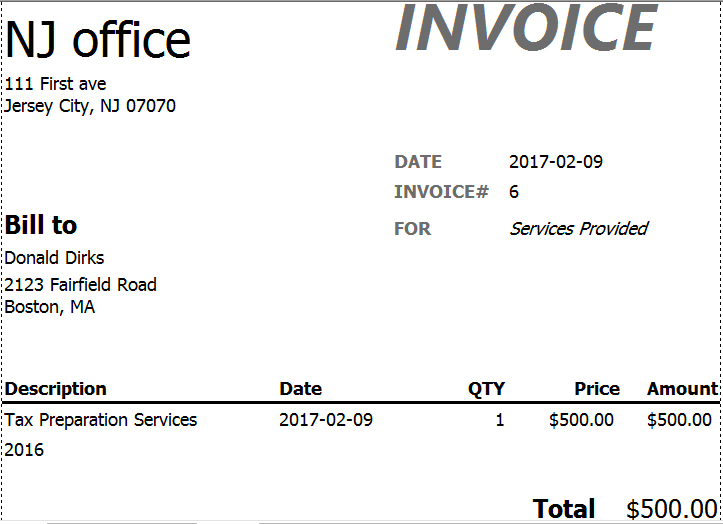

You can create an invoice quickly in TaxWorkFlow using the invoice wizard. Before you use the wizard, you need to add prices for the services you offer. Once the prices are set, go to the Billing page and click on Services Invoice Wizard.

The invoicing form lets you add details, such as work time item, invoice credit item, and referral credit. Unfortunately, TaxWorkFlow’s invoices aren’t as professional and customizable as other solutions like QuickBooks Online and FreshBooks.

Sample invoice created in TaxWorkFlow (Source: TaxWorkFlow)

With TaxWorkFlow, you can create, manage, and track project-related tasks and information. You can assign projects to multiple team members, and you can create projects in bulk if needed. If you have regular tasks, you can set up recurring projects so that you don’t have to enter the required information every time you create a project.

You can choose from prebuilt project templates, and if you don’t find one that fits your needs, you can create a customized template. We also like TaxWorkFlow’s in-depth project tracking, particularly the ability to view completed or scheduled tasks and manage problems associated with each project. Also, there’s an accessible Add Work Time option that allows you to track time spent by your employees.

TaxWorkFlow allows you to generate reports about various aspects of your accounting firm. For instance, you can run project reports that include detailed information, such as project status, deadlines, and key milestones. Similarly, you can create problem reports that provide useful insights into specific problems or issues that have occurred during the execution of projects.

TaxWorkFlow integrates with QuickBooks Online to provide more accounting features, such as improved invoicing and bank reconciliation. This connection also lets you upload your QuickBooks clients automatically using predefined templates as well as import and export data, such as invoices and estimates.

Tip: Before importing your client information from QuickBooks, ensure that QuickBooks and QBFC13.0 are installed on your computer. If you’re using TaxWorkFlow 2.0.0.41210 or a later version, then the QBFC13.0 file is already included in your package. Otherwise, you need to download QBFC13.0 and then install it separately.

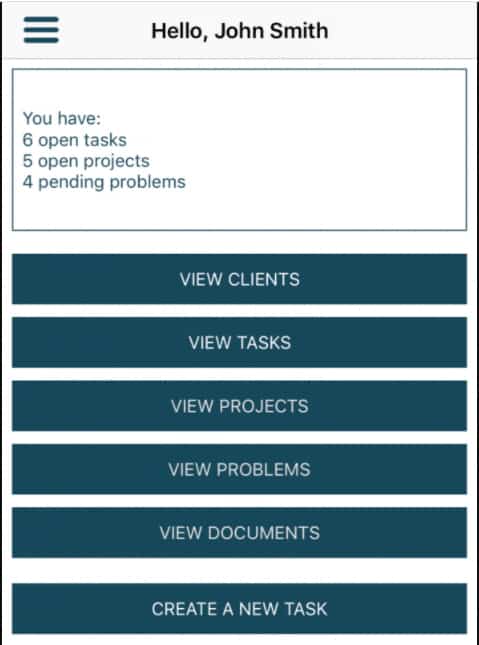

The TaxWorkFlow mobile application allows you to view the list of your tasks, projects, and problems. From the mobile dashboard, you can access quick links to execute different tasks. You can also navigate the app from the menu. The mobile app is available on Google Play and the App Store. To connect the mobile app to your TaxWorkFlow database, click on the File menu on your desktop app, select Connection Settings, and then scan the quick response (QR) code that shows up using the app.

TaxWorkFlow mobile app (Source: TaxWorkFlow)

I believe TaxWorkFlow is easy to use, and I would have awarded it a perfect score if the program doesn’t require initial installation and setup. TaxWorkFlow uses a Windows-based interface rather than a browser-based dashboard, making it user-friendly, especially for those who are familiar with Windows operating systems.

This means you can use Windows controls, like keyboard shortcuts for quick tasks and faster navigation using keys, like Tab, Space, Enter, and arrow keys. As a result, you don’t have to wait for a few seconds for each tab to load when switching between screens.

As a hybrid solution, TaxWorkFlow downloads only the necessary data from the cloud, rather than the entire page. This means you can enjoy the fast processing speed and ease of use that you get from a PC desktop platform, plus the advantages of collaboration, sharing, and productivity that come from working in the cloud.

There are different ways you can contact TaxWorkFlow for support, including phone and email assistance. For minor issues, you can check out its various resources, such as quick guides, FAQs, and blogs. However, it doesn’t offer a live chat feature which we believe could have been useful for users who require swift and convenient customer support method.

How We Evaluated TaxWorkFlow

We evaluated and scored TaxWorkFlow using the internal scoring rubric below.

15% of Overall Score

We checked not only the initial purchase or subscription fee but also any ongoing costs, such as updates, support, and training.

35% of Overall Score

The core features we wanted to see, directly related to managing your accounting practice, carry the highest weight. This includes features like direct access to your client’s books, client management, time tracking and billing, and task and workflow management.

20% of Overall Score

A good accounting practice management software should also offer fundamental bookkeeping features to support your firm. Some of the essential bookkeeping features we look for include general ledger (GL), A/P, and A/R management.

10% of Overall Score

We recommend an accounting practice management software that your team can quickly learn and use.

10% of Overall Score

Ideally, accounting practice software providers should offer various ways for users to seek support, including phone and email support, self-help guides, and training opportunities.

10% of Overall Score

We checked out online reviews to see if users have positive experiences with the software.

TaxWorkFlow FAQs

TaxWorkFlow is a hybrid solution; meaning the interface works offline, but the data you enter are all stored in the cloud.

Yes, it is, especially if you are accustomed to Windows-based operating systems.

TaxWorkFlow replicates clients’ data in real time and stores them off-site to ensure that they’re immediately available in case an unexpected event, such as disasters or power outages, happens.

Yes, you can, and the TaxWorkFlow team will even help you migrate your data to your new system.

TaxWorkFlow enables you to import or export your existing data using Excel spreadsheets.

Bottom Line

TaxWorkFlow provides a complete tax and accounting practice management solution for tax firms and professionals who want to improve their profitability and productivity. The pricing structure isn’t that flexible, but it offers a robust set of features that help you simplify your practice management workflows. Also, the ability to choose whether to store your data in-house or locally allows you to customize the system based on your compliance and security preferences.