When we compared FreeTaxUSA vs TaxAct, we found that TaxAct has the overall edge given its mobile app and the ability to file business returns. However, before choosing between the two, it is important to assess your tax situation and the features that are most important to you.

If you are self-employed or need to file an individual tax return no matter your tax situation, FreeTaxUSA may be a good fit for you because of its free federal and low-cost state filing. Meanwhile, limited liability companies (LLCs) and S corporations (S-corps) seeking to file their business taxes online are suited better for TaxAct.

FreeTaxUSA vs TaxAct At-a-Glance Comparison

|  | |

|---|---|---|

Best For | Self-employed business owners wanting free federal filing and low-cost state filing | LLCs and S-corps wanting to file Form 1065 or 1120S online |

Pricing |

|

|

Schedule C Business Income & Loss | ✓ | ✓ |

Data Import | ✓ | ✓ |

Audit Guidance and/or Defense | ✕ | ✓ |

Deduction Finder | ✓ | ✓ |

Tax Pro Assistance with Business Returns | Schedule C only | Schedule C only |

S-corp & Partnership Returns | ✕ | ✓ |

Average User Review Score on Third-party Sites | 2.7 out of 5 | 1.9 out of 5 |

For More Information |

Taxes are easier with clean books. Get on top of your financials today with Merritt Bookkeeping. |

|

When To Use

FreeTaxUSA vs TaxAct: Pricing

There are a couple of major differences between FreeTaxUSA vs TaxAct, including the fact that FreeTaxUSA doesn’t support business returns for C corporations (C-corps), S-corps, and partnerships. Also, while FreeTaxUSA offers free filing for all federal tax returns, TaxAct offers free federal filing for only very simple 1040s. Finally, TaxAct is available as either cloud-based or desktop software, whereas FreeTaxUSA does not offer a desktop software. If you elect to use TaxAct’s desktop software, you’ll have access to five federal e-files, which is useful if you have to file multiple returns. Neither provides full-service tax preparation nor filing services.

FreeTaxUSA vs TaxAct: Live Assistance

FreeTaxUSA | TaxAct | |

|---|---|---|

Communication Method | Email or live chat; Pro Support subscribers can schedule a virtual meeting | Phone, email, and live chat |

Qualifications of Professionals | CPAs, EAs, or tax specialists | CPAs, EAs, or tax specialists |

Tax Pro Assistance for Individual Returns | ✓ | ✓ |

Tax Pro Assistance for Business Returns | ✕ | ✕ |

While FreeTaxUSA doesn’t provide tax pro assistance with business returns or full-service preparation and filing, users that elect for Pro Support can schedule a virtual meeting. This is a feature that TaxAct lacks, although you can communicate through email, live chat, or phone.

FreeTaxUSA vs TaxAct: Helpful Tools

FreeTaxUSA | TaxAct | |

|---|---|---|

Deduction Maximizer | ✓ | ✓ |

Amended Returns | ✓ | ✓ |

Prior Year Return Filing | ✓ | ✓ |

Audit Support | Available with Deluxe upgrade | ✓ |

Tax Calculator | ✕ | ✓ |

Import W-2s & 1099s | ✕ | ✓ |

Audit Defense | ✕ | Additional fee |

Cryptocurrency Support | ✕ | ✕ |

TaxAct offers more helpful tools than FreeTaxUSA, including a tax calculator, the ability to import W-2s and 1099s, and audit defense for an additional fee. Both provide a deduction maximizer, the ability to file amended returns, and prior year return filing. One feature they both lack is support for cryptocurrency transactions.

FreeTaxUSA vs TaxAct: Mobile App

FreeTaxUSA App | TaxAct Express App | |

|---|---|---|

Availability | N/A | iOS and Android |

Products Supported | N/A | Free, Deluxe, Premier, and Self-Employed |

Talk Live with Tax Specialist | N/A | ✓ |

E-File Return | N/A | ✓ |

Scan and Upload W-2 | N/A | ✓ |

IRS Refund Tracking | N/A | ✓ |

View/Print/Save Return as PDF | N/A | ✓ |

In the battle between TaxAct vs FreeTaxUSA in terms of mobile app, TaxAct clearly wins. The TaxAct Express app lets you e-file your federal and state tax returns on any mobile device. Its features include free federal extension filing, IRS refund tracking, and W-2 capture.

If you have any questions, you’ll receive enhanced support from a tax specialist with live chat. All online products are supported, which includes Free, Deluxe, Premier, and Self-Employed. What’s more, TaxAct allows you to switch from the app to the desktop and pick up right where you left off.

FreeTaxUSA vs TaxAct: Customer Service & Ease of Use

FreeTaxUSA | TaxAct | |

|---|---|---|

User Interface (UI) | Easy-to-use | Intuitive |

Support Channels | Email or live chat; Pro Support subscribers can schedule a virtual meeting | Phone, email, and live chat |

Expert Help Offered | ✓ | ✓ |

Additional Services | Free prior year returns, and tax extensions | Deduction maximizer, audit support, and tax calculator |

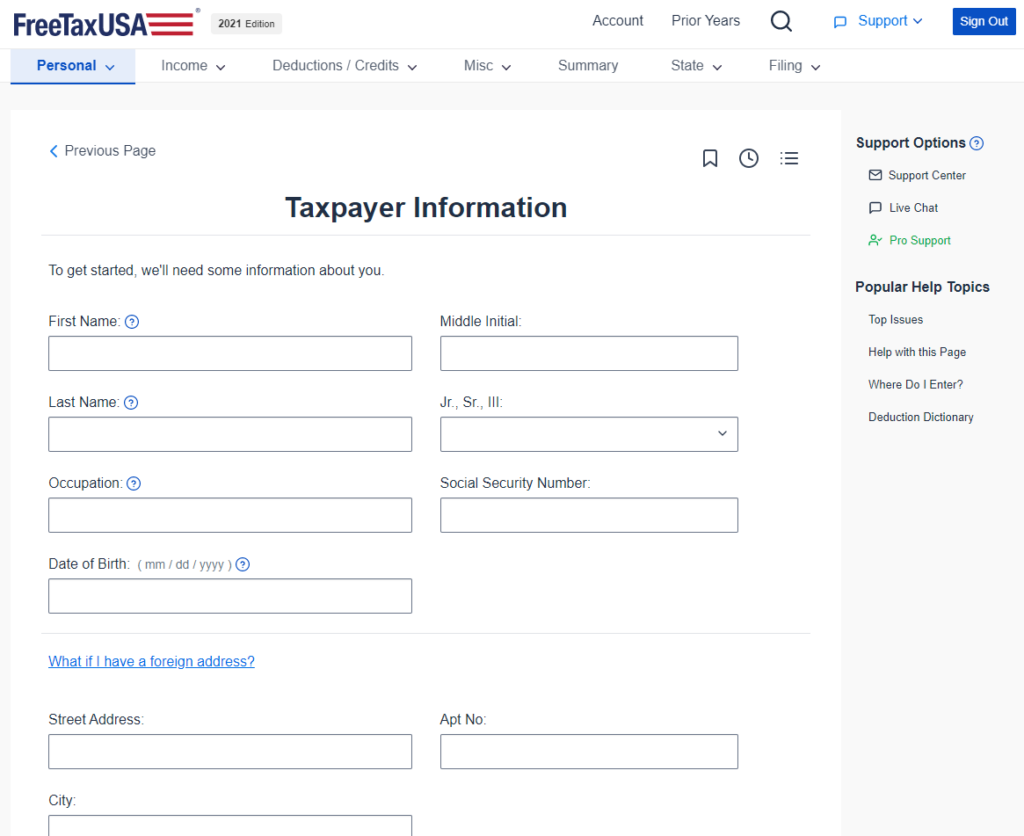

FreeTaxUSA’s interface is clean and easy to use, and once you log in, you’ll be directed to a page that allows you to set up your account information. Its navigation tabs are user-friendly, and they allow you to jump to sections of the site such as income, deductions and credits, and miscellaneous topics. It will prompt you to answer a few questions and help you determine whether you qualify for certain credits or deductions. It will also calculate your estimated tax refund or amount due automatically.

While the platform lacks phone support, you can get in touch via email or search for topics on its Customer Support page. If you upgrade to the Deluxe edition for $49.95, you’ll receive access to its live chat feature.

FreeTaxUSA Dashboard

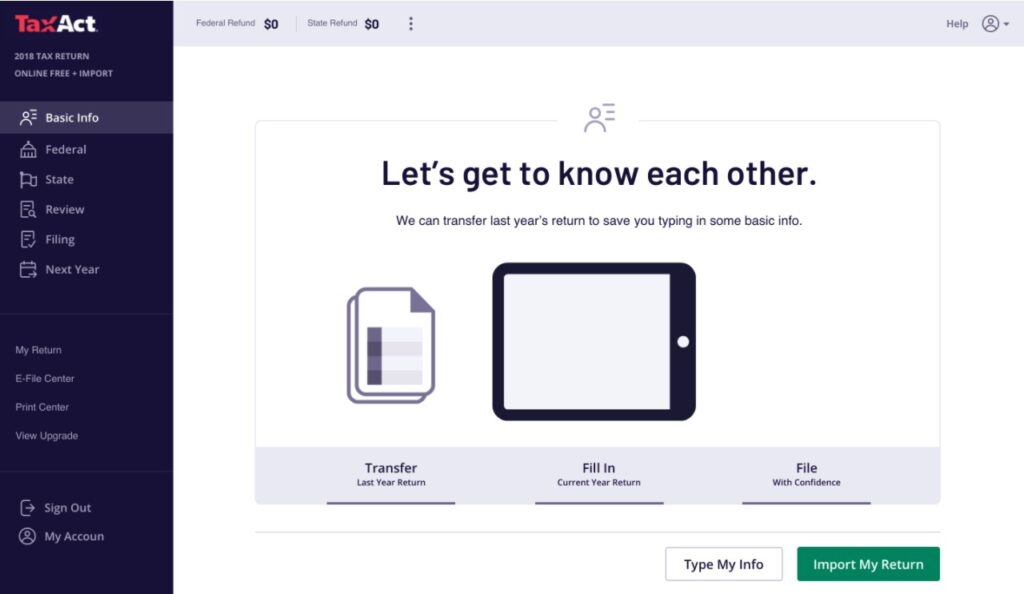

Meanwhile, TaxAct also has a clean UI that is easy to navigate, and it is designed in an interview format which is helpful for novice users. You have the choice of guided or unguided navigation, making it easy to enter your information. You can access all the sections with the left navigation bar and a quick summary of each section lets you catch data entry errors. You can also easily import your tax forms, a feature that FreeTaxUSA lacks.

TaxAct provides account and technical support via phone, email, and live chat for all of its products and an online knowledge base that provides answers to support issues. If you sign up for Xpert Assist, which is available for an additional fee, you get access to unlimited screen sharing with a tax expert. This service is available on-demand, and in some states, you can schedule a call with one of TaxAct’s tax professionals.

TaxAct dashboard

TaxAct vs FreeTaxUSA: User Reviews

We found three third-party websites that reported user reviews for both FreeTaxUSA and TaxAct. While FreeTaxUSA scored better with users than TaxAct, neither provider scored very well. We’ve found that tax software as a whole receive very low user reviews and we attribute that to the stress and frustration taxpayers feel around the complications of filing tax returns. While FreeTaxUSA’s reviews are marginal, they’re actually among the highest we’ve seen for tax preparation software.

Many of the negative reviews of FreeTaxUSA were regarding the state return not being free. According to a response from FreeTaxUSA support, there is a free state version for very simple returns, but its only available if you click to the FreeTaxUSA site from a specific link on the IRS website. We can see how that would frustrate users. But we also note that at $14.99 per state, FreeTaxUSA has far cheaper rates for state returns than any other software we’ve reviewed.

FreeTaxUSA earned the following average scores on popular review sites:

- Sitejabber1: 2.5 out of 5 based on about 287 reviews

- Trustpilot2: 3.2 out of 5 based on about 56 reviews

- SuperMoney3: 3.5 out of 5 based on around 19 reviews

Most the negative reviews for TaxAct discussed the lack of customer support and the difficulty talking to a human on the phone. Some reviewers also complained of “bait and switch” with the pricing plans. I agree the pricing plans might be confusing, but they are far simpler than the pricing plans of their main competitor, TurboTax.

TaxAct earned the following average scores on popular review sites:

- Sitejabber4 1.8 out of 5 based on about 135 reviews

- Trustpilot5: 1.5 out of 5 based on 43 reviews

- Supermoney6: 3.9 out of 5 based on 11 reviews

Frequently Asked Questions (FAQs)

You can prepare and file an individual return for free. This includes various tax situations, like rental income and investments and self-employed individuals who need to file a Schedule C. If your adjusted gross income is less than $46,000, then state filing is free. Otherwise, it costs $14.99 to file your state tax return, which is significantly less than what most tax software providers charge.

Yes, TaxAct will refund your software costs and the difference of a higher tax liability or lower refund in the event of an error caused by its team.

Yes, FreeTaxUSA offers free federal filing for prior-year returns and $17.99 for state filing. Online filing is unavailable—you must mail your tax return.

Yes, TaxAct allows for DIY online filing of Forms 1120, 1120S, and 1065.

Bottom Line

TaxAct is an excellent choice for small business owners seeking an online platform with a competitive price point, while FreeTaxUSA is a great option for self-employed individuals and freelancers seeking an inexpensive solution to filing their personal income tax returns. Both have many features in common, but FreeTaxUSA lacks a mobile app and the ability to file business returns.

User review references:

1 Sitejabber | FreeTaxUSA

2 Trustpilot | FreeTaxUSA

3 Supermoney | FreeTaxUSA

4Sitejabber | TaxAct

5Trustpilot | TaxAct

6Supermoney | TaxAct