The Federal Unemployment Tax Act (FUTA) tax is what employers pay the Internal Revenue Service (IRS) to fund the unemployment program that pays eligible workers who have lost their jobs. This is separate from state unemployment taxes (SUTA). Federal regulations only require employers to pay a maximum of 6% on each employee’s first $7,000 of earnings. At the end of each year, you’ll use Form 940 to determine and report the total amount of FUTA taxes you owe and have paid.

If you want to automate FUTA tax payments and filing, consider using a payroll solution like Gusto. Gusto tracks earnings and calculates your FUTA taxes per employee up to the required threshold. It also remits your taxes to the IRS quarterly, ensuring you aren’t penalized for waiting until year-end to pay. Sign up today.

Who Pays FUTA Tax

While FUTA taxes are calculated and processed every time you do payroll, these aren’t deducted from employee wages. As an employer, you have to pay FUTA tax if you meet the following requirements:

- Paid $1,500 or more in employee wages during a calendar quarter of this year or the previous year

- Employed one or more full-time, part-time, or temporary workers for at least some part of the day in any 20 or more different weeks in the current or previous year

- Employed household staff (someone who performs housework in a home, college club, or fraternity/sorority) and paid more than $1,000 in wages in a quarter

- Paid a farmworker more than $20,000 cash wages during any calendar year or employed 10 or more farmworkers during any 20 or more different weeks in the current or preceding calendar year

How FUTA Tax Is Calculated

The maximum tax rate for FUTA tax is 6%. The tax is applied to the first $7,000 of each employee’s earnings. This includes tips, commissions, and other payments, including moving expenses. However, fringe benefits—like meals and contributions to employee health plans, life insurance, and retirement accounts—are exempt.

Here are some examples:

If you paid an employee $5,000 in a year, the FUTA tax computation will be:

$5,000 × 0.06 or 6% = $300

If the employee earns $11,500 and you only pay FUTA tax on the first $7,000, the computation will be:

$7,000 × 0.06 or 6% = $420

Note that states may also have unemployment taxes under the SUTA. A few states even allow employee contributions to SUTA (like Alaska, for example, where employers pay 73% of the costs and employees pay the remaining 27%). If your business is required to pay SUTA tax, you may get a tax credit from the federal government, which can reduce your FUTA tax by as much as 5.4%.

For example, if you pay SUTA tax and get a 5.4% credit on your FUTA tax, then your FUTA tax rate is only 0.6%. So, if an employee earns $5,000 in a year, the computation will be:

$5,000 × 0.006 or 0.6% = $30

If you paid an employee $11,000 a year and you only apply FUTA tax to the first $7,000, the computation will be:

$7,000 × 0.006 or 0.6% = $42

For a quicker way of determining what you will owe if you have a FUTA tax credit, use our calculator.

Need help with more payroll calculations? Check out our guide on how to calculate payroll.

FUTA Credit Reduction States

Some states borrow money from the federal government to pay unemployment benefits to state citizens. If they don’t pay the federal government back, they become a credit-reduction state. For employers, this means that you will pay a higher FUTA tax rate as the government reduces SUTA tax credits by 0.3% for each year that the state owes on its loan.

When FUTA Tax Payments Are Due

The amount of your FUTA tax liability determines when it should be paid. Payments can be made annually or quarterly. If your FUTA tax is over $500 for the calendar year, you need to deposit at least one quarterly payment and then remit the remaining amount by the fourth quarter.

If your FUTA tax is less than $500 in a calendar quarter, carry it over to the next quarter. You can continue carrying the tax liability over until the cumulative FUTA tax is more than $500. However, you have to pay the entire amount—even if it never exceeds $500—by January 31 of the next calendar year. If your FUTA tax balance exceeds $500 and you don’t send in quarterly payments, you can be charged penalties.

FUTA tax payments must be deposited by the last day of the month after the end of the calendar quarter. For example, for the second quarter ending on June 30, the due date will be July 31. If the payment date falls on a Saturday, Sunday, or legal holiday, you can deposit on the next business day.

Calendar Quarter | If FUTA Tax is More Than $500 on: | Tax Payment is Due By: |

|---|---|---|

Q1: January–March | March 31 | April 30 |

Q2: April–June | June 30 | July 31 |

Q3: July–September | September 30 | October 31 |

Q4: October-December | December 31 | January 31 of the next year |

How to Pay FUTA Taxes

You need to pay FUTA taxes via the Electronic Federal Tax Payment System (EFTPS). This is a free system provided by the Department of Treasury for paying federal taxes. You can enroll online through the EFTPS website or call 800-555-447 Monday through Friday, 9:00 a.m. to 6:00 p.m. Eastern time (ET).

If you have a payroll service, your provider can make FUTA tax payments for you. However, the IRS recommends that you create an EFTPS account anyway so that you can check payments, switch companies, and have the option to deposit payments yourself.

FUTA tax payments must be submitted by 8:00 p.m. ET at least one calendar day before the tax due date. In extraordinary circumstances, same-day wire payments are allowed. Note that this type of transaction requires a Same-Day Payment Work Sheet, which you can find on the EFTPS website. Submit both filled-out pages to your financial institution.

When to File FUTA Tax on Form 940

While FUTA tax payments may require quarterly payments, filing of Form 940 to report your taxes owed should be done by January 31 of the year following the year you need to report. However, if you deposited all your FUTA taxes quarterly when they were due, you can file as late as February 10.

If you’re wondering where to file Form 940, the IRS prefers that you submit your form electronically. You also have the option to mail it, but you must use the U.S. Postal Service, as most delivery services will not deliver to P.O. boxes. There are different addresses depending on the state. You can check the Form 940 instructions for the appropriate mailing addresses.

Where to Get Form 940

You can get Form 940 from the IRS website. It is an interactive document that allows you to fill out specific data fields online and then print them once you’re done. You can also download and print the form without filling it out electronically.

- Download IRS Form 940

- View IRS Form 940 instructions

Form 940 is used by most businesses, but some companies in specific industries need a different form, such as Form 943 for agricultural employees. You can check the IRS website if you think you require a tax document other than Form 940.

Note that the IRS typically releases annual versions of Form 940. Check the IRS website toward the end of the calendar year if an updated form has been posted.

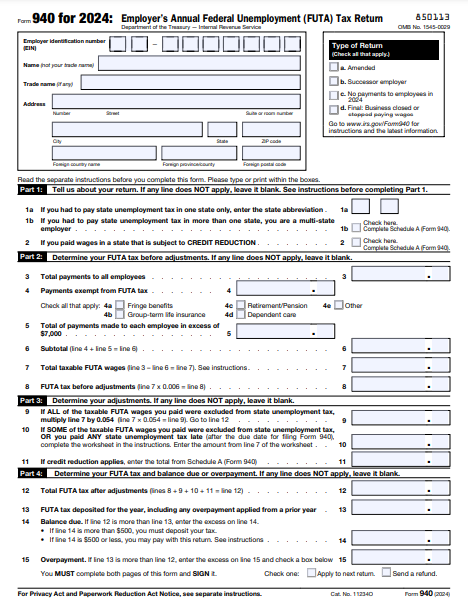

How to Complete Form 940

To complete Form 940, you have to provide information about your business, total employee earnings, and FUTA tax details. The form has the following sections:

- General information: This is where you enter your contact information and employer identification number (EIN). Fill out the trade name box if your business operates under a name different from your business’ legal name. Check the box to the right (titled Type of Return) to see if any of the conditions apply to you; generally, they won’t.

- Part 1: Indicate whether you paid unemployment tax in one state. If you’re a multistate employer and/or one of the states is a credit reduction state, you have to attach a completed Schedule A form. Unless all your employees are exempt from state unemployment taxes, you must fill out this section.

- Part 2: Calculate the total FUTA that you owe. The form asks for total wages, exempt wages, and salary payments made to each employee earning over $7,000 (you can check the Form 940 Instructions for other taxable FUTA wages). Then, multiply the total amount by 0.6% (0.006) to determine your base amount.

- Part 3: Calculate any adjustments you need to make to your FUTA calculation. This is required if you were either partially or fully exempt from SUTA taxes. You’ll need to add in any FUTA amounts that you didn’t pay SUTA on. Note that if you’re a multistate employer, you may need a completed Form 940 Schedule A for this section.

- Part 4: Follow the form’s directions to determine your FUTA owed. If you accidentally overpaid, you can choose to apply the excess to your next FUTA tax payment or have the IRS send you a refund of the balance.

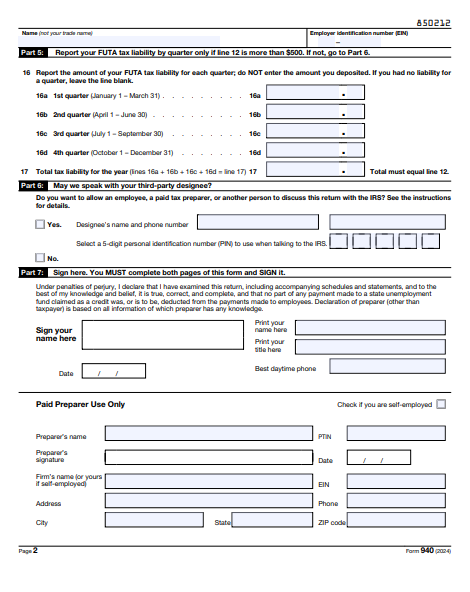

- Part 5: Show your total FUTA liability for each quarter. If the FUTA reported on line 12 (in Part 4) is less than $500, skip this section.

- Part 6: If you have a third party handling your accounts and want to allow the IRS to contact them for questions, fill out this section. This has to be the name of a specific person, not an organization’s name or a person’s job title. You and your designee need to choose a five-digit PIN that the IRS will use to confirm the person’s identity when talking to them.

- Part 7: Sign and print your name and give the phone number for contacting you during the day.

Want to learn about more payroll tax forms that employers are responsible for completing? Check out our guide on payroll forms.