The best payroll services—such as online payroll software, professional employer organizations (PEOs), and human resources (HR) systems—help businesses pay employees correctly, manage tax withholdings, and ensure deductions are withheld (for benefit premiums, retirement savings, and more). In this guide, we compiled a list of the nine best payroll services for small businesses.

- Gusto: Best for small businesses needing full-service payroll and solid HR tools

- ADP Run: Best for fast-growing businesses that want flexible payroll services

- Rippling: Best all-in-one HR, payroll, and IT solution (also offers PEO services)

- QuickBooks Payroll: Best for accountants and local contractor payments

- Paychex: Best for solopreneurs and startups wanting payroll and incorporation services

- Square Payroll: Best for small restaurants, retail shops, and Square POS users

- Papaya Global: Best for paying international employees and contractors

- TimeTrex: Best free payroll service for companies willing to file taxes on their own

- Justworks: Best low-cost PEO to outsource HR and payroll administration

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Top Online Payroll Services Compared

All of the providers on our list offer tools for calculating wages and taxes, paying via direct deposits, generating payroll reports, and managing basic employee data. Online self-service portals are also available for employees to view payslips, documents, and personal information. Here are some of the standout features.

Starter Monthly Pricing | Global Payroll Functionality | |||

|---|---|---|---|---|

| Free month when you run your first payroll | $6 per employee plus $40 base fee | Contractors only |

|

| Three months free payroll | ✓ (paid add-on)

|

| |

| First month free | ✓ (paid add-on) |

| |

Choose either a 30-day free trial or discounted base fees for three months | $6 per employee plus $45 base fee | ✕ | ✕ | |

Three months free payroll | $5 per employee plus $39 base fee | ✕ (via third-party partner) |

| |

| ✕ | $6 per employee plus $35 base fee | ✕ | ✕ |

| ✕ | $15 per employee monthly for global payroll | ✓ |

|

| 30-day free trial | $0 (for the Community edition) | ✕ |

|

✕ | $59 per employee for the first 49 workers | ✕ |

| |

*A Professional Employer Organization (PEO) is a co-employment service that helps manage your day-to-day HR, payroll, and benefits processes. Meanwhile, an Employer of Record (EOR) is an HR service that allows you to hire and pay workers in countries outside of the US. Learn more about the two solutions in our PEO guide and What is an EOR article. | ||||

In numerous buyer’s guides across our site, we evaluated these payroll companies using a 5-star scale with criteria specific to the type of payroll services they provide and the businesses they cater to. We prioritized affordability and ease of use in our rankings. You can reference any of the featured products below in specific buyer’s guides that apply to your business. To view our full evaluation criteria, check out our How We Evaluated section.

You can also check out our video below for essential features you need to consider when looking for a payroll service and some of our recommended software. Note that the video may contain inaccurate information (such as pricing details, new functionalities, and recommended users), please refer to this article for the updated information.

Gusto: Best for Small Businesses Needing Full-service Payroll & Solid HR Tools

Pros

- Full-service payroll with tax payments/filings included in all plans

- Unlimited and automatic pay runs

- Multiple direct deposit options

- Offers hiring, job posting, and performance review tools

- Reasonably priced plans

Cons

- Health insurance is limited to 37 states

- Time tracking, multi-state payroll, and paid time off (PTO) management included only in higher plans

- No dedicated payroll specialist

- Basic support includes limited live support hours

Plans & Pricing

- Simple: $40 plus $6 per employee monthly

- Plus: $80 plus $12 per employee monthly

- Premium: Custom priced

- Contractor-only payroll plan: $35 plus $6 per contractor monthly

- For companies without W-2 employees only

Add-ons

- State payroll tax registration: Pricing varies per state

- HR advisory services and priority support for Plus plan only: $8 per employee monthly (included for free in the Premium tier)

- International contractor payments across 90-plus countries: Custom-priced

- R&D tax credits: 15% of identified tax credits

- Health insurance and other benefits: Pricing varies by benefit

*Note that the above are just some of the Gusto add-ons. Visit the provider’s website to see all of its pricing information.

**Get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

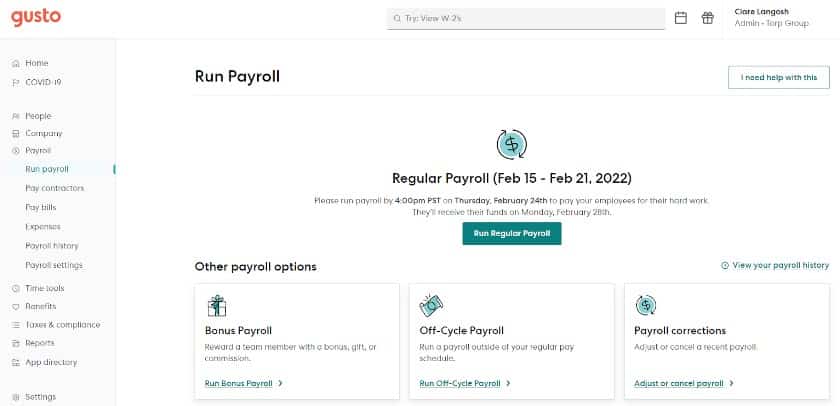

Gusto ranks well among our payroll buyer’s guides, earning the best overall in six guides and ranking high in many others. It’s a great payroll service for small businesses because it’s reasonably priced and its features are very well-rounded—you can run payroll an unlimited number of times, automate tax payments and filings (federal, state, and local taxes), post job ads, track applicants, and receive HR support.

While Gusto offers health insurance, the coverage includes 37 states only (unavailable in Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming). For health benefits options that are available in all states in the United States, consider other payroll providers, like Paychex and Square Payroll.

Gusto’s payroll dashboard (Source: Gusto)

Gusto Is Featured in

- Best Payroll for Small Businesses

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Payroll Software for Mac

- Best Church Payroll Services

- Best Payroll for Trucking Companies

- Best Payroll Software for Nonprofits

- Best HRIS/HRMS Software

- Best Construction Payroll Software

- Best Payroll Software for Accountants

- Best Payroll Software for Paying Contractors

Gusto Overview

ADP Run: Best for Growing Businesses That Need Flexible Payroll Tools

Pros

- Multiple plan options

- Offers secure paychecks with advanced fraud protection

- Feature-rich solution suite; has hiring, talent management, and learning tools, including PEO services

- Benefits plans include standard and nonstandard options, such as employee discounts

Cons

- Pricing isn’t transparent

- Time tracking, health insurance, and workers’ compensation are paid add-ons

- W-2/1099 form delivery and filing are available for an additional fee

- Lacks unlimited pay runs

Plans & Pricing

- Essential*: $49 base monthly fee plus $2.50 per employee, per pay run

- Enhanced: Custom priced

- Complete: Custom priced

- HR Pro: Custom priced

*Pricing is based on a quote we received for 25 employees

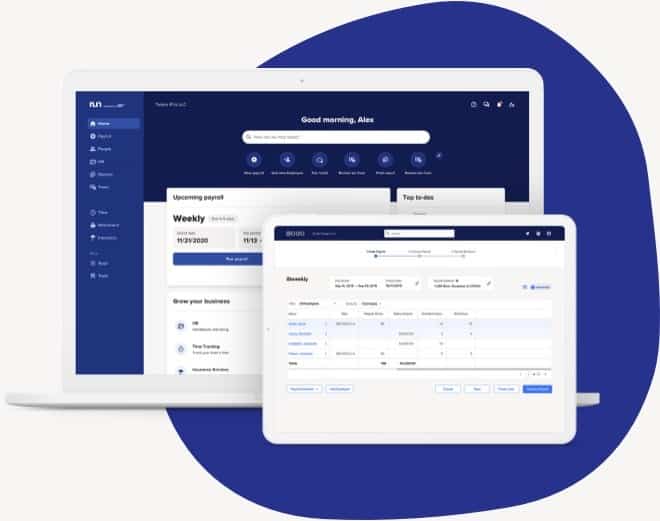

ADP Run has subscription options that include features ranging from payroll to a combination of payroll, time tracking (with GPS functionalities), and HR (recruiting, background checks, and even consulting are available). The provider also has numerous products beyond its ADP Run payroll solution, including a PEO that makes it easy for businesses with plans to grow over the years to transition easily.

Its suite streamlines HR processes, from hiring to retiring. Payroll companies like Gusto don’t offer all the tools you’ll need to manage the entire employee lifecycle, especially as your company grows. Paychex has features similar to ADP’s, but they aren’t as robust, such as job postings (ADP can post to more than 25,000 job boards, while Paychex only has a dozen).

ADP Run’s cloud-based platform allows you to run payroll from anywhere and any device, provided there’s an available internet connection. (Source: ADP Run)

ADP Is Featured in

While ADP Run ranked in several of our best payroll lists, ADP’s other products also made it to some of our payroll and HR buyer’s guides. Roll by ADP and ADP TotalSource are on our list of the best payroll apps and best PEO companies, respectively.

- Best Construction Payroll Software

- Best Payroll Software for Small Businesses

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Payroll Software for Mac

- Best Payroll for Trucking Companies

- Best Payroll Apps

- Best PEO Companies

- Best HRIS/HRMS Software

ADP Run Overview

Rippling: Best All-in-one HR, Payroll, and IT Software

Pros

- Integration with more than 500 business software

- Modular HR, payroll, and IT solutions

- PEO option can easily be switched on and off

- Offers global payroll and EOR solutions

Cons

- You can’t buy its payroll solution (and other modules) without purchasing its core workforce management platform first

- Gets pricey as you add features

- One-on-one HR help desk with phone and email support is a paid add-on

Plans & Pricing

Rippling lets you add tools like applicant tracking and payroll to its core platform. While its pricing page shows a starter monthly fee of $8 per user, you have to contact the provider so it can create a custom package for you.

For a Rippling plan that includes full-service payroll, time tracking, and its core workforce management platform, we were given a quote of $35 plus $8 per employee monthly. This also includes access to onboarding and offboarding tools, as well as software integration options.

Add-ons

- App, device, and computer inventory management*: $8 per employee monthly

- Benefits administration: Pricing varies, depending on your insurance broker

- HR help desk: Custom-priced

- PEO services: Custom-priced

- Global payroll*: $20 per employee or contractor monthly

- EOR services*: $599 per employee monthly

*Pricing is based on a quote we received

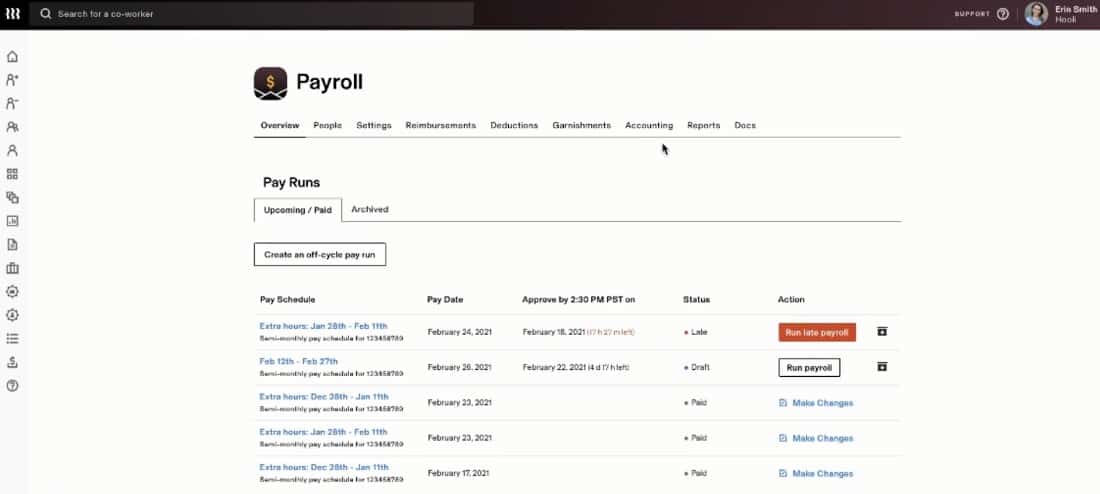

Rippling appears in a lot of our HR and payroll buyer’s guides, primarily due to its efficient and modular HR, payroll, and IT products that you can integrate—provided you get its core workforce management platform. It’s great for tech-heavy companies, given the IT solutions that allow you to manage the devices and work-related apps that are usually provided to employees.

The platform also integrates with 500-plus third-party software, such as accounting, HR, sales, expense management, and productivity tools. It even offers EOR services for hiring global employees, international payroll solutions, a PEO option you can switch on/off, and workflow tools you can easily customize. It can handle payroll, manage employee information, administer benefits, automate time and attendance, and track applicants.

Rippling’s payroll dashboard (Source: Rippling)

Rippling Is Featured in

- Best HRIS/HRMS Software

- Best HR Payroll Software

- Best Payroll for Small Businesses

- Best Payroll Software for Mac

- Best Construction Payroll Software

- Best PEO Companies

- Best International Payroll Services

- Best Payroll Software for Accountants

- Best Payroll Software for Paying Contractors

- Best Church Payroll Services

- Best Employer of Record

Rippling Overview

QuickBooks Payroll: Best for Accountants & Local Contractor Payments

Pros

- Unlimited payroll runs with a low-cost contractor payments plan

- Next- and same-day direct deposit options

- Seamless integration with QuickBooks Accounting

- Tax penalty protection program covers penalties (up to $25,000 per year) regardless of who makes the mistake

- Partner program for accountants includes discounts that can also be passed to clients

Cons

- Automated local tax filings available only in its higher tiers

- Tax penalty protection is included in the Elite plan only

- Payroll product with special discounts for accountants requires you to use QuickBooks Accounting

- Basic HR features

- Limited health benefits coverage (not available in HI, VT, and DC)

Plans & Pricing

- Payroll Core: $45 plus $6 per employee monthly

- Payroll Premium: $80 plus $8 per employee monthly

- Payroll Elite: $125 plus $10 per employee monthly

Contractor payments package: $15 monthly for 20 workers; plus $2 for each additional contractor

- Includes next-day direct deposits, 1099 e-filings, and a contractor self-setup tool

QuickBooks Payroll Partner Accountant Program

- Accountant perk: Free access to QuickBooks Payroll Elite with QuickBooks Online Accountant

- Discounts: 30% off the monthly base fees and 15% off the per-employee fees, with the option to pass the discount to new clients

QuickBooks Payroll helps users manage their payroll entirely online and has pay processing products for specific niches like accounting firms. Its solid tools and reasonably-priced plans are just some of the reasons why it ranks well in our payroll buyer’s guides—currently holding the top spot in our lists of best payroll for accountants, contractors, and trucking companies.

What we and many users like about the platform is the variety of products it offers. Its online payroll solutions are part of a larger set of Intuit products that integrate seamlessly. Since many small businesses start out using QuickBooks for accounting, adding payroll is usually the logical next step. Plus, it offers a contractor payment plan that’s more affordable ($15 monthly for up to 20 workers) than Square Payroll and Gusto (monthly fees of $6 per contractor and $35 + $6 per worker, respectively).

QuickBooks Payroll allows you to change payment methods and add employee time data while processing payroll. (Source: QuickBooks Payroll)

QuickBooks Payroll Is Featured in

- Best Payroll Software for Accountants

- Best Payroll for Trucking Companies

- Best Payroll Software for Paying Contractors

- Best Payroll for Small Businesses

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Church Payroll Services

- Best Construction Payroll Software

- Best Payroll Software for Mac

- Best Payroll Software for Nonprofits

QuickBooks Payroll Overview

Paychex: Best for Solopreneurs & Startups That Need Payroll & Small Business Incorporation Services

Pros

- Special package for solopreneurs includes payroll, incorporation support, and access to a 401(k) plan

- Multiple pay options (eg., check, direct deposit, and pay cards)

- Offers a dedicated payroll specialist

- Flexible payroll and HR plans

Cons

- Pricing isn’t all transparent

- Time tracking, benefits, recruiting, and performance management tools are paid add-ons

- Has a bit of a learning curve (due to robust features)

- Third-party software integrations cost extra

Plans & Pricing

- Paychex Flex Essentials: $39 plus $5 per employee monthly

- Paychex Flex Select: Custom priced

- Paychex Flex Pro: Custom priced

Paychex Plan for Solopreneurs and the Self-employed

- Paychex Solo: Custom priced

- Includes payroll, self-employed 401(k), and incorporation services

Paychex offers a suite of HR and payroll solutions, including PEO services, that make it a great option for businesses of all sizes. Solopreneurs can start with its Paychex Solo tier, which includes access to payroll, a self-employed 401(k) plan, and incorporation services to help establish and protect their business. Once their companies start to expand, they can transition to Paychex Flex, which is great for fast-growing businesses that need payroll and HR tools.

The provider appears in several of our buyer’s guides, even ranking high on our best HR payroll list and best payroll apps guide. Having access to a dedicated payroll specialist is one of its best features, in addition to flexible pay options and a “Voice Assist” solution for hands-off pay processing. However, you have to pay extra or sign up for a premium plan to access many of its HR solutions like benefits administration, SUI management, garnishment payment services, and time tracking.

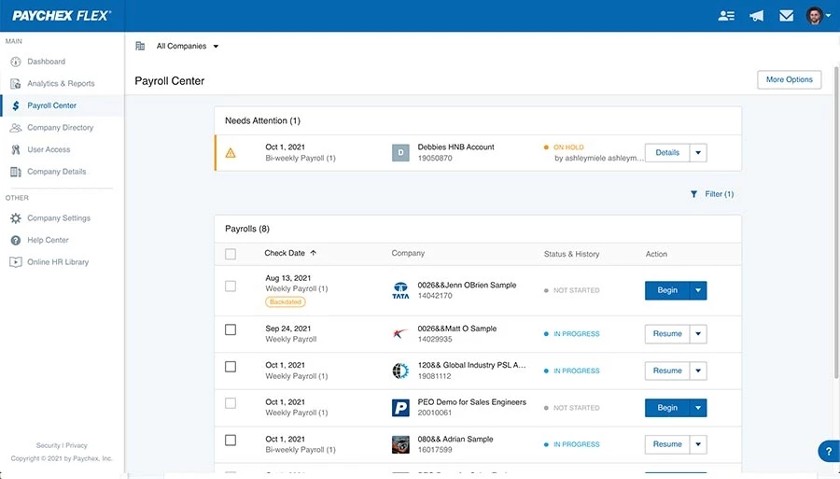

With Paychex Flex, you can add multiple company entities and easily track pay runs on its “Payroll Center” dashboard. (Source: Paychex)

Paychex Is Featured in

- Best HR Payroll Software

- Best Payroll Apps

- Best Nanny Payroll Service

- Best Payroll for Small Businesses

- Best PEO Companies

- Best Payroll Software for Accountants

- Best HRIS/HRMS Software

- Best Restaurant Payroll Software

Paychex Overview

Square Payroll: Best for Small Restaurants, Retail Shops & Square POS Users

Pros

- Affordability

- Low-cost contractor-only plan

- Seamless integration with Square products

- Offers next-day direct deposits and instant payment options

Cons

- Next-day direct deposits and instant payments require a Square Payments account

- Standard direct deposit timeline is four days

- Limited HR features

Plans & Pricing

- Pay employees and contractors: $35 plus $6 per employee monthly

- Pay contractors only: $6 per contractor monthly

Square Payroll comes with several essential solutions that make managing employee payments easy for administrators. In addition to full-service payroll, it has basic time tracking, tips and commissions tracking, employee benefits, and team management tools. If you only employ and pay contractors, Square Payroll has a low-cost contractor-only plan, which is cheaper than Gusto’s contractor payroll tier.

It ranks well in our payroll buyer’s guides, appearing in many of our lists given its affordability and efficient pay processing tools. Square Payroll is even our top-recommended payroll app for small businesses. Its seamless integration with Square’s POS and payments products make it a great option for bars, restaurants, and retail shops because you can have employees clock in/out out via the POS terminal and transfer data (such as attendance and tip info) seamlessly to its payroll solution for pay processing. Learn more about what it offers and how it works in our What Is Square article.

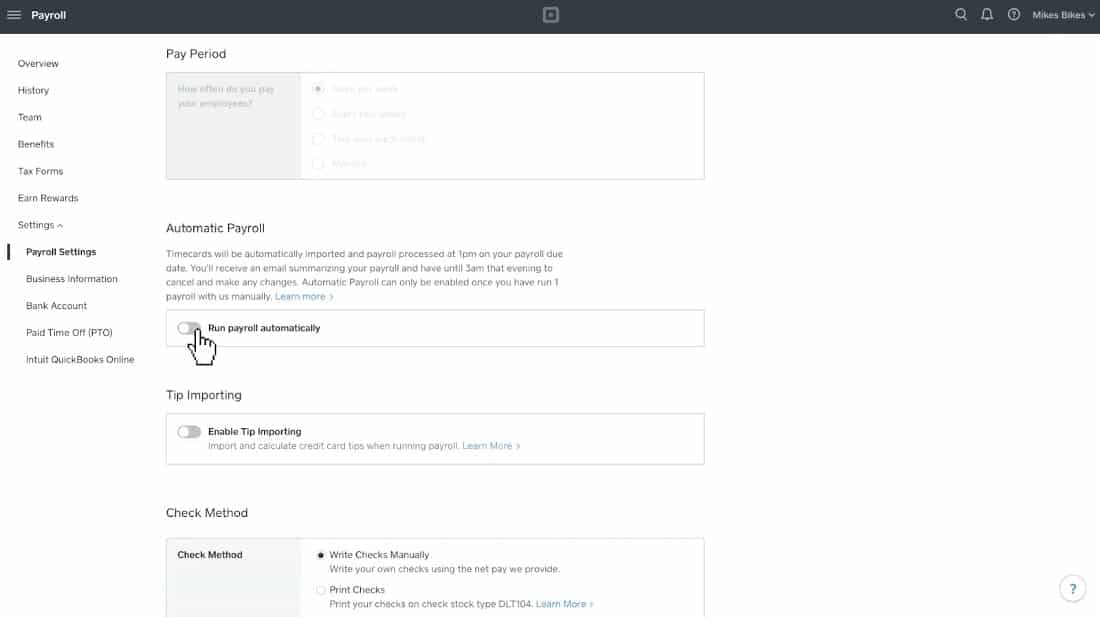

With Square Payroll, you can choose whether to activate its automatic pay runs, tip importing, and check printing capabilities. (Source: Square Payroll)

Square Payroll Is Featured in

- Best Payroll Apps

- Best Payroll for Small Businesses

- Best Restaurant Payroll Software

- Best HR Payroll Software

- Best Payroll Software for Mac

- Best Payroll Software for Paying Contractors

Square Payroll Overview

Papaya Global: Best for Paying International Employees and Contractors

Pros

- Transparent pricing

- Handles payroll, HR, and compliances across several nations and localities

- EOR in more than 160 countries; lets you hire without assistance from a local entity

- Cross-border payroll payments in as fast as 72 hours

Cons

- Can get expensive depending on the services you require

- Lacks 24/7 customer support

- Business intelligence reports and immigration services cost extra

- No local entities; only has partners in countries that it services

Plans & Pricing

- Employer of Record: Starts at $650 per employee monthly

- Contractor Management: Starts at $30 per month per contractor

- Global Expertise Services: Starts at $190 per employee monthly

- Supplemental benefits plans and immigration support

- Full-Service Payroll: $12 per employee monthly

- Includes access to the payroll platform, embedded payments, employee portal, and partner network

- Payroll Platform License: Starts at $3 per employee monthly

- Access to online solutions for managing employee data (no payroll services)

- Payments-as-a-Service: Starts at $3 per employee monthly

- Facilitate ad hoc workforce payments (e.g., national insurance payments)

- Data and Insights Platform License: Starts at $150 per location monthly

Papaya Global offers solid payroll services for global businesses. It handles both employee and contractor payments, plus it automates global payroll in more than 160 countries—making it our top choice for international payroll services. It also provides PEO services, offering a suite of solutions that includes full benefits management, legal and compliance support, and hiring services.

In addition to its efficient payroll and HR tools, we like that it has transparent pricing. Similar international payroll providers and PEO services, such as ADP and Rippling, typically require you to request a quote. Further, Papaya Global integrates with HRIS, time tracking, expense management, and enterprise resource planning (ERP) software. However, its partner systems aren’t as robust as Rippling’s 500-plus options.

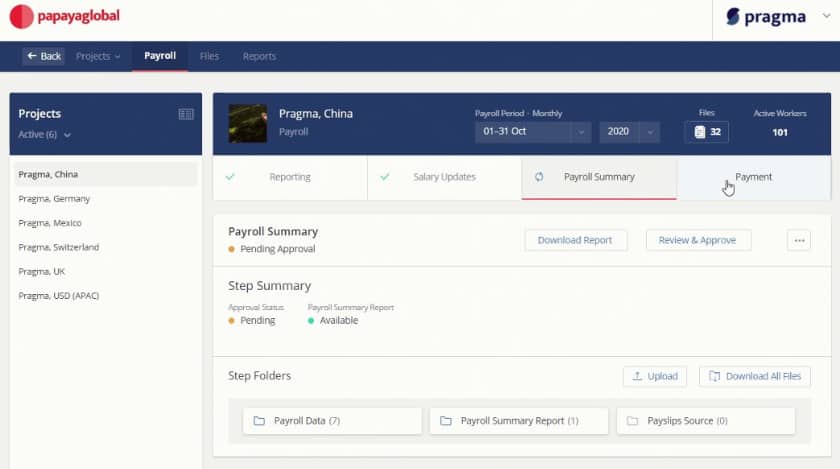

Papaya Global’s payroll dashboard shows payroll “projects” per country, including an overview of payments, pay runs, and salary updates. (Source: Papaya Global)

Papaya Global Is Featured in

Papaya Global Overview

TimeTrex: Best Free Payroll Service for Companies Willing to File Payroll Taxes on Their Own

Pros

- Feature-rich free tier

- Automatic payroll runs

- Integrates with other payroll tools like QuickBooks, ADP, and Paychex

- Has recruiting, invoicing, and expense tracking tools

Cons

- User dashboard looks cluttered

- Free tier only includes basic payroll, scheduling, and time tracking tools

- Doesn’t handle payroll tax filings

- You have to upgrade to its paid plans to access its mobile apps and technical support

Plans & Pricing

- Community Edition: Free

- Professional Edition: Starts at $30 per month

- Corporate Edition: Starts at $50 per month

- Enterprise Edition: Starts at $80 per month

Note that all paid plans cover up to 10 employees. Special rates are available for larger teams. Contact TimeTrex for a quote.

TimeTrex is great for businesses looking for a payroll service that’s feature-rich and free to use. With its platform’s Community Edition, you get all the basic tools you need to manage payroll, staff attendance, PTO, schedules, and employee information. However, its interface looks outdated and is an open-sourced platform that needs to be downloaded (a cloud-hosted option is available only to paid plan holders). Plus, its payroll tax functionalities don’t include automated tax filings.

Aside from payroll and HR tools, it offers online time clock apps that work on web browsers and mobile iOS/Android devices—although signing up for TimeTrex’s free product only grants you access to its web browser-based time clock. If you need job costing, geofencing, invoicing, expense tracking, and recruiting tools, you have to get the higher tiers of its paid version.

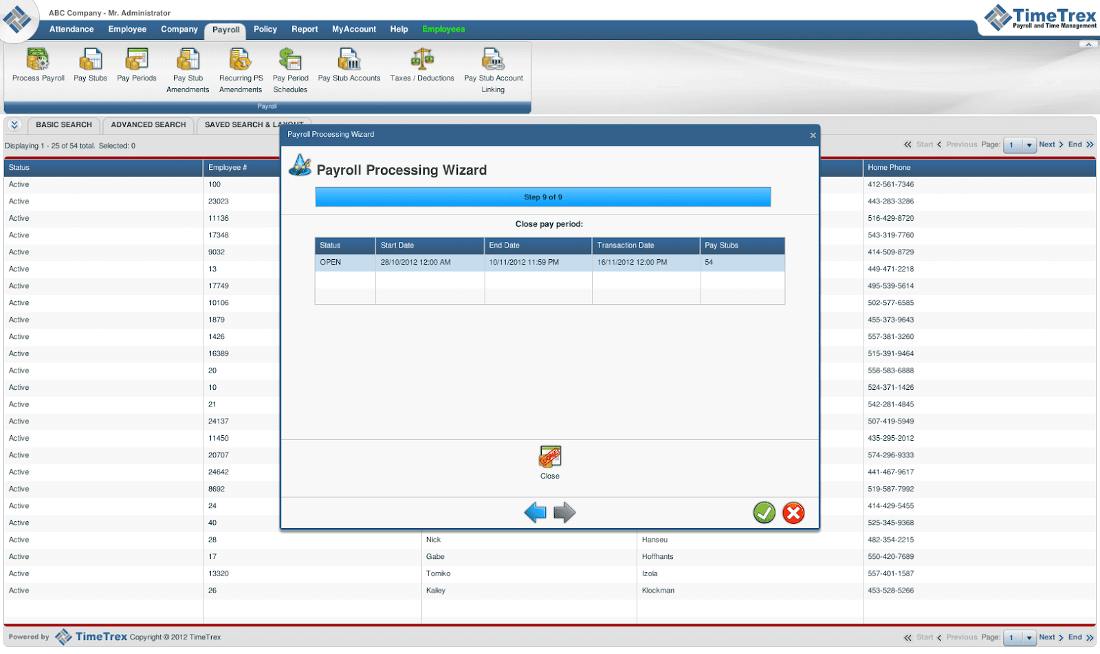

TimeTrex has an online wizard to guide you through the payroll process. (Source: TimeTrex)

TimeTrex Is Featured in

TimeTrex Overview

Justworks: Best for Companies That Need a Low-cost, High-functioning PEO

Pros

- Intuitive interface

- Transparent pricing with affordable PEO plans

- Enterprise-level benefits from major insurance companies plus 401(k) plans; offers health and wellness perks

- Offers standalone payroll and EOR solutions

Cons

- Time tracking is a paid add-on

- Limited integrations

- Has pre-set payout schedules for hourly and non-exempt salaried employees (set every other Friday)

Plans & Pricing

- Basic: $59 per employee monthly

- Plus: $109 per employee monthly

Add-ons

- Justworks Time Tracking: $8 per employee monthly (requires Justworks PEO or Justworks Payroll)

- Justworks Payroll: $50 plus $8 per employee monthly (standalone solution)

- Justworks Employer of Record: $599 per employee monthly

- pricing is for services via Justworks-owned local entities; fees may vary for EOR services via local partners

Justworks didn’t show up in a lot of our buyer’s guides mainly because of its price and the type of service it provides. It’s a PEO that acts as a co-employer that handles your day-to-day HR, payroll, and benefits administration tasks. It isn’t ideal for those looking for a no-frills payroll solution, as its PEO service comes at a much higher cost than other straight payroll providers.

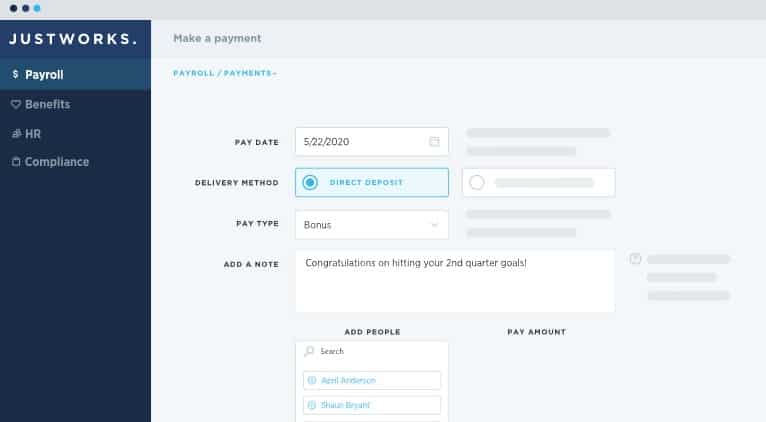

However, what’s great about Justworks is its transparent pricing. Most PEO providers, such as ADP TotalSource, Rippling PEO, and Paychex PEO, will require you to contact their sales team to request a quote. Its PEO plans also include a wide range of features—from automated direct deposits and off-cycle payments to online employee onboarding and HR consulting. Plus, Justworks offers standalone solutions for managing only payroll and EOR.

Justworks lets you add employee messages to bonuses and special payments. (Source: Justworks)

Justworks Is Featured in

Justworks Overview

Methodology: How We Evaluated the Best Payroll Services for Small Businesses

To find the best small business payroll solutions for this article, we looked at our payroll-related buyer’s guides and compiled a list of providers that often appear in those lists. We also included those that offer specific payroll services, such as PEO and international pay processing.

Note that our buyer’s guides use a five-star scale that covers several criteria, such as essential pay processing functionalities, basic HR features (like onboarding), customer support options, and ease of use. Pricing is also an important factor, as well as feedback that users leave on popular review sites (such as G2 and Capterra).

Frequently Asked Questions (FAQs)

The ideal payroll service for small businesses provides all the tools you need to pay your employees accurately and compliantly. Payroll tax payment and filing services should be included so you don’t have to worry about handling these yourself. Access to basic HR solutions is also important to help you manage employee data, new hire onboarding, and benefits with ease.

Paying employees can be challenging, especially for employers who don’t know how to handle payroll, and partnering with a reliable payroll service eliminates the need for manual pay calculations. Plus, there are legal obligations and laws you need to follow when paying employees. Payroll companies can help you manage compliance requirements—from state new hire reporting to payroll tax computations and tax form filings.

For standard payroll services, which include automatic pay calculations and tax filing services (including basic payroll compliance tools), you should expect to pay anywhere from $40 to $60 per employee monthly. The cost will go up if you need other solutions like time tracking and employee benefits.

If you know the basics of doing payroll, then yes, you can process this yourself. You can manually compute payroll either by hand, with a calculator, or by using Excel. However, this is only advisable for businesses with very small teams―fewer than 10 workers―as it can be confusing and stressful to keep track of payments, deductions, benefits, and tax reports if you have a large workforce.

Bottom Line

Choosing the best payroll service for a small business can be a bit challenging and overwhelming given the range of payroll solutions available in the market. If you are looking for the best option or are switching payroll providers, consider your company’s immediate HR and payroll needs, including your growth plans.

You can also check our buyer’s guides where we compare many of these providers side by side. You could even choose to hire a local bookkeeping or accounting service to do your payroll; it’ll likely be more expensive than some of the options we reviewed, but if you value face-to-face service, it could be worth it.