GnuCash is an open-source small business accounting software that helps you manage and track your bank accounts, stocks, income, and expenses. Its features include statement reconciliation, scheduled transactions, double-entry accounting, and a checkbook-style register for tracking cash flow. It is free and is available for Windows, Mac, and Linux.

It is one of the few free desktop business accounting software available. Users give GnuCash an overall rating of 4.4 out of 5, but only 3 out of 5 for ease of use. I downloaded and installed GnuCash and tested it using our accounting case study and found it difficult to use, although it does have the potential to be a good software once you learn to use it.

We are driven by the Fit Small Business mission to provide you with the best answers to your small business questions—allowing you to choose the right accounting solution for your needs. Our meticulous evaluation process makes us a trustworthy source for accounting software insights. We don’t just scratch the surface; we immerse ourselves in every platform we review by exploring the features down to the finest nuances.

We have an extensive history of reviewing small business accounting software, and we stay up-to-date with the latest features and enhancements. Our first-hand experience, guided by our internal case study, helps us understand how the different products compare with each other and how they work in real-world scenarios.

pros

- Features double-entry accounting

- Is completely free open-source software that can be customized by programmers

- Doesn’t require an internet connection after installation

- Is available for Windows, Mac, and Linux

Cons

- Is difficult to use

- Has poor user experience (UX)

- Offers very limited customer support options

- Lacks inventory accounting

GnuCash Alternatives & Comparison

Visit our guide to the best free accounting software for other easier-to-use free options for your small business.

GnuCash Reviews From Users

| PROS | CONS |

|---|---|

| Personal data is not on the web | User interface (UI) |

| Can import Quicken (QFX) files | Multiple users report QIF file import fails |

| Open source | Cannot print bank reconciliation |

Users who left a GnuCash review remarked that they like that it is desktop software so they don’t have to worry about what their data is being used for by cloud-based free software—although we haven’t heard or seen evidence of any problems in this area. Users also appreciated that it can import QFX files from Quicken, which we agree is nice.

Of course, users loved that it is open-source software so they never have to worry about vendors going out of business and you losing your data. We agree, even if all GnuCash support were to disappear, everything you need to continue to keep your books is on your computer.

By far the biggest complaint by reviewers who gave GnuCash a low rating is that it won’t properly import QIF files. While it is supposed to import these files, users reported various problems, including the program completely shutting down, a vague error message appearing, or the program freezing. We didn’t find similar reports of problems importing QFX files, so we recommend exporting your bank data as a QFX file rather than a QIF file.

Here are the user ratings of GnuCash on popular review sites:

- Software Advice[1]: 4.5 out of 5 stars based on around 50 reviews

- SourceForge[2]: 4.5 out of 5 stars based on about 115 reviews

Fit Small Business Case Study

We used an internal case study to evaluate GnuCash’s features across 15 key areas that are essential for small business accounting software. Here are the results of our study:

GnuCash vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

GnuCash: Free

-

Wave: Free

-

Quickbooks Online Plus: $90 per month

GnuCash and Wave are both free—GnuCash is a desktop software, while Wave is web-based. QuickBooks Online Plus is the most popular version of QuickBooks and our choice for the best small business accounting software. While we don’t expect GnuCash to offer all the features of QuickBooks Online Plus, which costs $90 per month, we feel it’s useful to compare the features of GnuCash to the “gold standard.”

- Banking: GnuCash scored significantly better for banking than Wave, primarily because of the great reconciliation feature in GnuCash and the ability to print checks. However, it is much easier to connect your bank account in Wave than in GnuCash. While GnuCash allows for bank connections, it requires some technical expertise to do so.

- A/P: GnuCash scored slightly better than Wave in A/P because you can create a credit from your vendor and create recurring expense transactions.

- Ease of setup: While I find GnuCash difficult to use, it does have some great import features that make it much easier than Wave to set up your company initially. GnuCash allows you to import your chart of accounts, customers, and vendors—which will save a lot of time if transitioning from a different bookkeeping software.

GnuCash was similar or lost to Wave in the remaining categories, but here are the shortcomings that I think are the most important:

- A/R: While you can create and send invoices in GnuCash, they look very generic and unprofessional. Wave has a much better default invoice with a few customization options to make it ever better.

- Integrations: GnuCash has no integrations with other software, whereas Wave is integrated with Zapier, which can be used to create custom Zaps with hundreds of other programs.

- Inventory: Neither GnuCash nor Wave have adequate inventory accounting, so you’ll need to calculate cost of goods sold (COGS) by hand. If you have inventory, I highly recommend you go for a paid accounting program like QuickBooks that will automatically track COGS.

- Ease of use: Wave has a much better UI that makes it easier to use than GnuCash. All transactions can be initiated with the click of a button from the left menu bar.

- Mobile app: GnuCash does not have a mobile app. Wave’s mobile app is not as good as the typical app for a paid program, but it does allow you to send invoices and scan receipts.

GnuCash Pricing

GnuCash is completely free, but its team of volunteers created a donation page for those wanting to contribute to the open-source community. It’s available to download for Linux, Microsoft Windows, and Mac OS X devices.

GnuCash Features

Despite being free software, GnuCash offers an extensive list of features designed to simplify small business accounting functions. Below is an overview of some of its most notable features.

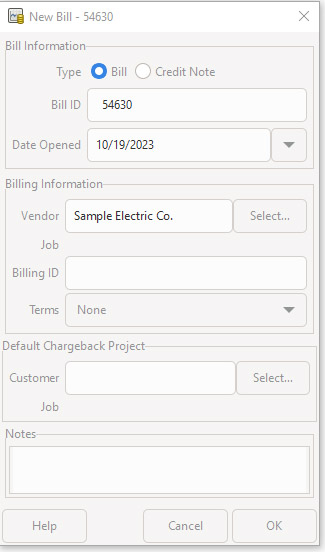

To access the A/P module, go to the vendor overview under the Business menu. GnuCash’s A/P module isn’t the most visually appealing as it utilizes a lot of windows when creating vendors, editing vendors, creating payment terms, and entering billing:

Creating a Bill

When using the A/P module, ensure that you have entered all jobs, items, and vendors before creating a bill—it would be tedious to do it all as you’re creating the bill. GnuCash also doesn’t have an auto-record function, so the software won’t record a new vendor automatically just by entering the vendor’s name in the field. Overall, we find the A/P module challenging to use, even for certified public accountants (CPAs). The navigational flow isn’t as streamlined as other accounting software programs we’ve reviewed.

However, what we like in billing is that you can assign billable expenses to customers to add them to the customer’s invoice at a later time. This feature is often present in paid accounting software programs but is a rarity in free software. Though the billing function doesn’t have the best form design, we’re still giving it credit for its advanced features.

Once you’re done with the bill, you can view billing details under the Entries section of the billing module. If you have recurring expenses, you can set recurring billing for that expense, and GnuCash will include it in its scheduled transactions tab.

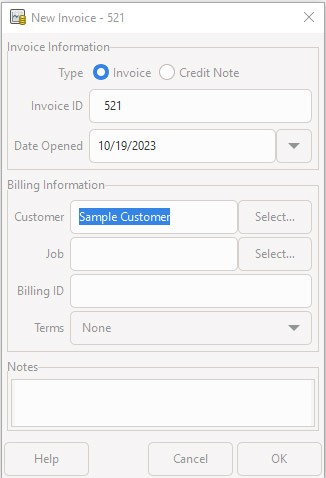

Just like the A/P module, we’re giving the A/R module a low score in subjective ease of use. During testing, we found it challenging to use GnuCash. It has a steep learning curve, and it takes time to master the software, so we can’t recommend this for do-it-yourself (DIY) business owners.

The A/R module is in the “customers” overview. You can manage your customers here, add new ones, and view their information. The dashboard only shows customer information. Outstanding balances aren’t readily available in the A/R module dashboard.

Creating an Invoice

The invoice form is similar to the billing form. Once the invoice is created, you can view invoice details in a separate tab. You can change the income account affected, quantity, price, applicable discounts, and taxes. After posting the invoice, you can print the invoice. Its design is traditional, and it has no attractive template or colors.

We can’t recommend GnuCash for invoicing because it doesn’t provide customization features. Instead, check out Zoho Books for its excellent invoicing functionality like adding logos, changing colors, and modifying font styles. Read our review of Zoho Books for more information.

Even though it’s free desktop software, you can connect your bank account to GnuCash. There is a wizard that guides you through the process, but it is not nearly as easy as other software we reviewed. It will take some technical knowledge to connect your bank. Overall, we’re pleasantly surprised with GnuCash’s cash management features and consider it the main strength of the software.

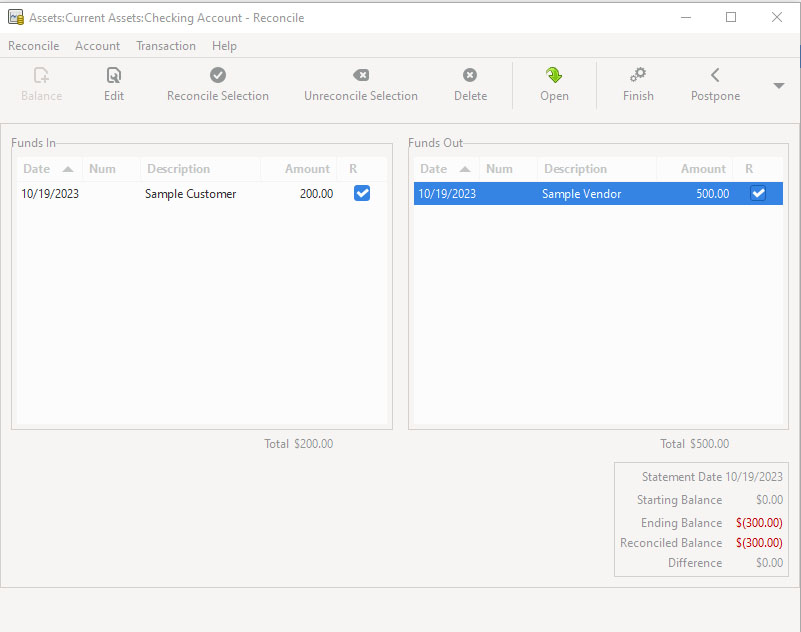

For a free program, cash accounting in GnuCash is impressive. The reconciliation feature is excellent as it presents cash receipts and disbursements side-by-side. You can tick the box if the records match the items listed in your bank statement:

Reconciling accounts

If items that haven’t been recorded appear on the bank statement, you can exit the reconciliation window and create an expense entry for bank service charges. Don’t worry, because GnuCash will remember the items you’ve ticked, and you’ll also see recent transactions added. After you reconcile accounts, GnuCash won’t generate a bank reconciliation statement automatically—you’ll have to go to Reports to create one.

Adding sales taxes to invoices is convenient in GnuCash, and taxes are presented in the printable invoice. The only struggle here is that it’s hard to view sales tax liability in detail. We prefer seeing detailed sales tax liability so that users can see all transactions with sales tax plus sales tax adjustments from credit memos.

Reporting isn’t one of GnuCash’s noteworthy features. It can generate basic financial reports, but we didn’t find it useful enough for small business reporting.

Available Reports | Unavailable Reports |

|---|---|

|

|

GnuCash is hard to use for small businesses that wish to DIY bookkeeping. The only help available is to check the self-help information online. There’s no way to contact GnuCash by phone, email, and live chat. In addition, you’ll struggle to find third-party accountants who are familiar with GnuCash and able to assist you. Zoho Books is an excellent alternative software if you want better customer service.

How We Evaluated GnuCash

We evaluate bookkeeping software based on a weighted average score across 15 different categories:

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

GnuCash has been around since 1998, mainly for personal finance. In 2001, it added small business accounting.

Yes, GnuCash is totally free with no hidden charges, ads, and in-app purchases. When you download and install it, you can use all its features.

GnuCash is a desktop application, not cloud-based software. It stores data where you choose, like in your desktop’s hard drive, so if your hard drive gets destroyed physically or by a virus, then you’ll lose all data.

Bottom Line

GnuCash is free software that doesn’t have hidden charges or credit card requirements. Like most open-source platforms, it’s difficult to use. The interface is old-school, and even experienced bookkeepers will need time to learn the program.

If you have plans to modify the source code to enhance GnuCash, we recommend speaking with a programmer. Overall, if you’re looking for software that can be used “out of the box,” there are better free options available, like Wave.