Gusto and Justworks both offer HR and payroll support and earn high scores in our evaluation for features and ease of use. Gusto is a payroll software that helps you manage your payroll and offer benefits, while Justworks is a professional employer organization (PEO) that focuses heavily on ensuring your business is complying with payroll and HR laws and offering the best benefits.

So, which one should you choose? In our assessment of Gusto vs Justworks, we recommend both for the following niches:

- Gusto: Best small business payroll system with solid HR solutions

- Justworks: Best PEO service to outsource payroll and HR compliance

There are instances when neither Gusto nor Justworks is best. We found a good alternative if you’re struggling to decide between a PEO and HR or payroll software:

- Rippling: Best for businesses planning to grow that need the option to turn their PEO off and still have access to the HR payroll software system they’re familiar with

Gusto vs Justworks Compared

| ||

|---|---|---|

Our Evaluation Score | 4.76 out of 5 | 4.10 out of 5 |

Monthly Fees | Starts at $40 + $6 per employee | Starts at $59 per employee |

Direct Deposit Processing Timelines | Four- and two-day; next-day processing with premium plans | Four business days prior to specified pay dates |

Health Insurance, Retirement, and Commuter Benefits* | ✓ | ✓ |

Health Insurance Coverage | Available in 38 states (Plus DC) | Available in all states |

Workers’ Compensation | ✓ | ✓ |

Employee Perks | Free Gusto Wallet app with financial management tools | Gym benefits and health advocacy services |

Payroll Tax Filings and Year-end Reporting | ✓ | ✓ |

State New Hire Reporting | ✓ | ✓ |

Time Tracking | Included in premium plans | Paid add-on ($8 per employee monthly) |

Employee Onboarding | ✓ | ✓ |

PEO Services | ✕ | ✓ |

Access to HR Advisers | Available in highest tier | ✓ |

Robust Software Integrations | ✓ | Limited |

Customer Service Support | Chat, email, help desk, knowledge base, phone support, FAQs | 24/7 (live rep), knowledge base, chat, email, help desk, phone support, FAQs |

*Some benefits plans cost extra or have participation fees | ||

Want to learn more about PEOs? Read our What is a PEO guide to know how they work and whether they are right for your business.

When to Consider Gusto & Justworks

Let’s take a closer look at when each software might be best for you:

Compared to Justworks, Gusto is more of a software than a service. It is a good option for small businesses that need an HR payroll solution to manage employees and basic day-to-day HR tasks.

Its automation tools streamline HR and payroll processes, while its multiple payment options allow you to pay workers via pay cards, direct deposits, and paychecks. A range of benefits plans is also available to your employees, and you even get basic HR solutions for hiring, onboarding, performance reviews, and software provisioning (or managing employee access to commonly used business apps).

| PROS | CONS |

|---|---|

| Reasonably priced, full-featured, and easy to use | Health insurance is available only in 37 states |

| Offers most needed HR benefits like health insurance and 401(k) | You have to upgrade to its premium plans for next-day direct deposits |

| Integrates with many third-party software | May not be flexible enough for businesses scaling quickly |

| Has HR solutions for tracking applicants, posting jobs, onboarding new hires, and managing performance reviews | Doesn’t offer PEO services if you need an expert team to handle your day-to-day HR, payroll, compliance, and employee benefits |

Justworks provides more of a service than a software. As a PEO, it provides a co-employment option for businesses looking for competitive benefits to offer employees and efficient HR tools to streamline processes. As a co-employer, it will handle your payroll, file taxes for you under its employer identification number (EIN), and manage employee benefits plans.

It’s best for those that want payroll and HR benefits but don’t have the time or expertise to manage them all, or for larger companies that are comfortable giving up some control in return for being relieved of the administrative tasks of HR.

| PROS | CONS |

|---|---|

| Affordable PEO program (compared to similar providers) | Less control over some HR functions |

| Handles compliances, takes legal responsibility | Medical, dental, and vision plans are available only in Plus tiers |

| 24/7 customer service | Limited integrations |

| Access to enterprise-level benefits packages from major health insurance companies | Paydays for hourly and nonexempt salaried employees must follow Justworks’ regular schedule (Fridays) |

Best for Pricing: Gusto

| ||

|---|---|---|

Pricing Score | 5 out of 5 | 4 out of 5 |

Monthly Fees | Simple: $40 + $6 per employee Plus: $80 + $12 per employee Pro: Call Gusto for quote | Basic: $59 per employee Plus: $109 per employee |

Special Plan | Contractor-only Payroll: $35 + 6 per contractor monthly | Part-time employees*: $59 per worker monthly |

Time Tracking | Included in higher tiers | $8 per employee monthly (via Justworks Time Tracking add-on) |

Add-ons | Benefits administration using own broker: $6 per eligible employee monthly Health insurance: Pay for premium only 401(k) retirement savings: Pricing varies depending on provider/plan integration 529 college savings: $6 per participant monthly (with an $18 monthly minimum) | Contact Justworks for premium payment details |

*This flat-rate pricing only applies to part-time employees with 29 or fewer work hours per week. For months when you don’t have part-time staff, Justworks will charge you its regular rates for full-time employees (and vice versa). | ||

It’s hard to compare Gusto vs Justworks for pricing because the services and solutions these providers offer vary slightly from the other. Plus, both have different pricing schemes—Gusto charges base monthly and per-employee fees, while Justworks has per-employee monthly fees based on the number of workers you have.

However, if you’re only looking at subscription costs, Gusto is more affordable. Its starter plan is priced at only $40 plus $6 per employee monthly (or $46 monthly for one employee); whereas Justworks’ monthly fees for its Basic tier start at $59 per employee.

Since Our Last Update: Gusto has increased the pricing of its contractor-only payroll plan—from $6 per worker monthly to $35 plus $6 per contractor monthly. As part of a promo, new clients who sign up for this plan will get discounted pricing of only $6 per contractor monthly (no base fee) for the first six months. After this period, you will be charged the regular monthly fee.

When to Consider Justworks

While pricing is important, keep in mind that you get what you pay for. Gusto may be far less expensive, but it is a payroll software with only basic time tracking and HR tools. Justworks, on the other hand, offers PEO services. It handles more of the administrative work and takes on more responsibilities, including legal concerns in some cases. So if you don’t have an in-house HR staff and have the budget to spend, then Justworks is an excellent choice.

Gusto vs Justworks Pricing Calculator

Want an easy way to calculate costs? Use our online calculator to compute the estimated monthly and annual fees for Gusto and Justworks.

Best Payroll Features: Gusto

| ||

|---|---|---|

Payroll Features Score | 4.75 out of 5 | 4.13 out of 5 |

Full-service Payroll | ✓ | ✓ |

Payroll Tax Payment and Filing Services | ✓ | ✓ |

Year-end Tax Reports (W-2/1099) | ✓ | ✓ |

Direct Deposit Processing Timelines | Four- and two-day; next-day processing with premium plans | Four business days prior to specified pay dates* |

Manual Paychecks** | ✓ | Only for supplemental bonus payouts |

Pay Card Option | ✓ | ✕ |

Off-cycle Payments | ✓ | ✓ |

Vendor Payments | ✕ | ✓ |

*Friday paydays for hourly and non-exempt salaried staff; every 15th and end of the month for salaried employees **Requires you to prepare paychecks yourself | ||

Gusto lets you manage payroll for any type of employee. Similar to Justworks, it calculates and remits payments; files state, federal, and local taxes; and does end-of-year tax reporting. It also handles multiple pay rates, tips credits, garnishments, PTO policies, and multistate payroll.

Since Our Last Update: Gusto is no longer offering the Cashout program, which enabled employees to access a portion of their earned salaries between paydays.

You can pay employees by check, direct deposit, or pay card. Time, workforce, and project tracking are also included in its higher tiers, but if you’re already using a time and attendance solution, Gusto integrates with time tracking systems like When I Work, 7shifts, Homebase, and QuickBooks Time (formerly TSheets).

Gusto lets you change paydays, add pay schedules, and activate its “Payroll on AutoPilot” feature if you want automatic pay runs. (Source: Gusto)

When to Consider Justworks for Payroll

Justworks may not have a pay card option and only pays employees through direct deposits, but it can handle all types of payouts like tips, off-cycle payroll, bonuses, contractor payroll, and vendor payments. It does accept manual check payments for supplemental bonus payouts, but you have to select the “physical check” option in the system and prepare the checks yourself. This is unlike Gusto, which lets you easily switch from direct deposit payouts to check payments if you need to.

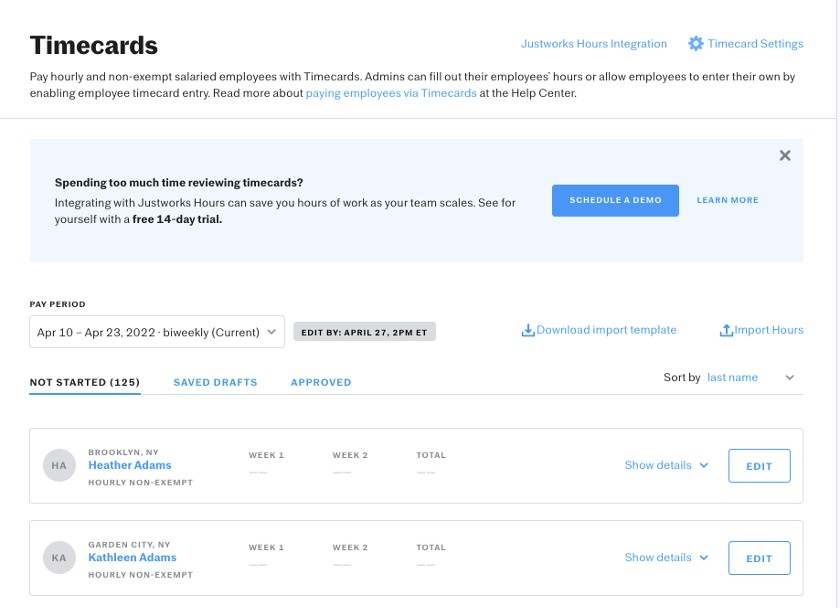

While Justworks integrates with QuickBooks Time to capture the work hours you need to pay employees, you can use its “Timecards” feature to directly input time data into the system. You can also get its time tracking add-on, Justworks Time Tracking, which is priced at $8 per employee monthly (as of this writing).

With Justworks, you can choose to enter the employees’ work hours yourself or allow workers to input their own time data for pay processing. (Source: Justworks)

Looking for payroll options other than Gusto and Justworks? Check our best payroll services guide for our top recommendations.

Best for HR & Employee Benefits: Justworks

| ||

|---|---|---|

HR Features Score | 3.88 out of 5 | 4.75 out of 5 |

Health Insurance, Retirement, and Commuter Benefits* | ✓ | ✓ |

Health Insurance Coverage | Available in 37 states | Available in all states |

Non-standard Employee Benefits | College savings plans; free Gusto Wallet app with financial management tools | Gym benefits and health advocacy services |

Workers’ Compensation | ✓ | ✓** |

Wage Garnishment Services | South Carolina excluded | ✓ |

State New Hire Reporting | ✓ | ✓ |

Employee Onboarding | ✓ | ✓ |

Job Postings and Applicant Tracking | Basic job postings and applicant tracking | ✕ |

PTO Management | ✓ | ✓ |

Harassment Prevention and Inclusion Training | ✓ | ✓ |

Employee Performance Reviews | ✓ | ✕ |

PEO Option | ✕ | ✓ |

*Some benefits plans cost extra or have participation fees **Doesn’t cover businesses with employees doing high-risk manual labor | ||

As a PEO, Justworks will place you in an enterprise-level plan for insurance, which means much better rates—plus, they’re available in any state. It works with UnitedHealth, Kaiser, and Aetna. It also provides dental and vision, HSA/FSA, medical reimbursement programs, gym benefits, commuter benefits, life and disability insurance, and health advocacy services. For 401(k) options, Justworks partners with Slavic401k and assumes fiduciary responsibility for it, so you can offer your employees this benefit without incurring legal risk.

While Gusto and Justworks both offer workers’ compensation through AP Intego and have HR experts on hand to answer your questions on compliance issues, Justworks is the stronger of the two for compliance—although, its workers’ comp program doesn’t cover businesses that engage in high-risk manual labor (such as construction). In addition to keeping you up-to-date on the changing laws and regulations, it offers online training for sexual harassment and discrimination prevention, so it’s easy to comply with state and city requirements.

However, it lacks the hiring tools that Gusto offers. For instance, Justworks doesn’t have the capability to help you manage and track employee work goals and performance reviews, but Gusto does.

When to Consider Gusto for HR & Employee Benefits

As a health insurance broker, Gusto has access to over 3,500 plans from more than 100 carriers that work with small businesses. Thus, it can find you a good plan for your employees, and it offers dental and vision insurance, HSA, FSA, retirement savings (through Guideline), commuter benefits, and Gusto Wallet, a free financial management app.

However, its health insurance isn’t available in 13 states (Alabama, Alaska, Hawaii, Louisiana, Mississippi, Montana, Nebraska, North Dakota, Rhode Island, South Dakota, Vermont, West Virginia, and Wyoming); if your business is located in one of the areas it services, Gusto is a good option for you.

Compared to Justworks, Gusto’s compliance support is simpler but includes new hire reporting, workers’ compensation, and Affordable Care Act (ACA), Health Insurance Portability and Accountability Act (HIPAA), and Employee Retirement Income Security Act (ERISA) compliance. It also handles child support garnishments for all states except South Carolina. Plus, it provides online solutions for tracking applicants, posting open jobs, and monitoring performance reviews.

Best for Reporting: Tie

| ||

|---|---|---|

Reporting Score | 5 out of 5 | 5 out of 5 |

Basic Reports | Available | Available |

Report Customizations | ✓ | ✓ |

Both providers offer standard reports that you can generate and export into CSV file formats. It also has customization options if you want to create your own reports.

However, in comparing Justworks vs Gusto in terms of employee handbook support, Justworks is a better option, as it provides handbook setup assistance even with its basic plan. With Gusto, you have to sign up for its highest tier (Premium) or, if you’re on the Plus plan, pay an add-on fee of $8 per employee monthly for this service.

Best for Ease of Use, Customer Support & Integrations: Gusto

| ||

|---|---|---|

Ease of Use Score | 4.75 out of 5 | 4.38 out of 5 |

Ease of Use | Good | Good |

Access to HR Advisers | Available in highest tier | ✓ |

How-to Guides | ✓ | ✓ |

Third-party Software Integrations | Robust | Limited |

Customer Service | Via phone, email, and chat | Via phone, email, chat, SMS, and Slack |

24/7 Support | Weekdays only | ✓ |

In assessing Justworks vs Gusto, we found that these two programs have wonderfully intuitive interfaces—and it’s easy to find the tools you need. Both have in-app help, online guides, and access to HR professionals who can give expert advice on HR, payroll, and compliance issues. Although, Justworks includes HR consulting services in all of its plans, whereas Gusto only offers this in its higher tiers.

However, if you need robust third-party software integrations, Gusto has a wider network as compared to Justworks. The latter connects with only QuickBooks Time, QuickBooks, and Xero, while the former integrates with accounting, hiring, learning management, time tracking, legal, POS, and collaboration tools.

When to Use Justworks

If you need 24/7 access to customer support, then consider Justworks. Gusto’s support team is available only on weekdays (from Monday through Friday, 6 a.m. to 5 p.m. Pacific time). You can even contact Justworks’ support team through phone, email, chat, SMS, and Slack. With Gusto, you only get phone, chat, and email support.

Best for Popularity Among Users: Gusto

| ||

|---|---|---|

User Feedback | Mostly positive | Mostly positive |

Average User Ratings* | 4.45 out of 5 | 4.65 out of 5 |

Average Number of Reviews* | More than 2,100 | Nearly 200 |

*Data from third-party review sites like G2 and Capterra, as of the writing | ||

To compare Gusto vs Justworks on user popularity, we looked at each providers’ average overall ratings and the number of reviews on third-party review sites like G2 and Capterra. For user ratings, Justworks’ average score is higher than Gusto’s, with a 4.65 out of 5 versus the latter’s 4.3 rating, as of this writing. However, Gusto’s average number of reviews online is higher—it has close to 2,300 compared to Justworks’ more than 220 reviews.

What Users Think: Gusto vs Justworks

How We Evaluated Gusto vs Justworks

Although we are comparing Gusto vs Justworks, it’s not to declare a winner. Both are excellent services that meet specific needs. Our evaluation highlights the providers’ differences and strengths so that you can decide which service is best for you. Aside from pricing and payroll functionalities, we looked at ease of use, HR features, integration and benefits options, customer support, and whether HR professionals are available to give expert advice.

Click through the tabs below for a more detailed breakdown of our evaluation criteria.

25% of Overall Score

We looked at whether providers offer transparent pricing, multiple plan options, and unlimited pay runs. We also checked if they charge setup fees and have a plan that costs less than $50 per employee.

25% of Overall Score

Automated tax filing services, year-end tax report prep, automatic pay runs, and two-day direct deposits are just some of the features that we consider essential payroll services. Providers are rated more favorably if they offer both employee and contractor payroll services, including a tax penalty-free guarantee.

25% of Overall Score

We looked for user-friendly, intuitive, and customizable platforms, including those that integrate with common small business software like QuickBooks, Homebase, and When I Work. We prefer providers with how-to guide options and live phone support.

10% of Overall Score

10% of Overall Score

We took the average review ratings from G2 and Capterra, which are based on a five-star scale; any option with an average of 4+ stars is ideal. Also, any software with 1,000+ reviews on any third-party site is preferred.

5% of Overall Score

Aside from offering basic payroll reports, we considered whether these are customizable and if you could create new reports to fit your specific needs.

Frequently Asked Questions (FAQs)

No, Gusto isn’t a PEO, nor does it offer PEO services.

Gusto is a cloud-based HR payroll software designed to streamline basic HR processes—from hiring and onboarding to pay processing and performance review management. On the other hand, a PEO (like Justworks) provides a co-employment option where it assumes responsibility for some of your business’s HR tasks, like paying employees, filing payroll taxes, and handling compliance.

With Gusto, you get a reasonably priced and user-friendly HR payroll software for managing employees. It provides the essential HR tools you need to handle the entire employee lifecycle, from hiring to retiring.

What’s also great about Gusto is its multiple payroll plans, allowing you to choose an option that best fits your company’s HR requirements. You can start with its basic package if you have simple payroll and HR needs, and then upgrade to its higher plans if you want additional HR solutions like performance reviews and HR advisory services.

Bottom Line

When choosing Gusto vs Justworks, the main questions you need to ask are, how much HR work do you want to pass to someone else, and how important is it for you to offer competitively priced insurance rates?

Both programs offer user-friendly software, access to benefits, and full-service payroll with tax filings and year-end reporting. Although Gusto makes it easy for you to manage your payroll and benefits yourself, Justworks’ PEO service takes on many day-to-day HR tasks and responsibilities.

However, if you want an affordable small business payroll solution with essential HR tools and robust third-party software integrations, Gusto is the best option for you. It may not have Justworks’ PEO services and extensive health insurance coverage (Gusto is limited to only 38 states, plus D.C.), but it offers a wide variety of benefits options and even provides access to HR professionals who can help you manage compliance issues. Sign up for Gusto today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.