There are many factors to consider when learning how to choose a payroll service. You have to consider your business’ needs and find a type of provider that can match it—after which, you’ll have to pick out specific providers and find one with all the features you’re looking for. In this article, we help narrow down the types of services that will best suit your small business while also giving insight into some common questions businesses ask when choosing payroll providers.

While you’re researching, look for payroll software with free trial offers such as Gusto. It offers one month free when you run your first payroll. Take note, however that this offer will be applied to your Gusto invoice while all applicable terms and conditions are met or fulfilled.

Step 1. Evaluate Your Business

Start by figuring out:

- The size of your company and business location

- The types of employees you have and how you pay them

- The features you need

- Whether you have HR staff or an employee dedicated to running payroll, or will be running payroll yourself

- Your budget

- Whether you need benefits options, as well as other services or software you want to integrate with your payroll service (time and attendance, accounting, employee scheduling)

Here’s a more in-depth look at each factor to consider before choosing a payroll solution.

Regardless of which payroll service you choose, the size of your business matters. You will run across payroll companies that claim they can handle payroll for any size company, from one employee to 100,000. And while this is true for some, it doesn’t mean they’re right for you. In fact, with the big providers, you may end up paying for services you don’t need and won’t use.

Some general guidelines are:

- 0–5 employees: You’re considered a very small business and are subject to fewer regulations, so you won’t need to worry about compliance issues. All of the payroll options we mention in Step 2 should work for you. However, if you go with your accountant or bank, you will need to make sure you have workers’ compensation insurance and the right paperwork filed with the state. Be sure you know the basics of how to do payroll so you’re not held accountable for anyone else’s mistakes.

- 6–50 employees: You’re considered a small business and may have certain requirements in some states for certain provisions, like sick leave. Your business is still small enough that a free payroll solution, like the ones on our free payroll software guide, can work since you don’t need all the bells and whistles. If you opt to do this, you’ll need to make sure you are compliant with payroll laws, both federal and state.

- 50–100 employees: You’re still a small business, but you will want a payroll provider that can comply with all federal requirements, including the Family and Medical Leave Act (FMLA). All-in-one HR payroll software is a good option. Check out our HR payroll system guide to see our top-recommended solutions.

- 100+ employees: You’re moving toward a medium-sized business and need to consider the cost of volume (i.e., a solution that charges a high rate per employee, such as PEOs, can get expensive quickly). You will need to comply with all federal and state laws. A human resources information system (HRIS) is a must here since you have over 100 people in your organization and are likely to need benefits administration.

The city and state locations of your business and remote or overseas employees are important to consider in your payroll selection:

- Just one location or locations all in the same state: You have the simplest payroll situation. Most options are available to you.

- More than one location/remote employees in more than one state (or country): You’ll have to meet more regulations. You’re better off opting for HR or payroll software to ensure compliance with federal, state, and city requirements. International payroll services, such as those on our list of top global payroll solutions, are essential if you have workers in other countries.

Next, what kind of compensation you give your employees should be considered when looking at payroll providers. Are they truly employees, or are some considered independent contractors? To know the difference between the two, read our 1099 vs W-2 workers guide.

If you have mostly part-time or full-time employees, then most payroll providers can work for you since they will require the standard tax reporting. If you use a lot of independent contractors, or 1099 employees, you will want to check that your chosen payroll service can also pay them without an additional fee. You’ll also want to make certain you’ve classified the different employee types correctly.

If your business includes:

- All hourly employees: You will most likely want to look at payroll software that includes a time tracking feature like QuickBooks Payroll (through its QuickBooks Time solution). You may also want to consider using a payroll system that can integrate with time and attendance software. Read our guide to the best time tracking system to find a solution that fits your requirements.

- All salaried employees: This is the simplest situation for a payroll provider, and we recommend payroll or HR software unless you have only one to four employees. Then, you could consider any payroll option, including DIY-style plans.

- Combination of hourly and salaried: You will most likely want to look at payroll software that includes an ability to pay both sets of employees on separate pay schedules (i.e., salaried might be monthly or twice per month, whereas hourly might be biweekly).

- Only independent contractors: In choosing a payroll service for contract workers, you should look for providers that have packages designed solely for that purpose. They’re usually cheaper, especially online payroll software. You can get away with only paying $5 or $6 per contractor monthly, and some won’t charge you a dime during the months you don’t pay anyone. Check out our top contractor payroll service picks.

Knowing what to look for in a payroll service is important as it will help simplify your search for a new provider. Payroll services that can handle a range of different-sized businesses tend to be costlier than others and provide more features (like responding to garnishment notices). Companies that only have a handful of employees will sometimes opt for simpler services that address their needs of just paying employees and taxes.

If you’re only paying salaried or hourly employees, most payroll software will work to some degree. However, if you need to pay commissions, you’ll need to find software that can handle those calculations. It should also integrate with your pay processing system for seamless payments. For suitable options, check out our list of best commission tracking software.

For instance, a business that pays four part-time employees would not need to pay a premium for payroll services that provide top-notch insurance rates. The law doesn’t require benefits until you reach 50 full-time equivalent employees, so in most cases, a very small operation wouldn’t need that option.

If you have a big workforce, note that some services and software just aren’t built to handle large companies. If you have 50 employees today but project you’ll have 150 within the next year, you wouldn’t need to sign up for software that doesn’t do a good job handling payroll for more than 100 employees. Always consider how many employees you have today and how many you plan to have in the future.

Also, when researching payroll providers, look for online reviews from similar-sized companies that have used them. User feedback will provide insight into the provider’s actual services.

You may wonder why you would need to have any payroll or HR expertise in your company at all considering that you’re looking for a new payroll service. The truth is that although you will be paying a company to help do your payroll, your business is still ultimately responsible for any mishaps that may occur—unless you partner with a Professional Employer Organization (PEO), which shares some liability with you.

Opting for a DIY payroll software isn’t the best idea if nobody has any payroll or HR knowledge. You may be able to ensure your employees are paid but may not understand how much in taxes to withhold or how or when to report to the IRS and other tax agencies.

Budget is an important factor when choosing a payroll provider. Most services charge you monthly, so take the time to figure out how much you can afford. I recommend looking at it on an annual basis as well; some services charge extra for handling year-end tax reports.

Keep in mind that having more employees usually drives up payroll service costs. However, some services charge the same rate if your employee count falls within the same pricing level. Let’s say you have 20 employees, and the provider charges $40 per employee for companies with 20 to 30 workers. You can maximize value and lock in the rate by getting as close to 30 employees as possible (without going over, of course).

Lastly, be mindful of add-ons. These are features that aren’t built into the package you sign up for. They cost extra money and can drive up your costs quickly. Be sure to total all costs, by month and year, so you can do a reasonable comparison across the providers.

If your business wants to or already offers benefits, you’ll need to check that the payroll services you are interested in offer in-house options. Some don’t offer benefits at all but will process deductions if you sign up for them with an outside provider.

Not having a benefits option can make your payroll more complicated since you’ll have to manage each component in different systems, and may even need to administer the benefits yourself. If you want to offer benefits, I recommend looking at providers that currently offer benefits provisions as an additional service with their payroll software.

If you are or will be using software that you want to connect to your payroll software, you’ll need to keep them in mind. Start a list so you can inquire about them with a representative or search for them on the service’s website. Many online payroll services will allow you to load data from any software if you can download it into a spreadsheet format. Some have automated integrations that will connect the systems with the click of a button.

Some of the most popular payroll integrations to consider are accounting, employee scheduling, time and attendance software, and point-of-sale (POS) software. The more employees and less time you have, the higher the chances are that you will benefit from some software integration.

If you’re paying even one employee by the hour, you’ll have to track their work time. While time tracking software isn’t a requirement, it can be beneficial, especially if you have more than 10 employees. Some services will allow you to send these hours via email or even call them in. Others have time tracking built into their software, and all you have to do is enter the hours; however, manually entering hours can become cumbersome as you grow.

If you decide you’d rather automate this process, time and attendance software would be your best bet. It’ll shift the burden of documenting work hours (via clocking in and out) to the employees, and all you have to do is review and approve them. If the time and attendance system integrates with your payroll software, all information will transfer electronically, such as employee paycheck calculations.

Similar to time tracking, if you provide paid time off or sick leave, or if you simply need to track absences, you will want a software solution that helps you do just that. This option will create less paperwork for you and provide you with insights into your workforce and potential hiring/firing decisions.

Step 2. Narrow Down Your Payroll Service Options

Here is an overview of the four main solutions you may be interested in when selecting a payroll service.

At this point, you’ve probably got somewhat of an idea as to what will and won’t work for you. If you’re not looking to meet anyone in person or partner with a co-employer, you can cross out bookkeepers and PEOs. Make a list of the providers that are still under consideration.

Step 3. Research, Compare & Decide Which Provider Is Right for You

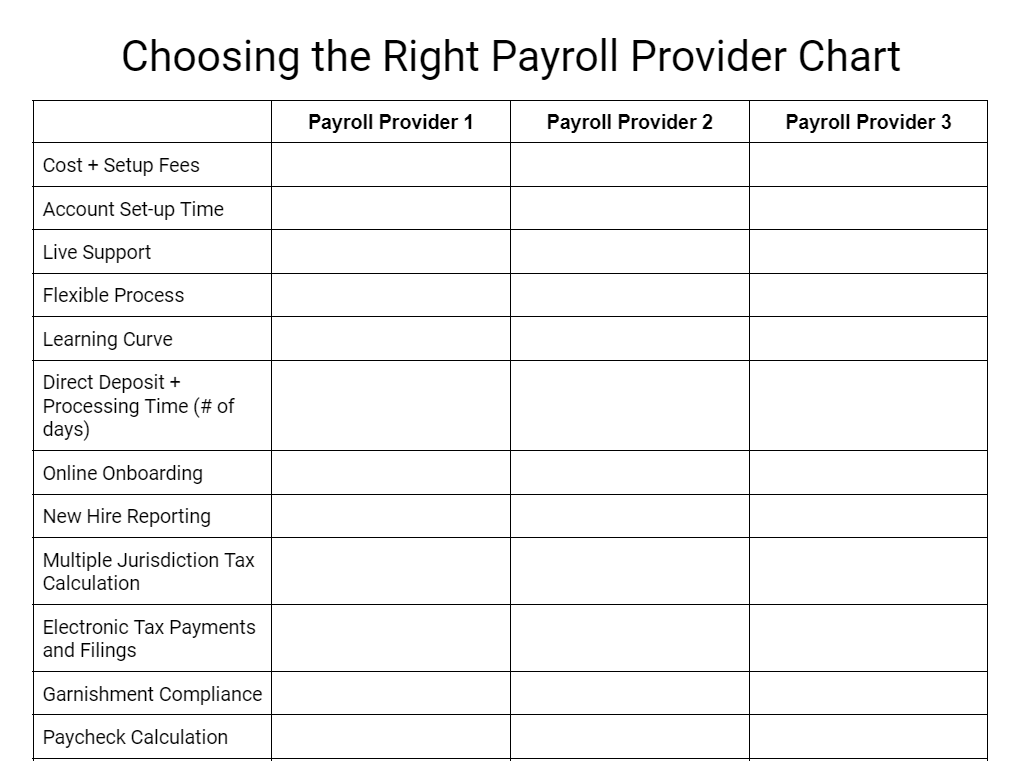

The next step you should take is to research payroll service providers and compare them based on the features you need. I recommend starting a chart that lists the differences between the providers that capture your interest. This will make it easier for you to see how each provider stands up against the other.

For your convenience, you may use the below comparison chart we’ve created. Simply fill in the details to allow you to objectively see the pros and cons of each provider.

Other Considerations for Choosing a Payroll Service

Though the number of employees you have, where they work, and their employment types matter a lot when picking a payroll provider, we also want to give you a couple of other factors to consider:

Workers’ compensation, payroll taxes, and other compliance issues are important areas you will need to keep up with once you start to hire people. If you’re a business owner who just wants compliance done, you will want to strongly consider HR software or payroll software. For example, if you choose a payroll service like Gusto (read our review), you can purchase and set up your workers’ comp coverage right from the software.

If you would rather do it yourself to track costs, then you can buy workers’ comp on the private market or through a broker. Just remember, your accountant and your bank most likely won’t guarantee compliance like an HR or payroll software provider would.

Customer reviews are an essential part of shopping for payroll services. The best ones are on third-party sites. They’re usually unbiased and show both the pros and cons. I recommend giving extra weight to those that have businesses in your industry and/or a similar number of employees, so you get a better preview of the experience you are likely to have with the service. Expert payroll reviews are also essential.

When you’ve narrowed your choices down to two or three payroll providers, ask them for existing customers so you can speak with them about their experience. You could also ask for prior customers. Many services may not automatically provide this information, but the rep you’re working with can check with the other clients they work with to see if they’d be willing to discuss their experiences.

When you speak with a customer, ask them about their overall experience, what went wrong during integration, what problems they’ve encountered, and how the provider has supported them and their employees as their business has grown and evolved. This will give you a clear picture of what it’s like to be a customer of the chosen payroll provider.

One of the important steps on how to choose payroll software is to look at the providers’ reputation. Check their track record, and if they provide reliable services and solutions to their clients.

Payroll software and service providers typically use cloud-based systems that rely on internet connection to work. If there are system outages or downtimes for maintenance, ask the payroll provider how often this happens and how soon they can get the software up and running again.

Check whether the payroll provider offers other services, such as benefits plan administration and access to HR advisors, that you can get either as a paid add-on or an additional feature if you upgrade to a higher tier.

Having access to online payroll tools that can streamline pay processes is great, but it should not be difficult to learn and use. The interface should be user-friendly and intuitive so you can run payroll with ease.

Frequently Asked Questions (FAQs)

What is the best payroll software?

It depends on your payroll needs. The best pay processing software for your business should meet all of your criteria—from ease of use and budget to functionalities and customer support.

Is a cloud-based payroll system better than a self-hosted solution?

If you don’t have an in-house IT expert or team to manage a self-hosted system, then a cloud-based payroll is the right one for you. Regardless of which option you choose, you must get a system with high-security standards to protect your payroll and employee data.

What’s the best time to switch payroll providers?

While you can change payroll providers at any time, scheduling this at the end of a quarter or calendar year will make it easier for you to track and manage payroll taxes and required government form filings.

Bottom Line

There are numerous payroll service options for small businesses, but they’re not a one-size-fits-all solution. So, knowing how to choose a payroll service will help you find the right solution for you.

You should choose the best one for your business based on the features you need and your budget. Be sure to differentiate wants versus needs and factor in any major business changes (size, location) you anticipate happening within the next five years.