The best PEO companies offer full HR and payroll services and provide solid support in handling regulatory compliances, payroll tax regulations, and labor laws. PEO services should also include access to a wide range of benefits at better rates—options and pricing that, at times, you can’t normally get as a small or midsize business.

For this guide, we reviewed 12 PEO companies for small businesses and narrowed the list down to our top eight recommendations.

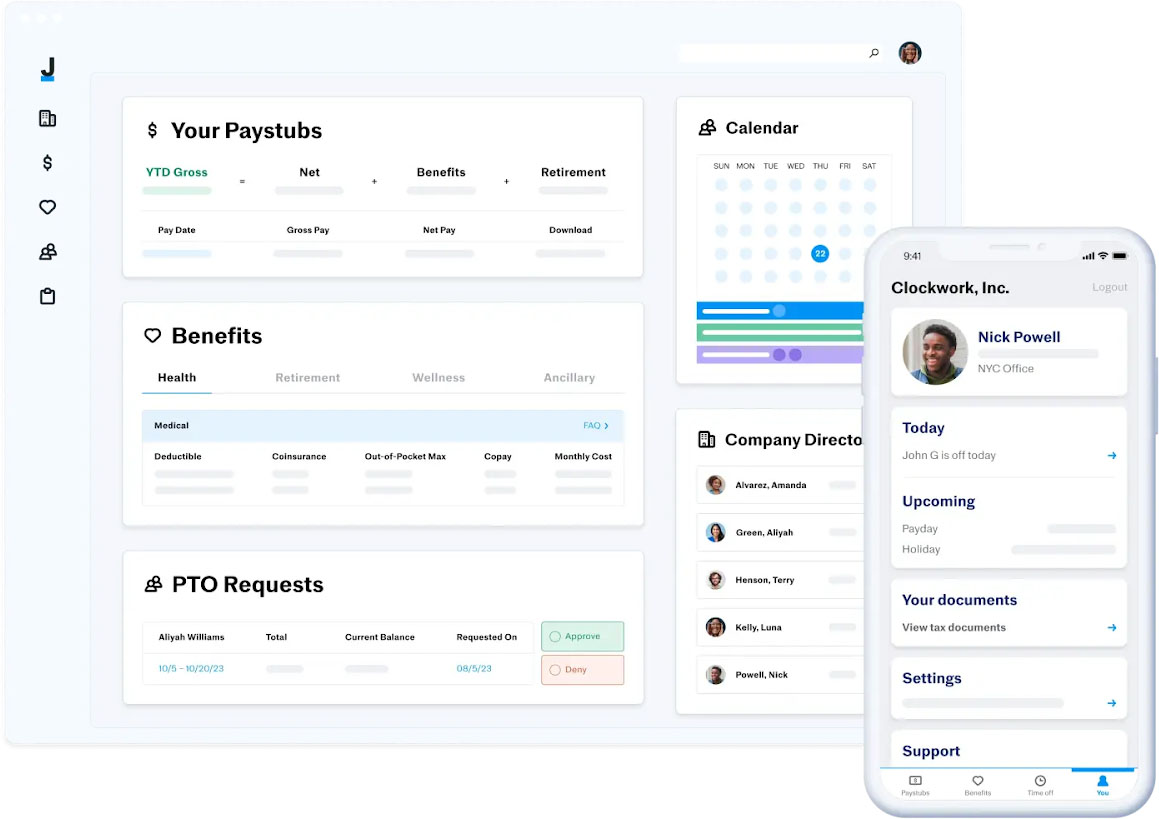

- Justworks: Best overall PEO

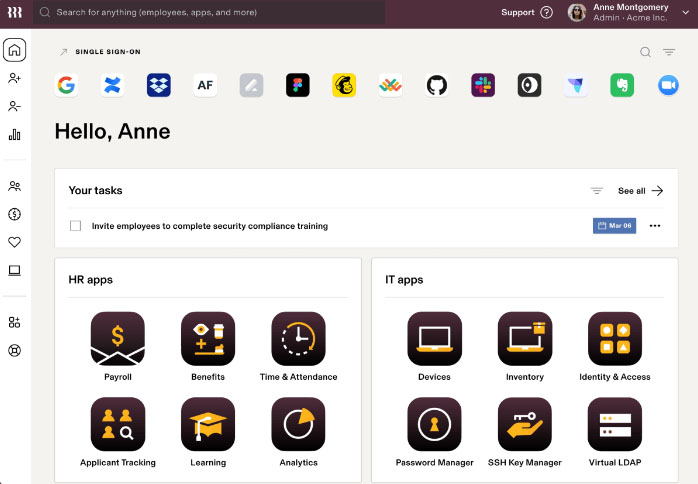

- Rippling: Best for businesses needing HR and IT management

- XcelHR: Best for robust benefits

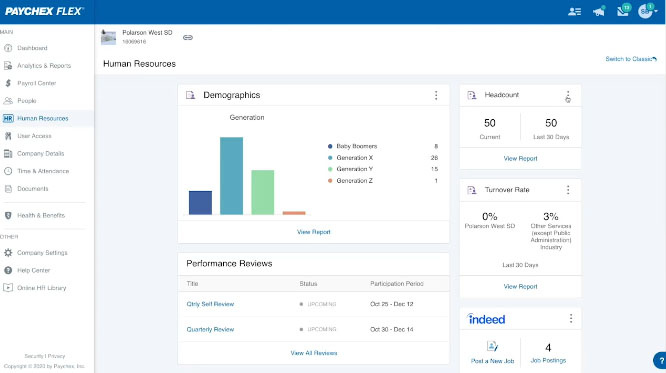

- Paychex PEO: Best for highly customizable PEO plans

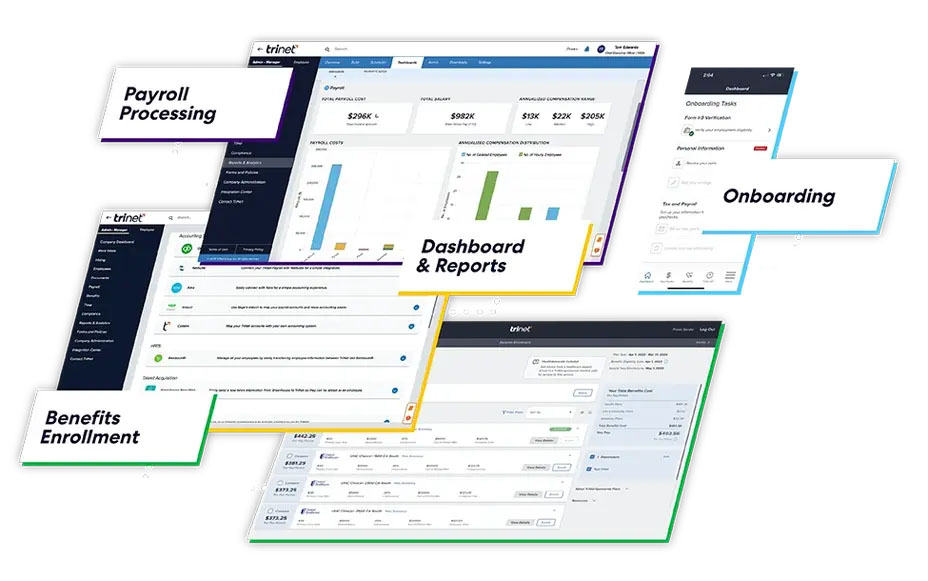

- TriNet: Best for industry-specific PEO services

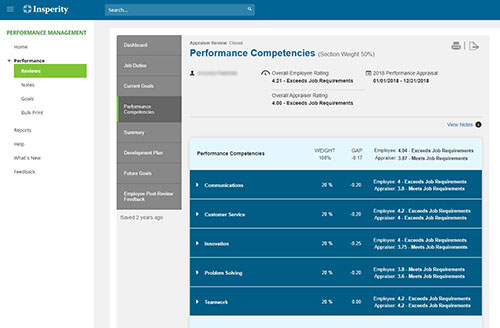

- Insperity: Best for midsize businesses needing training

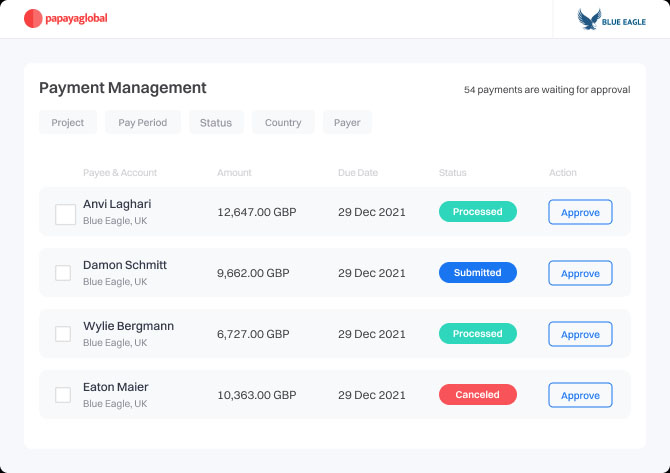

- Papaya Global: Best for international payroll and EoR services

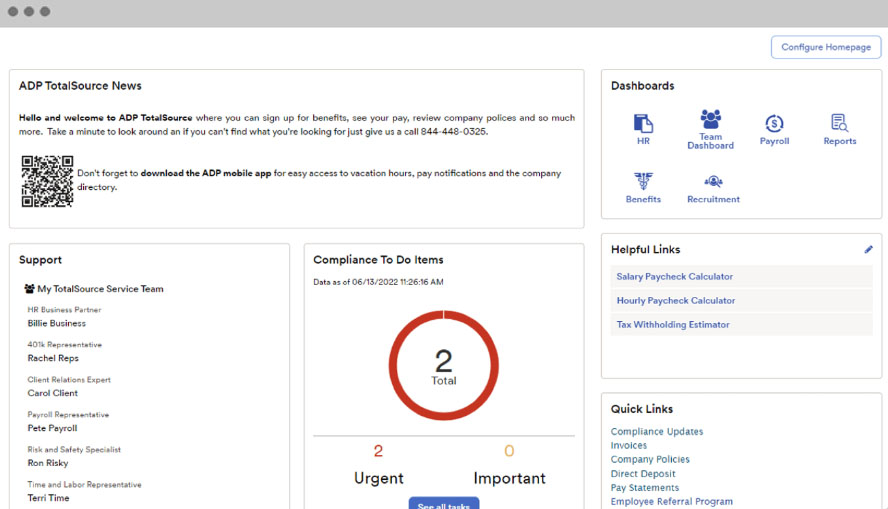

- ADP TotalSource: Best for growing businesses

Grow your business with tailored PEO solutions from Justworks |

|

Best PEO Providers for Small Businesses Compared

All the professional employer organization (PEO) companies we reviewed offer hire-to-retire services, pay processing, payroll tax administration, year-end tax forms, employee benefits plans, and compliance assistance. Below are the providers’ standout features.

Our Score (out of 5) | Starter Monthly Pricing | IRS- and ESAC- Certified | Unlimited Pay Runs | Unique Employee Benefits | 24/7 Phone Support | |

|---|---|---|---|---|---|---|

4.46 | $59/employee | ✓ | ✓ | Health advocacy services; fitness membership | ✓ | |

4.30 | Call for quote | ✕ | ✓ | 1:1 expert healthcare guidance | ✕ | |

4.26 | Call for quote | ✕ | Set schedule | Home insurance; travel and entertainment discounts | ✕ | |

4.22 | Call for quote | ✓ | Set schedule | Financial wellness tools | ✓ | |

4.21 | $150/employee for a company with 25 workers* | ✓ | Set schedule | Wide range of employee discounts | ✕ | |

4.20 | Call for quote | ✓ | Set schedule | Employee assistance program | ✕ | |

4.18 | $25/employee for payroll; $599/employee for EoR | ✕ | ✓ | Global health benefits | ✕ | |

| 4.12 | $85/employee* | ✓ | Set schedule | Discounts at retailers and restaurants | ✓ |

*Pricing is based on a quote we received

Best PEO Company Quiz

At Fit Small Business, our mission is to provide small business owners with the best answers to their small business questions. Our subject matter experts are committed to bringing you unbiased evaluations of HR and payroll software and services.

We use product data and a detailed methodology to objectively assess each solution we recommend, regardless of whether they are partner companies. Our evaluations and ratings are based on a set of criteria, which includes features, pricing, ease of use, and customer support. We also apply our expert insights and consider real-world user feedback to help you make the best purchasing decision.

Justworks: Best Overall PEO Service for Small Businesses

Pros

- Enterprise-level benefits from major insurance companies + 401(k)

- Excellent customer support

- Now offers EoR services and international payments

- IRS- and ESAC-certified

Cons

- Limited integrations

- Users say the PTO tools are not robust

- Has preset payout schedules for hourly and non-exempt salaried employees (set every other Friday)

Rippling: Ideal for Tech-heavy Companies Needing Robust Integrations & IT Hardware Support

Pros

- Excellent integration capabilities with over 500 options

- Can easily turn PEO on and off and still access HR/payroll software

- Intuitive interface

- Can pay international contractors

- Modular HR, payroll, benefits, and IT solutions

Cons

- Lacks IRS and ESAC certification

- You can’t buy its payroll solution (and other modules) without purchasing its core workforce management platform first

- Gets pricey as you add functions

- Phone support with HR experts costs extra; how-to guides are limited

XcelHR: Lead PEO for Benefits & Employee Assistance Plans

Pros

- Wide range of benefits, including home insurance and an employee assistance plan

- Compliance support includes workplace safety inspections and policy help

- Dedicated representative; live support available

Cons

- Interface looks dated

- Pricing isn’t transparent

- Lacks ESAC certification (which is the gold standard for PEOs); no longer on the IRS-certified PEO list

Paychex PEO: Best for Businesses Seeking Highly Customized PEO Plans

Pros

- Customizable PEO plans with a wide range of benefits options

- Access to an HR team with various specialties

- IRS- and ESAC-certified

Cons

- Pricing isn’t transparent

- Can get pricey as you add features

- Fees can change each year

TriNet: Top Pick for Businesses with Industry-specific Needs

Pros

- Tailors your plan to your industry

- Prices decrease when employees meet social security or unemployment rate maximums

- IRS- and ESAC-certified

Cons

- Dedicated reps for larger businesses only

- Pricing not transparent

Insperity: Ideal for Midsize Businesses Wanting Complete PEO Services Focused on Training

Pros

- Employees can directly contact Insperity for a wide range of concerns

- Excellent training tools and LMS for employees

- Access to 50 prebuilt reports

- IRS- and ESAC-certified

Cons

- Pricing isn’t transparent

- Has a bit of a learning curve

- Help section is hard to find and isn’t in-depth

- Starter plan requires a minimum of five employees

Papaya Global: Leader for Global Businesses Needing International Payroll & Compliance Support

Pros

- Handles payroll, HR, and compliances for over 100 nations

- Transparent pricing

- Employer of Record (EoR) in over 160 countries; lets you hire without assistance from a local entity

Cons

- Can get expensive depending on the services you require

- Lacks 24/7 customer support

- Doesn’t have IRS and ESAC certifications

ADP: Perfect for Growing Businesses Wanting the Expertise of a Big PEO

Pros

- Highly experienced PEO that’s IRS- and ESAC-certified

- Dedicated reps are helpful

- Global payroll available

- Access to enterprise-level benefits

Cons

- Pricing isn’t transparent

- Software looks dated

- Customer service isn’t always easy to contact

- Time tracking and recruiting tools are paid add-ons

PEO Costs—How It Works

PEO companies follow different pricing schemes, most of which are based on employee headcount. Some have flat monthly per-employee fees, while others charge a percentage of your worker’s salary. A few PEOs also consider your company’s credit rating and your employees’ health benefits history to determine pricing.

For PEOs with flat monthly pricing, expect to pay somewhere between $40–$160 per employee monthly. For PEOs that charge a percentage of payroll, the fee is about 2%–12% of payroll.

An employer-of-record (EoR) is slightly different from a PEO. These services set up employment in other countries. Like a PEO, an EoR handles all payroll, benefits, and tax compliance in the country. Prices typically start around $500 per employee per month.

How We Chose the Top PEO Companies

We examined 12 top-of-the-line professional employer organization companies for essential HR and payroll tools small businesses need, weighing attributes accordingly. We considered size, special features, user feedback, and more. Overall, Justworks ranked highest among small business PEOs.

To see our full evaluation criteria, click through the tabs in the box below.

20% of Overall Score

We looked for providers with transparent pricing, zero setup fees, and charges on a per-employee basis. Most PEOs in this guide do not list their pricing online and require you to call and get a custom quote

20% of Overall Score

We looked for robust HR administrative support, from hiring to retiring, including assistance with employee career development, compliance tracking, and benefits offerings that are available across the US.

15% of Overall Score

We looked for automatic payroll runs, direct deposits, paper check options, W-2 reporting, and payroll tax processing (federal, state, and local taxes).

15% of Overall Score

In addition to having helpful features like how-to guides, dedicated representatives, and customer support options, we looked at user reviews from third-party sites like G2 and Capterra. Then, we averaged the ratings on a 5-star scale, wherein an average of more than 4 stars is ideal.

15% of Overall Score

While all the products on our list offer great features, this criterion looked at how well they worked for the needs of small businesses, especially those on a budget.

10% of Overall Score

We checked whether PEOs provide additional HR solutions, such as recruiting, applicant tracking, time and attendance, and learning management tools.

5% of Overall Score

The IRS and the Employer Services Assurance Corporation (ESAC) both certify PEOs for adherence to strict standards and ethical practices, so we checked whether these providers are certified. We also considered customized reports as these are often for compliance issues.

PEO Frequently Asked Questions (FAQs)

A PEO company provides businesses with a co-employment option, allowing it to share and manage employee-related responsibilities and liabilities with you. Typically, PEOs serve as your employees’ professional employer for payroll and tax purposes. However, you still have complete control over business decisions and operations.

With its full-service human resource outsourcing services, a PEO company handles your day-to-day administrative tasks—from pay processing to benefits administration and workers’ compensation management. Risk mitigation and HR compliance support are also included in a PEO’s services. Some PEO companies even provide end-to-end talent management solutions, such as hiring, training, and employee performance reviews.

While you may consider the pricing of a PEO expensive, it does handle all HR and payroll functions for your business. Essentially, it is replacing a full HR department. Considering the salaries of a full HR department, the pricing of a PEO is comparable.

Bottom Line

PEO companies invariably say that the biggest benefits their clients get are relief from HR administrative tasks and protection from noncompliance issues. These save their clients time and money—sometimes thousands of dollars. Studies by the National Association of Professional Employer Organizations (NAPEO) have shown that employers using a PEO see an average ROI of 27.3% and a retention improvement of 10% or better.

If you want to remove some of the headaches of managing HR and doing payroll on your own, contact a PEO and see how it can help you. We recommend Justworks as it has efficient HR, compliance, and payroll tools with enterprise-level benefits that small businesses normally don’t have access to. Its plans are also reasonably priced with monthly fees that become more affordable as you grow your workforce. Sign up for a Justworks plan today.