Performing payroll reconciliations regularly can be a great way for you to catch any errors or outstanding items that may need attention. There are two components to payroll reconciliation—reconciling a payroll cycle before processing it and performing a balance sheet reconciliation to find errors. We’re going to walk you through everything you need to know to complete both and make payroll a little less stressful.

Conducting a payroll audit is another great way to verify your payroll process is accurate and avoid costly errors. Check out our article and free walkthrough video on conducting a payroll audit.

Payroll Summary Reconciliation

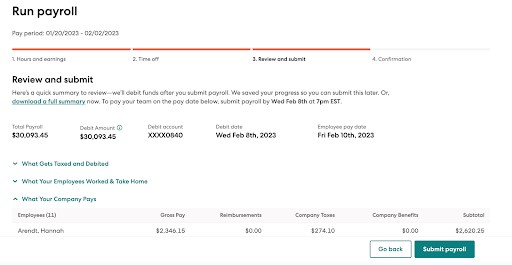

Before submitting a payroll, it’s important to perform a reconciliation to avoid having to correct any potential mistakes. Here are four simple steps you can follow:

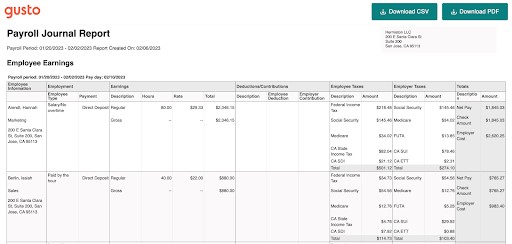

A payroll summary or register has all of the payroll data for each employee for the period. Before processing payroll, it’s important to verify all of the employee’s personnel and payroll information. Some of these include:

- Full name

- Employee information (address, SSN, etc.)

- Salary/hourly wage

- Regular and overtime hours

- Days/hours worked for the period

While salary amounts are pretty standard, hourly employees tend to have more variation in their pay rates each period. Many hourly employees even have different hourly rates for different roles that they hold within the organization. This can be an area where issues/mistakes are easily missed so you must review the correct rates for each employee, for all roles that they hold, before running payroll. Compare the rates on the payroll summary that you’re about to process to a master list of rates to make sure your employees are being paid accurately.

Similar to pay rates, if many of your employees are salaried, there might not be a ton of information that needs to be verified regarding hours before payroll is processed. However, for all of your hourly employees, hours are arguably the most important aspect of payroll reconciliation.

It’s important to be diligent when you’re entering hours into payroll to make sure that you don’t accidentally enter too many or too few hours. Verifying the hours worked during the period is a great opportunity for you to re-verify what you’ve entered into payroll to ensure that if there were any errors you can catch them before the payroll is processed. In addition to being time-consuming, dealing with overpayments and reclaiming those funds can create legal ramifications. So, it is best to just avoid those mistakes and the issues that come with them.

If you use a payroll provider, like Gusto, that has a built-in timekeeping system, there are far fewer manual entries required to process payroll. This can help you avoid errors that can get tedious and expensive. Try Gusto for free for 30 days and see if it’s the right fit for your business.

Many standard payroll deductions are pretty consistent and won’t need too much attention between payroll cycles, as they either don’t change or are calculated automatically by your payroll software. These regular deductions include but are not limited to:

- Federal and State Income Tax

- Social Security and Medicare

- Health Insurance Premiums

Still, it’s best practice to review them before processing payroll just to be sure nothing catches your eye as being off. In addition, there are often one-time deductions or reimbursements that are processed through payroll that may need more attention to ensure accuracy (such as an employee being reimbursed for personal funds spent for a work matter). You should verify all deductions and reimbursements (using whatever list or software you use to track these) before processing payroll.

Once you’ve reconciled all of your payroll data, including your employees’ personal information, pay rates, hours worked, and any deductions/reimbursements to your payroll register for the current period, you’re ready to process your payroll!

Balance Sheet Reconciliation

Another component to the reconciliation process involves the balance sheet. The best way to reconcile your payroll accounts is to list all of your payroll-related balance sheet accounts that don’t clear to $0 and research the issues that need to be rectified so all funds go where they should be.

To help simplify the process, we have a free payroll reconciliation spreadsheet. You can download the free spreadsheet and use the below step-by-step instructions to guide you.

Before we dive into the reconciliation process, first make a list of the balance sheet accounts you need to reconcile each month.

A balance sheet is one of the major financial statements businesses produce. It shows the balance of assets, liabilities, and equity accounts at a single point in time (December 31, 2022, for example) as opposed to a period (January 1, 2022–December 31, 2022).

Here’s a list of the payroll-related balance sheet accounts you may need to reconcile.

- Accrued Payroll: Net payroll amount that has been earned but not paid out

- 401(k) Payable: Contributions employees make to their 401(k) accounts (you can create different accounts if you have multiple retirement account options); you can also put any contribution matches your business is making into this account, and hold the money there until it’s paid

- Health Insurance Payable: Employee-paid insurance premiums plus contributions you have booked as a business expense but have not paid

Pro Tip: If your accounting system allows, consider labeling the transactions that consist of both employee and employer funds (use the codes EE and ER). This will help you during the reconciliation process, especially when you’re trying to research discrepancies.

Keep in mind that most likely all of the accounts you’ll be reconciling will be liability accounts. This means the money should stay in the account until you pay it out. The point of reconciling your payroll accounts is to ensure nothing is lingering too long; when you do find items that don’t clear from your payroll balance sheet accounts each month or quarter, you may likely have forgotten to pay a bill, or a transaction wasn’t recorded correctly.

If you’re feeling a little unsure about this step, the general ledger accounts, or related journal entries, take a quick look at our guide on how to do payroll accounting.

You’ll need to make copies for each payroll account on the balance sheet and make a new copy at the end of each month. Label the spreadsheet with the account name. You should have a beginning and ending balance for each that ties to the general ledger (GL) balance records. Leave space as well for reconciling items.

Reconciling items are transactions that aren’t reflected correctly or at all in the GL. You’ll find it causes your GL to be out of balance, meaning it won’t be clear how the account’s beginning balance transitioned to the ending balance.

You’ll need a monthly transaction report from your GL for each payroll-related balance sheet account, preferably one that shows the beginning and ending balances for the month. Reports you may need to gather from your payroll software are a payroll register or the list of monthly payroll transactions, payroll tax report, payroll deduction report, etc.

For more complex issues, you may have to dig into your payroll cash reports or itemized invoices from your benefits providers.

Now you’re ready to start reconciling your payroll accounts. If you can download the transactions from your accounting software into a spreadsheet, the process may be easier—or you can copy and paste them onto your spreadsheet.

If your account had transactions for the month but has a $0 balance at month-end, you should show this on your reconciliation sheet and verify it’s clear. I would still paste the transaction list in another tab just to have it in your records if you need to take another look at the account.

If there is a balance at month-end, you’ll need to sift through each debit and credit to find those that did not clear completely. When dealing with numerous transactions, I always found it helpful to delete the debits and credits that net to $0, so it’s easy to see what’s remaining.

If your business is really small and you have a handful of transactions, this process will be a breeze, and you may not need to do that. Either way, I still recommend maintaining a separate tab that shows all of the transactions, whether they cleared or not.

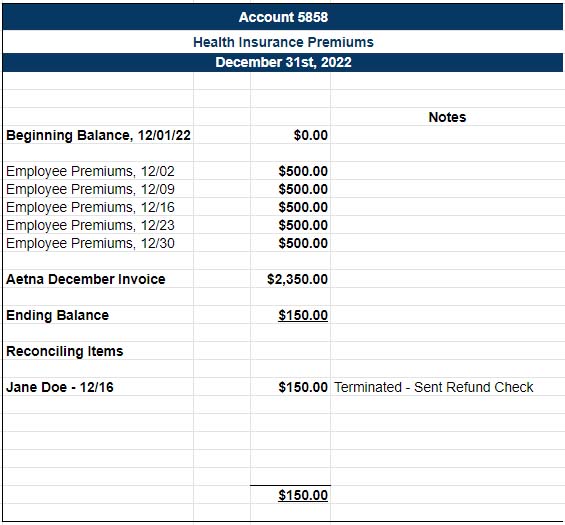

For Example: In the image below, we see that employee health insurance premiums were collected during weekly payroll runs and booked to the liability account, totaling $2,500 ($500 per weekly payroll, for 5 weeks).

We also see where the business paid the insurance company $2,350 to cover the December insurance bill. The issue is that even after paying the $2,350 insurance bill, there is still a $150 credit left in the account from the employee premiums.

To resolve the issue and clear the account, you’ll need to research the reason behind it before coming up with a solution. In this case, Jane Doe was deducted the insurance premium for the entire month, but was terminated on the 16th, and is owed a $150 refund.

Download our free payroll reconciliation template

Reconciling items can be vastly different in what they require to resolve. In our health insurance premium example above, the first step would be to take a look at the health insurance invoice. Is it itemized by employee? Also, look at your payroll deduction report for the month. Take a look at the employee paychecks you withheld $500 from for the month, or $250 from each pay period. Are the employees still with the company? Are they showing on the invoice?

Depending on the answers to these questions, you may need to reverse the $500 transaction and refund an employee their money, work with the insurance company to determine if the invoice needs to be corrected, or hold the money to pay on next month’s bill.

Other common reconciliation items you may run into are:

- A check was voided in the payroll system but not the GL (having payroll software that’s integrated with your GL can eliminate this issue, because it automates the process).

- A bill from your benefits provider was different from expectations; maybe an employee left, and you withheld their premium for the next month. If you didn’t notify the company, the charge will still show on the invoice. This can lead to an additional, unnecessary expense if you allow it.

- Employees left before 401(k) contributions qualified for vesting; the funds would be set aside and still show in the liability account if not yet paid but will need to be reversed to reconcile.

- You expensed charges that should have been covered by employee deductions.

When doing payroll reconciliations, don’t be afraid to dive deep when necessary. Call vendors, verify payroll details with employers, check your bank and tax records, etc. Also, pay attention to payroll compliance rules; if you’re only paying taxes quarterly or annually, some of your tax liability accounts have a balance more often than not. Stay abreast of the deadlines, and be sure the charges clear when they should.

Bottom Line

As a small business owner, it won’t hurt to learn how to reconcile payroll. Even if you hire a bookkeeper to do the reconciliation for you, you need to know what to expect, so you know when something is off. If expectations and actual payments don’t match exactly, the differences should be cleared promptly.