We’ll walk you through filling out Form 2553, which businesses and other eligible entities use to elect to pay taxes as an S corporation (S-corp). To make this election, you’ll have to fill out a four-page, four-part form. Once completed, you’ll be notified roughly 60 days after you filed whether your election was accepted or denied. Read on for the step-by-step instructions for Form 2553.

Key Takeaways

- The deadline to file Form 2553 is two months and 15 days from the start of the first S-corp tax year.

- If you can show reasonable cause for missing the deadline, you have 3 years and 75 days from the start of the S-corp tax year to make a late election.

- Before completing the form, you must ensure that the corporation is a domestic corporation, has no more than 100 eligible shareholders, and has only one class of stock.

- All shareholders must sign Form 2553.

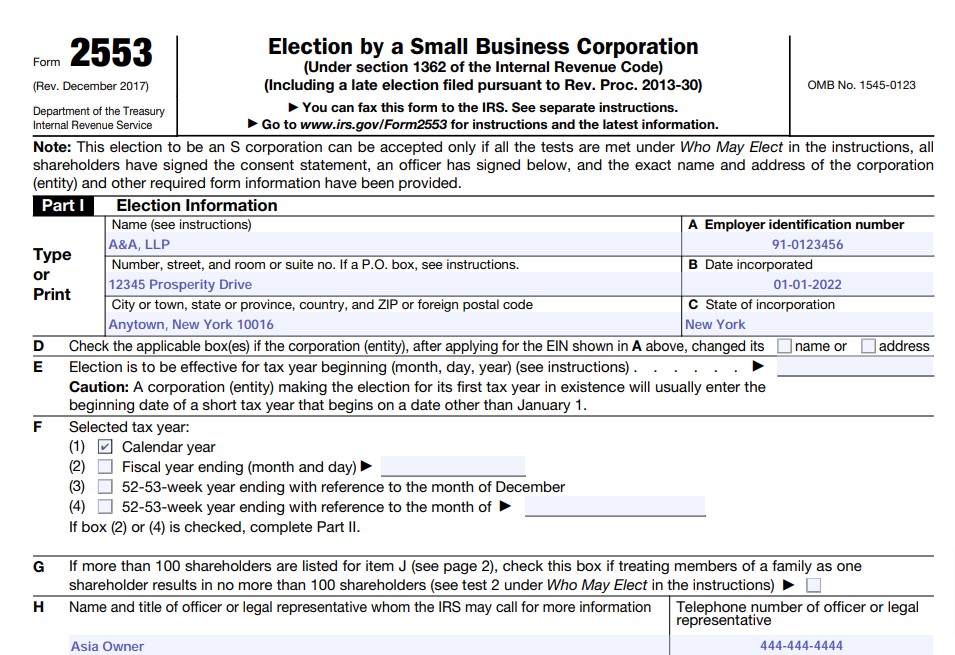

Step 1: Complete Election Information Section in Part I

This section requires you to provide information like your company’s name, address, and employer identification number (EIN) and the names of shareholders and their percentage ownership. Let’s look at how to complete each line below.

1.1. Enter the name of the corporation and its mailing address at the top of the form. If the corporation’s mailing address is the same as the owner’s or shareholder’s, enter “C/O” and the person’s name following the corporation’s name.

1.2. Enter the corporation’s EIN in Part I, box A. If you have yet to apply for an EIN, read our guide on how to get an EIN. If the corporation hasn’t received its EIN by the time the form is due, enter “Applied For” and the date the EIN was applied in the space for the EIN.

1.3. Enter the date the corporation was formed in Part I, box B.

1.4. Enter the state of incorporation in Part I, box C.

1.5. Check box D if the corporation changed its name or address after applying for an EIN.

1.6. Check the appropriate section in box F to indicate which type of tax year your corporation follows. If you check boxes (2) or (4), you should complete Part II:

- Calendar year: A calendar year is a one-year period between January 1 and December 31. The vast majority of small businesses use the calendar year as their tax year, with their tax year ending in December.

- Fiscal year ending (month and day): If not December 31, provide the month and day that your tax year ends. There are strict limitations on an S-corps ability to elect a non-calendar fiscal year.

- 52–53-week year ending with reference to the month of December: A 52–53-week tax year is a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month.

- 52–53-week year ending with the reference month that your corporation provides: The reference month is the month that the corporation provides.

1.7. If you have more than 100 shareholders listed in Section J and wish to treat family members as one shareholder, check box G. If this section does not apply, leave this section blank.

1.8. Enter the name of the corporate representative that the IRS may contact in box H.

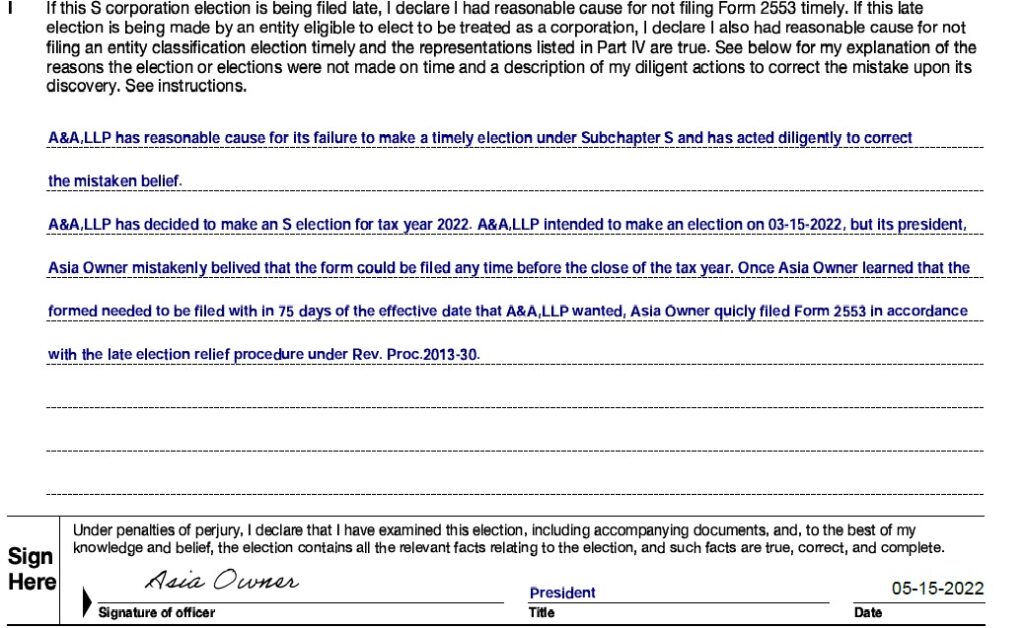

1.9. If you are making a late election, complete Section I, stating the reasonable cause for making the election late. To make a late election and receive relief, you must satisfy the following:

- You intended to be classified as an S-corp but failed to qualify as an S-corp solely because the election was not timely.

- You had reasonable cause for its failure to make the election on time.

- The S-corp and all shareholders reported their income consistent with an S-corp election in effect for the year the election should have been made and all subsequent years.

- Less than three years and 75 days have passed since the effective date of the election. If you are not making a late election, leave this section blank.

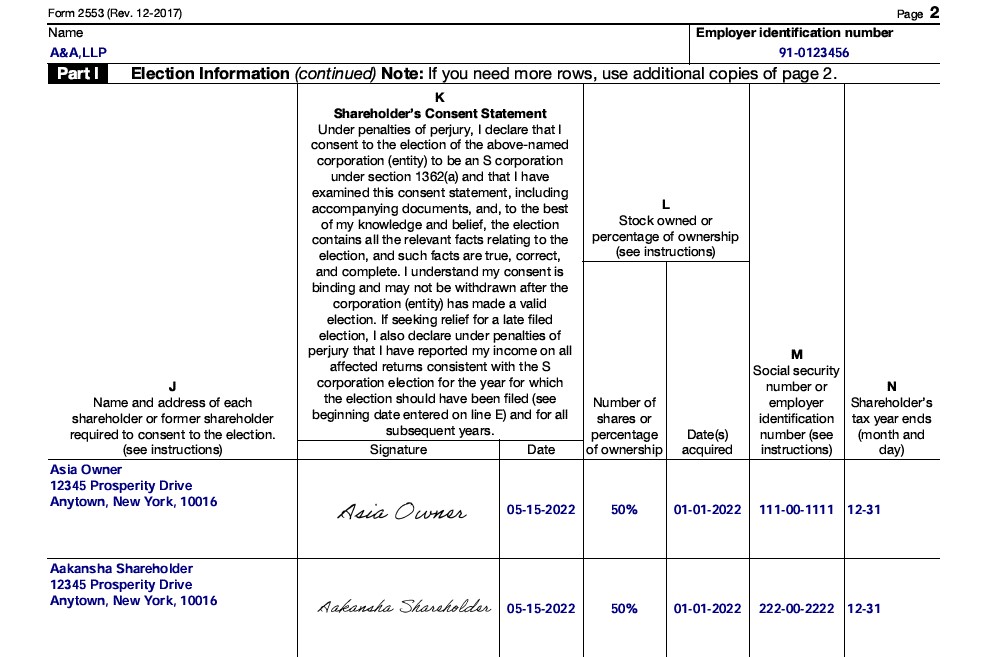

1.10. Enter the name and address of each shareholder required to consent to the election in box J.

1.11. Each shareholder should sign and date the shareholder’s consent statement located in box K.

1.12. Enter the number of shares or percentage ownership and dates acquired for each shareholder in box L.

1.13. Enter the Social Security number or EIN for each shareholder in box M.

1.14. Enter the shareholder’s tax year in box N.

A&A, LLP is a newly formed limited liability partnership (LLP) that was formed on Jan. 1, 2022. Rather than being treated as a partnership for taxes, its members, Aakansha and Asia, decided to make an S-election but did so on May 15, 2022.

Sample Form 2553, Part I, Lines A–H, Page 1

Since A&A, LLP decided to make an election late, it must complete Section I, providing a reasonable cause for the late election.

Sample Form 2553, Part I, Line I Page 1

Asia and Aakansha both filled in the requested information in boxes J through N of the section page of Part I.

Sample Form 2553, Part I, Lines I Page 2

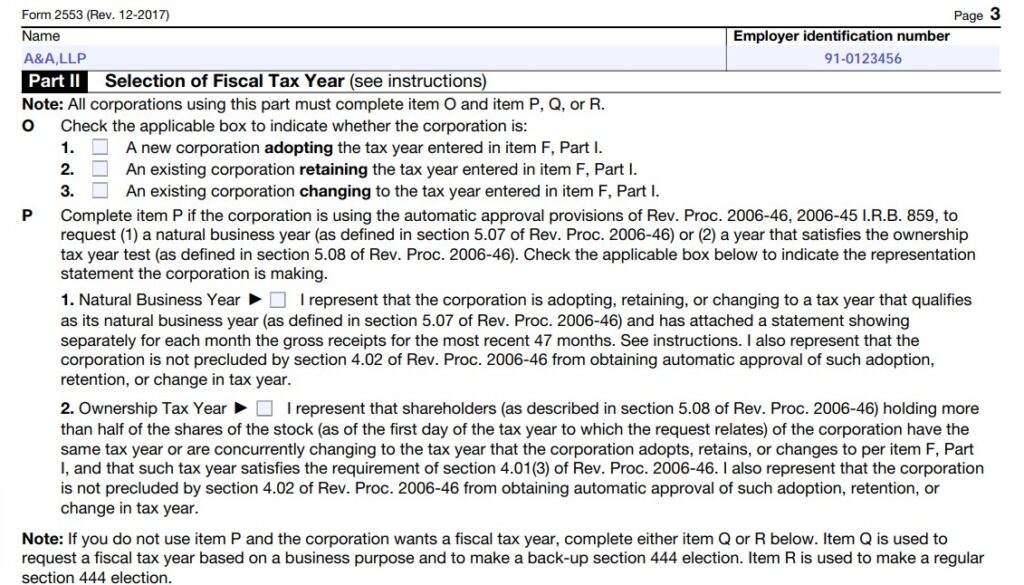

You only need to complete Part II if you’re selecting a non-calendar year-end, as indicated by selecting box 2 or 4 in item F on the first page. Otherwise, you can jump to Step 3.

Here, you’ll provide the IRS with your corporation’s fiscal year on lines O through R. Let’s look at the steps to complete this section below:

2.1. In box O, check the appropriate box to indicate whether the corporation is

- A new corporation adopting the tax year entered in item F, Part I

- An existing corporation retaining the tax year entered in item F, Part I

- An existing corporation changing to the tax year entered in item F, Part I

2.2, Complete item P if the corporation is using the automatic approval to request a natural business year or a year that satisfies the ownership tax year test. Check either box 1 or 2 to indicate whether the corporation is making a statement to select a natural business year or an ownership tax year:

- Natural business year is the period of 12 consecutive months (or 52–53 consecutive weeks) ending at a low point of the organization’s activities for the year. For example, an S-corp can have a natural business year of July 1 to June 30th.

- Ownership tax year is the tax year of the shareholders owning more than 50% of the stock in the corporation.

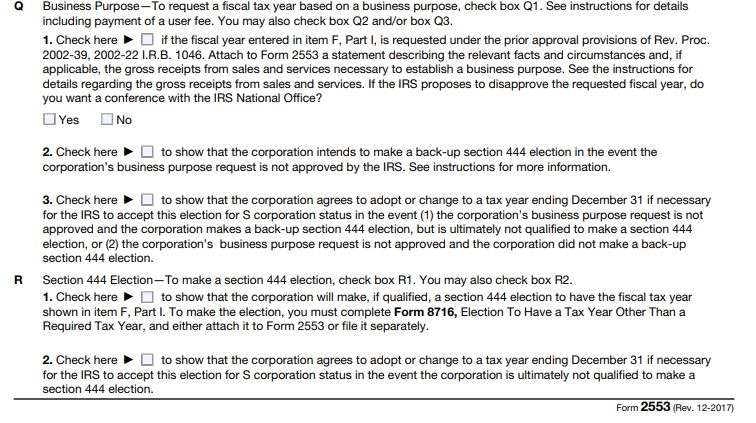

2.3. Check box Q1 if your corporation would like to select a fiscal year based on business purposes. If you check this box, it will take an additional 90 days for the Form 2553 to be accepted.

2.4. Check box Q2 to show that the corporation intends to make a backup section 444 election in the event the corporation’s business purpose request is not approved. This is an election to select a tax year other than the required tax year.

2.5. If the corporation’s business purpose request is denied and the corporation makes a backup section 444 election, but the corporation is ultimately not qualified to make a section 444 election, then the corporation agrees to adopt or change to a tax year ending December 31 if the IRS requires this for the IRS to accept this election for S-corp status by checking box Q3.

2.6. If the company meets the requirements, it may indicate that it intends to do so by marking box R1 and reporting its fiscal tax year as the one listed in item F, Part I. Fill out IRS Form 8716 to make the election.

2.7. If the company is not eligible to make a Section 444 election, checkbox R2 to indicate that it will adopt or convert to a tax year ending December 31 if the IRS requires this to accept the S-election.

Let’s look at how Part II of Form 2553 was filled out by Asia and Aakansha. Since they checked box 1 in item F of Part I indicating a calendar-year end, A&A, LLPs aren’t required to complete Part II. They should include it with their return but leave it blank.

Sample Form 2553, Part III, Lines O–P, Page 3

Lines Q & R do not apply to A&A, LLP, so Asia and Aakansha left this section of the form blank.

Sample Form 2553, Part III, Lines Q–R, Page 3

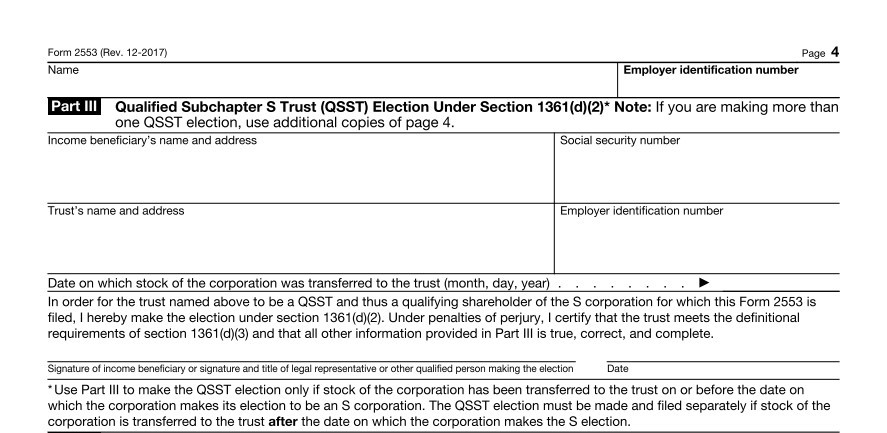

Part III of the form is used solely by corporations making a Qualified Subchapter S Trust (QSST) Election Under Section 1361(d)(2). This type of election is made on behalf of a trust that retains ownership as the shareholder of an S-corp; this will typically be the income beneficiary or legal representative. If this section does not apply to you, you can skip it and jump to Step 4.

3.1. This section is similar to Part I, you’ll need to fill in the income beneficiary’s name, address, and Social Security number, as well as the trust’s name, address, and EIN.

3.2. Under the identifying information, you’ll need to supply the date on which stock of the corporation was transferred to the trust.

3.3. Lastly, the income beneficiary will need to sign and date this section.

Part III of Form 2553 does not apply to A&A, LLP, so Asia and Aakansha left this section of the form blank.

Sample Form 2553, Part III, Page 4

Step 4: Include the Representations Made in Part IV in Any Request for a Late Election

There is no information to complete in Part IV. It just provides a list of representations that you must make in any request for late election relief.

Expert tip from Tim Yoder, CPA: Having an S-election denied can have serious consequences for your business. The election is straightforward if you file Form 2553 on time, but things get very technical if filing late. I’d recommend getting professional tax help if you’re filing late.

When To File Form 2553

Depending on your company’s situation, you must file Form 2553:

- During the tax year that precedes the tax year for which the corporation wants the S-corp election to take effect

- No later than two months and 15 days from the beginning of the tax year in which the election is to take effect

- With your tax return or separately if you miss the initial deadline and want to make a late election

Where To File Form 2553

To file Form 2553, the corporation must submit the form to the appropriate IRS service center by mail or fax.

Corporation's Primary Place of Business, Office, or Agency | Address or Fax Number |

|---|---|

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or Wisconsin | Department of the Treasury Internal Revenue Service Center Kansas City, MO 64999 Fax: (855) 887-7734 |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, or Wyoming | Department of the Treasury Internal Revenue Service Center Ogden, UT 84201 Fax: (855) 214-752 |

How To Revoke an S-election

To revoke an S-election, you should submit a statement of revocation to the service center where you file your annual return.

The statement should include the following information:

- The corporation revokes the election made under Section 1362(a)

- Name of the shareholders

- Address of the shareholders

- Taxpayer identification number of the shareholders

- The number of shares of stock owned by the shareholders

- The date (or dates) on which the stock was acquired

- The date on which the shareholder’s taxable year ends

- The name of the S-corp

- The S-corp’s EIN

- The election the shareholders revoke

- The statement must be signed by the shareholders under penalties of perjury

- Signature and consent of shareholders who collectively own more than 50% of the number of issued and outstanding stock of the corporation, (whether voting or nonvoting)

- Indication of the effective date of the revocation (or prospective date)

- Signature of person authorized to sign return

Frequently Asked Questions (FAQs)

No. Form 2553 must be filed by mail or by fax.

No, there is no fee to file IRS Form 2553. However, if you checked box Q1 indicating that the reason for electing a fiscal year is a “business purpose,” you’ll be charged a fee of $6,200 to use a fiscal year based on a business purpose.

Yes, you can still make a late election, but you’ll have to do so via private letter ruling.

Bottom Line

Now that you know how to fill out Form 2553, keep in mind that a properly filed form must be sent in no later than 75 days from the start of business for a new company. You can send this form to the IRS by fax or mail, and you should hear from them within approximately 60 days.