Form 943, the Employer’s Annual Federal Tax Return for Agricultural Employees, is a federal tax form used to report the amount of taxes withheld from an employee’s pay. Agricultural employers that have paid wages subject to FICA taxes or federal income tax withholding to one or more farm workers throughout the year must file Form 943.

Key Takeaways:

- You can download Form 943 from the IRS website

- All employers with agricultural workers must submit Form 943 to the IRS every year

- Forms are due to the IRS no later than Jan. 31 of the year following wages paid

- The best way to file tax forms is to use e-file—or check where to mail them in our compiled list.

If you’d rather not manually fill out and file Form 943, consider using payroll software like SurePayroll, which supports agricultural employers. It will automatically calculate FICA and federal income taxes for each payroll and complete all filings on your behalf so you don’t have to worry about doing it yourself. Try SurePayroll free for two months.

Learning how to fill out Form 943 can be time-consuming and confusing, so we’ve compiled the process into five easy steps.

Step 1: Complete Employer Information

In this section, you will provide general information about your business such as business name, tax ID (or employer identification number), and mailing address.

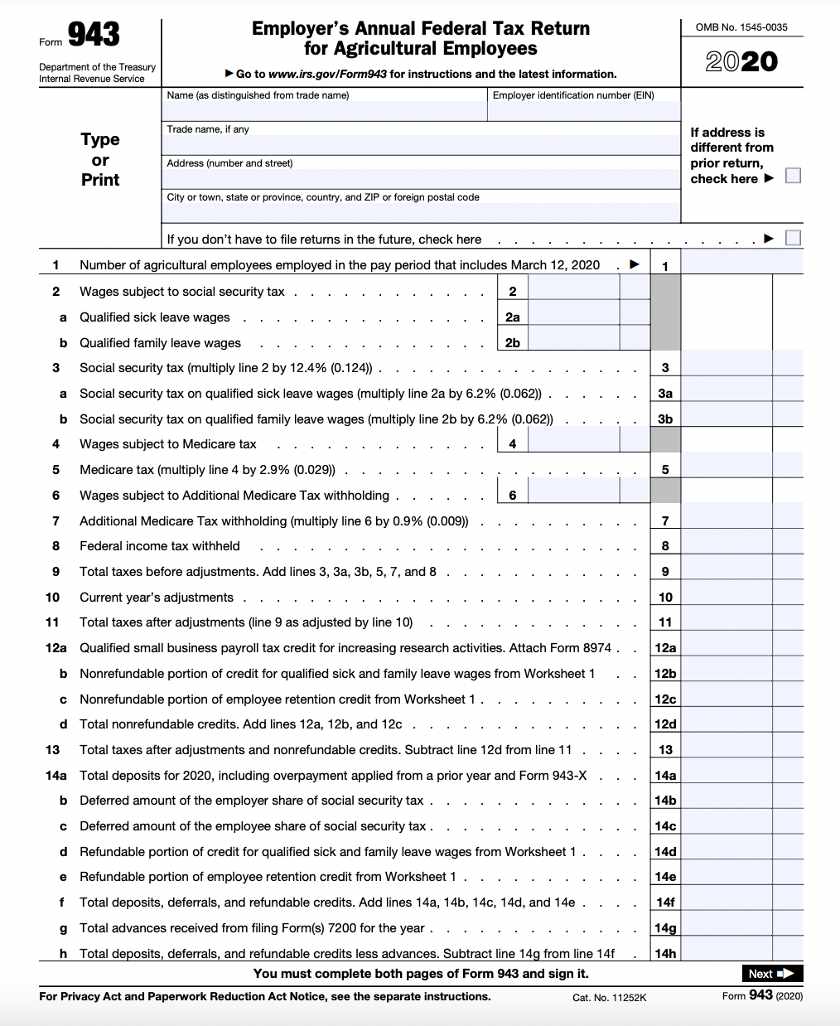

Step 2: Complete Form 943, Lines 1 through 16

The next step is to complete the first 16 lines of Form 943:

- Line 1: Enter the number of agricultural employees on your payroll during the pay period that included March 12, 2023.

- Line 2: Enter the total cash wages, including qualified wages (other than qualified health plan expenses) for the employee retention credit, subject to Social Security tax that you paid to your employees for farmwork during the calendar year.

- Line 2a: Enter the qualified taxable sick leave wages you paid to your employees during the year.

- Line 2b: Enter the qualified taxable family leave wages you paid to your employees during the year.

- Line 3: Multiply line 2 by 12.4% (0.124) and enter the result on line 3.

- Line 3a: Multiply line 2a by 6.2% (0.062) and enter the result on line 3a.

- Line 3b: Multiply line 2b by 6.2% (0.062) and enter the result on line 3b.

- Line 4: Enter the total cash wages, including qualified sick leave wages, qualified family leave wages, and qualified wages for the employee retention credit that you paid to your employees for farmwork during the calendar year.

- Line 5: Multiply line 4 by 2.9% (0.029) and enter the result on line 5.

- Line 6: Enter all wages, including qualified sick leave wages, qualified family leave wages, and qualified wages for the employee retention credit that are subject to Additional Medicare Tax withholding.

- Line 7: Multiply line 6 by 0.9% (0.009) and enter the result on line 7.

- Line 8: Enter the federal income tax you withheld from your employees’ wages.

- Line 9: Add the total Social Security tax (lines 3, 3a, and 3b), Medicare tax (line 5), Additional Medicare Tax withholding (line 7), and federal income tax withheld (line 8).

- Line 10: Use line 10 to adjust for rounding of fractions of cents or adjust for the uncollected employee share of Social Security and Medicare taxes on third-party sick pay or group-term life insurance premiums paid for former employees.

- Line 11: Combine lines 9 and 10; enter the result on line 11.

- Line 12a: Enter the amount of the credit from Form 8974, line 12.

- Line 12b: Enter the nonrefundable portion of Credit for Qualified Sick and Family Leave Wages From Worksheet 1.

- Line 12d: Enter the nonrefundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before Oct. 1, 2021.

- Line 12g: Add lines 12a, 12b, and 12c. Enter the total on line 12g.

- Line 13: Subtract line 12g from line 11. Enter the result on line 13.

- Line 14a: Enter your deposits for this year, including any overpayment that you applied from filing Form 943-X, in the current year.

- Line 14d: Enter the refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021.

- Line 14f: Enter the refundable portion of credit for qualified sick and family leave wages for leave taken after March 31, 2021, and before Oct. 1, 2021.

- Line 14h: Add lines 14a, 14d, and 14f. Enter the total on line 14h.

- Line 15: If line 13 is more than line 14h, enter the difference on line 15. Never make an entry on both lines 15 and 16.

- Line 16: If line 14h is more than line 13, enter the difference on line 16. Never make an entry on both lines 15 and 16.

Before moving on to step 17, you’ll need to check off the box next to which depositing schedule your business is required to follow, either semiweekly or monthly.

Step 3: Complete Form 943, Line 17

This is a summary of your monthly tax liability, not a summary of deposits made. This section is broken into each month, January through December. If line 13 is less than $2,500, don’t complete line 17. Complete line 17 only if you were a monthly schedule depositor for the entire year and line 13 is $2,500 or more.

Step 4: Complete Form 943, Lines 18-27

The next step is to complete the last eight lines of Form 943:

- Line 18: Enter the qualified health plan expenses allocable to qualified sick leave wages.

- Line 19: Enter the qualified health plan expenses allocable to qualified family leave wages.

- Line 22: Enter the qualified sick leave wages for leave taken after March 31, 2021, and before Oct. 1, 2021.

- Line 23: Enter the qualified health plan expenses allocable to qualified sick leave wages reported on line 22.

- Line 24: Enter the amounts under certain collectively bargained agreements allocable to qualified sick leave wages reported on line 22.

- Line 25: Enter the qualified family leave wages for leave taken after March 31, 2021, and before Oct. 1, 2021.

- Line 26: Enter the qualified health plan expenses allocable to qualified family leave wages reported on line 25.

- Line 27: Enter the amounts under certain collectively bargained agreements allocable to qualified family leave wages reported on line 25.

Step 5: Complete Form 943, Third-Party Designee & Signature

According to the Form 943 instructions, you can permit the IRS to speak to someone about this form on your behalf.

For example, you could put your CPA as a third-party designee. Be sure to include their name and telephone number. If you don’t want to designate anyone, you can select no.

Finally, you will sign and date Form 943 indicating that you agree with the information that has been included on this form and that, to your knowledge, it is accurate.

Who Has to File Form 943

Agricultural employers are required to file the IRS 943 Form if they have paid wages to one or more farmworkers and the wages were subject to Social Security and Medicare taxes or federal income tax withholding.

Not all payments made to farmworkers are taxed, so if you’re not sure if your farmworkers’ wages were subject to these taxes, you can check with this test:

- You have paid an employee cash wages of $150 or more in a year for farm work.

- The total (cash and noncash) wages that you’ve paid to all farmworkers is $2,500 or more.

When to File Form 943

Generally, farm employers have to file Form 943 by Jan. 31 of the year after you paid the wages, unless you made timely deposits during the year in full payment of your liability due for the year. In that case, you must file by Feb. 10.

If your total employment taxes exceed $2,500 in the year, you’ll have to make electronic deposits throughout the year on a monthly or semiweekly schedule. The IRS will use your lookback period to determine whether you must pay the tax monthly or semiweekly.

Penalties for Late Filing

For each month or part of a month in which you should have reported on your annual 943 form, you’ll be subject to a failure to file penalty of 5% of the unpaid tax due. The maximum penalty is 25% of the tax due.

In addition to this, you’ll also be subject to a failure to pay penalty of 0.5% per month of the amount of the tax due. The maximum penalty is 25% of the tax due.

If you fail to file and fail to pay for the same time period, the IRS won’t double charge you penalties. The failure to file penalty will be reduced by the amount of the failure to pay penalty.

Where to Mail Form 943

The best way to file tax forms is to use e-file. This service, offered by the IRS, allows you to file your tax returns electronically for free. Filing your tax return electronically will ensure it is received on time.

If you prefer to mail in your tax forms instead, the state you live in will determine where your tax return is mailed. Refer to the table below for the address to mail your Form 943 return.

Remember that information may change, and it’s always best to verify the mailing address before sending anything.

Form 943 Mailing Address by State

State | Without a Payment | With a Payment |

|---|---|---|

Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury Internal Revenue Service Kansas City, MO 64999-0008 | Internal Revenue Service PO Box 806533 Cincinnati, OH 45280-6533 |

Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0008

| Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 |

No legal residence or principal place of business in any state. | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 | Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 |

EXCEPTION: Exempt organizations; federal, state, and local government entities; and Indian tribal government entities regardless of location. | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0008 | Internal Revenue Service P.O. Box 932200 Louisville, KY 40293-2200 |

Frequently Asked Questions (FAQs)

IRS Form 943 is used by employers to report annual taxes for agricultural workers. If you employ farm workers, you’re legally required to file this form every year.

Yes—IRS Form 943 can be filed online through the IRS e-file system. Filing online is often faster and more convenient than paper filing. It also reduces the risk of errors, as the system can catch common mistakes and offer prompts to correct them. This can help ensure your form is accurate and complete, which can prevent potential issues.

If you fail to file IRS Form 943 on time, you could face penalties from the IRS. The penalty amount varies based on how much tax is due and when.

Bottom Line

There are a lot of things that go into reporting tax withheld for agricultural employees. By following these instructions on how to fill out Form 943 and where to mail your completed form, you can avoid any potential interest or penalties from the IRS.

If you’d rather not manually fill out Form 943, consider using a payroll software that supports agricultural payroll, like SurePayroll. SurePayroll will automatically calculate FICA and federal income taxes for each payroll and complete all filings on your behalf so you don’t have to worry about doing it yourself. Try SurePayroll free for two months.