Investors benefit from hiring a property manager to handle maintenance and daily responsibilities, allowing them to focus on more investments and personal interests. When learning how to hire a property manager, it’s essential to define your needs and budget. You must also thoroughly research possible candidates—including their personality, experience, and communication skills—to identify a compatible option. Our step-by-step approach will guide you through when and how to hire a property manager, the qualities of a great property manager, and alternatives.

1. Define Your Needs

Before hiring, you must determine the specific services you require from a property manager, such as tenant screening, maintenance, rent collection, and financial reporting. Additionally, consider the level of involvement you want in property management. Assess whether you need legal and regulatory compliance assistance, and define your expectations.

Here are some questions to ask yourself so you can determine your needs:

- Are you looking for a hands-on role in decision-making, or do you prefer a more hands-off approach, delegating most responsibilities to the manager?

- How often do you want to be notified about how your property is performing: weekly, monthly, quarterly?

- What type of communication do you prefer? Email, video conference, in-person, or phone call?

- How will you pay for the service? Will rents cover it, or will you pay a portion out of pocket?

- Do you want interaction with tenants or to remain somewhat anonymous?

- What is your real estate exit strategy, and does it align with the property management contract terms?

- When and how do you want to receive your net proceeds? Direct deposit? A check? Monthly?

- How much of an advance maintenance deposit do you want to provide? If repairs exceed this deposit, what amount can the property manager go over before contacting you?

Choosing Between a Property Manager & Property Management Company

As you master how to hire a property manager, you should also determine whether you’re interested in hiring an individual property manager or a property management company. The decision often depends on the size and complexity of your real estate portfolio, specific needs, and financial resources.

- Those with a single property and wanting a more personal touch may find an individual property manager more suitable. Property managers can build a closer, one-on-one relationship with property owners and tenants, fostering better communication and trust. Additionally, property managers often charge lower fees, making them a cost-effective choice for owners with a single property. Their direct involvement and familiarity with the property can lead to quicker issue resolution.

- Property owners with multiple properties or those needing comprehensive services typically opt for property management companies. Property management companies excel in managing more extensive portfolios, providing a more comprehensive array of services and maintaining established relationships with contractors and suppliers. These offer convenience and scalability for property owners with multiple units.

2. Evaluate Your Budget

You want to ensure you’re charging enough rent to cover all the property’s expenses, including property management fees. Evaluate your budget and be realistic about the costs of hiring a property manager or management company, considering their fees and any additional expenses that may arise. Property management fees can range from 4% to 12% of the gross monthly rent, depending on location and property type. There may also be additional fees for things like leasing and maintenance.

If you know in advance the most you can afford to pay, you’ll be better prepared when you discuss fees with the property manager. It’s essential to strike a balance between your budget constraints and the quality of services you expect, as choosing a property manager solely based on cost may not always result in the best outcome for your property.

3. Research & Interview

Research local companies or individuals—and don’t hesitate to ask fellow property owners for recommendations and interview several candidates. During these interviews, ask about their experience, credentials, and references to find the right fit for your property.

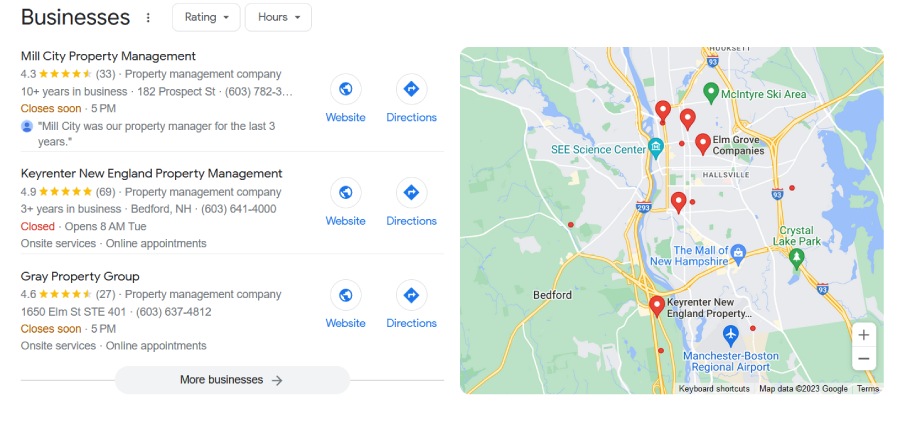

To find prospective property managers, start by contacting other investors, real estate agents, and landlords with firsthand experience. If you need further research, perform an online search with the keyword “property managers near me” (or your property). Read online reviews, check their social profiles, and evaluate their website.

Results from a local search for a property manager (Source: Google)

You’ll also want to speak with them in a formal interview. Prepare questions for your interview based on your needs. These can include things like pricing and fees, communication, tenant screening, and their references. Here are a few questions to help you brainstorm:

- How long have you been in business?

- How many properties are you currently managing?

- Do you have a team or work alone?

- What is your fee structure? Can you provide a list of all fees?

- How often will you keep me updated?

- Can I tour a few of your properties and speak to some landlords and tenants you manage?

- What technology will you use?

- Which vendors and subcontractors will you use to handle maintenance? What is the turnaround time for repairs?

4. Check Qualifications

Before finalizing your choice, ensure the property manager meets all local licensing requirements and holds the necessary insurance coverage. It’s also crucial to do background research to confirm their track record and reputation in the industry. These steps will help you find a trustworthy, qualified professional to manage your property effectively.

Licensing and qualifications vary by state, but here are a few items to verify with the manager:

- Most states require a property manager to have a real estate license and be at least 18 years of age (this requires specified education and passing an exam).

- Proper documentation of insurance coverage.

- Though not required, find someone with experience to reduce potential risks to your investment.

- Certifications are not generally required, but there are many national property management organizations that provide education, training, and certifications, making it a bonus.

5. Discuss Duties & Fees

When evaluating a property manager, talk to them about their duties and responsibilities at your properties, and how much they will be compensated for said duties and general job position. As discussed in step one, depending on your needs, talk about their processes for tenant selection, maintenance and repairs, emergencies, expenses and budgeting, and inspection procedures, as these are all crucial to your success.

Before finalizing your agreement with a property manager, and in accordance with their duties, it’s crucial to grasp the fee structure. This includes management fees, leasing fees, and any markups on maintenance. See to it that you inquire about any hidden costs or unexpected charges to avoid surprises. Property management fees typically fall within 8% to 12% of the property’s gross revenue, but confirming the specifics will help you budget accurately for your property management needs.

Pro tip: Besides their duties and fees, ensure your communication styles mesh to guarantee a good working relationship. Establish clear communication from the outset to set the right expectations and maintain a smooth working relationship with your property manager. Discuss the methods and frequency of updates on property performance and financial reports. This upfront clarity ensures you stay well-informed about your property’s status and financial matters throughout your partnership with the property manager.

6. Visit Their Properties

Whenever feasible, consider visiting properties currently under the management of your candidate property manager. This allows you to assess firsthand their approach to maintenance and tenant relations.

Additionally, don’t forget to obtain and thoroughly check references. Reach out to the references provided by the property manager to gather valuable feedback from fellow property owners who have had direct experience working with them.

7. Review Contracts

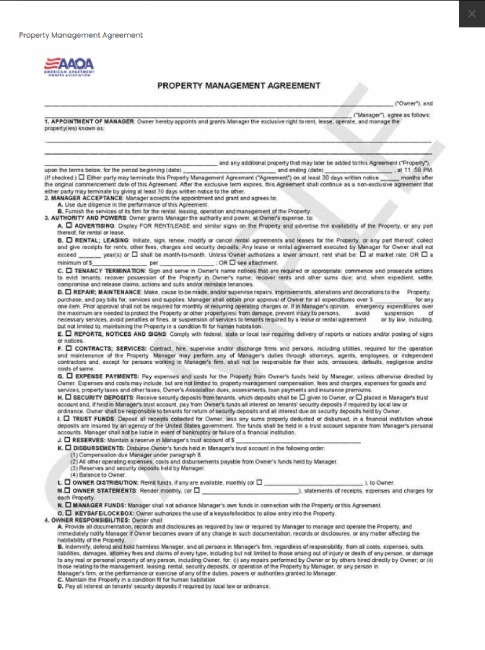

Take the time to thoroughly review the property management contract, focusing on fees, responsibilities, and terms to ensure they match your expectations and legal standards. It’s wise to consult an attorney before signing the contract to safeguard your interests. Additionally, inquire about their exit strategy, understanding how they plan to handle the management relationship should it need to end for any reason.

Sample property management agreement

(Source: American Apartment Owners Association)

8. Monitor Performance

Maintaining ongoing monitoring of your property manager’s performance is important to ensure they consistently meet your expectations and adhere to the terms outlined in the contract. Regular evaluation helps see to it that your property is well-managed and that issues or concerns can be promptly addressed to maintain the property’s value and tenant satisfaction.

While you don’t want to micromanage your property manager, you do want to ensure that they’re collecting rent, paying the bills, keeping units rented, and maintaining the building in good repair. Ultimately, your weekly, monthly, quarterly, and yearly reports will indicate if the property manager continues to perform well or has dropped the ball.

For detailed information on a property manager’s duties and responsibilities and property management fees, see our article, What Does a Property Manager Do & How Much Do They Cost?

Qualities of a Great Property Manager & Red Flags to Avoid

While considering when you should hire a property manager, it’s crucial to begin by identifying the key qualities you seek, recognizing that an effective one should possess a diverse set of essential skills.

Essential Qualities | Red Flags |

|---|---|

Solid communication skills | Poor communication |

Problem-solving abilities | High tenant turnover and vacancy |

Organizational skills | Lack of transparency |

Knowledge of state, local, and federal housing laws | Maintenance neglect |

Service-oriented | Financial irregularities |

A great property manager needs strong communication and organizational abilities, which enable effective interaction with property owners and tenants while efficiently managing property operations. Additionally, they should demonstrate problem-solving skills and deeply understand housing and landlord-tenant laws and regulations, ensuring a smooth property management experience when you decide to hire a property manager.

Avoid those who lack transparency and effective communication, as these can lead to trust issues and misunderstandings. Steer clear of property managers who display negligence in maintenance or financial irregularities, as these issues may harm property conditions and financial stability. Financial irregularities include late or incomplete rent payments to property owners, mishandling of security deposits, or unexplained fees.

When to Hire a Property Manager (& When Not To)

When to Hire a Property Manager | When NOT to Hire a Property Manager |

|---|---|

Need help managing out-of-state properties: Hiring a property manager can save you time, responding to emergency calls, and travel expenses if you don't live near your property, like managing your vacation rental property. | Want to avoid extra expenses: Fees can be as high as 8%-12% of your gross monthly rental income. Before hiring, assess whether your investment property can remain profitable with the added expense. |

Maintain large or multiple properties: The work can become overwhelming if you manage more than one or two properties or an apartment complex. A property manager or property management company can alleviate the stress. | Have a small portfolio: If you only have one or two small properties and they’re located nearby, you may opt for self-management to keep down costs. |

Want to avoid handling difficult tenants: Property managers serve as buffers between tenants and landlords and have a process to handle evictions, property inspections, leasing, and rent collection. | Don’t want to relinquish control: Property management also may not suit owners wanting complete control, as it removes daily involvement. This shift can be challenging for those emotionally attached to their property or keen on self-management. |

Are building a portfolio: If you're buying multiple rental properties, you may want to hire a property manager. The property manager can help stabilize and manage properties while you search for additional real estate. | Don’t want the extra work finding the right property manager: Finding the right manager that aligns with your business preferences also may require additional effort and screening. |

Are required by your lender to outsource property management: Some lenders require hiring a property manager. They may also require hiring one if the borrower has no prior experience with investment property or if your property is struggling financially. | Have experience as a property manager: If you already have property management experience and don’t want to outsource, doing it yourself can be more cost-effective. |

Maintaining even one property, let alone multiple rental properties, demands substantial effort. Engaging a property manager is smart for owners seeking assistance with property upkeep or those wishing to avoid daily maintenance responsibilities. When deciding when to hire a property manager—or not to—evaluate the benefits of hiring, including freeing up time toward additional property investments, quality family time, or personal pursuits.

Alternatives to Hiring a Property Manager

In cases where you decide against hiring a property manager, various circumstances may be at play. Perhaps the fees affect profitability, you reside in one of the units, or you prefer self-management. In such scenarios, other options can save significant time and money. These alternatives eliminate the need to chase tenants for rent collection, handle online landlord banking, respond to maintenance requests, and stay organized.

Online Property Management Software

Online property management software helps you manage your maintenance, tenant screening, leasing documents, and listing vacancies online. Online property management software offers comprehensive and a la carte property management. Also, it allows landlords to handle everything in one convenient place conveniently.

Software |  | |||

|---|---|---|---|---|

Best For | Free property management software for up to 75 units | Independent landlords seeking comprehensive property management services | Property management firms handling up to 5,000 units | Most affordable paid subscription plan for property owners |

Key Features |

|

|

|

|

Monthly Starting Price | Free; paid plans start at $12 monthly | Free; paid plan costs $7 per unit | $58 per month | Free; paid plans start at $10.75 monthly |

Learn More | or | or | or | or |

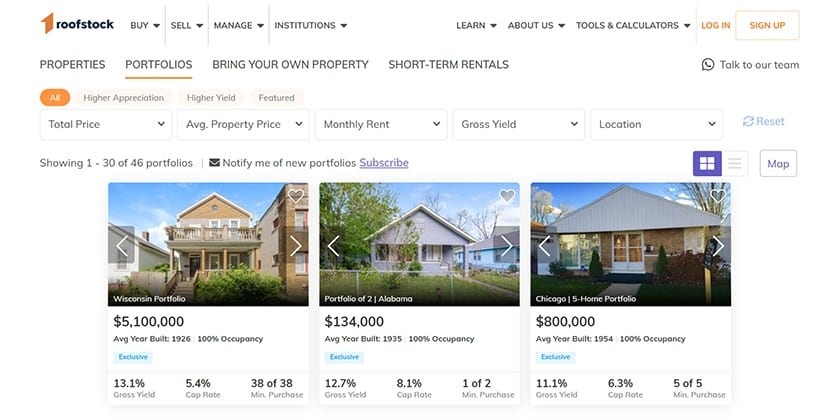

Turnkey Rental Properties

When contemplating why to hire a property management company, turnkey properties are a good option if you want to buy a property that doesn’t require upfront maintenance, is sometimes fully rented, and has property management services. When considering a turnkey property, ensure the property management company is experienced. Review their property management agreement and interview them to guarantee they’re a good fit.

Roofstock’s single-family portfolios (Source: Roofstock)

If you want to invest in turnkey real estate, Roofstock, one of our leading turnkey real estate companies, offers passive real estate investors several options. It includes the opportunity to invest in a property or a portfolio and also provides a 30-day money-back guarantee and a lease-up guarantee. It operates in 26 states As of this writing, Roofstock is available in AL, AZ, AK, CA, FL, GA, IL, IN, KS, KY, MI, MN, MS, MO, NV, NJ, NY, NC, OH, OK, PA, SC, TN, TX, VA, and WI. and sells new and completely renovated single-family homes occupied by renters and maintained by a property management company.

Self-manage Rental Properties

If you only have a few units or are planning to buy a duplex, triplex, or fourplex and live in one unit, you might want to self-manage your rental properties. Hiring a property management company for a few units typically isn’t cost-effective. If you self-manage, you’ll need a separate bank account for handling rental income and expenses.

If you only have a few units, self-management may be easier.

Crowdfunded Real Estate

If you want to own an investment property without any management responsibilities, you might consider investing in crowdfunded real estate. Real estate crowdfunding is financing investment property by pooling funds from numerous investors through online platforms. This collective investment allows individuals to participate in real estate projects with relatively small amounts of capital, often for fractional ownership or debt investments, aiming for shared profits or interest payments.

Frequently Asked Questions (FAQs)

Whether to hire a property management company depends on various factors, including the number of properties you own, your expertise in property management, and your available time and resources. Property management companies can benefit those with multiple properties who seek comprehensive services or want to delegate management tasks. However, self-management may be an option for single-property owners with sufficient time and knowledge. Carefully assess your unique situation and needs before making a decision.

Hiring a property manager to rent your house can be a practical choice, especially if you are moving a distance, prefer a hands-off approach to property management, or have limited time. They can handle tenant screening, rent collection, maintenance, and legal compliance, making the rental process smoother. However, weighing the associated costs and whether your house can generate enough income to cover the property management fees are essential.

One common reason owners of single-family rental homes hire property managers is to alleviate the burden of tenant management. Property managers handle tenant screening, lease agreements, and rent collection tasks. This expertise ensures owners secure reliable tenants, minimizes vacancies, and reduces the potential for disputes and aggravation, making the rental process smoother and more profitable for single-family property owners.

Bottom Line

Hiring a property manager involves several key steps. Begin by defining your property management needs and budget constraints. Then, research and identify potential candidates or management companies and conduct thorough interviews. Verify their qualifications, reputation, and legal compliance next. You’ll also want to review contracts meticulously, consulting with an attorney if necessary, and understand the fee structure and fee ranges. Finally, establish clear communication channels and monitoring procedures to ensure a successful property management partnership.