Melio and Wise are two prominent providers in the financial technology (fintech) space that offer distinct approaches to the financial challenges of businesses. While Melio excels in simplifying domestic bill payments and vendor management, Wise (formerly TransferWise) stands out as a global leader in international money transfers and currency exchange. We provide a detailed Melio vs Wise comparison, helping businesses navigate their options for smoother financial operations.

- Melio: Ideal for businesses seeking strong accounts payable (A/P) and vendor management tools

- Wise: Optimal for businesses that send and receive international payments regularly

Melio vs Wise At-a-Glance Comparison

| ||

|---|---|---|

Monthly Platform Fee (per User) | $0 | $0 |

Distinctive Features |

|

|

Customizable Account Permissions | ✕ | ✓ |

Approval Workflows | ✓ | ✕ |

Batch Payments | ✓ | ✓ |

Business Debit Card | ✕ | ✓ |

Mobile App | iOS | iOS and Android |

Payment in Multiple Currencies | ✕ | ✓ |

Optional Federal Deposit Insurance Corp. (FDIC) Insurance | ✕ | ✓ |

Short-term financing | ✓ | ✕ |

Vendor Portal | ✕ | ✕ |

For More Information |

When To Use

Melio vs Wise: Pricing (Melio Wins)

Melio | Wise | |

|---|---|---|

Monthly Platform Fee | $0 | $0 |

Registration Fee | $0 | $31 |

Number of Users | Unlimited | Unlimited |

ePayment/Automated Clearing House (ACH) Transaction Fees | $0 | Fee varies by currency (from 0.43%) |

Check Mailing Fee | $1.50 per check payment (first two checks per month are free) | N/A |

Invoice Mailing Fee | N/A | N/A |

Payment by Debit or Credit Card | $20 flat fee or 2.9% when paying with card | |

International Wire Transfer (Local Currency) | 1% of payment (up to $30) for same-day delivery | |

International Wire Transfer (USD) | $20 flat fee within three business days | |

Faster ACH Payments | 1% of payment (up to $30) for same-day delivery | N/A |

Faster Check Payments | $20 flat fee within 3 business days | N/A |

Free Trial | N/A | N/A |

For More Information |

Neither Melio nor Wise charge a monthly fee, but Wise charges a one-time registration fee of $31. Neither provider restricts the number of users. However, we chose Melio as the winner because it offers more options to pay, including check mailing. It also provides the option of faster ACH and check payments, which is unavailable with Wise, and while Melio charges 2.9% for payment by debit or credit card, Wise’s fees vary by currency and start at 0.43%.

In addition to the fees above, Wise charges additional fees related to its business debit card, which are detailed below:

- Registration fee: $5

- Withdrawing USD 100 per month, per account: Free for two or fewer withdrawals

- ATM fees over USD 100 per month, per account: 2% plus $1.50 per withdrawal

- Account funding transactions: 2%

- Converting money: From 0.43%, fee varies by currency

Melio vs Wise: Features (Wise Wins)

Melio | Wise | |

|---|---|---|

A/P and Accounts Receivable (A/R) Features | ✓ | ✓ |

Compatible Accounting Software | QuickBooks, Xero, FreshBooks, and Business Central | QuickBooks, Xero, FreshBooks, NetSuite, Sage, and Wave |

Mobile App | iOS | iOS and Android |

Batch Payments | ✓ | ✓ |

International Payments | ✓ | ✓ |

Approval Workflows | ✓ | ✕ |

Autocapture Receipts & Bills | ✓ | ✕ |

Business Debit Card | ✕ | ✓ |

Payment in Multiple Currencies | ✕ | ✓ |

Manage Currencies | ✕ | ✓ |

Customizable Account Permissions | ✕ | ✓ |

Optional FDIC Insurance | ✕ | ✓ |

Vendor Portal | ✕ | ✕ |

Audit Trails | ✕ | ✕ |

Melio and Wise have many of the same features, including the ability to make batch payments and international wire transfers, although Melio is limited to payment in USD. Both are compatible with QuickBooks, Xero, and FreshBooks, but Melio also integrates with Business Central while Wise also integrates with NetSuite, Sage, and Wave.

Both also offer a mobile app, but Melio’s is only compatible with iOS devices, whereas Wise’s is available for iOS and Android users. Melio allows for approval workflows and autocapture of receipts and bills, two features that Wise lacks. Another Melio feature not available in Wise is short-term financing. Melio’s “Pay over time” feature provides 1 to 12 month financing of unpaid bills to allow additional flexibility in your cashflow.

However, we selected Wise as the winner in this category because it also lets you manage more than 40 currencies and switch between them when the exchange rate looks good. What’s more, it gives you access to digital business debit cards that you can provide to your employees.

Its unique features include no foreign transaction fees and the ability to set up spending alerts. You can also set up customizable account permissions and get access to optional FDIC insurance. Learn more about Wise’s business debit card as well as its other features in our Wise business account review.

Melio vs Wise: A/P (Melio Wins)

Melio | Wise | |

|---|---|---|

A/P and A/R Features | ✓ | ✓ |

Compatible Accounting Software | ✓ | ✕ |

Mobile App | ✓ | ✕ |

Batch Payments | ✓ | ✓ |

International Payments | ✓ | ✓ |

Approval Workflows | ✓ | ✕ |

Autocapture Receipts & Bills | ✕ | ✕ |

When it comes to A/P capabilities, Melio offers a couple of features that are unavailable with Wise—automatic bill capture, recurring bills, and the ability to track 1099 contractor payments with a report that is accessible from the desktop. Neither provider offers an intelligent virtual assistant, but because of Melio’s additional features, we selected it as the winner in this category.

Melio vs Wise: A/R (Melio Wins)

Melio | Wise | |

|---|---|---|

Create & Send Invoice | ✓ | ✓ |

Add Logo to Invoice | ✓ | ✓ |

Recurring Invoices | ✓ | ✕ |

Sales Tax Tracking | ✕ | ✕ |

Invoice Customization | ✕ | ✕ |

While neither Melio nor Wise offer the ability to track sales tax or customize invoices, both let you upload a logo to your invoice. Melio lets you set up recurring invoices—and this feature is unavailable with Wise, which is why we selected Melio as the winner in this category.

Melio vs Wise: Ease of Use (Tie)

Melio | Wise | |

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

Both Melio and Wise are cloud-based software with a user-friendly dashboard and an online help section. Because both are so easy to use, we ruled this category a tie.

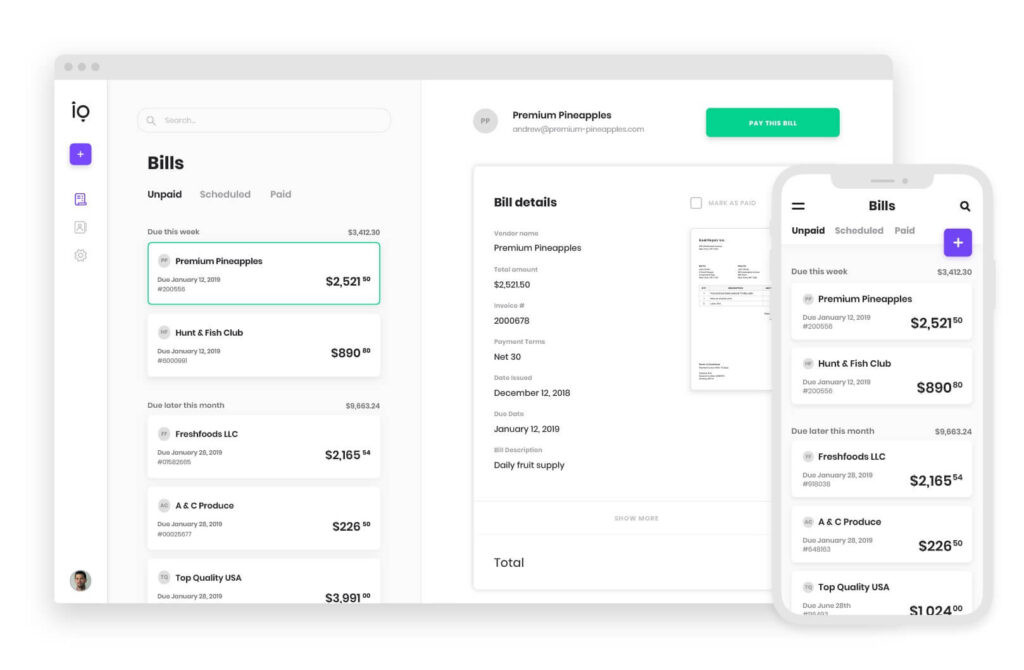

Melio’s dashboard for paying bills

Melio vs Wise: Mobile App (Wise Wins)

Melio | Wise | |

|---|---|---|

Accessibility | iOS only | iOS and Android |

Pay Bills | ✓ | ✓ |

Transfer Funds | ✕ | ✓ |

Open New Currency Balances | ✕ | ✓ |

Convert Funds | ✕ | ✓ |

Bill/Receipt Scanning | ✕ | ✕ |

Invoice Customers | ✕ | ✕ |

Send Estimates & Sales Receipts | ✕ | ✕ |

Melio’s mobile app is available for iOS devices only, and you can only use it to make payments. Wise’s mobile app is available for both iOS and Android users, and you can use it to transfer funds, open new currency balances, pay bills, and convert funds. Although neither app lets you invoice customers, we chose Wise as the winner because of its additional capabilities.

Melio vs Wise: Customer Support (Wise Wins)

Melio | Wise | |

|---|---|---|

Customer Support Hours | Monday to Friday, 9 a.m. to 8 p.m. Eastern time | 24/7 |

Email Support | ✓ | ✓ |

Live Chat Support | ✓ | ✓ |

Searchable Knowledge Base | ✓ | ✓ |

Online Help Resources | ✓ | ✓ |

Phone Support | ✕ | ✓ |

Community Support | ✕ | ✕ |

Melio provides customer support during regular business hours, which includes email and live chat support and access to online help resources and a searchable knowledge base. Wise provides the same type of support as Melio, with the addition of phone support.

However, it does not provide support hours on the website—it only states that its team is ready to help you by chat, email, or phone if your issue is too difficult or confusing. We chose Wise as the winner in this category because of the access to phone support.

Frequently Asked Questions (FAQs)

It normally takes one to three business days to process transactions with Melio.

Wise is ideal for businesses or individuals involved in international transactions, such as freelancers, ecommerce businesses, expatriates, and companies with international suppliers or clients.

No, it is only possible to make international wire transfers in US dollars.

Yes, Wise offers a mobile app for both iOS and Android users. It allows you to initiate and track international money transfers and currency exchange transactions.

Bottom Line

Melio was designed to simplify bill payments for small and midsize businesses, allowing them to pay bills electronically, track payments, send invoices, and manage their financial transactions. Meanwhile, Wise is primarily known for its international money transfer and currency exchange services. It enables businesses to send money internationally with lower fees and more favorable exchange rates compared to traditional banks.