Melio, a modern payment solution, provides you flexibility with how you pay your bills—it gives you the option of paying by bank transfer, such as through automated clearing house (ACH), or your credit card, even if your vendors only accept checks. It also helps streamline the accounts payable (A/P) process by gathering all of your bills in one user-friendly interface. Though it has outstanding A/P features, Melio cannot process payments in currencies other than United States dollars (USD) and has no mobile app for Android users. The Melio platform is free, and users only need to pay per successful transaction.

The Fit Small Business mission is to deliver the best answers to people’s small business questions. Hence, we spend hours researching and testing so that we develop editorial reviews that can help our audience. For this article, we used a rubric that scored software against a set of criteria that we expect to see in an accounts payable platform.

Pros

- Unlimited users can be added for free

- Send single or recurring invoices

- Free to pay and receive bank transfers

- No monthly fee for the platform

- Your vendors don’t need a Melio account to receive payments

Cons

- Unable to send international wires in currencies other than USD

- No Android app

- No telephone support

- Can only process payments to businesses, not individuals

Is Melio Right for You?

Is Melio right for you?

Melio Alternatives & Comparison

Melio Reviews From Users

| Users Like | Users Dislike |

|---|---|

| User-friendly interface | Unsuccessful payments to vendors |

| Friendly customer reps for users who were able to talk with a Melio representative | Unresponsive support line or for some users, inexistent customer support |

| Easy-to-use app | Slow payments |

Users who left a Melio review said that its dashboard is user-friendly and easy to navigate. Reviewers also praised the freedom and flexibility to pay vendors and receive payments from customers. They also appreciate the ability to set up user roles and approval workflows.

On the flip side, there are complaints about its unresponsive support, especially when urgent issues arise, such as fraudulent activity. Users also dislike that there’s no way to contact support via telephone.

The platform has earned the following average scores on popular review sites:

- Trustpilot[1]: 4.4 out of 5 based on around 1,200 reviews

- Capterra[2]: 4.2 out of 5 based on more than 350 reviews

- Better Business Bureau (BBB)[3]: 2.9 out of 5 based on about 100 reviews

Signing up is completely free, and Melio has no monthly subscription fees. It’s an affordable solution for businesses because they only pay per transaction, which can be advantageous if they have very few transactions.

PAY (A/P) | GET PAID/ACCOUNTS RECEIVABLE (A/R) |

|---|---|

|

|

Melio Features

We evaluated Melio’s general and special A/P features. General A/P features include adding vendors, viewing unpaid bills, and paying bills. Meanwhile, special A/P features focus on A/P automation features like workflows, automatic bill capture, and vendor portals.

Melio scored fairly in this criteria because it contains the essential general A/P features we’d like to see. However, our in-depth analysis reveals that Melio is best partnered with accounting software services like QuickBooks Online and is not meant to be used standalone to handle daily business transactions. It’s a great A/P solution, but we don’t recommend using Melio as a substitute for accounting software.

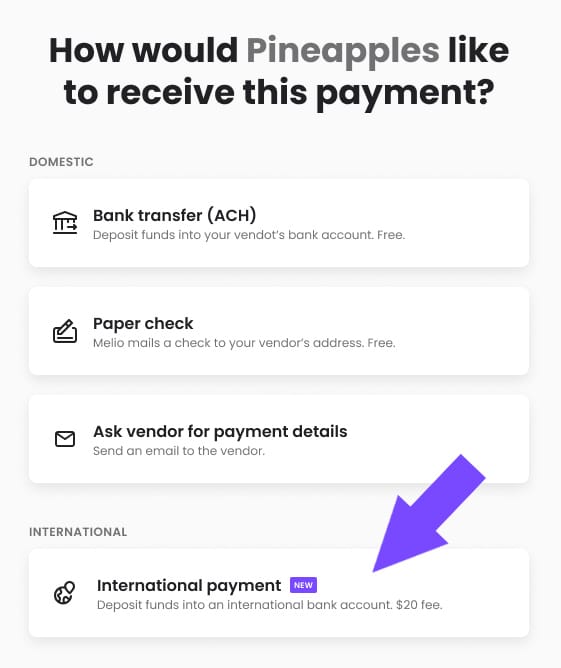

From your Melio dashboard, you can easily pay all of your vendors, including those in other countries (see Melio’s list of countries)—and they don’t even need to have a Melio account to accept payment. You can send international bank transfers in US dollars for a flat fee of $20, no matter the amount of the payment. Melio also allows you to make multiple payments to international and domestic vendors at the same time.

Making international payments with Melio (Source: Melio)

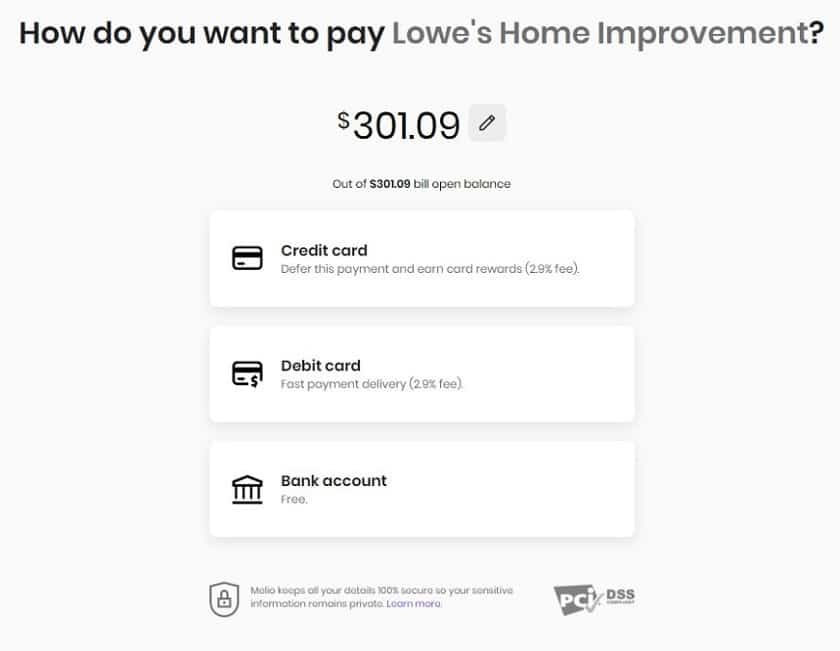

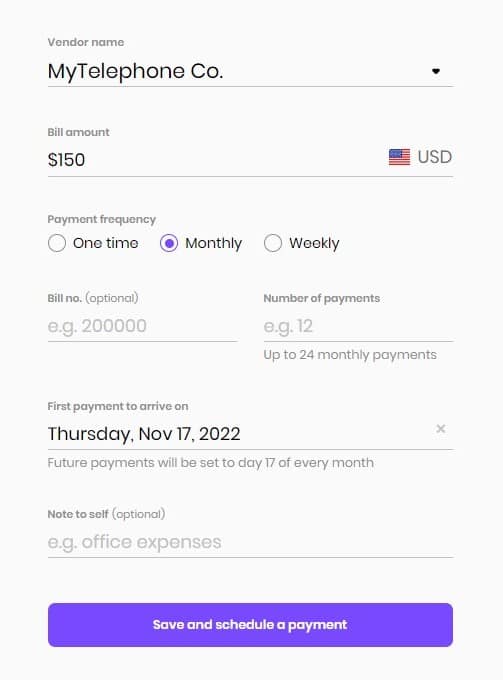

You can make payments via bank transfer or credit card, and you can also have business checks sent on your behalf to arrive in five to seven business days. Expedited payment processing allows for fast checks to arrive within three business days or a same-day bank transfer for additional fees. Other features include the ability to pay multiple bills together or split a single bill into several payments. You can also set up recurring payments for bills you pay regularly.

Payment Options

Melio syncs with QuickBooks Online (all versions except Simple Start), QuickBooks Desktop, FreshBooks, and Microsoft Dynamics 365 Business Central for A/R functions, which includes the ability to send payment requests and auto-reconcile incoming payments. It syncs with QuickBooks Online for A/P functions, which eliminates dual data entry with an automatic two-way sync for all of your bills and bill payments.

You can use Melio to pay contractors and generate a report that will assist you or your accountant with processing 1099 forms if you have paid them more than $600 in a year. You can easily classify and export a CSV file of this information for quick access.

Melio’s special A/P features are not as comprehensive as those of its competitors. It doesn’t have a vendor portal, automatic bill capture from email, and audit trails. However, we don’t see these missing features as a major miss. Being a platform with no subscription fee, we think that these trade-offs won’t matter greatly.

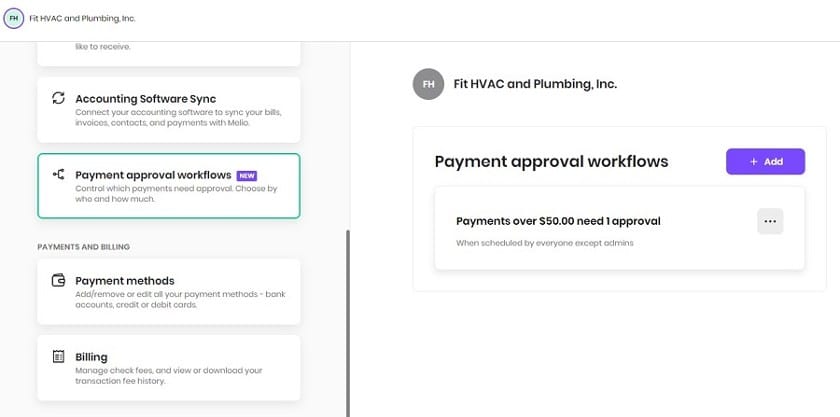

Melio allows you to add your team members and set up approval workflows so that you’re able to stay on top of who is managing which payments. You can invite other people from your business, your accountant, or your bookkeeper for free and set up their roles so that you can review and approve payments before they’re sent.

Setting up an approval workflow in Melio

Melio offers three ways to add a bill: upload the file, enter the details manually, or sync with QuickBooks Online. If you opt to upload the invoice, you can select a PDF or JPG file from your computer or phone, which will be read automatically by Melio’s artificial intelligence (AI) technology and filled in with the relevant information to schedule the payment.

Entering bills in Melio manually

The platform’s user interface is intuitive and easy to use. If you have an Intuit account, you can use this to sign in and get started. Otherwise, you can sign up for free in a matter of minutes, and it doesn’t take long to add vendor details. Melio’s dashboard provides you with an integrated tool that allows you to manage and track all of your A/R and A/P through a single platform, streamlining these processes.

Melio’s customer support team is available Monday through Friday, 9 a.m. to 8 p.m. Eastern time, and closed on federal holidays. You can use live chat to connect with customer support during operating hours. You can also email Melio’s support team, and a rep will get back to you within 24 hours inside the operating hours.

Melio’s help center is also a good resource as you can browse through different topics or use the search bar to find something more specific. One of the most noteworthy aspects of Melio’s customer service is that it maintains a list of customers who have requested a new feature and will notify them when it’s released. The reason Melio didn’t score better for Ease of Use is that telephone support isn’t offered at this time.

How We Evaluated Melio

Melio is part of our best A/P software roundup. We considered Melio’s pricing, general A/P features, special A/P features, and ease of use.

25% of Overall Score

In assessing the pricing, we considered the transparency, affordability, and flexibility of pricing plans. We also gave more credit to the software providers that can accommodate more users.

25% of Overall Score

When considering basic A/P functionality, we looked at features, such as creating vendors, tracking vendor transactions, viewing outstanding bills, recording vendor credits, and other minor A/P features.

25% of Overall Score

In evaluating special A/P features, we focused more on A/P automation. We heavily considered the ability of the software to reduce data entry time, workflow approvals, and batch processing. We also included the following:

25% of Overall Score

Frequently Asked Questions (FAQs)

Yes, but only for transactions. Signing up is completely free, and you don’t need to pay a monthly subscription.

It takes around one to three business days to process transactions.

There are some exceptions to what you can pay with Melio, which include personal payments, payments from prepaid cards, balance transfers, payroll transactions, cash advances, flammables and explosives, and pharmaceuticals.

Yes, Melio offers an API for users to create unique integrations and functionalities within the platform.

Bottom Line

Melio streamlines the A/P process from the moment a business owner receives a bill to when vendors receive their payment. It provides businesses with numerous funding options, including those that vendors don’t typically accept, such as credit cards. It allows you to manage all of your bills and customer invoices from one platform at an affordable price.