Right now you likely have a business idea. Awesome! Now you need to think through that idea by getting your thoughts on paper. The One-Page Business Plan will walk you through each step of planning your business idea. Once you know your financial projections, you can finish the basics of this plan in less than 15 minutes. Planning is a great way to thoroughly understand the costs and income potential of your business idea.

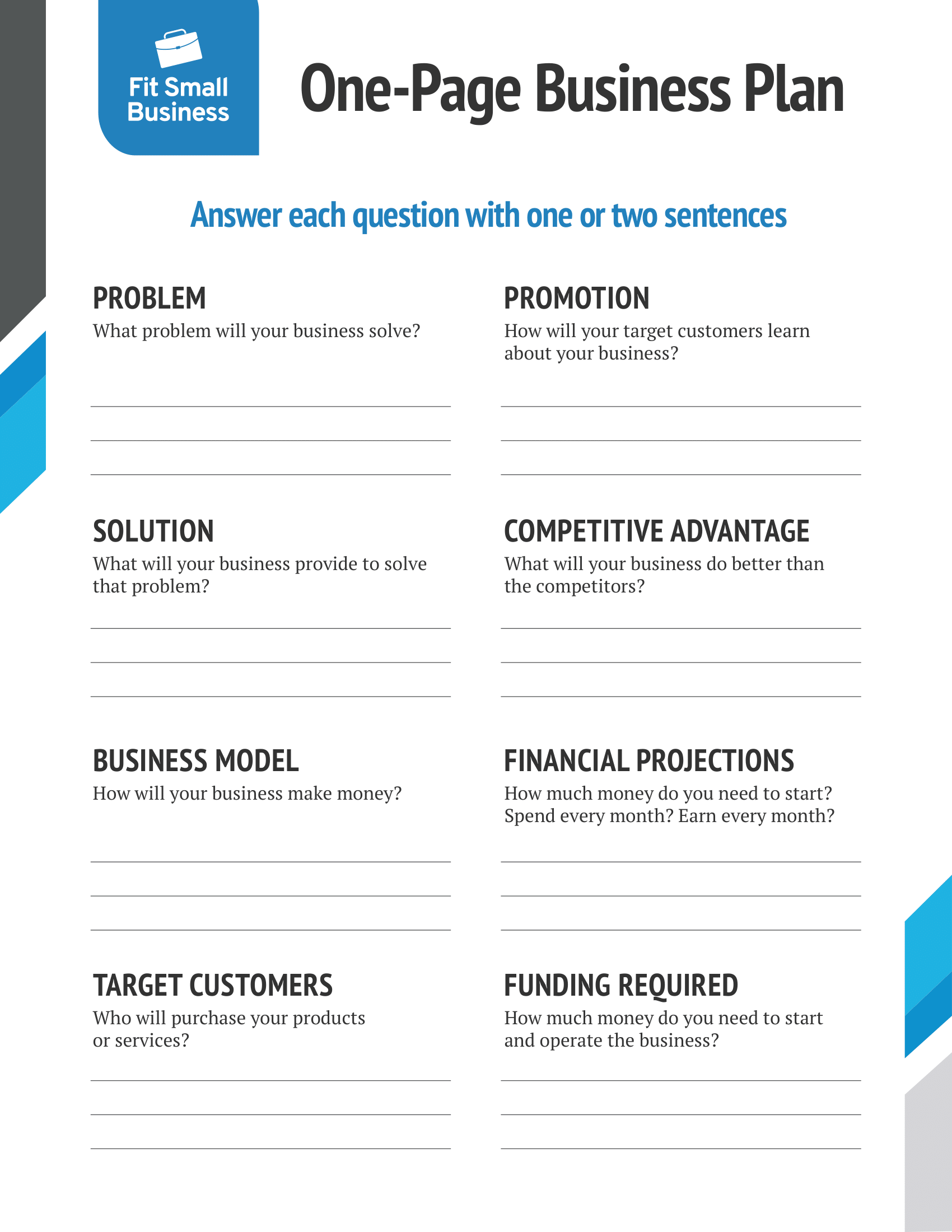

Before continuing, download our one-page business plan template:

Download the template and save it to your desktop for easy access. The fields in the PDF are editable. You can also print out the document and write by hand. Answer each question with one or two sentences—feel free to write in incomplete sentences.

If you need additional space to write then place your basic ideas on the template, and continue writing on a personal document.

1. Problem

Question: What problem will your business solve?

Every business solves a problem. What specific problem will your business solve for a customer? Try to get down to the core issue your customer is having.

For example, for a landscape company, “time wasted” maintaining a lawn may be a problem for your customer; however, if possible, make it more specific. For example, the specific problem may be an unkempt lawn. You can visually see an unkempt lawn—it’s much harder to see “time wasted.”

2. Solution

Question: What will your business provide to solve that problem?

You’ve identified the problem, now you need the solution. What specific action will you take to resolve the customer’s issue? This solution is your product or service. Don’t be afraid to get specific with your solution.

Going back to the landscaping example, your solution is to improve an unkempt lawn and maintain it. However, I challenge you to go one step further with your solution. Perhaps you’re creating a lawn that makes neighbors jealous, which is a solution tied to an emotion—very powerful.

Tip: If you’re starting a new type of business, try to test your solution on a small scale without spending a lot of money. This test makes sure customers will pay you for the solution. In entrepreneurship, a common saying for a struggling new business is that it created “a solution to a problem that doesn’t exist.” Don’t be that business.

3. Business Model

Question: How will your business make money?

For many businesses, its business model is straightforward. A product is sold or service is provided, and the company is paid.

You also want to outline how and where the products and services will be sold. Will they be sold in your own business or office. Someone else’s store or office? Will you be engaging in ecommerce—on your own website or an online marketplace such as Amazon?

During this step, you should also set your pricing—which basically means, how much will you charge? This can be difficult to figure out. Consider browsing competitor websites for pricing. You may want to call a competitor and ask for a quote.

4. Target Customers

Question: Who will purchase your products or services?

Your target customers are your ideal customers. The worst answer to who is your target customer is “everyone.” Not even some of the most popular companies started out for everyone—Facebook was for college students, Amazon sold books. Also, a common marketing saying is that if you’re “marketing to everyone, you’re marketing to no one.”

When thinking about who your target customers are, think demographics. Think about features such as age, income, gender, hobbies, and location.

When you’re clear on your target customers, your marketing strategy will become apparent as well—you’ll understand where and how to spend your marketing dollars.

5. Promotion

Question: How will target customers learn about your business?

List any strategies you will use to get potential customers to learn about your business. As a new business, it may be challenging to reach and persuade your first customers. How will you do it?

In-person networking and marketing for your business are often more effective than online marketing. However, some online marketing is free and can have the ability to reach a lot of people.

If looking for local customers, consider claiming and optimizing your free Google My Business (GMB) listing. Additionally, once you create your GMB listing, set up your free one-page website. Affordable!

6. Competitive Advantage

Question: What will your business do better than the competitors?

Before you can state your competitive advantage, study your competitors—learn their strengths and weaknesses. Once you know you can do better than competitors, choose one or two areas where you know you can outperform them.

For example, if you notice they have poor online reviews, you can have exceptional customer service. In fact, your marketing can even call that out, such as a satisfaction guarantee.

Or maybe you can be faster than your competitors—“done in two days or less!” Don’t be afraid to call out your competitors and state why your business has the best “X.”

7. Financial Projections

Question: How much money do you need to start?

One part of financial projections is called startup costs—how much money you need to open your doors. For this cost, simply list all the items and services you need to get your business started.

When estimating the startup cost, you’ll want to overestimate on the amount, rather than underestimate. Often, a new business owner may be unaware of certain startup costs. If you underestimate costs, you could run out of cash before you get your first customer.

Question: How much will you spend every month?

Calculate how much money your business is likely to spend every month. Make the calculations for the first 12 months.

This may take research. You may have to pick up the phone and request a quote for items such as raw materials, equipment, and insurance.

Question: How much will you earn every month?

Now for the fun part—the amount of money you expect to make. How many customers do you plan on having every month for the first 12 months? You should have your pricing from the business model step. Take the number of customers times the price to come up with an estimated income every month.

Depending on your type of business, you may expect to grow your customer base every month. You may expect to only have a few customers in your first month—by 12 months, dozens of new customers. However, you don’t have to grow. Some companies may be content with a few consistent customers every month.

8. Funding Required

Question: How much money do you need to both start and operate your business?

Funding required is the total amount of money you need to start and operate your business for at least six months. You typically should have more funding than just the amount to start.

What if the company doesn’t get the sales you initially predicted? Or a natural disaster hits such as a hurricane or pandemic? Does your business have enough funds saved up to get through a difficult time?

Now that you have the amount of funding required to start and operate for at least six months, you can go out and raise that money through various sources, such as:

- Personal funds

- Family and friends

- Crowdfunding

- Business credit cards

- Personal loan

The One-Page Business Plan Alternative

If you’d like to create a more in-depth business plan after reading through this guide, remember, there are different types of business plans. For example, if you’re seeking funding from a bank or investor, you will need to create a traditional business plan. This type of plan requires more thorough market research and financial forecasting.

Bottom Line

Now that you have your one-page business plan created don’t put it in a drawer never to be looked at again! As you move forward with your business, revisit your plan often.

It’s a best practice to keep track of your income and expenses to see if your predictions played out correctly. Did you outperform your goals? What’s working well or not so well? Use your one-page business plan to reflect on your business’s current state and update it if necessary.