Included as a standard report in most payroll software, a payroll register is a detailed record of all employees’ payment data. It’s the paycheck records of every employee in one report, including the total gross pay for each employee, each type of deduction and amount, and the total net amount that each employee receives.

A payroll register is useful to run each payroll period. It provides you with detailed information that makes it easier to make your payroll tax deposits, submit your quarterly taxes, and provide information to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

Payroll Register Structure

Here’s the data you should generally see on your payroll register:

- Name of each employee

- Pay period

- Pay date

- Regular hours worked for each employee

- Overtime hours worked for each employee, if applicable

- Each employee’s pay rate

- Each employee’s gross pay

- Federal, state, and local taxes withheld

- Employee portion of Social Security and Medicare taxes

- Any other applicable deductions

- Each employee’s net pay

- Employer benefits contributions, if applicable

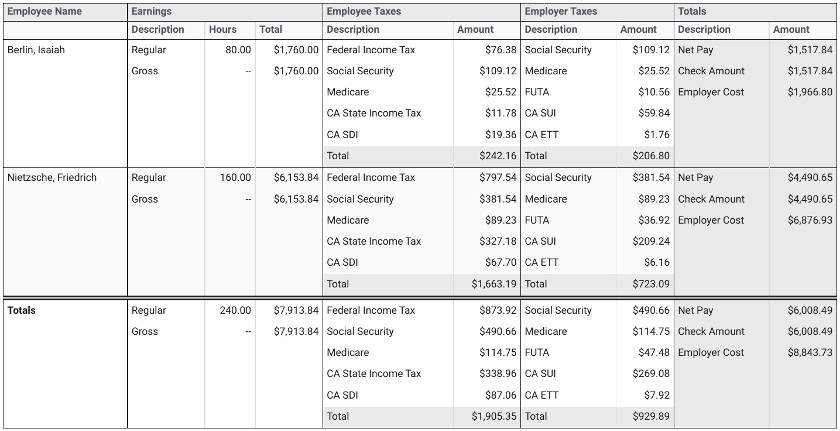

Sample payroll register indicating regular pay, deductions, total net pay, and employer costs. (Source: Gusto)

Besides the employee-specific data shown above, you’ll also see totals on your payroll register for each line item. You can see the total hours worked for all employees, as well as the total gross pay for the pay period, allowing you to calculate the overhead costs of employing your team.

Payroll Register vs Payroll Journal vs Wage Summary

Many people confuse payroll registers and payroll journals, sometimes using the terms interchangeably. However, they are different.

A payroll register contains more detailed information about individual employees and is usually restricted to the finance department and executives. In contrast, a payroll journal includes only companywide payroll totals and is often shared across the payroll and finance teams and anyone else who needs to be aware of total payroll costs.

A third report, the wage summary, provides data similar to a payroll register—but only for a single employee.

Using a Payroll Register

Doing payroll is more than just paying your employees—you’re also required to withhold taxes and report information to the SSA and IRS. A payroll register is important because it helps your payroll team ensure they’re managing your payroll effectively, showing a detailed breakdown of the information you need to provide and allowing you to spot any obvious errors with total amounts or an individual’s pay.

The payroll register should be a part of your regular payroll process, but it can also be run over longer periods of time. You can run it for the last quarter to show you data on payroll costs over a broader time to try to spot trends.

Here’s what you can use the payroll register to do:

- Complete your company’s IRS Form 941 (quarterly tax) payments

- Calculate the cash required to cover payroll

- Ensure accurate benefits deductions (healthcare, retirement, etc.)

- Provide payroll data to your workers’ compensation insurance provider

- Complete verification of employment requests for banks and lenders

- Maintain accurate and compliant payroll records

Besides that, a payroll register is also a good business operations report to run. It can show if your employees are working more overtime than normal—costing you additional money—and how much your company benefits are costing as you increase your headcount.

The payroll register also plays a crucial role in financial planning and budgeting, as it helps businesses track their labor costs and monitor changes over time. Especially if you run a payroll register for a longer time period, like quarterly and annually, your finance team can spot trends that can help them prepare for higher expenses during certain times of the year.

What’s more, it breaks down how much money you need to pay in taxes, both as an employer and on behalf of your employees. This helps you set aside the appropriate sums of money to ensure your tax payments are covered and that you’re not facing a cash crunch.

Payroll Reconciliation

Payroll reconciliation is essentially double-checking your work. When you compare your payroll register with the amount you’re paying to your employees, tax agencies, and healthcare or retirement providers, you’re doing payroll reconciliation.

Doing this task is vital to ensuring payments are accurate. Not only could you face fines and penalties for paying an incorrect amount to a tax agency, but if you pay your employees incorrectly, then you could have unhappy employees who are ready to look for another job.

Keep in mind that your payroll register will only have accurate information if you’ve entered the correct data. Using payroll software can help in this regard, double-checking the info to ensure everything is set. Consider using Rippling—an HR platform with full-service payroll and tax processing tools. Learn more about it in our in-depth Rippling review or check our guide to the best payroll software for some options.

Benefits of Using a Payroll Register

A payroll register is a powerful tool that can offer numerous advantages to small businesses. Here’s why you, as a small business owner, should consider using a payroll register in your regular payroll and accounting processes:

Accuracy and Transparency: The comprehensive nature of a payroll register ensures that all aspects of employee compensation are meticulously recorded. This includes gross pay, deductions, taxes, and net pay, providing a transparent record for both employees and management. This transparency not only builds trust with your employees but also helps you maintain clear and precise financial records.

Legal Compliance: Labor and tax laws require businesses to keep detailed payroll records. A payroll register helps you comply with these requirements by ensuring that all necessary data is systematically recorded and preserved. This can save you from potential legal complications and penalties down the line.

Financial Planning and Budgeting: A payroll register gives you a clear picture of your total labor costs. This information is invaluable when it comes to financial planning and budgeting. By understanding your payroll expenses, you can make informed decisions about hiring, wages, benefits, and more.

Audit Readiness: If your business is audited, you will need to provide detailed payroll records. A comprehensive payroll register allows you to easily furnish this information to auditors, reducing stress and the risk of fines or penalties.

Payroll Register Legal Considerations

A payroll register is useful in meeting federal and state record-keeping requirements. According to the Fair Labor Standards Act (FLSA), employers must keep payroll records for at least three years. These records must include:

- Employee name

- The hours worked for each pay period

- Pay period dates and paycheck date

- Pay rate

- Taxes withheld

- Pay frequency

A payroll register keeps all of this information, making it one of the most vital payroll reports for your business compliance. While the FLSA does not mandate that you use a payroll register to meet their requirement, it’s simply a natural fit to do so.

Best Practices for Using Payroll Registers

In the world of payroll management, accuracy and efficiency are paramount. Implementing best practices for using payroll registers can help ensure that your business stays compliant with laws, maintains accurate records, and streamlines the payroll process.

Here are some key tips to consider:

- Implement strong data security measures to safeguard your payroll register from unauthorized access.

- Retain payroll records for the legally required period.

- Regularly review the payroll register to spot any potential errors or inconsistencies.

- Consider using reliable payroll software to manage your payroll register. This can automate many tasks, reduce errors, and streamline the payroll process.

Payroll Register Frequently Asked Questions (FAQs)

A payroll register provides a comprehensive record of all payroll expenses, including wages, bonuses, taxes, and deductions. This detailed insight into your labor costs is crucial for effective financial planning and budgeting. As a small business owner, you can use this information to make informed decisions about hiring, wage increases, benefits offerings, or cost-saving measures.

If you discover errors or inconsistencies in your payroll register, it’s important to address them immediately to maintain accurate financial records and ensure fair employee compensation. Depending on the nature of the error, you may need to update an employee’s pay rate, correct hours worked, or adjust a tax deduction. It might also be helpful to review your payroll processes to identify how the error occurred and implement measures to prevent similar mistakes in the future.

In the event of an audit, having a well-maintained payroll register can be incredibly beneficial. Auditors will require detailed payroll records, and your payroll register provides this information in a comprehensive, organized manner. This not only simplifies the audit process but also demonstrates your business’s commitment to legal compliance and accurate record-keeping.

A payroll register plays a crucial role in promoting transparency around employee compensation. It provides a detailed breakdown of each employee’s gross pay, tax deductions, other deductions (like health insurance or retirement contributions), and net pay. Sharing relevant portions of this information with your employees can build trust, as it shows that their compensation is calculated fairly and accurately. Remember, however, to always respect privacy regulations and guidelines when sharing payroll information.

Bottom Line

A payroll register includes vital payroll data you need to effectively run your business, ensure employees are paid correctly, and maintain compliance with federal regulations. As part of your regular payroll process, it also helps you double-check your work to make sure all aspects of your payroll are accurate. Consider using payroll software that makes running a payroll register report a seamless process.